Table of Contents

Yes, from HDB upgrade to a private condominium. Many HDB homeowners will have these questions planted into their brains through peer pressure or advertisement at some point in time. There are plenty of ads out there selling the ideas of “upgrading to private property” or “sell your HDB and buy two condominiums for a better future,” etc.

Today, I will share a case study on how Alex (Not the real name) upgraded from an HDB flat to private property that I did in 2015. Alex and his family approached me in 2015 with their upgrading plan. They stayed in a fully paid 5-rooms HDB flat in Choa Chu Kang back then.

There were many considerations and decisions to be made before executing the upgrading plan. Let’s take a closer look at it now.

- Step 1: Are you eligible to upgrade to a condominium if you own an HDB.

- Step 2: Affordability and financial calculation for buying a condominium.

- Step 3: Decide to buy first or sell first.

- Step 4: The timeline management of property sales and purchase processes

Yes, Alex needs to check if he is eligible to purchase a private property as he owns an HDB. The 2 points that he needs to take note are HDB Minimum Occupation Period and Citizenship:

HDB Minimum Occupation Period (MOP)

Firstly, Alex needs to fulfill his HDB Minimum Occupation Period (MOP), which is the period that he is required to physically occupy his flat before he can buy a private property or sell the HDB flat on the open market.

The duration of the MOP depends on the purchase mode, flat type, and flat application date.

| Mode of Purchase | MOP |

|---|---|

| Flat bought from HDB (BTO / Sales of Balance Flat) | 5 years Note: MOP for Prime Location Public Housing (PLH) and Plus model flats is 10 years. |

| Flat bought under the Design, Build and Sell Scheme (DBSS) flats from property developer | 5 years |

| Flat bought under the Selective En bloc Redevelopment Scheme (SERS) | For SERS sites announced before 7 Apr 2022

For SERS sites announced on or after 7 Apr 2022

You may need to pay the Seller’s Stamp Duty (SSD) if you sell your replacement flat within a certain holding period. For more information on the SSD, please visit IRAS’ website. |

Resale flat bought from the open market

| 5 years |

| Flat bought under the Fresh Start Housing Scheme | 20 years |

Citizenship

For Citizenship, as long as there is one Singapore citizenship between husband and wife, they can keep the HDB after buying the condominium. But Additional Buyer’s Stamp Duty (ABSD) is payable if you decide to buy the condominium and keep the HDB.

If both the Co-owner are Singapore Permanent Residents (SPR), they cannot keep the HDB after purchasing private property. They will need to sell the HDB within six months after purchasing private property.

Step 2: Affordability and Financial Calculation for Buying Condominium

Purchasing a property in Singapore is considered a big-ticket item; thus, It is crucial to determine his finances right at the beginning before committing to any purchase. Therefore before Alex proceeds with his upgrade plan, he needs to know the following on pointers:

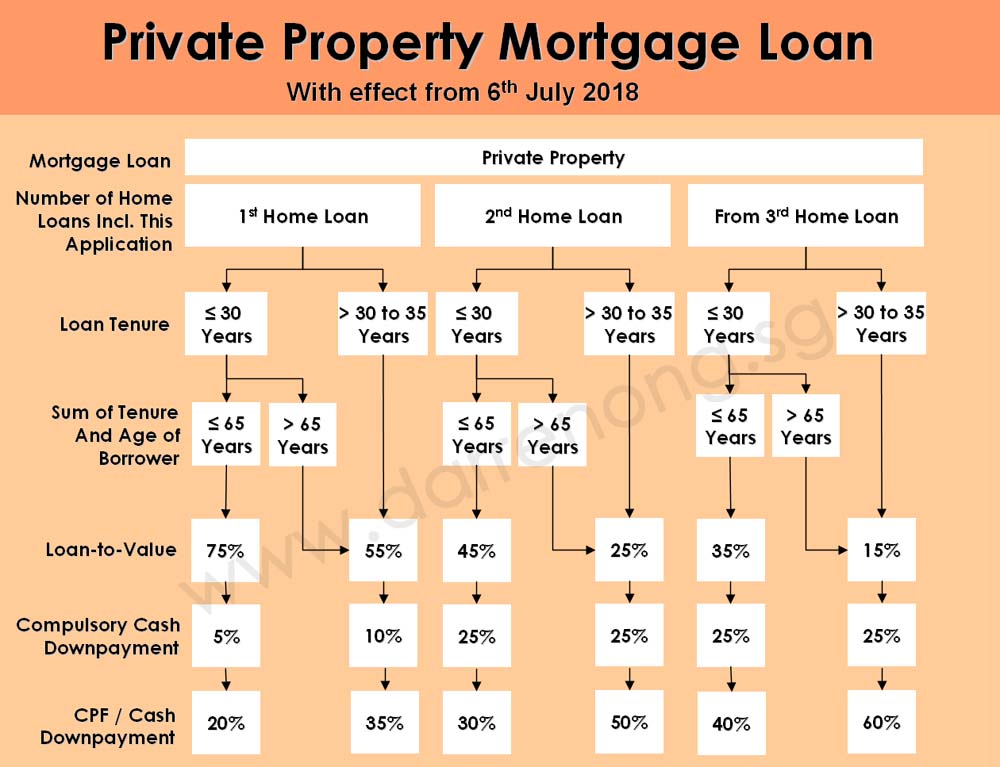

Mortgage Loan

As Alex’s fully paid his HDB, he can borrow up to 75% (LTV) of the property valuation or purchase price for the next purchase, whichever is lower, based on the first housing loan but subject to income and bank approval.

On the other hand, if Alex’s HDB still has an outstanding loan, he will be subjected to a lower Loan-to-Value (LTV) based on second home loan rules.

Bank in-Principle Approval (IPA)

I suggest that I link up a banker for him to assist with a bank in-principle approval (IPA) to determine the maximum mortgage loan quantum that he is eligible to loan. It will be easier for him to set his budget with the IPA, the cash he set aside for the purchase, and his CPF saving.

After forwarding the necessary income documents to the banker, within a day, the bank returned with $2.2 million in-principle approval.

As mentioned above on the LTV 75%, the $2.2 million in-principle approval translates to a maximum purchase price of up to $2.93 million.

The Initial Downpayment for Buying Condominium

Since the LTV is 75%, it means that the initial downpayment will be 25% of the property valuation or purchase price, whichever is lower. It is further breakdown into two parts as following:

- Deposit = Option Fee (1% cash) + Option Exercise Fee (4% cash)

- Initial payment = 20% Cash or CPF

About Buyer's Stamp Duty When Purchase Property in Singapore

Buyer’s Stamp Duty (BSD) is a tax that buyers paid on documents signed when they buy or acquire property residing in Singapore. During the Singapore Budget 2023, the Government announced that BSD rates for both the residential and the non-residential properties will be raised with effect from 15th Feb 2023. The amount payable is:-

| On or after 15 Feb 2023 | ||

|---|---|---|

| Purchase price or market value of the property | BSD rates for residential properties | BSD rates for non-residential properties |

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Next $500,000 | 4% | 4% |

| Next $1,500,000 | 5% | 5% |

| Remaining amount | 6% | |

| From 20 Feb 2018 to 14 Feb 2023 | ||

|---|---|---|

| Purchase price or market value of the property | BSD rates for residential properties | BSD rates for non-residential properties |

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Remaining amount | 4% | |

Example 1: A condominium was purchased on 17 Feb 2023 at $2,500,000 which is reflective of the market value

| Market Value of the Property | BSD Rate | Calculation |

|---|---|---|

| First $180,000 | 1% | = $1,800 (1% x $180,000) |

| Next $180,000 | 2% | = $3,600 (2% x $180,000) |

| Next $640,000 | 3% | = $19,200 (3% x $640,000) |

| Next $500,000 | 4% | = $20,000 (4% x $500,000) |

| Next $1,500,000 | 5% | = $50,000 (5% x $1,000,000) |

| Remaining $1,500,100 | 6% | = $0 |

| BSD Payable | = $94,600 ($1,800 + $3,600 + $19,200 + $20,000 + $50,000) | |

Buyer Stamp Duty Transitional provision

There will be a transitional provision for the Buyer Stamp Duty (BSD), where the BSD rates on or before 14th Feb 2023 will apply for cases that meet all the following conditions below:

The sellers granted the Option to Purchase (OTP) to the potential buyers on or before 14th Feb 2023;

The buyer exercised* the OTP on or before 7th Mar 2023, or within the OTP validity period, whichever is earlier; and

This OTP has not been varied on or after 15th Feb 2023.

*For the stamp duty purposes, the OTP is considered exercised when the Acceptance to OTP or Sale and Purchase Agreement (SPA) (whichever is applicable) is executed, i.e. signed by the buyer.

The applications for the transitional BSD remission involving OTPs exercised after 7th Mar 2023 will not be accepted. This is even if the validity period of the OTP extends beyond or commences after 7th Mar 2023.

The buyer do not need to apply for transitional remission if they are acquiring residential properties with a purchase price or market value (whichever is higher) of $1.5 million and below, or the non-residential properties with a purchase price or market value (whichever is higher) of $1 million and below, as there are no changes to the BSD rates for properties acquired up to these values.

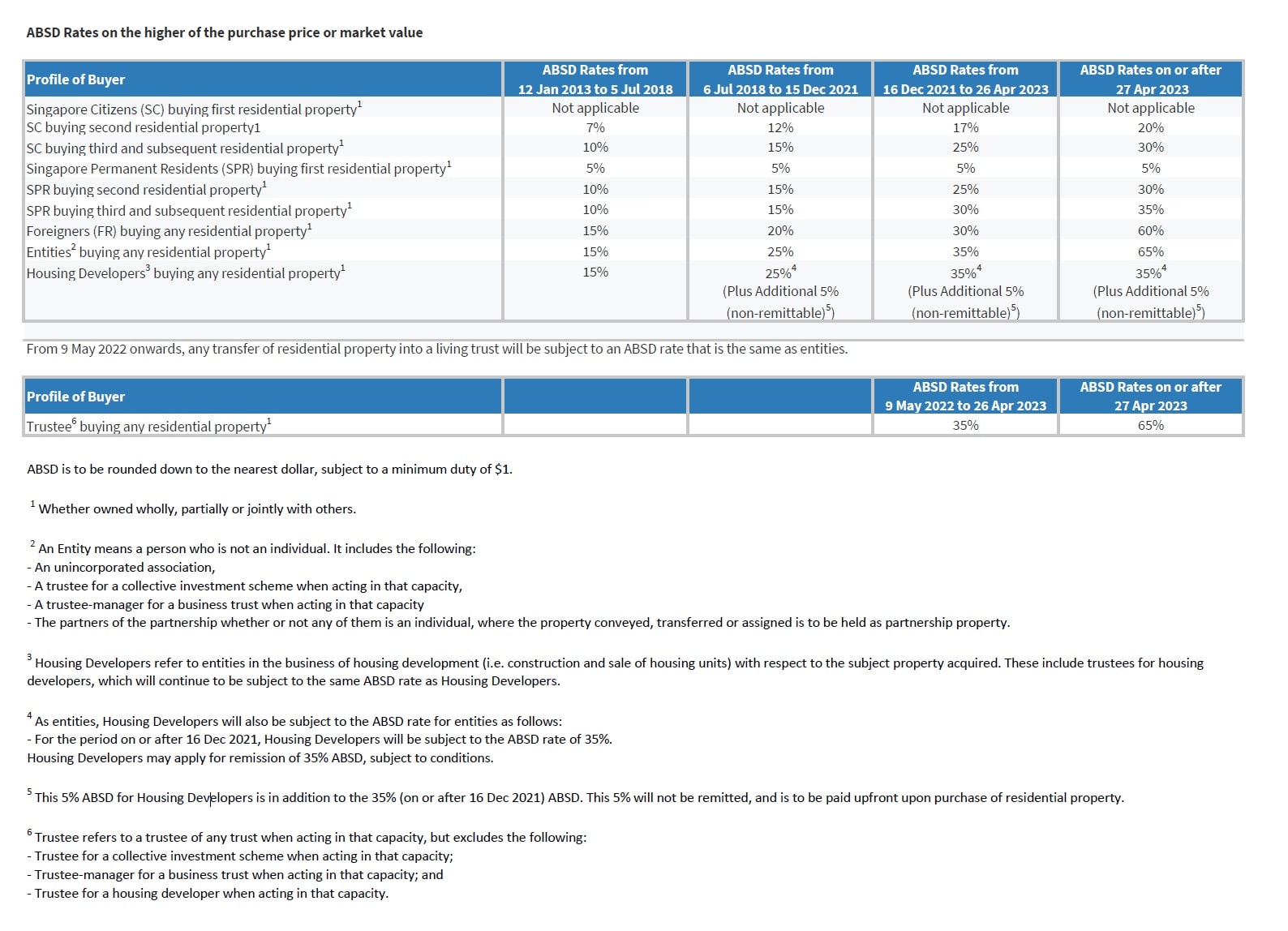

Additional Buyer’s Stamp Duty (ABSD) is when Singaporean purchase their second or subsequent properties, they are liable to pay the ABSD on top of the BSD.

For Alex’s case, he needs to decide to sell first to avoid paying ABSD or pay the ABSD first if he proceeds to buy first and apply for ABSD remission if he sells the first property within six months.

For SPR and Foreigner, they are liable to pay ABSD on their first purchase. The amount payable is:-

Legal and Misc Fees (Property Tax, Insurance, Management Fees)

Alex also needs to factor in the prorated amount of property tax and management fee that the seller already paid. With the legal cost and insurance, the total amount can be up to approximately $5000 to $6,000 range easily.

Affordability on Monthly Mortgage

Lastly, an important point is the monthly mortgage, whether Alex can sustain the monthly payment.

I then calculated the monthly installment that he needs to service for his home loan against his CPF contribution. He then top-up the monthly installment shortfall in cash, which he is comfortable and within his mean.

Step 3: Decide To Buy First or Sell First

To buy the next property first or to sell the current property first? It does have some differences and impact on Alex’s finances.

For example, if Alex proceeds to buy the next property first, he needs to pay extra 12% (2015 rate) ABSD upfront and subsequently apply for ABSD remission as married couple matrimonial home if he managed to sell his current HDB within six months.

On the other hand, if he decides to sell his current home first, he does not need to worry about paying the extra 12% (2015 rate) ABSD, as it will be their first property for the next purchase since he sold his current home first.

Step 4: Property Sales and Purchase Timeline Management

Timeline is crucial when it comes to selling your current property and buying the next concurrently. It is a process that needs a careful plan so that homeowner can have a smooth transition.

Firstly, if you do not need the fund from the current property, you may buy your new home first, but 12% (2015 rate) ABSD applies before you sell the existing property.

Secondly, if you need the fund from the current property, you will need to wait for it’s legal completion to cash out the sale proceeds and unlock your CPF saving. In this process, you will need to request a temporary extension of stay from the HDB buyer to transit smoothly to your new home.

You will receive your sale proceeds cashier order on the completion day, but typically it takes 1-2 days for the bank to clear the cashier order. It takes about two weeks for the CPF fund to be refunded back to your CPF ordinary account.

Alternatively, you may apply for the bank bridging loan to bridge the CPF fund from the current house to the new home. This can shorten the time taken to complete the purchase process.

Alex’s Case Study (HDB Upgrade Private Condominium)

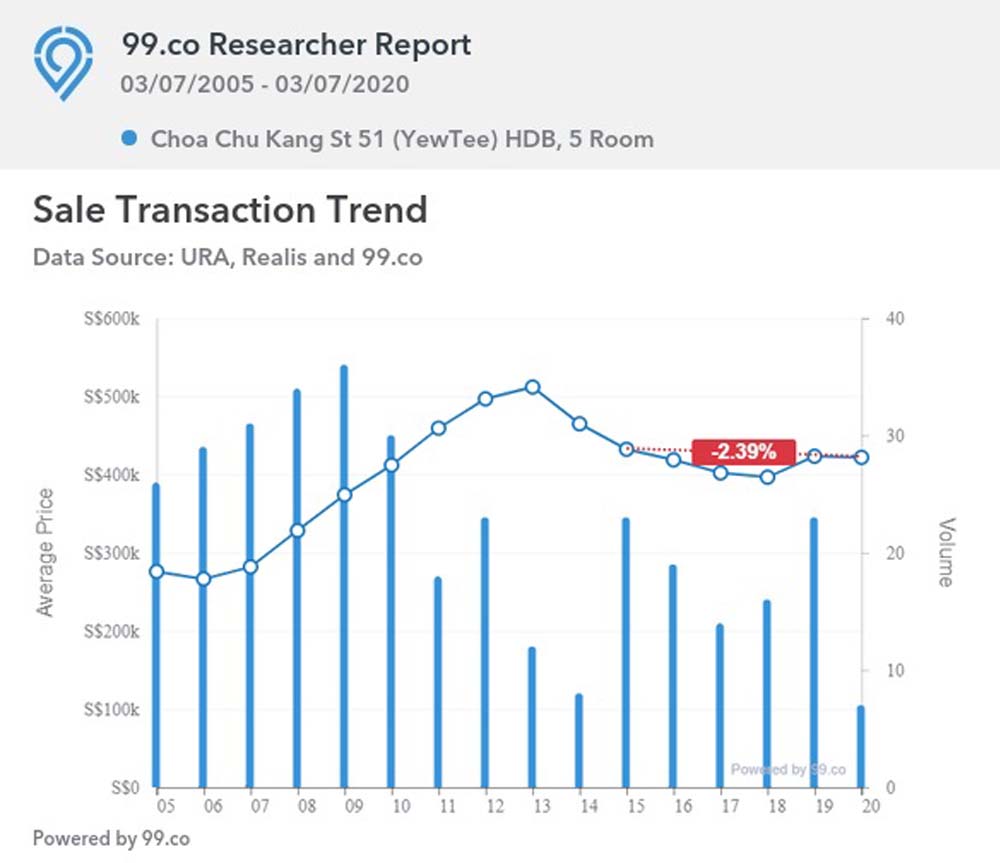

I have extracted the data trend of Alex’s previous home in Choa Chu Kang for a simple analysis. The transaction price trend starts on a declining trend in the surrounding area beginning in 2013.

Alex made a quick decision to sell the HDB to cut loss and decided to upgrade to private property.

From the transaction price trend above, the overall price declined by 2.39% from 2015 to 2020. With the HDB price dropping and the CPF accrued interest compounding effect, it is obvious that the cash proceeds become lesser over time.

A simplified illustration between 2015 and 2020 on the effect of declining valuation price and CPF accrued compounded interest rate:

In 2015

Selling Price: $500,000

Outstanding Loan: $0

CPF Utilised + Accrued Interest: 350,000

Cash Proceed: $500,000 – $350,000 = $150,000

In 2020

Selling Price: $488,000

Outstanding Loan: $0

CPF Utilised + Accrued Interest: $395,992

Cash Proceed: $488,000 – $395,992 = $92,008

If Alex decided to hold his HDB until 2020, the cash proceeds that he received is $92,008 instead of 5 years ago at $150,000.

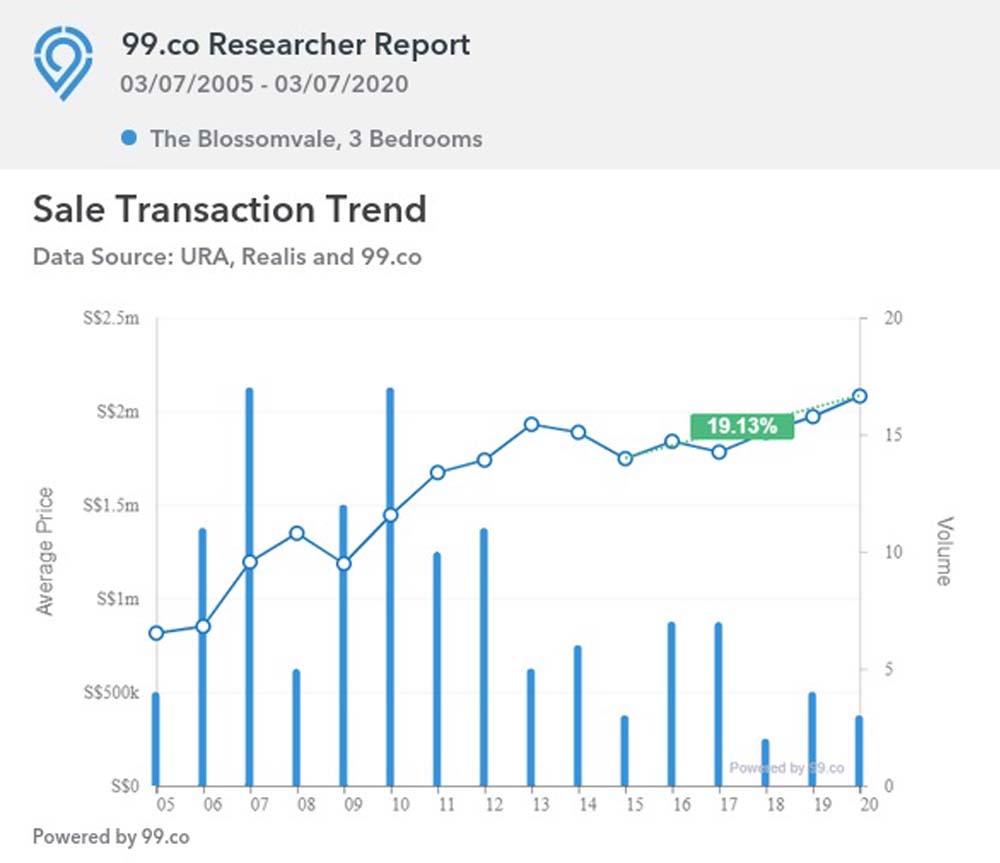

Let’s take a look at Alex’s condominium transaction price trend. From 2015 to 2020, the transacted price within the surrounding area appreciated by 19.13% over five years.

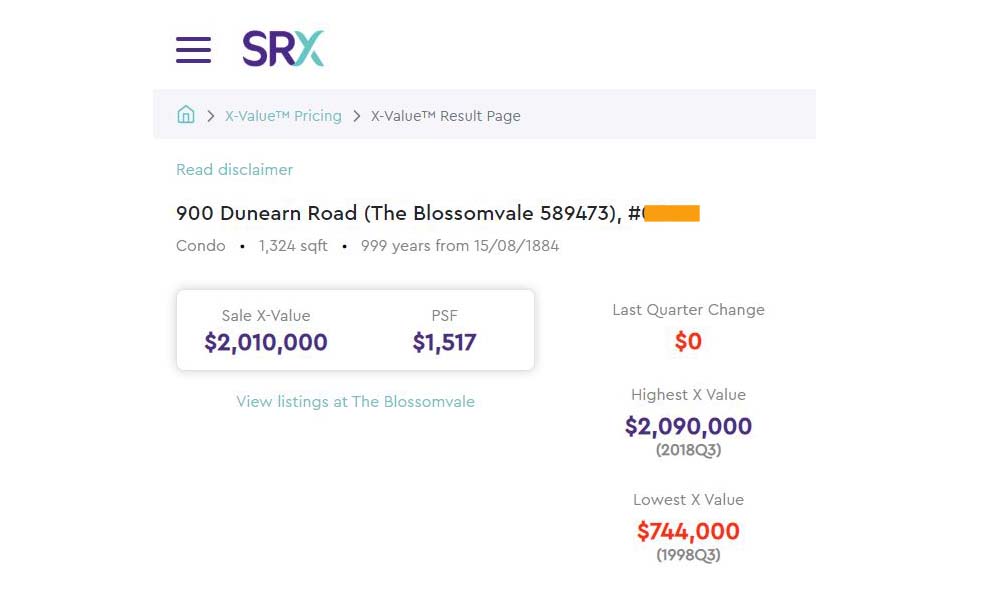

For Alex’s current private property, the valuation has appreciated too. He purchased the property at $1,700,000 in 2015 and the current property valuation shown in SRX x-value is worth $2,010,000 in 2020. It almost appreciates at 19%.

In Summary

When upgrading from HDB to private property, you need to remember the four main pointers:-

- Eligibility to upgrade

- Affordability and financial calculation

- Decide to buy first or sell first

- Timeline management

With these pointers to serve you as a guide, I hope you can better understand and plan your upgrading plan with a smooth transition to your new home.

Get the Right Help for Your Property Deal

Always plan ahead with your property planning especially if you are exploring your property asset progression to step up the property ladder.

Making decisions about property investment and financial planning can be challenging, but you don’t have to do it alone. Whether you’re considering using the first time buyer or season investors, depending on your situation, getting expert advice can make things much clearer and easier.

I’m here to offer personalized help and information that fits your situation. I can assist you in understanding Singapore’s housing market better, helping you with your financial decisions and property plans.

If you’re looking for guidance or have questions about your property deal, connect with me today. I’m ready to help you make informed choices and support you in achieving your property goals in Singapore.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls