Can I Use CPF Savings (OA/SA/RA etc.) To Pay For Second Or Subsequent Property in Singapore?

If you already have an existing property or properties, there are still some reasons why you might consider getting second or subsequent properties. Maybe you’re considering different equities for investment purposes, or perhaps you want to get a place you’d like to live in a few years later, or for your children or your parents.

The common question that everyone has during this stage will be – “Can I use my CPF savings to pay for my second or subsequent properties?”

The answer is YES!

You can utilize your CPF savings to pay for your second or subsequent property purchase. However, it might not be as straightforward as using your CPF savings when you purchased your first property.

Before I go into details, let’s take a look at the Basic Retirement Sum and Full Retirement Sum for a better understanding when you go through the examples below:

The Basic Retirement Sum applies to members who turned 55 in 2016 to 2027:

| 55th birthday on or after | Basic Retirement Sum |

| Age 55 in 2016 | $80,500 |

| Age 55 in 2017 | $83,000 |

| Age 55 in 2018 | $85,500 |

| Age 55 in 2019 | $88,000 |

| Age 55 in 2020 | $90,500 |

| Age 55 in 2021 | $93,000 |

| Age 55 in 2022 | $96,000 |

| Age 55 in 2023 | $99,400 |

| Age 55 in 2024 | $102,900 |

| Age 55 in 2025 | $106,500 |

| Age 55 in 2026 | $110,200 |

| Age 55 in 2027 | $114,100 |

The Full Retirement Sum applies to members who turned 55 in 2003 to 2027:

| 55th birthday on or after | Full Retirement Sum |

| 1 July 2003 | $80,000 |

| 1 July 2004 | $84,500 |

| 1 July 2005 | $90,000 |

| 1 July 2006 | $94,600 |

| 1 July 2007 | $99,600 |

| 1 July 2008 | $106,000 |

| 1 July 2009 | $117,000 |

| 1 July 2010 | $123,000 |

| 1 July 2011 | $131,000 |

| 1 July 2012 | $139,000 |

| 1 July 2013 | $148,000 |

| 1 July 2014 | $155,000 |

| 1 July 2015/6 | $161,000 |

| 1 January 2017 | $166,000 |

| 1 January 2018 | $171,000 |

| 1 January 2019 | $176,000 |

| 1 January 2020 | $181,000 |

| 1 January 2021 | $186,000 |

| 1 January 2022 | $192,000 |

| 1 January 2023 | $198,800 |

| 1 January 2024 | $205,800 |

| 1 January 2025 | $213,000 |

| 1 January 2026 | $220,400 |

| 1 January 2027 | $228,200 |

The amount of CPF savings you can utilize on the purchase of your second or subsequent properties differs; it depends largely on when you purchase the property due to CPF rules changes:

1. Property that was purchased before 10 May 2019

You can utilize your CPF savings, up to the Valuation Limit (which is the purchase price or the market value of the property at the time of the acquisition, whichever is lower)

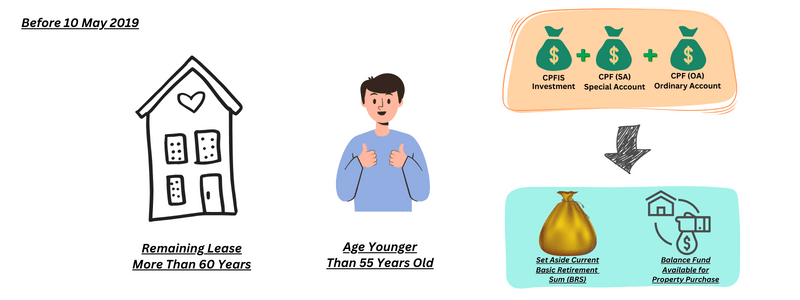

For the second or subsequent property with a remaining lease of minimally 60 years that is purchased between 1st July 2006 and 10th May 2019, after fulfilling the following criteria based on your age.

If your age is below 55 years old, you will have to put aside the current Basic Retirement Sum (BRS) before you can use your CPF savings in your CPF OA to pay for your second or subsequent properties.

The BRS can make up from:

- CPF Special Account (SA),

- CPF savings that you used for investments

- CPF OA

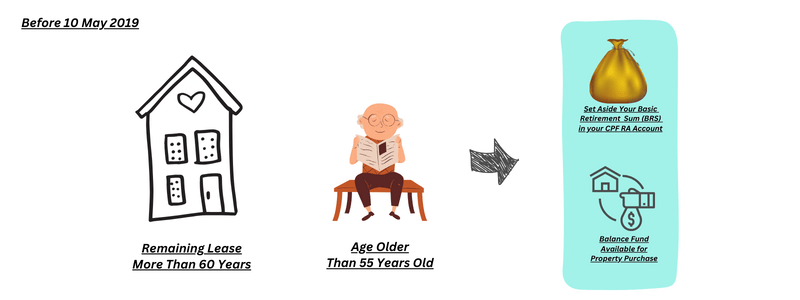

If your age is 55 years old and above, you will need to put aside your Basic Retirement Sum (BRS) in your Retirement Account before you’re allowed to use your balance CPF OA savings for the purchase of your second or subsequent properties.

2. Property that was purchased from 10th May 2019

The amount of CPF savings that you are allowed to use for the second or subsequent properties purchase will depend on the remaining lease of at least one of the properties you possess or are getting, where you have utilized your CPF savings for the property, can cover the youngest buyer to at least 95 years old.

The few different circumstances I have commonly seen are:

- The remaining lease of at least one of the properties you possess or are getting, where you have used CPF savings for the property purchase, can cover you to at least 95 years old when your age is below 55 years old or above 55 years old.

- The remaining lease of all the properties you possess or are getting, where you have used CPF savings for the property purchase, cannot cover you to at least 95 years old when your age is below 55 years old or above 55 years old.

Example 1:

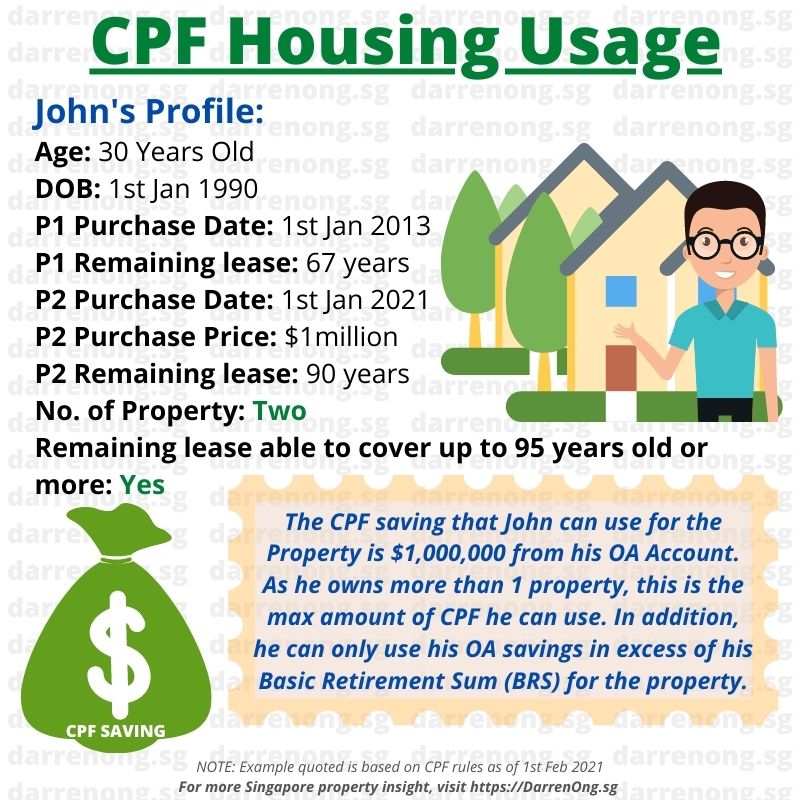

If your age is below 55 years old, and you have utilized your CPF savings for the first property purchase. Subsequently, you purchase your second or multiple properties, where one of the properties can cover you up to at least 95 years old.

In this scenario, you have to set aside the current Basic Retirement Sum before you can utilize your balance savings from your CPF OA (up to valuation limit or purchase price, whichever lower) for the new purchase.

The maximum sum of CPF savings that you’re allowed to utilize is determined by the remaining lease of the property and the age of the youngest buyer who is using the CPF savings for the property purchase must be able to cover up to at least 95 years old.

Example 2:

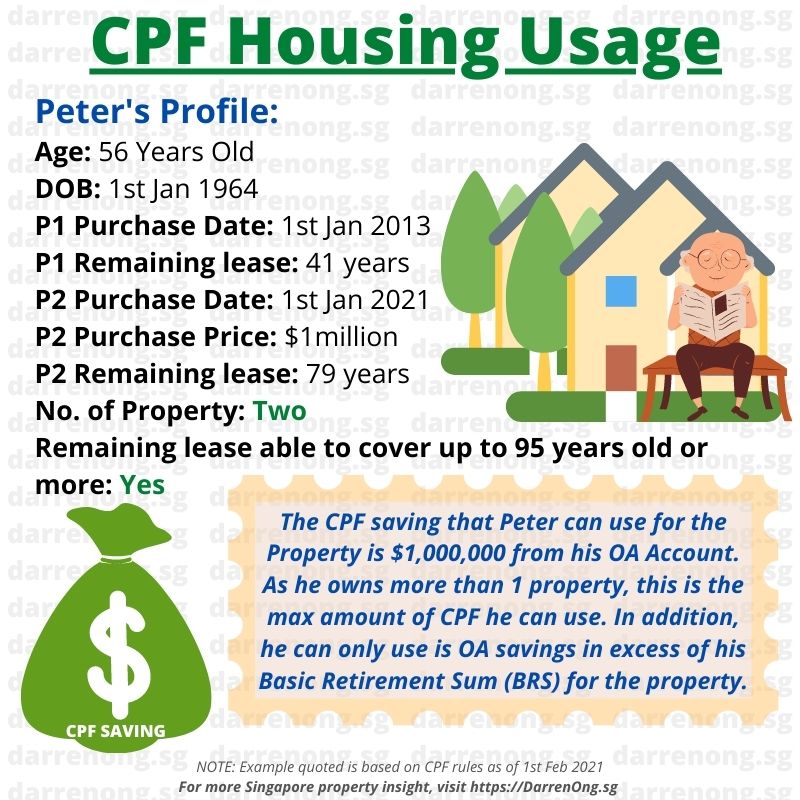

If your age is 55 years old and above, you have to set aside your Basic Retirement Sum (BRS) in your CPF Retirement Account (RA) before you can utilize the balance CPF savings in your Ordinary Account for the second purchase.

You’re also allowed to use your Retirement Account savings (excluding interest earned, grants received from the Government, and top-ups made under the Retirement Sum Topping-up Scheme) in excess of your BRS, where you are eligible or approved by the CPF board.

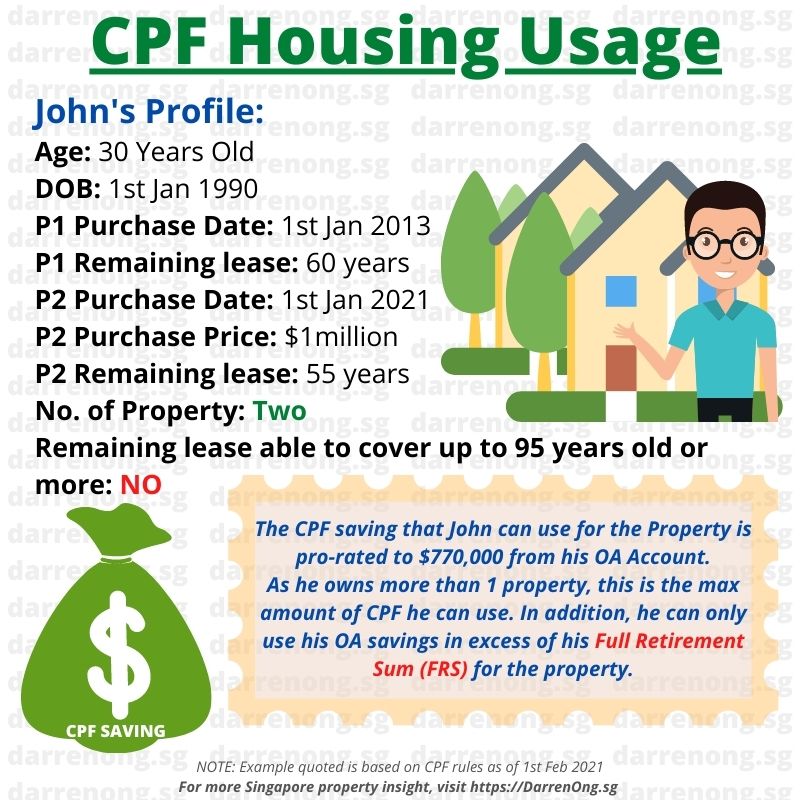

Example 3:

If none of the properties you own or are purchasing, where you have used your CPF savings for the first property purchase, have a remaining lease that cannot cover you to at least 95 years old.

If you are below 55 years old, you have to put aside the current Full Retirement Sum before you can utilize your balance CPF OA saving for the second or subsequent property purchase. The maximum CPF savings that you can use for the property purchase will be pro-rated.

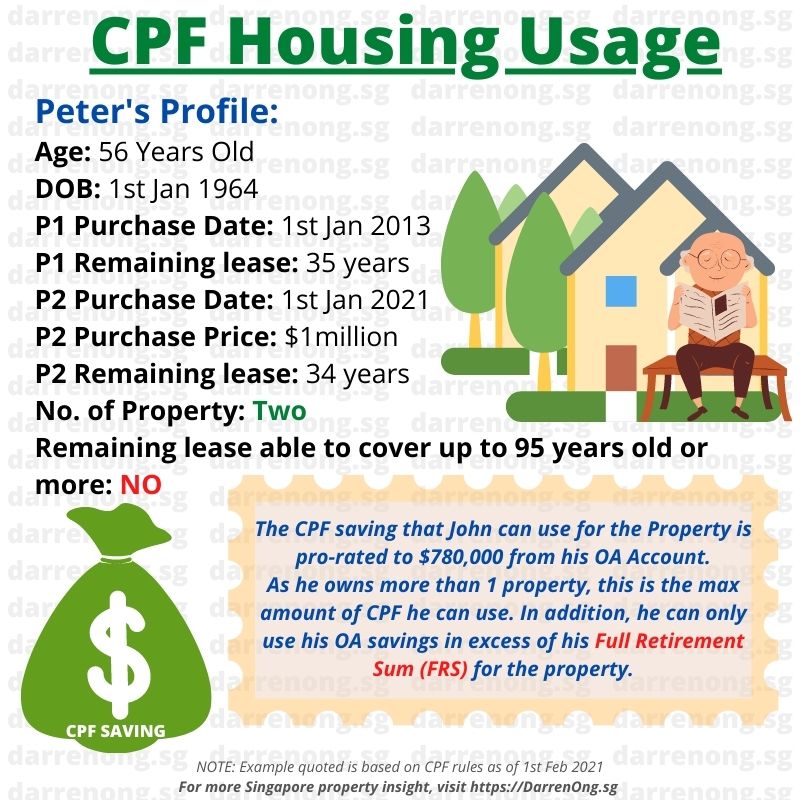

Example 4:

If you are 55 years old and above and both the properties that you own or are purchasing, cannot cover you up to at least 95 years old. You will have to put aside your Full Retirement Sum in your CPF Retirement Account before you can use any excess savings in your Ordinary Account for the property.

The CPF OA saving that you can utilize for the second or subsequent property purchase is pro-rated as the remaining lease cannot cover the youngest buyer up to 95 years old.

If you intend to sell your existing property (such that your new property would be your only property paid using your CPF savings), you will be given a 6-month grace period to do so. During the grace period, you do not have to set aside the applicable BRS or FRS. The grace period is:

(a) 6 months from the date of issue of the Temporary Occupation Permit if the new property is under construction; or

(b) 6 months from the completion date of purchase if the new property is a completed property.

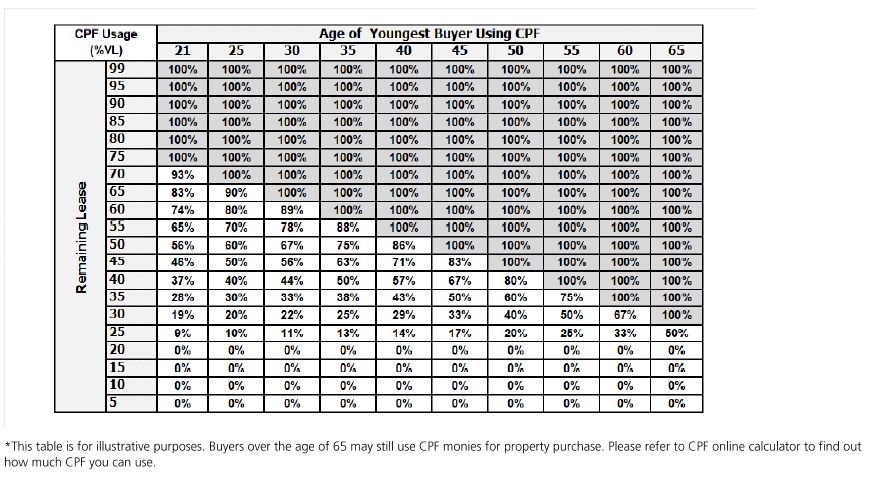

Additional information about Maximum CPF usage based on VL (%)

Maximum CPF usage based on VL (%)

Alternatively, if the remaining lease does not cover the youngest buyer up to at least 95 years old, you may use the following formula to calculate the pro-rated maximum CPF saving usage:

Pro-Rated CPF Usage = (Remaining lease of property – 20) / (95 – age of youngest buyer using CPF – 20)

TIP: You can use the CPF Housing Usage Calculator to calculate how much funds you can utilize to purchase your second or subsequent property.

In Summary:

The answer is YES! It is possible to use the CPF savings to purchase a second or subsequent property. You are free to use your excess CPF savings to purchase the second property after setting aside the necessary saving for retirement.

Buying the second or subsequent property might not be straightforward after all and there are many other considerations that you have to factor in such as affordability, Additional Buyer Stamp Duty (ABSD), Total Debt Servicing Ratio (TDSR), and mortgage Loan-to-Value (LTV) limit restriction.

You may get in contact with me if you require professional advice or need to understand more before you proceed with your purchasing plan.

I hope that the above example clears some of your mind pertaining to utilizing the CPF savings to purchase multiple properties in Singapore.

I welcome you to contact me for further discussion should you have any doubts about CPF savings usage that might concern you.

Hello, I am Darren Ong

As a real estate professional, my duty is to help my clients achieve financial freedom and grow their wealth through Property Wealth Planning™.

I believe that with prudent strategies and a clear investment road map, anyone can enjoy a life of abundance and financial stability.

Darren Ong (王伟丞)

Associate District Director of Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: +65 9383 9588

Comments are closed.