Table of Contents

A Complete Guide to Buy A Property in Singapore in 2025

When buying a property in Singapore, there are tons of questions that might be at the back of your mind. These questions usually include property type to buy, rules and regulation, affordability, financial aids, location, and procedure, to name a few.

In Singapore, with extensive government property market policy, regulation, and financial aids such as the CPF housing grant, most Singaporeans are still able to afford a home; the 2020 homeownership rate at 87.9%.

Here are some fundamentals of what property seeker or home seeker needs to know about homeownership in Singapore 2025.

Types of Singapore residential properties and which you can buy (local, PR or foreigners)

In Singapore, like many other countries around the world. There are public residential housing and private residential properties.

For public residential housing by the Housing Development Board (HDB), only the following is eligible to purchase if they fulfill one of the purchasing schemes, which I will share more in public residential housing (HDB) section.

- Singapore Citizen (SC) or

- Permanent Resident (PR)

As public residential housing (HDB) is heavily subsidies by the government, the foreigners are not eligible to purchase.

For private residential properties, they are classified under various types of property:

- Executive condominium (EC),

- Private residential apartment / condominium (condo), and

- Landed housing property.

For executive condominium (EC), it is not so straightforward as other private property. Although a private developer builds it, purchasing an EC has rules to follow based on the three category which I will share more in the EC section:

- Brand new EC purchasing from housing developer,

- EC that just turn 5 years old from TOP, We call these the MOP EC, and

- EC that turn 10 years old from TOP, we call these privatized EC.

For a private apartment/condominium, SC, PR, or foreigners are free to purchase.

For landed property, SC are free to purchase. SPR and Foreigners need government approval to buy purchases.

Age Matters

For public housing (HDB):

- you must be at least 21 years old to purchase with a family nucleus.

- For single who are unmarried or divorced, you need to be 35 years old except for windowed, or an orphan can be 21 years old.

For private property:

- you must be at least 21 years old to purchase a property.

- The purchaser age can be below 21 years if it’s purchased under a trust

CPF Usage on Property

Your CPF Ordinary Account (OA) savings can be used to buy a HDB flat, or buy or build private and residential properties in Singapore. The CPF OA savings can also be used for downpayment and housing loan taken for the property purchase, stamp and legal fees, loan taken for the construction of your house and the purchase of vacant land (for private properties only), as well as Home Protection Scheme premiums (for HDB flats only).

The amount of CPF OA that you can utilize is subject to the valuation limit (VL) and withdrawal limit (WL) depending on the property you buy. I will elaborate more about this under the different type of property section.

- VL refers to the market value or the purchase price of the property at the time that you are buying, whichever is lower.

- WL refers to the maximum amount of CPF that you can use for your property, currently capped at 120% of the valuation limit.

You may be keen to read more about

using CPF saving for second properties.

Purchasing Public Residential Property (HDB Flat)

Who is eligible to purchase HDB Flat:

Lets look into details on each of the property type below and who is/are eligible:

| Types of Property | BTO / Resale Flat |

|---|---|

| Public Housing (HDB Flat) | SC + SC SC + SPR SC SC + Non SC Spouse |

Public Housing (HDB Flat) Scheme

There are several schemes that you can use to buy HDB flat. In general, there must be at least one SC when purchasing an HDB flat.

| Types of Scheme | Citizenship | Min. Age | Family Nucleus / Remark |

|---|---|---|---|

| Public | SC + SC SC + PR PR + PR (at least 3 yrs PR) | 21 | Spouse and children. Parent and siblings. Children under your legal custody, care and control. |

| Fiance / Fiancee | SC + SC SC + PR PR + PR (at least 3 yrs PR) | 21 | Your spouse to be, must be listed in the application as either: – a co-applicant (if 21 years old or above). – an occupant. |

| Single SC | SC | 21 or 35 | Unmarried or divorced: at least 35 years old. Widowed or an orphan: at least 21 years old. For orphan, please refer to ophans scheme. |

| Joint Singles | SC | 21 or 35 | Unmarried or divorced: at least 35 years old. Widowed or an orphan: at least 21 years old. For orphan, please refer to ophans scheme. |

| Non – Citizen Spouse | SC | 21 or 35 | Age 21 up, spouse must have valid Long Term Visit Pass or Work Pass at time of resale application with at lease 6 months pass validity. Age 35 up, spouse must have valid Visit Pass or Work Pass at time of resale application with at least 6 months pass validity. |

| Non – Citizen Family | SC | 21 | must form family nucleus with either parents or sibiling or children under your legal custody, care and control. At least 1 parent / child must have a valid Long Term Visit Pass or Work Pass at time of resale application with at least 6 months pass validity. |

| Orphans | SC | 21 | must include at least 1 more single SC or PR sibling as co-applcation or occupier. At least one of your deceased parents must be SC or PR. If below 35 years old, must not have another sibling who is younger than 35 years old buying/owning another flat under the orphans, single or joint singles scheme. |

| Conversion | SC + SC SC + PR | 21 | Spouse and children. Parent and siblings. Children under your legal custody, care and control. |

For more details, you may refer to https://www.hdb.gov.sg/residential/buying-a-flat/understanding-your-eligibility-and-housing-loan-options/flat-and-grant-eligibility

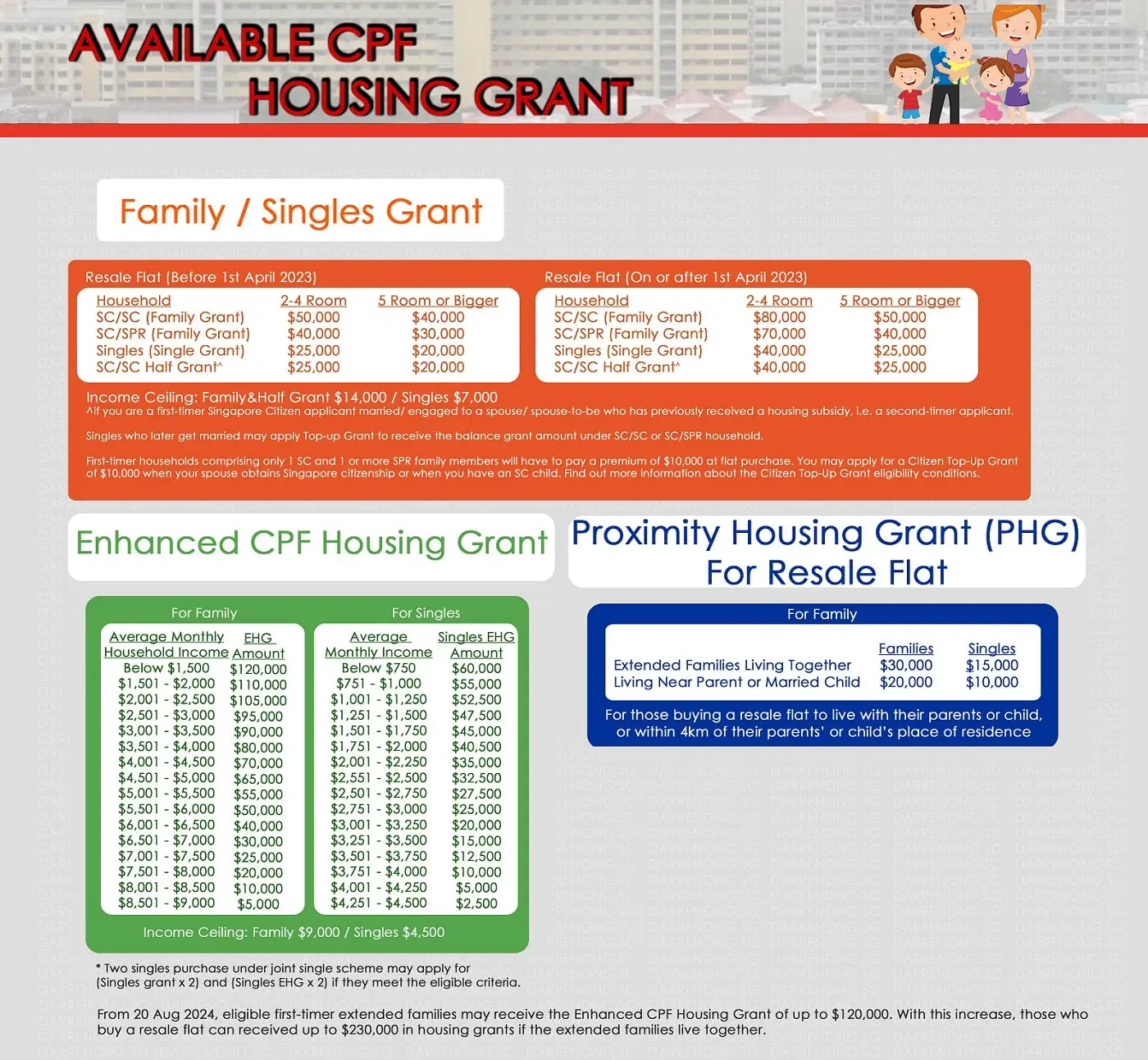

Types of CPF Housing Grant Available for HDB Flat

The available CPF housing grants that you are eligible to apply for will depends on the type of scheme you purchase the flat, as well as your total household income.

Let’s take a look at the possible CPF housing grants for each scheme:

| Purchasing Scheme | Types Of Grant |

|---|---|

| Public scheme Conversion scheme | Family Grant Enhanced CPF Housing Grant (EHG) Half-Housing Grant Singles Grant EHG (Singles) Proximity Housing Grant |

| Fiance/Fiancee scheme | Family Grant Enhanced CPF Housing Grant (EHG) Half-Housing Grant Proximity Housing Grant |

| Single SC scheme Non-citizen spouse scheme Non-citizen family scheme | Singles Grant EHG (Singles) Top-Up Grant (at a later stage) Proximity Housing Grant |

| Joint singles scheme Orphans scheme | Singles Grant Enhanced CPF Housing Grant (EHG) Proximity Housing Grant (for Joint Singles Scheme only) |

For HDB Flat – CPF Housing Grant (First Timer Grant, Enhanced Housing Grant (EHG) and Proximity Housing Grant (PHG))

At a glance, let’s take a look on the available types of CPF Housing Grant and the increased EHG from 20th Aug 2024 as announced by MND and HDB to provide support to middle to lower income 1st timer HDB flat buyers.

- Enhanced Housing Grant (EHG) increased from $80,000 to $120,000 for eligible 1st-timer families.

- Enhanced Housing Grant (EHG) increased from $40,000 to $60,000 for eligible 1st-timer singles.

The revised higher Enhanced Housing Grant (EHG) amount will apply to 1st timer buyers who:

- submit their resale application on or after 20th Aug 2024,

- apply for an HDB Flat Eligibility (HFE) letter on or after 20th Aug 2024, or

- apply for a new flat from the Oct 2024 BTO exercise onwards.

The HDB will disburse the additional grant quantum (i.e. the difference between the current grant and the increased grant) within 2 months from the date of their HDB resale completion. Buyer DO NOT need to approach the HDB and will not face any disruption to their HDB resale completion.

For more details, you may refer to https://www.hdb.gov.sg/residential/buying-a-flat/understanding-your-eligibility-and-housing-loan-options/flat-and-grant-eligibility

Using CPF Ordinary Account (OA) Saving to Purchase Public Housing (HDB Flat) under CPF Housing Scheme:

You may use CPF Ordinary Account (OA) saving for the following:

- Direct payment of the purchase price of the HDB flat (including the cost of the common areas, if any) to HDB or sellers.

- Repayment of the housing loan in whole or part and/or the monthly instalments of the housing loan taken for the purchase of the HDB flat.

- Payment of the stamp duty, legal fees and other related costs incurred by you in connection with the purchase or mortgage of the HDB flat.

- Payment of the cost incurred by you in respect to upgrading cost under HDB Main Upgrading Programme (MUP) and/or Town Council Lift Upgrading Progreamme (TCLUP) in part or whole and/or by monthly instalments.

You cannot use CPF OA saving for the following:

- Payment of booking fees, option fees or deposit to HDB.

- Payment of the initial 5% of the lower of the purchase price or the valuation price of the property at the time of purchase.

- Payment of resale levy to HDB where applicable.

- Payment of construction works, improvements, repair and/or renovation of your HDB flat.

- Payment of monthly service and conservancy charges including all rates, taxes and other charges imposed on your HDB flat.

- Repayment of non-housing loans (i.e. loans not taken for the purchase of your HDB flat).

- Payment of purchase price that is above the lower of the purchase price or the valuation price of the property at the time of purchase for resale HDB flat (i.e. cash over valuation (COV)).

- Reimbursement of any payments made to HDB out of your personal funds in respect of the purchase of the HDB flat.

The CPF Withdrawal Limits toward your HDB flat is subjected to the CPF Housing Limits based on the purchase date, remaining lease of the HDB flat at the time of purchase as well as the purchaser age.

1. For HDB flat bought:

- before 1 July 2013; or

- from 1 July 2013 but before 10 May 2019 with a remaining lease of at least 60 years at the time of purchase; or

- from 10 May 2019 with a remaining lease that can cover the youngest owner using CPF for the flat till age 95,

the maximum amount of CPF that can be used towards the HDB flat or DBSS flat is as below.

| Type of flat | Type of purchase | Type of loan | Maximum amount of CPF that can be used |

| HDB flat | Direct from HDB | No loan | Up to the purchase price of the flat or such amount as may be required by HDB |

| HDB loan | Up to the purchase price of the flat or the housing loan taken to buy the flat | ||

| HDB flat | Resale | HDB loan | Up to the lower of the purchase price or the valuation price of the property at the time of purchase, if you cannot set aside the Basic Retirement Sum (“BRS”) Up to the housing loan taken to buy the flat, if you can set aside the BRS |

| Direct from HDB / Resale | Bank loan | Up to the lower of the purchase price or the valuation price of the property at the time of purchase, if you cannot set aside the BRS Up to an additional 20% of the lower of the purchase price or the valuation price of the property at the time of purchase, if you can set aside the BRS |

2. For HDB flat bought

- from 1 July 2013 but before 10 May 2019 with a remaining lease of less than 60 years but at least 30 years at the time of purchase:

- The maximum amount of CPF savings that can be used for the HDB flat is capped at a percentage of the lower of the purchase price or the valuation price of the property at the time of purchase. The percentage is computed based on the remaining lease of the flat when the youngest eligible owner using CPF savings reaches age 55.

- To be eligible to use CPF, your age plus the remaining lease of the flat must be at least 80 years at the time of purchase.

- No CPF savings can be used if the remaining lease of the HDB flat is less than 30 years at the time of purchase.

3. For HDB flat bought

- For HDB flat bought from 10 May 2019 with a remaining lease that does not cover the youngest owner using CPF for the flat till age 95:

- The maximum amount of CPF savings that can be used for the HDB flat is capped at a percentage of the lower of the purchase price or the valuation price of the property at the time of purchase. The following table shows a rough guide on how the maximum amount of CPF savings that you can use for your property changes with age and the remaining lease of the property.

Maximum amount of CPF savings that you can use for your property:

| Age of youngest owner using CPF (in years) | |||||

|---|---|---|---|---|---|

| 25 | 35 | 45 | 55 | ||

| Remaining lease of flat (in years) | 70 and above | 100% | 100% | 100% | 100% |

| 60 | 80% | 100% | 100% | 100% | |

| 50 | 60% | 75% | 100% | 100% | |

| 40 | 40% | 50% | 67% | 100% | |

- No CPF savings can be used if the remaining lease of the HDB flat or DBSS flat is 20 years or less at the time of purchase.

Who is eligible to purchase EC:

For EC, as mentioned, it is divided into 3 different groups. They are:

- For brand new EC, only SC+SC or SC+PR is eligible to buy, but you still need to follow the public housing (HDB) purchase scheme.

- For resale EC after the minimum occupation period (MOP), from the 6th year onward to before the 10th years’ privatization, you do not need to follow the HDB purchasing scheme. SC or PR are eligible to buy even you are Single. But foreigners are not allowed to purchase.

- For fully privatized EC, typically after the 10th-year mark, SC, PR, or foreigners are allowed to purchase. For this, it is consider purchasing a private property in Singapore too.

| Types of Property | Citizenship Eligibility |

|---|---|

| Brand New EC | SC + SC SC + SPR |

| Resale EC (6-10 years) | SC + SC SC + SPR SC Alone SPR Alone |

| Fully Privatized EC (after 10 Years) | SC + SC SC + SPR SC Alone SPR Alone Foreigners |

For brand new EC, You have to qualify for any of the eligibility schemes to purchase:

- Public Scheme (at least 21 years old)

- Fiancé/Fiancée Scheme (at least 21 years old)

- Orphans Scheme (at least 21 years old)

- Joint Singles Scheme (at least 35 years old)

For resale EC (6-10 years old EC) or privatized EC (after 10 years):

- You must be at least 21 years old.

- You do need the above eligibility scheme to purchase.

- You are free to either buy as single or with someone else. There is no restriction on the family nucleus.

- If you are purchasing resale EC (6-10 years old EC), you need to fulfil the citizenship eligibility as mentioned in the previous section.

For Executive Condominium (EC) – First Timer Only

Only if you and any of your co-applicants is/are first timer and fulfill the CPF Housing grant eligibility at the point of booking the new EC unit from the housing developer. The CPF Housing Grant for new EC are:

- Family Grant; or

- Half-Housing Grant

| Avg gross monthly household income of all persons in application, i.e. applicants and occupiers | Family Grant | Half-Housing Grant For first-timer with second-timer | |

|---|---|---|---|

| SC/ SC Household | SC/ SPR Household | ||

| $10,000 or lower | $30,000 | $20,000 | $15,000 |

| $10,001 to $11,000 | $20,000 | $10,000 | $10,000 |

| $11,001 to $12,000 | $10,000 | Nil | $5,000 |

| $12,001 to $16,000 | Nil | Nil | Nil |

For more details, you may refer to https://www.hdb.gov.sg/residential/buying-a-flat/executive-condominium/cpf-housing-grants

Using CPF Ordinary Account (OA) Saving to Purchase Executive Condominium (EC) Under CPF Housing Scheme:

Refer to Using CPF Ordinary Account (OA) Saving to Purchase Private Residential Property Under CPF Housing Scheme.

Purchasing Private Property

Who is eligible to purchase a Private Property:

For private property, as mentioned, it is divided into 3 different groups. They are:

- For fully privatized EC, typically after the 10th-year mark, SC, PR, or foreigners are allowed to purchase.

- For private apartment/condominium, SC, PR, or foreigners are allowed to purchase.

- For landed property, SC are free to purchase. SPR and Foreigners need government approval to buy purchases.

| Types of Property | Citizenship Eligibility |

|---|---|

| Fully Privatized EC (after 10 Years) | SC + SC SC + SPR SC Alone SPR Alone Foreigners |

| Private Apartment / Condominium | SC + SC SC + SPR SC Alone SPR Alone Foreigners |

| Landed Property | SC PR / Foreigners need approval |

Private Property Scheme:

You are free to either buy as single or with someone else. There is no restriction on the family nucleus. However, for restricted property such as Landed property, you need to fulfil the citizenship eligibility as discussed in the previous section.

Using CPF Ordinary Account (OA) Saving to Purchase Private Property Under CPF Housing Scheme:

You may use CPF Ordinary Account (OA) saving for the following:

- Direct payment of the purchase price of the private property to property developer or sellers.

- Repayment of the housing loan in whole or part and/or the monthly instalments of the housing loan taken for the purchase of the property, land and/or construction on that land.

- Payment of the stamp duty, legal fees and other related costs incurred by you in connection with the purchase or mortgage of the property and/or construction of the house.

You cannot use CPF OA saving for the following:

- Payment of option fees to property developers or seller.

- Payment of the initial 5% of the lower of the purchase price or the valuation price of the property at the time of purchase.

- Payment of construction works, improvements, repair and/or renovation of your private residential property.

- Payment of monthly service and conservancy charges including all rates, taxes and other charges imposed on your private residential property.

- Repayment of non-housing loans (i.e. loans not taken for the purchase of your private residential property).

- Payment of purchase price that is above the lower of the purchase price or the valuation price of the property at the time of purchase for resale private residential property (i.e. cash over valuation (COV)).

- Reimbursement of any payments made to property developers or sellers out of your personal funds in respect of the purchase of the private residential property.

If you are an undischarged bankrupt, you are not allowed to withdraw your CPF savings to buy or build private residential property.

For private residential properties which are under construction, CPF savings can be used to meet the progressive payments to the property developers when due.

For private residential properties constructed by unlicensed developers, CPF savings can only be released when the properties are completed up to the roofing stage.

Additional conditions on the use of CPF savings for purchase of land and construction of house

a. CPF savings cannot be used to pay the land and/or the construction cost of the house directly. You would have to use your own funds (and seek for reimbursement later) and/or a loan to meet the said payments first.

b. Request for reimbursement of CPF savings have to be made within six months from the issue of the Temporary Occupation Permit (“TOP”). The reimbursement will be in the form of a one-time payment, subject to available balance in your OA. Monthly withdrawals are not allowed.

c. Application for the above purpose should only be submitted, together with the below documents, after the TOP has been issued:

i. Valuation report of the completed property prepared by a licensed valuer. Valuation report prepared by the financier will be considered on a case by case basis. The Board reserves the right to re-asses the value of the property, if necessary;

ii. Breakdown of contractors’ construction costs;

iii. Original receipts to show evidence of the payments made from your own funds, if you are applying for reimbursement;

iv. Financier’s Letter of Offer for the land/construction loan(s); and

v. Grant of written permission from Urban Redevelopment Authority (URA) for the proposed ‘reconstruction’ or ‘erection’ of the new property.

The CPF Withdrawal Limits toward the private residential property is subjected to the CPF Housing Limits based on the purchase date, remaining lease of the HDB flat at the time of purchase as well as the purchaser age.

1. For private residential property bought:

- before 10 May 2019 with a remaining lease of at least 60 years at the time of purchase; or

- from 10 May 2019 with a remaining lease that can cover the youngest owner using CPF for the property till age 95,

the maximum amount of CPF that can be used towards the private residential property is as below.

| Date of property purchase | Maximum amount of CPF that can be used |

|---|---|

| Before 1 September 2002 | Up to the lower of the purchase price or the valuation price of the property at the time of purchase, if you cannot set aside the Basic Retirement Sum (“BRS“)

Up to the housing loan taken to buy the property, if you can set aside the BRS |

| From 1 September 2002 | Up to the lower of the purchase price or the valuation price of the property at the time of purchase, if you cannot set aside the BRS

|

2. For private residential property bought:

- from 19 July 2005 but before 10 May 2019 with a remaining lease of less than 60 years but at least 30 years at the time of purchase:

- The maximum amount of CPF savings that can be used for the private residential property is capped at a percentage of the lower of the purchase price or the valuation price of the property at the time of purchase. The percentage is computed based on the remaining lease of the property when the youngest eligible owner using CPF savings reaches age 55.

- To be eligible to use CPF, your age plus the remaining lease of the private residential property must be at least 80 years at the time of purchase.

- No CPF savings can be used if the remaining lease of the private residential property is less than 30 years at the time of purchase.

- from 19 July 2005 but before 10 May 2019 with a remaining lease of less than 60 years but at least 30 years at the time of purchase:

3. For private residential property bought:

- from 10 May 2019 with a remaining lease that does not cover the youngest owner using CPF for the property till age 95:

- The maximum amount of CPF savings that can be used for the private residential property is capped at a percentage of the lower of the purchase price or the valuation price of the property at the time of purchase. The following Table shows a rough guide on how the maximum amount of CPF savings that you can use for your property changes with age and the remaining lease of the property.

- from 10 May 2019 with a remaining lease that does not cover the youngest owner using CPF for the property till age 95:

Maximum amount of CPF savings that you can use for your property

| Age of youngest owner using CPF (in years) | |||||

|---|---|---|---|---|---|

| 25 | 35 | 45 | 55 | ||

| Remaining lease of flat (in years) | 70 and above | 100% | 100% | 100% | 100% |

| 60 | 80% | 100% | 100% | 100% | |

| 50 | 60% | 75% | 100% | 100% | |

| 40 | 40% | 50% | 67% | 100% | |

- No CPF savings can be used if the remaining lease of the private residential property is 20 years or less at the time of purchase.

Mortgage loan and cost incurred in purchasing a property in Singapore

Purchasing a property in Singapore may be a big decision for the majority, especially for first-time buyers.

You need to plan with extra care as it is a big financial commitment, thus calculate your sum correctly in order not to miss out on those that you need to prepare upfront as well as while servicing the monthly mortgage.

” Do your sums before committing to purchase. If unsure, engage a professional agent to assist you before you realized something is amiss.”

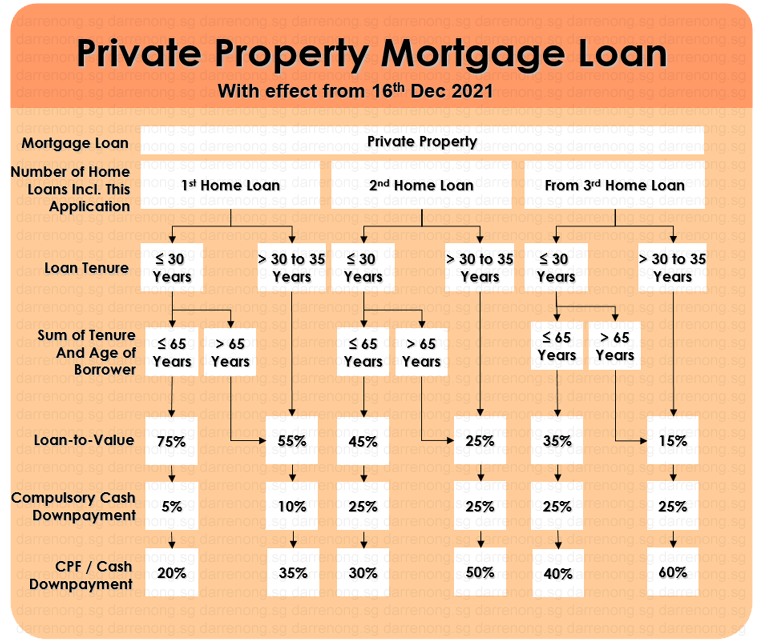

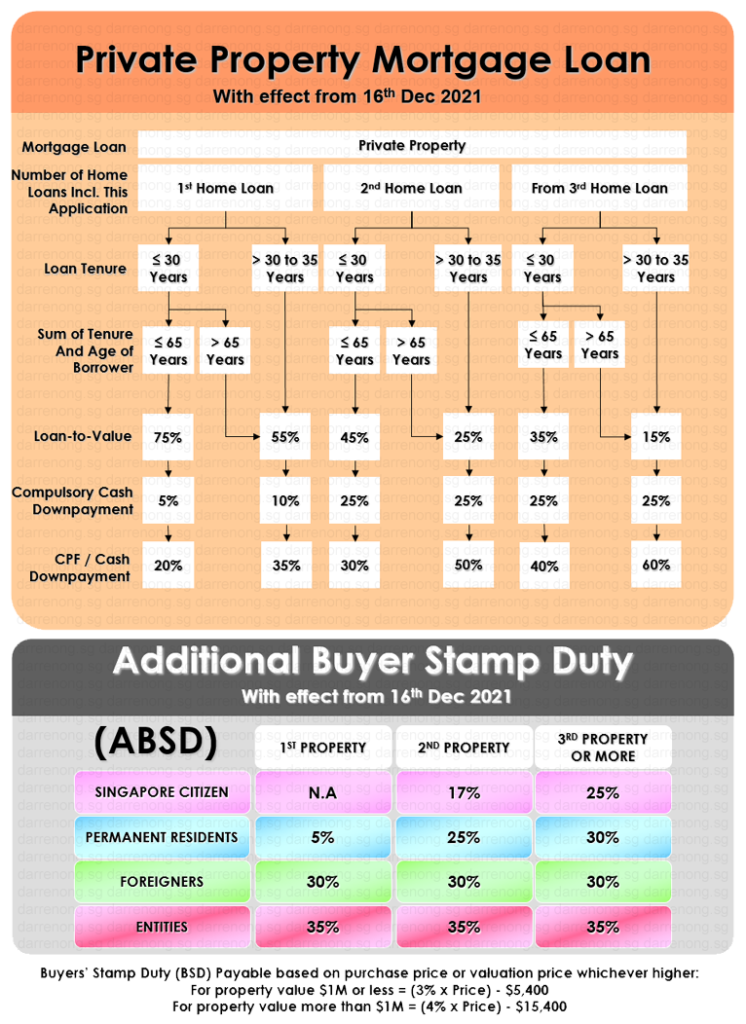

Mortgage Loan to Value, Minimum Cash & CPF Outlay

Before you commit to any unit that you are keen on, you must check on your mortgage loan amount that you can get. Otherwise, you may be caught in a situation where the mortgage loan amount is not able to cover up to the amount that you need. If this situation arises, you will have to pay the shortfall in cash, which the majority would want to avoid.

After getting the mortgage loan amount checked, you can look for the unit that you are keen on and is financially comfortable with while working out the following sum:

- monthly installment to service

- monthly recurring cost

- upfront cash needed

- upfront CPF needed if any

For HDB flat, the upfront cash needed depends on who you take up the mortgage loan with (HDB or Bank) and the valuation of the property.

For private property, it will be more straightforward across the board as you can only apply for a mortgage loan from the bank.

Let’s take a look in more detail on the cash and CPF downpayment needed and its loan to value (Max. loan) allowable, subject to HDB or Bank approval.

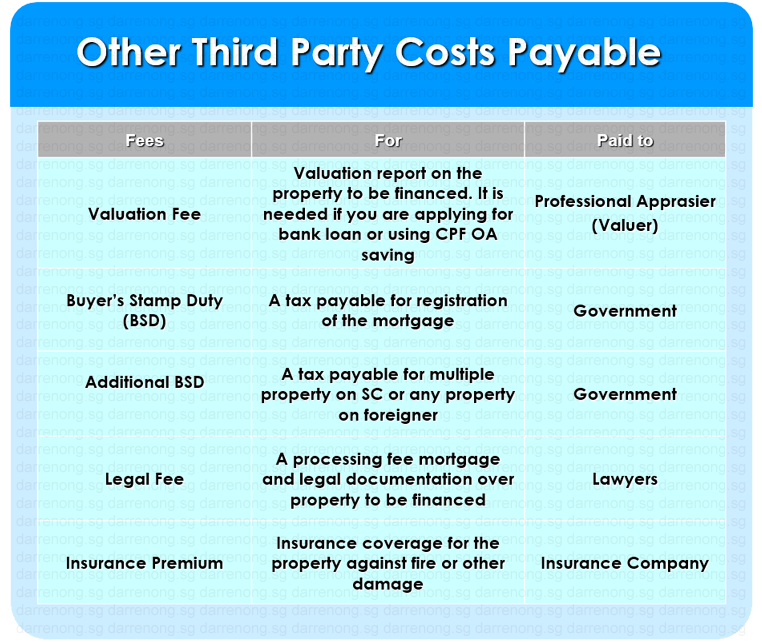

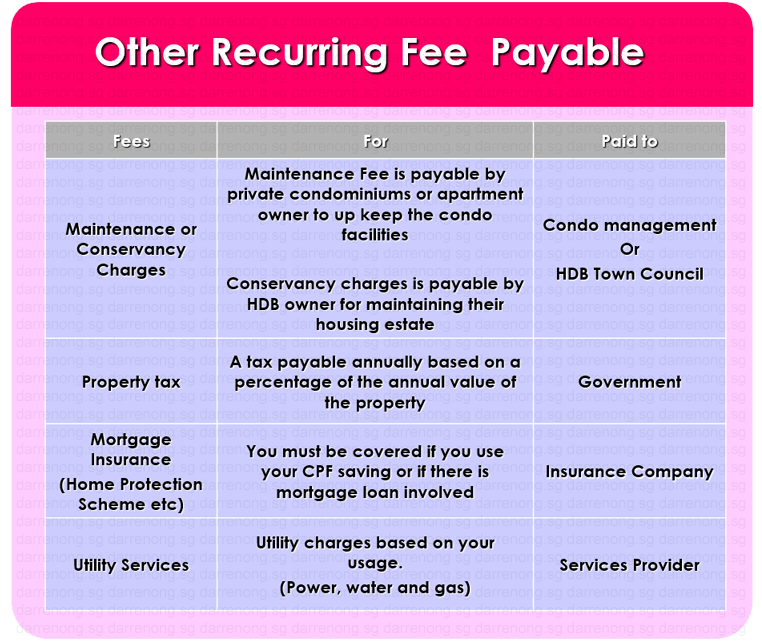

Other Cost Incurred in Purchasing a Property in Singapore

In general, the cost breakdown to purchase a property in Singapore is as following:

- Deposit (Option Exercise Fee)

- Downpayment

- Approved mortgage loan

- The shortfall from the mortgage loan, if any

- Cash over valuation, if any

- Buyer’s Stamp Duty

- Additional Buyer’s Stamp Duty

- Conveyancing / Legal Fee

- Agent Professional Fee

- Other miscellaneous costs

Other recurring costs that you might miss out on are:

- Property tax

- Maintenance fee / Conservancy charges

- Utility supply charges

- Mortgage insurance

- Home insurance (fire insurance etc.)

Buyer Stamp Duty Rate (wef on or after 15 Feb 2023)

| Property Value | Residential BSD Rate |

|---|---|

| First S$180,000 | 1% |

| Next S$180,000 | 2% |

| Next S$640,000 | 3% |

| Next S$500,000 | 4% |

| Next S$1.5 million | 5% |

| Remaining amount | 6% |

Example 1:

A landed house was purchased on 20 Feb 2023 at $4,000,000 at market value:

| Market Value of the Property | BSD Rate | Calculation |

|---|---|---|

| First $180,000 | 1% | = $1,800 (1% x $180,000) |

| Next $180,000 | 2% | = $3,600 (2% x $180,000) |

| Next $640,000 | 3% | = $19,200 (3% x $640,000) |

| Next $500,000 | 4% | = $20,000 (4% x $500,000) |

| Next $1,500,000 | 5% | = $75,000 (5% x $1,500,000) |

| Remaining $1,000,000 | 6% | = $60,000 (6% x $1,000,000) |

| BSD Payable | = $179,600 ($1,800 + $3,600 + $19,200 + $20,000 + $75,000 + $60,000) | |

For more details, you may refer to https://www.iras.gov.sg/taxes/stamp-duty/for-property/buying-or-acquiring-property/buyer’s-stamp-duty-(bsd)

Case Study: Property Purchase Cost Breakdown

Mr. and Mrs. Lee (first-timer) both Singaporean, bought a four-room resale HDB in Jan 2022 at $365,000 at a valuation price near their parent. Their combined income is $11,500 with a bank IPA of loan up to $689k. The cost breakdown using a bank loan is:

Purchase Price: $365,000

CPF Housing Grant Available:

Family grant $50,000

Proximity grant $20,000

Downpayment payable:

- 5% of valuation = $18,250 (Cash)

- 20% of valuation = $73,000 (Cash / CPF)

- 75% of valuation Max. loan eligible

- Buyer’s Stamp Duty (BSD) = $5,550 (CPF)

- Additional BSD = $0

- Cash over valuation (COV) = $0

- Conveyancing Fee = approx. $3,000 (CPF)

- Other miscellaneous costs include a valuation fee of $120 and hdb resale application fee of $80, etc. (Cash)

- Agent Professional Fee = typically 1% + GST (Cash)

Additional cost and stringent rules on purchasing properties that might affect you

- For private property owners buying HDB

A private property owner is not able to apply for an HDB loan unless 30 months later, after selling their private property. Prior to 30 Sept 2022, If they are using a bank mortgage loan or not taking any mortgage loan to purchase the HDB resale flat first, they must also dispose of the private property within six months from the keys collection of the HDB resale flat. With effect from 30 Sept 2022, the private residential property owners, as well as former private residential property owners will have to wait 15 months before they are allowed to buy a non-subsidized HDB resale flat on the open market. However the 15 months wait-out period will not apply to seniors aged 55 and above who wish to downgrade from private residential property to HDB if they buy a 4-room or smaller resale HDB flat. Please note that the 15 months wait-out period is “a temporary measure” to moderate million-dollar HDB demand due to the continuous rise in volume and this temporary measure will be reviewed in the future depending on the housing demand and market conditions.

- For HDB owners buying private property

HDB owners only can proceed to buy a private property after they fulfill the Minimum Occupation Period (MOP), currently five years from the date of completion. If they purchase the private property first without selling their HDB flat or if they proceed to buy second properties, they will be subject to ABSD, TDSR, and LTV rules. You may refer to the below table for reference on how much more you need to pay should you below to this group.

Searching for the ideal property

Once you get your sum ready. We are free to start hunting for the property to buy. You may engage a professional property agent to help in the search and analyze which are the property development that has upside potential for capital appreciation or good rental yield to purchase before any physical onsite viewing arrangement is fixed.

The agent should help you to shortlist suitable properties based on your requirements and budget for you to view. He will then assist you with the price negotiation with the seller or seller’s agent.

“Engaging the right agent to do the job not only helps you save your time but also helps you save more than what you need to pay for a professional agent fee if purchase price is negotiated down.”

For example, imagine the agent that you engage helps you to negotiate $20,000 lower more, but you are paying him/her some $5,000 fee. Isn’t a win-win situation?

You may connect with me if you need any unbiased advise in analyzing property if it has any upside potential before you commit buy. In addition, I will help you with a full range of services from a mortgage loan arrangement, conveyancing law firm arrangement, and the necessary documentation needed. and also not forgetting the most important part to negotiate the best price for you?

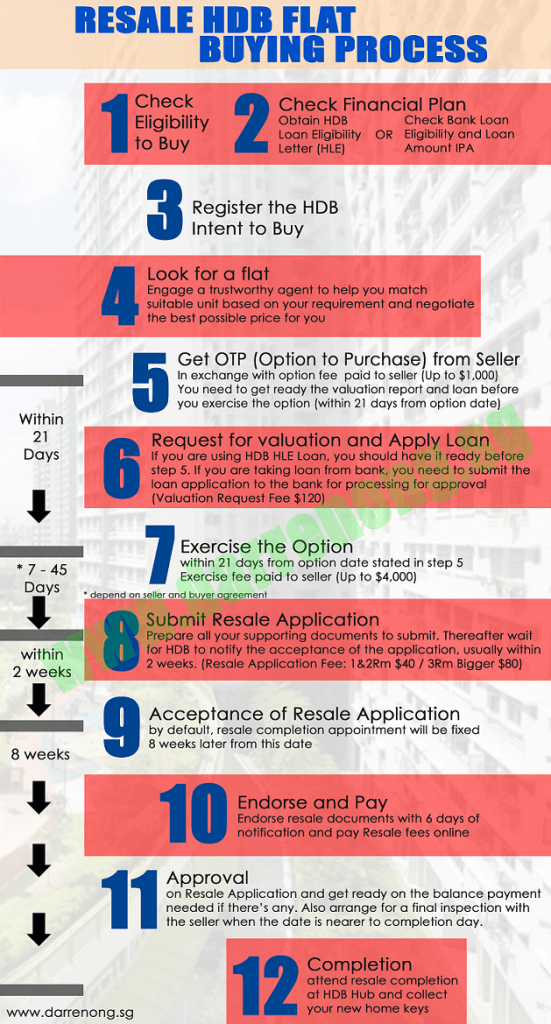

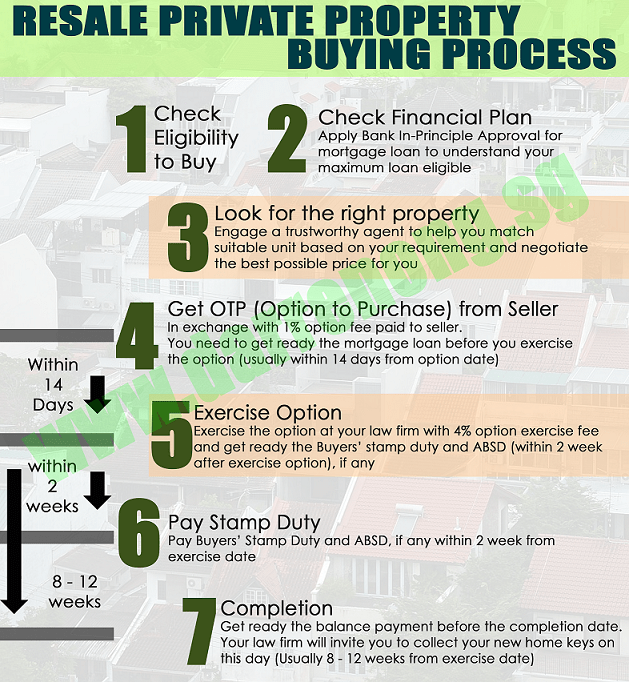

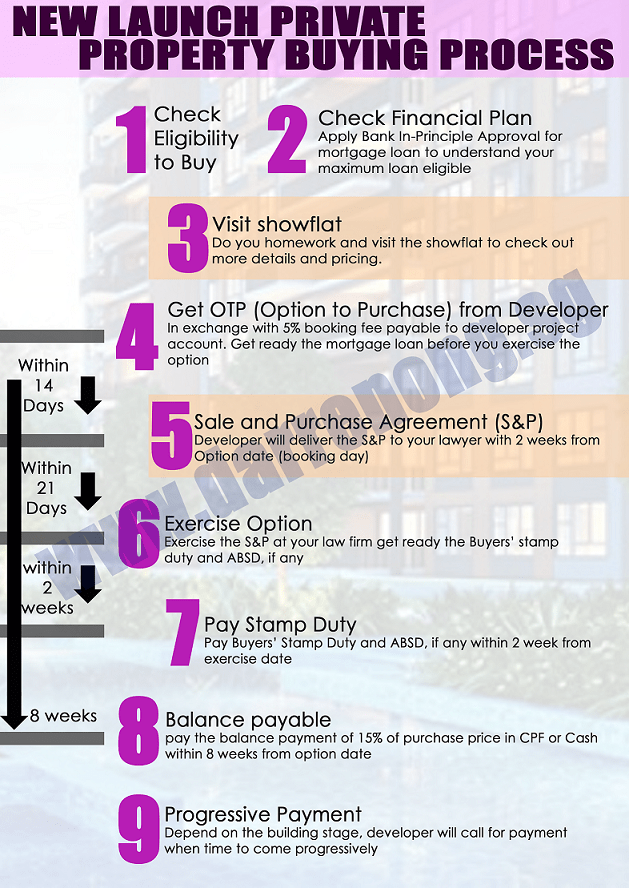

Timeline Matters

Lastly, the payment schedule that you should expect as well as the duration of the whole process until completion, where you will collect your new home keys. Let’s take a look at the standard timeline for now. I suggest you consult a professional property agent if you are in a more sophisticated situation.

For the new launch Executive Condominium (EC) timeline and how to go about purchasing, you may want to read more at my other topics “Where can you find an Executive Condominium (EC) in 2025“.

Things to look out for when buying second properties

When purchasing second properties, it is not as straightforward as there are even more stringent rules to follow.

CPF fund saving usage restriction unless you fulfill the basic retirement sum, then you can use the balance CPF saving to purchase your second properties.

Also, you need to know about the tighten rules on Loan-to-Value (LTV), Additional Buyers’ Stamp Duty (ABSD), and Total Debt Servicing Ratio (TDSR) restriction and Property Asset Progression aka Property Wealth Planning.

You may want to read more on these topics below:

I hope the above guide clears some of your minds about buying a property in Singapore.

I welcome you to contact me for further discussion if you need any advice on purchasing property or restructuring your property portfolios, such as investing in new launch property or upgrading plans, etc.

I am more than willing to share and discuss. Cheer!

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls