When buying a property in Singapore, there are tons of questions that might be at the back of your mind. These questions usually include property type to buy, rules and regulation, affordability, financial aids, location, and procedure, to name a few.

In Singapore, with extensive government property market policy, regulation, and financial aids such as the CPF housing grant, most Singaporeans are still able to afford a home; the 2020 homeownership rate at 87.9%.

Here are some fundamentals of what property seeker or home seeker needs to know about homeownership in Singapore 2024.

1. Types of Singapore residential properties and which you can buy (local, PR or foreigners)

In Singapore, like many other countries around the world. There are public residential housing and private residential properties.

For public residential housing by the Housing Development Board (HDB), only Singapore Citizen (SC) or Permanent Resident (PR) is eligible to purchase if they fulfill one of the purchasing schemes, which I will share more about in point 4.

As public housing (HDB) is heavily subsidies by the government, the foreigners are not eligible to purchase.

On the other hand, the private residential properties, there are various types from executive condominium (EC), private apartment/condominium (condo), and landed housing.

For executive condominium (EC), it is not so straightforward as other private property. Although a private developer builds it, purchasing an EC has rules to follow based on:

- Brand new EC purchasing from housing developer,

- EC that just turn 5 years old from TOP, We call these the MOP EC, and

- EC that turn 10 years old from TOP, we call these privatized EC.

For a private apartment/condominium, SC, PR, or foreigners are free to purchase.

For landed property, SC and PR are free to purchase. Foreigners need government approval to buy purchases.

Lets look into details on each of the property type below and who is/are eligible:

1.1 Who is eligible to purchase HDB:

Types of Property BTO / Resale Flat Public Housing (HDB) SC + SC

SC + SPR

SC

SC _ Non SC Spouse

1.2 Who is eligible to purchase Executive Condominium (EC):

For EC, as mentioned, it is divided into 3 different groups. They are:

- For brand new EC, only SC+SC or SC+PR is eligible to buy, but you still need to follow the public housing (HDB) purchase scheme.

- For resale EC after the minimum occupation period (MOP), from the 6th year onward to before the 10th years’ privatization, you do not need to follow the HDB purchasing scheme. SC or PR are eligible to buy even you are Single. But foreigners are not allowed to purchase.

- For fully privatized EC, typically after the 10th-year mark, SC, PR, or foreigners are allowed to purchase.

Type of Property Brand New EC Resale EC

(6-10 Years)Fully Privatized EC

(after 10 Years)Executive Condominium (EC) SC+ SC

SC + SPRSC + SC

SC + SPR

SC Alone

SPR AloneSC + SC

SC + SPR

SC Alone

SPR Alone

Foreigners

1.3 Who is eligible to purchase Private Property:

Types of Property Brand New / Resale Private Apartment / Condominium SC

SPR

ForeignersLanded Property SC

PR

Foreigners need approval

2. Age Matters

For public housing (HDB), you must be at least 21 years old to purchase with a family nucleus. For single who are unmarried or divorced, you need to be 35 years old except for windowed, or an orphan can be 21 years old.

For private property, you must be at least 21 years old to purchase a property. The purchaser age can be below 21 years if it’s purchased under a trust

3. CPF Usage on Property

You can use your CPF Ordinary Account (OA) saving to purchase property in Singapore. The amount that you can utilize is subject to the valuation limit (VL) and withdrawal limit (WL).

VL refers to the market value or the purchase price of the property at the time that you are buying, whichever is lower.

WL refers to the maximum amount of CPF that you can use for your property, currently capped at 120% of the valuation limit.

You may be keen to read more aboutusing CPF saving for second properties.

4. Purchasing Scheme Available

4.1 For public housing (HDB)

There are several schemes that you can use to buy HDB flat. In general, there must be at least one SC when purchasing an HDB flat.

| Types of Scheme | Citizenship | Minimum Age | Family Nucleus / Remark |

|---|---|---|---|

| Public | SC + SC SC + PR PR + PR (at least 3 yrs PR) | 21 | Spouse and children Parent and siblings Children under your legal custody, care and control |

| Fiance/Fiancee | SC + SC SC + PR PR + PR (at least 3 yrs PR) | 21 | Your spouse to be, must be listed in the application as either: - a co-applicant (if 21 years old or above) - an occupant |

| Single SC | SC | 21 or 35 | Unmarried or divorced: at least 35 years old Widowed or an orphan: at least 21 years old For orphan, please refer to ophans scheme |

| Joint Singles | SC | 21 or 35 | Unmarried or divorced: at least 35 years old Widowed or an orphan: at least 21 years old For orphan, please refer to ophans scheme |

| Non-Citizen Spouse | SC | 21 or 35 | Age 21 up, spouse must have valid Long Term Visit Pass or Work Pass at time of resale application with at lease 6 months pass validity Age 35 up, spouse must have valid Visit Pass or Work Pass at time of resale application with at least 6 months pass validity |

| Non-Citizen Family | SC | 21 | must form family nucleus with either parents or sibiling or children under your legal custody, care and control. At least 1 parent / child must have a valid Long Term Visit Pass or Work Pass at time of resale application with at least 6 months pass validity |

| Orphans | SC | 21 | must include at least 1 more single SC or PR sibling as co-applcation or occupier. At least one of your deceased parents must be SC or PR. If below 35 years old, must not have another sibling who is younger than 35 years old buying/owning another flat nder the: orphans, single or joint singles scheme. |

| Conversion | SC + SC SC + PR | 21 | Spouse and children Parent and siblings Children under your legal custody, care and control |

For more details, you may refer to https://www.hdb.gov.sg/cs/infoweb/residential/buying-a-flat/resale/eligibility-

4.2 For Executive Condominium (EC)

You have to qualify for any of the eligibility schemes for purchasing a brand new EC:

- Public Scheme

- Fiancé/Fiancée Scheme

- Orphans Scheme

- Joint Singles Scheme

As for resale EC or privatized EC, you do need need the above eligibility scheme to purchase. You are free to either buy as single or with someone else. There is no restriction on the family nucleus.

4.3 For private property

You are free to either buy as single or with someone else. There is no restriction on the family nucleus.

5. Types of CPF Housing Grant Available

Sad to say, the CPF housing grant is only available for public housing and EC. There is no grant for purchasing a private property in Singapore.

The available CPF housing grants that you are eligible to apply for will depends on the type of scheme you purchase the flat stated in point 4.

Let’s take a look at the possible CPF housing grants for each scheme:

Purchasing Scheme Types Of Grant Public scheme

Conversion schemeFamily Grant

Enhanced CPF Housing Grant (EHG)

Half-Housing Grant

Singles Grant

EHG (Singles)

Proximity Housing GrantFiance/Fiancee scheme Family Grant

Enhanced CPF Housing Grant (EHG)

Half-Housing Grant

Proximity Housing GrantSingle SC scheme

Non-citizen spouse scheme

Non-citizen family schemeSingles Grant

EHG (Singles)

Top-Up Grant (at a later stage)

Proximity Housing GrantJoint singles scheme

Orphans schemeSingles Grant

Enhanced CPF Housing Grant (EHG)

Proximity Housing Grant (for Joint Singles Scheme only)

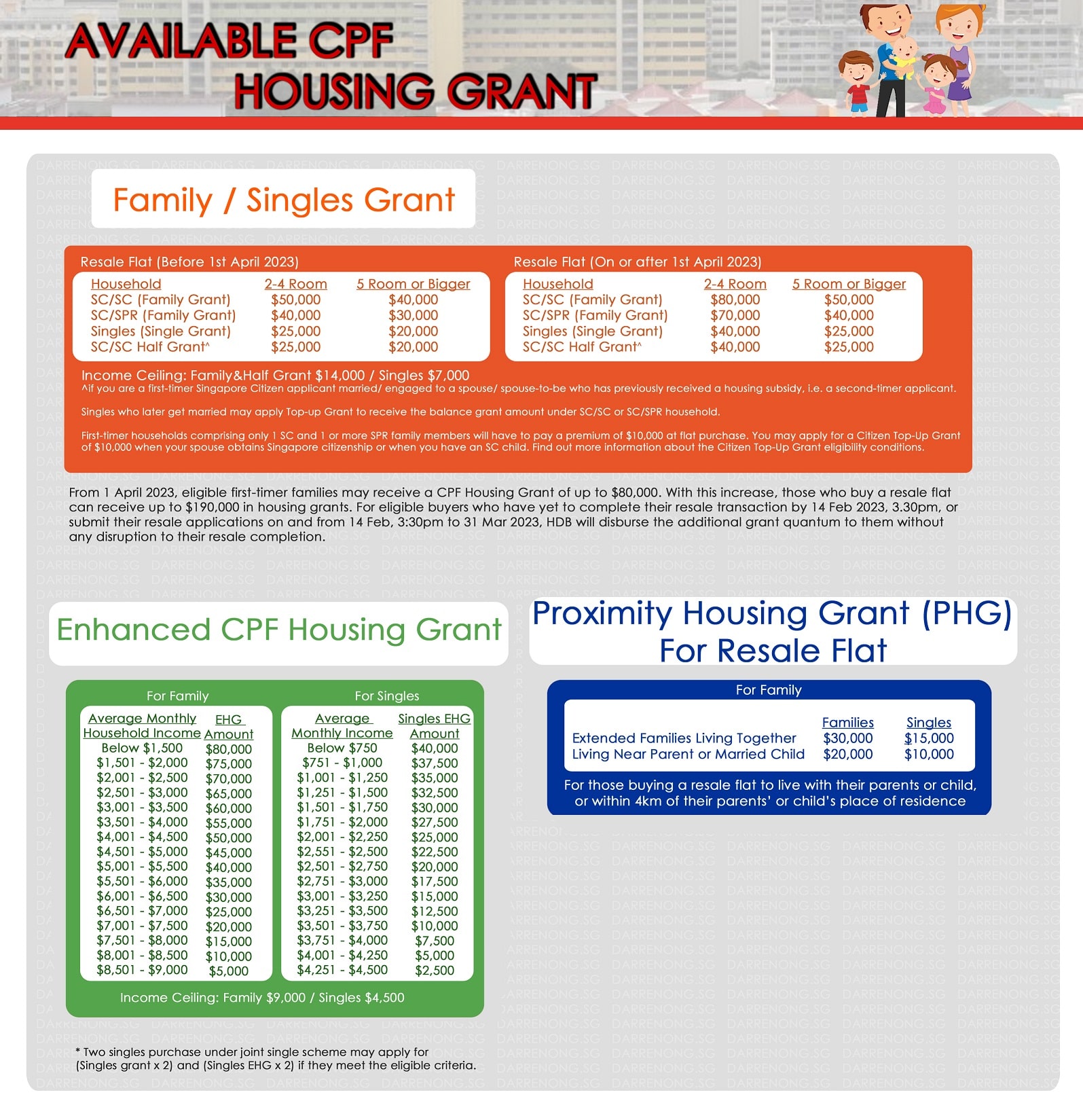

5.1 For HDB Flat – CPF Housing Grant (First Timer Grant, Enhanced Housing Grant and Proximity Housing Grant)

At a glance, let’s take a look on the available CPF Housing Grant before and after 1st April 2023.

As announced on the Singapore Budget 2023, there will be higher grant for to support the first-time HDB resale flat buyers from 1st April 2023.

The higher grant amount is for eligible buyers who submit HDB their resale applications on or after 1st Apr 2023, the HDB will disburse the higher grant quantum before the HDB resale completion, as per current practice. For eligible HDB buyers who have yet to complete their HDB resale transaction by 3.30pm on 14th Feb 2023, or have summitted their HDB resale applications on and from 3.30pm on 14th Feb 2023 to 31st Mar 2023, the HDB will disburse the additional grant quantum (i.e. the difference between the current grant and the increased grant) within 3 months from the date of their HDB resale completion. Buyer DO NOT need to approach the HDB and will not face any disruption to their HDB resale completion.

CPF Housing Grant for HDB

For more details, you may refer to

https://www.hdb.gov.sg/cs/infoweb/residential/buying-a-flat/resale/schemes-and-grants/cpf-housing-grants

5.2 For Executive Condominium (EC) – First Timer Only

Only if you and any of your co-applicants is/are first timer and fulfill the CPF Housing grant eligibility at the point of booking the new EC unit from the housing developer. The CPF Housing Grant for new EC are:

- Family Grant; or

- Half-Housing Grant

| Avg gross monthly household income of all persons in application, i.e. applicants and occupiers | Family Grant | Half-Housing Grant For first-timer with second-timer | |

|---|---|---|---|

| SC/ SC Household | SC/ SPR Household | ||

| $10,000 or lower | $30,000 | $20,000 | $15,000 |

| $10,001 to $11,000 | $20,000 | $10,000 | $10,000 |

| $11,001 to $12,000 | $10,000 | Nil | $5,000 |

| $12,001 to $16,000 | Nil | Nil | Nil |

For more details, you may refer to

https://www.hdb.gov.sg/residential/buying-a-flat/executive-condominium/cpf-housing-grants

6. Mortgage loan and cost incurred in purchasing a property in Singapore

Purchasing a property in Singapore may be a big decision for the majority, especially for first-time buyers.

You need to plan with extra care as it is a big financial commitment, thus calculate your sum correctly in order not to miss out on those that you need to prepare upfront as well as while servicing the monthly mortgage.

” Do your sums before committing to purchase. If unsure, engage a professional agent to assist you before you realized something is amiss.”

Before you commit to any unit that you are keen on, you must check on your mortgage loan amount that you can get. Otherwise, you may be caught in a situation where the mortgage loan amount is not able to cover up to the amount that you need. If this situation arises, you will have to pay the shortfall in cash, which the majority would want to avoid.

After getting the mortgage loan amount checked, you can look for the unit that you are keen on and is financially comfortable with while working out the following sum:

- monthly installment to service

- monthly recurring cost

- upfront cash needed

- upfront CPF needed if any

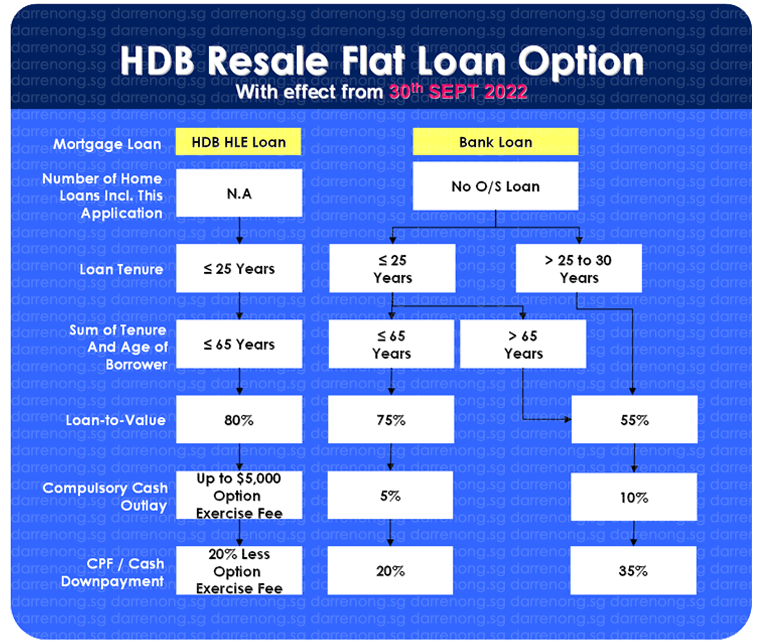

For HDB flat, the upfront cash needed depends on who you take up the mortgage loan with (HDB or Bank) and the valuation of the property.

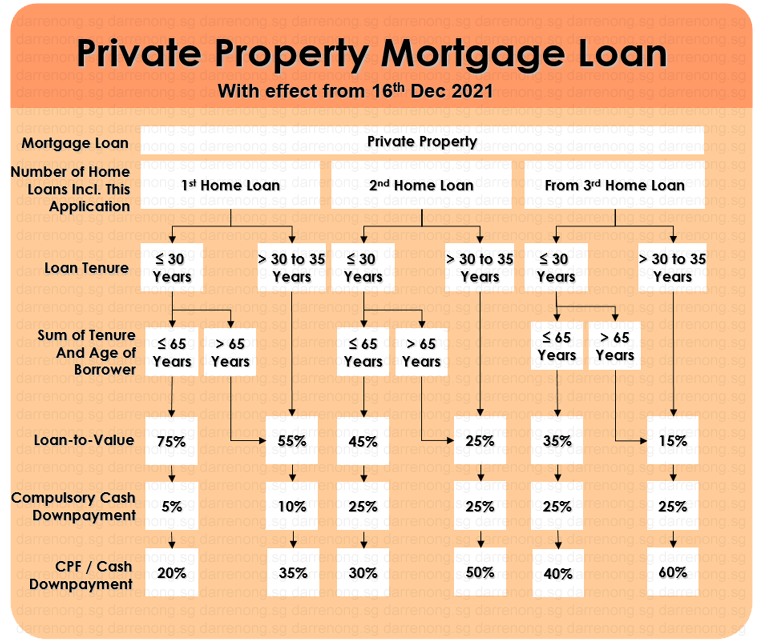

For private property, it will be more straightforward across the board as you can only apply for a mortgage loan from the bank.

Let’s take a look in more detail on the cash and CPF downpayment needed and its loan to value (Max. loan) allowable, subject to HDB or Bank approval.

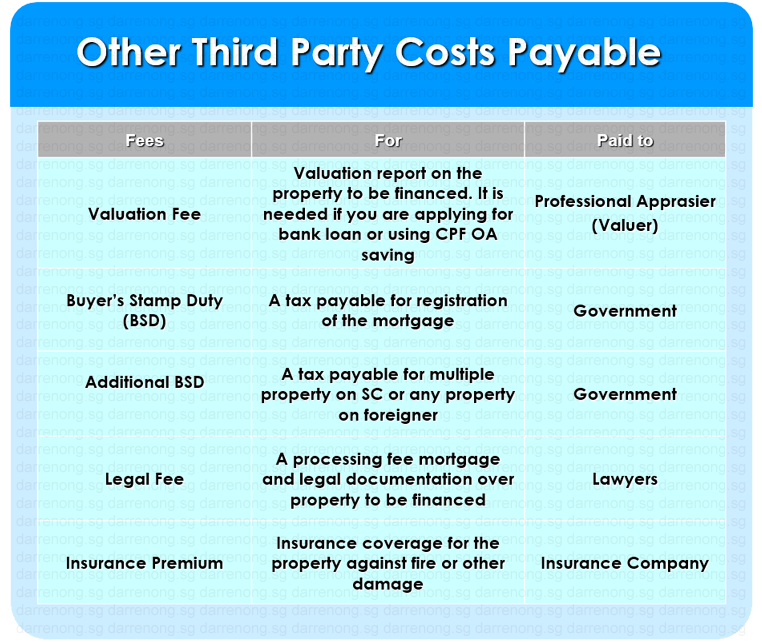

In general, the cost breakdown to purchase a property in Singapore is as following:

- Deposit (Option Exercise Fee)

- Downpayment

- Approved mortgage loan

- The shortfall from the mortgage loan, if any

- Cash over valuation, if any

- Buyer’s Stamp Duty

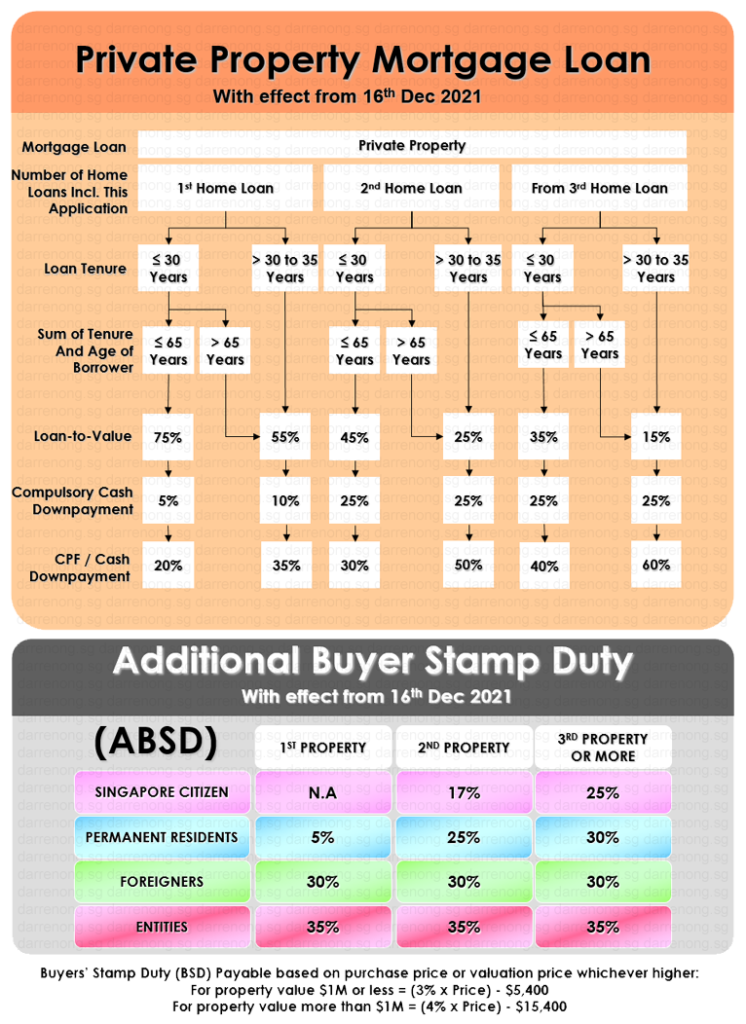

- Additional Buyer’s Stamp Duty

- Conveyancing / Legal Fee

- Agent Professional Fee

- Other miscellaneous costs

Buyer Stamp Duty Rate (wef on or after 15 Feb 2023)

| Property Value | Residential BSD Rate |

|---|---|

| First S$180,000 | 1% |

| Next S$180,000 | 2% |

| Next S$640,000 | 3% |

| Next S$500,000 | 4% |

| Next S$1.5 million | 5% |

| Remaining amount | 6% |

Example 1:

A landed house was purchased on 20 Feb 2023 at $4,000,000 at market value:

| Market Value of the Property | BSD Rate | Calculation |

|---|---|---|

| First $180,000 | 1% | = $1,800 (1% x $180,000) |

| Next $180,000 | 2% | = $3,600 (2% x $180,000) |

| Next $640,000 | 3% | = $19,200 (3% x $640,000) |

| Next $500,000 | 4% | = $20,000 (4% x $500,000) |

| Next $1,500,000 | 5% | = $75,000 (5% x $1,500,000) |

| Remaining $1,000,000 | 6% | = $60,000 (6% x $1,000,000) |

| BSD Payable | = $179,600 ($1,800 + $3,600 + $19,200 + $20,000 + $75,000 + $60,000) | |

For more details, you may refer to

https://www.iras.gov.sg/taxes/stamp-duty/for-property/buying-or-acquiring-property/buyer’s-stamp-duty-(bsd)

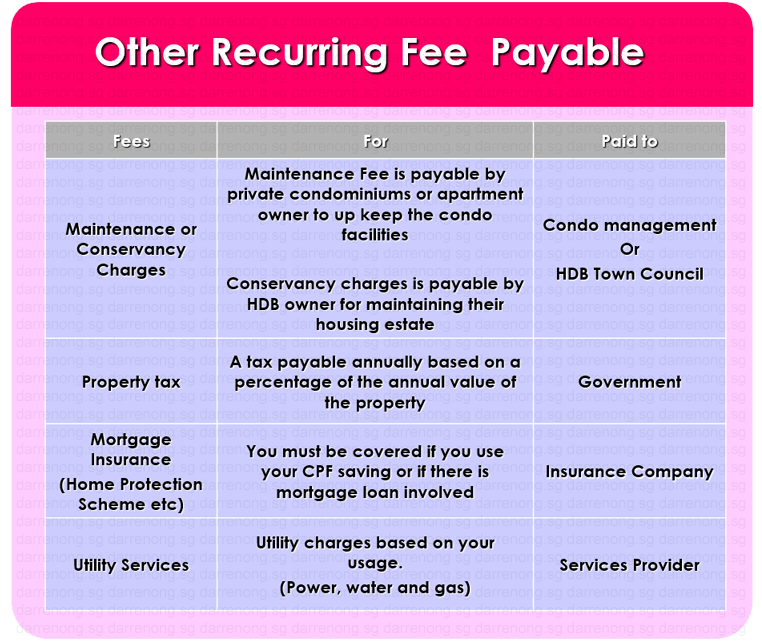

Other recurring costs that you might miss out on are:

- Property tax

- Maintenance fee / Conservancy charges

- Utility supply charges

- Mortgage insurance

- Home insurance (fire insurance etc.)

Case Study:

Mr. and Mrs. Lee (first-timer) both Singaporean, bought a four-room resale HDB in Jan 2022 at $365,000 at a valuation price near their parent. Their combined income is $11,500 with a bank IPA of loan up to $689k. The cost breakdown using a bank loan is:

Purchase Price: $365,000

CPF Housing Grant Available:

Family grant $50,000

Proximity grant $20,000

Downpayment payable:

- 5% of valuation = $18,250 (Cash)

- 20% of valuation = $73,000 (Cash / CPF)

- 75% of valuation Max. loan eligible

- Buyer’s Stamp Duty (BSD) = $5,550 (CPF)

- Additional BSD = $0

- Cash over valuation (COV) = $0

- Conveyancing Fee = approx. $3,000 (CPF)

- Other miscellaneous costs include a valuation fee of $120 and hdb resale application fee of $80, etc. (Cash)

- Agent Professional Fee = typically 1% + GST (Cash)

7. Additional cost and stringent rules on purchasing properties that might affect you

- For private property owners buying HDB

A private property owner is not able to apply for an HDB loan unless 30 months later, after selling their private property.Prior to 30 Sept 2022, If they are using a bank mortgage loan or not taking any mortgage loan to purchase the HDB resale flat first, they must also dispose of the private property within six months from the keys collection of the HDB resale flat.With effect from 30 Sept 2022, the private residential property owners, as well as former private residential property owners will have to wait 15 months before they are allowed to buy a non-subsidized HDB resale flat on the open market. However the 15 months wait-out period will not apply to seniors aged 55 and above who wish to downgrade from private residential property to HDB if they buy a 4-room or smaller resale HDB flat.Please note that the 15 months wait-out period is “a temporary measure” to moderate million-dollar HDB demand due to the continuous rise in volume and this temporary measure will be reviewed in the future depending on the housing demand and market conditions.

- For HDB owners buying private property

HDB owners only can proceed to buy a private property after they fulfill the Minimum Occupation Period (MOP), currently five years from the date of completion. If they purchase the private property first without selling their HDB flat or if they proceed to buy second properties, they will be subject to ABSD, TDSR, and LTV rules. You may refer to the below table for reference on how much more you need to pay should you below to this group.

8. Searching for the ideal property

Once you get your sum ready. We are free to start hunting for the property to buy. You may engage a professional property agent to help in the search and arrangement of the onsite physical viewing.

The agent should help you to shortlist suitable properties based on your requirements and budget for you to view. He will then assist you with all the price negotiation with the seller or seller’s agent.

“Engaging the right agent to do the job not only helps you save your time but also help you save even more than what you need to pay for a professional agent fee.”

For example, imagine the agent that you engage helps you to negotiate $20,000 lower more, but you are paying him/her some $5,000 fee. Isn’t a win-win situation?

Do give me a message or call if you need a professional agent to help you. I may be able to help you with a full range of services from a mortgage loan arrangement, sourcing of property, a legal firm link up, and all necessary documentation needed. Also, not forgetting the most important part to negotiate the best price for you?

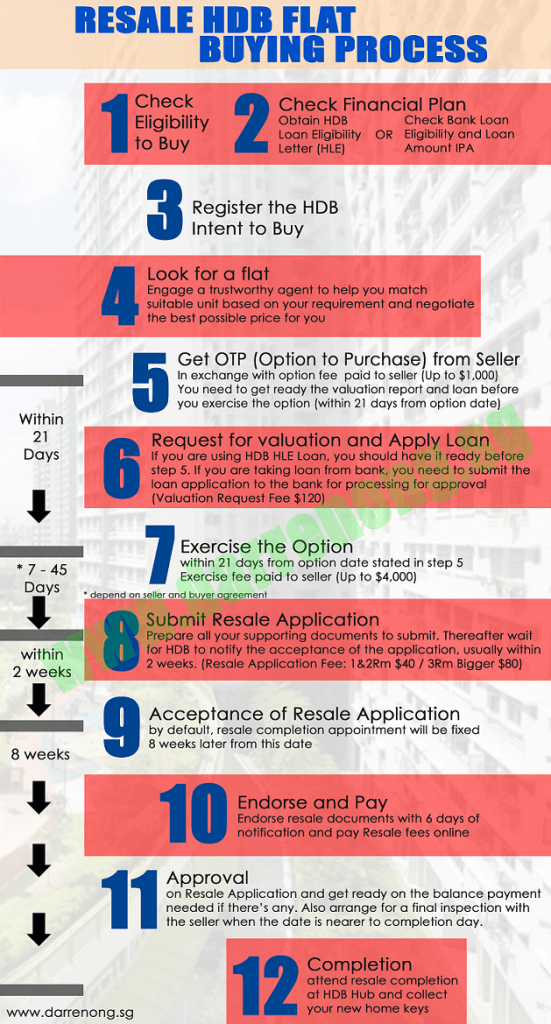

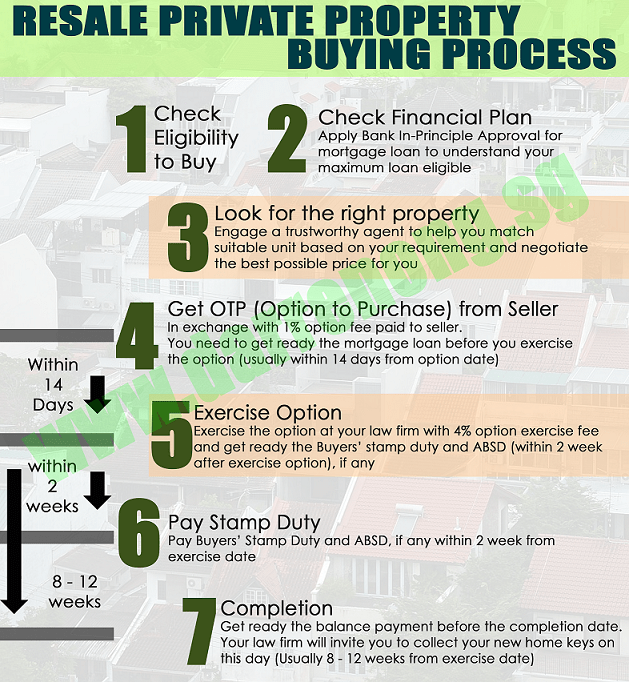

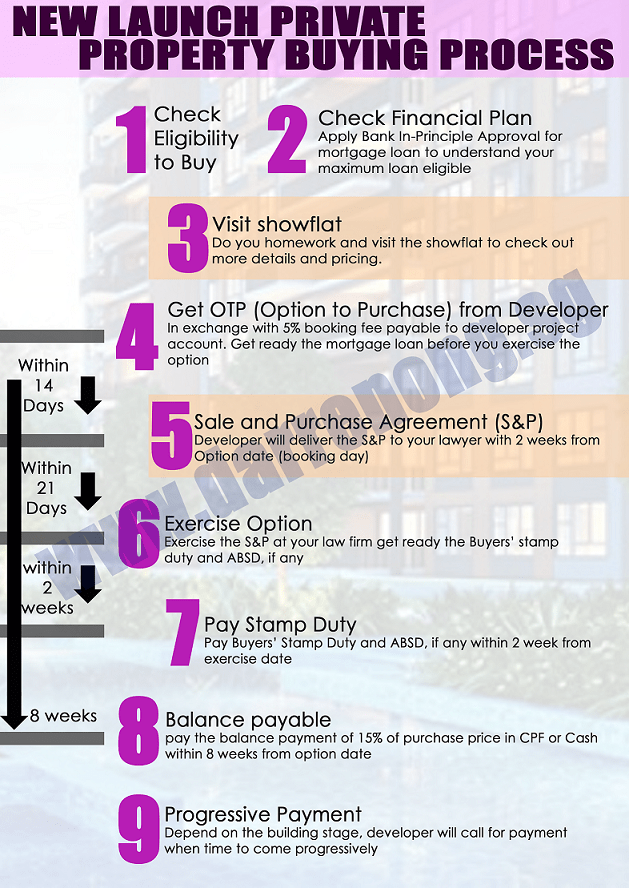

9. Timeline Matters

Lastly, the payment schedule that you should expect as well as the duration of the whole process until completion, where you will collect your new home keys. Let’s take a look at the standard timeline for now. I suggest you consult a professional property agent if you are in a more sophisticated situation.

For the new launch Executive Condominium (EC) timeline and how to go about purchasing, you may want to read more at my other topics “Where can you find an Executive Condominium (EC) in 2024.

10. Things to look out for when buying second properties

When purchasing second properties, it is not as straightforward as there are even more stringent rules to follow.

CPF fund saving usage restriction unless you fulfill the basic retirement sum, then you can use the balance CPF saving to purchase your second properties.

Also, you need to know about the tighten rules on Loan-to-Value (LTV), Additional Buyers’ Stamp Duty (ABSD), and Total Debt Servicing Ratio (TDSR) restriction and Property Asset Progression aka Property Wealth Planning.

You may want to read more on these topics below:

I hope the above guide clears some of your minds about buying a property in Singapore.

I welcome you to contact me for further discussion if you need any advice on purchasing property or restructuring your property portfolios, such as investing in new launch property or upgrading plans, etc.

I am more than willing to share and discuss. Cheer!