Table of Contents

The Deferred Payment Scheme (DPS) for New Launch EC

In the dynamic real estate landscape of Singapore, the allure of upgrading from an HDB flat to an Executive Condominium (EC) is undeniable. However, for many HDB homeowners, the challenge lies in managing the financial transition, especially when their funds are entwined with their existing flats, waiting for the opportune moment to cash out.

So, how does one tread this financial tightrope? Enter the Deferred Payment Scheme (DPS) for EC.

How does the deferred payment scheme work? It’s essentially a flexible financial arrangement tailored to the needs of potential EC buyers. The DPS is a beacon of hope, particularly for HDB homeowners awaiting the proceeds from their flats. Instead of being held back by immediate cash requirements, the DPS offers a breather, allowing buyers to commit to an EC while managing their cash flow more comfortably.

But what is the deferred payment scheme in Singapore specifically for ECs? Executive condominium developers, recognizing the financial challenges faced by potential EC buyers, especially existing HDB flat owners, have incorporated the DPS to facilitate smoother property transitions. It’s a strategic move, offering an appealing pathway for those wanting to upgrade their living spaces without the immediate financial strain.

To put it into perspective with an example of a deferred payment scheme, consider the recent EC launch of Tenet in Tampines. A significant 72% of its units were claimed during its launch, with the DPS playing a pivotal role in enticing potential buyers to showcase its efficacy. Another example is the recent EC launch of Altura in Bukit Batok. It claims 62.5% sales during its launch in August 2023, followed by 87.5% sales claimed after it was open to the 2nd timer in September 2023,

For HDB flat owners eyeing an upgrade to an EC, understanding the pros and cons of the deferred payment scheme is vital as it may determine whether it is a good option for them to up the property ladder. As they navigate the intricacies of deferred payment scheme Singapore property choices, the DPS emerges as a game-changer, promising financial flexibility in pursuing their dream EC.

Understanding the EC Deferred Payment Scheme

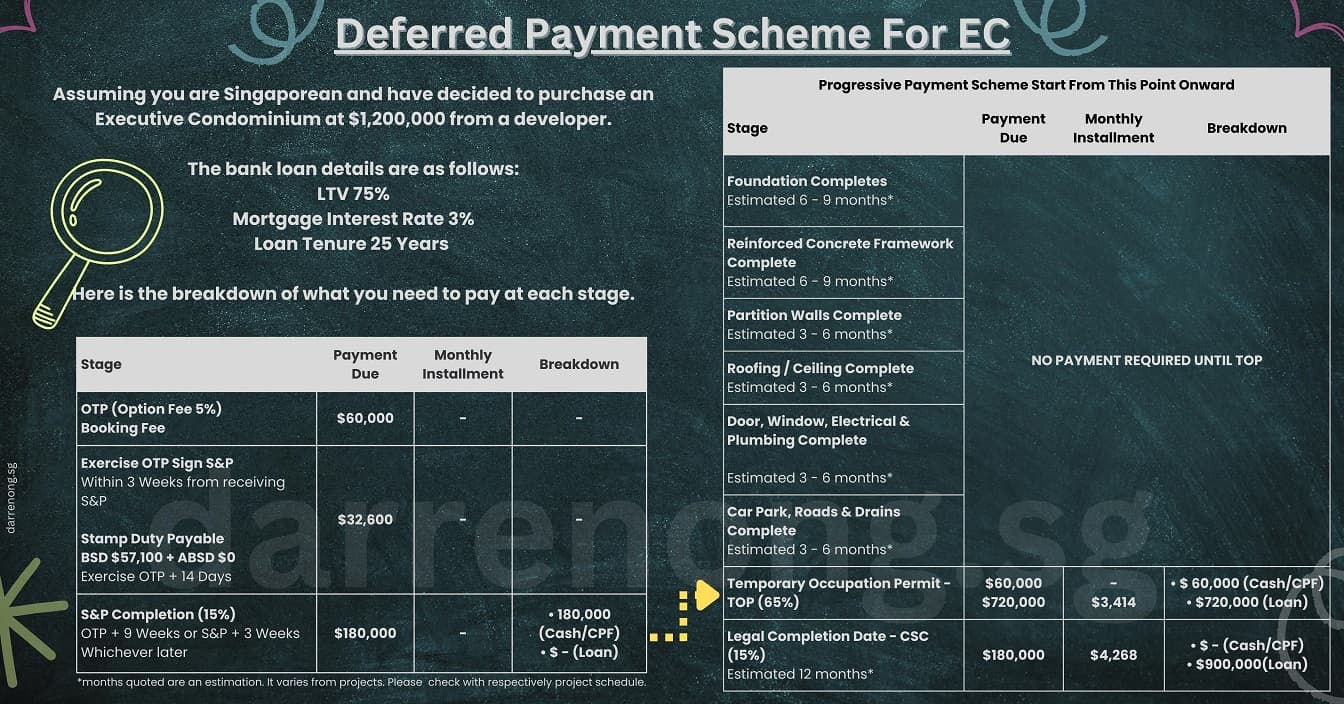

So, how does the deferred payment scheme work for EC buyers? Delving into its specifics, the EC Deferred Payment Scheme permits buyers to make an initial downpayment of 20 percent – a composition of 5% in cash and the flexibility to use either 15% cash or CPF for the remainder. The pivotal advantage comes next: an impressive 65% payment deferment until the Notice of Temporary Occupation Permit (TOP) issuance. In short, this delay lasts until the new EC home is ready to collect the key, and the last 15% payment of the new EC is payable upon the new EC obtaining the Certificate of Statutory Completion (CSC).

For potential EC homeowners, a significant decision awaits. The choice lies between the traditional Normal Progressive Payment Scheme and the increasingly popular EC Deferred Payment Scheme. It becomes particularly enticing for current HDB flat owners who have yet to venture into selling their HDB flats. Choosing the deferred scheme means they sidestep the burden of managing two simultaneous mortgage loans. Crucially, there’s a complete reprieve from loan repayments during the construction phase. It is a game-changer, offering them the breathing space to steer their financial commitments without undue strain adeptly.

Notably, the Deferred Payment Scheme is familiar to existing homeowners. First-time buyers exploring their initial foray into the property market can also leverage this financing option. However, the scheme’s natural appeal becomes evident among those already nestled in an HDB flat, especially those awaiting the sale and subsequent cash out from their HDB. The Deferred Payment Scheme emerges as a preferred route, offering both convenience and financial flexibility during the transition.

However, every silver lining has its own cloud. Opting for the EC Deferred Payment Scheme when purchasing a New Launch EC comes at a slightly elevated price. The increase is typically around 3% compared to the standard EC purchase price. This marginal premium is a worthwhile investment for many eager to climb from an HDB flat to an EC. Those who took up the EC deferred payment scheme can also treat the 3% as a one-off interest payable since someone has to help foot the 65% bill during the construction stage.

Different stages of the EC Deferred Payment Scheme

| Stage of Construction Completion | % of Purchase Price |

|---|---|

| Booking of Unit | 5% Cash |

| Upon signing S&P Agreement or within 8-weeks from date of Option | 15% Cash or CPF |

| Completion of foundation work | – |

| Completion of reinforced concrete framework | – |

| Completion of partition walls | – |

| Completion of roofing | – |

| Completion of door frames, windows frames, electrical wiring, internal plastering and plumbing work | – |

| Completion of car park, drains and roads serving the housing project | – |

| Obtained Temporary Occupation Permit (TOP) | 5% Cash or CPF 60% Cash or CPF or Loan |

| Obtained Certificate of Statutory Completion (CSC) | 15% Cash or CPF or Loan |

A Practical Example of the EC Deferred Payment Scheme Illustration

Imagine Mr. and Mrs. Raja, a current HDB flat owner in Singapore, looking to upgrade to an Executive Condominium (EC). They are keen on a new EC launch priced at SGD 1.2 million. However, their finances are still tied up in her HDB flat with existing monthly installments to pay for.

If they opt for the Normal progressive payment scheme, they must fork out 5% (cash) and 20% (CPF or cash) for the downpayment if they can secure a 75% maximum loan for the new EC. After that, the installment will kick in progress during the completion of each construction stage, as I have shared in the progressive payment scheme. It means they will have to pay their existing HDB monthly installment and the new EC monthly installment simultaneously, which may be stretchy.

Now, if they explore the EC Deferred Payment Scheme option, the DPS structure is as follows:

- Downpayment: 5% in cash (SGD 60,000) and utilizes 15% from CPF or cash (SGD 180,000). That’s a total of SGD 240,000 upfront.

- Deferral Period: Instead of starting her repayments immediately, they can breathe easy. The next 65% (SGD 780,000) is deferred until the new EC is ready to collect the key. There are no monthly mortgage repayments for the new EC during the construction stage.

- Notice of Temporary Occupation Permit (TOP): Fast forward a couple of years, their new EC is complete, and they receive the TOP notice. They only begin servicing the 65% deferred amount via the monthly installment when TOP. Ideally, by this time, they may have sold their HDB flat, freeing up more financial resources.

- Notice of Certificate of Statutory Completion (CSC): Usually estimated one year or less, the last 15% payment will be due, and the installment for the final 15% kicks in.

Below is a detailed explanation of the payment breakdown and monthly installment at each completion stage for EC Deferred Payment Scheme.

Pros and Cons of the Deferred Payment Scheme

Pros of the Deferred Payment Scheme:

- Financial Flexibility: This is especially beneficial for those awaiting the sale of their HDB flat. With DPS, buyers can delay a significant portion of their payment, aiding them in managing their cash flow effectively.

- No Double Mortgage: DPS prevents buyers from shouldering two mortgage loans simultaneously. If an individual is still servicing a loan for their current HDB flat, they do not have to start payments for the new EC immediately.

- Safety Net Against Delays: Buyers under DPS are somewhat shielded if the EC project experiences construction delays. Since they haven’t paid the majority of the property price, their money isn’t entirely locked in.

- Encourages Upgrading: DPS can push some residents to upgrade from an HDB to an EC, especially when they are financially stretched.

- Potential for Higher Returns: With the deferred payments, the EC buyers can invest their money elsewhere in the interim, potentially reaping higher returns.

Cons of the Deferred Payment Scheme:

- Slightly Higher Cost: As mentioned, when opting for the DPS, the purchase price is typically around 3% higher than those who opt for the Normal progressive payment scheme.

- Interest Rate Volatility Risk: If you bought during a low-interest rate period, you may have to pay more when the loan kicks in after the new EC is ready. Conversely, if you purchased during a high-interest rate period, it may be better to go for a deferred payment scheme and anticipate the interest rate to come down when your new EC is ready in 2-3 years.

- Higher Overall Loan Interest: Over the loan tenure, the accumulated interest might be higher. The loan quantum might be higher since the property price is slightly inflated under DPS by 3%, resulting in more interest paid over time.

Summary of EC Deferred Payment Scheme (DPS)

The EC Deferred Payment Scheme offers a unique opportunity for potential buyers in Singapore to navigate the property landscape with greater financial flexibility. Primarily catering to HDB flat owners awaiting sales and first-time buyers seeking varied payment options, the DPS can alleviate the immediate financial strain. Buyers can better manage their finances without overburdening themselves by allowing a deferral on a significant portion of the property’s price until completion. However, this comes at the cost of a slightly increased property price. As with all financial decisions, while the allure of flexibility is strong, buyers need to weigh the pros against the cons, ensuring they’re making the best choice for their future in the dynamic realm of Singapore’s property market.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Senior Associate District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Selling Your Condo in Singapore 2025: Step-by-Step Guide & What to Know Before You Start

Selling your condo soon? Learn how to sell a condo in Singapore with confidence — from staging and pricing to picking a trusted property agent. Avoid costly mistakes and discover tips that help you sell faster and smarter.

Where Can You Find and How to Buy an Executive Condominium in 2025

Upcoming Tampines St 62 Aurelle of Tampines 晶莹轩 EC Target Q1 2025 Launching. Other Available New Launch EC in 2025. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Buying a Property in Singapore? 8 Key Tips on What to Look Out For

What to look out for when buying a condo or property in Singapore? Learn 8 key tips to help you choose or spot the right property for investment or own stay with capital appreciation and exit strategy.

Is It Still Safe to Enter the Property Market In 2025 Amid U.S. Tariffs?

How Trump’s Tariffs Could Affect Singapore’s Condo And HDB Prices. Is it safe to enter the Singapore property market in 2025 amid recession fears and U.S. tariffs? Learn how interest rates, supply trends, and market resilience could shape your next move.

How to Upgrade When My HDB Reached Minimum Occupation Period (MOP)

For HDB owners who have fulfilled the 5-year MOP (Minimum Occupation Period) in Singapore, discover your next move. Find out if you should sell your flat (resale HDB) or upgrade to a private property, with clear tips for smart homeownership planning.

Freehold Vs Leasehold Properties, Which Suit You Best?

Explore the key differences between freehold and leasehold properties in Singapore. Understand their advantages, investment potential, and determine which property type aligns with your goals.