Table of Contents

Where Can You Find And To Buy An Executive Condominium (EC) in 2025

Are you planning to set up a home together with your partner for the first time (First-Timer) or are you an existing HDB flat owner planning for a shift of home for the second time (second-timer), but was sandwiched between HDB and Private condominium? Or are you earning too much making you not eligible for HDB Build-to-Order (BTO) flat yet still not financially ready for a private condominium? Let’s get some basic understanding of Executive Condominium (EC) before we go into the topic of “Where to buy an Executive Condominium in 2025”. Unlike HDB flats, EC is built by private developers with a full range of facilities similar to that of a private condominium. The EC land parcels are first sold as public housing via HDB and purchasers need to fulfill the HDB-EC eligibility criteria before buying one. EC is a unique type of property in Singapore that comes with the public-private hybrid. It is considered public housing for the first 10 years and thereafter it will be privatized and become a private condominium. Firstly, let’s take a closer look at the criteria that you need to fulfill before booking an EC.

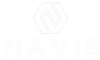

Check out below table for more Executive Condominium (EC) eligibility:

NOTE: If you are unable to view the table below, please click HERE again?

Executive Condominium (EC) Eligibility Criteria Checklist

Core Nucleus

A household’s eligibility for housing subsidies is assessed based on the core nucleus, which is formed by the applicant(s) and occupier(s) who enable the household to meet the eligibility conditions for the EC unit purchase. They must remain in the EC application, as well as during the minimum occupation period (MOP) after the EC unit purchase.

Your household must comprise 1 of the following groups:

- You and your fiancé or fiancée

- You and your spouse, and child(ren)

- You, your parents and siblings. If you are an unmarried/ widowed/ divorced Singapore Citizen (SC) buying an EC with parents, at least 1 of your parents must be a SC or Singapore Permanent Resident (SPR).

- You and your child(ren) under your legal custody, care and control (for widowed/ divorced persons). If the care and control of your child is shared with your ex-spouse, you must obtain his/ her written agreement before you may list your child in an EC application.

- You and your siblings who are orphans and single, i.e. unmarried, divorced or widowed persons@ may apply for an EC unit with the following criteria:

- All your siblings are listed in the same application, and they are not applying for/ owning/ renting a flat separately.

- At least 1 of your deceased parents was a SC or SPR.

- You and up to 3 other singles as core applicants

@ Divorced or widowed persons who have child(ren) and can form a family unit will not qualify to buy a flat as orphaned siblings.

Citizenship

Fiancé and fiancée, married couples and/ or parent(s) with child(ren), orphaned siblings

You must:

- Be an SC

- Include at least 1 other SC or SPR

Two or more singles

- All singles applying jointly for an EC unit must be SCs.

Age

- At least 21 years old

- At least 35 years old, if two or more singles are applying jointly

Monthly household income ceiling

The total income of all persons listed in the EC application must not exceed $16,000.

You will be guided by the property developer on the submission of documents, such as income documents, when you book an EC unit.

Ownership/ Interest in property in Singapore or overseas other than HDB flat

Interest or ownership in a property

You have acquired a property through purchase or when it is:

- Acquired by gift;

- Inherited as a beneficiary under a will or from the Intestate Succession Act; or

- Owned, acquired, or disposed of through nominees.

Private residential property

All applicants and occupiers listed in the EC application:

- Must not own or have an interest in any local or overseas private property; and

- Must not have disposed of any private property in the last 30 months before the EC application.

Non-residential property

For EC land sales launched on or after 9 May 2023 (including those where the tenders have not closed) all persons listed in the EC application can, as a household, own up to 1 non-residential property at EC application and up to 30 months before EC application.

Note:

A private residential property includes but is not limited to a house, building or land that is under a residential land zoning (including land with multiple land zoning[1]), Executive Condominium (EC) unit, privatised HUDC flat and mixed use development[2].

Non-residential property is a property under a non-residential land zoning and/ or the permitted use does not include housing.

[1] E.g., residential with commercial at 1st storey or commercial and residential

[2] E.g., properties with a residential component, such as HDB shop with living quarters.

Previous housing subsidies

A subsidised housing unit refers to:

- A flat bought from HDB

- A resale flat bought on the open market with CPF housing grant

- A Design Build and Sell Scheme (DBSS) flat bought from a property developer

- An EC unit bought from a property developer

- Other forms of housing subsidy (e.g. enjoyed benefits under the Selective En bloc Redevelopment Scheme (SERS), privatisation of HUDC estate, etc)

Payment of premium or resale levy

If you and/ or any core applicants or core occupiers have taken a housing subsidy, you are considered a second-timer^. All second-timer core applicants and core occupiers will need to pay their respective resale levies, if applicable, when buying an EC unit from the property developer. Find out more on the resale levy payable.

If you and/or any core applicants or core occupiers have taken 2 housing subsidies, you are not eligible to apply or be listed as a core occupier in an EC application.

^ If you are a single buying with up to 3 other singles, you and/ or your core applicants must be first-timers to be eligible to buy an EC unit from the property developer.

Ownership/ Interest in HDB flat

If you or any persons listed in the application owns or has an interest in any HDB flat, you must dispose of the flat within 6 months of completion of the EC unit purchase.

Undischarged bankrupt

Prior consent must be obtained from the Official Assignee (OA) or the private trustee for the purchase of an EC unit.

You do not need to seek prior consent from the OA or the private trustee if you are listed as an occupier of the EC unit.

Wait-out period before applying to buy an EC unit from a property developer

Cancellation of application after booking a flat from HDB

If you have booked a flat from HDB and subsequently cancel your flat booking, you must wait out a 1-year period from the date of the cancellation before you may apply or be listed as a core occupier to buy an EC unit from a property developer.

Termination of the Sale and Purchase Agreement for an EC unit

If you had previously bought an EC unit from a property developer with a CPF Housing Grant and subsequently terminated the Sale and Purchase Agreement, you must wait out a 5-year period from the date of the termination before you may apply or be listed as a core occupier to buy an EC unit from a property developer.

Owners/ Ex-owners of an EC unit bought from a property developer

If you currently own or have recently disposed of your ownership in an EC unit, you must wait out a 30-month period from the date of disposal of the EC unit before you may apply or be listed as a core occupier in an application to buy another EC unit from a property developer, subject to other eligibility conditions.

Pros and Cons of an Executive Condominium (EC)

Based on the latest incoming ceiling, if your combined household income is between $12,000 and $16,000, you belong to the privileged group, which you are classified as the middle-class category. Instead of leveling up two tiers straight into private property, you may consider leveling up one tier for an Executive Condominium (EC) to enjoy the privilege of an EC. Besides, it is brand new that comes with a warranty, and you get to enjoy the CPF housing grant if you meet the criteria. You also get to enjoy the condominium facilities that HDB BTO does not have. But of course, you are still free to go for resale public housing (resale HDB Flat) if you don’t mind an older flat without a warranty or with no facilities such as a swimming pool, gym, function room, etc. Alternatively, you may go for a private resale condominium but typically more expensive than an EC. Below are some pros and Cons of buying an Executive Condominium (EC).

| PRO | CON |

|---|---|

| 25% – 35% cheaper than a private condo. | Income ceiling up to $16,000. Those higher are not eligible |

| Enjoy up to 30k CPF Housing Grants depending on your total household income | Must qualify under one of the HDB eligibility schemes |

| Gets the premium façade and facilities of a private condominium | Mortgage loan only from Bank, not HDB and you must pay at least 25% down payment in cash/CPF |

| Get private property status after 10 years | Same as HDB BTO, you need to fulfill 5 years MOP before selling |

Additional Pointers That You May Not Know About An Executive Condominium (EC)

| NO ABSD payable for HDB upgraders |

| Price subsidies – CPF Housing Grant and Lower land cost on EC land |

| Deferred Payment Scheme Available – Pay 20% downpayment and 80% deferred till TOP |

| No 2nd loan restriction – up to 75% loan to value (LTV) for upgrader |

| Condo lifestyle living with full condo facilities at lower entry price as compare to condominium |

| Asset Progression – using properties over time to grow your wealth |

| No Ethnic Restriction When Buying or Selling |

| NO Seller Stamp Duty – All owner occupied estate with 5 years minimum occupation period (MOP) |

| Buy first Sell Later for upgrader without ABSD incurred |

| Special Bridging Loan – Unlock existing HDB flat value |

| EC comes with 5 years MOP and 10 years privatized. |

| No subsidy recovery, unlike HDB Prime and Plus mode upon selling |

Please get in touch with me to learn more about the Pros and Cons of an Executive Condominium (EC). I will share with you more in-depth (Free non-obligatory casual discussion). With some basic understanding of EC and its eligibility condition, let’s take a look at the available or upcoming EC that you can consider in 2025 and how to go about booking a unit for yourself.

Buying Procedures

Step 1: EC sales launch

| Process | Payments |

|---|---|

The property developer will announce the project launch in the newspapers, social media, their website, etc. You may contact the property developer to find more information on:

|

No payments at this stage |

Step 2: Submit application

| Process | Payments |

|---|---|

| You must submit an application to the property developer. Property developer has the choice to offer the units via computer balloting or walk-in selection. | Check with property developer |

Step 3: Receive outcome of application

| Process | Payments |

|---|---|

| Property developer will inform you of the outcome. | No payments at this stage |

Step 4: Booking An EC Unit

| Process | Payments |

|---|---|

Property developer will invite you to book an EC unit and grant you the Option to Purchase (OTP), if you are eligible to buy an EC unit. For applicants applying for CPF Housing Grant Submit the completed EC application form, the application form for CPF Housing Grant for EC, and all other required supporting documents directly to the property developer. After booking an EC unit, you must submit the completed application form to use your CPF savings to the CPF Board for processing. This is so that you can use your CPF savings or the CPF Housing Grant, or both, for the payment of your EC unit. Prompt submission will ensure that you will be able to use the CPF funds to pay for the balance downpayment. | 5% option fee by Cashier’s Order, cheque or telegraphic transfer/ Fast and Secure Transfers/ MAS Electronic Payment System |

Step 5: Sign Sale and Purchase Agreement

| Process | Payments |

|---|---|

Property developer will invite you to sign the Sale and Purchase Agreement. You are advised to engage a solicitor to handle the conveyancing matters, arrange with a financial institution for financing, and check with CPF Board on the use of your CPF savings to pay for the EC unit. | 15% of the purchase price plus 1-3% legal and stamp fees by CPF OA savings or cash within 9 weeks from the date of OTP or signing of the Sale and Purchase Agreement. For applicants who are eligible for the CPF Housing Grant, the grant forms part of your CPF funds and can be used to pay the balance downpayment. |

Step 6: Collect keys to EC unit

| Process | Payments |

|---|---|

| Property developer will invite you to collect the keys when the EC project is completed. | Check with property developer. Please also read the conditions after buying. |

Before you decide to go for an Executive condominium, I would suggest you go through the following steps first:

- Eligibility Check to make sure you are eligibility to buy an EC.

- Financial Assessment to make sure you are buying within your budget.

- Visit the EC Showflat to understand more first.

- Shortlist and purchase a unit only you have go through the above 3 steps. Do note that shortlisting the right unit to purchase is very important as it may affect your exit strategy in future.

Do feel free to connect with me if you need any assistance on the above steps. It is highly recommended that you go through them first before you make any decision to purchase.

Available Executive Condominium (EC) 2025

| Location | Yishun Close |

| Town | Yishun |

| Developer | Sing Holdings (Yishun) Pte Ltd. |

| TOP Date | June 2027 |

| Unit Type | 3 / 4 /5 bedroom |

| No. of Blocks | 11 of 14 Storey |

| No. of Units | 616 |

| Location | Bukit Batok West Ave 8 |

| Town | Bukit Batok |

| Developer | Qingjian & SNC Realty |

| TOP Date | Mar 2027 |

| Unit Type | 3/4/5 Bedrooms |

| No. of Blocks | 6 of 15 Storey |

| No. of Units | 360 |

| Location | Bukit Batok West Ave 5 |

| Town | Bukit Batok |

| Developer | CDL |

| TOP Date | Mar 2029 |

| Unit Type | 3/4/5 Bedrooms |

| No. of Blocks | 2 Blocks of 12 Storey and 8 Blocks of 12 Storey |

| No. of Units | 512 |

Novo Place EC

| Location | Plantation Close |

| Town | Tengah |

| Developer | Hoi Hup Realty & Sunway Property Development |

| TOP Date | Q1 2027 |

| Unit Type | 3 / 3+Study / 4 / 4+Study Bedrooms |

| No. of Blocks | 7 Blocks of 18 Storey |

| No. of Units | 508 |

Aurelle of Tampines EC 晶莹轩

| Location | Tampines Street 62 |

| Town | Tampines |

| Developer | Sim Lian Group |

| TOP Date | Dec 2028 |

| Unit Type | 3/4/5 bedroom |

| No. of Blocks | 14 Blocks of 14 Storey |

| No. of Units | 760 |

Launching Soon! Read more about

AURELLE OF TAMPINES EC @ TAMPINES STREET 62 EC BY SIM LIAN GROUP

SOLD OUT Executive Condominium (EC)

| Location | Tengah Garden Walk |

| Town | Tengah |

| Developer | Taurus Properties SG Pte. Ltd. (CDL & MCL Land) |

| TOP Date | Dec 2027 |

| Unit Type | 2+S / 3 / 4 / 5 |

| No. of Blocks | 12 |

| No. of Units | 639 |

| Location | Tampines Street 62 |

| Town | Tampines |

| Developer | Qingjian Realty & Santarli Realty |

| TOP Date | Est. 2026 |

| Unit Type | 3/4/5 Bedrooms |

| No. of Blocks | 11 |

| No. of Units | 618 |

| Location | Fernvale Lane |

| Town | Sengkang |

| Developer | Frasers & CSC Land |

| TOP Date | June 2026 |

| Unit Type | 2/3/4/5 Bedrooms |

| No. of Blocks | 9 |

| No. of Units | 496 |

| Location | Canberra Crescent |

| Town | Canberra / Sembawang |

| Developer | MCC Land |

| TOP Date | Apr 2026 |

| Unit Type | 3/4 Bedrooms |

| No. of Blocks | 9 |

| No. of Units | 413 |

GOVERNMENT LAND SALES

Updated on 17th Jan 2025

LAND SOLD

| Location | Type | Land Area (sq m) | Gross Plot Ratio (GPR) | Status |

|---|---|---|---|---|

| Tampines Street 95 (Tampines E18) | EC | 22,488.9 | 2.5 | Sold |

| Jalan Loyang Besar (Pasir Ris E11) | EC | 28,405.5 | 2.5 | Sold |

| Plantation Close (Tengah E3) | EC | 20,038.2 | 2.8 | Sold |

| (AURELLE OF TAMPINES) Tampines Street 62 EC Launching Soon! (Tampines E13 Parcel B) | EC | 28,000.2 | 2.5 | Sold |

| (NOVO PLACE) Plantation Close (Tengah E2) | EC | 16,441.2 | 2.8 | Sold |

*Estimated launch date. Detailed sales conditions will be made available when the site is launched for sale.

CONFIRMED LIST

| Location | Type | Site Area (HA) | Proposed Gross Plot Ratio (GPR) | Status |

|---|---|---|---|---|

| Senja Close | EC | 1.01 | 3.0 | March 2025* |

| Woodlands Drive 17 | EC | 2.52 | 1.7 | April 2025* |

| Sembawang Road | EC | 1.90 | 1.4 | May 2025* |

*Estimated launch date. Detailed sales conditions will be made available when the site is launched for sale.

RESERVE LIST

| Location | Type | Site Area (HA) | Proposed Gross Plot Ratio (GPR) | Status |

|---|---|---|---|---|

| Coming Soon | EC | |||

| Coming Soon | EC |

* Site is not ready for application. The detailed conditions of sale will be released on the month indicated.

Understanding the EC Normal Progressive Payment Scheme Vs EC Deferred Payment Scheme

Understanding the EC Normal Progressive Payment Scheme

Learn more about the EC Normal Progressive Payment Scheme here with calculation example for you understanding.

Understanding the EC Deferred Payment Scheme

Learn more about the EC Deferred Payment Scheme here with calculation example for you understanding.

Need Consultation?

Contact Me

Feel free to connect with me!

Senior Associate District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: +65 9383 9588

Buying a Property in Singapore? 8 Key Tips on What to Look Out For

What to look out for when buying a condo or property in Singapore? Learn 8 key tips to help you choose or spot the right property for investment or own stay with capital appreciation and exit strategy.

Is It Still Safe to Enter the Property Market In 2025 Amid U.S. Tariffs?

How Trump’s Tariffs Could Affect Singapore’s Condo And HDB Prices. Is it safe to enter the Singapore property market in 2025 amid recession fears and U.S. tariffs? Learn how interest rates, supply trends, and market resilience could shape your next move.

How to Upgrade When My HDB Reached Minimum Occupation Period (MOP)

For HDB owners who have fulfilled the 5-year MOP (Minimum Occupation Period) in Singapore, discover your next move. Find out if you should sell your flat (resale HDB) or upgrade to a private property, with clear tips for smart homeownership planning.

Freehold Vs Leasehold Properties, Which Suit You Best?

Explore the key differences between freehold and leasehold properties in Singapore. Understand their advantages, investment potential, and determine which property type aligns with your goals.

How Much Do You Need to Earn to Afford a Condo in Singapore?

How much salary do you need to buy a condo in Singapore? Calculate loan, cash, CPF needed & avoid costly mistakes. Read the full guide now!

How To Building Retirement Capital Through Property: Breaking the Misconceptions About Property Upgrading

Looking to grow your retirement capital in Singapore? Discover how smart property upgrading and strategic investments can accelerate your wealth-building journey. From first-time buyers to seasoned homeowners, learn how to leverage property for long-term financial freedom.