Table of Contents

Is It Still Safe to Enter the Property Market In 2025 Amid U.S. Tariffs?

With renewed concerns about a possible recession in 2025, many homeowners and investors in Singapore may begin to ask the pressing question: Is it still safe to enter the property market?

Over the past few years, property prices have climbed steadily, buoyed by strong demand, limited supply, and a stable economic environment. But with global uncertainties piling up — from shifting interest rate policies to geopolitical tensions — it’s understandable that some might hesitate before making their next move.

The short answer? Yes — and here’s why. Backed by decades of historical data, sound economic fundamentals, and well-calibrated government policies, the Singapore property market continues to be a stable and resilient asset class. For buyers and investors with a long-term perspective, the current environment still offers opportunities — especially when approached with careful planning and clear objectives.

Recession Fears Resurface Amid New U.S. Tariffs

On April 8, 2025, Singapore’s Prime Minister Lawrence Wong addressed Parliament, expressing deep concern over the United States’ recent imposition of a 10% universal tariff on imports, including goods from Singapore. He described the move as a “seismic change in the global order,” warning that it poses significant risks to Singapore’s trade-dependent economy and challenges the long-standing principles of free and open trade.

In response to these developments, the government announced the formation of a National Task Force chaired by Deputy Prime Minister and Minister for Trade and Industry Gan Kim Yong. This task force includes key partners such as the Singapore Business Federation, the Singapore National Employers Federation, and the National Trades Union Congress (NTUC). They aim to assist businesses and workers in navigating the uncertainties arising from the tariffs.

Meanwhile, Budget 2025, rolled out earlier this year, includes a range of short-term support measures to help Singaporeans cope with rising costs and economic uncertainty. These measures include CDC and SG60 vouchers, utility rebates, and enhanced assistance through SkillsFuture and the SkillsFuture Jobseeker Support Scheme.

On 9 April 2025, the U.S. formally confirmed a 90-day pause on further tariff escalation, set to end on 8 July 2025. While Singapore’s direct export exposure to the U.S. is relatively modest, these tariffs have injected fresh uncertainty into global trade flows and capital markets. This, in turn, could impact investor confidence, household sentiment, and broader financial market stability — all of which have downstream implications for Singapore’s property market.

If the current 10% tariff holds steady, the overall impact on housing may remain contained. However, sentiment-driven pullbacks may occur, especially in higher-value private transactions, as buyers grow more cautious. HDB resale demand is expected to stay firm, although decision-making timelines could stretch as families take a more wait-and-see approach.

At the same time, the Singapore Dollar has strengthened against the U.S. Dollar, and the Monetary Authority of Singapore (MAS) has taken steps to ease monetary conditions — helping to preserve competitiveness and offset potential headwinds. These measures offer a degree of resilience, but buyers in the private property market may still adopt a more conservative stance until there’s greater clarity on how the trade situation unfolds.

Following recent developments, the Ministry of Trade and Industry (MTI) has revised Singapore’s 2025 GDP growth forecast from 1%–3% to 0%–2%, acknowledging that escalating trade tensions present real downside risks to Singapore’s open and externally oriented economy.

Naturally, the possibility of a recession raises concerns — particularly for those considering large financial decisions such as buying property. However, it’s essential to understand that a recession doesn’t automatically translate to a property market crash. In Singapore, the property market is shaped by more than just GDP figures — it is supported by demand-supply dynamics, policy interventions, market resilience, and investor sentiment, all of which play critical roles.

What History Tells Us: 16 Recessions, But Not Always a Property Crash

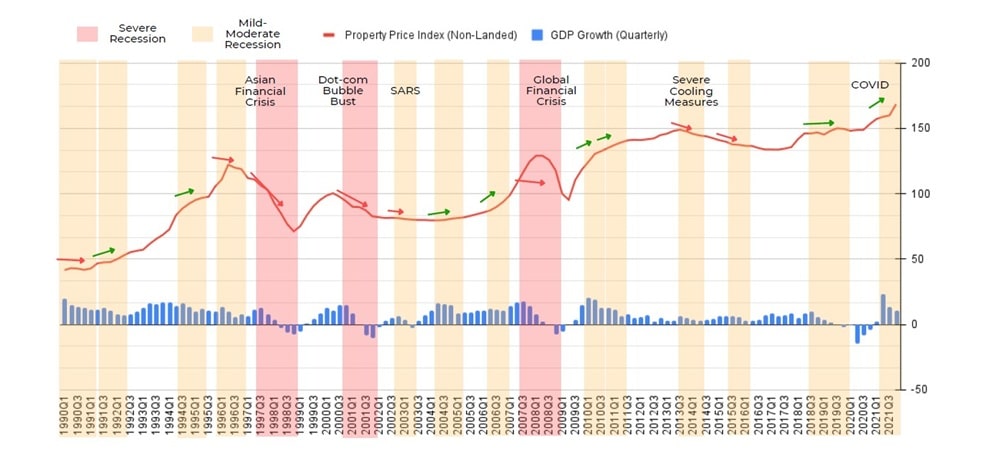

Since 1990, Singapore has experienced 16 periods of recession, defined as two or more consecutive quarters of GDP contraction. While the term “recession” naturally raises concern, historical data suggests that it doesn’t always lead to a drop in property prices — particularly in Singapore’s context.

Out of those 16 recessions, only 8 were followed by property market declines — a 50% occurrence rate. That means the property market remained stable or even appreciated in half of those downturns.

When we look closer, the three most severe price corrections occurred during extraordinary global events—the 1998 Asian Financial Crisis, the 2008 Global Financial Crisis, and the 2020 COVID-19 pandemic. These were systemic shocks that impacted not only Singapore but the entire global financial system, resulting in sharp contractions in confidence, liquidity, and economic activity.

The remaining 13 recessions were considered mild to moderate, and in 8 of those instances, property prices in Singapore continued to hold or rise. That’s a 61.5% probability that real estate values remained resilient despite economic slowdowns.

This tells us that not all recessions are created equal—and not all will cause property prices to fall. The severity and underlying cause of a recession matter. In periods of manageable downturns—such as the dot-com bubble, trade slowdowns, or health-related events like SARS—Singapore’s property market has shown its strength, underpinned by local demand, sound fundamentals, and timely government intervention.

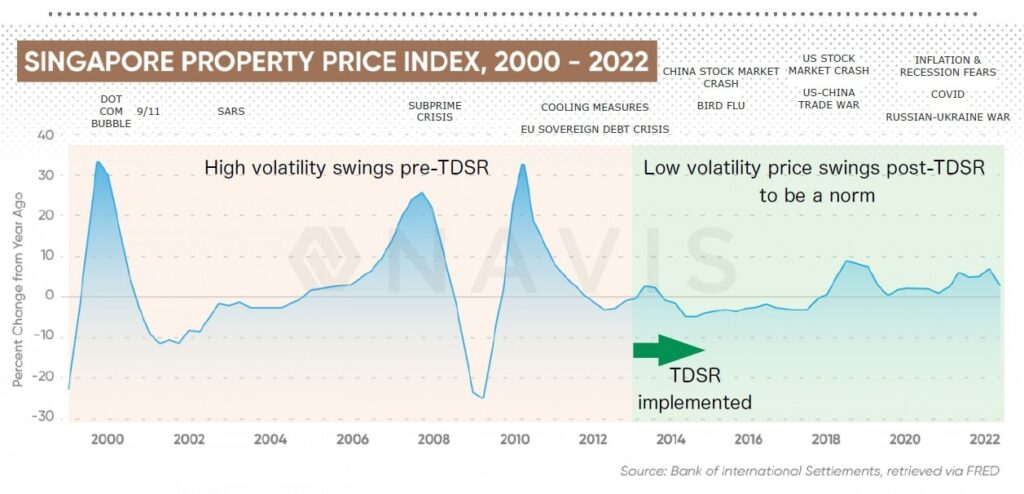

The "Dam Effect": How Policy Safeguards Cushion Singapore's Property Market

Since 2013, Singapore has taken deliberate steps to engineer a more stable and sustainable property market. One of the most effective outcomes of this effort is what many observers now refer to as the “dam effect.”

Much like how a dam controls water flow, Singapore’s property policies have helped moderate market cycles, preventing excessive booms and steep crashes. This stability is largely credited to a carefully layered set of macro-prudential measures, including:

- Loan-to-Value (LTV) limits

- Total Debt Servicing Ratio (TDSR) framework

- Additional Buyer’s Stamp Duty (ABSD)

- Seller’s Stamp Duty (SSD)

- And a suite of targeted cooling measures

With the proper rules in place, this system of layered protection has strengthened household financial resilience and reduced speculative activity. Buyers today are more cautious and better prepared, while owners generally hold on to properties with healthier cash flow positions.

Over the past decade, even during external shocks like trade conflicts, health pandemics, or cyclical economic dips, property prices in Singapore have shown remarkable resilience. When they occur, market corrections tend to be shallow and short-lived, and prices often recover quickly once stability returns.

This “dam effect” doesn’t mean the market is invincible. But it does mean that shocks are less likely to trigger panic selling or severe downturns, giving homeowners and long-term investors a greater sense of security.

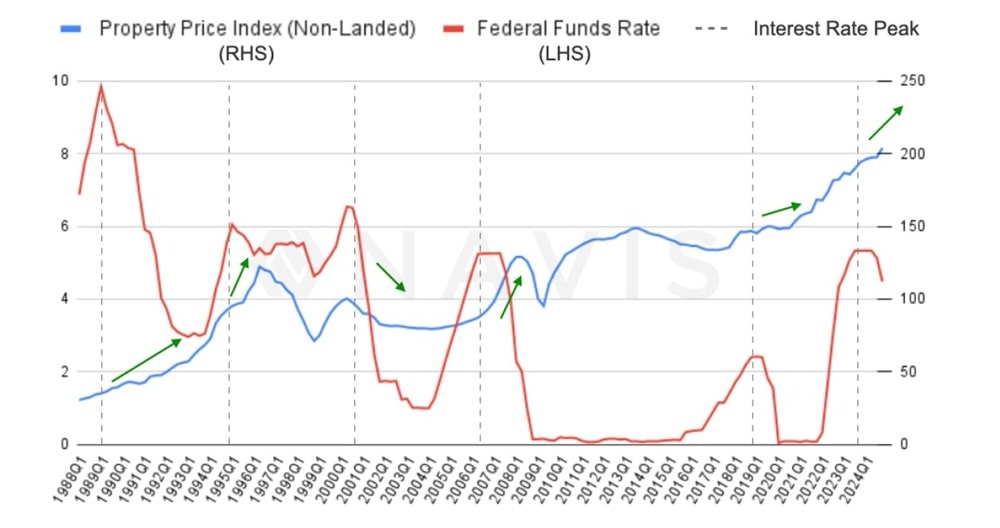

Falling Interest Rates and the Return of Investor Confidence

As we head deeper into 2025, one key economic trend is drawing close attention — the prospect of falling interest rates. With global growth uncertainties and easing inflation, the U.S. Federal Reserve has signaled the possibility of at least two rate cuts this year, and market watchers believe more may follow if conditions worsen.

Typically, the Fed reduces interest rates in 25 basis point increments, which may seem marginal at first glance. However, these cuts can substantially impact borrowing costs, especially for homebuyers and property investors.

In Singapore, fixed mortgage rates are currently around 2.4%. Should rates begin to decline, monthly instalments will naturally decrease. This translates into better cash flow for landlords, particularly if they are still enjoying decent rental income. When instalment burdens ease, the urgency to sell also lessens, which helps to stabilise property prices even during broader economic uncertainty.

Global capital markets have turned increasingly volatile following the U.S. tariff announcement. Interestingly, instead of retreating to traditional safe-haven assets like U.S. Treasuries, many investors have pulled back, causing long-term yields to rise — a counterintuitive signal that points to growing concern over U.S. fiscal stability, inflation risks, and the long-term sustainability of debt levels.

This puts the Federal Reserve in a tight spot. To rein in rising yields, it could inject liquidity by purchasing Treasuries — which might weaken the U.S. Dollar and fuel inflation. Alternatively, if the Fed raises rates to cool inflation, it could risk slowing global economic momentum.

For Singapore, this means that SORA (Singapore Overnight Rate Average) — the benchmark rate for floating home loans — may shift in response to these external forces. Although MAS does not set interest rates, SORA often moves in tandem with global liquidity trends and U.S. rate policies.

In this environment, buyers — especially those on floating-rate mortgage packages — should be prepared for interest rate fluctuations and consider reviewing their loan terms or refinancing strategies where appropriate.

At the same time, the volatile stock market environment is prompting many investors to reconsider where they park their capital. As risk appetite shifts, real estate is once again being seen as a more stable and tangible investment that offers both long-term capital appreciation and steady rental yields.

Historically, Singapore’s property market has responded positively to such conditions. Property prices have appreciated four out of five times after interest rates peaked and began to fall. A low interest rate environment tends to revive buyer interest, particularly among seasoned investors seeking predictable returns.

If this cycle plays out similarly, we may see renewed activity from both local and foreign investors, especially in sought-after areas with limited new supply — reinforcing the resilience of the market through yet another wave of global uncertainty.

Supply-Demand Fundamentals Remain Supportive

While interest rates and macroeconomic shifts tend to dominate headlines, one of the most grounded indicators of property market resilience is still the classic balance of supply and demand — and in Singapore, that balance continues to point toward strength and stability in the years ahead.

Between 2025 and 2027, the supply of newly completed private residential units is expected to fall significantly below the 10-year average of 12,000 units per year. Current projections estimate about 5,300 units in 2025, 7,600 in 2026, and 11,000 in 2027. With fewer new units entering the market, competition for available homes is likely to remain strong, especially in established and high-demand areas.

On the demand side, we continue to see a steady flow of HDB owners reaching their Minimum Occupation Period (MOP), many of whom are ready to take the next step in their property journey. Backed by CPF savings and built-up equity from their first home, these upgraders form a consistent demand base for both new launches and resale condominiums.

That said, 2025 is projected to see the lowest number of MOP flats in 11 years, with only 6,974 HDB units reaching eligibility for resale. This reduced supply of MOP flats means fewer upgraders entering the private market, which may help support HDB resale values and limit excess pressure in the private resale segment.

In particular, the Outside Central Region (OCR) and the Rest of Central Region (RCR) — where most upgraders tend to buy — are expected to face continued demand amid limited upcoming supply. A slowdown in Government Land Sales (GLS) and fewer successful en bloc transactions have also restricted developers’ ability to replenish their landbanks, adding to the tight supply situation.

At the same time, Singapore’s broader fundamentals remain strong. Population growth, political stability, a healthy rental market, and a resilient job landscape are all key drivers supporting housing demand — both from locals and foreign residents.

When supply is constrained, and demand is genuine, prices tend to stay supported. This creates a favorable backdrop for buyers and investors who are focused on long-term value, rather than short-term market noise. The fundamentals are intact; for many, that’s reason enough to stay confident.

Final Thoughts: Is It Still Safe to Enter the Property Market?

As we navigate through a period of global economic uncertainty, it’s natural for buyers and investors to feel cautious. Headlines may be filled with concerns over recession risks, trade tensions, and shifting interest rates. Yet, amidst the noise, Singapore’s property market continues to offer clarity, resilience, and long-term value.

No one can predict the future with absolute certainty. But when we look at the facts, history, and the safeguards in place, there’s plenty of reason to take heart and remain calmly confident in Singapore real estate as a stable, long-term asset.

Here’s why:

- Our economy is strong, and the government remains proactive in responding to evolving conditions.

- Multiple cooling measures — such as ABSD, SSD, LTV limits, and TDSR — can be eased if needed, providing tools to support the market.

- Local demand is genuine and steady, backed by CPF savings and long-term homeownership needs.

- The Singapore Dollar remains a strong and trusted currency, reinforcing our market’s value in times of global currency volatility.

- Real estate here has consistently shown resilience during past recessions, bouncing back stronger when global conditions stabilize.

In fact, the more uncertain the world becomes, the more attractive Singapore’s real estate appears — not just to local buyers but also to foreign investors and global businesses looking for a safe, stable, and transparent market.

The ballasts of our property market — from financial prudence to policy safeguards — are firmly in place to weather storms. Whether you’re a first-time homebuyer, an upgrader, or a long-term investor, entering the market today isn’t just about timing the cycles — it’s about making a confident and well-informed step toward long-term security and growth.

So, is it still safe to enter the property market?

With the right mindset, strategy, and guidance — absolutely, yes.

If you’re seeking property-related advice, feel free to reconnect for a friendly chat and explore how we can plan your journey together.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls