We all know by now that Executive Condominium (EC) is a hybrid of public and private housing. It would mean that, like any other HDB flat regulation, the EC homeowners need to fulfill the five-year Minimum Occupation Period (MOP) before they can start to sell to any potential buyer.

It will come to a point for many EC homeowners to start to think if they should hold on, sell, or reinvest in another better property choice.

I will share some pointers here on how you can analyze if it’s to sell or to hold:-

Firstly, do you know your EC will privatize in the 10th years? So you need to know the reason if you intend to sell just after MOP.

You need to ask yourself the following three questions:

First, are you being influenced by your neighbors who recently cash out from their EC?

Or secondly, are you worry that you may not have profits in the future when you decided to sell?

Or thirdly, are you planning to cash out and invest the profits into other better potential property investment?

Let’s have a brief look at the past EC market in the 1999s.

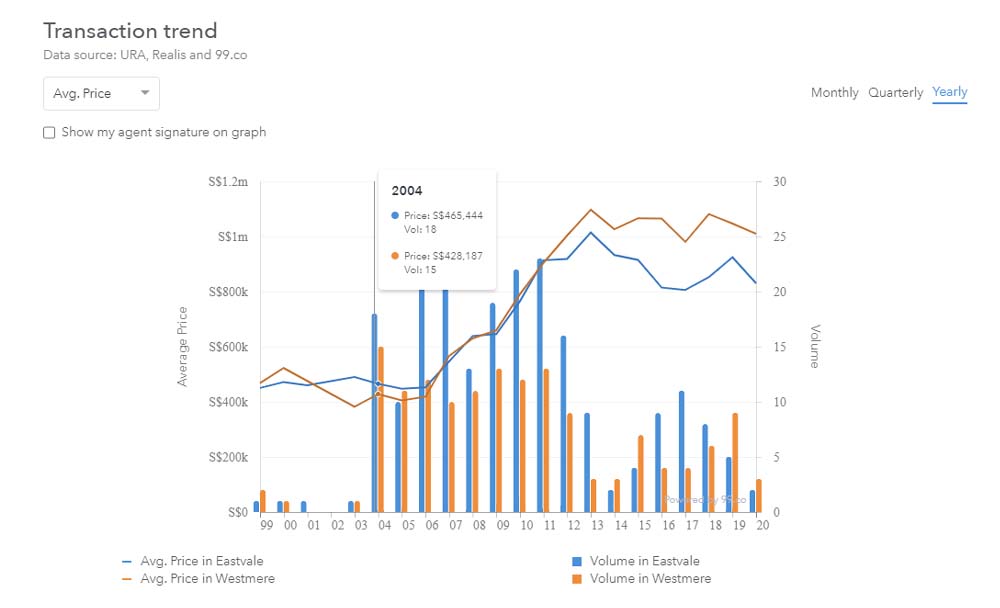

EC first emerged mainly in the eastern and western parts of Singapore. Examples like Eastvale in Pasir Ris and Westmere in Jurong are going for as low as $400+K. Back then, the common consensus was to wait until the EC fully privatized before EC homeowners cash out for profits.

But today, there’s a change of different mindset. Perhaps due to the many choices of new launch projects or even property advertisements on the hot topic on sell 1 buy 2 strategies or resale property that seem too worth to jump into investing it in the resale market that swings more homeowners to sell right after MOP, to cash out and reinvest their profits much earlier into multiple properties.

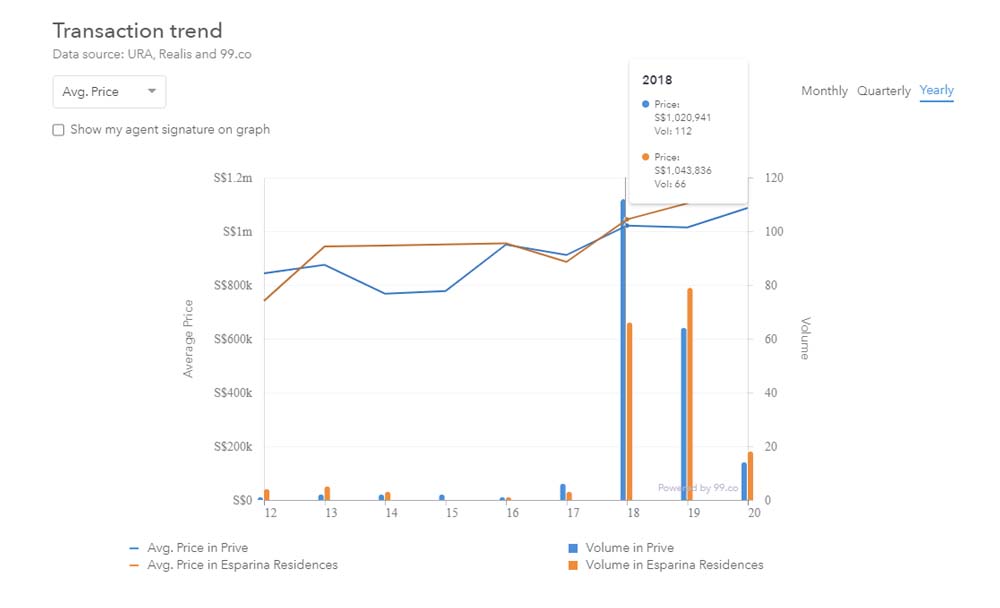

Let’s take a look below at the resale volume for some of the ECs launched in 1999 versus 2013 when it was resold in their 5th-year mark. It is very obvious back then for 1999 launched ECs, there were not many EC’s homeowners resell their EC compared to those launched in 2013 and subsequently resold in the 2018 period.

Now let me share some pointers that you may want to consider before deciding to sell or hold.

6 Points You May Want To Consider Before Selling Right After Your Executive Condominium MOP

- How many competitor sellers in your EC?

- What is the upcoming or current supply of newly MOP EC or recently TOP (Temporary Occupation Permit) condominiums near your home?

- Are there any potential growths in your neighborhood?

- Is your next investment likely to be better?

- How is the economic situation affecting your selling?

- How is your subsequent property affordability?

1. How many direct competitor sellers you have in your EC at present?

Like other property, be it HDB, newly TOP condominium, or newly MOP EC, many homeowners start to cash out when eligible to sell.

There are many reasons for homeowners to cash out. It can be moving to a bigger home or prime location due to increased income, or some may cash out to downgrade to a smaller home or back to an HDB flat to fully pay off using the profits from their current home.

Some also cash out via different methods (for example, selling it off versus equity loan) to reinvest into multiple properties or instruments.

When it comes to marketing, supply and demand play a big part. When your EC just reached MOP during the initial stage, surely there will be many neighbors start to sell.

Do note about the Supply and Demand that affecting your selling price!

Imagine that most homeowners are rushing to be the first to sell, where supply may be higher than demand. It will be much tougher to get a good price during this time, worst still if your EC development is large where buyers have ample choices of units to turn, especially those that are more urgent to sell.

Most of the time, when the urgent sellers finished offloading, we will start to see demand slowly exceeds the supply where prices start to stabilize, and this process usually takes months.

2. What is the upcoming or current supply of newly MOP EC or recently TOP (Temporary Occupation Permit) condominiums near your home?

Besides your direct competitors from your neighbors within your EC development, you also need to understand and watch out for upcoming and current supply from other newly MOP EC or recently TOP condominiums nearby your home. As mentioned in point 1, it may directly impact you where supply more than demand, which affects your selling prices.

An ideal situation is your MOP EC is within a neighborhood with older condominiums and surrounded with a pool of MOP BTO flats owners coming after your home as an upgrader.

Most homeowners are somehow attached to the location that they stayed as their family has settled into the area. As such, we can see many of the HDB or even DBSS owners start to go after newly MOP EC or recently TOP condominium near to their existing home.

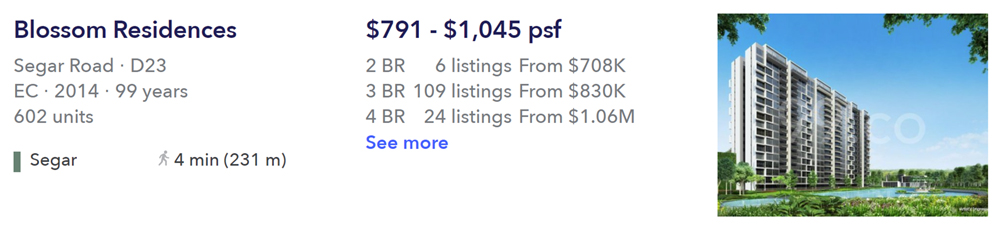

For example, Blossom Residences, a newly MOP EC located along Segar Road in Bukit Panjang. It is highly sought after by the nearby MOP BTO homeowners in Segar Road, Fajar Road, and Senja Road.

Another example is The Canopy EC in Yishun, which sees their potential buyers from the newly MOP DBSS Adora Green and nearby MOP BTO homeowners in Yishun Greenwalk.

3. Are there any potential growths in your neighborhood?

When it comes to analyzing real estate investment, one of the ways is to research the neighborhood via the URA Master Plan, if any upcoming plans can lead to potential growth.

Most people know about potential growth when it comes to buying real estate. But the fact is that, as a property seller, you also need to research if there is any upcoming potential gain for your property.

If there are some upcoming infrastructure or development plans coming on their way to your areas, for example, like MRT stations, mega shopping mall, tech park, or even regional centre that could lead to potential growth, then hold on to 1 or 2 years more may bring you more returns on your current home investment. Thus, it may not always be the case that you have the maximum profit upon reaching MOP for EC or TOP for a condominium.

4. Is your next property investment likely to be better?

In any investment, there will be profit or loss. Many homeowners count on the profits and hoping to realize them after selling their property, but before you make any move, be clear what you are buying next.

Be prudent, research well, and weigh the various options available first, not jump straight into buying anything.

Buying into yet to privatized EC or newer condominium near areas with infrastructure or development plans with potential growth is something you need to keep a lookout to park your fund for a better investment.

Besides the above, many EC homeowners sell because their children start to grow up and need a bigger space, thus relocating to a bigger private home. Some reinvest into a private property near their parent, in-laws, or better locations near transportation hubs, MRT, or schools.

Do note that it is good to consider both the domestic and investment aspects as any wise decision made will impact positively on your retirement plans down the road.

5. How is the economic situation affecting your selling?

If it is in the down market where property prices are correcting, I do not suggest selling your property. However, you should only consider selling if you are in a situation where you need to cash out for some personal reason (e.g. job loss), or already bag a huge gain from the current property and wish to let go, to take advantage of another property with more discount.

Ultimately, EC is generally for owner-occupied, so it should not correct as much, as holding it is more for own occupancy rather than for investment.

Generally, in a down market, it affects the more expensive property as the price correction is more massive as investors bailout.

For example, a correction of 8% in a $4 Million property will easily mean $320,000 lesser versus $80,000 in a $1 Million property. However, when the market recovers, it would mean that you stand to gain significantly more if you can hold the property through the down period.

Taking some examples during the COVID-19 period, I seem buyers came to offer way below the original asking price for two of the landed properties that I am marketing. It is because, during a down period, buyers are more prudent in their spending, thus lesser buyers in the resale market except the cash-rich going around starting to pick up good deals as a form of investment opportunities.

Other than the economic down market, sometimes we see the Government introducing new cooling measures to curb the property market. Sellers may want to adopt a “wait and see” approach before the situation gets better.

6. How is your subsequent property affordability?

The last pointer to everyone out there is always to buy or invest in something within your affordability, and not to lock yourself in any unnecessary caught up situation, which affects yourself and your family.

Always sell with a clear plan and buy wisely to avoid potential loss in the future.

In Summary,

Do not think that Executive Condominium MOP is the key to unlock yourself and rush to sell.

In Singapore, most homeowners are somehow bombarded with advertisements via printed ads or online ads, showing you all the different benefits of cashing out the first-hand profit right after MOP.

But the right timing to sell a property is not just at MOP, but it should also be based on many other factors such as the few pointers I shared above.

Lastly, plan and research well, and know your main reason behind selling before you make any move. You should know the answer better than anyone else.

Hello, I am Darren Ong

As a real estate professional, my duty is to help my clients achieve financial freedom and grow their wealth through Property Wealth Planning™.

I believe that with prudent strategies and a clear investment road map, anyone can enjoy a life of abundance and financial stability.

Darren Ong (王伟丞)

Associate District Director of Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: +65 9383 9588