The Right Method in Using Your CPF Can Make or Break Your Financial Future

Locking your CPF funds in your HDB flat is eating away at your wealth.

With your CPF dumped into your HDB flat, you:

Dear Property Owners,

Do You Know That You Are Sitting On A Gold Mine Which Can Unlock An Early Retirement With Passive Income?

Do you know that many homeowners have already UPGRADED to private properties with just $8K and upwards household income without touching their savings?

Those with $10K income and upwards have even started owning PASSIVE INCOME generating investment properties.

Would you like to explore your available options?

Have You Ever Wondered?

1.) When you can upgrade?

2.) How much income you need to afford it?

3.) What is the initial payment needed?

4.) If upgrading is only for the rich?

What if I tell you that you are not alone?

Many home owners earning $7K and above have approached me before with similar concerns. It is not new and I see many in their 20-40s especially, needing assistance in this area.

With my clear and fact-based insights and step-by-step Property Wealth Planning strategies, they have since upgraded comfortably to private properties, created passive income streams and have a clear investment roadmap for the next 5-10 years.

How would it change your life if you could do the same ?

Financial freedom and a comfortable retirement is possible for those who know how.

What you do today can have massive ripple effects on your FINANCIAL FUTURE.

Let’s meet up for a FREE and NON-OBLIGATORY consultation session.

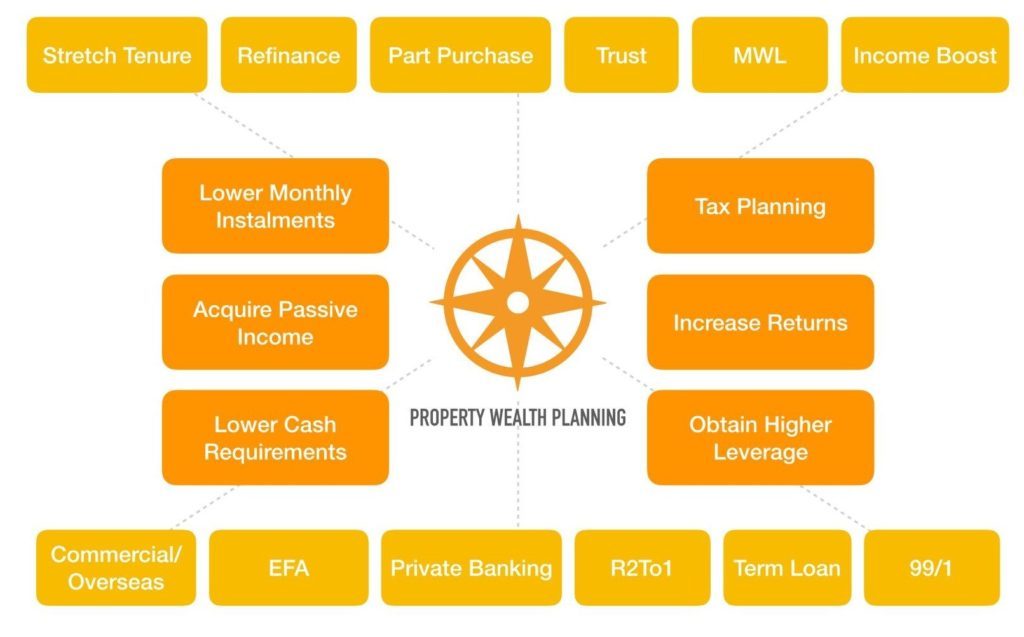

Property Wealth Planning (PWP)™ has been helping property owners like you increase their wealth accumulation capabilities and plan for their financial future.

Join thousands of property owners who have benefited from the low-risk and systematic investment plans that PWP provides.

During my sharing session, I will cover with you:

Property Wealth Plan™

A conservative and achievable plan to help you accumulate wealth quicker.

Financial Analysis

An in-depth analysis of your financial position and upgrading choices.

Funding Requirements

A report of all funds required for stamp duties, legal costs and miscellaneous fees.

Investment Analysis Method

A proven analysis method to filter the options in the market and determine the right property for you.

Investment Road Map

Plan ahead for the next 10 years with actionable steps at each phase.

Strategies & Techniques

Real life strategies that I have used to help clients multiply their property portfolios.

Mr and Mrs Lim, both 34 years old, were owners of a 4 room HDB flat. They sought me out to sell their HDB to buy a resale Executive Maisonette.

After walking through a detailed financial analysis with them, I recommended them methods to help them accumulate wealth without just relying on their income.

Make Money Work For Them

By using low risk and proven Property Wealth Planning™ strategies, they have since upgraded to a condominium without touching any of their savings and even have $200k set aside in a rainy day fund.

With my systematic investment road map, they even managed to own an investment property 6 months later.

Mr and Mrs Chai, with a combined income of $9K, sought my advice for selling their current 2 bedroom condominium to upgrade to a newer 3 bedroom condominium.

Property Wealth Planning™

After detailed analysing, we found that they could achieve more than an upgrade. Today, they own not 1, but 2 condominiums and yet have $300K cash set aside as their rainy day fund.

Smart Strategies Backed By Research

By using low risk and systematic Property Wealth Planning strategies, they are now paying lesser installments than if they had just upgraded to a 3 bedroom condominium.

And this is possible through the rental income from their investment property.

If you are like most Singapore HDB Owners today, you are probably servicing your loan using your CPF.

You might even believe that it is best to pay off the loan as soon as possible.

My facts-based research shows how it impacts your financial goals & the potential huge difference PWP™ makes in your retirement funds.

Locking your CPF funds in your HDB flat is eating away at your wealth.

With your CPF dumped into your HDB flat, you:

Lose the 2.5% interest or more you earn from leaving it inside CPF.

Incur accrued interest of 2.5% that you need to pay back when you eventually sell.

5% is TAKEN AWAY from your cash proceeds year after year when you sell.

Due to a lack of understanding, many clients assume that their dream properties are out of their reach due to worries like age, income, risks etc.

As a Property Wealth Planner™, I provide rigorously researched analysis to lower your risks and creative solutions customized for you for your property asset progression plan.

Sadly, some clients have missed their chance and wished I was there to advise them in the past.

Will you want to have the same regrets when you look back 10 years down the road? I certainly hope not.

During my sharing session, I will cover with you:

With Property Asset Progression or Property Wealth Planning™ strategies and a guided investment road map from me, you can:

Achieve Financial Freedom

Start working towards a financially free future.

Grow Your Property Portfolio

With safe and proven property wealth planning™ insights and a systematic road map.

Generate Passive Income

With minimal or zero additional financial commitment.

Maintain Rainy Day Reserves

A healthy and financially prudent cash reserve set aside for rainy days.

Retire Earlier Safely

With a secure financial safety net that provides your family peace of mind.

YOU DESERVE A MUCH BETTER LIFE!

At this point, you can give up and continue what you are doing but let’s be frank, you won’t still be reading if that’s what you wanted.

All I ask now is for 1 hour of your time. That’s it.

After an hour, you can choose to either walk away or ……

As an investor myself and with FIELD-TESTED and PROVEN Property Wealth Planning™ strategies, I will guide you step by step to UPGRADE and make your property work for you instead.

This 1 hour might CHANGE YOUR LIFE.

Get a limited period 1-time FREE consultation where I will share with you how I have helped many clients, who were in the same situation, grow their wealth.

Hello, I am Darren Ong

As a real estate professional, my duty is to help my clients achieve financial freedom and grow their wealth through Property Wealth Planning™.or Property Asset Progression

I believe that with prudent investing property strategies and a clear investment road map, anyone can enjoy a life of abundance and financial stability.

Darren Ong (王伟丞)

Senior Associate District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: +65 9383 9588

Property Wealth Planners™ are equipped with the most up to date and advanced financing & portfolio structuring techniques in the market. Always ensure that you are advised by trusted professionals in your journey towards financial freedom.

Fancy a Property Agent Career? Call me today!

Let me help you achieve financial freedom safely and predictably.

Let me share with you over a limited period 1-time FREE and non-obligatory consultation.

Disclaimer: The property asset progression case studies are for educational use only and we make no representation or warranties with respect to the accuracy, applicability, or completeness of its contents. Any forward-looking statements outlined in this landing page are simply our opinions, estimates, expectations, or forecasts for future potential, and thus are not guarantees or promises for actual performance. As required by law, we can make no guarantees that you will achieve any results. Results will vary from case to case. The terms “Property Wealth Planning” and “Property Wealth Planners” are trademarked assets of Navis Living Group, a Division of Huttons Asia Pte Ltd. Unauthorized usage is strictly prohibited and legal recourse will be pursued for any violations. In adherence to the Personal Data Protection Act, by submitting your personal particulars through the forms on this website, you are hereby agreeing to allow us to contact you via the contact information you have provided. No part of this site may be reproduced or reused for any other purposes whatsoever without our prior written permission. Other terms used Property Asset Progression, Singapore Property Investment, Property Portfolio Restructuring, Investing Property Strategies, and Property Upgrading.

Learn More

Share what you’re considering. I’ll reply with a data-backed view and what to watch out for.

By submitting, you agree to be contacted for this request. Your details won’t be shared.