Table of Contents

How CPF accrued interest affect property cash proceeds

Almost all Singaporean homeowner utilized their CPF Ordinary Account (OA) savings when purchasing a property in Singapore. Either they use all the savings in CPF OA to service their home loan, if not a significant portion of it.

In this article, I will share what you need to know CPF accrued interest when you plan to utilize your CPF OA savings to service your home loan in Singapore over a long period, usually spanning over decades.

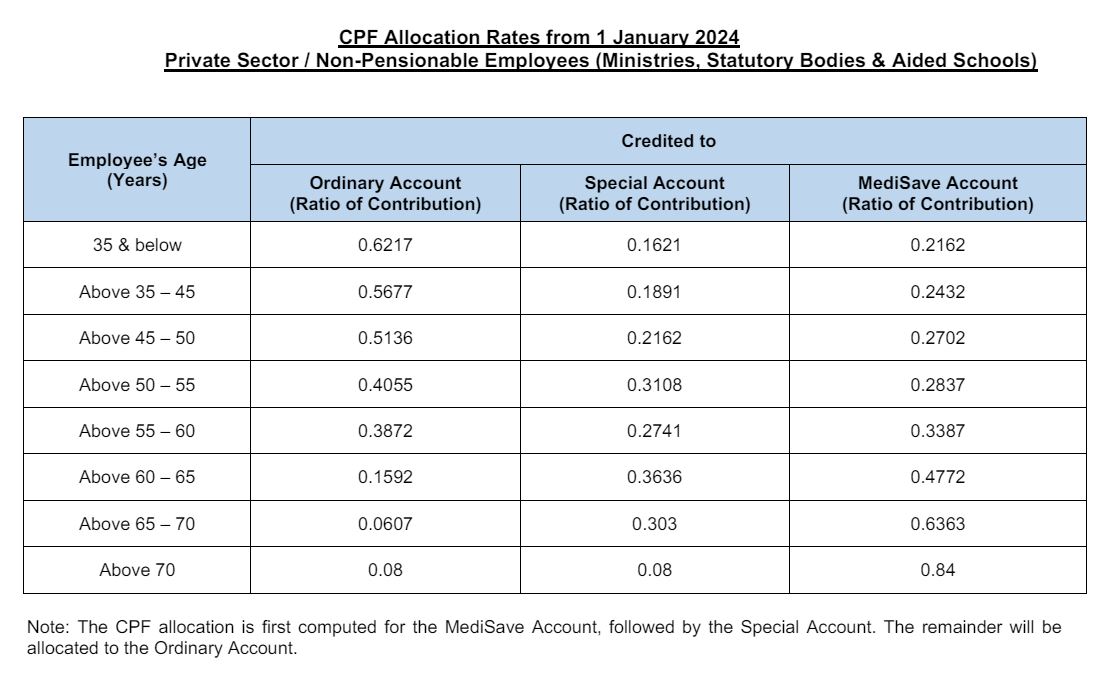

Let us recap the CPF contribution rates and allocation rate from 1st Jan 2024 till date for the private sector and public sector non-pensionable employee first for later part of illustration:

| Employee’s age (years) |

Contribution rates from 1 January 2024 (monthly wages > $750) |

||

|---|---|---|---|

|

By employer (% of wage) |

By employee (% of wage) |

Total (% of wage) |

|

| 55 and below | 17 | 20 | 37 |

| Above 55 to 60 | 15 | 16 | 31 |

| Above 60 to 65 | 11.5 | 10.5 | 22 |

| Above 65 to 70 | 9 | 7.5 | 16.5 |

| Above 70 | 7.5 | 5 | 12.5 |

CPF Contribution Rates 2024

CPF Allocation Rate Example:

If the CPF contribution of an employee (30 years old) is $100 in 2024, the allocation of his CPF contribution will be computed as:

- Employee’s Age (Years): 35 & below

- CPF Contribution: $100

- MediSave Account: $21.62 ($100 x 0.2162)

- Special Account: $16.21 ($100 x 0.1621)

- Ordinary Account: $62.17 ($100 – $21.62 – $16.21)

You can utilize your CPF OA savings either to purchase public housing (HDB) or private property. In this article, we will look into just buying one property.

If you are keen to know more about using CPF savings for multiple properties, you can check out here.

Before we go any further, let take a look at the difference between HDB concessionary housing loan and bank loan payment and loan structures.

| HDB concessionary housing loan | ||

|---|---|---|

| Down Payment | Maximum Loan | |

| HDB (wef 30 Sept 2022) | 20% (CPF / Cash) | 80%* (Monthly CPF/Cash) |

| Private Property | NA | NA |

* Subject to credit check and HDB approval

| Bank Loan for HDB or Private Property | ||

|---|---|---|

| Down Payment | Maximum Loan | |

| HDB | 25% (5% must be cash) (20% CPF/Cash) | 75%** (Monthly CPF/Cash) |

| Private Property | 25% (5% must be cash) (20% CPF/Cash) | 75%** (Monthly CPF/Cash) |

Most home buyers, if not all, will start to use their CPF OA savings to pay the down payment of 10%-20% at the initial stage.

After that, when the sale and purchase transaction is over, you are the rightful homeowner. It is where you start to service your home loan monthly using your CPF OA saving before you top any cash if your CPF monthly contribution is not enough to maintain the home loan.

So many of them may have ended up used the whole of 100% using CPF for HDB or 95% for private property.

The answer is when you use your CPF OA savings for housing; you are drawing out funds from your CPF ordinary account. Thus whatever amount that you draw out, you will not earn the annual interest.

Instead of earning the annual interest for your CPF OA savings, you will be charged on the amount that you draw out to service the monthly installment of your home, which is known as the CPF accrued interest.

In 2018, I met this client of mine, Mr. and Mrs. Lim, who have contacted me that they need to dispose of their current HDB flat (first owner BTO Flat since 1998) since they are going to collect their next HDB BTO flat in due course.

As HDB rule and regulation, all HDB homeowners can only own an HDB flat at a time. Thus they need to dispose of the current old property when they collect the next HDB flat.

After I have sat down with them to understand more about their situation and plug out all the figures used to date, with detailed financial calculation and explanation, then they realized that they are being charged so much on the CPF Accrued Interest.

After a short conversation, I get to know that they fully paid off their current housing loan in the first five years using CPF OA savings. Then thinking that they do not have to worry about the monthly installment after fully paid off the housing loan, but without realizing there is something called CPF Accrued Interest.

Case study 01: Utilising CPF OA Savings for Housing in Singapore

Purchase on 1998 in Woodlands

Purchase price: $220,000

CPF principal Sum utilized for housing: $280,184

CPF Accrued Interest: $113,577

Current market valuation in 2018: $365,000

They ended up selling the flat at a loss of $28,761 after refunding the CPF principal sum utilized, and CPF accrued interest back to their CPF Ordinary Account.

Assuming they have fully paid off the $220,000 on day one when they collect their flat. In 20 years, they will need to return CPF accrued interest of $140,495.62.

| Balance | Accrued Interest | Total Interest | Year |

|---|---|---|---|

| $220,000.00 | $5,500.00 | $5,500.00 | 1999 |

| $225,500.00 | $5,637.50 | $11,137.50 | 2000 |

| $231,137.50 | $5,778.44 | $16,915.94 | 2001 |

| $236,915.94 | $5,922.90 | $22,838.84 | 2002 |

| $242,838.84 | $6,070.97 | $28,909.81 | 2003 |

| $248,909.81 | $6,222.75 | $35,132.55 | 2004 |

| $255,132.55 | $6,378.31 | $41,510.87 | 2005 |

| $261,510.87 | $6,537.77 | $48,048.64 | 2006 |

| $268,048.64 | $6,701.22 | $54,749.85 | 2007 |

| $274,749.85 | $6,868.75 | $61,618.60 | 2008 |

| $281,618.60 | $7,040.46 | $68,659.06 | 2009 |

| $288,659.06 | $7,216.48 | $75,875.54 | 2010 |

| $295,875.54 | $7,396.89 | $83,272.43 | 2011 |

| $303,272.43 | $7,581.81 | $90,854.24 | 2012 |

| $310,854.24 | $7,771.36 | $98,625.60 | 2013 |

| $318,625.60 | $7,965.64 | $106,591.24 | 2014 |

| $326,591.24 | $8,164.78 | $114,756.02 | 2015 |

| $334,756.02 | $8,368.90 | $123,124.92 | 2016 |

| $343,124.92 | $8,578.12 | $131,703.04 | 2017 |

| $351,703.04 | – | $140,495.62 | 2018 |

From the table above, over 20 years, it is not hard to see that over the years, the CPF accrued interest increased from $5,500 to $140,495.62. The longer you utilized your CPF OA savings, the more CPF accrued interest you have to pay back when you sell your property. It means that your cash proceeds receivable after selling will be lesser or even be zero.

The fact is that the CPF principal sum plus the CPF accrued interest is always on the rise over the years. Still, when the 99 years leasehold HDB or private condominiums’ remaining lease gets shorter, the market valuation of the property will decrease. It means that the longer you hold the property, the higher the chance of selling at a loss will happen.

On the other hand, if Mr. and Mrs. Lim did not utilize their CPF OA savings for housing, below is what going to happen:

- They would have earned the 2.5% CPF interest in their CPF OA savings from the CPF board.

- They do not need to refund money into their CPF OA savings when they intend to sell the property, meaning after selling the property, they will take full market value in cash.

But in the current market context, many Singaporean are unable to fork out extra cash to service their home loan. Therefore they utilized their CPF OA savings instead.

Case study 02: Not Utilising CPF OA Savings for Housing in Singapore

Imagine Mr. and Mrs. Lim, both 36 years old, were earning a monthly income of $4,500 and $3,500, respectively. Based on the CPF allocation table, 21% of the salary will go into their CPF OA account which is ($945 + $735) = $1,680 monthly

For a simple illustration, assuming both of them work for the past 20 years with the same income without pay increment, they both will have the principal sum of ($1,680 x 12 months x 20 years) = $403,200 in total in their CPF OA savings.

With the CPF board giving out 2.5% interest annually, they will have a total CPF OA saving fund of $514,980.30 in total.

I have mentioned earlier that many Singaporean are unable to fork out extra cash to service their home loan; instead, they make use of their CPF to pay for their monthly housing installment.

So to utilize your CPF OA savings for housing and at the same time to prevent the negative sale or zero cash profit, my suggestion is to monitor the market value closely. When the time is right, execute the plan to sell and cash out before the property valuation turns into a downward trend.

Case Study 03: Renting the flat and buy 2nd properties is it wise?

Let take an example of purchasing 2nd property at $800,000.

with effect from 27th April 2023, the ABSD incurred for 2nd property is 20% for Singapore citizens, which is $160,000

Imagine that Mr. and Mrs. Lim rent out the flat at $2,500 monthly, this works out to be $30,000 yearly.

After factoring the CPF accrued interest (estimated $8,500), you have $30,000 – $8,500 = $21,500 annually balance.

With $21,500, you need about ($160,000 / $21,500) = 7.44 years to make back your ABSD.

If you factor in the property tax incurred yearly, it will take even longer to make back your ABSD before you can see some light over at the other end.

Lastly, we must still thank our government and CPF system because only with CPF OA savings, many buyers can leverage and afford to buy their property.

But in other to take full advantage of it, you must monitor and execute your exit plan at the right time to gain maximum profit for your retirement plan.

The reason why Mr. and Mrs. Lim gets to know about the CPF accrued interest is that they contacted me, and I care to explain to them.

Just imagine that if Mr. and Mrs. Lim sits onto the property and utilizing their CPF OA savings to pay off their housing loan decade over a decade and stay put. Do you think they are free of debt when CPF accrued interest is still rolling?

In 25 or 30 years later, when they intend to sell their house and cash out for retirement, do you think they will have cash after selling?

If you were holding onto your property and utilized your CPF OA savings for the housing loan, I suggest that you look into your CPF accrued interest incur to date and have a though of your exit plan on when is the right and best time.

If you are not sure about how to go about the financial calculation, I do provide FREE consultation for Property Wealth Planning for my client property portfolio and work toward their retirement plan.

Do feel free to contact me for a non-obligatory friendly discussion so that I can understand your current situation before I can help you and propose the best suitable plans for you to consider and plan ahead.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls