Table of Contents

Today, Let me share an EC Upgrading case study that was back-dated in Mid 2014.

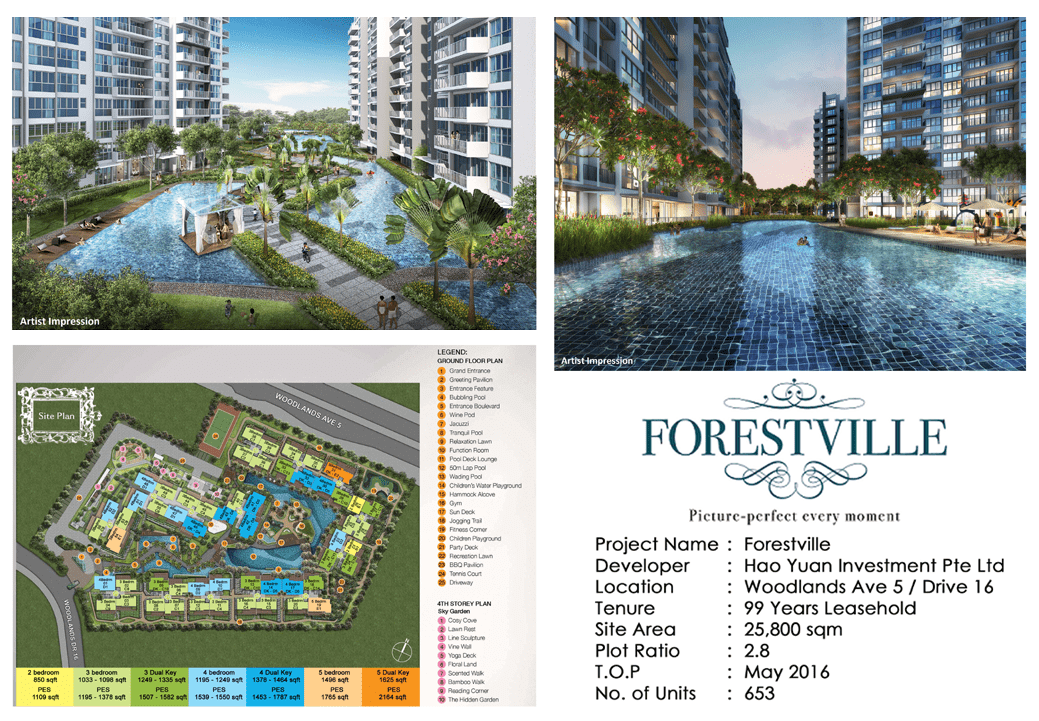

During one warm weekend afternoon, I first met Mr. and Mrs. Su (not real names) when I was on a new launch showflat duty for Executive Condominium (EC), Forestville. Time flew in the blink of an eye, 5 years had passed and reached its Minimum Occupation Period (MOP) on 1st April 2021.

It was one of the new launch showflat that I have participated in, and as a core team member in the fourth year of my real estate career.

As usual, I welcomed them into the show flat, walk them through, and presented the Forestville EC to them.

After that, I invited them over to the discussion area for a short discussion to understand their profile and needs before I could recommend them the right unit.

After some chat over the table, I get to know that they belong to the privileged group where they are fully eligible to purchase an EC.

However, they came with a see-look mindset and did not check about their finances, but they are open to exploring the option.

At the very moment, when they mentioned that they are open to exploring the option, I was thinking about how I could help them to upgrade so that they can cash out from their existing HDB and enjoy a better living environment in private housing estate.

So I started to ask, “where do you stay, and how many rooms flat?”

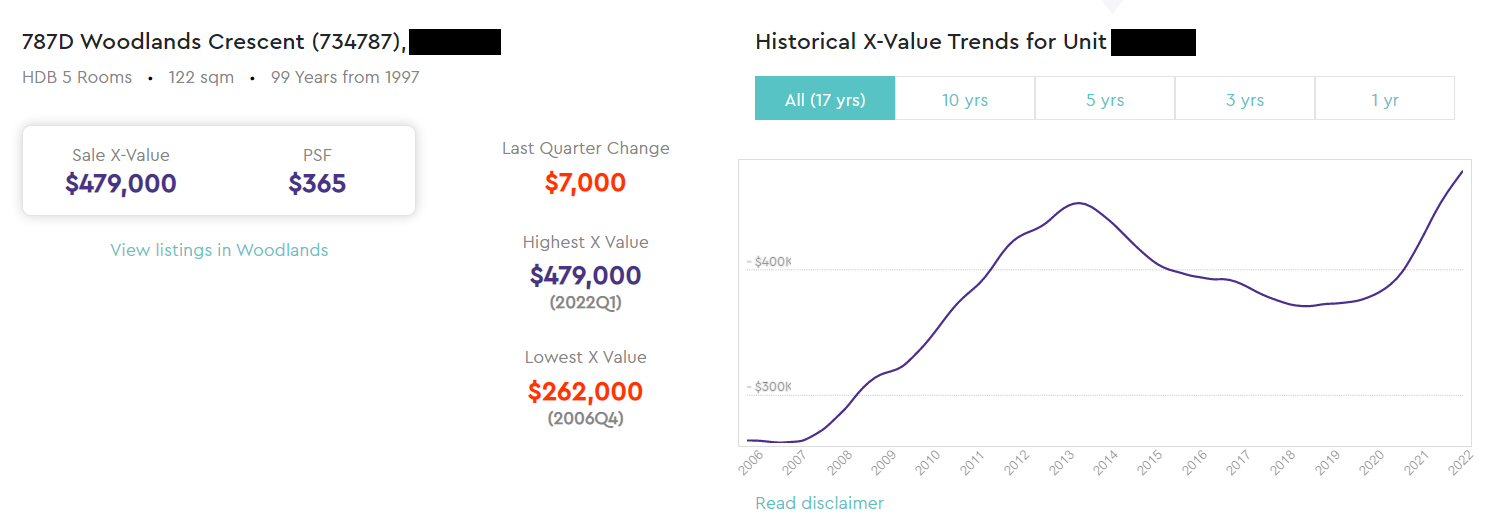

Upon knowing their current flat is at Woodlands, which is an area I am very active, I knew that their current home valuation might not appreciate anymore or appreciate at a much slower pace.

The reason being the HDB lease starts from the year 1997, which is 17 years old, from 1997 to 2014.

True enough! From the same period from Jan 2014 to Feb 2022, The 5 Room HDB only appreciated 17% in Woodlands but the EC, Forestville appreciated 40%.

As we all know by now that the property market in Singapore bounced back after the COVID-19 circuit breaker, and it went straight upward for many consecutive quarters. As such, the Woodlands HDB 5 rooms flat managed to recover from -12% before the COVID-19 outbreak to a positive 17% in Feb 2022.

Nevertheless, does this 17% able to sustain? It is a question mark, and we shall monitor.

At the same time, looking at the trend for Forestville during the same period of time, it appreciated 40%. In terms of capital gain, it was much higher as compared to HDB capital gain due to the quantum of HDB is lower.

Jan 2014 to Feb 2022 Woodlands 5 Rooms Trend Vs Forestville Trends

I then share with them the past transaction in the area that they stay and explaining to them about the property valuation depreciating problem that they will potentially face if they decide to continue to stay put.

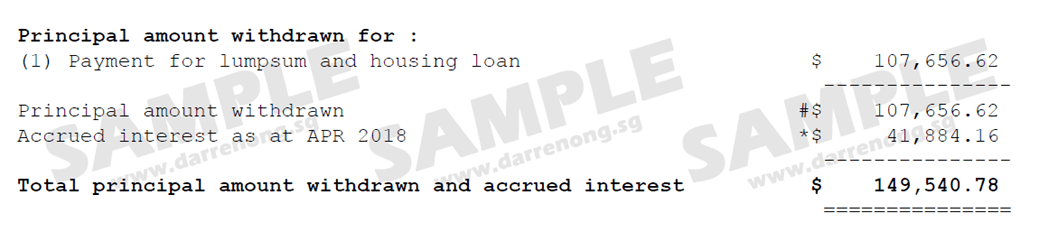

I also share about the CPF accrued interest incur when they use their CPF saving on servicing the monthly repayment, which can accumulate to a significant amount when times goes by.

Next, for them to consider upgrading to an EC, I shared with them the upside of an EC such as:

- potential capital appreciation based on the history of EC past transaction.

- upcoming development and transformation of Woodlands town.

- advantage of property lease renewing to 99 years.

- better private living environment for their children to grow up and lifestyle changes, etc.

I ended the discussion with a financial calculation for purchasing an EC based on an average price of three bedrooms.

It is to give them a head start on how much the initial payment that they need to prepare if they decide to go ahead with the upgrade plan.

I also suggested that they need a banker to help them to assess their finances by applying for bank in-principle approval (IPA) to understand better about the maximum housing loan that they can get when purchasing a property.

The IPA is to ensure that they will not go into the situation where they need to top up a lump sum of cash for the initial payment due to lack of loan amount.

After hearing about the bank IPA, they are curious about the maximum housing loan that they can get. Thus I linked up a banker to assist them with the bank IPA application the very next day.

I ended the day by sending them off without closing the deal, but I am glad that they are considering my proposal of exiting from their old HDB flat and upgrade for the better.

Fast forward to the IPA approved day, we had some discussion again, but this time I was invited to their home.

I shared with them the financial plan for selling their existing home, and the expected cash-proceed they can receive after repaying the outstanding mortgage loan and CPF refund with accrued interest.

Now with all the essential figures and details gathered about the selling and buying, finances, and the gain v.s loss in different scenarios (to keep, to stay put or to upgrade).

It is time for them to decide whether to press the green light to proceed and execute the upgrading plan.

Within days of discussion, Mr. & Mrs. Su finally decided to execute the upgrading plan from their old HDB to an EC.

In the third week of July 2014, we revisited the showflat, but this time I helped them to shortlist for an ideal unit that they are keen, the HDB approval to purchase an EC was smooth as all the necessary supporting documents were intact.

While waiting for HDB approval, we start to prepare their home for sale as they wish to sell first, stay over at their parent place while waiting for the EC to receive its TOP.

I strategize the marketing activity, and it only took me about one month to secure a potential buyer to make an offer for their second-floor HDB flat in the third week of August 2014.

You may be keen to read more about “7 Tips for Singapore Property Seller to Sell Their Property Fast“.

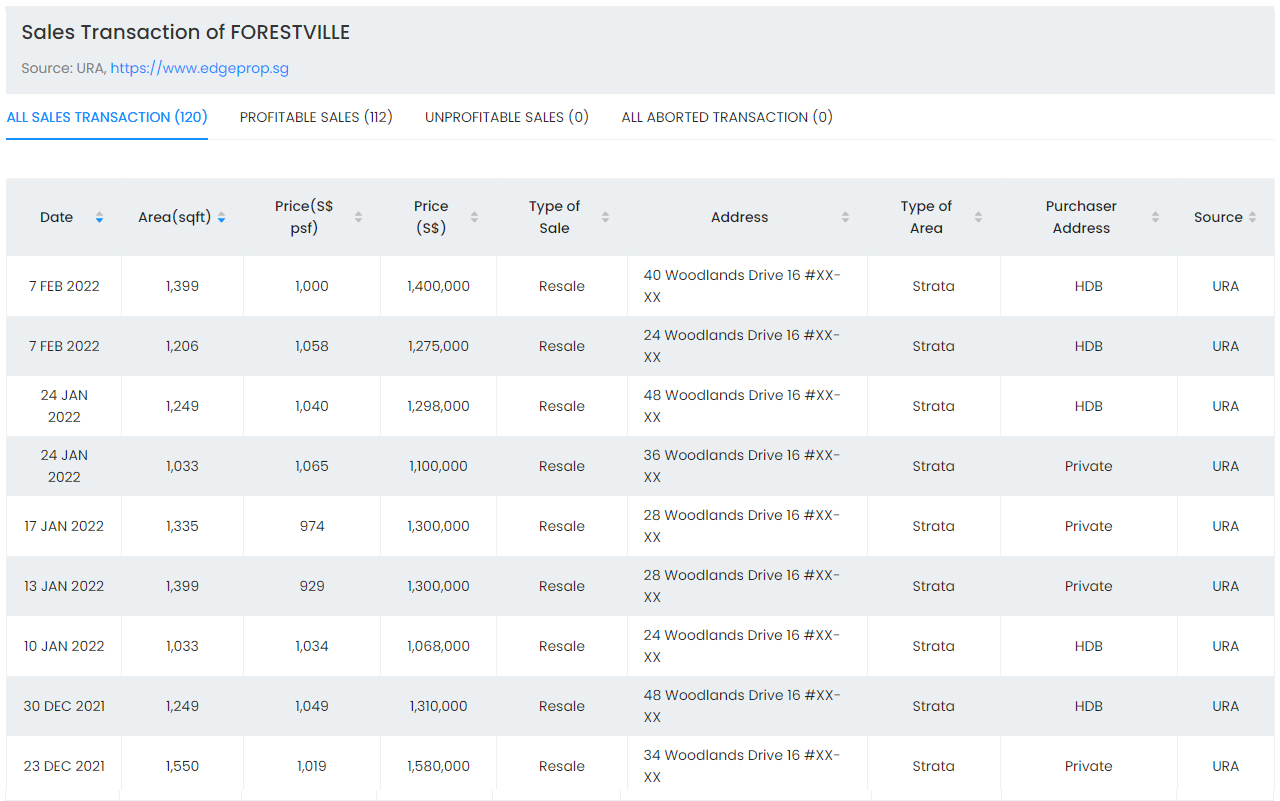

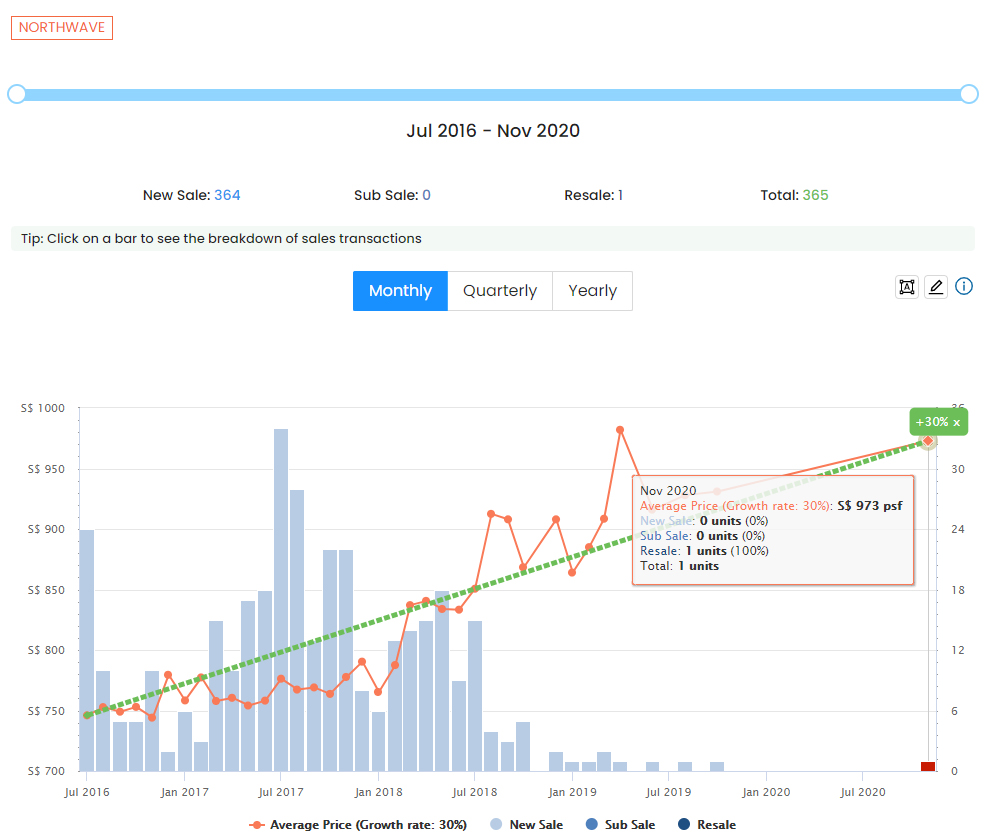

While writing this article, I checked their EC transaction trend within the same area.

I am happy that years ago, I analyzed for them and suggested to them the idea of upgrading to avoid making a loss or achieving lesser capital gain in their HDB.

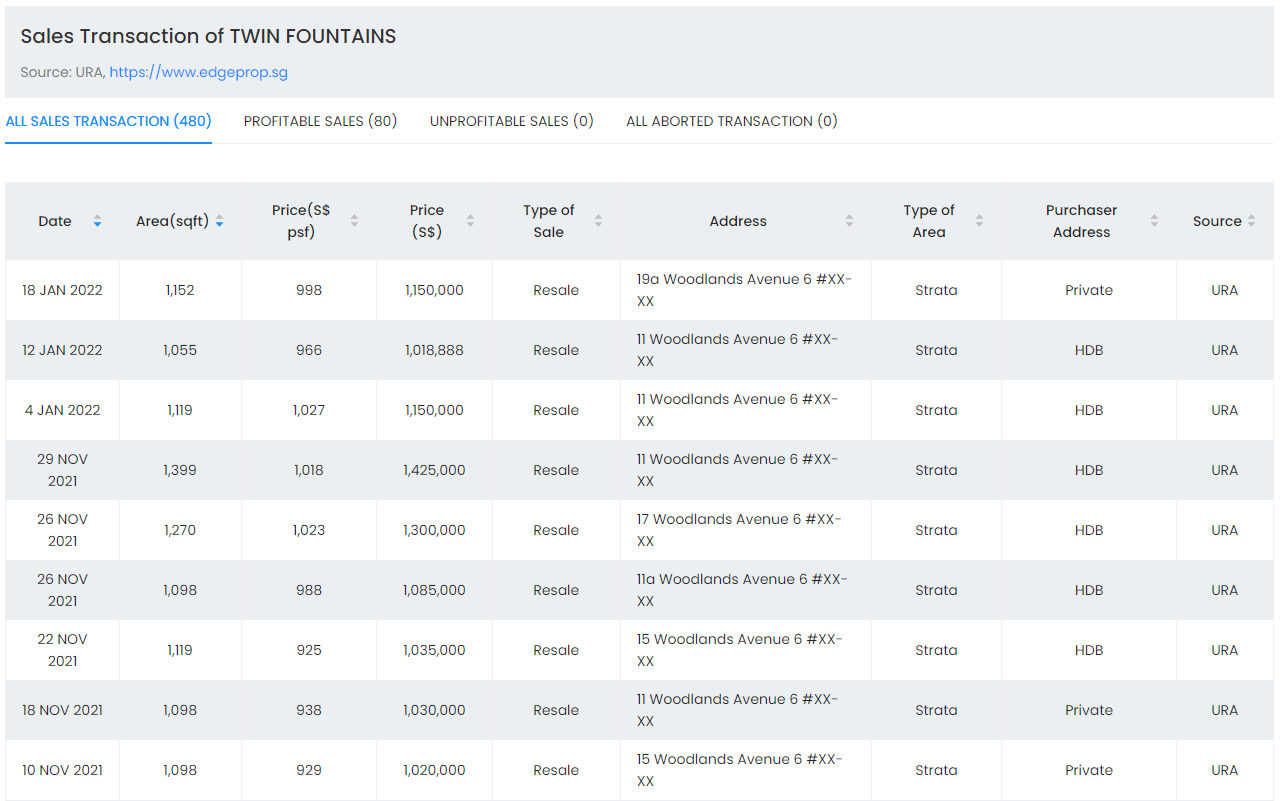

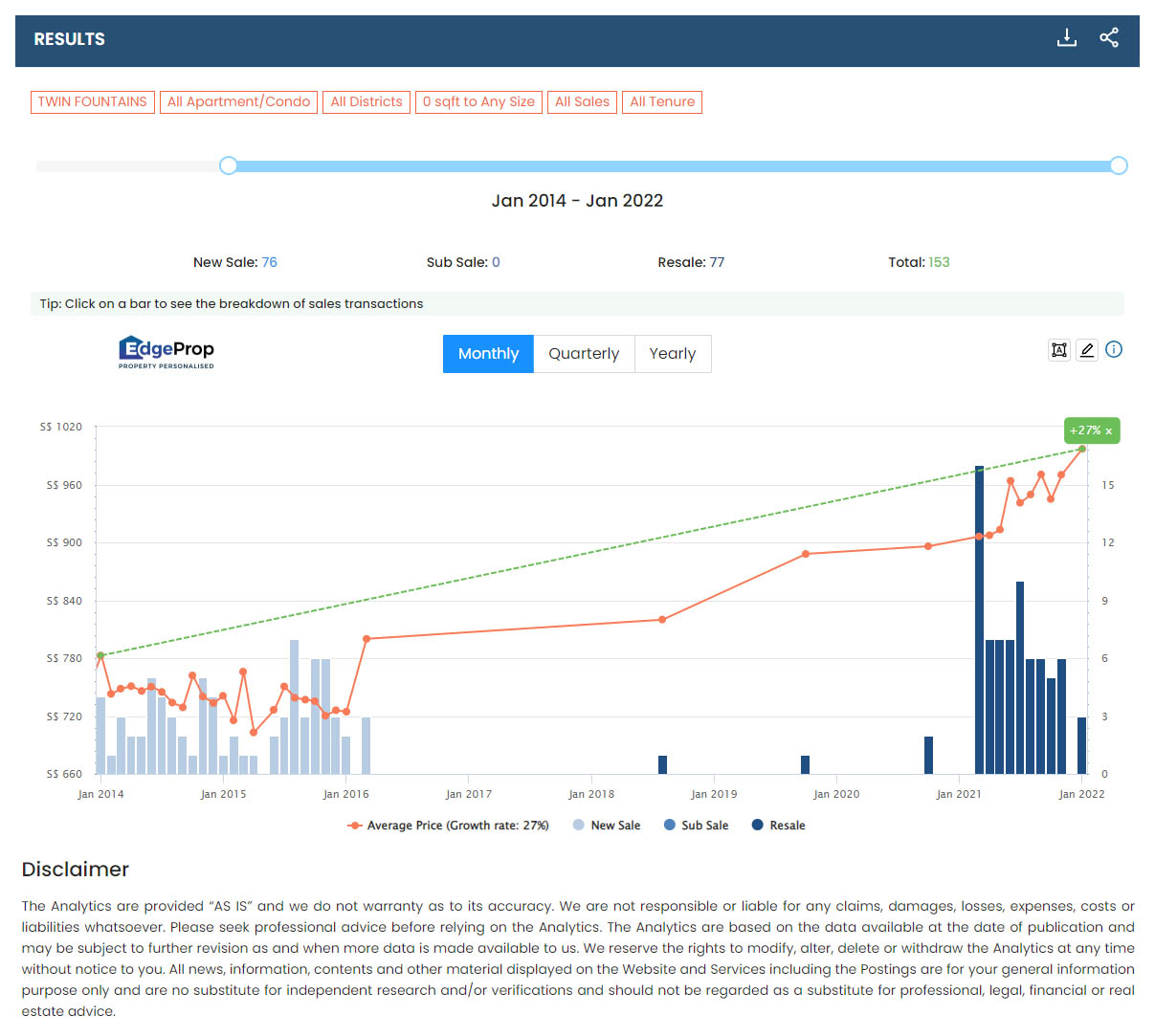

Currently, Forestville and Twin Fountain are sitting on an 40% and 27% capital gain respectively. which is much higher than the 17% of Woodlands HDB 5 room flat now.

Considering the pre-COVID-19 price trend of -12% for the Woodlands HDB 5 room flat, the gain of the EC will be even more.

Back then, they bought the EC at $731 psf, and today the EC that are eligible to sell is transacting on average at $997 psf to $1029 psf. Its increase of $266-298 psf, translates to a potential capital appreciation of $283,556 – $317,668 now.

Twin Fountain Sale Transaction Trend 2014-2022

Should they decide to stay put in their old HDB flat, by now, it’s already 23 years old. The transaction trend of the HDB may start to decline any time after the pandemic when situation go back to the norm, there is a high chance that property valuation prices will be lower.

By then, it will make a negative sale, losing a portion of their CPF saving with no cash proceed in return, making them harder to execute the upgrade plan now.

If you need a real estate agent for advice about upgrading, you may feel free to drop me a message for a non-obligation friendly discussion. Cheer!

Financial Calculation

In 2014 (17 Years of stay)

Mr. & Mrs. Su agreed to sell their home back then at $415,000

Their HDB outstanding loan was $65,923

The total CPF Utilized + Accrued Interest for both their CPF account to be refunded was $268,130.09

After repaying the HDB outstanding loan and CPF refund, it was the case of a positive sale.

The sales proceed that they received are $80,946.91, which they can use for the initial payment of their upgrading plan.

Adding up their CPF OA account balance and the CPF refund from their HDB, they have a total of $346,742 fund to purchase for the EC.

You may be keen to read more about “How CPF accrued interest affect property cash proceeds“.

Below is an example of an illustration, assuming they stay put till the pre-COVID-19 before the property market picks up. which is 23 years later from the day they purchased the HDB flat.

Based on the decline of -12% from the day they sold at $415,000, the expected value would be around $365,200 right before the COVID-19 outbreak.

The estimated HDB outstanding loan should be around $38,138.97 to date, and the CPF fund utilized + accrued interest by now should have increased to an estimated amount of $380,552.

Based on the above figure, should Mr. and Mrs. Su continue to stay in their current HDB flat, they will face negative sales proceed (-$53,490.97) issue where there is no cash proceed.

It’s mean that they will have no cash received when selling their HDB flat. At the same time, they will make a lesser CPF refund of -$53,490.97 (loss of CPF fund) in this case.

Let calculate based on the current x-value of the property today. The estimated HDB outstanding loan should be around $38,138.97 to date, and the CPF fund utilized + accrued interest by now should have increased to an estimated amount of $380,552.

Based on the above figure, should Mr. and Mrs. Su continue to stay in their current HDB flat till today, they will be lucky enough to have a positive sales proceed of $60,309.03 due to the over property market picking up.

However, with this amount of cash proceeds, it would be difficult for them to plan for an upgrade without touching their hard earn saving.

But as they have already moved for the better, they are now sitting on an estimated gain of $283,556 – $317,668 in their EC.

As such, if they wish to upgrade today, there are too little cash proceeds from the sale of the HDB.

Thus they will need to fork out more money from their hard-earned saving to upgrade to an EC or private property.

Furthermore, the recent new launch prices are getting higher due to higher land sales prices, which means that they will need to fork out more money from their saving to upgrade.

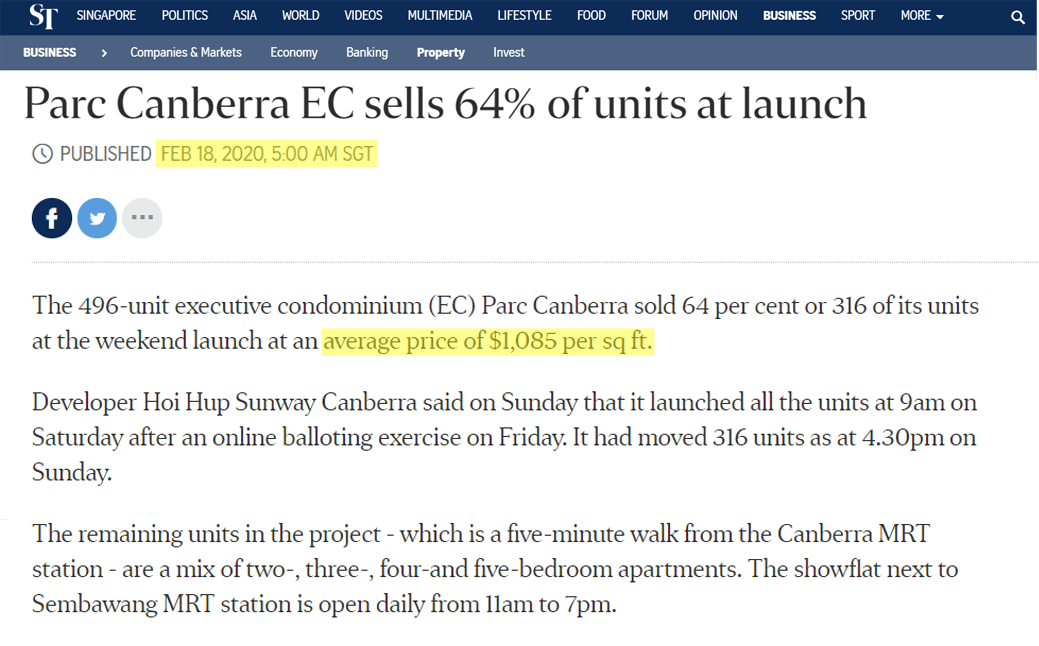

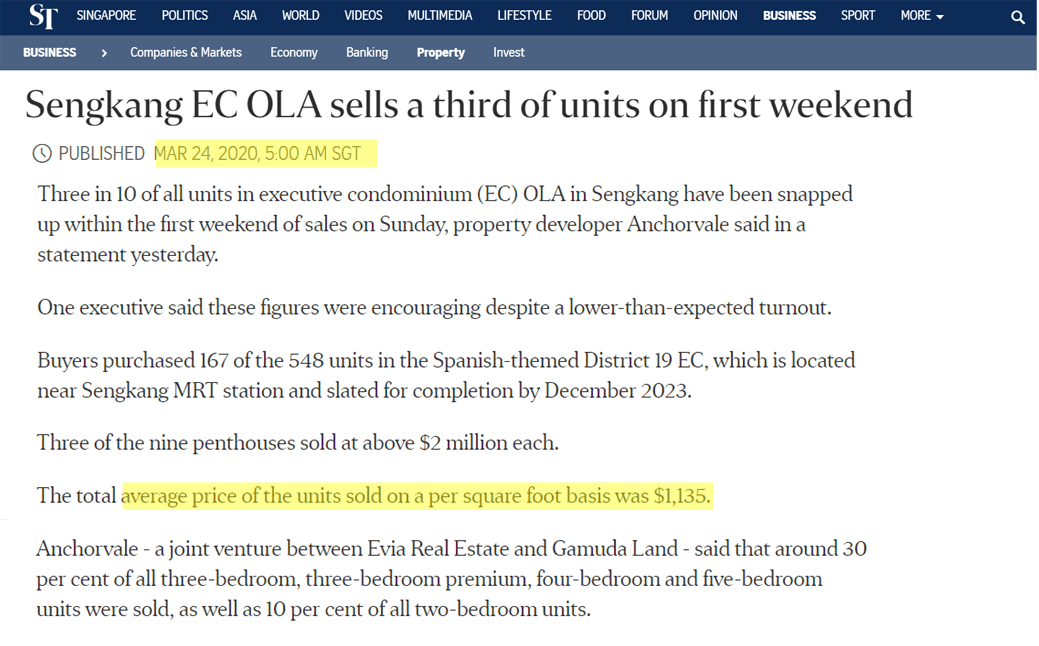

Take recent examples like the new launch EC at Parc Canberra at Sembawang, Canberra Link, and Ola at Sengkang, Anchorvale Crescent. Their average launch PSF are $1,085 and $1,135 respectively.

Using the same unit size, the unit price that I helped them to shortlist in 2014:

- Bought at $780,000 for $731 psf with a unit size of 99 sqm.

- The initial outlay will be a 5% booking fee ($39,000) and a 20% downpayment ($156,000).

- The total initial payment is $195,000.

(NOTE: For simplicity, the calculation above does not factor in the buyer stamp duty and legal fee).

Today, if Mr. and Mrs. Su book a unit at Parc Canberra, the breakdown figures:

- it would cost them $1,156,322, taking the reference average launch PSF of $1,085 reported.

- The 5% booking fee will be $57,816.10 and 20% downpayment $231,264.40.

- The total initial payment will be $289,080.50.

(NOTE: For simplicity, the calculation above does not factor in the buyer stamp duty and legal fee)

It’s worked out to be $94,080.50 extra in the initial payment as compared to the year 2014.

As for Mr. and Mrs. Su’s current home, there is room for further capital appreciation with the recent average launch psf compared to the current resale transaction in the nearby district or the upcoming new EC launch.

There is room for capital appreciation.

If we were to take some of the EC in the Canberra area, it already crosses above the $1000 PSF mark. Furthermore, the upcoming new launch EC in 2022 and 2023 located at Yishun Ave 9, Tampines Street 62, and Tengah Walk Garden are expected to have a breakeven price of $1,025 PSF, $1,161 PSF, $1,059 PSF respectively before factoring developer profit margin.

It is all higher than the average PSF transacted nearby at Mr. and Mrs. Su’s home today.

You may be keen to read more about “Where can you find and how to buy an upcoming Executive Condominium (EC)“.

Future: Construction costs will definitely set to increase due to increased cost in material and manpower!

As reported on 16th May 2020, steps to curb transmission will raise construction costs.

It will be less likely that the new launch price will drop as developers and contractors will now need to spend more on regularly testing their workers to prevent COVID-19 from spreading within their site.

Let’s wish Mr. & Mrs. Su happy staying in their current home and continue to enjoy the potential capital appreciation in time to come.

If you wish to analyze your current position about upgrading to an EC, you may want to contact me for a friendly non-obligation discussion.

After reading the EC Upgrading Case Study, If you need an opinion on your property investment plans? Or help to get your property sold or rented?

Get a 1-time free 30 min Property Wealth Planning (PWP) consultation.

A PWP consultation includes:

- An in-depth financial affordability assessment

- Highly relevant investment insights

- A clear and customized investment road map for your real estate investment journey ahead.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Disclaimer

The Analytics are provided “AS IS” and we do not warranty as to its accuracy. We are not responsible or liable for any claims, damages, losses, expenses, costs, or liabilities whatsoever. Please seek professional advice before relying on The Analytics. The Analytics are based on the data available at the date of publication and may be subject to further revision as and when more data is made available to us. We reserve the rights to modify, alter, delete or withdraw the Analytics at any time without notice to you. All news, information, contents and other material displayed on the Website and Services including the Postings are for your general information purpose only and are no substitute for independent research and/or verifications and should not be regarded as a substitute for professional, legal, financial or real estate advice.

Data Source: SRX & Edgeprop

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls