Table of Contents

Is Sell One Buy Two Properties Concept Workable?

You probably have heard or come across the “sell one, buy two properties” concept, and it has always been in the headline of many real estate investment marketing campaigns.

These marketing campaigns have often painted the ideas so nicely to homeowners that it is workable and achievable.

But I must caution you and be financially prudent in making such a move as there are many factors you need to consider in terms of risk management and financial management.

One of the reasons why “sell one buys two properties” as an investment is HDB tightens rules for the transfer of flat ownership!

From 1 April 2016, all HDB flat owners cannot transfer their flat ownership to a family member except for special circumstances.

It would mean that HDB owners cannot give up their HDB ownership by transferring to the spouse to purchase private property to avoid Additional Buyer Stamp Duty (ABSD). This method is more commonly used in the private property called decoupling or part-purchase. One of the owners will sell his/her share to the remaining owner/spouse and exit from the existing property so that his/her name is free up to purchase the second property.

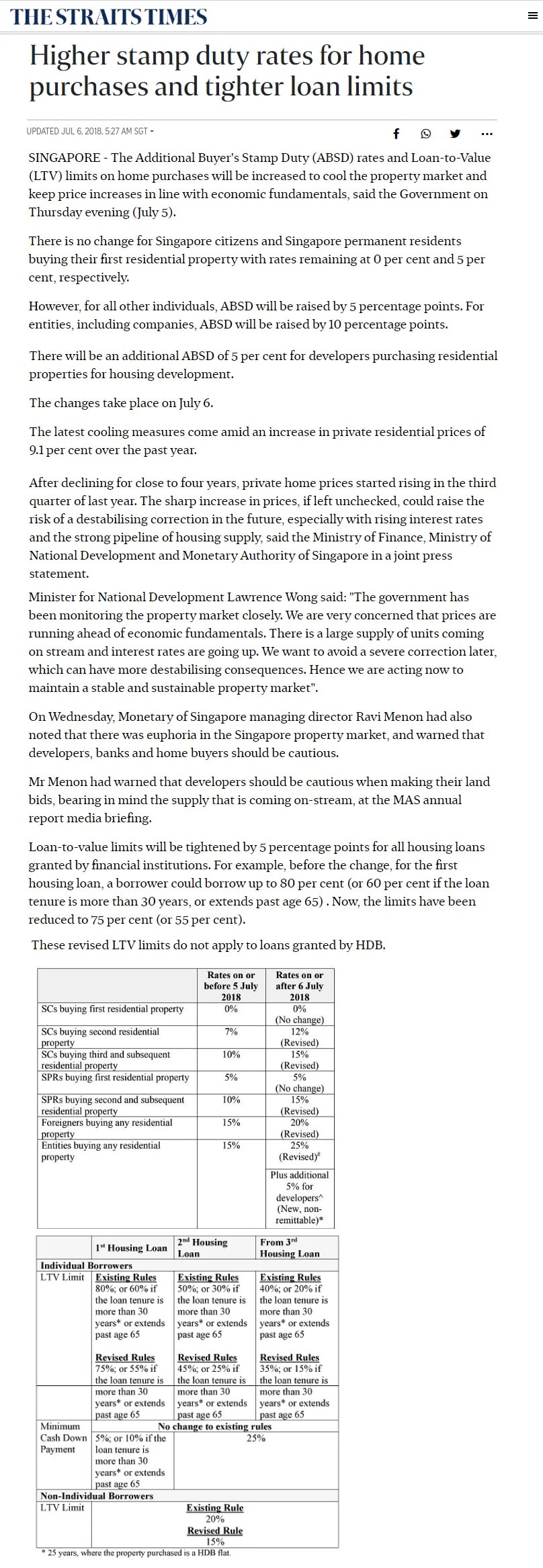

The other reasons why “sell one buys two properties” as an investment is because new property cooling measures announced with higher ABSD rates, tighter of loan limits!

About Additional Buyer Stamp Duty (ABSD)

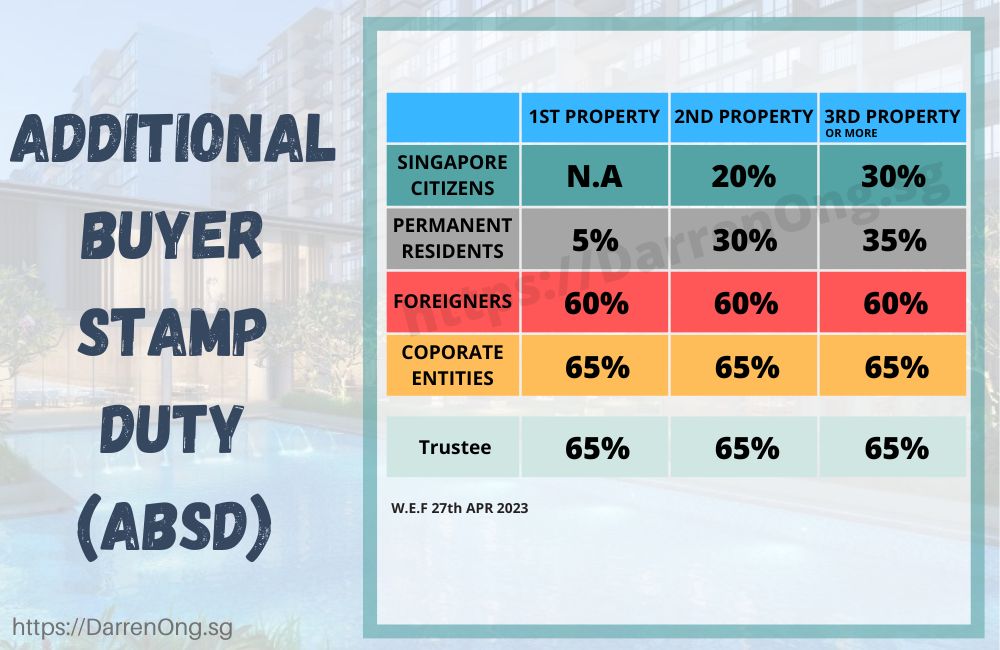

As you can see from the ABSD table below, the ABSD tax incurs for a Singaporean to purchase a second residential property is 20% additional on top of the existing Buyer’s Stamp Duty (BSD) and 30% extra for third or subsequent residential property with effect from 27th Apr 2023.

This would mean that for a $1 million property purchase price for purchasing a second property, you will need to fork out an additional $200k ABSD on top of the normal Buyer’s Stamp Duty (BSD).

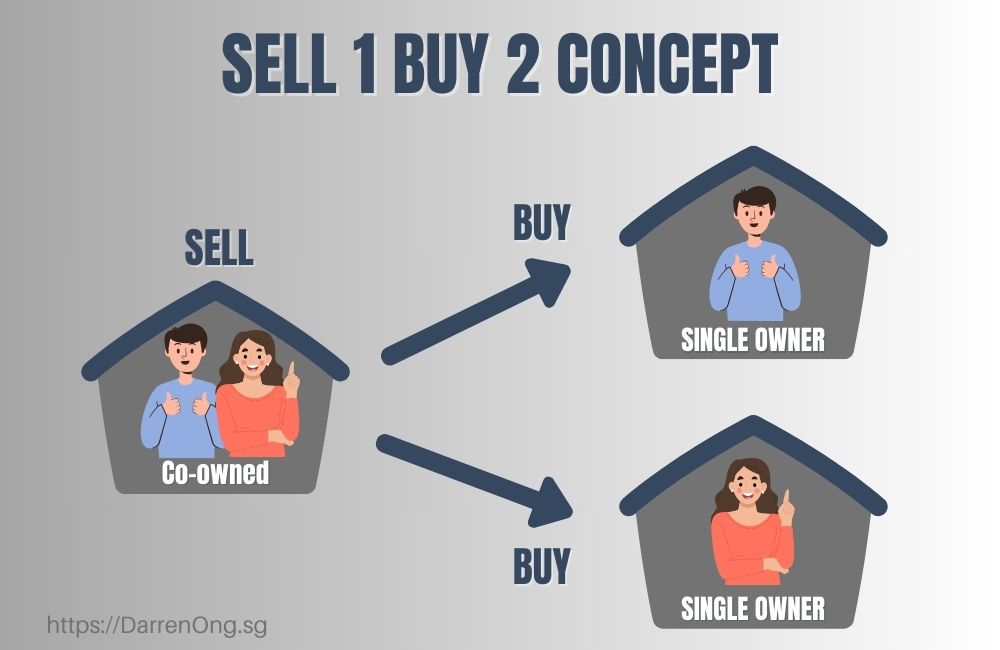

Thus, as mentioned earlier, due to HDB policy changes from 1 April 2016, flat owners cannot transfer their ownership to their family members or spouse. It is logically ideal to sell one and buy two if the married couple is considering investing in a second property while not willing to pay the extra ABSD tax.

Technically, many property agents will suggest to HDB homeowner couples by selling their co-owned HDB and buying one under each name (husband buy one and wife buy one). It would mean that the property count for each of them is still considered one where ABSD does not apply. Indirectly, the couple now owns two-property but one under each name.

Let’s take a look at the upside of selling one HDB to buy two private properties.

But is it workable for all couples?

There will be some form of risk each need to take in any form of investment. Thus it depends on the individual to take the risk on and how they are financially prudent. But surely there are Pros and Cons in doing so. Let’s examine it now.

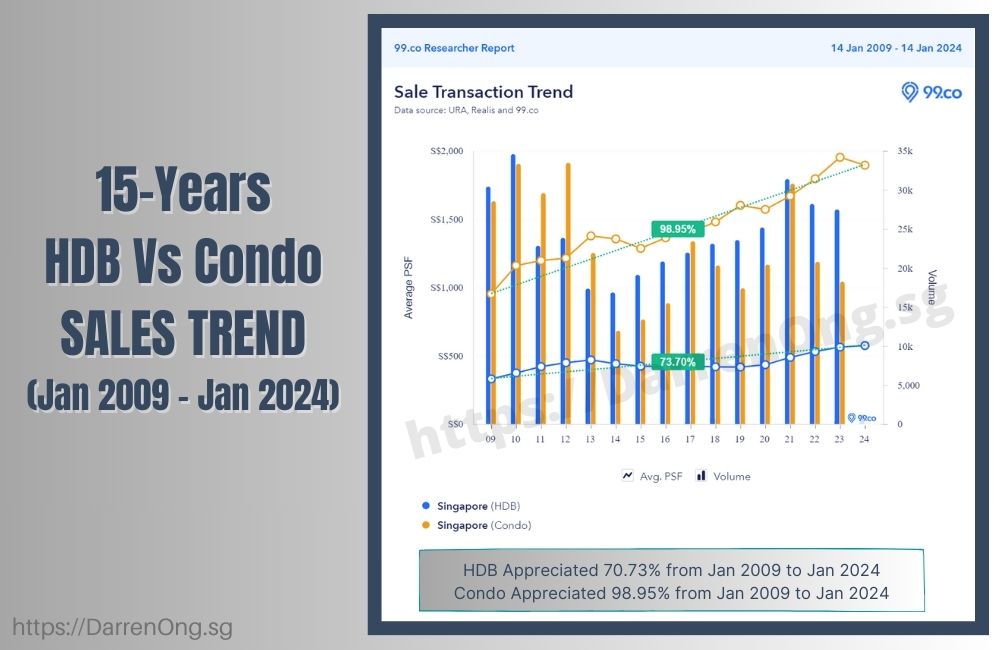

The chart shown above shows the HDB flat prices vs private condo prices for the past 15 years between 2009 and 2023.

The HDB flat prices dived downward 6 years between 2013 and 2019 when the government introduced a series of cooling measures to curb the property market in 2013. The cooling measures severely impacted the HDB market including tightening Loan-to-value (LTV), introducing mortgage servicing ratio (MSR), and restricting PR purchases unless obtained full three-year PR status.

On 10 March 2014, the government and HDB further curtailed negotiating cash-over-valuation (COV) by changing the process to remove the seller’s valuation request before granting Option to Purchase (OTP) to the buyer.

In late 2019, the government introduced the Enhanced Housing Grant (EHG) which saw some swing in buyers from the BTO to the resale flat. In the 2020 – 2023 period, due to COVID-19, the BTO flat encountered a slight delay in completion which further swung some of the buyers to the resale flat which pushed up the demand and the price in the resale flat and we saw it appreciate over the past 15 years was 73.70%.

But unlike HDB flats, private property in Singapore was not much affected when the cooling measure was introduced in 2013. We saw the private property market dip for two years and it started to appreciate. The average price for non-landed private property appreciated over the same period by 98.95%, as shown above from 2009 to 2023.

With the above few cooling measures, the HDB price index remains flat from 2013 to 2019 and only increases after 2020, with a lower appreciation for the past 15 years as compared to private property in terms of psf. Although the psf gain between HDB flats and private condos doesn’t seem to be huge, but if you look at the property value, it does make a big difference. Below is a simple illustration:

- Example 1: Assuming the HDB flat is priced at $500k. With a 73.70% gain, the dollar gain will be $368,500.

- Example 2: Assuming Condo priced at $1.5mil. With a 98.95% gain, the dollar gain will be $1,484,250.

Many well-informed HDB homeowner couples start to capitalize sooner possible by disposing of the HDB flat and renouncing their ownership once reached their Minimum Occupation Period (MOP).

After disposing of the HDB flat, the couple then purchases one private residential property from the resale market under one name (e.g., husband) for their occupancy and purchases one more from the new launch sale, under another name (e.g., wife) as an investment property. This way, as mentioned earlier, the property count under each of them is considered one property. Thus ABSD does not apply.

But financially, the couple would have to bag with heavier mortgage loans for two properties than just owning one HDB flat. Therefore, it is essential to have some financial knowledge in personal finances, CPF Ordinary Account (OA) saving and contribution, mortgage loan eligibility, and monthly mortgage repayment so as not to be caught in between any unforeseen circumstances.

Seem workable with “sell one buy two” concept? All you need is to be financially prudent and have some reserve cash and CPF saving to tide you over the challenging period if such a scenario occurs, and this investment concept could pay off and work well for you.

Whenever there is an upside, there must have some downside too.

Let’s take a look at the downside of selling HDB to buy two properties now.

There were up and down periods for the economy worldwide, especially in Singapore, as our country relies a lot on other big countries in our economy. In Nov 2019, The Business Times warned of the sluggish economy, being laid off, and depreciating property values. The Monetary Authority of Singapore (MAS) also cautious Singaporeans to think twice about the potential risks of such a “sell one buy two” property investment plan.

Shortly after the above Business Times news, the COVID-19 pandemic strikes our shore in early 2020. We see companies halting their operations during the circuit-breaker period between 7 April and 1 June 2020, and many workers lost their job due to the economic downturn and COVID-19 pandemic.

In 2020, the overall unemployment rate hits 2.9% in Singapore, the highest in more than a decade, and retrenchments doubled. In August, the Manpower Ministry further reported that the unemployment rate rose again and hits another record high at 3.4% climbs past the global financial crisis’ high recorded in Sept 2009. The current unemployment rate as of Q3 of 2023 was 2.0%, which shows some improvement, thus more possibility for dual-income per household.

To have a workable sell one buy two properties plan, both the husband and wife must have a monthly income to support the two mortgage loans for both the property, respectively.

Take an example of the current COVID-19 pandemic, if either one of you lost your job during this period. If you do not have enough savings to tide you over the challenging time while servicing the monthly mortgage repayment, your property may end up with a foreclosure sales or maybe end up forced to sell at a loss.

You may say that the government is giving a lending hand by introducing the repayment deferment for residential property loans for individuals during the COVID-19 pandemic. But do bear in mind that it is not always the case that the government has such temporary relief. Just take a look at the past; there is no such temporary relief during all pandemic or economic downturn.

Therefore, it should not consider the COVID-19 temporary mortgage deferment relief as it will be lifted and taken away and back to normal.

Suppose your investment property is well-located in the right location where you do not have to worry about being unable to secure tenants. In this case, you may not need to worry about being caught in unforeseen circumstances that may lead to forced to sell at a loss.

With the upside and downside explanation that I have shared, you must seriously evaluate your finances and select the right property to invest in when executing the “sell one buy two” plans.

“By now, you should have some ideas about the “sell one buy two” properties concept.”

Allow me also to share some of the finances pointers that you must take note of to determine if you are suitable for this approach.

Finances pointers for selling your HDB and buy two private residential properties plan:

- Available CPF Ordinary Account (OA) saving for the purchase after selling the HDB.

- Available cash proceeds + personal savings you have for the purchase after selling the HDB.

- Monthly CPF contribution v.s. Monthly mortgage repayment to determine any cash top, if necessary.

- Mortgage loan eligibility for the purchase.

- Research the potential rental yield, rental income, rentability of the investment property, and potential capital appreciation.

- Research on the potential capital gain from the investment property.

- Reserve CPF and cash saving after the purchase for a rainy day.

Finances pointers for keeping the HDB while buying investment private residential property plan:

- Available CPF Ordinary Account (OA) saving to the purchase after setting aside the Basic Retirement Sum (BRS).

- Available cash savings you have to purchase the investment property.

- Mortgage loan eligibility and Loan-To-Value Limit to buy the investment property based on either the first housing or second housing loans.

- Research the potential rental yield, rental income, rentability of the investment property, and potential capital appreciation.

- Research on the potential capital gain from the investment property.

- Additional Buyer’s Stamp Duty (ABSD) payable.

- Reserve CPF and cash saving after the purchase for a rainy day. (In a case investment property unable to rent out.)

On a side track, some of my clients, while they are keen on the sell one to buy two concepts, but after going through their finances with them, they realized that they are on the risky side of this concept thus didn’t proceed with the sell one buy two.

But among those who do not go ahead with the sell one buy two plan, many recognize that the HDB prices do not appreciate as much if not in a downward trend. Thus most still decided to sell their HDB and upgrade to just one private property for the time being and wait for the right opportunity before entering to buy their investment property in the future when they are ready.

Conclusion about sell one buy two properties plan

To sum it up, my first advice is to be financially prudent and don’t fall into the nicely painted plan on the advertisement, do your calculation, and the cost involved, not only the initial cost but also the monthly fee payable.

Secondly, do not jump into buying any property. Shortlist wisely and do your research. You may use the URA masterplan to do your research and identify potential areas to buy. You should shortlist rentable investment property with good potential capital appreciation where the property is sitting in the growth areas.

Lastly, please plan ahead and do not rush into it. Not all cases can execute the plan at one go. Some first-time investors plan it slightly longer to shortlist their investment property when they are ready after owning their first private residential property.

“In real estate, every sale, purchase, or investment plan is unique. There is no single property asset progression plan that is suitable for everyone. You got to plan and consider your available fund, timeline, profile, and needs to minimize risk and maximize gain.”

As one of my blog readers, and if you need some advice from me on which angle to plan and invest, I welcome you for a non-obligatory short friendly property wealth planning discussion.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls