Table of Contents

9 Mistakes That Landlords Commonly Overlook

We all know that an investor usually buys property as an investment vehicle, turning it into an income-generating asset. Generally, while waiting for capital appreciation over some time, investors will rent the property out, making it an income-generating asset to enjoy passive income.

This also applies to HDB flat owners, where some of them decided to turn their HDB into an income-generating asset to cope with their necessary expenses need.

Being a landlord, sometimes it’s seemed to be too easy when things go smoothly according to plan. One ideal example is getting a lease signed and waits to collect the monthly rent from the tenant on time.

But many a time, it doesn’t go according to plan and dispute or problems arise due to overlooked mistakes made by either party involved.

Here are some guides that you, as a landlord, must know to avoid mistakes when renting your investment property before you start to regret it.

Always Check All Tenants Profile

Sometimes landlord or their representing agent eagerly wanted to secure the tenant. They may overlook and skipped the tenant’s profile screening. This is a substantial mistake that you must avoid.

Checking all tenant profiles help you to ensure: –

- Is tenant legally residing in Singapore? Check all work pass and a student pass for validity from the ICA website.

- Tenant eligibility to rent your property? This is more for HDB flat, as a tenant needs to fulfill the ethnic quota limit, and some work pass holders are not eligible to rent HDB flat. Thus do your diligent due check before you unknowingly broke the rules. Always consult a trusted real estate professional or advise if you are unsure.

- Does the tenant meet the ethnic quota limit for HDB flat?

Please spend a little time and effort to screen your potential tenants now could prevent unnecessary costly events arise later on.

Renting Out Without Relevant Approval For Subletting / Not Following Local Subletting Rules

As an HDB flat landlord, you’re required to make sure the subletting approval is granted to you from HDB before you rent out your HDB flat. Please refer to the HDB website for more details on HDB flat subletting.

As a private property landlord, you’re also required to make sure you follow the rules when you rent out your property. Please refer to the URA website for more details on private property subletting requirement.

You will also need to avoid any short term rent requests as it against Singapore law.

- For private residential properties, No shorter than three consecutive months

- For HDB, No shorter than six consecutive months

Failed to Make Sure Tenant Pay Stamp Duty

Stamp duty is payable within 14 days by the tenant on documents relating to the lease of immovable properties in Singapore. Do note that the tenancy agreement will have legally binding power once the stamp duty has been paid.

Signing Tenancy Agreement Without Vetting Or Clarifying The Terms and Conditions

I will go through all the terms and conditions or clauses in the tenancy agreement with the Landlord before they sign on the dotted line. I strongly recommend that you (the Landlord) read all the terms and conditions in the tenancy agreement and seek for advice or clarification with your realtor if in doubts before you sign on the dotted line.

On a side note, do not ever rely on a verbal agreement with the tenant that is not recorded as it is tough to prove who is right or wrong.

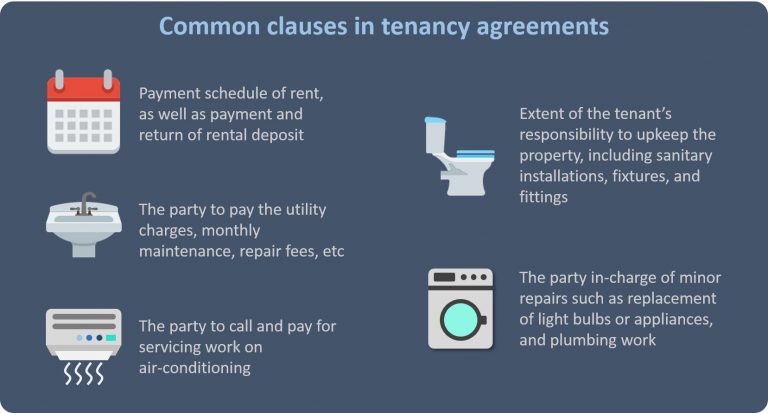

Some common clauses to note:

No Proper Handover Inspection During Move-In and Move-Out

One of the most common mistakes that a landlord must avoid before a dispute arises.

The Landlord should provide the tenant with a clean and tenable living condition property. I will suggest that the Landlord provide and show all the cleaning or servicing invoices or receipt to the new tenant to prevent the tenant from turning to your back and claim that you didn’t clean the property or service the air conditional during move-in handover.

On the day of handover, I recommend the Landlord to go through the inventory list with the tenant.

The Landlord should take as many photos as possible of the physical state of the property and its inventory list items.

Invite the tenant to acknowledge all the photos taken as proof of the physical state of the property.

During the move-out handover, the tenant must yield up the property as per the same condition when landlord handover during move-in.

These include dry cleaning of the curtains, air-conditional servicing, and necessary cleaning of the apartment. All invoices or receipts should be in place to show Landlord during the handover.

Didn't Keep Track On Quarterly Aircon Servicing

Many landlords and tenant overlooked on the quarterly air-conditional servicing. It is a good practice to get the quarterly air-conditional servicing invoice or receipt from the tenant. Alternatively, add in a clause and request tenant to sign a quarterly air-conditional servicing contract throughout the whole tenancy period.

Didn't Get Your Property Insured

Nobody will know what will happen the very next moment. Imagine a faulty e-scooter explodes and burns down your property and belongings. For HDB, you are covered automatically under the Home protection scheme.

For a private property owner, you are not automatically covered, thus please get home insurance if you are renting out your property.

Not Engaging a Realtor

When you DIY, dealing with other realtor representing the tenant. It is sometimes not as easy to negotiate the terms and conditions as the other realtor will not have your best interest as he/she is representing the tenant.

I would suggest that you engage a professional realtor as he/she may be in the best position to advise you accordingly during the negotiating and before the handover of the unit.

Assuming Your Realtor Will Manage All Tenancies

It is a common assumption from the landlord that their realtor will manage their leases throughout the tenancy. But according to the CEA guideline, the realtor’s responsibilities end after both landlord and tenant sign the tenancy agreement after the property handed over to the tenant.

Please refer to CEA website for further clarification.

Understand your realtor responsibilities:-

Lastly, I hope this article clears some of your doubts behind your mind and know the do and don’t well when you are renting your investment property to enjoy your smooth monthly passive income.

I welcome you to contact me for a non-obligation short discussion, should you have any doubts or while looking for a tenant or entering into the real estate investment.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls