Rent Out HDB For Rental Income While Upgrading To Private Property? Is HDB An Asset Or A Liability?

In real estate investment, there are plenty of ways for investors to invest their funds into properties. Real estate properties are real and tangible; in Singapore, properties are highly sought after because the risk of the value of the property becoming nothing is low.

It is quite rare in Singapore for property developers to go bust. Since the Asian Financial Crisis, we only saw the property developer behind Sycamore Tree, and Laurel Tree went into trouble. In such cases, the affected project will be under receivership, and the Controller of Housing will review the project account.

About the property developer goes bust, the latest news article from The Straits Times dated 30 January 2020, Titled “Condo developer goes bust: Court ruling provides home buyers relief.” It also mentioned that buyers have priority to claims ahead of other unsecured creditors. With the relief, the investor or purchaser will have more confidence to make their purchase.

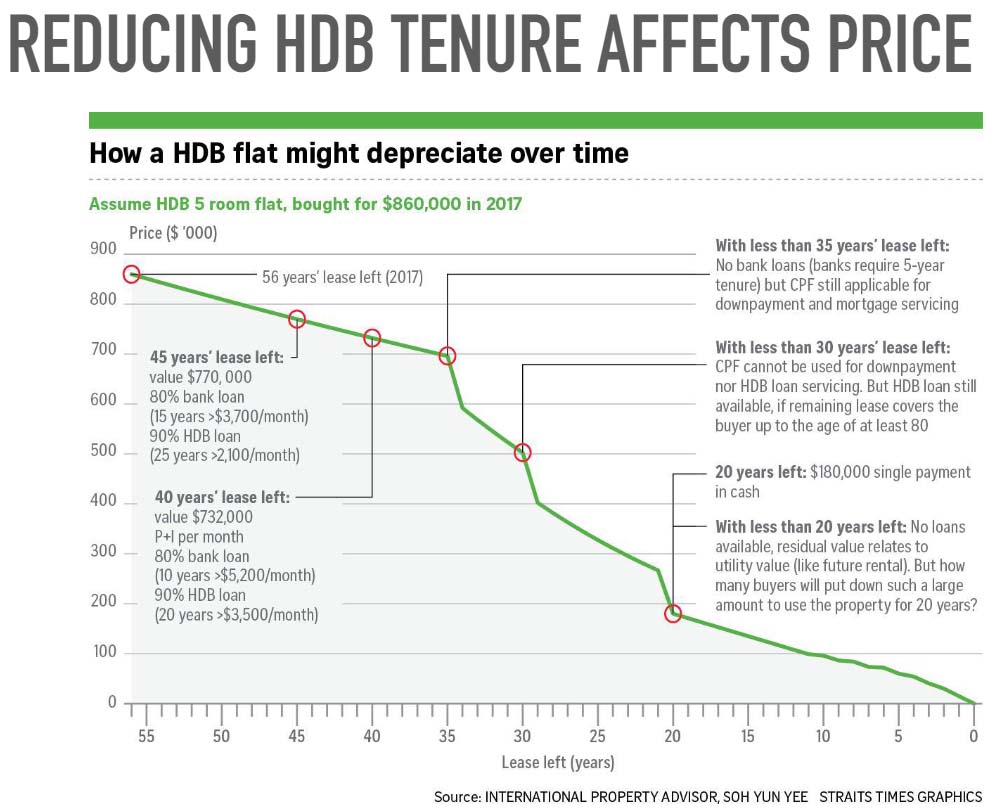

The other only scenario that the investment goes to zero is when you purchase property with a very short remaining tenure and hold it till its expiry.

The three basic categories that investors commonly invested in are residential, commercial, and industrial properties.

About This Article

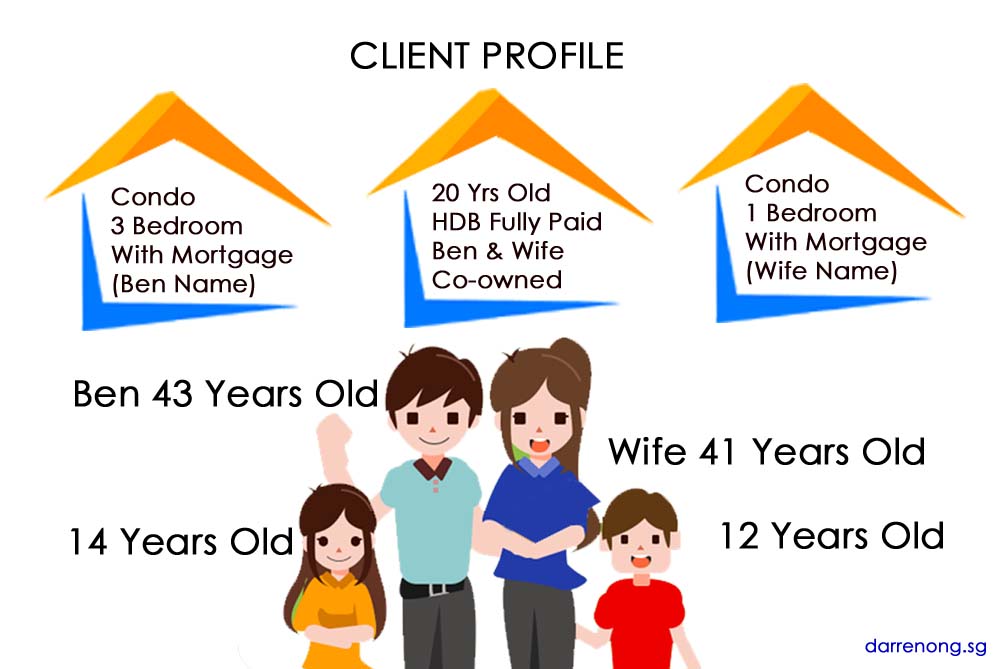

The reason that triggers me to blog about this topic, HDB, an asset or a liability, is that I recently have a friend, Ben (not his real name), asking me for advice about restructuring their property portfolio. We had a short discussion, and I can understand the angle that he is coming from for his plan.

It’s not the first time that friends or clients told me that they wish to invest in private property while retaining their HDB for rental income. But is it worth doing it?

For better understanding, let’s evaluate Ben’s portfolio before we examine the trends and figures.

Plans & Portfolio

Let me share their portfolio now:

- Ben co-owned a fully paid 20 years old HDB flat with his wife (owner occupied).

- Ben also owned one more 3 bedroom condominium with an outstanding loan. (Tenanted)

- Ben’s wife owned one more 1 bedroom condominium with an outstanding loan as well. (Tenanted)

- Ben was thinking of buying another bigger private property for their occupancy. However, Ben wishes to keep the HDB flat for rental income.

Rules and Regulations Affecting Them

With the information I gathered, the straightforward restriction is as follows:

- The number of properties Ben own is two before the next purchase.

- The number of properties Ben’s wife owns is two before the next purchase.

- Wef from 16 Dec 2021, if they purchase the next property, Ben and his wife are liable for 25% Additional Buyer’s Stamp Duty (ABSD) on top of the Buyer’s Stamp Duty (BSD).

- As of 16 Dec 2021, they are also affected by the 55% Total Debt Servicing Ratio (TDSR) limit.

- The next purchase will be subject to a lower Loan-to-Value (LTV) at a maximum of 45% due to each of them still having an outstanding mortgage on their private property.

Despite the above rules and regulations affecting them, there are ways to overcome some of them, if not all.

But as they plan to retain their HDB for rental income, today, I shall write the pro and con of holding onto your HDB for rental income.

HDB Valuation Appreciating vs. Depreciating

In the past, when Singapore is in the developing country stage, the HDB homeowners thought that their HDB flat is an asset. They believe that their HDB valuation will appreciate over time. But lately, HDB homeowners start to question the value of their HDB.

As reported in The Straits Times on 28 December 2017, the Selective En bloc Redevelopment Scheme (SERS) would not apply to all flats. The property value of leasehold homes will depreciate to zero, and the land will return to the State when the lease expired.

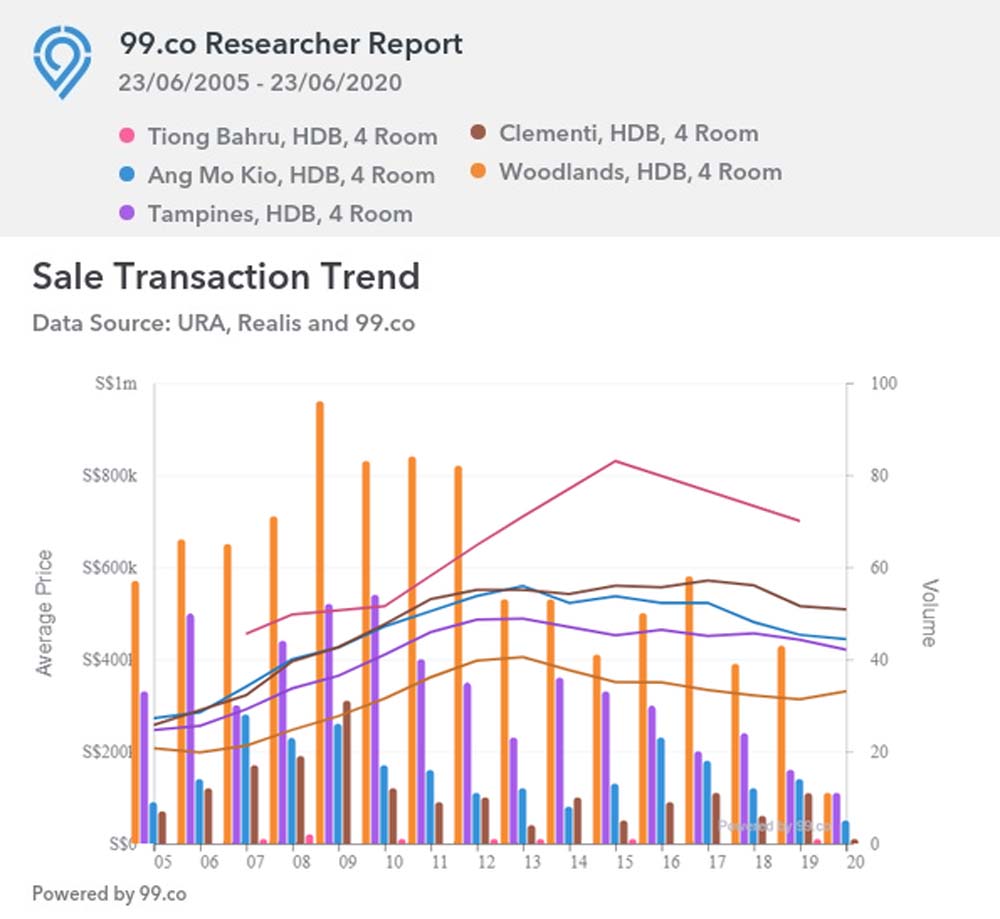

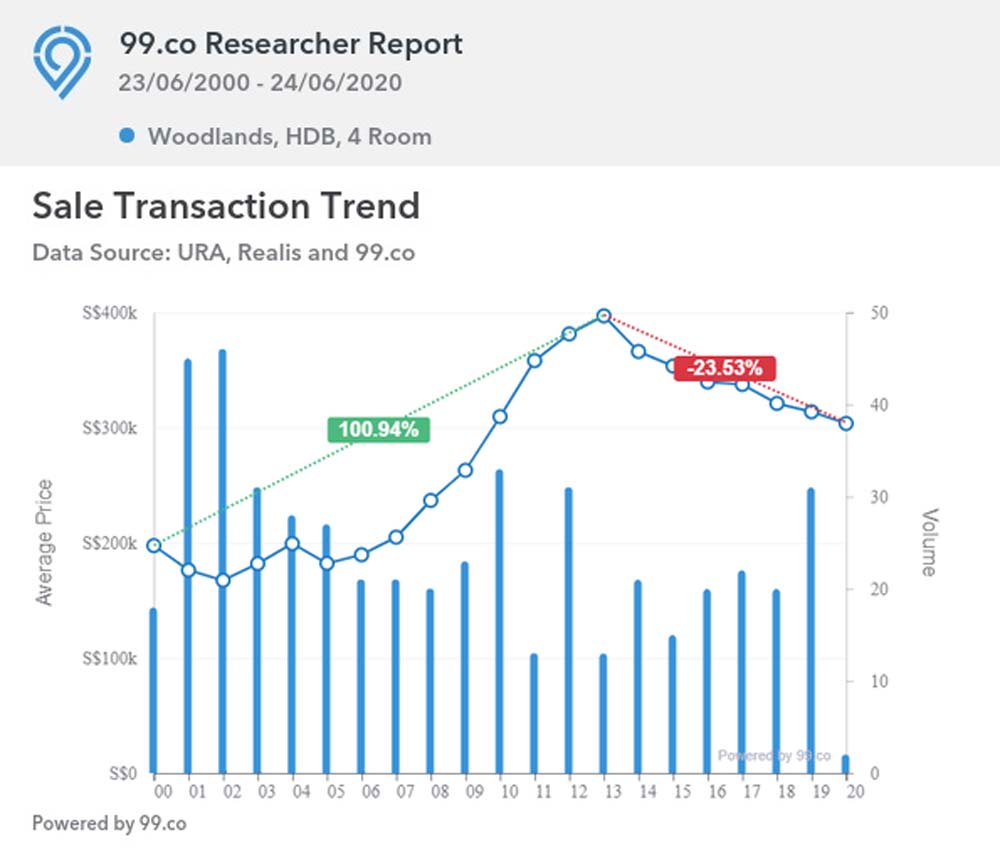

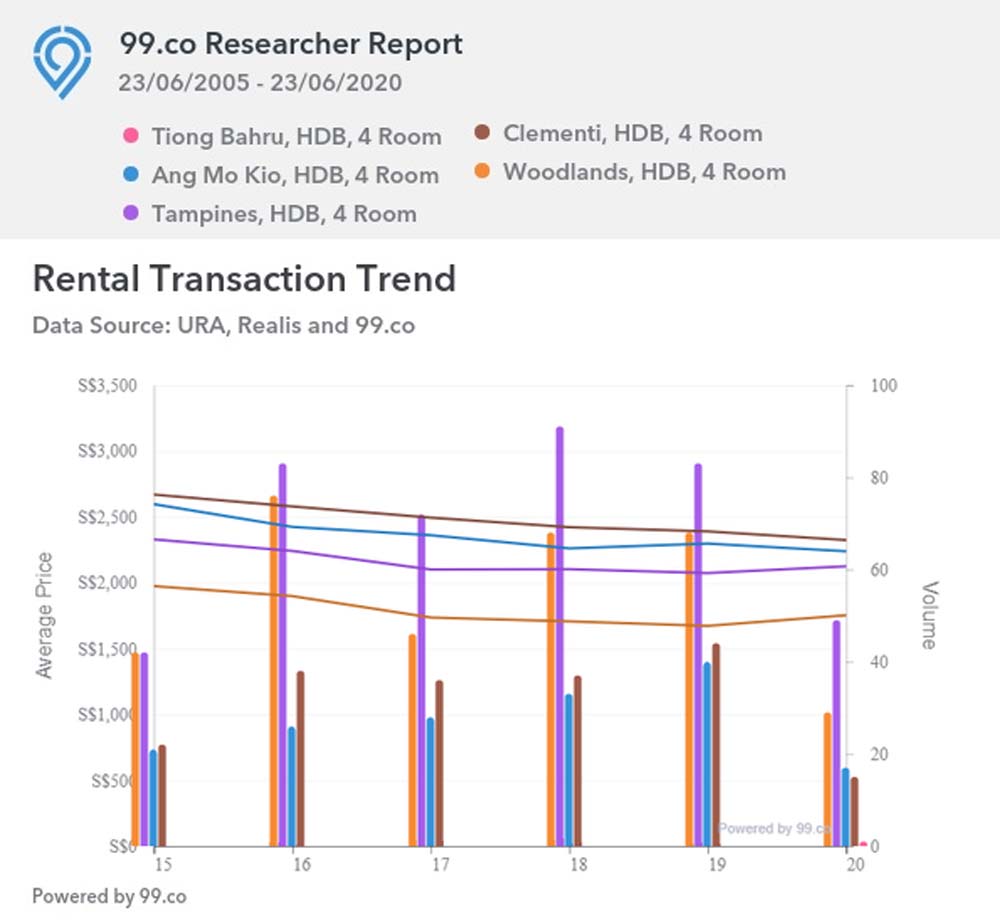

Between 2005 and 2020, the sale transaction trend for property age older than 30 years in various parts of Singapore. The value of the property starts to go downward at some points in time.

One example in Woodlands HDB flats, for the past seven years, it declined 23.53% from $400,000 to $305,000. It translates to an average of 3.36% decline per year or equivalent to approximately $12,000 reduction per year and eventually becomes zero with the lease expired.

HDB Rental Income Opportunity

When it comes to the rental income opportunity, most tenants prefer a new apartment over an old apartment. Thus, retaining old HDB for rental income may not be a wise choice.

An older apartment also tends to fetch a lower rental rate as compared to a newer apartment.

The average old (over 30 years) HDB 4 room flat rental rate is currently going at $1,500 to $2,300, depending on the area. But in 2015, it was approximately $1,900 to $2,700.

Compounding CPF Accrued Interest

CPF accrued interest is something many homeowners are not aware of.

CPF Board pays out 2.5% annual interest currently to its member on the saving in the Ordinary Account.

But when homeowners use their CPF savings for property purchase, instead of the CPF board paying the annual interest, the homeowner has to bear the accrued interest.

The table below shows how the compounded CPF accrued interest build up over the year and how it affects you. Each year CPF accrued interest will be higher than the year before.

Read more about How CPF Accrued Interest Affect Property Cash Proceeds

| Balance | Accrued Interest | Total Interest | Year |

|---|---|---|---|

| $220,000.00 | $5,500.00 | $5,500.00 | 1999 |

| $225,500.00 | $5,637.50 | $11,137.50 | 2000 |

| $231,137.50 | $5,778.44 | $16,915.94 | 2001 |

| $236,915.94 | $5,922.90 | $22,838.84 | 2002 |

| $242,838.84 | $6,070.97 | $28,909.81 | 2003 |

| $248,909.81 | $6,222.75 | $35,132.55 | 2004 |

| $255,132.55 | $6,378.31 | $41,510.87 | 2005 |

| $261,510.87 | $6,537.77 | $48,048.64 | 2006 |

| $268,048.64 | $6,701.22 | $54,749.85 | 2007 |

| $274,749.85 | $6,868.75 | $61,618.60 | 2008 |

| $281,618.60 | $7,040.46 | $68,659.06 | 2009 |

| $288,659.06 | $7,216.48 | $75,875.54 | 2010 |

| $295,875.54 | $7,396.89 | $83,272.43 | 2011 |

| $303,272.43 | $7,581.81 | $90,854.24 | 2012 |

| $310,854.24 | $7,771.36 | $98,625.60 | 2013 |

| $318,625.60 | $7,965.64 | $106,591.24 | 2014 |

| $326,591.24 | $8,164.78 | $114,756.02 | 2015 |

| $334,756.02 | $8,368.90 | $123,124.92 | 2016 |

| $343,124.92 | $8,578.12 | $131,703.04 | 2017 |

| $351,703.04 | - | $140,495.62 | 2018 |

Putting The Above Together

- Annual Rental Income = $2,000 x 12 = +$24,000

- Declining HDB Value = $400,000 x (-3.36%) = (-$13,440)

- CPF Accrued Interest = (-$5,500)

If we take into account the decline in HDB value and CPF accrued interest, the nett rental income is:

- $24,000 – $13,440 – $5,500 = +$5,060

But please note that the above does not consider property tax, monthly town council conservancy charges, property upkeeping maintenance, and repair cost if any. If we factor these costs in, the nett rental income will be even lower.

If Ben proceeds to purchase the 3rd property, he is liable for 25% Additional Buyer Stamp Duty, which will take more years to recover from rental income.

My Suggestion For Ben

There are a few ways to restructure Ben’s property portfolio. In this article, I will list down one of the more straightforward approaches.

Instead of retaining the aging depreciating HDB for a rental opportunity, I suggest Ben dispose of the HDB to cut loss and invest in a newer property.

Also, he still owns a three-bedroom condominium with an outstanding mortgage. If he proceeds to purchase, he is liable to pay 17% ABSD for 2nd property purchase.

I suggest that Ben move into his three-bedroom condominium for his own-stay and, with sufficient funds available, consider buying the next property under trust under his children’s name for children without paying ABSD.

In Summary

It is not always true that retaining your aging leasehold property will generate rental income for you. Instead, it can be a liability that is not putting money into your pocket.

You must check to determine if the property that you own is performing well. Also, check if its valuation is on appreciating trend or started on the depreciating trend and make the correct move next.

By now, you should have some idea of how an aging leasehold property might affect you due to its valuation and compounding CPF accrued interest.

Do drop me a message for a friendly non-obligatory discussion if you need advice on real estate investment strategies.

Rent Out HDB Upgrading Private Property

Hello, I am Darren Ong

As a real estate professional, my duty is to help my clients achieve financial freedom and grow their wealth through Property Wealth Planning™.

I believe that with prudent strategies and a clear investment road map, anyone can enjoy a life of abundance and financial stability.

Darren Ong (王伟丞)

Associate District Director of Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: +65 9383 9588