Table of Contents

What To Look Out For When Buying a Condo or Property in Singapore? Learn The 8 Key Tips Here.

Buying a property in Singapore is one of the biggest financial commitments most people will ever make. Yet, despite the high stakes, many buyers rush into a purchase based on emotion rather than logic. Whether it’s being swayed by a beautifully staged home/showflat or simply following market hype, these decisions can often lead to regret, especially when the property turns out to be difficult to sell or doesn’t grow in value as expected.

The truth is, not all properties in Singapore are profitable or worth buying. Just because a development is new, conveniently located, or highly marketed doesn’t automatically mean it’s a good investment. It’s not enough to just find a unit that fits your budget, what truly matters is understanding the property’s fundamentals, capital appreciation potential, and its future resale or rental demand.

As someone who has helped many clients secure homes and investment units with strong exit strategies, I’ve seen what works and what to avoid. In this article, I’ll share practical and time-tested tips that go beyond just choosing a “nice” unit. These are insights I personally use when helping buyers assess whether a property has the right attributes to grow in value, remain in demand, and ultimately support your long-term property journey in Singapore.

- Big Development vs Small Development

- Unit Type Matters

- Compare with Surrounding Developments

- Check Remaining Lease

- Location, Amenities & Transport Connectivity

- Study the URA Master Plan: Future Developments Nearby

- Zoom Into the Unit Checks: Orientation, Layout & Condition

- Avoid Overpaying: Is the Asking Price Reasonable?

1. Big Development vs Small Development

One of the most overlooked factors when buying a property in Singapore is the size of the development. Here I’m talking about, is the size of the development, not the unit itself. While small boutique condos may seem attractive for their exclusivity, larger developments, especially those with 200 units and above, tend to offer better long-term value and resale potential. The reason is simple: in bigger developments, there are more transactions happening regularly. This consistent sales activity helps to push up the property’s valuation over time, giving you a better benchmark for future resale or refinancing.

Another advantage is cost efficiency. Monthly maintenance fees in larger condos are typically lower because they are shared across a greater number of households. This can make a noticeable difference over the years, especially for families or those planning to stay long-term. Moreover, larger projects usually come with a wider range of facilities such as full-length swimming pools, gym equipment, BBQ pits, function rooms and even tennis court, these features that are appeal to a broader market of future buyers or tenants.

Smaller developments, on the other hand, may often face liquidity issues. With fewer units changing hands, it becomes harder to gauge the market value and even harder to find recent comparable sales transaction during resale. This can lead to pricing uncertainty or slower transaction timelines when you’re ready to sell. If you’re aiming for a property that holds strong resale demand, a bigger development gives you more assurance.

For a clearer picture, always check the recent transaction history of the development through URA or your property agent. If your property agent has the resources, he/she should be able to give you a more detailed breakdown of the transaction history. A project with active sales volume over the past 3 to 5 years is usually a healthy sign and a strong signal that you’re looking at a more “liquid” asset when it’s time to exit.

2. Unit Type Matters

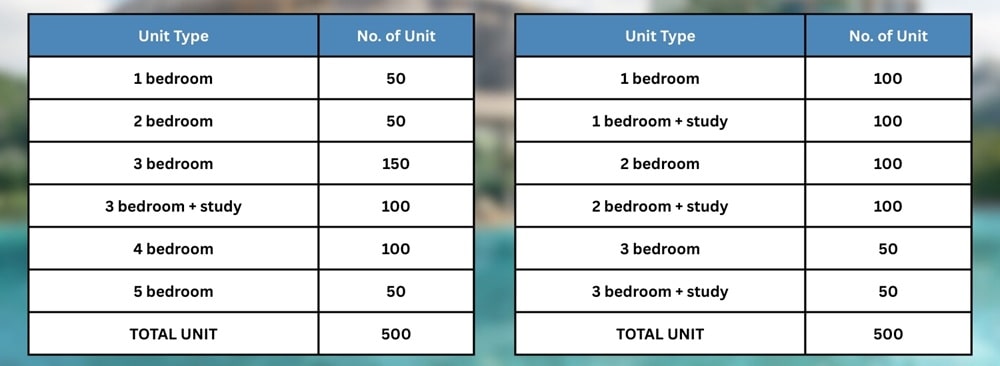

While development size are important, the unit mix within a condo can quietly make or break your property’s long-term potential, especially if you’re buying for own stay or for future resale. A common mistake some buyers make is choosing developments that are heavily skewed toward smaller units like 1- and 2-bedroom layouts, simply because they are more affordable or appear easier to rent out.

The problem? These developments often cater primarily to investors, which means many of the units are tenanted instead of owner-occupied. This leads to a higher turnover of tenants and a more transient living environment. Over time, such properties may face inconsistent upkeep, a less cohesive community, and potential issues with noise or maintenance standards. For buyers who are looking for a home, not just an investment, this kind of environment may not be ideal.

Moreover, if the entire development is filled with similar small units, you’ll face tougher competition when it comes time to sell. With so many identical options in the market, your unit may struggle to stand out. On the other hand, developments with a more balanced unit mix, including family-sized 3- and 4-bedroom units, tend to attract more owner-occupiers, which creates a more stable community and better long-term holding power.

If you’re buying for own stay, consider the demographics and lifestyle needs of the typical residents in the area. Are they families, couples, or singles? And if you’re planning for long-term appreciation, choose a unit type that meets practical needs, not just short-term affordability.

3. Compare with Surrounding Developments

Before deciding on any condo, it’s crucial to look beyond the development itself and compare it with similar properties in the surrounding area. Far too often, buyers get fixated on a particular unit or project without doing enough homework on what else is available nearby. This can lead to overpaying for a property that may not necessarily be the best value, especially when another development just a few streets away offers better features or pricing.

Start by comparing properties with similar attributes such as lease tenure, location, and unit size. Is there a nearby development with a similar age and facilities but with a noticeably lower price per square foot (PSF)? If so, it’s worth digging deeper. Sometimes, the price difference may be due to factors like lower maintenance costs, better facilities, a more efficient layout, or even a better managing agent who does a better job in upkeeping the development clean and well-maintained.

It’s also important to physically visit the developments you’re comparing. Online listings can’t show you the full picture. Walking through the grounds gives you a better sense of the layout, the cleanliness of common areas, the condition of the facilities, and the overall vibe of the community. Some condos may look great on paper but feel outdated or poorly maintained in person and vice versa.

Additionally, check the unit layout during your visits. Some developments have more efficient or practical designs that make better use of space, which may not be obvious from floor plans alone. These seemingly small differences can significantly affect both your living experience and the resale appeal later on.

In short, doing your research and comparing surrounding developments can help you avoid overpaying and ensure you’re choosing a property that offers true value in the current market.

4. Check Remaining Lease

One of the most important, yet often overlooked, factors when buying a property in Singapore is the remaining lease of the development. Many buyers focus on the immediate features of the unit or project but fail to consider how the remaining lease can affect financing, resale value, and long-term demand.

As a general guide, it’s safer to look for developments that are younger than 20 years old. These properties still retain a relatively long lease tenure, which helps preserve their value over time. More importantly, you should always check whether the remaining lease can cover the youngest buyer in your household till the age of 95. If it doesn’t, you could face restrictions when using CPF funds or taking a bank loan with lower loan-to-value, both of which can limit your options significantly.

Properties with shorter remaining leases also tend to see their pool of eligible buyers shrink over time, which may make it harder to sell when you’re ready to exit. That’s why it’s critical not just to think about affordability now, but also to assess whether the property will remain attractive to the next buyer five or ten years down the road.

If you’re looking at a resale condo, consult your property agent to assess the development’s performance trend, whether it has been on an upward, sideways, or downward track. This gives you a clearer idea of whether the property is still in demand or slowly losing value.

For new launches, it is slightly different because the remaining lease are still fresh. What you need to do is to evaluate the potential upside of entering at current prices and whether there’s room for future appreciation based on upcoming developments, infrastructure plans, and market positioning. Always work with a real estate professional who can give you this information so that you are well informed before you make any purchase decision.

By taking the remaining lease and performance trajectory into account early, you’ll make a more confident decision, one that not only serves your current needs but also protects your capital for the future.

5. Location, Amenities & Transport Connectivity

When it comes to property, the old saying still holds true — location is everything. In land-scarce Singapore, where demand for well-connected and convenient housing remains strong, the right location can make all the difference in a property’s long-term value and future exit potential. Whether you’re buying for own stay or investment, choosing a property near everyday amenities and essential services is one of the smartest moves you can make.

Properties that are nearer to MRT stations, bus stops, reputable schools, supermarkets, and shopping malls tend to attract more interest, both from buyers and tenants. This high demand naturally supports stronger price resilience and rental yields, even during market slowdowns. A home that are easily accessible to public transport, groceries, or dining options is simply more convenient, and convenience always sells.

For families, proximity to popular primary schools adds another layer of desirability and advantages. Many parents are willing to pay a premium to secure a home within the 1km priority admission zone of top schools, which means such properties often hold their value better over time. Likewise, homes located near business hubs or upcoming transformation zones may also enjoy home value appreciation from increased demand in the future.

The key is to not just look at the condo itself, but also the bigger picture of its surroundings. Are there well-established amenities already in place? Is the area known for good connectivity, or will you need to wait years for basic infrastructure to catch up? Properties that check these boxes tend to be more sought after, which makes your exit, whether through resale or rental, much easier down the road.

6. Study the URA Master Plan: Future Developments Nearby

Before you commit to buy any property, one of the smartest steps you can take is to check the URA (Urban Redevelopment Authority) Master Plan. This is a free and publicly available tool that gives you a long-term view of what’s being planned around your chosen property, from new residential estates to commercial hubs, healthcare facilities, or even MRT lines. Understanding what’s coming next in the area can give you a clear advantage in spotting properties with future upside.

Look out for empty plots of land near the development. If they’re zoned for future residential, mixed-use, or healthcare use, that’s usually a positive sign. These upcoming projects can enhance the neighbourhood’s appeal and help push up valuation over time. For example, a currently quiet area might transform dramatically once a new MRT line, shopping mall, or hospital is completed nearby. Buying before these changes take place often gives you a better entry price with room for appreciation.

However, not all nearby developments are beneficial. You’ll want to avoid units that directly face industrial-zoned land, as these tend to bring noise, heavy traffic, and lower desirability. Such developments may also limit your future resale pool, especially among owner-occupiers who value peace and lifestyle quality.

The Master Plan can also help you avoid overestimating a location’s future potential. Not every undeveloped plot is slated for something attractive, and not every “up-and-coming” area will grow at the same pace. Having this clarity upfront helps you set more realistic expectations and avoid buying based on speculation alone.

In short, studying the URA Master Plan allows you to make a more informed decision, especially when you’re considering a property’s long-term capital growth. It’s a simple step but tells you a lot of information about up-and-coming plans.

7. Zoom Into the Unit Checks: Orientation, Layout & Condition

While many buyers focus on the overall development and location, it’s equally important to evaluate the specific unit you’re considering. After all, this is the space you’ll be living in or renting out, and its features can significantly impact not just your daily comfort, but also your future resale potential.

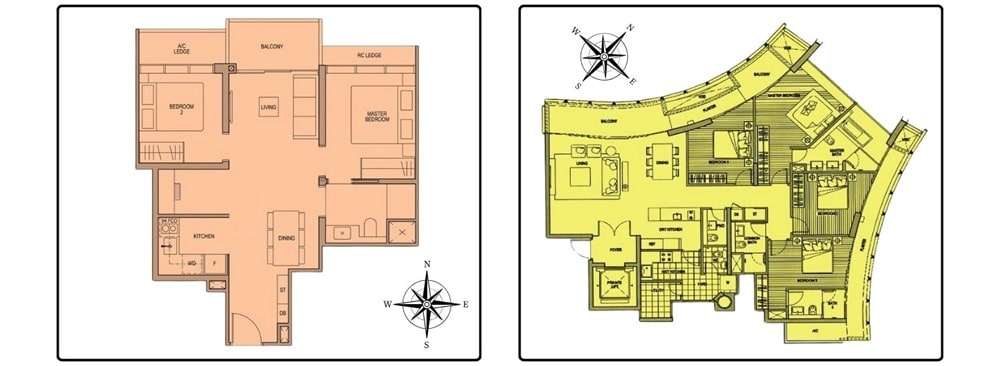

Start with the unit’s orientation. In Singapore’s tropical climate, units facing the west sun can become uncomfortably hot in the afternoons, which may affect both your living experience and your ability to sell later. Many savvy buyers avoid west-facing units altogether for this reason. Similarly, units that are too close to expressways, main roads, or noisy amenities such as schools or playgrounds may suffer from higher noise levels, which can turn off future buyers.

Layout is another crucial factor. Efficient layouts with minimal wasted space tend to be more appealing, especially in smaller units. Look out for awkward corners, long corridors, or unusable spaces that can reduce the functional size of the home. Buyers and tenants alike appreciate homes that feel open, practical, and easy to furnish, and this plays a key role in marketability.

Don’t overlook the condition of the unit either. Check for signs of water seepage, popping tiles, poor ventilation, or visible cracks. These may indicate deeper issues with waterproofing, structure, or ventilation systems. Such defects can lead to costly repairs and may affect the valuation or even cause delays in getting a buyer or tenant later.

Finally, remember that while renovation can fix aesthetics, it cannot fix certain attributes, like orientation, layout efficiency, or facing. These are permanent features that will follow you through your ownership journey. Getting them right from the start ensures your property remains desirable and competitive in the resale market.

8. Avoid Overpaying: Is the Asking Price Reasonable?

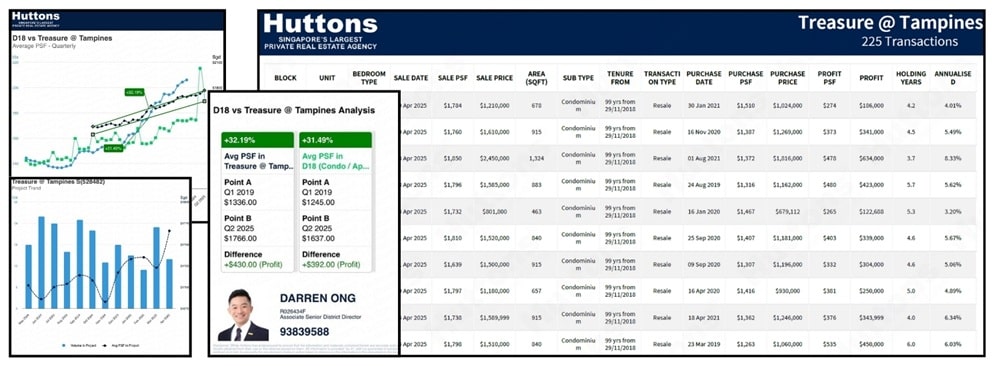

Credit to Huttons SuperApp - Property Performance & Trend Analysis

In a hot market or a well-marketed property/project, it’s easy to get swept up in emotion and make a rushed offer, especially if you’re afraid of missing out. But one of the most important steps in property buying is to assess whether the asking price is actually reasonable. Overpaying can limit your capital appreciation and hurt your long-term exit strategy.

Just because a unit is listed at a certain price doesn’t mean it reflects the true market value. Always benchmark it against recent transactions in the same development or nearby projects with similar attributes. This gives you a more realistic sense of what buyers are actually willing to pay, not just what sellers are asking for.

The best way to do this is to consult your property agent to prepare a Comparative Market Analysis (CMA). A well-prepared CMA will show you how your target unit stacks up against similar units in terms of size and floor level. It can also highlight any premiums or discounts based on unit condition or specific attributes like unblocked views or proximity to amenities.

Entering at the right price point gives you a stronger starting position, whether your goal is long-term investment or future resale. On the flip side, paying too much upfront can reduce your profit margin, especially if the market turns or if newer competing projects are launched nearby. Thus, by staying grounded in real data, not hype, you’ll protect your downside and make a more financially sound decision.

Final Thoughts: Buy Smart, Plan Ahead

Buying a property in Singapore is more than just about finding a place to live, it’s a major financial decision that can either set you up for long-term growth or tie up your resources with little returns. That’s why it’s important to look beyond surface-level appeal and think strategically and logically from the start. A well-chosen property should not only meet your current needs but also serve you well in the years to come, whether through capital appreciation, rental income, or a smooth exit when it’s time to move on.

By considering key factors like development size, unit type, remaining lease, surrounding amenities, and even upcoming government plans, you’re not just buying a home, you’re buying an asset. And like all assets, it should be evaluated based on logic, numbers, and potential upside. Rushing into a purchase based on emotion or hype can easily lead to disappointment down the road, especially if the property is difficult to sell, loses value, or doesn’t attract the kind of demand you expected.

Smart buying is about having clarity from the beginning. Know your entry point, understand the demand and supply dynamics of the area, and always think about your exit strategy. Ask yourself — who will want to buy this unit from me in 5 to 10 years? Will this unit still appeal to the next generation of buyers or tenants?

Whether you’re a first-time buyer, upgrader, or seasoned investor, these principles remain the same. The goal isn’t just to buy a property — it’s to buy it right.

Let’s Have a Chat Before You Make Your Next Move

If you’ve made it this far, chances are you’re serious about making the right property decision, and that’s a great start. Whether you’re buying for own stay or looking for your next investment, it always helps to get a second opinion to gain more clarity before committing.

Everyone’s situation is different, from budget, goals, and timeline, to lifestyle needs. If you’d like to explore your options or simply ask a few questions before taking the next step, I’d be happy to connect. Over the years, I’ve helped many buyers find properties with strong fundamentals and good exit strategies — not just homes, but assets that work for them over time.

Drop me a message or reach out for a friendly, no-obligation discussion. Sometimes, all you need is a clear plan and the right guidance to buy with confidence and avoid the mistakes rather than regret them later on.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls