| Resale HDB Selling Guide 2024 | HDB Resale Procedures |

A detailed guide for HDB homeowners who intends to sell their HDB flat in 2024.

There are many reasons homeowners decided to sell their current property, be it upgrading, downsizing, cashing out, going through divorce or administrator case, or from any unforeseen circumstances. But be it HDB or private property, there are rules and regulations to get your property sold and procedures to follow before you eventually get the deal through.

Since 2010 when I joined this industry, I noticed many of my clients tend to forget the complicated procedures of selling the HDB flat.

“Master the HDB rules & regulations and resale procedures – The Art of Selling HDB Flat.”

Pre-selling to post-selling of the HDB flat usually takes months before it is legally completed and handover to the new homeowner. It is very normal for the sellers to forget the complicated procedures. But don’t fret! You may refer back to this article to guide you through the process. Alternatively, you can engage a professional agent to handle the marketing and sales of your HDB flat.

After getting a series of constant updates on the procedures from me, some of my clients suggested that I write an article about the “Resale HDB Selling Guide“; thus, today, I am writing this guide for HDB homeowners.

I will share the essential points to note when you decide to sell your HDB flat. Do note that some of the points mentioned in this article may not be common to the first-time HDB seller. I hope you can ask a housing agent for professional advice when you are in doubt or unsure to avoid painful mistakes.

Here is a quick summary of the 15 steps for selling your resale HDB flat:

- Check your eligibility to sell

- Do your sum correctly

- Decide professional housing agent or DIY

- Register your HDB Intent to Sell

- Advertise your home for sale

- Arrange for viewings for interested buyers (physically or virtually)

- Grant HDB Option to Purchase (OTP)

- Buyer to request a valuation

- Buyer to exercise the OTP

- HDB resale application submission

- Safety inspection by HDB branch officer

- HDB resales documents endorsement and Convenancying Payment

- Resale HDB approval

- HDB buyer’s final inspection

- Attend HDB completion appointment and handover to new homeowners

Additional Take Away

1. Check Your Eligibility To Sell

You need to make sure that you fulfill the following before you can sell you HDB flat:

Minimum Occupation Period (MOP)

The duration of the MOP depends on the purchase mode, flat types, and flat application date. You may log in to My HDBPage, under My Flat > Purchased Flat > Flat Details > Minimum Occupation Period (MOP) to check if you have met the MOP.

The MOP countdown clock starts from the day your flat purchase is legally completed where you attend your HDB appointment at the HDB Hub.

For owners of new and resale Prime Location Public Housing (PLH) flats, the MOP is 10 years from the legal completion date.

Here is a summary of the MOP duration based on the mode of purchase:

| MOP Duration | Mode of Purchase |

|---|---|

| 5 Years | Flat bought from HDB (BTO) (Exclude PLH flat) |

| 5 Years | DBSS from property developer |

| 5 Years | Resale HDB flat from the open market with or without CPF housing grant(s) (Exclude PLH flat) |

| 10 years | Flat bought under Prime Location Public Housing (PLH) scheme (BTO or resale flat inclusive) |

| 5 or 7 years | Flat bought under Selective En Bloc Redevelopment Scheme (SERS) For SERS sites announced before 7 Apr 2022

For SERS sites announced on or after 7 Apr 2022

You may need to pay the Seller’s Stamp Duty (SSD) if you sell your replacement flat within a certain holding period. For more information on the SSD, please visit IRAS’ website. |

| 20 years | Flat bought under the Fresh Start Housing Scheme |

Ethnic Integration Policy (EIP) and Singapore PR quota

To ensure a balanced ethnic mix in HDB estates, thereby promoting racial integration and harmony, you need to check the EIP and SPR quota. You may check at EIP/SPR quota and only arrange house viewing with eligible buyers. Do note that HDB updates the EIP/SPR quota on the first day of every month.

If you are NOT bankrupt or divorced, you may skip the following two pointers.

Bankruptcy Act

Under HDB and Bankruptcy Act, if the seller is an undischarged bankrupt, the consent of the official assignee (OA) may have to be obtained before selling the HDB flat. The OA consent is needed for the following two points:

- Before selling, if the non of the flat owners are SC (non-Singapore citizen household) is an undischarged bankrupt, the seller shall obtain the consent of the OA to the resale before submitting the resale application to HDB.

- If the seller (non-Singapore citizen household) becomes an undischarged bankrupt after submitting the HDB resale application and before the legal HDB completion, he must inform HDB and obtain the consent of the OA before the legal HDB completion.

Divorce

If you are going through a divorce, you need to produce:

- Writ for Judicial Separation (also known as Deed of Separation), or

- Interm Judgment ( also known as Decree Nisi) and Cert. of Making Interim Judgment Final (also known as Decree Nisi Absolute), or

- Divorce Certificate (for Muslims), or

- Order of Court (if any).

2. Do You Sum Correctly

After clearing step one on the eligibility to sell your HDB flat, you are ready to go into the second step. It would help if you did your sum, which is one of the most critical steps not to ignore or make mistakes.

Please prepare a piece of paper so that you can write down the numbers when you read on…

There are mainly a few things you need to get hold of. It includes the HDB flat indicative valuation, the recent nearby transactions, the current nearby asking prices, and the current market trend and performance.

Put together and analyze the above-mentioned pointers, then you will have a clearer picture of how much to set your selling price realistically.

Once you have a selling price in mind, find out your outstanding mortgage loan and the CPF saving refund plus accrued interest for all the sellers after selling the flat. This will lead you to the estimated cash proceeds you are expecting to receive upon sales completion.

HDB Indicative Valuation

You should find out how much is your HDB flat worth before you decide on your selling price. The HDB indicative or expected valuation serve as a guide for you to understand how much is the fair market value of your property.

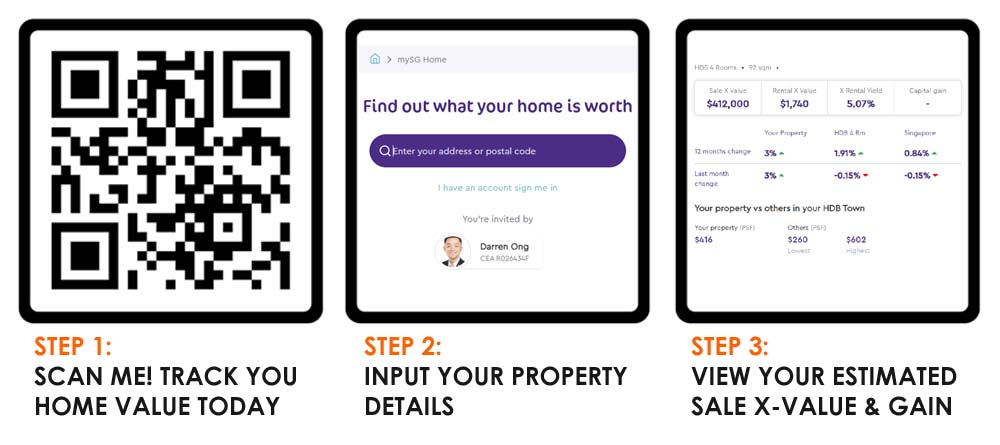

One easy way to obtain an estimation of your HDB indicative valuation is via SRX x-value. You may follow the following three simple steps to find out your indicative home x-value.

You may get in touch with me to find out how you can maximize your home value with my strategies.

Recently Nearby HDB Transactions

You must also find out who recently sold their unit that is similar to your HDB flat and at what price they sold. If you have the indicative value and recently sold unit price, you will be able to estimate how much to set your selling price.

The easiest way to get the past transaction selling price is through the HDB website at Resale Flat Prices. All you need is to input the flat type, location, and date of registration to display all the relevant recent sold/transacted data.

Current Nearby Asking Prices

This is the easiest part of all, where you can log on to the popular property portal and do a search on the asking price of the property nearby your home.

Outstanding Housing Loan

The outstanding housing loan is the unfulfilled lump sum that you have yet to pay off for your current property. You may log in to myHDB > Purchased Flat > Financial info to find out more information if you are using an HDB HLE loan. Alternatively, if you are using a bank loan to finance your HDB, you will need to call up the bank to get the outstanding loan amount from the customs officer.

Outstanding Housing Loan

The outstanding housing loan is the unfulfilled lump sum that you have yet to pay off for your current property. You may log in to myHDB > Purchased Flat > Financial info to find out more information if you are using an HDB HLE loan. Alternatively, if you are using a bank loan to finance your HDB, you will need to call up the bank to get the outstanding loan amount from the customs officer.

CPF Saving Used with Accrued Interest

You will need to log in My CPF > My Statement > Section C: Property and record down the Net amount used plus Accrued interest. The amount will be used to determine how much cash proceeds you will receive after selling the house.

Read more about

“how CPF accrued interest affect your cash proceeds.”

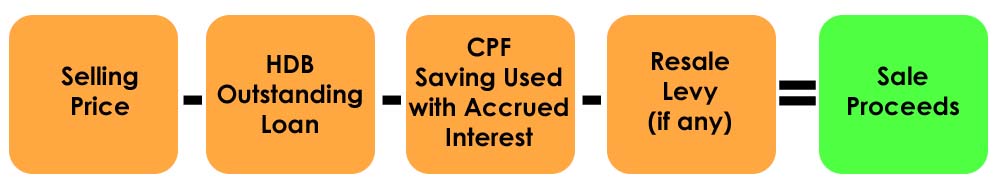

Estimated Cash Proceeds (Profit / Loss)

With the above information gathered, you will be able to determine your estimated cash proceeds from the selling. You will know in advance if your property will have profit or loss when you sell within the fair market price.

Here is how you calculate the final sale proceeds of your HDB from selling your flat:

Outstanding housing loan

minus Return of CPF saving used with accrued interest

minus Any other amounts payable, e.g., resale levy

equal Sale Proceeds.

3. Decide Professional Housing Agent or DIY

So far, so good for the above-mentioned financial calculation? If it is clear, that is great! Else, I suggest you start talking to a professional realtor to find out more before you make any move.

If you have some experience in selling previously and are clear about what to do to handle sales and purchases of HDB, you may decide to do it yourself. But be sure that you will need to handle all the phone inquiries and negotiations yourself.

Some may be unsure how to handle buyer’s inquiries, buyer’s objections, dislike answering unknown calls requesting for viewing appointment or dislike direct negotiation with the buyer, or not sure about the long procedures to follow through legal completion. I suggest you engage a professional real estate agent to handle the marketing and sales procedure to have a hassle-free transaction and experience.

A professional real estate agent service can help you with the following:

- Give you the right advice on what to look out for, and prepare your property to give the buyer the best first impression

- Create maximum exposure to blast the advertisement via various channel

- Handle the complex resale procedure and paperwork involved

- Prepare detailed presentation kits for the potential buyer

- Handle buyer’s inquiries and objections

- Arranging viewing appointment, either physically or virtually, due to COVID-19 restriction

I hope the above pointers will help you make a better decision on DIY or engaging a professional to do the job for you.

4. Register Your HDB Intent To Sell

You are required to register an“Intent to Sell” via HDB Resale Portal before you start selling your flat. The HDB Resale Portal will also check your eligibility to sell your flat upon registering the Intent to Sell. You can only grant the HDB Option to Purchase after 7 days of registering the Intent to Sell.

Do note that only one flat owner needs to register the Intent to Sell. If you engaged a real estate agent, he/she would be able to guide you through registering the Intent to Sell.

The Intent to Sell will expire in 12 months upon successful registration. Seller will have to resubmit a fresh Intent to Sell if it expired.

The seller must only grant the HDB Option To Purchase to the buyer(s) with a valid Intent to Sell.

5. Advertise Your Home For Sale

You may now put up your unit for sale to look for potential buyers. But before you invite any potential buyer to view your property, your property must be presentable. You may refer to the following blog post for some 7 tips to sell your property fast.

Besides securing the right buyer at the fastest time, you should also secure at the highest possible price realistically following step 2 above.

6. Arrange For Viewings For Interested Buyers (Physically or Virtually)

Arranging to view property for potential buyers before the COVID-19 outbreak is mainly by physical viewing. But after the COVID-19 outbreak, physical viewing was restricted. Real estate agents turn all viewing arrangements into virtual viewing.

After going through circuit breaker phases 1, 2, and 3, many restrictions are lifted. Physical viewing of property resume but limited to 8 viewers per day until early May 2021 due to a resurgence of COVID-19 cases in the community in Singapore. Once again, Singapore moves into Phase 3, “Heightened Alert,” which took effect from 8 May 2021, where physical viewing is limited to 5 viewers per day. It was further tightened into Phase 2, “Heightened Alert,” which starts on 14 May 2021 and will last until 13 June 2021. This time physical viewing is limited to 2 viewers per day, including property agent.

With only 2 visitors (1 real estate agent and 1 buyer) per day per property, forcing more property viewing into virtual is more effective during this period. Thus, only real estate agents who can adapt to the changes and conduct property viewing virtually still operate as per normal.

7. Grant HDB Option to Purchase (OTP)

If you and the potential buyer agree with the sale price, you can grant the buyer the HDB Option to Purchase (OTP) to receive the option fee from the buyer.

The HDB OTP has a standard of 21 days option period for the buyers to get ready their valuation report and mortgage loan. You CANNOT grant another HDB OTP to another buyer before the HDB OTP expired. The HDB OTP will expire after 21 days, 4 pm, and the seller can grant the HDB OTP to another buyer.

Do note and check if the buyer registers their Intent to Buyer, and check their eligibility. If the buyer decides to purchase using HDB HLE, then he/she need to have a valid HDB HLE before seller grant OTP to them.

8. Buyer To Request a Valuation

As the property seller, you need to understand why the buyer needs a valuation of the property they are buying.

When the buyer purchases the flat with their CPF savings or a housing loan from the bank/financial institution (FI) or HDB, they must submit a “Request for Value” to HDB via the HDB resale portal by the next working day upon receiving the HDB Option to Purchase (OTP) from you, to determine the value of the flat. The value of the flat will forms the basis for their CPF usage.

The HDB or bank/FI will also take the value as the reference unless otherwise advised by a bank/FI. With effect from 16th Dec 2021, the maximum loan-to-value (LTV) of HDB housing board loans is tightened by 5%-points from 90 percent to 85% of the value, and the FI maximum LTV is at 75% of the value, subject to buyer combine income and HDB/FI approval.

Please note that the assigned valuer may request to inspect the flat for valuation. You must, within three working days, allow the assigned valuer to inspect the flat.

The value of the flat will remain valid for a period of 3 months from the day it is made available in the HDB Resale Portal.

9. Buyer To Exercise The OTP

Once the valuation is ready, together with the HDB HLE or Letter of Offer from the Bank/FI, the buyer must exercise the OTP within 21 calendar days from the option date.

When the buyer proceeds to exercise the OTP, all buyers must sign the “Acceptance” section in the OTP and pay a deposit not exceeding $5,000. Please note that the Option fee is part of the deposit.

Suppose the buyer fails to exercise the OTP by the 21st day, 4 pm. The buyer will forfeit the Option Fee, and you can grant a new OTP to another buyer.

10. HDB Resale Application Submission

You and the buyer must agree to a date to submit the HDB resale application within the number of days on page 4 of the OTP that both had agreed on previously.

Both you and the buyer have to submit the HDB resale application separately. Either you or the buyer can be the 1st party to submit first, and within 7 days the 2nd party must submit the HDB resale application.

11. Safety Inspection By HDB Branch Officer

You will be informed of the inspection date in HDB’s notification of the acceptance of the resale application.

The purpose of the inspection by the HDB Branch is to check for windows safety, and unauthorized renovation works in the resale flat, which may damage the common property or other flats in the building and affect the structural stability of the building.

12. HDB Resales Documents Endorsement and Convenancying Payment

HDB will notify you and the buyer once the resale documents are available in the HDB Resale Portal. Both you and the buyer must endorse the documents within 6 days upon receiving the notification from the HDB.

If you purchase with an HDB loan and wish to use HDB conveyancing, you will need to proceed to the payment steps to make payment for HDB conveyancing.

13. Resale HDB Approval

You are almost approaching the end of the transaction. Once all documents are endorsed by both you and buyers. HDB will process to grant the resale HDB approval when all documents are in place.

Now you need to make sure your property tax is fully paid for the year. You also need to pay up the town council conservancy charge up until the HDB legal completion date.

14. HDB Buyer’s Final Inspection

Before the HDB completion appointment, you need to allow the buyer to have a final inspection to ensure all movable items are shifted out in vacant possession state.

15. Attend HDB Completion Appointment and Handover to New Homeowners

Lastly, you and the buyer will attend the HDB legal completion appointment in HDB Hub Toa Payoh.

If you are taking an HDB housing loan, you will sign the mortgage document/agreement during the resale completion. You will also need to hand over the keys to the flat to the new owner.

Congratulation! You have completed the resale procedure.

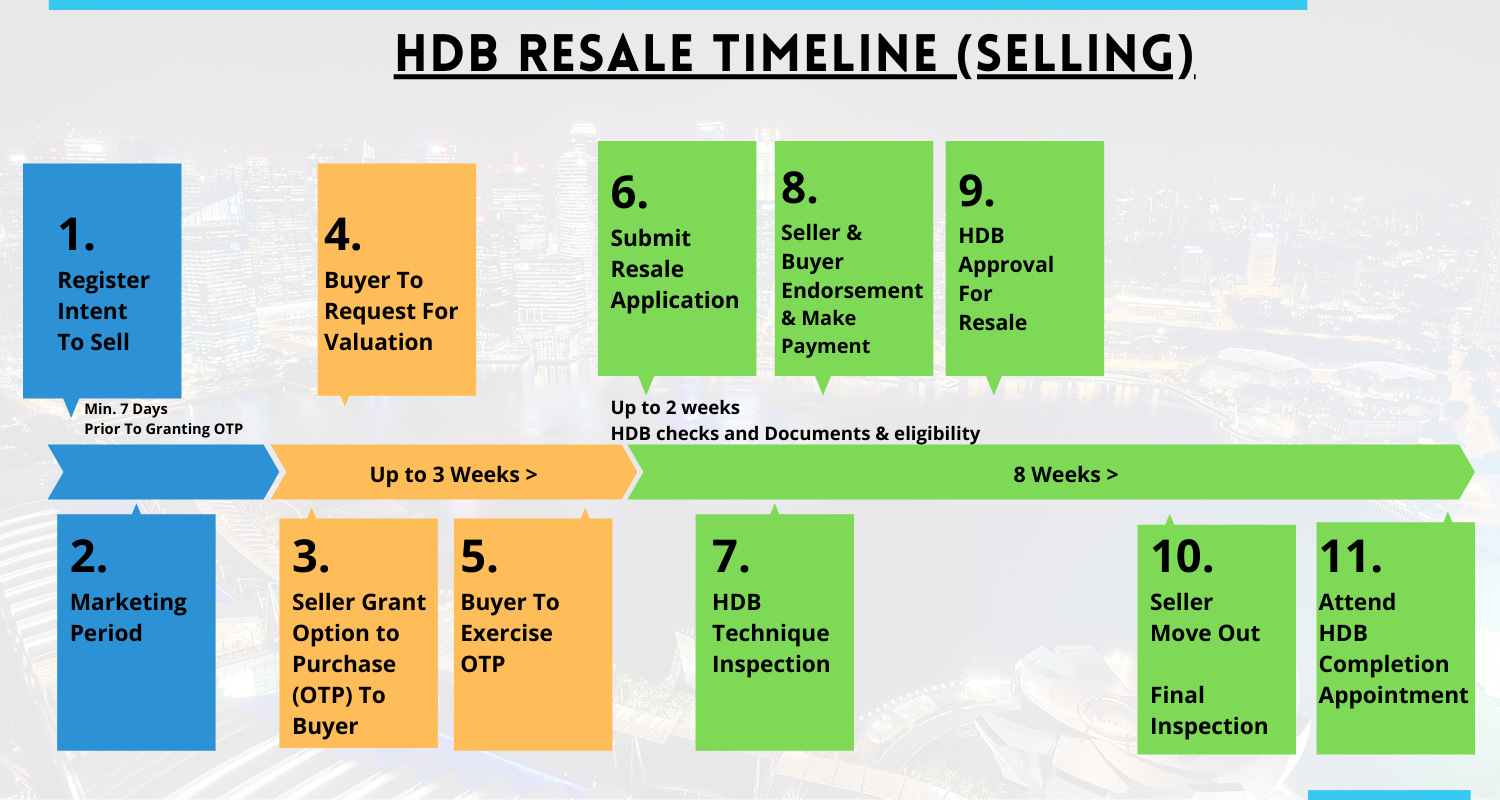

16. HDB Resale Timeline

The above timeline summarizes the HDB resale procedure timeline from the day you submit the HDB Intent to Seller until the HDB resale legal completion. It takes about 12-14 weeks from the day you (the seller) grant the OTP to the buyer until HDB resale legal completion.

17. Important Notes

WHY did you want to sell? You have to know your purpose, and is there a need to sell?

WHERE will your next home be? You have to plan your next move correctly.

WHAT are the pros and cons if you execute the plan?

WHEN is the right time to execute your plan? It is good to know the market trend and analyze the right time to execute your plan.

HOW do you want to execute your plan? You need to have a set of action plans in place to make it work well.

WHO shall assist you in executing the plan? Be it do it yourself or engage a professional realtor, most importantly, make it work.

18. Conclusion

I hope this article provides you with a clearer picture about selling your HDB flat. You need to take note of many steps and clear them before reaching the HDB legal completion steps.

This article only provides you with the standard scenario procedures. Should you have any complicated scenario, I suggest you consult a professional realtor to assist you in executing your plan.

If you like to know more insight, you may feel free to connect with me and I shall share more with you in person.

Property Consultation

If you still have no idea how to execute but have a plan in mind, you may connect with me, and I will craft out all the best possible proposal plans for you.