Table of Contents

1. CPF Rules & Regulations and Early HDB Loan Repayment

As an HDB flat owner, you might be considering making early loan repayments at some point. It’s crucial to understand how CPF regulations can impact your ability to repay your housing loan, especially after turning 55. Managing your retirement funds and housing needs with your CPF savings becomes a priority at that stage.

To effectively plan for this, it’s essential to get familiar with the following key areas:

- Early HDB Loan Repayment Options

- Understanding the CPF Retirement Account

- Using CPF savings to pay off your housing loan after 55

- CPF contribution rates after age 35

- How to Make Early Partial or Full Repayment of Your HDB Housing Loan

- Reserve Ordinary Account savings for housing payment

2. Early HDB Loan Repayment Options

To lower your financial obligations, you can use your CPF Ordinary Account (OA) savings for partial capital repayments or to fully settle your outstanding HDB loan before turning 55. However, it’s essential to be aware that CPF Housing Limits may apply in these cases.

2.1 Understanding CPF Housing Limits

How much CPF savings can you use for your property purchase?

Suppose you’ve already used your CPF Ordinary Account (OA) savings for a property. In that case, you can monitor your current CPF savings usage and the applicable limits through your Home Ownership dashboard on the CPF website.

For those looking to purchase a property, the amount of CPF savings you can tap into depends on the following conditions:

Suppose the property’s remaining lease can cover the youngest owner using OA savings until at least age 95. In that case, you can use your CPF savings without restrictions, making it easier to finance the property. For more details, you may refer to the .pdf file below.

If the property’s remaining lease cannot cover the youngest owner using OA savings until at least age 95, There will be limitations on how much CPF savings you can use. In such cases, depending on the remaining lease, only a portion of your OA savings can be used for the property purchase. For more details, you may refer to the .pdf file below.

You may use the CPF Housing Usage Calculator to estimate how much CPF OA savings you can use for a property purchase.

For example, if you’re 30 years old and the property has a remaining lease of 65 years. Since the remaining lease can cover you until you are 95, you can use your CPF OA savings without restriction.

Understanding these rules is essential to maximize your CPF benefits while planning your property purchase.

3. What is the CPF Retirement Account?

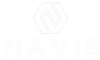

Your CPF Retirement Account (RA) will be created when you turn 55. At this point, your CPF savings from the Special Account (SA) and then the Ordinary Account (OA) are transferred to your RA to meet the required Full Retirement Sum (FRS).

3.1 What are the Basic Retirement Sum, Full Retirement Sum, and Enhanced Retirement Sum applicable to me?

The Basic Retirement Sum (BRS), Full Retirement Sum (FRS), and Enhanced Retirement Sum (ERS) provide guidelines on the amount of CPF savings you need to set aside to receive monthly payouts during retirement. These sums help ensure you have sufficient funds for your retirement needs.

3.2 Basic Retirement Sum and Full Retirement Sum

Your BRS and FRS depend on the year you turn 55 and remain fixed for the rest of your life. Below are the retirement sums applicable for members turning 55 between 2024 and 2027:

| Year You Turn 55 | Your BRS is | Your FRS* is |

|---|---|---|

| 2024 | $102,900 | $205,800 |

| 2025 | $106,500 | $213,000 |

| 2026 | $110,200 | $220,400 |

| 2027 | $114,100 | $228,200 |

*The FRS is set at twice the BRS.

To better understand the history, see the Full Retirement Sums since 1995. You can also find out how the retirement sums are designed and determined and why the retirement sums are increasing yearly to help you better plan for your future.

3.3 Enhanced Retirement Sum

If you are 55 or older, you can top up your Retirement Account (RA) to the Enhanced Retirement Sum (ERS) for higher monthly payouts. Here are the ERS amounts from 2024 to 2027:

| Year | Enhanced Retirement Sum (ERS) |

|---|---|

| 2024 | $308,700 |

| 2025 | $426,000 |

| 2026 | $440,800 |

| 2027 | $456,400 |

The ERS is currently three times the BRS. However, starting in 2025, the ERS will be raised to four times the BRS, allowing members to voluntarily top up more in their RA to enjoy higher monthly payouts in retirement. As the ERS increases every January, you can continue to top up your RA each year.

The amount you set aside in your CPF Retirement Account will fund your CPF LIFE monthly payouts, ensuring you have income to cover daily expenses from age 65 onwards, regardless of how long you live.

Secure Lifelong Monthly Payouts with CPF LIFE

When planning for retirement, one can feel overwhelmed. You may wonder whether your savings will be sufficient for your golden years. CPF LIFE (Lifelong Income For the Elderly) is a national annuity scheme that provides guaranteed monthly payouts for life. This means you’ll never have to worry about outliving your retirement savings.

Key Information about CPF LIFE

Watch the CPF LIFE informational video for more insights on how CPF LIFE works and how it secures your retirement income.

To learn more about monthly payouts and how CPF LIFE supports your retirement, visit the official CPF LIFE page.

If you continue working beyond 55, you can still use your CPF Ordinary Account (OA) contributions to pay off your housing loan. Even if you have yet to reach the Full Retirement Sum (FRS) by the time you turn 55, your OA contributions can still be used for loan repayments.

However, it’s wise to consider setting aside some of your CPF savings to take advantage of the attractive CPF interest rates, which can help enhance your monthly payouts during retirement.

Keep in mind that CPF Housing Limits may apply. These limits are in place to ensure that you don’t overextend your CPF savings on housing loan repayments, protecting your funds for retirement.

5. CPF contribution rates

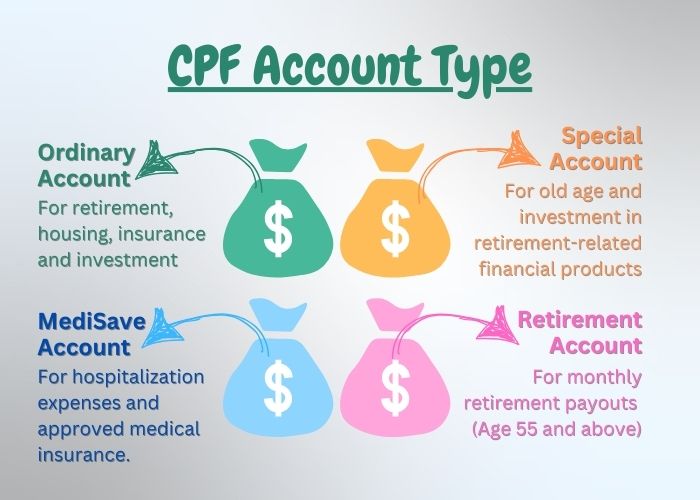

When planning for your future, it’s important to note that the portion of your CPF contributions allocated to the Ordinary Account (OA) decreases progressively from age 35. As you age, more CPF contributions are directed to your Special Account (SA) and MediSave Account (MA) to better prepare for retirement and healthcare needs. Before turning 55, you can only use your CPF OA savings for housing loan repayments.

5.1 How Are CPF Contributions Allocated?

When you are younger, more CPF contributions go into your Ordinary Account (OA), which supports housing purchases. As you age, more contributions are shifted to your Special Account (SA) for retirement and MediSave Account (MA) for healthcare expenses. You may refer to the 2024 CPF allocation rates for more detailed information.

The adjustment in contribution allocation takes effect from the first day of the month after your birthday when you move to the next age group.

Example:

If you turn 35 on January 13, 2024:

- Your allocation rates for January 2024 will be based on the “35 years and below” group.

- Your allocation rates from February 2024 onward will reflect the “Above 35 to 45 years” group.

CPF Allocation Rates from 1 January 2024

Private Sector / Non-Pensionable Employees (Ministries, Statutory Bodies & Aided Schools)

Note: The CPF allocation is first computed for the MediSave Account, followed by the Special Account. The remainder will be allocated to the Ordinary Account.

Example: If the CPF contribution of an employee (30 years old) is $100, the allocation of his CPF contribution will be computed as:

| Employee’s Age (Years) | 35 & Below |

| CPF Contribution | $100 |

| Ordinary Account | $100 – $21.62 – $16.21 = $62.17 |

| Special Account | $100 x 0.1621 = $16.21 |

| MediSave Account | $100 x 0.2162 = $21.62 |

The ERS is currently three times the BRS. However, starting in 2025, the ERS will be raised to four times the BRS, allowing members to voluntarily top up more in their RA to enjoy higher monthly payouts in retirement. As the ERS increases every January, you can continue to top up your RA each year.

5.2 Additional Information on CPF

For more details on CPF withdrawal options when you reach 55, you can visit the official CPF Board website for more comprehensive information to help you plan your retirement and manage your CPF savings effectively.

6. How to Make Early Partial or Full Repayment of Your HDB Housing Loan

6.1 Application for Partial Capital Repayment or Redemption of Housing Loan:

You can request a partial capital repayment or full redemption of your HDB housing loan through the HDB e-Service. Log in using your Singpass and navigate to ‘Other Related Services > Partial Capital Repayment’ or ‘Redemption of Housing Loan.’

After you submit your request, you will receive an acknowledgment via your registered email address, along with payment instructions to complete the process.

6.2 Partial capital repayment Options:

Once your request is received, the scheduled date for partial capital repayment will be set for one month later. You can choose from two options:

- Make the partial capital repayment and shorten the loan repayment period while keeping your monthly installments the same.

- Make the partial capital repayment and revise your monthly installment amount.

The minimum partial repayment amount is:

- $500 if your loan commenced before April 1, 2012.

- $5,000 with increments in multiples of $1,000 if your loan started on or after April 1, 2012.

After completing the partial capital repayment, your loan tenure will be reduced while maintaining your current monthly installment amount. If you prefer to adjust your monthly installment concurrently, do not use the e-Service. Instead, you should schedule an appointment via the HDB e-Appointment service and visit your HDB Branch office, where the HDB Branch office will tailor a repayment plan for you.

Making partial capital repayments can reduce the interest paid on your housing loan. To estimate your potential interest savings, use the Housing Loan Interest Calculator via the HDB e-Service by logging in with your Singpass and selecting ‘Other Related Services > Housing Loan Interest Calculator.’

6.3 Full Redemption of Your HDB Housing Loan:

The proposed redemption date for your housing loan will be set one month from the date your request is received. All payments must be completed by this date. The redemption amount and any applicable fees for loan discharge will be calculated during the submission process. Once your request is submitted to HDB, you will receive an acknowledgment from the HDB via email with detailed payment instructions.

6.4 How the Redemption Amount is Calculated

The redemption amount includes interest accrued up to the proposed redemption date. The calculation is as follows:

Outstanding loan balance at submission month + interest from the start of the redemption month to the proposed redemption date = Estimated redemption amount.

The following formula can represent this:

OL + [OL x (IR/12) x (N/M)] = Estimated redemption amount, where:

- OL = Outstanding housing loan at submission month

- IR = Current HDB housing loan interest rate per annum (p.a.)

- N = Number of days from the start of the redemption month to the proposed date of redemption

- M = Number of days in the redemption month (month of the proposed redemption)

Example:

- Submission date: June 15

- Proposed redemption date (for N and M): July 14

- Outstanding loan (OL): $105,000 (as of June 15)

- HDB loan interest rate (IR): 2.60% p.a.

- Estimated redemption amount: $105,000 + [$105,000 x (2.60%/12) x (14/31)] = $105,102.74.

By paying off your housing loan early, you can reduce the total interest payable on your housing loan. To estimate the interest savings, use the Housing Loan Interest Calculator available via the HDB e-Service. You may log in and go to ‘Other Related Services -> Housing Loan Interest Calculator.’

You must pay the Registration fee and conveyancing charges for housing loan discharge When completing a Total Discharge of Mortgage (TDM) for your housing loan.

The fees are as follows:

Registration fee (applicable only for lease-issued cases):

- $38.30

Conveyancing charges (inclusive of 9% GST) based on flat type:

- 1-room: $23.95

- 2-room: $35.95

- 3-room: $47.95

- 4-room: $59.95

- 5-room: $71.90

- Executive: $83.90

These charges will apply when discharging your HDB mortgage.

6.5 Payment modes for Partial capital repayment or Redemption of Your Housing Loan:

Before proceeding with payment for partial capital repayment or full loan redemption, ensure you have submitted your request via HDB’s e-Service (Singpass login required) and received the email acknowledgment.

You can make payments using one or a combination of the following methods:

- CPF

- GIRO (if you are already using GIRO for your monthly housing loan installments)

- PayNow via SGQR (participating banks)

- AXS Channels: AXS Station (Kiosk), AXS e-Station (Online), and AXS m-Station (Mobile app)

- eNETS Debit (participating banks)

No further action is required to make payments via CPF or GIRO. HDB will notify the CPF Board or your bank to process the deduction.

For payments via PayNow via SGQR, AXS channels, or eNETS Debit, refer to the email acknowledgment titled ‘Instructions for Payment’ for the necessary links and details to complete your payment.

6.6 Additional instructions for payment modes

CPF

You must be the registered flat owner to use your CPF savings for partial housing loan repayments or to redeem your HDB loan fully and Total Discharge of Mortgage (TDM) fees.

For full loan redemption, your monthly CPF deductions will automatically stop once HDB receives your redemption request. If the redemption is canceled, you must submit new instructions for monthly CPF deductions by filling out the CPF withdrawal form available at the HDB branch managing your flat.

Under the CPF Board’s policy, flat owners who purchase a resale or DBSS flat can use their CPF Ordinary Account (OA) savings up to the purchase price or the market valuation price, whichever is lower, at the time of purchase. Suppose there is still an outstanding loan after this. In that case, you can continue to use your OA savings for loan repayments, provided you set aside the Basic Retirement Sum (BRS) in your CPF account to ensure a basic monthly income during retirement.

- Members under 55 must set aside the current BRS.

- Members 55 and above must meet the applicable BRS for their age.

Before submitting your request for partial capital repayment or loan redemption, check with the CPF Board to confirm the remaining amount you can withdraw for your flat to ensure a successful deduction.

Note that different CPF usage limits apply if:

- Your flat was purchased before May 10, 2019, with a remaining lease of less than 60 years at the time of purchase; or

- Your flat was purchased on or after May 10, 2019, and the remaining lease does not cover the youngest owner using CPF savings for the flat up to age 95.

For more details, visit the CPF Board website.

GIRO

Suppose you are already using GIRO for your monthly housing loan installments. In that case, you can choose GIRO as the payment method for partial capital repayment or full redemption of your housing loan. Be sure to select this option when submitting your request online. Please note that this GIRO option is only available if your submission is made between the 6th (12:00 am) and the 22nd (5:00 pm) of the current month.

The GIRO deductions occur on the 28th of each month, and the payment is reflected on your home loan account on the last day of the month.

If the GIRO deduction fails, a second deduction will be attempted on the 6th of the following month (or the next working day), pending your confirmation. Suppose this second deduction is successful, and payment is received by the proposed repayment date. In that case, housing loan interest will be charged up to and including the date the repayment amount is received.

NETS via AXS payment channels

The maximum amount you can pay via NETS depends on the daily withdrawal limit you have set with your bank. Confirm this limit with your bank before proceeding with your NETS payment through AXS Station, e-Station, or m-Station. Ensure the partial capital repayment payment is completed by the proposed date.

eNETS Debit or PayNow via SGQR

The maximum payment amount for eNETS Debit or PayNow depends on your bank’s daily withdrawal limit. It’s essential to check with your bank regarding this limit before proceeding with payment.

To use eNETS Debit, you must have an Internet banking account with one of the following participating banks:

- Citibank

- DBS/POSB

- OCBC Bank

- Standard Chartered Bank (SCB)

- United Overseas Bank (UOB)

For PayNow via SGQR, participating banks include:

- Bank of China (BOC)

- Citibank

- DBS/POSB

- HSBC

- Industrial and Commercial Bank of China (ICBC)

- Maybank

- OCBC Bank

- Standard Chartered Bank (SCB)

- United Overseas Bank (UOB)

Please note that 2-factor Authentication (2FA) will be required for payments exceeding a certain amount, as set by your bank.

Ensure that your payment is made by the proposed partial capital repayment date.

Other important information

- There is no lock-in period or administrative fee for making partial capital repayments on your housing loan.

- There is no interest rebate if the payment amount received is below the minimum required amount.

- Housing loan interest will be charged up to and including the date your partial capital repayment or loan redemption is received.

- Your request is subject to the terms and conditions outlined in your Mortgage and Memorandum of Mortgage and HDB’s prevailing policies. HDB reserves the right to reject any request at its discretion.

6.7 CPF Board Home Protection Scheme (HPS) for Partial Capital Repayment:

- Your HPS premium will be adjusted in accordance with changes to your loan quantum or repayment period.

- If you are covered under the Single Premium HPS, your current HPS coverage will be terminated. The surrender value, which represents the unused portion of your premium, will be credited to your CPF Ordinary Account. A new annual premium HPS policy will be issued based on your latest outstanding loan amount and repayment term. For further details, please get in touch with the CPF Board directly.

7. Reserve Ordinary Account savings for housing payment

7.1 Can I Reserve My Ordinary Account Savings for Housing Payments After Age 55?

To help members plan for the future, those who wish to reserve their Ordinary Account (OA) savings for housing payments beyond the age of 55 can submit a request to the CPF Board before their savings are transferred to their Retirement Account (RA). This option is available for members who currently own properties or plan to purchase new ones. Applications can be submitted any time within 6 months before you turn 55, allowing at least five working days for processing.

Please take note that you will not be able to apply if:

- You are already 55 years old or above, or

- You have withdrawn CPF under the Reduced Life Expectancy (RLE) scheme.

When your monthly payouts under CPF LIFE or the Retirement Sum Scheme begin, the CPF board will transfer any reserved OA savings to your RA if you still need to meet the Full Retirement Sum. This transfer helps boost your RA savings, leading to higher monthly payouts.

7.2 What Happens to Your CPF When You Turn 55 (Summary Video)

Source: CPF

Looking for Real Estate Advice?

Whether you’re exploring options for your housing loan repayment, planning to upgrade your property, or need guidance on leveraging CPF for your next home purchase, I’m here to assist. I can help you make informed decisions tailored to your needs.

Connect with me today for a personalized real estate consultation and take the next step toward securing your ideal property.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Senior Associate District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Buying a Property in Singapore? 8 Key Tips on What to Look Out For

What to look out for when buying a condo or property in Singapore? Learn 8 key tips to help you choose or spot the right property for investment or own stay with capital appreciation and exit strategy.

Is It Still Safe to Enter the Property Market In 2025 Amid U.S. Tariffs?

How Trump’s Tariffs Could Affect Singapore’s Condo And HDB Prices. Is it safe to enter the Singapore property market in 2025 amid recession fears and U.S. tariffs? Learn how interest rates, supply trends, and market resilience could shape your next move.

How to Upgrade When My HDB Reached Minimum Occupation Period (MOP)

For HDB owners who have fulfilled the 5-year MOP (Minimum Occupation Period) in Singapore, discover your next move. Find out if you should sell your flat (resale HDB) or upgrade to a private property, with clear tips for smart homeownership planning.

Freehold Vs Leasehold Properties, Which Suit You Best?

Explore the key differences between freehold and leasehold properties in Singapore. Understand their advantages, investment potential, and determine which property type aligns with your goals.

How Much Do You Need to Earn to Afford a Condo in Singapore?

How much salary do you need to buy a condo in Singapore? Calculate loan, cash, CPF needed & avoid costly mistakes. Read the full guide now!

How To Building Retirement Capital Through Property: Breaking the Misconceptions About Property Upgrading

Looking to grow your retirement capital in Singapore? Discover how smart property upgrading and strategic investments can accelerate your wealth-building journey. From first-time buyers to seasoned homeowners, learn how to leverage property for long-term financial freedom.