Table of Contents

Freehold Vs Leasehold Properties, Which Suit You Best?

In Singapore, purchasing a private property is a major investment. Like every other one, you will have a lot to consider, such as tenure, location, size, layout, facing, and many more, when purchasing the property.

In this article, we shall look into the tenure of the private condominium property.

There are Freehold and Leasehold private property tenures in Singapore. Leasehold, there are 999-year leasehold or 99-year leasehold.

Walking down the street when we talk about freehold or leasehold property, many may prefer a freehold property over leasehold.

They have the concept that it is higher in value, and they can own the freehold property forever, and the government cannot take back. Thus they can pass it down to their next generation. But is it true? Let’s read on.

Yes, this is right! A freehold property does come with a higher value as compared to leasehold property, but higher in value means you will buy it with a premium price tag too.

Owner of the freehold property can hold onto the property indefinitely is not entirely true, provided the freehold property is not sitting on the land that the government needs to reclaim back for future development.

On the other hand, a leasehold property will need to be returned to the state after the tenure ends with zero value on the leasehold property.

Let’s examine further!

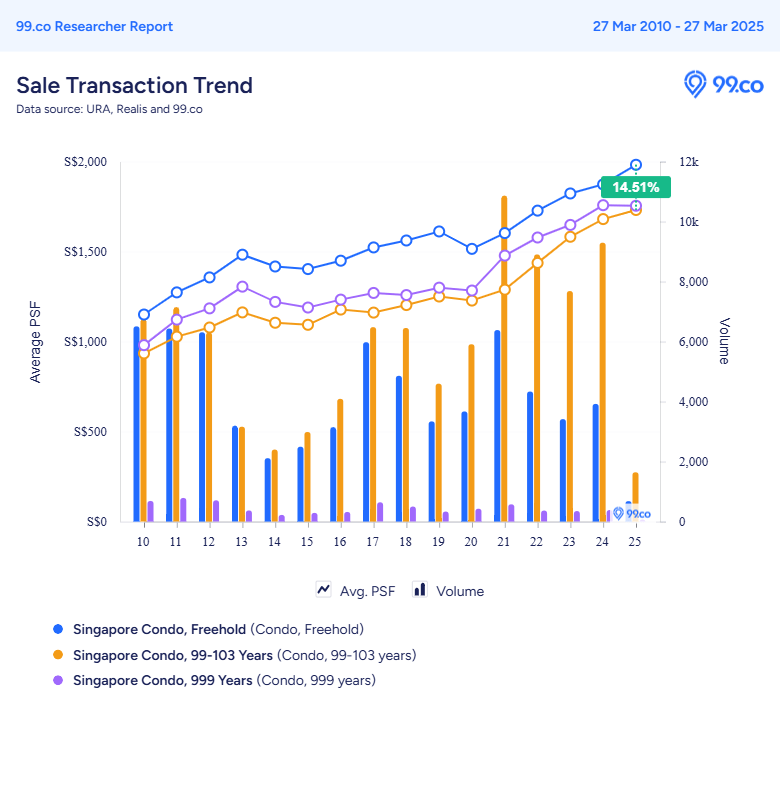

PAST DECADE SALE TRANSACTION TREND FOR FREEHOLD, 999-YEAR AND 99-YEAR LEASEHOLD PROPERTIES

From the sale transaction trend above for the past decade sale transaction, we can see that there is a premium tagged to freehold property, typically close to 15 percent higher, as compared to the leasehold property.

So which is better? Let me clear some of your thoughts that might be running behind your mind – Myths and Misconceptions;

Myth One

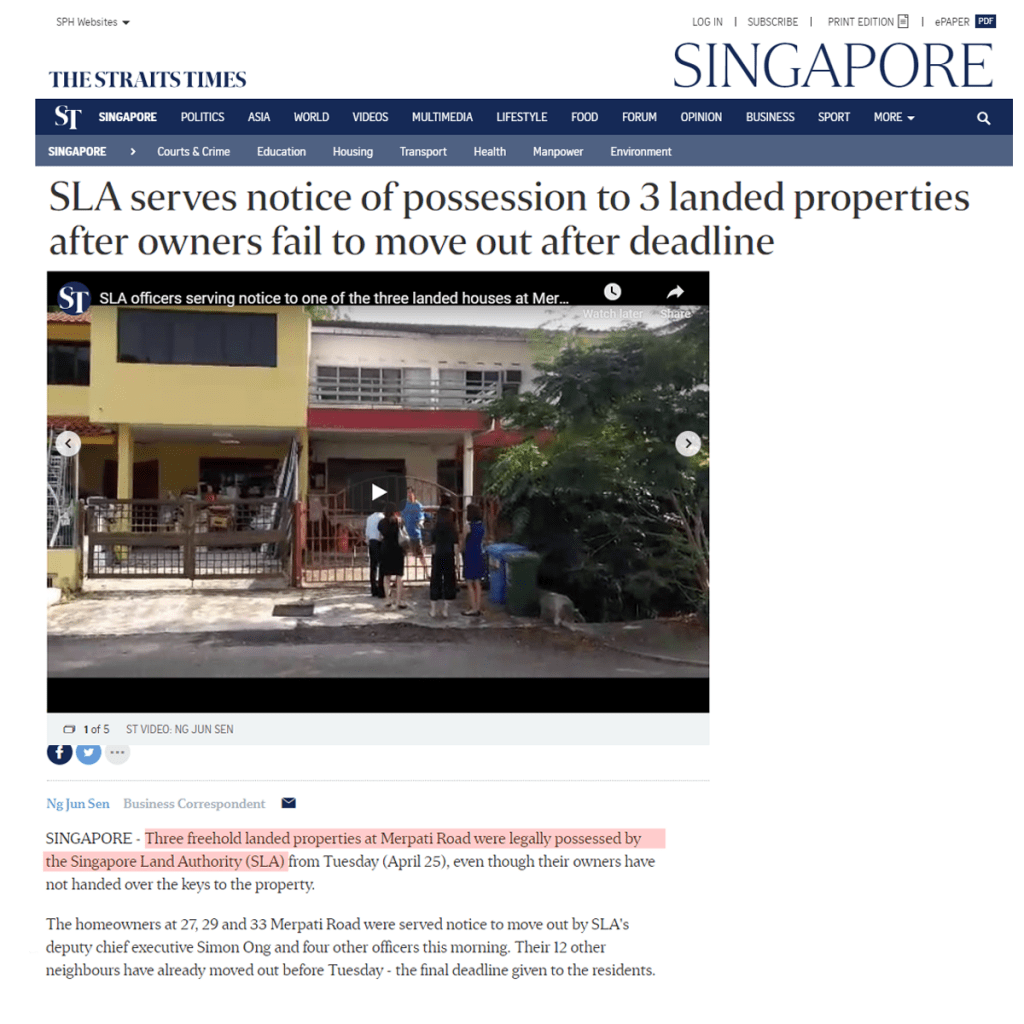

Do you know that not only leasehold property can be taken back by the government for infrastructure development? Your freehold property can still be reclaimed by the state as well if the land is in the plan for infrastructure development?

YES! IT’S TRUE!

Source: The Straits Times

Myth Two

Do you know that your freehold property can get en-bloc by a private developer?

YES! IT’S TRUE. As long as the majority of the owners agree to the en-bloc sale, you will have no choice to choose but to go along with the en-bloc sale.

But the positive side is that freehold properties should get a better price negotiated during en-bloc as compare to a leasehold property.

Myth Three

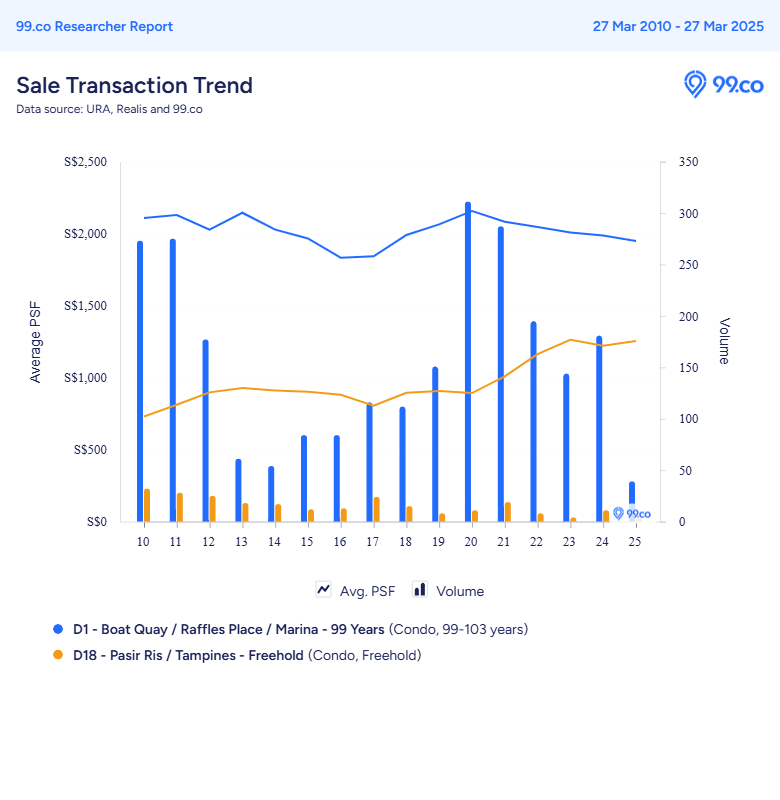

Do you know not all freehold property has a higher market value? Some leasehold property has a higher market value. YES! IT IS TRUE again. It is all depending on the location.

Let’s take a look at a simple Sale Transaction Trend below. It shows the freehold transaction trend in District 18 is lower than the leasehold trend in District 1 for the past decade. But If you were to compare apple to apple in the same district, it will be otherwise.

Rental Yields

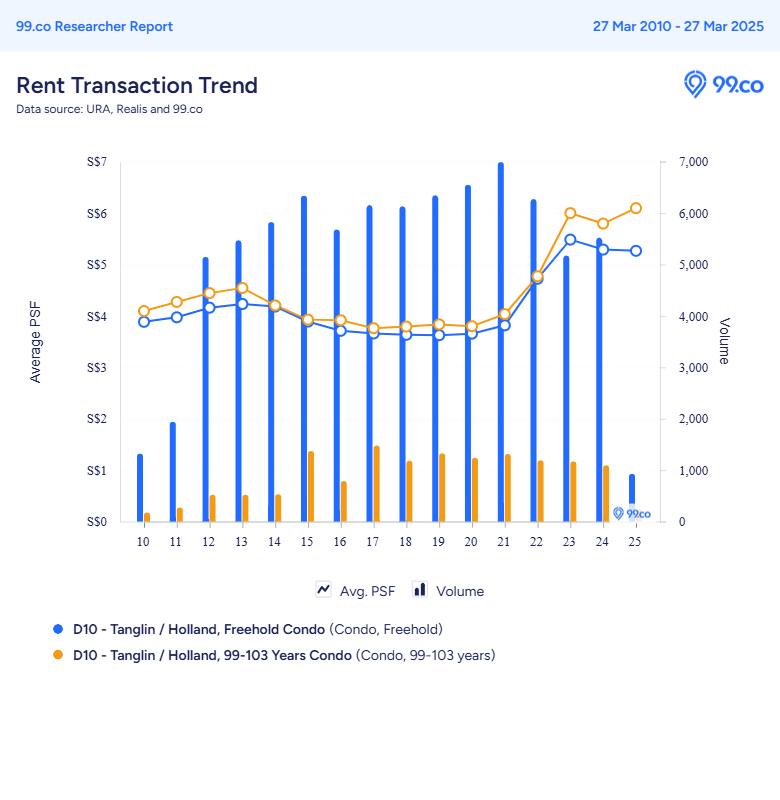

Do you know that, within the same location, leasehold property will get higher rental yields than freehold property?

It is true because freehold property is usually priced higher in the sale price but only enjoy the same rental rate or lower as the leasehold property because freehold property are sometime older as compared to leasehold property thus demand may not be that high.

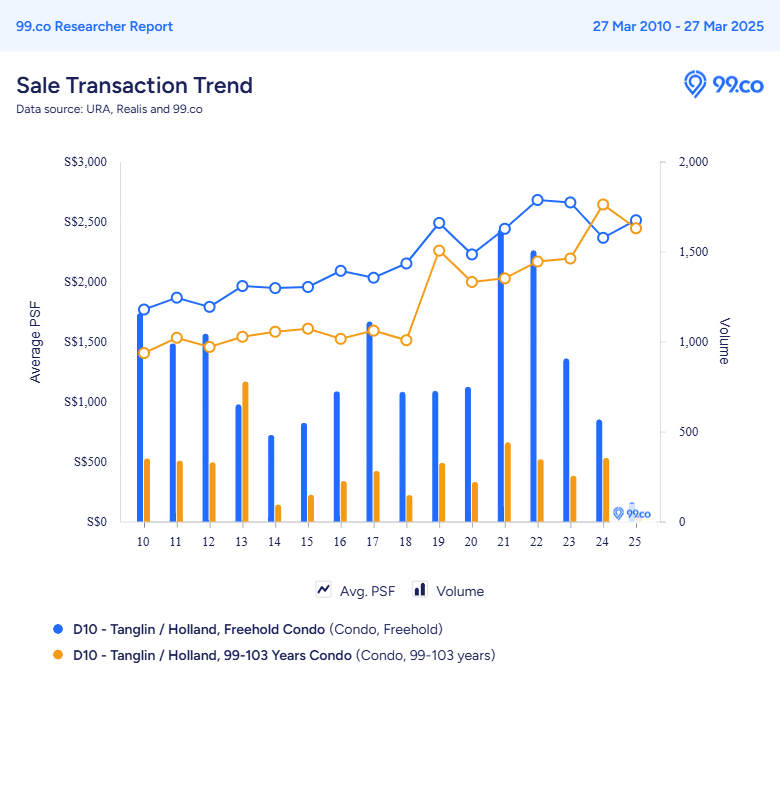

From the above sales and rental transaction trend, it is not hard to notice that the freehold properties price is slightly higher than and leasehold properties at any one time. But it’s rental for leasehold properties is higher than the freehold properties. The trends above clearly tell us that the rental yield for leasehold properties is usually higher than the freehold properties.

Let’s take a look at the below simple illustration:

Mr. Tan bought a leasehold condominium in District 19 at $1.5 million and generating $4,000 a month in rent.

Rental Yield = 3.2%

Mr. Lee bought a freehold condominium in District 19 nearby at $1.725 million and is also generating $4,000 a month in rent.

Rental Yield = 2.78%

PAST DECADE SALE TRANSACTION TREND FOR FREEHOLD AND 99-YEAR LEASEHOLD IN DIFFERENT DISTRICT IN SINGAPORE

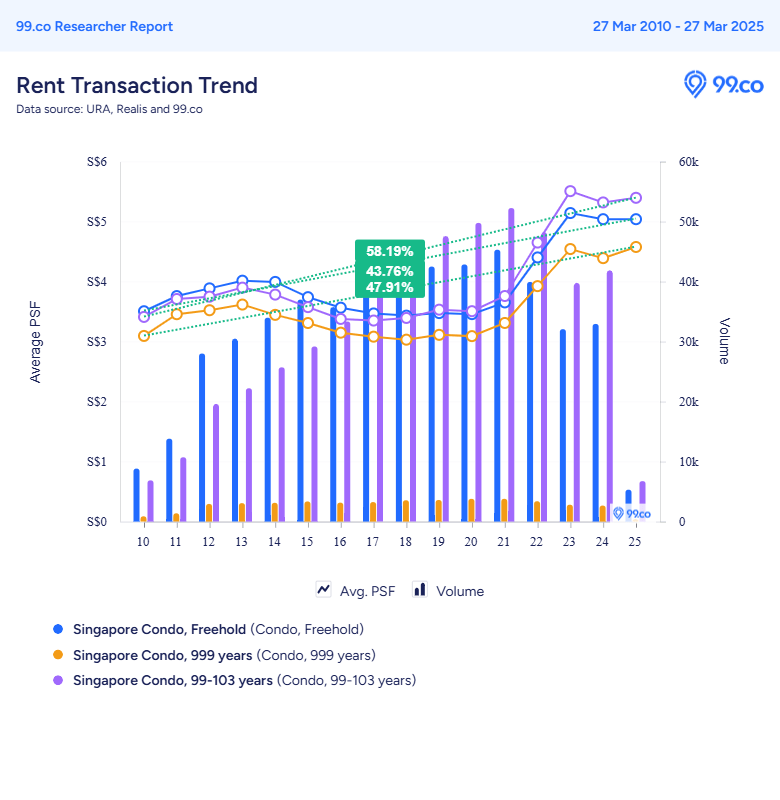

Let’s relook at the sale transaction trend for the past decade in Singapore. For Freehold development, it rises 43.76 percent over a decade. The 999 leasehold properties also rise 47.91 percent over a decade. As for 99 leasehold properties, surprisingly, it increases 58.19 percent higher than the other two.

For 999-year leasehold properties, some are treating it as freehold properties as their remaining lease would take almost many generations before it expired. Thus we will leave out the following sale transaction trend.

Let’s look deeper into various districts in Singapore and examine if the sale transaction trend remains consistent between Freehold properties and 99-year Leasehold properties.

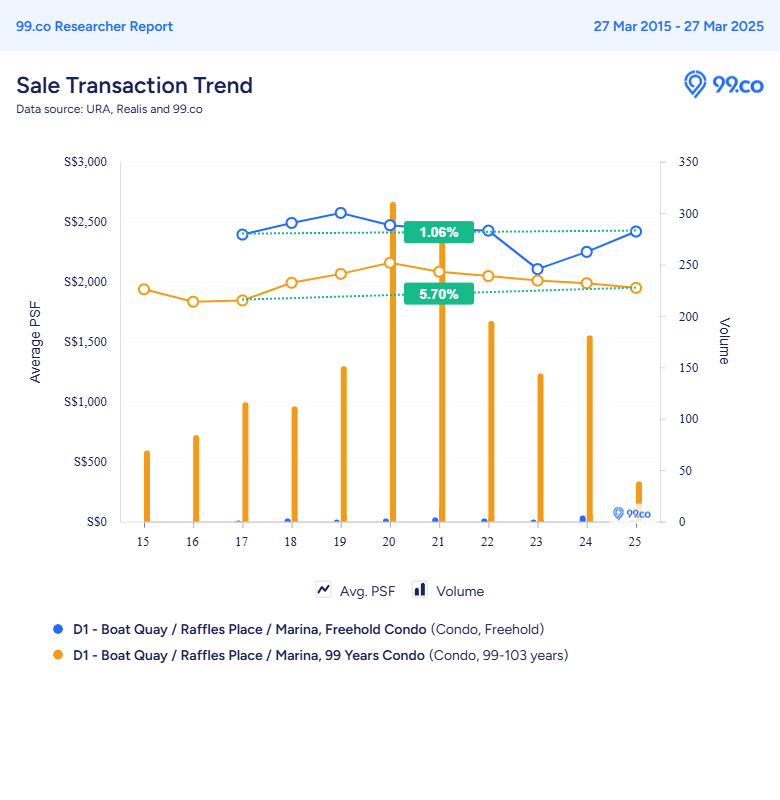

DISTRICT 01 (CCR):

There is a slight increase 1.06 percent for Freehold properties over the past years. As for the leasehold properties, it rises 5.70 percent over the past years.

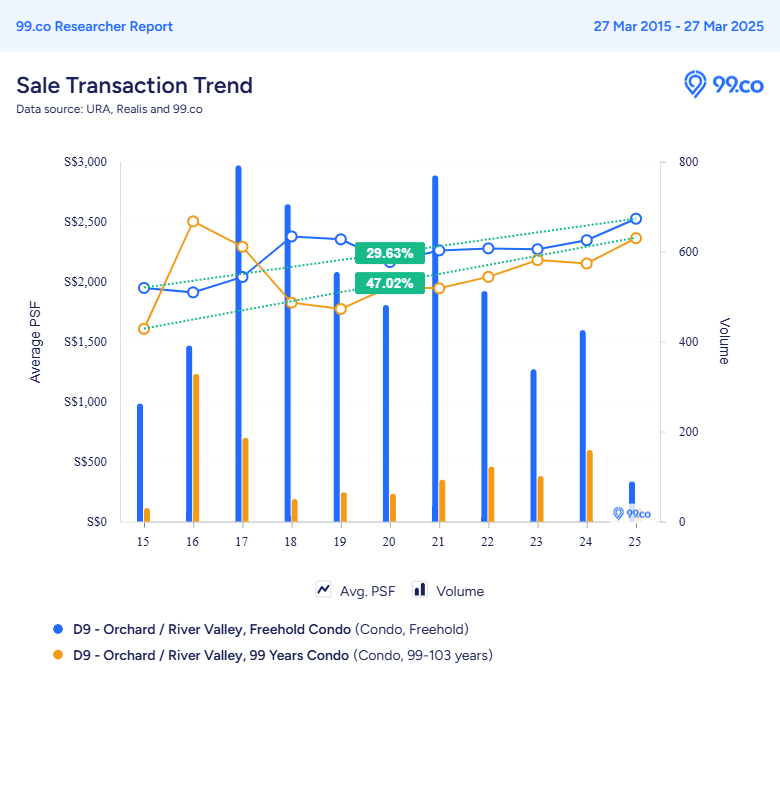

DISTRICT 09 (CCR):

In District 09, also at the Central Region (CCR). Both Freehold and Leasehold show an increase in percent, but the same thing happened. Freehold properties increase by 29.63 percent, while Leasehold properties increase 47.02 percent. Leasehold properties still appreciated more than Freehold properties.

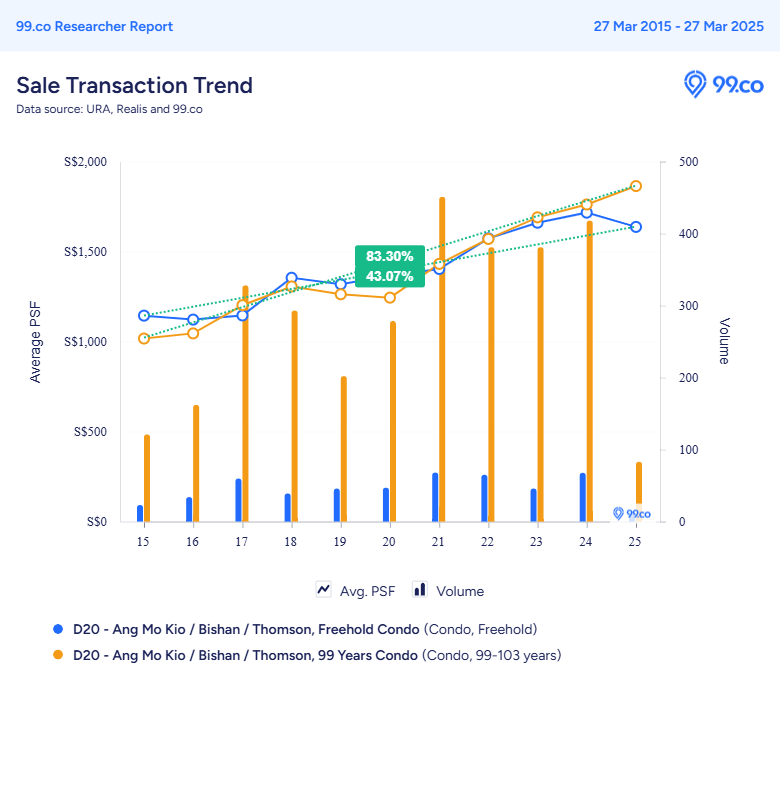

DISTRICT 20 (RCR):

In District 20 at the Rest of Central Region (RCR). We still see a similar Sale Transaction Trend. The Freehold properties increase 43.07 percent, which is lower than the Leasehold properties 83.30 percent.

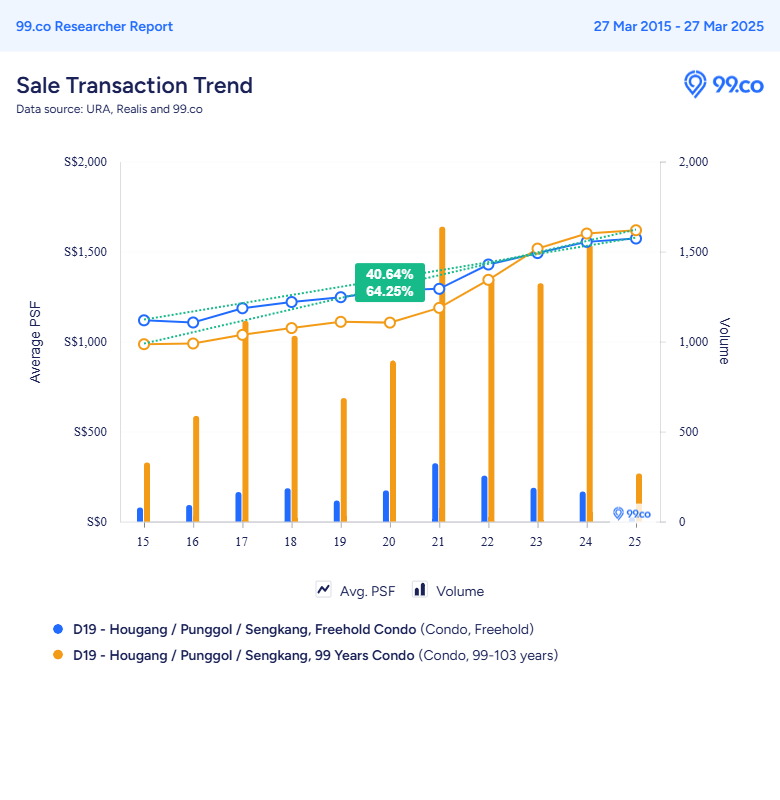

Let take a look further on the Sale transaction trend outside the central region (OCR)

DISTRICT 19 (OCR):

In District 19 at the Outside Central Region (OCR). Freehold properties still lower than the Leasehold properties at 40.64 percent and 64.25 percent, respectively.

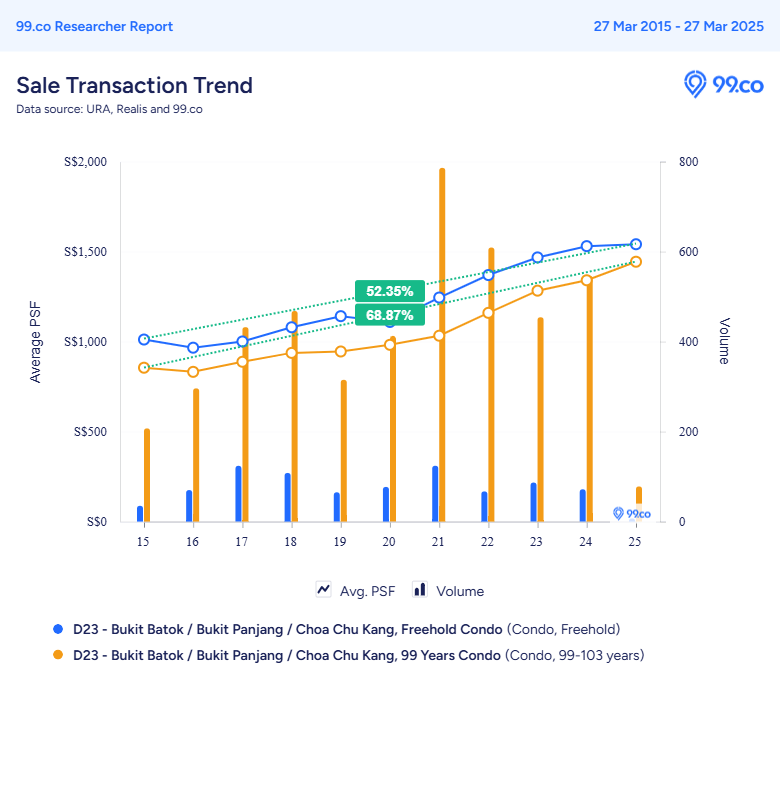

DISTRICT 23 (OCR):

Lastly, let take a look at another OCR district in District 23. The same sale transaction trend happened. Freehold properties increase by 52.35 percent, which Leasehold properties rise higher at 68.87 percent.

From the above sale transaction trend over the past decade, we can notice that leasehold properties appreciated more than freehold properties.

One reason why 99-year Leasehold properties prices appreciate more may attribute to the lower entry prices where there is more room for appreciation. Unlike Freehold properties, you will have to pay at 10-15 percent premium.

CONCLUSION

While locations play a vital part in investing in real estate in Singapore, you may want to look at the property tenure and understand which suits you better.

Leasehold condominium tends to have more room for value appreciation as compare to the Freehold condominium as the entry price is usually 10-15 percent lower.

But you must also note that unlike Freehold properties, the Leasehold properties will likely face the value depreciation over time and eventually dropped to zero in value if the lease reached the end of the 99 years. But it is quite unlikely to happen if the developer initiated an en-bloc sale.

But having said that, when the remaining lease is getting lesser, the developer will need to pay more to top up the lease back to 99 years, thus reducing your en-bloc sale profit if there’s any.

Also, the 99-year leasehold properties face housing loan and CPF usage restriction as well.

If the property cannot cover the younger purchaser until 95 years old when the remaining lease ended after 99 years, the purchaser will face some restriction in their housing loan and the allowed CPF sum usage.

Unlike a property that can cover the younger buyer until 95 years old, they can have full housing loans (90% for HDB and 75% for the bank, subject to credit assessment and relevant approval) and no restriction to CPF usage.

The advantage of Leasehold properties is that you are entering at a price tag 10-15 percent lower than Freehold properties, thus you will enjoy higher rental yield as compare to the nearby Freehold properties.

In my personal opinion, If you are buying an investment property to generate rental income. You should consider leasehold property, and you should monitor and execute your exit plan and cash out before the valuation starts to turn into depreciation mode to gain your maximum profit. Then you will be able to invest again in newer lease property to generate rental income and have spare profit cash for other investments.

If you are buying for your long term stay, you may consider a freehold property so that you do not have to bother about any loan or CPF restriction. Furthermore, it will be an excellent asset to pass down to your next generation if the property if the government is not taking back the land for infrastructure upgrading.

Once again, if you would like to find out more about upgrading to private condominium, real estate investment, or how to restructure your property portfolio, do feel free to contact me for a non-obligatory friendly discussion.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls