4 Factors Affecting Property Loan-To-Value (LTV) Limit Concerning You!

In Singapore, before you apply for a housing loan from banks or any financial institution (FI), you need to understand the Loan-To-Value (LTV) limits that might affect you. The LTV limit determines the maximum housing loan amount you can borrow, which determines how much upfront cash or CPF fund you need to set aside before committing any Singapore property purchase.

On 5th of July 2018, MND, MAS and MOF jointly announced that the LTV limits would be tightened by 5%-points on all housing loans granted by financial institutions (FI), as part of a package of measures to cool the property market in Singapore and keep housing price increases in line with economic fundamentals.

On the 15th of December 2021, MND, MAS, and MOF jointly announced another round of cooling measures to promote continued housing affordability. The government also calibrated the private residential property to dampen broad-based demand, especially from those purchasing property their 2nd or subsequent properties for investment rather than owner-occupation. The measures were introduced to tighten financing conditions for both the HDB and private housing to encourage greater financial prudence. The Government will also be ramping up the supply for both private and public housing in 2022.

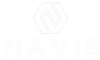

In a simpler term, the LTV limit means the loan amount as a percentage of the property’s value. For example, if your LTV limit is 75%, this means you can only borrow $750,000 from the bank for a property valued at $1,000,000.

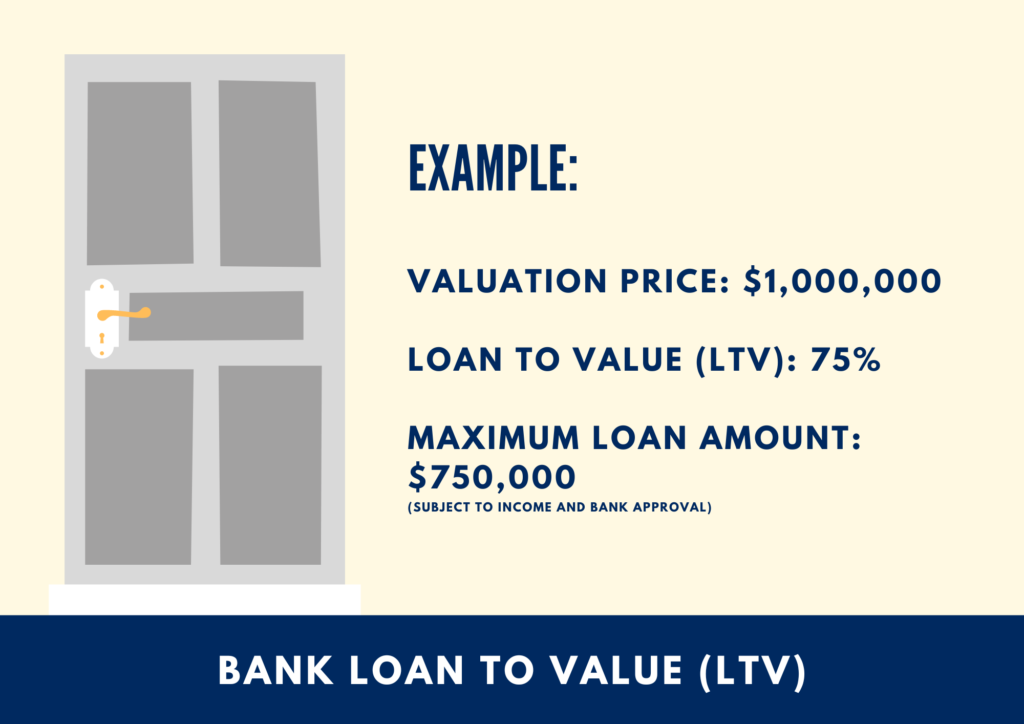

If you are buying the HDB flat using HDB Loan, then you need to take note of this section about the Loan to Value (LTV) for HDB loan.

- On 16 Dec 2021, the government announced that the LTV limited for HDB flat will be lowered from 90% to 85% for HDB loan.

- In just 9.5 months later on 30 Sept 2022, the HDB loan LTV limited is further lowered from 85% to 80%.

- After less than 2 years, on 19 Aug 2024, the MND and HDB announced the LTV for HDB loan will be further lowered by another 5% point from 80% to 75% with effect from 20 Aug 2024. This only apply to HDB loan. If your loan is from banks or other financial institution (FI), the LTV still remain as per 75%

So what are the 4 Factors Affecting Property Loan-To-Value (LTV) Limit Concerning You?

The four key factors that determine the LTV limits are: –

- Loan duration (Loan Tenure)

- Borrower(s) age

- Property type (HDB or Private property)

- Whether you have any existing housing loans

Loan duration (Loan Tenure)

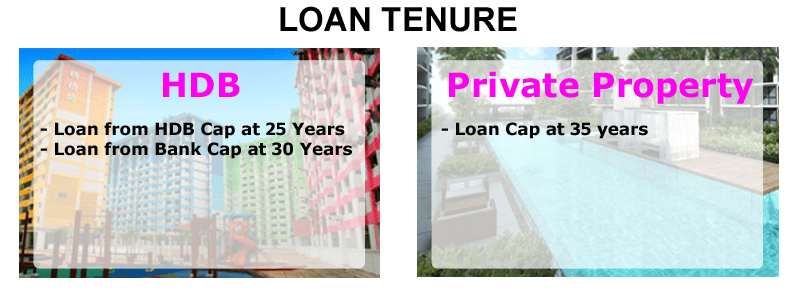

In Singapore, the maximum loan tenure for a housing loan is capped at:

- 30 years for HDB flats. (If you are applying for a loan through HDB directly, the maximum loan tenure will be 25 years)

- 35 years for non-HDB properties.

Do note the following that will result in a lower LTV limit, which in turn increases the upfront fund needed to purchase a property in Singapore:

- For HDB flat, if the loan tenure is more than 25 years.

- For non-HDB properties, if the loan tenure is more than 30 years.

Borrower(s) Age

In determining the LTV limit, one of the factors is the borrower(s) age. The borrower(s) ‘ age plus the loan tenure duration is one of the key factors. If the sum of the borrower(s) age and the loan tenure cross above 65 years old, the LTV limit will be lowered, resulting in a lower housing loan amount granted, which increases the upfront fund needed to purchase a property in Singapore.

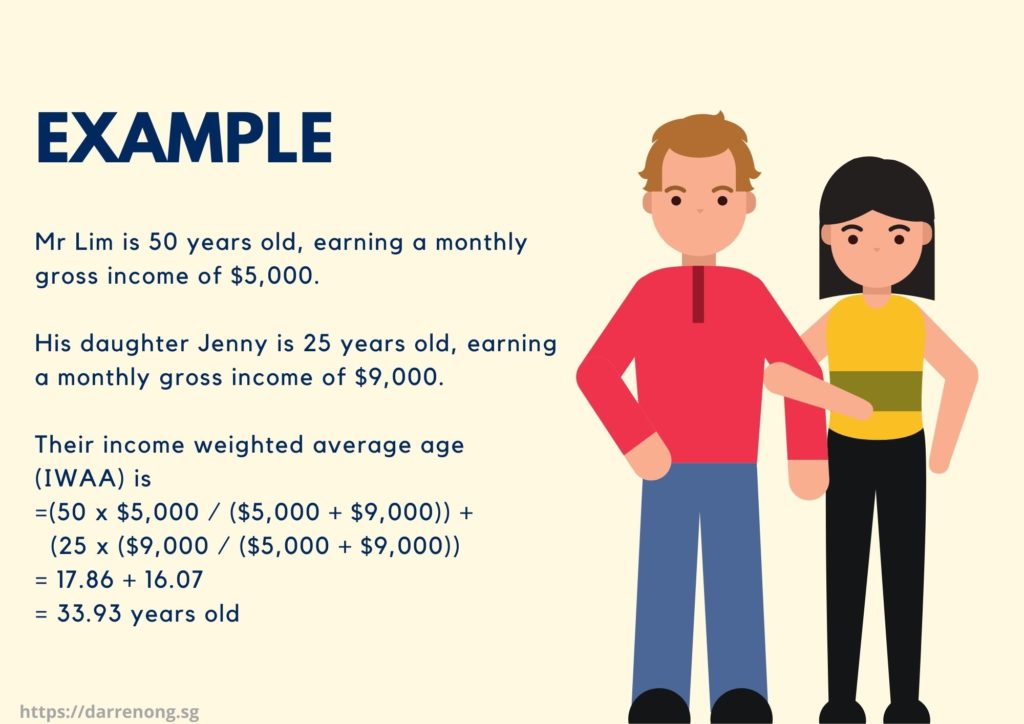

For joint borrowers, the income-weighted average age as their present age is used. The example below shows you how you can determine the income-weighted average age as it relates to your ability to repay the loan:

Assuming B1=Borrower 1, B2=Borrower 2

The income-weighted average age = (B1’s Age * B1’s gross monthly income / (B1’s gross monthly income + B2’s gross monthly income)) + (B2’s Age * B2’s gross monthly income / (B1’s gross monthly income + B2’s gross monthly income))

Since borrower age is one of the considering factors, the older borrowers might have a disadvantage compared to the younger borrower. This is one reason why we always encourage you to start young when investing in property in Singapore.

Let’s retake the above example.

Mr. Lim and his daughter Jenny each bought a condominium now. To borrow the maximum LTV of 75%. Mr. Lim only can take up to 15 years of loan tenure, which makes up to 65 years (50 years + 15-year loan tenure). This means that Mr. Lim might need to service a higher monthly installment as the loan tenure is shorter.

Since Jenny is 25 years old, she can take up to 30 years of loan tenure yet still enjoy the maximum Loan-to-Value of 75%. This means her monthly housing installment will be lower as compared to Mr. Lim.

Property Type

The type of property refers to an HDB flat or non-HDB flat (private property).

Typically for an HDB LTV Limit, it depends on whether you apply for your mortgage through HDB or Bank. Below is the difference:

WEF from 16 Dec 2021, for an HDB flat using a housing board loan, the maximum HDB LTV Limit can be up to 85% of the valuation, subject to your total household income and HDB approval. The HDB Loan LTV Limit is lowered to 80% on 30 Sept 2022 and further lowered from 80% to 75% with effect from 20 Aug 2024.

For a Bank loan, irregularly of HDB flat or private property residential property, the maximum HDB LTV Limit or Private Property, LTV Limit can be up to 75% of the valuation if it is your first mortgage loan and subject to your total household income and HDB or Bank approval.

Number of existing housing loan

Lastly, the number of housing loan(s) you are currently servicing is the most significant factor affecting the LTV limits you can borrow for your next housing loan. If you have structured your property portfolio through Property Wealth Planning, a high chance is that you are holding multiple properties now, which you might be affected by the lower LTV limits due to multiple housing loans.

The bank loan LTV limit table below summarizes Singapore’s residential property with effect from the 6 July 2018. You can borrow the percent based on your age, loan tenure, type of property purchased, and the number of housing loans you are servicing now.

Case Study Example on Singapore Mortgage Loan Limit or Loan-to-Value (LTV) Limits Using Bank Loan to Purchase Residential Property (HDB or Private Property) In Singapore

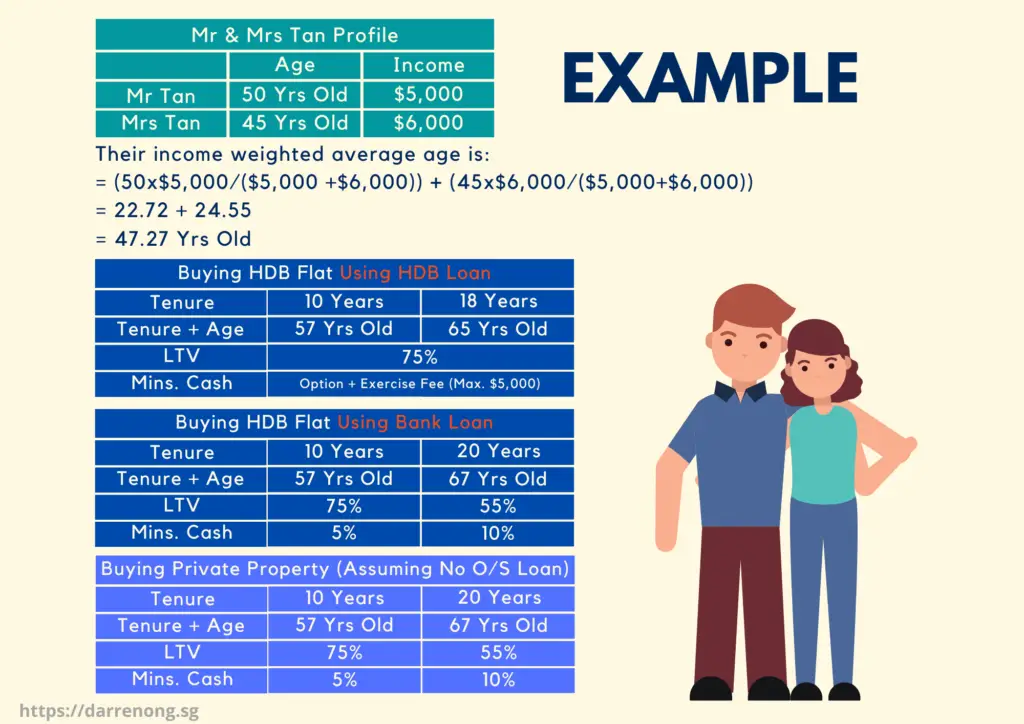

Assuming Mr. & Mrs. Tan is 50 and 45 years old, respectively. Mr. Tan earned a gross monthly income of $5,000, which Mrs. Tan earned a gross monthly income of $6,000. This example will show the calculation of their income weighted average age for buying their first HDB or first private property based on loan tenure of 10 years and 20 years using Bank Loan. You may refer to the above LTV Limits Summary Table for reference.

Please note that, If Mr. & Mrs. Tan is buying an HDB flat using HDB loan, the maximum loan tenure is 25 years or up to 65 years old.

As a buyer(s), you should understand the fundamental of Loan-to-Value (LTV) and its limits based on the 4 factors to determine the maximum loan that you can take up and determine how much initial outlay you need to set aside for the property purchase. Always start young to enjoy your retirement early!

I hope the above example clears some of your minds about the Loan-to-Value (LTV) limits when buying a property in Singapore.

I welcome you for a friendly non-obligation discussion should you need a consultation about your first property purchase or subsequent property purchase in determining the LTV limits that might affect you and the workaround ways to get a higher LTV limit.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Senior Associate District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

The Special EC Deferred Bridging Loan for HDB Upgraders

Planning to buy a new EC while still owning an HDB? Learn how the Special EC Deferred Bridging Loan helps cover CPF shortfall and avoid cashflow stress.

Selling Your Condo in Singapore 2025: Step-by-Step Guide & What to Know Before You Start

Selling your condo soon? Learn how to sell a condo in Singapore with confidence — from staging and pricing to picking a trusted property agent. Avoid costly mistakes and discover tips that help you sell faster and smarter.

Where Can You Find and How to Buy an Executive Condominium in 2025

Upcoming Tampines St 62 Aurelle of Tampines 晶莹轩 EC Target Q1 2025 Launching. Other Available New Launch EC in 2025. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Buying a Property in Singapore? 8 Key Tips on What to Look Out For

What to look out for when buying a condo or property in Singapore? Learn 8 key tips to help you choose or spot the right property for investment or own stay with capital appreciation and exit strategy.

Is It Still Safe to Enter the Property Market In 2025 Amid U.S. Tariffs?

How Trump’s Tariffs Could Affect Singapore’s Condo And HDB Prices. Is it safe to enter the Singapore property market in 2025 amid recession fears and U.S. tariffs? Learn how interest rates, supply trends, and market resilience could shape your next move.

How to Upgrade When My HDB Reached Minimum Occupation Period (MOP)

For HDB owners who have fulfilled the 5-year MOP (Minimum Occupation Period) in Singapore, discover your next move. Find out if you should sell your flat (resale HDB) or upgrade to a private property, with clear tips for smart homeownership planning.