Table of Contents

Achieve Financial Freedom through Property Investments in Singapore.

Financial freedom is an end goal for many people around the world. It is almost everyone who wishes to achieve financial freedom for early retirement.

There are many methods that you can achieve financial freedom. Through investment and diversify your savings and make your money work harder for you.

In Singapore, one of the safest methods is to invest in Real Estate to accumulate your wealth and reach retirement earlier.

In this article, I will share about Achieve Financial Freedom through Property Investments in Singapore.

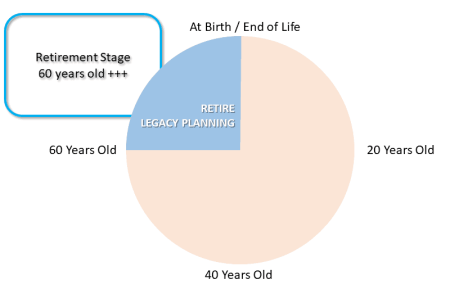

Everyone knows that our life expectancy is slightly above 83 years old on average in Singapore. But we can’t be working in our whole lifetime. We have a limited window period in our lifetime to accumulate their wealth for retirement.

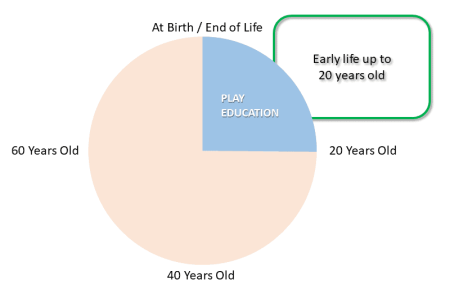

A simple illustration of the different stages of a typical human life can divide into 4 phases. I will illustrate based on our life expectancy in Singapore.

Four Phases Of Life

Phase One Of Our Life: At Birth - 20 Years Old

In our early stage of life, we are busy enjoying, playing, and learning during our childhood time. It is the time that most of us do not have any income.

At this stage, many of us, including myself, wish that it will be good if we can grow up faster so that we can start working and earning a living for ourselves.

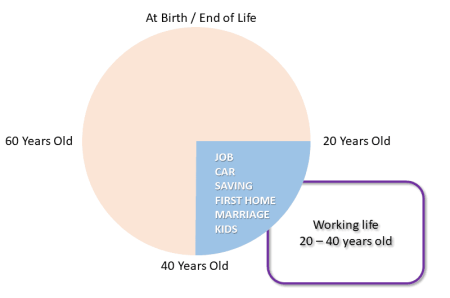

Phase Two Of Our Life: 21 - 40 Years Old

In this stage, many major events happened here.

When we graduated from school and started working, we tend to buy our first bike/car and first home. Getting married and having kids.

During this stage, many of us are busying working and paying off the vehicle/home loans, and children’s education fee, totally forgotten about the retirement plan.

I am here to remind you.

“You should start accumulating your savings (cash and CPF) in phase two of your life so that you can execute your first and subsequent investment plan later.”

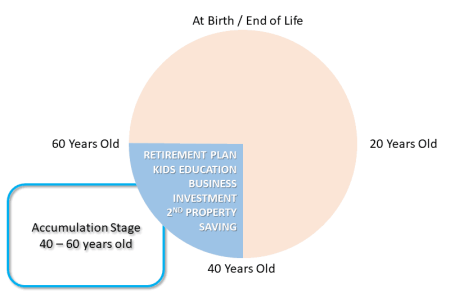

Phase Three Of Our Life: 41 - 60 Years Old

At the age of 40, many starts to think of business, buying a second property and worry about children education fee and what do we have for our children.

Many of them also start to worry about the future that they may be a burden to their children when the cost of living is getting higher.

Thus, by this age, you should have your various investments instrument in place and make your money work harder for your retirement plan not later than this stage of your life.

Phase Four Of Our Life: 61 Years Old Onward

Then by this stage, you should have a retirement nest that allows you to enjoy your life peacefully and comfortably with your grandchild when you retired.

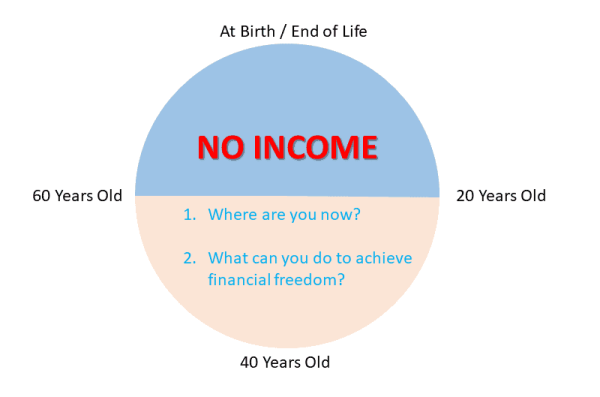

Typical Life Cycle

If you realized, half of the lifetime, many or almost all of us do not have any income (stage one and four).

The golden period that you can plan for retirement is in phase two of your life, where you are still young at your career peak and have enough energy to work harder to accumulate more saving before you regret.

By saving is not enough for you to grow your wealth and aim toward your retirement plan. Instead, you should invest the money that you have saved and make it work harder for you so that you can achieve financial freedom at the later stage of your life.

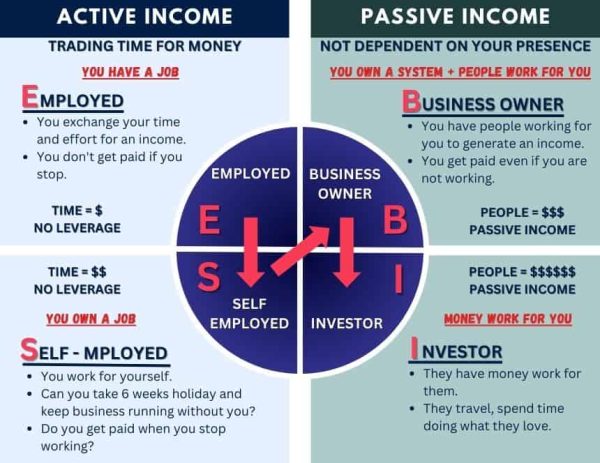

Type Of Income: Active Income vs Passive Income

The two types of income – Active and Passive income will determine where you stand and work toward your retirement goal. Let’s take a look at the difference between the two types of income using the ESBI concept by Mr. Robert Kiyosaki.

Many of them started in the E quadrant, trading your time working hard for others for an income. There are many people stuck in the E quadrant for not being planning well for their retirement. Some started to plan after years of working for others, realizing that they should start something for themselves.

Some began to work for themselves as self-employed at the S quadrant. You may take six weeks of holiday enjoying yourself, but you won’t have any income when you are enjoying your holiday.

Therefore, many are working toward achieving to be in the B quadrant to be a business owner so that they can employ people to work hard for them and have a steady income while they are on holiday.

But to maintain a business well is not as easy as it is. Some fold up the company after some time and go back to the E quadrant.

It is why I recommend that everyone should plan well and work toward being an investor and stay in the I quadrant where you invest your money and make the money work harder for you to achieve financial freedom. Some examples of investors that have accumulated their wealth by making their money work hard for them are Warren Buffet, Masayoshi Son, Robert Kuok, Peter Lim, Jim Rogers, and Robert Kiyosaki, to name a few. They travel, spend time doing what they love, and lead exciting lives. There are many ways that you can make your money work harder for you. Some investment type that we see commonly are:

- Real Estate

- Straits Time Index / Stocks

- Gold

- CPF OA Account

- SG Fixed Deposit

- SG Bank Saving Accounts

But one must be extra careful because not all are generating a good Return on Equity (ROE).

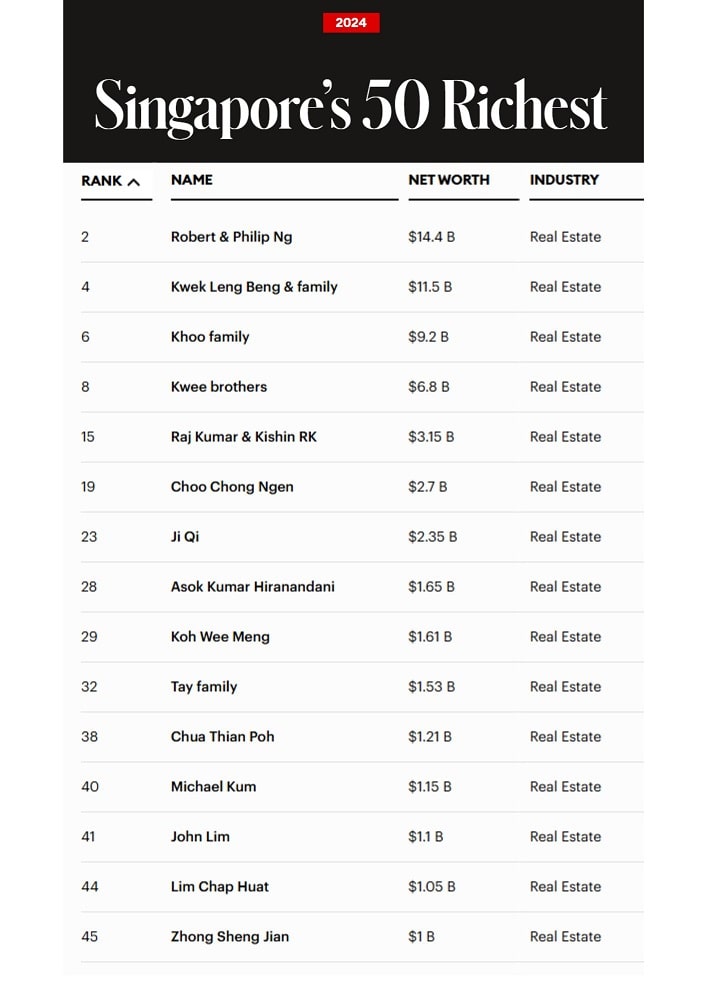

2024 Forbes Singapore's 50 Richest And The Industry They Are In

Based on Forbes Singapore’s Richest in 2022, 15 out of 50 made their wealth through real estate.

Why Investment In Real Estate?

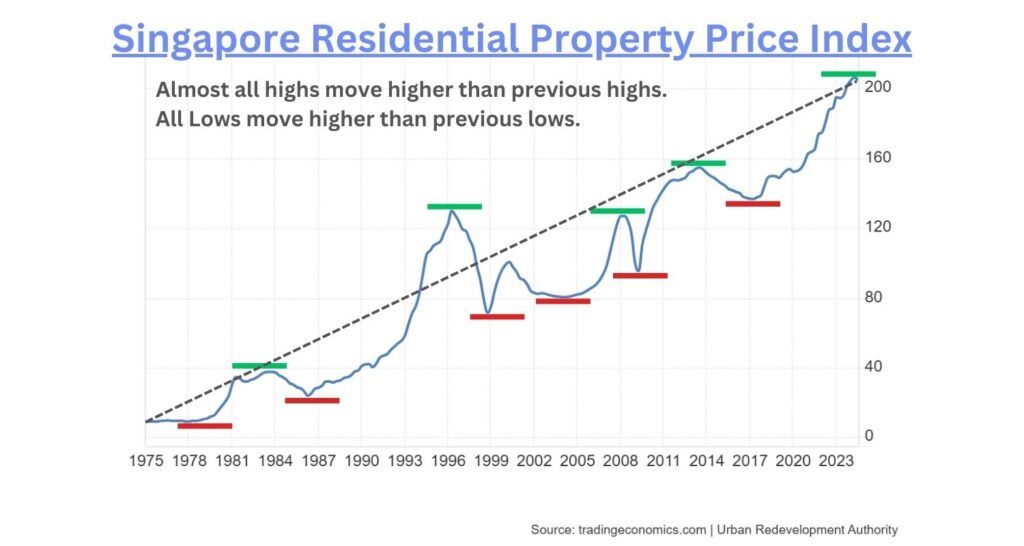

Singapore Property Price Index

Looking at the Singapore Property Price Index, although we see some downward trend along the way due to various financial crisis, the Dot-com bubble, Recession, SARS Outbreak, Singapore property curbs, and Covid-19, it has, on average, on an upward trend since 1980.

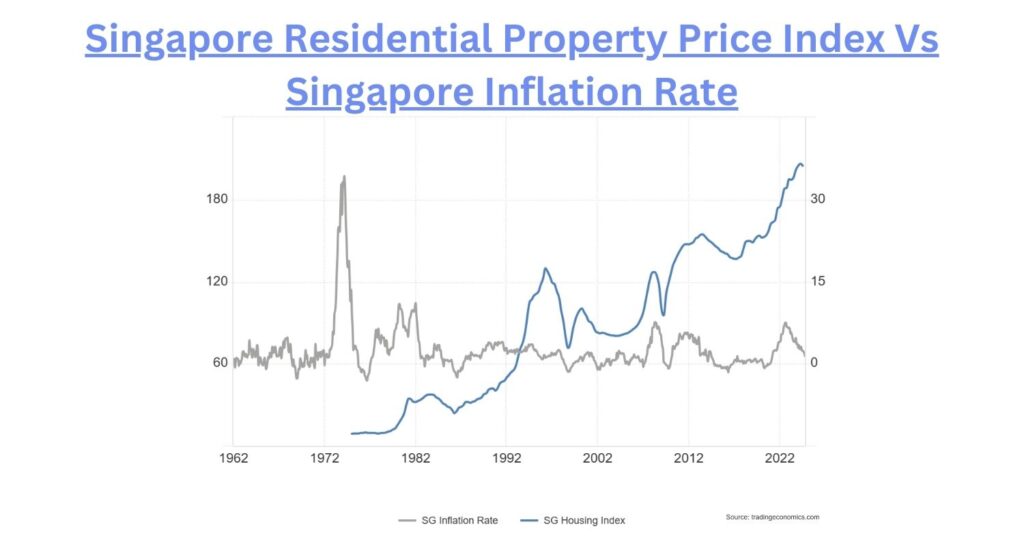

Singapore Residential Property Price Index VS Singapore Inflaction Rate

Furthermore, a positive inflation rate further pushes property prices on an upward trend.

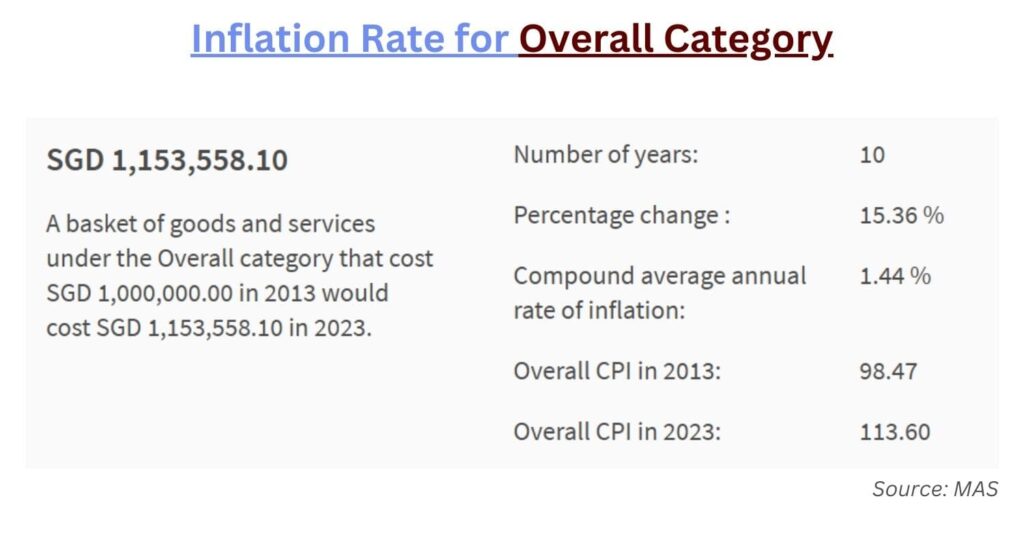

“$1 ten years ago is worth $0.87 today! How much will $1 today be worth in the next 10 years?”

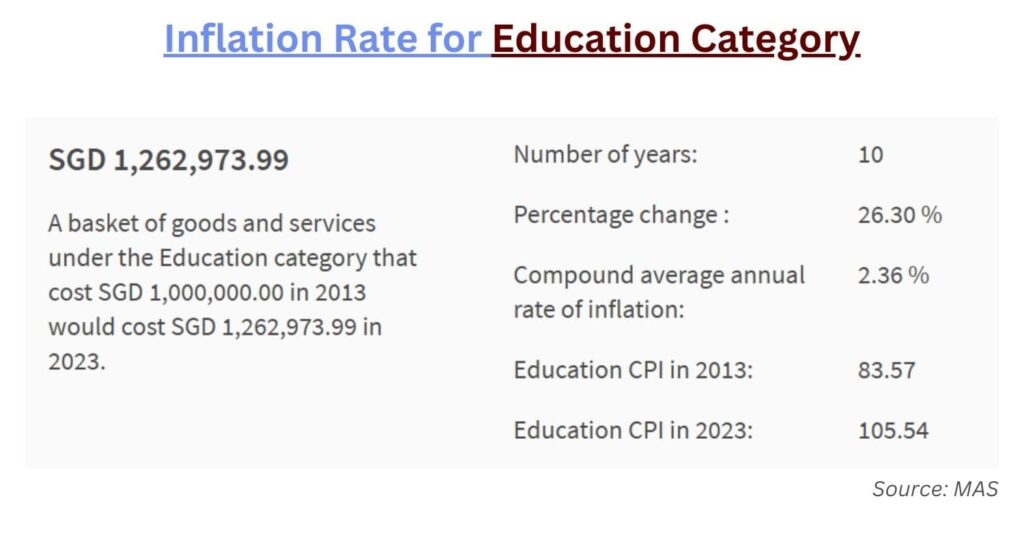

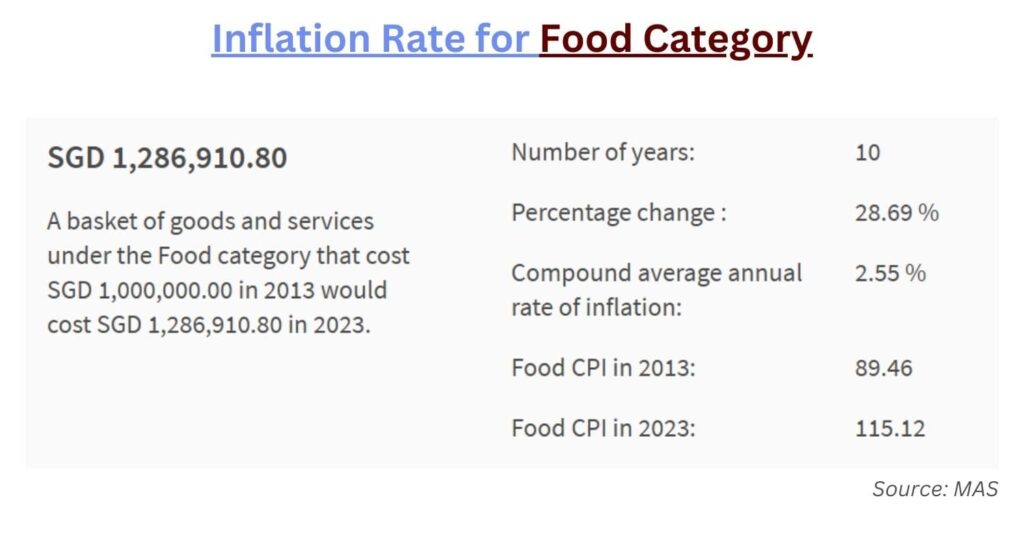

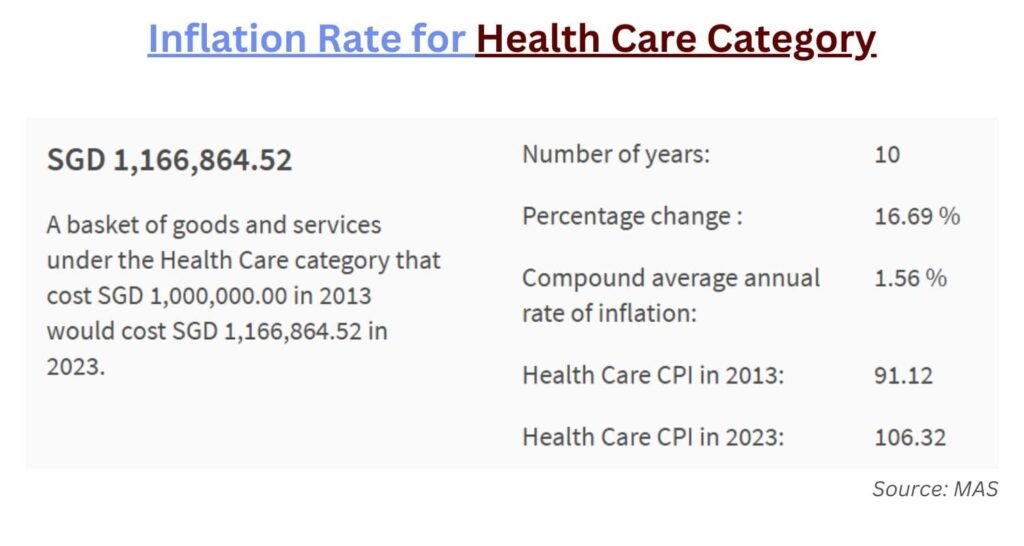

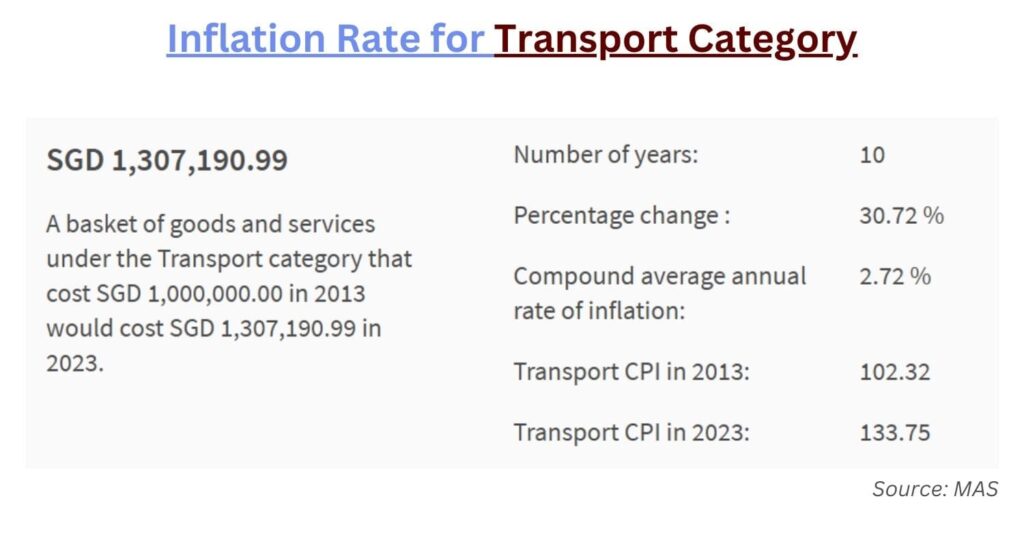

Inflation Affects Everything Around Us

Is Real Estate The Safest Hedge To Preserve And Grow Your Wealth?

Comparing to Education, Food, Health, and Transport category inflation rate, private property growth over ten years outperforms all others.

- Private Condo Growth: 54.61%

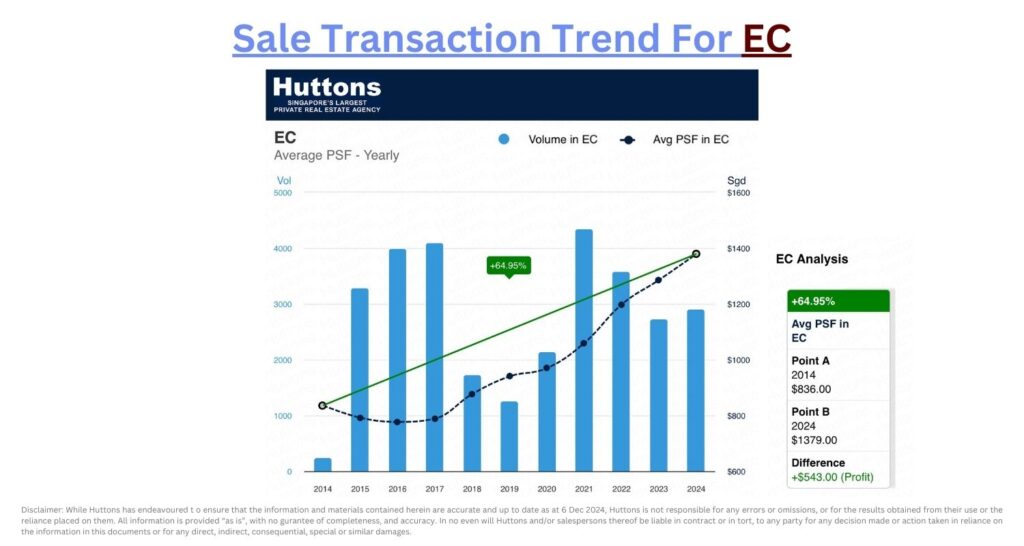

- Executive Condo Growth: 64.95%

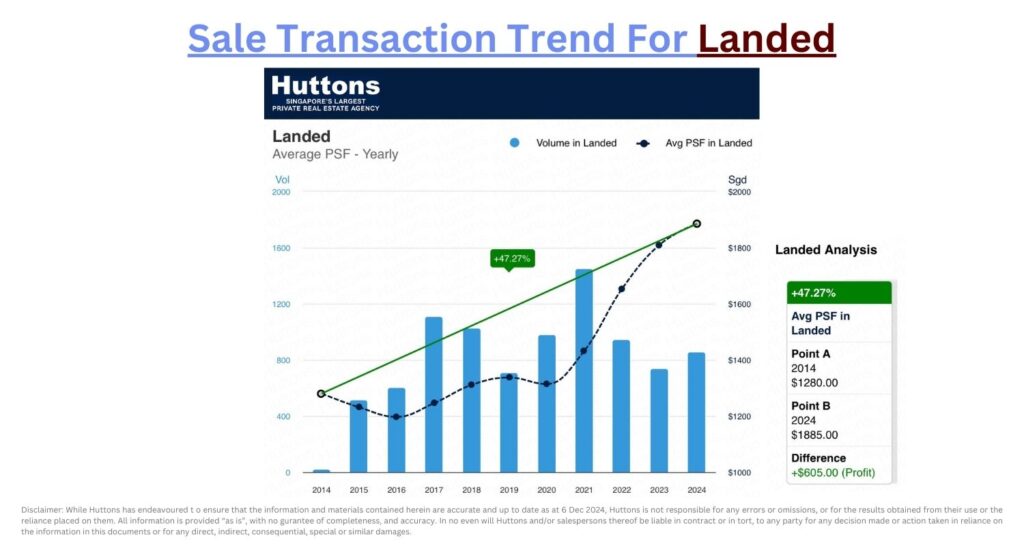

- Landed Property Growth: 47.27%

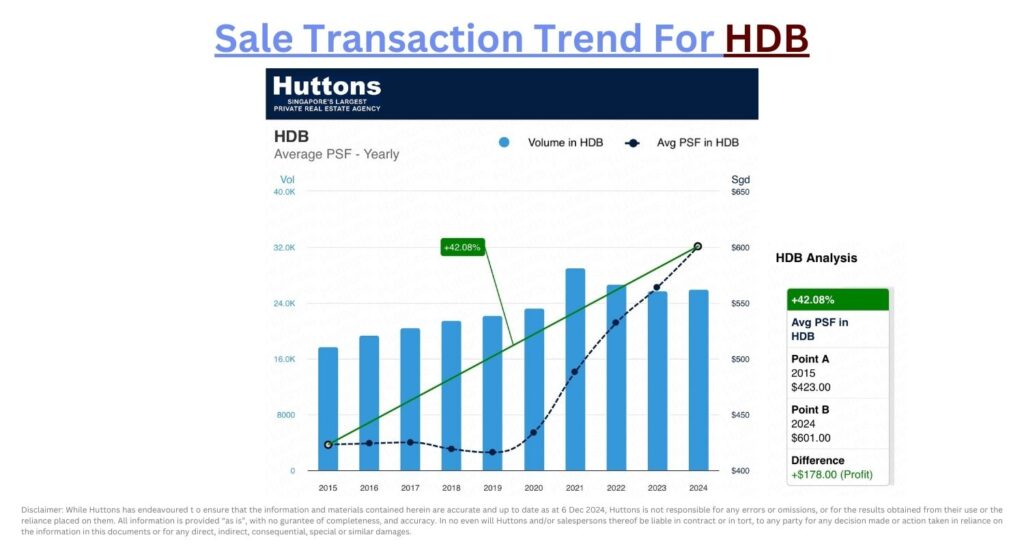

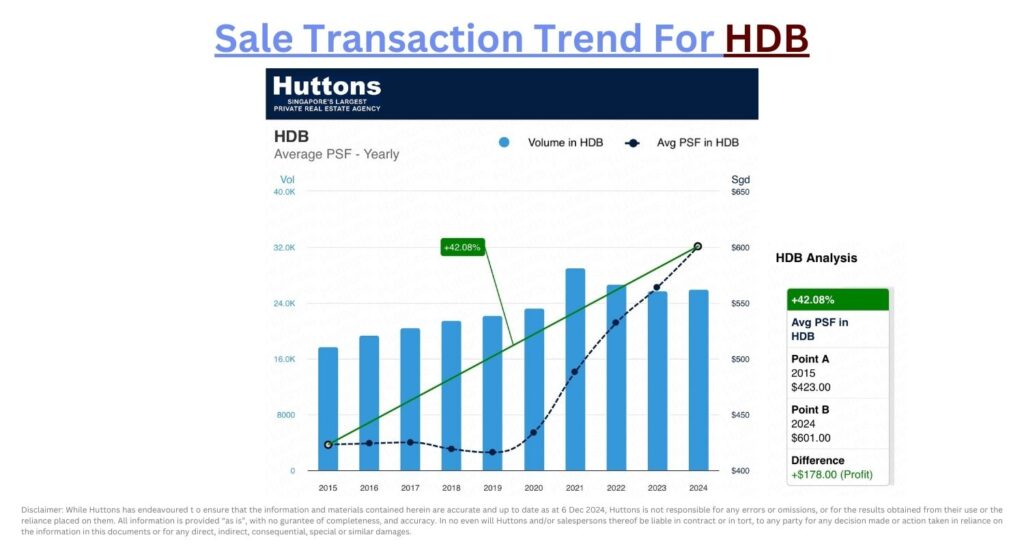

- HDB Flat Growth: 42.08%

Real estate investment advantages over other types of investments include potentially higher returns, stability, inflation hedging, and diversification.

Real estate potentially provides better returns than the stock market without as much volatility. It also has high tangible asset value, and values of the property tend to increase over time.

Most importantly, real estate property is Tangible. It is physically there. Thus should the value appreciated, you may choose to cash out. On the other hand, if it’s depreciated, you still can choose to rent it out to generate rental income or want to stay in the property physically.

Past 10 Years Study On Various Investment Choices

Let’s examine how does Singapore property fare against a basket of investment choices.

Case Study: 10 Years HDB Investment Returns

Growth Rate

42.08% Growth (4.208% per year)

$423psf to $601psf

Assuming 1,000sf unit, profit over 10 years, ($601-$423) psf x 1000 sf

$178k

Assuming 25% Downpayment and

75% Housing Loan,

Purchase Price: $423,000

Sale Price: $601,000

25% Downpayment: $105,750

Buyer Stamp Duty: $7,290

1% Brokerage Fee + GST: $4,610.70

Initial Capital Outlay: $117,650.70

Returns on Equity: 151.29%

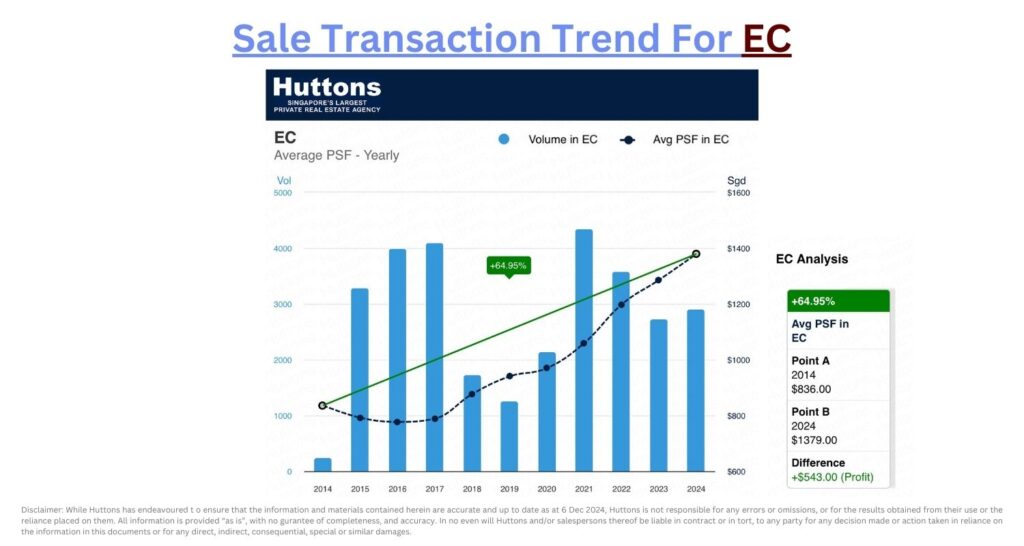

Case Study: 10 Years Executive Condominium (EC) Investment Returns

Growth Rate

64.95% Growth (6.495% per year)

$836psf to $1,379psf

Assuming 1,000sf unit, profit over 10 years, ($1,379-$836) psf x 1000 sf

$543k

Assuming 25% Downpayment and

75% Housing Loan,

Purchase Price: $836,000

Sale Price: $1,379,000

25% Downpayment: $209,000

Buyer Stamp Duty: $19,680

Initial Capital Outlay: $228,680

Returns on Equity: 237.45%

(Min. ROE as term loans possible whenever value goes up)

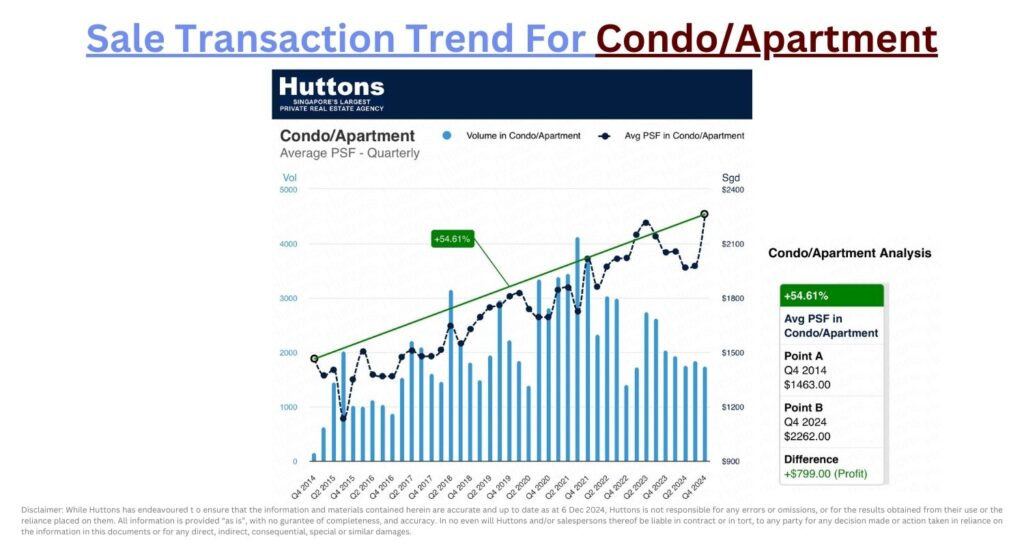

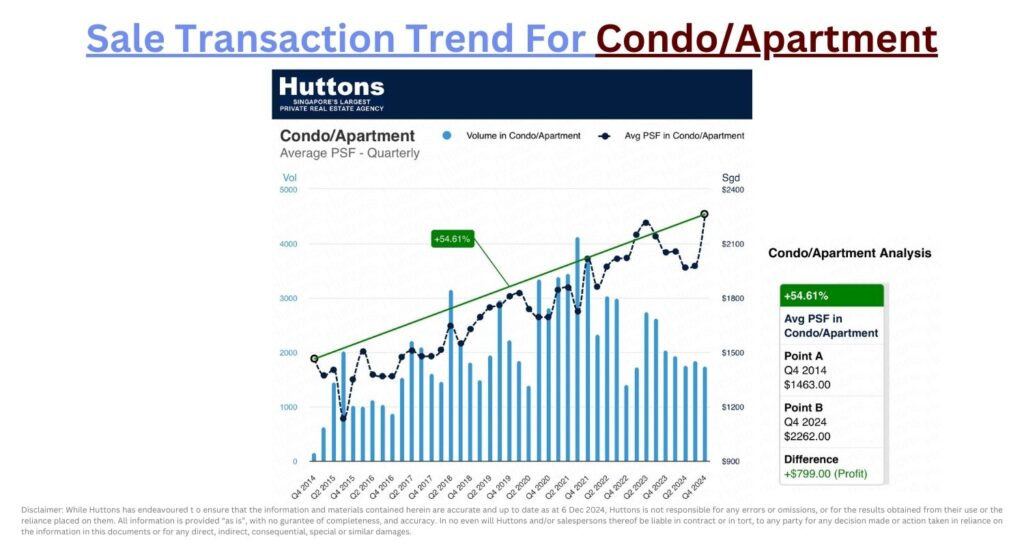

Case Study: 10 Years Condominium/Apartment Investment Returns

Growth Rate

54.61% Growth (5.461% per year)

$1,463psf to $2,262psf

Assuming 1,000sf unit, profit over 10 years, ($2,262-$1,463) psf x 1000 sf

$799k

Assuming 25% Downpayment and

75% Housing Loan,

Purchase Price: $1,463,000

Sale Price: $2,262,000

25% Downpayment: $365,750

Buyer Stamp Duty: $43,120

Initial Capital Outlay: $408,870

Returns on Equity: 195.42%

(Min. ROE as term loans possible whenever value goes up)

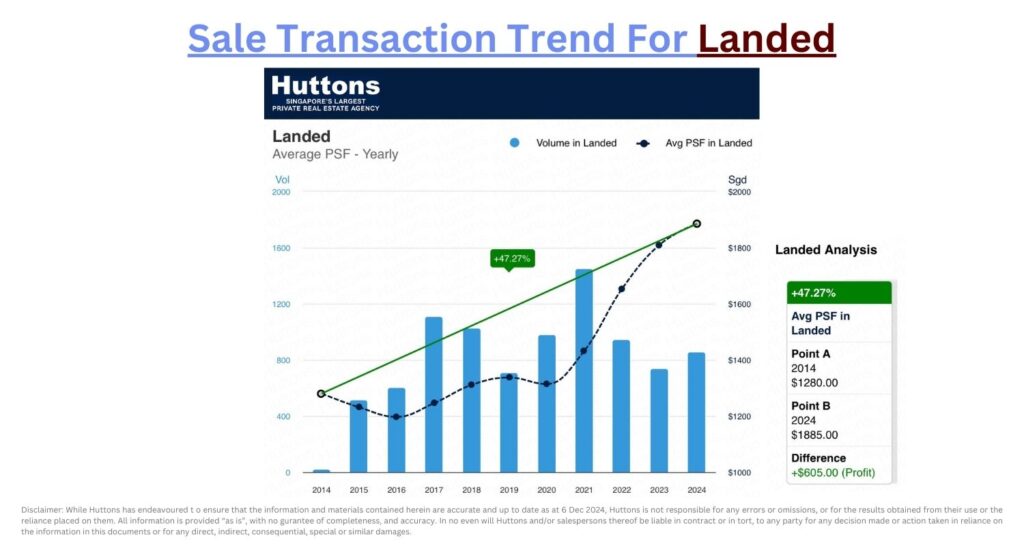

Case Study: 10 Years Landed Investment Returns

Growth Rate

47.27% Growth (4.727% per year)

$1,280psf to $1,885psf

Assuming 2,000sf unit, profit over 10 years, ($1,885-$1,280) psf x 2000 sf

$1,210,000

Assuming 25% Downpayment and

75% Housing Loan,

Purchase Price: $2,560,000

Sale Price: $3,770,000

25% Downpayment: $640,000

Buyer Stamp Duty: $97,600

Initial Capital Outlay: $737,600

Returns on Equity: 164.05%

(Min. ROE as term loans possible whenever value goes up)

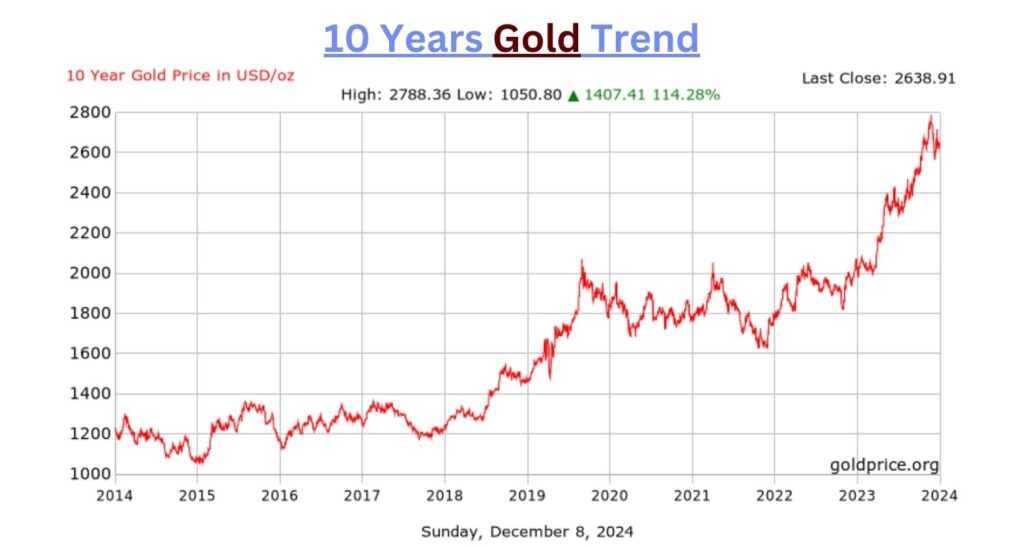

Case Study: 10 Years Gold Investment Returns

Returns on Equity: 114.28%

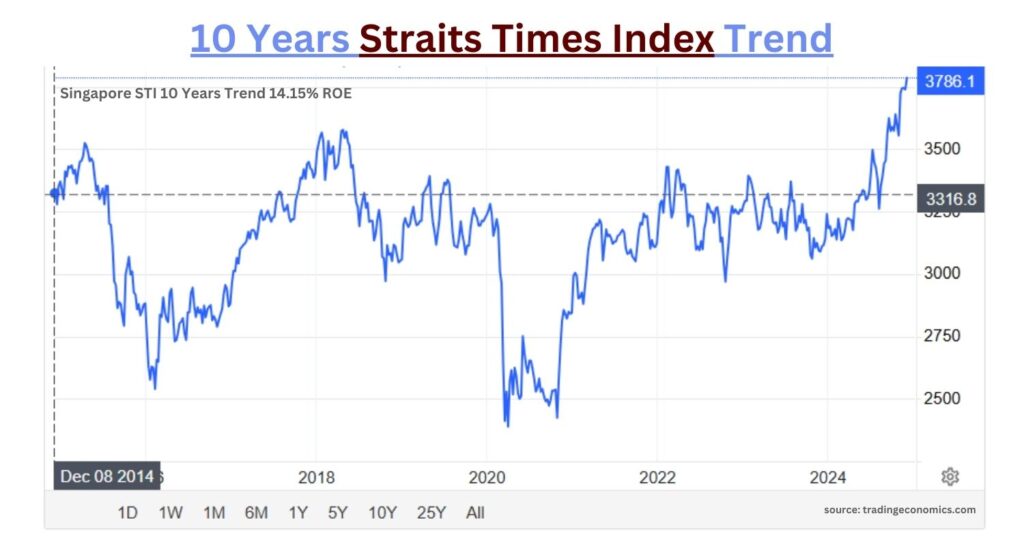

Case Study: 10 Years Straits Times Index Investment Returns

Returns on Equity: 14.15%

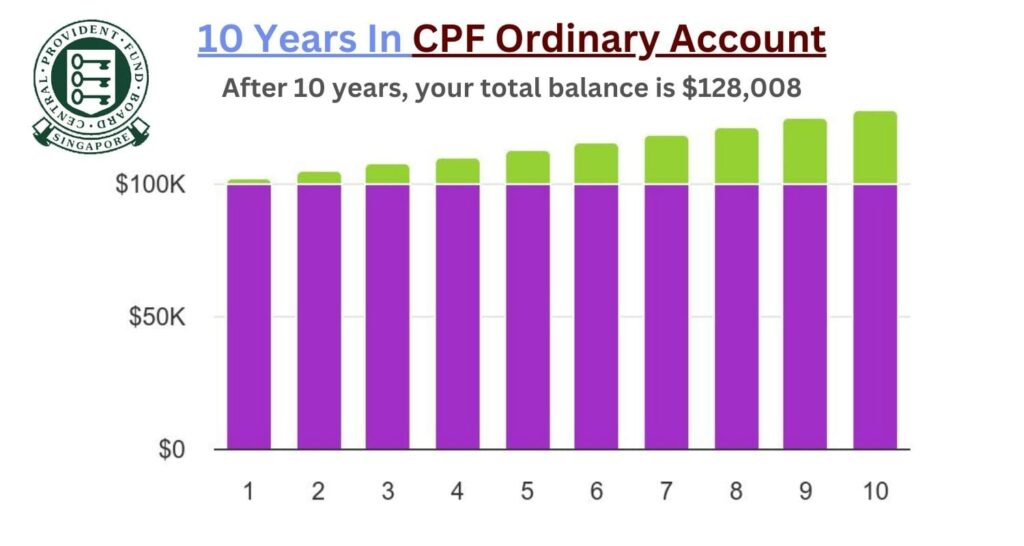

Case Study: 10 Years CPF Ordinary Account Returns

We all know that CPF Board is paying 2.5% p.a. for saving that are residing in the CPF Ordinary Account. Let’s assume you have $100,000 compounded at 2.5% annually over 10 years.

Today’s Value: $128,008

Returns on Equity: 28%

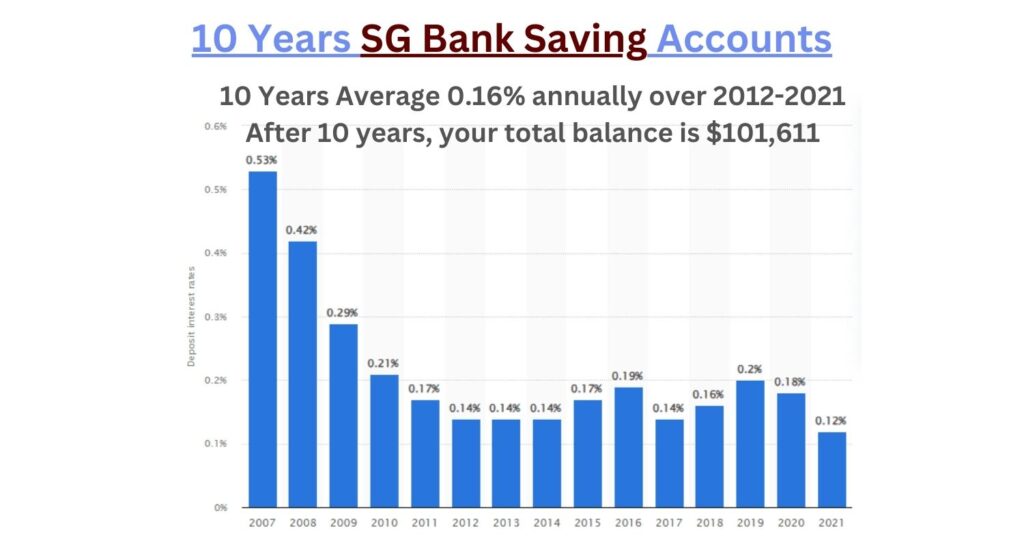

Case Study: 10 Years SG Bank Savings Account Returns

Assuming you have $100,000 compounded at average 0.16% annually over 10 years.

Today’s Value: $101,611

Returns on Equity: 1.6%

Case Study: 10 Years SG Fixed Deposits Account Returns

Assuming you have $100,000 compounded at average 3% annually over 10 years.

Today’s Value: $134,392

Returns on Equity: 34.39%

10 Years Comparison of Common SG Investment Choices Summary

| Investment Type | Initial Capital (2014) | Returns (Dec 2024) | Return on Equity % | *With 5/10 Years Rental Returns |

|---|---|---|---|---|

| Executive Condo | $228,680 | $543,000 | 237.45% | 374.45% |

| Condominium | $408,870 | $799,000 | 195.42% | 269.42% |

| Landed Property | $737,600 | $1,210,000 | 164.05% | 238.05% |

| HDB Flat | $117,650.70 | $178,000 | 151.29% | 188.29% |

| GOLD | $100,000 | $114,280 | 114.28% | NA |

| SG Fixed Deposits Account | $100,000 | $34,392 | 34.39% | NA |

| CPF Ordinary Account | $100,000 | $28,008 | 28% | NA |

| Straits Times Index | $100,000 | $14,150 | 14.15% | NA |

| SG Bank Savings Account | $100,000 | $1,611 | 1.6% | NA |

All property types are 25% cash deposit and 75% loan. Assuming 1.5% nett yields.

* Due to HDB/ECs need to fulfill MOP 5 years, the rental returns is based on 5 years returns, add 37% to ROE. Private properties add 10 years rental yield, 74% to ROE.

Why Do Properties in Singapore Keep Going Up in Value?

Let’s talk about a question many property investors ponder: why do Singapore properties seem to appreciate steadily over time? It’s not magic, but a mix of practical reasons that make our little red dot one of the most resilient property markets in the world.

Imagine this: You’re standing in a bustling MRT station, surrounded by people heading to work, new shopping malls popping up nearby, and sleek condos towering over the skyline. This vibrant scene is a snapshot of why Singapore property appreciates—it’s a combination of limited space, thoughtful urban planning, and strong demand.

Inflation: The Silent Price Riser

First, let’s talk inflation. You’ve probably noticed your kopi or hawker meal getting more expensive over the years. Property is no different. As inflation pushes the price of almost everything up, property values naturally climb too. And with higher material, labor, and construction costs, it’s no wonder new launches are priced higher than before.

Land Is Precious—and Pricey

In Singapore, land is a rare commodity. Think about it: we’re a tiny island with a growing population and limited space to build on. This makes land incredibly valuable leading to higher land cost. On top of that, new regulations like the Harmonisation of Floor Area (HFA) have raised costs for developers, which trickles down to buyers.

Infrastructure Makes a Difference

Picture this: a new MRT line opens in your area. Suddenly, everything feels more connected, and property prices start to creep up. This is the power of infrastructure development. The government’s constant investment in transportation networks, parks, and commercial hubs keeps neighborhoods evolving—and property values rising.

A Safe Bet in Uncertain Times

Singapore is like that reliable friend who never lets you down. Investors from around the world see our country as a safe haven, thanks to our stable economy and strong legal system. This global confidence drives demand for prime properties, especially in key districts, pushing up prices even further.

A Growing Population = Higher Demand

Every year, more people call Singapore home. Whether it’s families upgrading, new citizens settling in, or young couples buying their first flat, the demand for housing never really stops. More people competing for limited space? You guessed it—higher prices.

The Private Property “En-bloc Jackpot” Effect

Have you heard stories of homeowners striking gold with en-bloc sales? In land-scarce Singapore, older properties often get redeveloped to maximize land use. When these collective sales happen, they usually set new benchmarks for property values in the area, benefiting everyone.

A Deep Love for Property Ownership

Let’s face it—In Singapore, everyone love property. We see it as more than just a roof over our heads; it’s a symbol of stability and wealth. This cultural mindset ensures a steady demand for real estate, even during market slowdowns.

So, what does this all mean for property investors? Singapore’s property market isn’t just about bricks and mortar—it’s about a carefully crafted ecosystem where demand meets limited supply. Whether you’re buying for your own stay or as an investment, the long-term appreciation of property here is built on solid fundamentals.

If you’re considering a real estate investment, remember: every new launch, upgraded MRT line, and government policy is shaping the market—and the value of your property.

Ending Note to All

Investing in property is more than just buying a home or an asset—it’s about securing your future and creating opportunities for growth. Singapore’s property market has proven time and again to be resilient and rewarding, even in the face of global uncertainties.

Whether you’re a seasoned investor or just starting to explore the world of real estate, there’s no better time than now to take action. The factors that drive property appreciation—like inflation, land scarcity, and urban development—are ongoing, which means the market waits for no one. The longer you wait, the more you might miss out on opportunities to grow your wealth.

I know diving into the property market can feel overwhelming, especially with all the policies, market trends, and financial considerations. That’s why I’m here to help. As someone who’s passionate about Singapore real estate, I’d love to have a conversation with you—whether it’s about upgrading, finding the right property, or strategizing for your next investment.

Let’s connect with me to chat about your goals, and explore how real estate can fit into your plans for the future, and let’s start making your property investment dreams a reality.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls