4 Options for Property Owners to Sail Through Downturn

Since late 2019, the COVID-19 virus, also known as novel coronavirus, first infecting humans, causing flu-like symptoms to viral pneumonia and severe acute respiratory syndrome. It has since spread worldwide, infecting countless humans exponentially and claiming many innocent lives worldwide, and many livelihoods are affected.

As the COVID-19 first detected in Singapore on 23rd January 2020. The government has since stepped up with many preventive measures to tactic the ongoing pandemic. Still, with the number of returning citizens from oversea, the number of cases has also increased exponentially.

With the implementation of advanced measures such as stay-home notices, travel bans, quarantine order, social distancing, work from home, and many more, to tackle the spread of the COVID-19 virus, many businesses were also asked to halt their operation.

As the COVID-19 virus continues to spread worldwide, it affects the global economy and hits heavily on tourism, travel, manufacturing, transport, the hospitality industry, and even consumer spending worldwide, including Singapore. Many businesses are under heavy pressure, some are even facing bankruptcy threats, and many livelihoods were, in turn, affected as well.

There is so much uncertainty in the present where no one can accurately predict what will happen in the future. But one thing for sure now is everyone comes together to fight the COVID-19 virus.

In this uncertain period, even with the government resilience budget, many were facing difficulty; some have lost their jobs; some have their salary and bonuses significantly reduced, and some also asked to go on unpaid leave till further notice.

As such, through this article sharing, I hope that those who face difficulty or about to experience difficult times ahead will have their way out to cope and get over soon.

Let’s take a look at the few options that you can consider by using your property to help yourself through this difficult time.

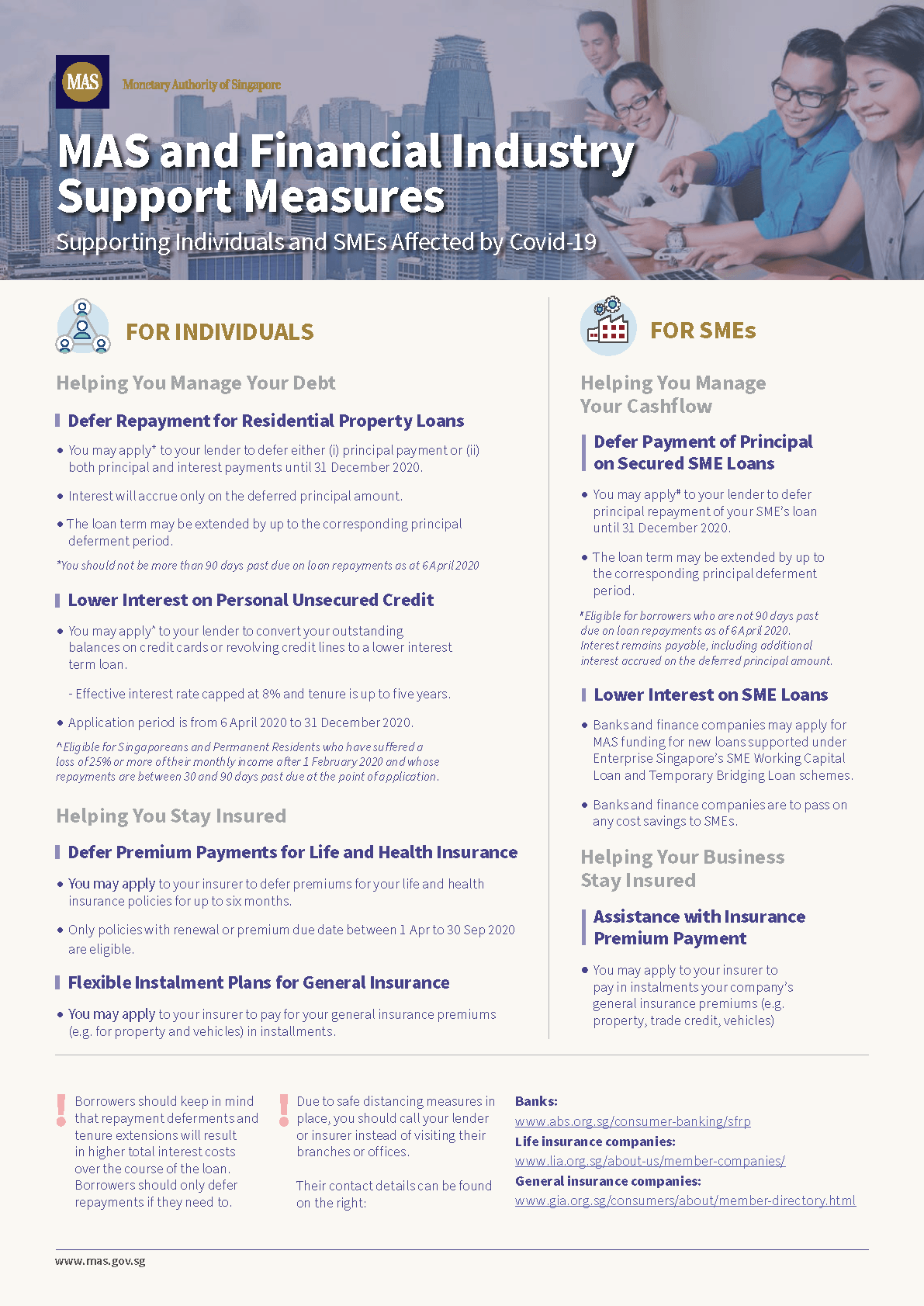

On 31st March 2020, the Monetary Authority of Singapore (MAS) has announced that individuals can apply to defer their home loan repayment and insurance premium payments. Also, SME can apply to defer their principal payment or lower the interest for their SME loan or people with unsecured loans can use to reduce their interest rates to tide over this challenging time amid the COVID-19 pandemic.

As a homeowner, you can apply for either principal deferment, interest deferment, or both principal and interest deferment for their home loan until 31st December 2020. But the precondition is that mortgagor is not in arrears for more than 90 days as of 6th April 2020.

This option is particularly beneficial for those who are not so heavily hit financially but do not have the home equity or lost the job without CPF contribution for home loan repayment. It is also useful for those who need to use the monthly home loan repayment cash for other cash flow expenses.

This option is also useful to Landlords if they lost their rental income to service the home loan as well.

Option 2: Refinancing and stretch your loan tenure

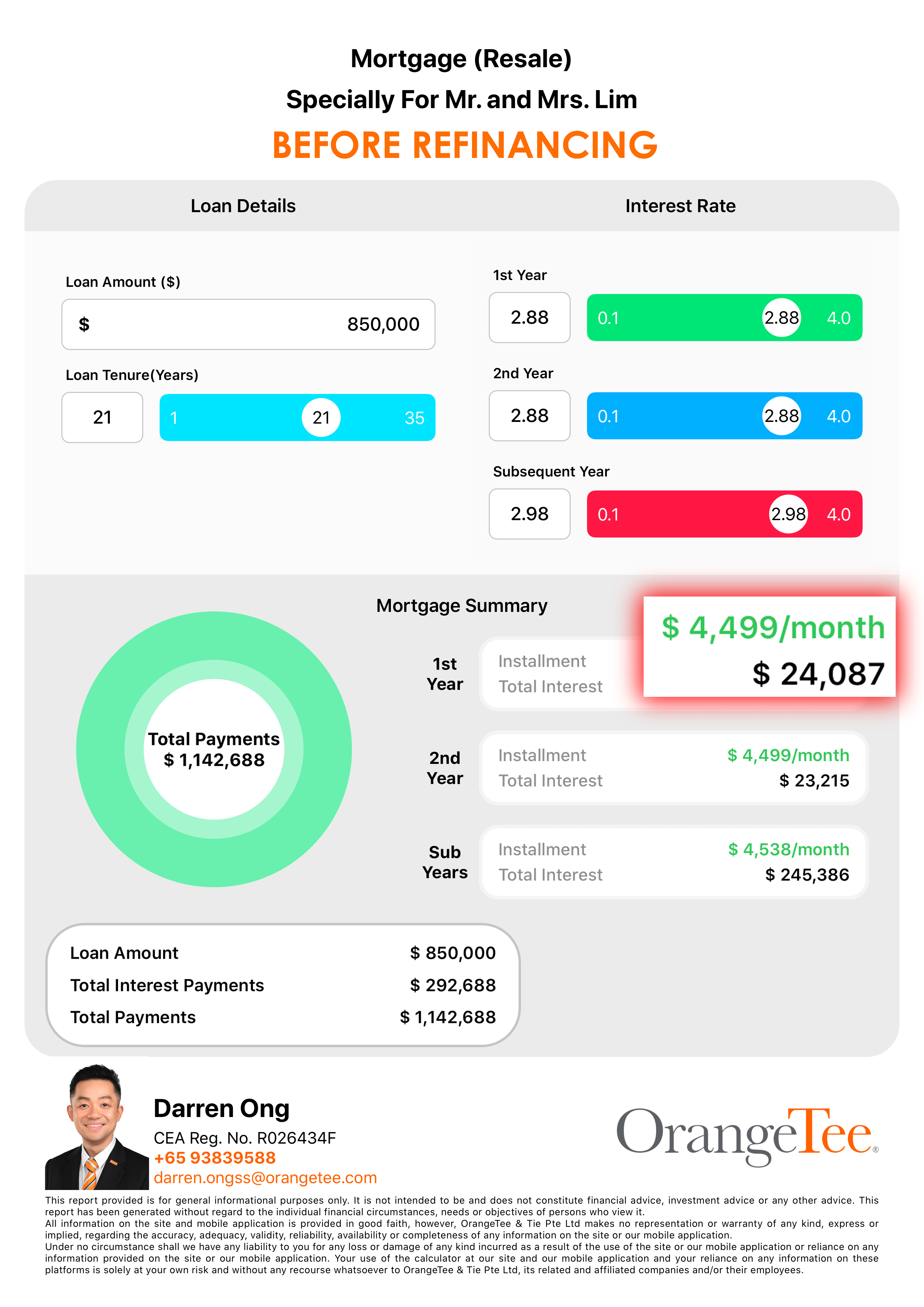

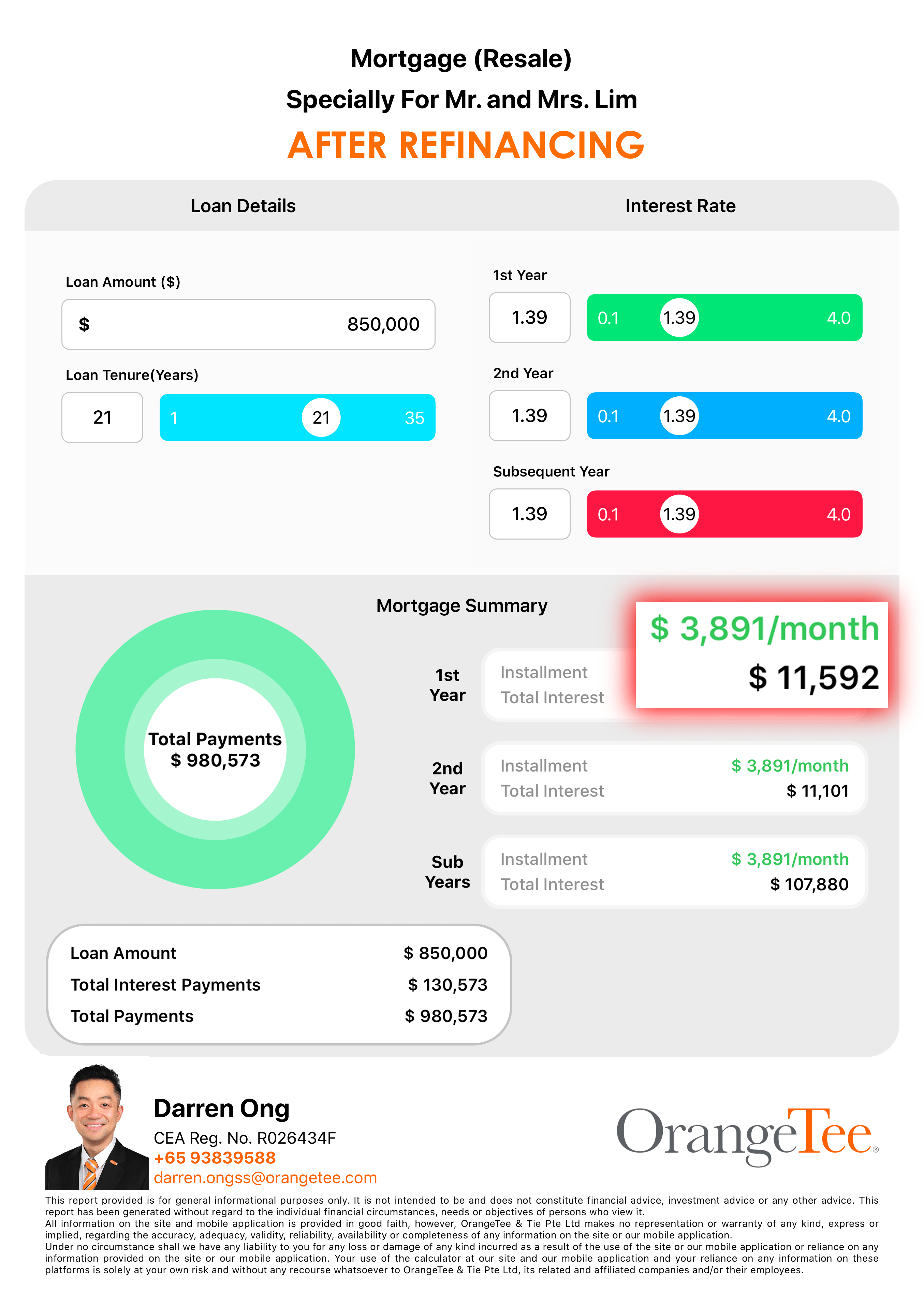

If you are still servicing an outstanding home loan and you have not refinanced before, high chance is that you are paying on a high-interest rate repayment now.

As Singapore track the interest rate of the US and the US Federal Reserve slashes the interest rates for the second time in less than two weeks on Sunday, 15th March 2020, it is a rare good chance for you to refinance to a lower interest rate package to save on the interest.

If you are eligible to refinance, please do so as soon as possible. Current home loan rates can be as low as 1.3% – 1.5% range.

Be sure that you are not within the lock-in period of your current home loan package when you apply to refinance your home loan.

If you are still within the lock-in period, you may want to contact your bank if there’s any leeway to refinance without incurring penalties within the lock-in period. I have heard from the client that the bank called them to refinance their home loan to lower rates within incurring penalties.

In a difficult time like this that is affecting everyone globally, the bank will be more willing to extend their helping hands to keep the market stables. So, please call the bank now and ask. You have nothing to lose by calling and ask.

A simple example of how much you can save by lower the interest rates:

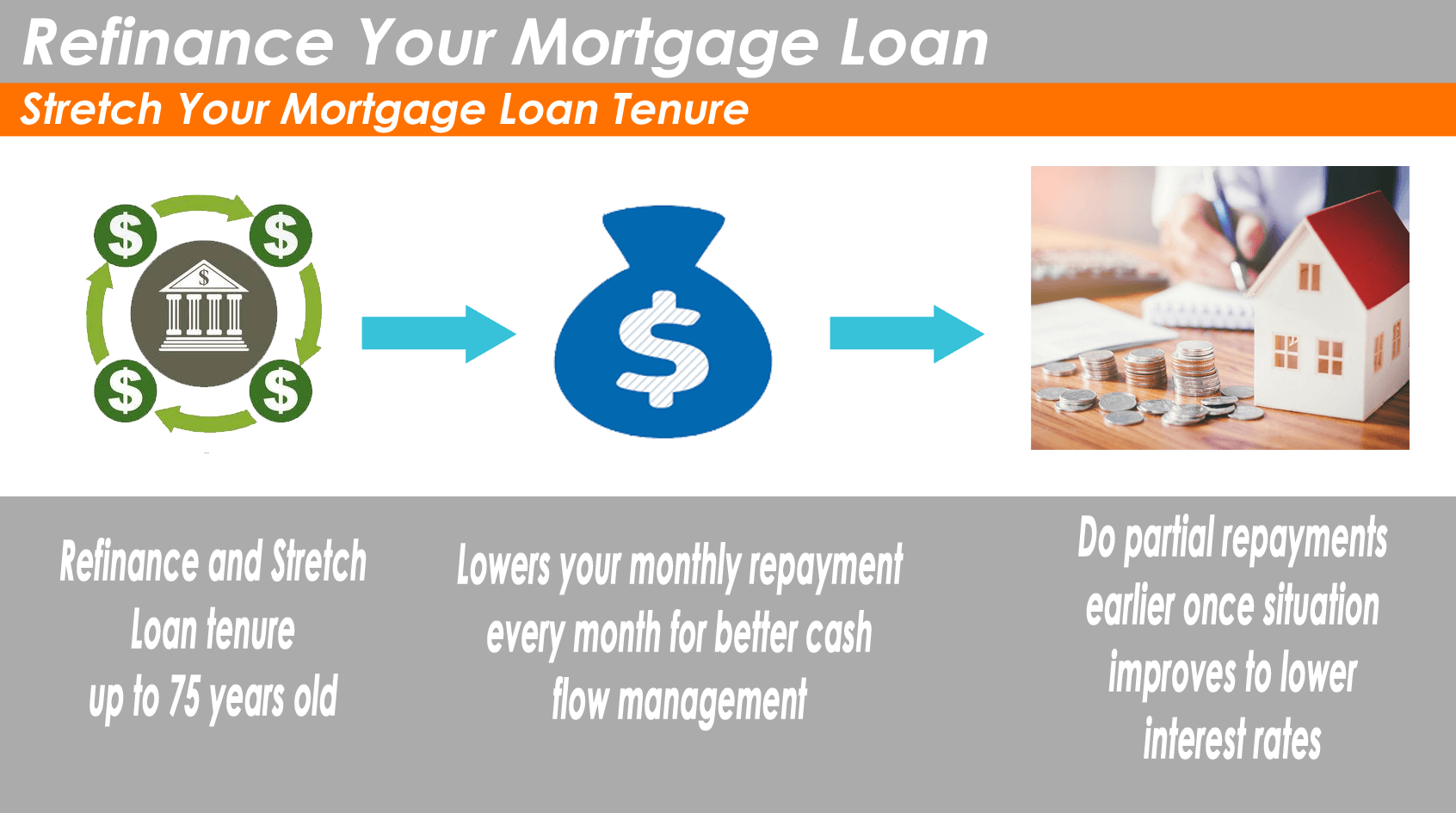

At the same time, when you refinance, you can choose the number of repayment years for your home loan, we call this loan tenure.

You may stretch the loan tenure of your private property home loan until you are 75 years old or up to 35 years maximum.

This way, you can reduce your monthly mortgage installments to free up some cash to tide over this difficult time. Until you are financially comfortable, then you can choose to reduce the loan tenure or even make a partial repayment.

But by stretching the loan tenure, the longer the repayment period, the more interest you pay.

Therefore my suggestion is that you can stretch your loan tenure in this challenging time to pay lesser monthly first. But try to reduce the loan tenure or make partial repayments if you can to reduce the interest that will incur over a long period.

You can apply option three together with option two so that you not only refinance to lower rates, lowering monthly repayment sum, but at the same time, you also cash out a lump sum of cash from your property to tide over this period.

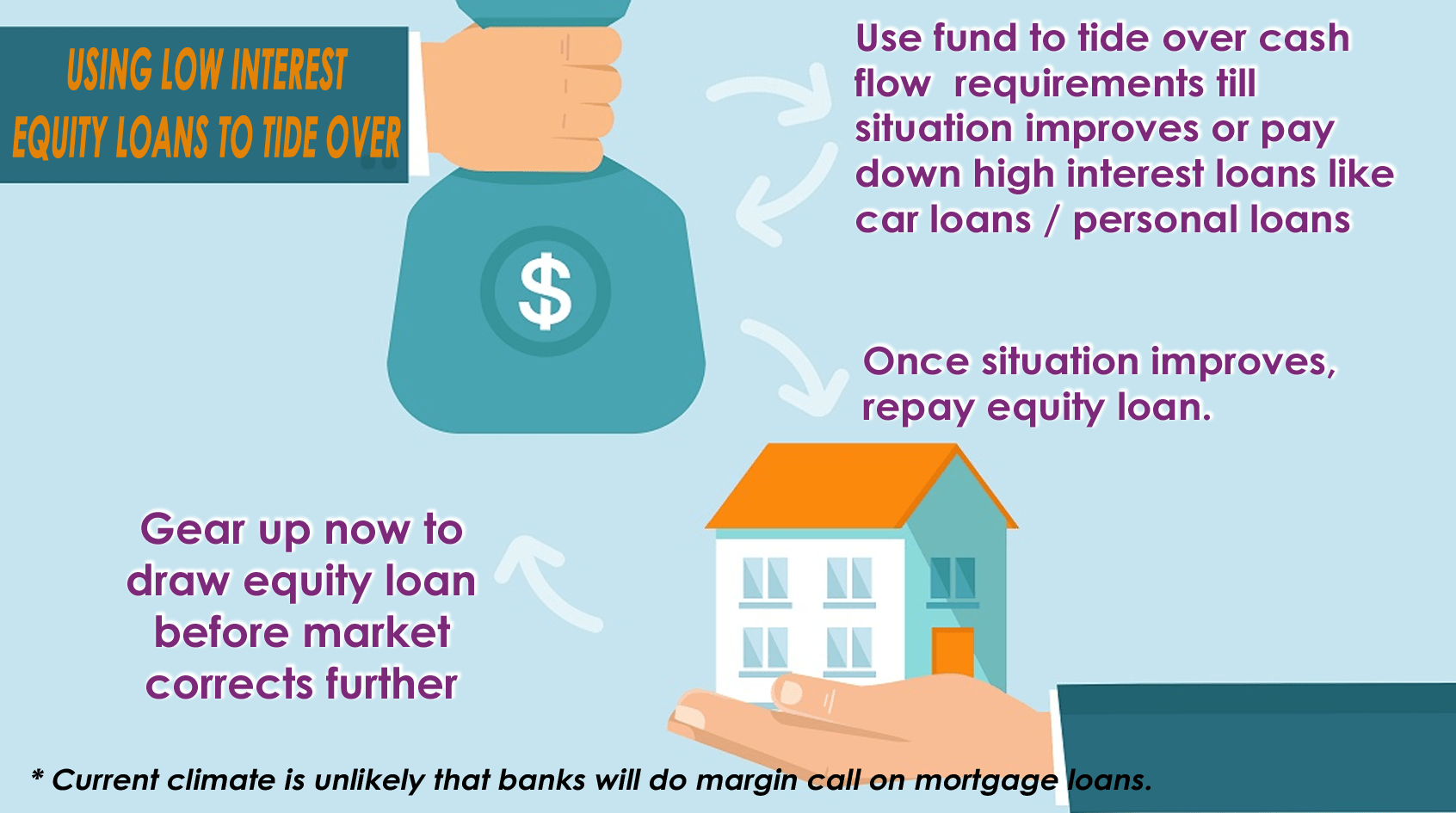

Option 3: Take up a Home Equity Loan

Another option that you might want to consider is to gear up and take up a lower interest equity loan from your property to cash out and tide over immediately

But this option is only applicable to private and commercial property owners, and you must have an income or sufficient assets to pledge. This option does not apply to HDB flat owners as HDB cannot be used to take up equity loan.

This option is suitable for small business owners who are facing cash flow issues and need to standby funds for operation.

Currently, equity loan rates are as good as the mortgage loan rate. It is ranging from 1.3% to 1.7% now.

Do note that this equity loan option will increase your outstanding loan and your monthly repayment. But it can provide you with some cash flow to settle other higher rate loans or tide you over your daily expenses in this challenging time.

Important note: you cannot use CPF funds to repay equity loans, and TDSR is applicable. Only retirees are allowed to borrow up to 50% of their private property value without subjecting to TDSR.

Option 4: Sell and downsize/rent temporarily

In case all the options are not workable for you. The last resort is by selling your property and downsize to a small property so that you can reduce your monthly housing loan repayments and have cash in hand.

But in case if you can’t buy after selling due to whatever reason, just rent a unit for the time being and make a come back when the situation gets better for you to re-enter.

Lastly, now nobody can give a definite answer to when the COVID-19 pandemic can put to stop and how long the global economy can get be back to its norm. Thus it is very important in a difficult time like what we are facing now, having sufficient cash flow on hand is critical, and it allows you to maneuver and remain solvent.

Your private property or commercial property may pull you out from the storm by providing you with some emergency funds during a down period.

You may drop me an email or a message if you are not sure what you can do, I may be able to help to come up with some plans or ideas for you.

I hope that these few options listed can give you some ideas to tide over in times like this. Hopefully, you do not need to execute any of this option, and you can weather through this storm.

You may follow me at the Top 15 Singapore Real Estate blogs list too.

Hello, I am Darren Ong

As a real estate professional, my duty is to help my clients achieve financial freedom and grow their wealth through Property Wealth Planning™.

I believe that with prudent strategies and a clear investment road map, anyone can enjoy a life of abundance and financial stability.

Darren Ong (王伟丞)

Associate District Director of Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: +65 9383 9588