Table of Contents

Singapore Property Market Outlook 2025: What's Next for Buyers and Investors?

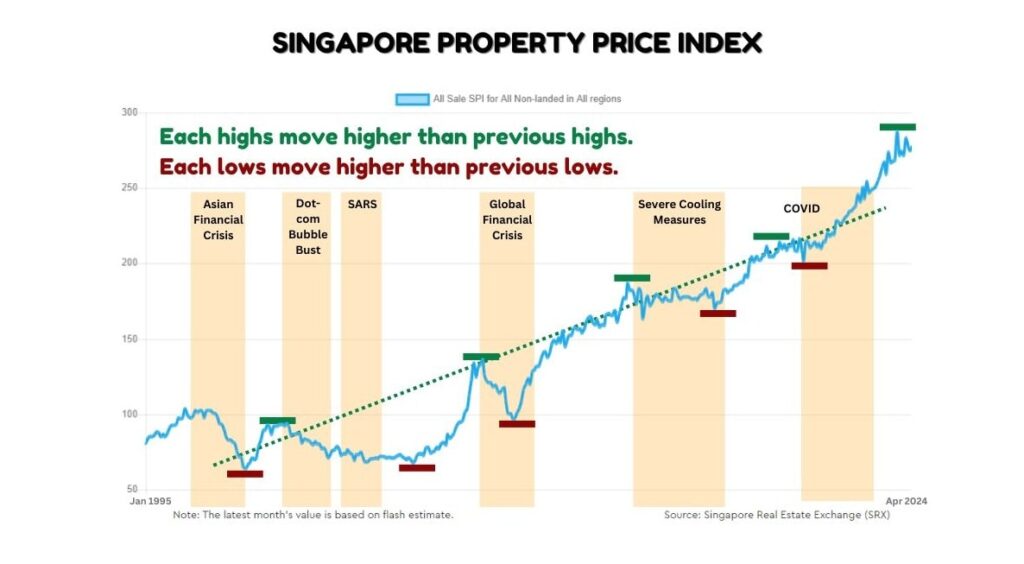

Singapore’s property market has long been regarded as a resilient and stable investment, attracting both local buyers and global investors. Over the past five years, property prices have climbed steadily, driven by strong demand, limited land supply, and a well-regulated financial environment. Despite multiple cooling measures and economic fluctuations, Singapore’s real estate sector has continued its upward trajectory, proving its strength as a long-term wealth-building asset.

As we enter 2025, a key question arises: Is now the right time to buy, upgrade, or invest? While property prices have seen consistent growth, the pace has moderated compared to previous years. Interest rates are expected to decline, improving affordability, but housing supply remains critically low, intensifying buyer competition. At the same time, the government continues to manage market stability through cooling measures, ensuring that price growth remains sustainable.

The balance between market opportunities and risks makes 2025 a pivotal year for homebuyers and investors. Understanding price trends, supply-demand dynamics, and financing conditions will be crucial in making well-informed decisions. This article provides a data-backed analysis of the Singapore Property Price Index, market sentiment, investment cycles, and key drivers shaping the real estate market. Whether you’re considering your first home, upgrading to private property, or looking for investment opportunities, having a clear view of the market landscape will help you decide whether to act now or wait for a better opportunity.

Global Market Performance & Strong Singapore Dollar: How It Affects Property Investment

Singapore’s property market is shaped not only by local demand and government policies but also by global economic trends and currency strength. As we step into 2025, financial markets worldwide have shown positive momentum, supporting investor confidence in real estate as a stable, long-term asset class.

Over the past year, major financial indices—including the S&P 500, Straits Times Index (STI), Hang Seng Index (HSI), and Shanghai Stock Exchange (SSE)—have recorded steady growth, reflecting economic recovery and investment optimism. Alternative assets such as gold and Bitcoin have also gained value, further signaling a shift toward wealth preservation and safe-haven investments.

The strength of the Singapore Dollar (SGD) reinforces the city-state’s position as a secure investment destination. Over the last five years, the SGD has outperformed major global currencies, including the Japanese Yen (JPY), Malaysian Ringgit (MYR), British Pound (GBP), Euro (EUR), and Australian Dollar (AUD). Even against the US Dollar (USD), the SGD has remained stable, showcasing Singapore’s strong financial fundamentals and economic resilience.

A stable and appreciating currency attracts wealth migration from high-net-worth individuals and institutions, boosting demand for prime properties in Singapore. Even with the 60% Additional Buyer’s Stamp Duty (ABSD) on foreign buyers, wealthy investors see Singapore as a safe and strategic location to preserve capital. Family offices, in particular, have been on the rise, managing over $100 billion in assets, further strengthening market liquidity.

For local buyers and investors, a strong currency and financial market recovery present both opportunities and challenges. While foreign capital inflows support property price stability and growth, increased demand for premium properties may intensify competition in certain segments. However, as Singapore remains a global financial hub with a well-regulated property market, it continues to be a top choice for long-term real estate investment.

Family Offices & Wealth Migration: What It Means for Singapore Property

Singapore has emerged as a global wealth hub, attracting ultra-high-net-worth individuals (UHNWIs) and family offices seeking financial security, political stability, and business-friendly regulations. Over the past few years, the number of family offices in Singapore has surged, managing over $100 billion in assets, reinforcing Singapore’s position as a preferred destination for wealth preservation and investment.

A family office is a private wealth management entity set up by wealthy families to oversee investments, estate planning, and succession management. Singapore’s low corporate tax rates, attractive financial ecosystem, and strong legal framework make it an ideal location for these entities. The 13O and 13U tax incentive schemes further incentivize family offices, allowing them to manage their funds with tax exemption, increasing their ability to deploy capital efficiently.

While foreign buyers face a 60% ABSD on residential property purchases, this has not significantly deterred wealth migration. Instead, foreign investors can channel their funds into alternative property investments, such as commercial real estate, office spaces, and real estate investment trusts (REITs), subject to lower stamp duties. Some also explore structured investment vehicles to optimize tax efficiency while still benefiting from Singapore’s stable real estate market.

The growth of family offices and institutional wealth in Singapore supports long-term property price stability. Additionally, the rise of global wealth management activities contributes to rental demand, as expatriate professionals managing these family offices seek high-quality housing in prime districts.

For local buyers, the increase in foreign capital and high-net-worth investors may add competition for prime assets, particularly in luxury properties. However, this also reinforces the resilience of Singapore’s property market, making it an attractive investment destination for those seeking stable capital appreciation and rental income potential.

Singapore Property Market Sentiment: Are Investors Feeling Optimistic?

Market sentiment plays a crucial role in shaping buyer confidence, pricing trends, and investment decisions. Singapore’s property market has demonstrated resilience in recent years, adapting to global uncertainties, rising interest rates, and government cooling measures. As we enter 2025, the outlook remains cautiously optimistic, with key indicators suggesting a stable and growing market.

According to the NUS Singapore Residential Price Expectations Index (NUS SRPI), market confidence rebounded in Q3 2024, reflecting increased optimism among developers and buyers. Stronger-than-expected price performance across all property segments and expectations of interest rate cuts have encouraged buyers to re-enter the market. Developers have also raised price benchmarks for new launches, signaling confidence in sustained demand.

Several factors are shaping sentiment for 2025. Falling mortgage rates are expected to improve affordability, attracting more first-time buyers and upgraders. The limited housing supply, particularly in the OCR (Outside Central Region) and RCR (Rest of Central Region), continues to create competitive buying conditions, supporting price stability. Additionally, high rental demand from expatriates and professionals in the finance, tech, and wealth management sectors reinforces the attractiveness of property investment.

However, cautious sentiment persists among some buyers, particularly those concerned about cooling measures and affordability constraints. While government policies ensure that price growth remains sustainable, some buyers may adopt a wait-and-see approach, hoping for further interest rate cuts or price corrections. That said, past trends indicate that Singapore’s property market rarely experiences sharp declines, and buyers who wait too long may face higher prices and increased competition later.

Overall, the 2025 property market outlook remains balanced, with favorable interest rate movements, strong local demand, and limited supply supporting price resilience. While short-term fluctuations may occur, the long-term fundamentals of Singapore’s real estate sector remain strong, reinforcing confidence among investors and homebuyers alike.

Understanding the Real Estate Investment Clock & Market Cycle

The real estate market moves in cycles, transitioning through periods of expansion, peak growth, slowdown, and recovery. Recognizing where Singapore’s property market stands in this cycle can help buyers and investors make more informed decisions on when to enter the market.

In 2025, key indicators suggest that Singapore is in the recovery phase, where prices are still rising but have not yet reached their peak. Housing supply remains low, while demand from HDB upgraders and investors remains strong. With interest rates expected to decline, financing conditions are set to improve, making it an opportune window for those considering an upgrade or investment.

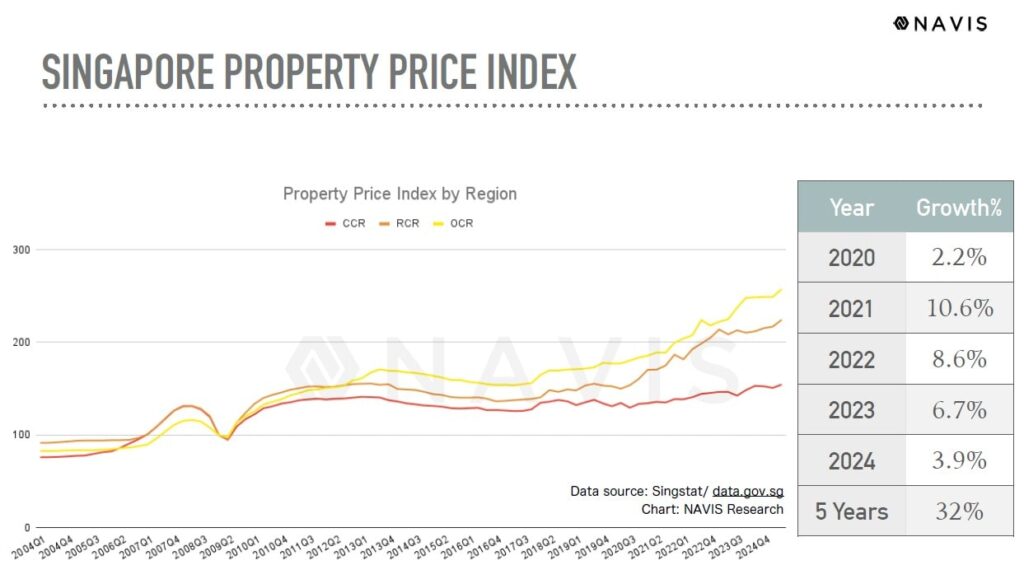

Singapore’s real estate cycle has historically been more stable than other global markets, primarily due to government intervention (property cooling measures) and controlled land supply. Unlike speculative property markets that experience sharp booms and busts, Singapore’s price movements are gradual and sustainable. Even during economic downturns, property values tend to correct mildly rather than collapse, reinforcing the market’s long-term resilience.

However, buyers should also consider that the property cycle does not guarantee uninterrupted price increases. While current conditions support continued growth, external factors—such as unexpected global economic shifts or additional cooling measures—could slow price appreciation. Nonetheless, past trends indicate that demand eventually returns, and waiting for a significant dip in prices may not always be the best strategy.

For those who are financially ready, entering the market during the recovery phase allows buyers to benefit from price appreciation before the market reaches its next peak. Investors looking for rental income opportunities may also find this an optimal time to enter, as rental demand remains strong, particularly in the RCR and OCR regions.

Ultimately, understanding the property cycle helps buyers time their purchase wisely, ensuring they enter at a stage that aligns with their financial goals and market expectations.

Singapore Property Price Index: Data-Backed Growth Trends

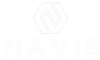

Property prices in Singapore have been on a steady long-term uptrend, supported by strong local demand, limited land supply, and government policies that prevent excessive speculation. Over the past five years, private residential prices have increased by 32%, with 2024 alone recording a 3.9% growth. While price appreciation has moderated compared to previous years, market fundamentals remain solid, and prices are expected to remain resilient in 2025.

A key turning point in Singapore’s real estate landscape was the 2013 introduction of the Total Debt Servicing Ratio (TDSR), which significantly reduced market volatility and speculative buying. Prior to TDSR, property prices experienced sharper swings, but the new loan framework has ensured more controlled and sustainable price movements. As a result, Singapore’s real estate market has become less prone to sudden crashes, reinforcing its stability as an investment asset.

Different property segments have performed at varying rates, with some outperforming others based on buyer demand and location. The Rest of Central Region (RCR), which includes city-fringe condos, has been the strongest performer, recording about 6.5% price increase in 2024 and about 39.1% growth over the past five years. This segment continues to attract HDB upgraders and investors looking for affordability and proximity to the city.

Meanwhile, the Outside Central Region (OCR), consisting of suburban condos, saw a 3.9% price increase in 2024 and about 38.1% growth over five years. The demand for mass-market condos remains robust, fueled by HDB upgraders transitioning into private housing. With a limited pipeline of new launches, prices in this segment are expected to stay firm.

In contrast, Core Central Region (CCR) properties—comprising high-end, luxury condos—grew by about 4% in 2024 and about 14.7% over five years. While foreign cooling measures have slowed foreign investor activity, demand from family offices and ultra-high-net-worth individuals remains stable, supporting price resilience in this segment.

HDB resale flats have been the best-performing segment, with about 9.3% price increase in 2024 and about 41.2% growth over the past five years. The rise of million-dollar HDB transactions and a limited supply of resale flats have contributed to this surge, making public housing an increasingly valuable asset.

Looking ahead, 2025 is expected to be another year of stable price movements, with limited supply and strong upgrader demand continuing to support prices. While external risks such as global economic uncertainty and government policies may influence short-term price trends, Singapore’s long-term property outlook remains positive due to controlled supply, strong economic fundamentals, and sustained demand.

Interest Rates & Inflation: What’s Next for Property Affordability?

Interest rates and inflation play a critical role in shaping property affordability and buyer sentiment. Over the past two years, rising interest rates led to higher mortgage costs, making some buyers more cautious. However, with inflation cooling and interest rates expected to decline, 2025 could bring a more favorable financing environment for homebuyers and investors.

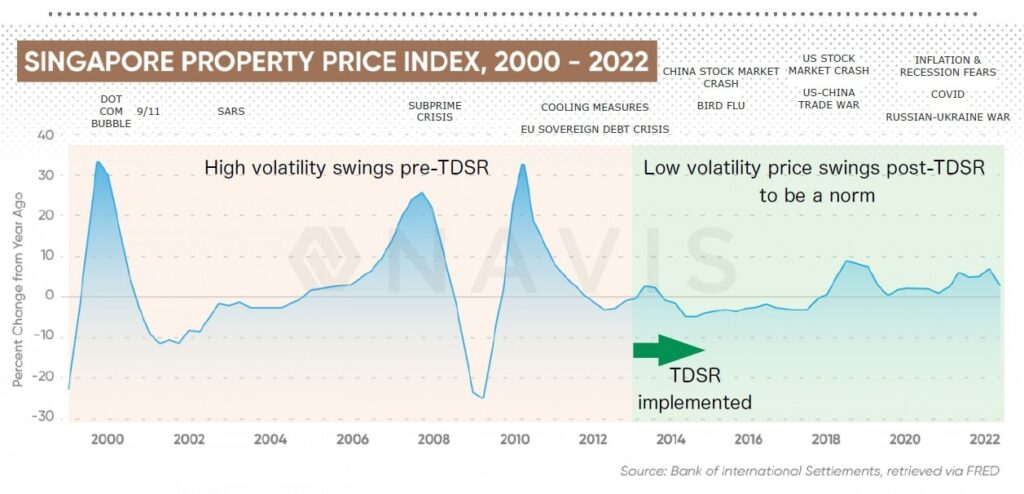

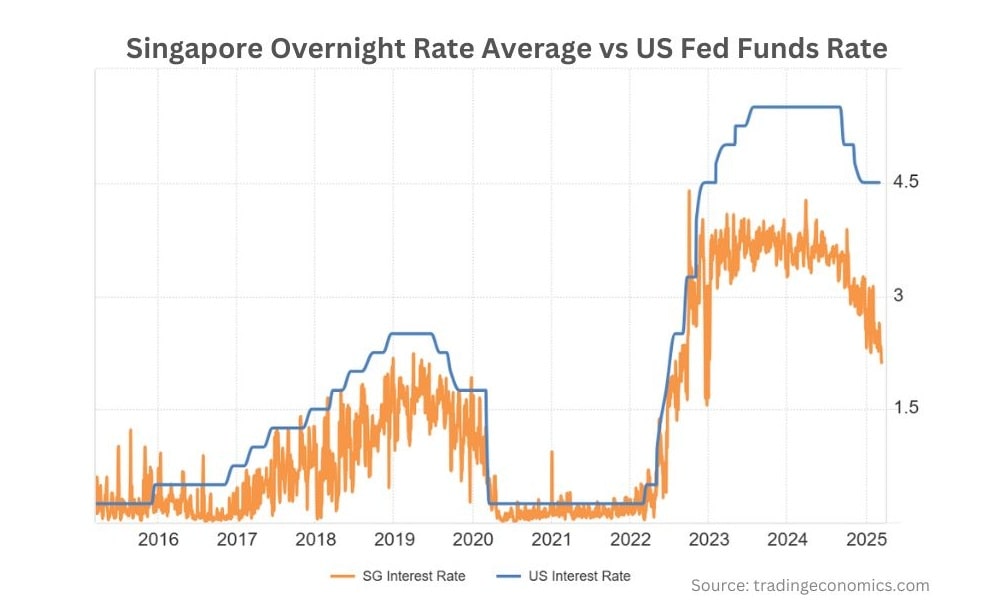

The US Federal Reserve has signaled potential rate cuts between 2025 and 2027, which will directly impact Singapore’s lending rates. As a result, the 3-Month SORA (Singapore Overnight Rate Average), which influences home loan rates, is expected to trend lower. Banks have already started offering more competitive fixed-rate mortgage packages, reflecting the market’s expectations for lower borrowing costs.

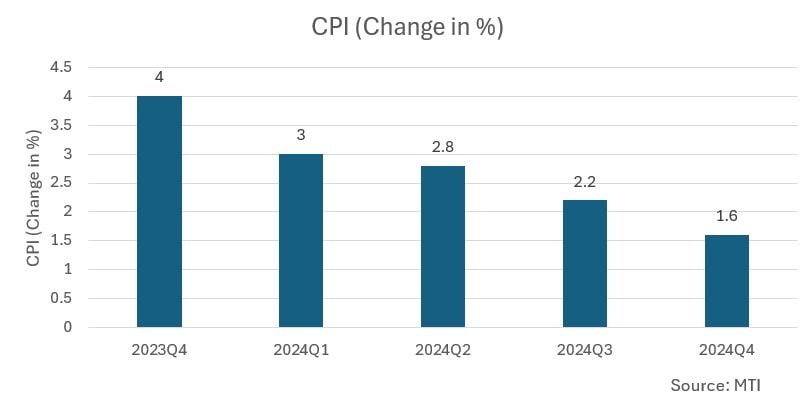

Inflation in Singapore remains moderate, with the Core Consumer Price Index (CPI) stabilizing around 2%. Historically, property prices have outpaced inflation, making real estate an attractive hedge against rising costs. With mortgage rates expected to hover around 2-3% in the next few years, buying conditions could improve, prompting more buyers to enter the market before property prices climb further.

A lower interest rate environment means better affordability and higher loan eligibility for those planning to upgrade or invest, particularly for buyers leveraging their CPF and mortgage financing. That said, buyers should remain cautious of short-term fluctuations, as global economic uncertainty could delay the pace of interest rate reductions.

While affordability is improving, property prices remain firm due to supply-demand imbalances. Those who wait for significantly lower rates may find themselves competing in a stronger market with higher prices. Given these factors, 2025 presents a window of opportunity for buyers who are financially ready to enter the market before competition intensifies.

Federal Reserve Interest Rate Forecast (2025-2027) & 3-Month SORA Impact

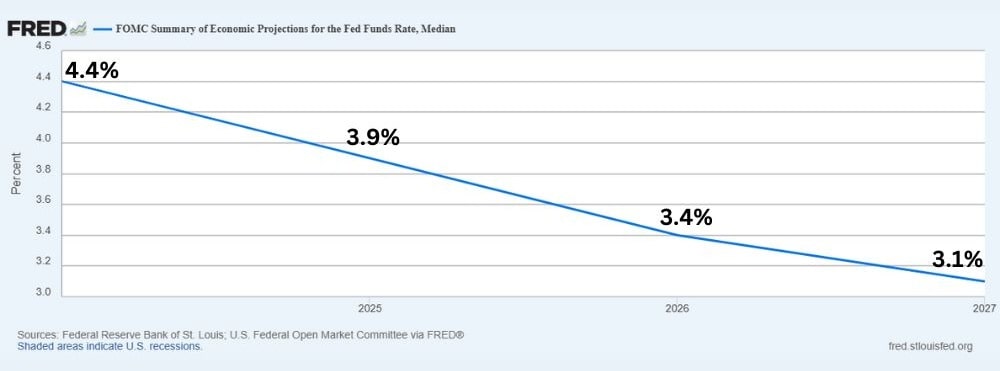

Interest rate movements in Singapore are closely linked to the US Federal Reserve (Fed), as global monetary policy influences local lending rates. Over the past two years, aggressive Fed rate hikes have led to higher mortgage rates in Singapore, cooling buyer sentiment and increasing financing costs. However, the outlook is changing, and the Fed is expected to cut interest rates gradually between 2025 and 2027, signaling a shift toward a more favorable borrowing environment.

The latest Fed projections suggest that rates could fall from 3.9% in 2025 to 3.1% by 2027, provided that inflation remains under control. As a result, Singapore’s 3-Month SORA rate—which determines mortgage rates—will likely decline in tandem, making home financing more affordable. Local banks have already begun adjusting their fixed-rate home loan packages, offering lower interest rates in anticipation of the coming rate cuts.

For homebuyers, this means that mortgage repayments may gradually decrease over the next few years, improving affordability and increasing purchasing power. Investors may find greater opportunities in rental properties, as lower borrowing costs can enhance rental yield potential.

However, buyers should remain mindful that interest rate reductions do not immediately translate into lower property prices. A lower interest rate environment often fuels increased demand, which could drive prices higher, especially in high-demand segments like OCR and RCR condos.

For those considering an upgrade or investment, locking in a property before rates fall further could be a strategic move. Competition may intensify once financing becomes more attractive to a larger pool of buyers. With the Fed signaling a gradual easing cycle, timing the market wisely can help buyers optimize both affordability and investment returns.

3-Month SORA vs U.S. Fed Funds Rate: What It Means for Refinancing & New Buyers

The 3-Month SORA (Singapore Overnight Rate Average) is the key benchmark used by banks to determine floating home loan rates in Singapore. It is closely influenced by global interest rate movements, particularly the US Federal Reserve’s (Fed) policy decisions. As the Fed prepares to lower interest rates between 2025 and 2027, Singapore’s SORA rate is also expected to decline, improving borrowing conditions for homebuyers and existing homeowners with mortgages.

Historically, when the Fed cuts rates, SORA follows with a slight lag, leading to lower mortgage rates in Singapore. Currently, mortgage rates are in the mid-2% range, but as rate cuts take effect, home loan packages could drop to around 2% or even lower in the coming years. This presents a window of opportunity for refinancing, as homeowners with higher locked-in rates may benefit from switching to lower-cost loans.

Lower SORA rates mean improved loan affordability and increased borrowing capacity for new homebuyers, making home purchases more attractive. However, as mortgage financing becomes more affordable, demand for properties could rise, particularly in high-demand segments like mass-market OCR condos and city-fringe RCR properties. Buyers waiting for the “perfect time” may find that while mortgage rates improve, property prices also edge higher due to stronger demand.

Monitoring SORA trends is crucial for those currently financing their homes at higher rates, as refinancing at the right time could lead to substantial long-term savings. Fixed-rate mortgage holders may also consider switching to floating-rate loans if the interest rate cycle enters a prolonged decline.

With rate cuts on the horizon, timing will be key for buyers and homeowners looking to optimize their mortgage strategy, ensuring they maximize affordability while securing a property at the right price.

Odds Favor Further Growth as Interest Rates Decline

History suggests that property prices in Singapore tend to rise in response to downward interest rates. While this is not a guaranteed outcome, lower borrowing costs typically increase affordability, encourage buying activity, and drive up demand, especially in high-growth segments such as OCR and RCR private condos.

Local banks have already factored in the expected rate cuts by adjusting their home loan offerings. Some banks are now offering fixed-rate mortgages below 2.5%, reflecting market expectations that interest rates will continue declining. This shift in financing conditions creates a more favorable environment for homebuyers, making it easier for buyers to secure larger loan amounts with lower monthly repayments.

However, property price appreciation will also depend on external economic conditions. If Singapore experiences strong GDP growth, employment remains stable, and demand continues to outpace supply, prices could see steady growth. On the other hand, if global uncertainties weigh on market confidence, price movements may be more moderate.

Another factor to consider is that falling interest rates encourage more buyers to enter the market, leading to greater competition for limited inventory. With the supply of new private homes below the 10-year average, buyers who wait too long may find themselves competing in a stronger market with higher prices.

Understanding the relationship between interest rates and demand cycles is key to making timely investment decisions for both first-time homebuyers and investors. With financing conditions improving and supply remaining tight, 2025 presents a window of opportunity for buyers who are financially prepared to enter the market before competition intensifies further.

Are There Good Reasons to Remain Bullish on the Market?

Despite ongoing cooling measures and global economic uncertainties, strong underlying factors support Singapore’s property market resilience. The combination of limited housing supply, sustained demand from HDB upgraders, and improving financing conditions all contribute to a positive long-term outlook.

One key reason for optimism is Singapore’s controlled land supply. The government carefully regulates land release through Government Land Sales (GLS) and en bloc redevelopment, ensuring supply remains measured and sustainable. Unlike other markets that experience oversupply-driven price crashes, Singapore’s property market remains fundamentally well-supported.

Another crucial factor is strong domestic demand. With more HDB flats reaching their Minimum Occupation Period (MOP) between 2025 and 2027, a new wave of upgraders is expected to enter the private property market. Many of these homeowners have seen substantial capital gains from their HDB flats, giving them the financial capability to transition to private homes, particularly in the OCR and RCR segments.

Additionally, Singapore’s economic stability and safe-haven status continue to attract high-net-worth individuals, family offices, and institutional investors, further strengthening the luxury property segment in the Core Central Region (CCR). Even with higher Additional Buyer’s Stamp Duty (ABSD) for foreigners, the inflow of global capital into Singapore remains significant, particularly through commercial property and alternative real estate investments.

While external risks such as inflation and global economic uncertainty may introduce short-term volatility, Singapore’s well-regulated property market has historically demonstrated strong recovery patterns. Past trends show that after each period of moderation caused by cooling measures or external shocks, the market eventually rebounds, driven by fundamental supply-demand imbalances.

For buyers and investors, this means that while price movements may not always be linear, the long-term trajectory remains upward. With interest rates expected to decline and the housing supply remaining tight, 2025 presents an opportunity for those who are financially ready to enter the market before competition intensifies further.

Housing Supply vs Demand (2024-2028): Why Shortages Persist & Prices Stay Firm

The persistent imbalance between housing supply and demand is a key driver of Singapore’s property market resilience. While the government manages land supply carefully, private residential completions remain well below historical averages, intensifying buyer competition. At the same time, demand remains strong, particularly from HDB upgraders, rental tenants, and long-term investors, ensuring that prices stay firm despite market fluctuations.

Limited Private Housing Supply: Not Enough to Meet Demand

Between 2025 and 2027, the number of new private residential units completed each year will remain significantly below the 10-year average of 12,000 units per year. The projected supply for the coming years is about 5,300, 7,600, and 11,000 units for 2025, 2026, and 2027, respectively.

With fewer new homes coming onto the market, competition for available units is expected to remain tight, particularly in the OCR and RCR segments, where most HDB upgraders seek to buy. The slowdown in Government Land Sales (GLS) and en bloc transactions further limits developers’ ability to replenish landbanks, restricting future supply growth.

Additionally, the number of resale HDB flats reaching the Minimum Occupation Period (MOP) in 2025 is expected to be the lowest in 11 years, at just 6,974 units. A lower supply of MOP flats means fewer upgraders entering the private market, keeping HDB resale prices firm and limiting resale private property transactions.

HDB BTO Launches: Expanding Supply, but Not an Immediate Solution

To address long-term housing needs, the HDB plans to launch over 50,000 Build-To-Order (BTO) flats between 2025 and 2027, exceeding its previous five-year targets. While this will provide more options for first-time buyers, it does not immediately relieve supply shortages, as these flats take time to complete the construction, typically 3 – 5 years.

In the short term, the number of available resale flats will remain constrained, forcing some buyers to turn to private housing, thereby maintaining demand pressure on OCR and RCR resale properties.

Developers Holding Firm on Prices: No Urgency to Discount

Unlike previous property cycles where excess unsold inventory led to price reductions, developers in 2025 are holding firm on pricing due to:

- Controlled land supply – Fewer GLS sites and en bloc transactions limit new project launches.

- High construction and material costs – Rising costs reduce developers’ ability to offer discounts.

- Strong buyer demand – Many new launches continue to sell well, particularly in mass-market and city-fringe locations.

With the quarterly unsold supply pipeline remaining below historical levels, developers are under no pressure to offer steep price cuts. Instead, prices are expected to remain stable or gradually appreciate, especially for projects in high-demand locations with limited competing supply.

What This Means for Buyers: Prices Likely to Stay Firm

For buyers hoping for a price dip, waiting for a major correction due to oversupply is unlikely to be a successful strategy. With low new completions, controlled developer pricing, and strong upgrader demand, private property prices are expected to hold firm or appreciate gradually over the next few years.

- HDB upgraders should expect stable resale prices and limited resale supply, pushing demand toward private housing.

- Investors should note the tight rental market, where supply remains constrained, and rents are expected to stay strong.

- New homebuyers should recognize that developers are setting new price benchmarks, particularly in OCR and RCR projects, and adjust expectations accordingly.

While market cycles can fluctuate, Singapore’s property market remains structurally sound, with strong fundamentals supporting long-term price appreciation.

New Launch Exit Strategy in 2028: Why Buying Now Could Be Advantageous

For buyers considering a new launch property in 2025, an important factor to assess is the exit strategy—particularly if they plan to sell after the three-year Seller’s Stamp Duty (SSD) period. Given current market conditions, buyers who enter the market may find themselves well-positioned for appreciation by 2028.

One of the biggest advantages of buying in 2025 is the low supply of new private homes. With private residential completions remaining below the 10-year average, the number of available resale properties will be limited by the time new launch buyers look to exit in 2028. At the same time, demand is expected to remain strong, particularly from HDB upgraders and investors looking for well-located private homes.

Another factor is the expected decline in interest rates over the next few years. If borrowing costs continue to ease, financing becomes more attractive, drawing more buyers into the market and increasing demand for resale units in 2028. Those who buy in 2025 could benefit from capital appreciation and increased market liquidity when choosing to exit.

From an investment perspective, new launch properties typically appreciate over the construction period as developers gradually raise prices in later sales phases. Buyers who secure units early in the launch cycle often benefit from capital gains when the project reaches Temporary Occupation Permit (TOP), typically three to four years after launch. This appreciation, combined with strong resale demand in 2028 due to limited supply, presents an opportunity for those planning a short- to mid-term investment strategy.

However, selecting the right project remains crucial. Buyers should assess factors such as location, developer reputation, rental demand, and price entry points to maximize their potential returns. While general market conditions favor long-term appreciation, choosing the right property will enhance the ability to exit profitably when market conditions are favorable.

For those considering a purchase, 2025 may offer an optimal entry point. This allows buyers to secure a property at pre-peak pricing, hold through the construction period, and benefit from increased demand by 2028 when resale supply remains tight.

Where Should Buyers Focus in 2025? Key Opportunities Based on Buyer Needs

As 2025 unfolds, buyers need to align their property choices with their financial goals, eligibility, and market conditions. Whether leveraging financing options, seeking an immediate home, or prioritizing investment potential, different segments of the market offer distinct advantages.

New Launch Condos: Best for Buyers Leveraging Progressive Payment

New launch condos provide the progressive payment scheme for those looking to minimize upfront financial commitments, allowing buyers to pay in stages as the project is built. This financing structure is especially beneficial for buyers who:

- Want to manage their cash flow more efficiently rather than commit to a full mortgage immediately.

- Expect their income to grow over the next few years, making the future mortgage more affordable.

- Prefer a brand-new home with the latest facilities and designs, often at a price lower than completed resale units in prime locations.

However, buyers must factor in price benchmarks as new launch units are typically priced at a premium, and OCR, RCR, and CCR projects are setting new price records. Early-phase buyers tend to benefit from capital appreciation as developers gradually increase prices throughout the launch cycle.

New Executive Condominiums (ECs): A Privileged Opportunity for Eligible Buyers

Executive Condominiums (ECs) remain one of the best value buys. They are priced lower than private condos but appreciate over time, especially after their full privatization in 10 years. However, they are only available to eligible Singaporeans who meet income and ownership requirements, making them an exclusive opportunity.

For those who qualify, ECs offer:

- Lower entry prices than private condos make them an affordable gateway into private housing.

- Potential for strong capital appreciation as ECs transition into full private condos after 10 years.

- High demand from HDB upgraders, ensuring a strong resale market post-MOP.

Given the limited supply of ECs, competition is expected to be strong, and prices will likely continue rising as demand outstrips availability.

Resale Private Property: Ideal for Immediate Occupancy & Rental Income

For buyers who need a home right away or are looking to generate rental income, resale private properties offer several advantages:

- Immediate occupancy, without the waiting time required for new launch construction.

- There is a wider selection of locations and unit types, as resale condos are available across mature estates and prime districts.

- Rental opportunities, particularly in the RCR and OCR properties, and demand from expatriates and professionals remain strong.

With limited new supply and continued demand from upgraders, resale prices in well-located projects are expected to remain firm. Investors who secure properties in high-rental-demand areas may benefit from both rental yield and future capital appreciation.

2025 Buyers Should Adjust Expectations: New Price Benchmarks & Investment Potential

Regardless of which segment buyers choose, 2025 will introduce new price benchmarks for new private condominiums and executive condominiums across different regions:

- OCR new launches condo: $2,200 – $2,700 PSF

- RCR new launches condo from $2,600 – $2,800 PSF

- CCR new launches condo from $3,000 PSF

- New executive condominium from $1,600 PSF

With rising land costs and supply constraints, these pricing levels reflect the new norm. Buyers must realign their expectations and recognize that waiting for prices to drop may not be a realistic strategy. Instead, focusing on long-term appreciation potential, rental demand, and strategic financing options will ensure better investment outcomes.

Final Thought: Which Option is Right for You?

Each property segment presents unique advantages depending on the buyer’s goals. New launch condos offer the flexibility of progressive payment, ECs provide privileged access to subsidized private housing, while resale private properties allow immediate rental income or occupancy. As supply remains tight and financing conditions improve, 2025 presents an opportunity for buyers ready to enter the market with a clear strategy.

Conclusion: Should You Enter the Singapore Property Market in 2025?

As we move into 2025, the Singapore property market remains resilient, supported by limited supply, strong upgrader demand, and an improving interest rate environment. While property prices continue to set new benchmarks, buyers should focus on long-term investment potential rather than short-term speculation.

For those considering a purchase, timing the market perfectly is nearly impossible. Historical trends show that Singapore’s property prices rarely experience sharp declines as the government carefully manages supply and demand. Buyers waiting for a significant price drop may find themselves facing even higher prices later due to rising demand and land costs.

Instead, buyers should assess their financial readiness and objectives before making a decision:

- First-time buyers can take advantage of progressive payment schemes in new launches or consider the resale of private properties for immediate occupancy.

- HDB upgraders should plan their move carefully, as the number of BTO MOP flats remains low, sustaining demand for resale properties.

- Investors looking for rental yield and long-term appreciation should focus on well-located OCR and RCR properties, where rental demand is strongest.

Additionally, buyers must adjust expectations to new price benchmarks in 2025, as OCR, RCR, and CCR new launches and new executive condominiums are expected to be priced higher than in previous years. Those who enter early in a launch cycle often benefit from lower entry prices and potential capital appreciation over time.

Ultimately, 2025 presents opportunities for financially prepared buyers who take a strategic approach. With interest rates expected to decline gradually, housing supply remaining below historical levels, and demand from HDB upgraders and foreign wealth migration staying strong, the long-term fundamentals of Singapore’s property market remain solid.

For those ready to act, the key is to make informed decisions based on affordability, financing options, and future market trends—rather than waiting for the perfect moment that may never come.

Making a property move is a significant step, and like any important decision, it should be based on facts, thorough assessment, and sound judgment rather than speculation or market noise. Every buyer’s situation is unique, and what works for one person may not be the right path for another.

As a professional real estate consultant, my role is to analyze your position, assess market conditions, and provide clear, strategic advice—not to push you into a decision but to ensure that when you do make one, it’s the right one for you.

Let’s chat if you’re considering upgrading, investing, or making your first purchase. I’ll help you evaluate your options with clarity, objectivity, and a data-driven approach so you can move forward with confidence.

Connect with me whenever you’re ready—no pressure, just professional guidance tailored to your goals.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Senior Associate District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: +65 9383 9588

Is It Still Safe to Enter the Property Market In 2025 Amid U.S. Tariffs?

How Trump’s Tariffs Could Affect Singapore’s Condo And HDB Prices. Is it safe to enter the Singapore property market in 2025 amid recession fears and U.S. tariffs? Learn how interest rates, supply trends, and market resilience could shape your next move.

How to Upgrade When My HDB Reached Minimum Occupation Period (MOP)

For HDB owners who have fulfilled the 5-year MOP (Minimum Occupation Period) in Singapore, discover your next move. Find out if you should sell your flat (resale HDB) or upgrade to a private property, with clear tips for smart homeownership planning.

Freehold Vs Leasehold Properties, Which Suit You Best?

Explore the key differences between freehold and leasehold properties in Singapore. Understand their advantages, investment potential, and determine which property type aligns with your goals.

How Much Do You Need to Earn to Afford a Condo in Singapore?

How much salary do you need to buy a condo in Singapore? Calculate loan, cash, CPF needed & avoid costly mistakes. Read the full guide now!

How To Building Retirement Capital Through Property: Breaking the Misconceptions About Property Upgrading

Looking to grow your retirement capital in Singapore? Discover how smart property upgrading and strategic investments can accelerate your wealth-building journey. From first-time buyers to seasoned homeowners, learn how to leverage property for long-term financial freedom.

Singapore Property Market Outlook 2025: The Trends, Risks, and Opportunities

Explore the 2025 Singapore property market outlook, price trends, and investment opportunities. Understand supply, demand, and interest rates to make informed decisions on buying, upgrading, or investing in real estate. Read more insights here!