Table of Contents

Introduction: How Much Do You Need to Earn to Afford a Condo in Singapore?

Buying your first private condominium in Singapore is a major financial milestone and a dream for many singles, couples, and families. But with property prices rising steadily and tighter loan regulations, many buyers find themselves asking — how much do they need to earn to afford a condo in Singapore?

Whether you’re a Singaporean, a Permanent Resident (PR), or a foreigner looking to buy property here, the journey can be overwhelming without a clear understanding of the total cost involved. It’s not just the property price — you’ll also need to factor in Buyer’s Stamp Duty (BSD), possible Additional Buyer’s Stamp Duty (ABSD), as well as loan restrictions like the Total Debt Servicing Ratio (TDSR), and Loan-to-Value (LTV) limits.

Many buyers underestimate how much cash or CPF savings they need upfront and how the monthly repayments will impact their finances. In addition, the MAS stress test interest rate often reduces the actual loan amount banks are willing to offer.

This guide breaks down every essential cost factor — from property prices across different regions to stamp duties, loan calculations, and the salary you realistically need to afford your first condo without overstretching yourself.

The Cost of Owning a Condo in Different Regions of Singapore

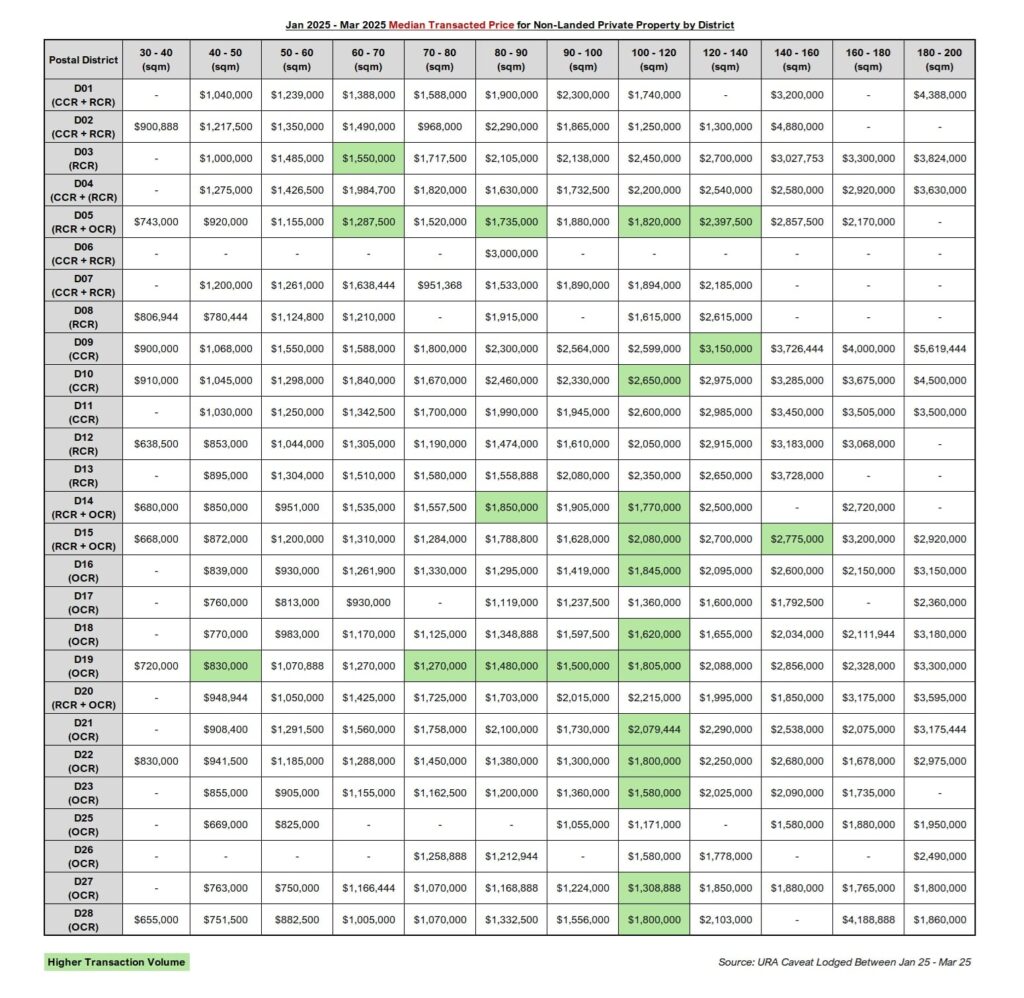

Location is one of the factors influencing the cost of owning a condominium in Singapore. The private residential market is generally categorized into three main regions — the Core Central Region (CCR), the Rest of Central Region (RCR), and Outside Central Region (OCR). Each region reflects a different level of demand, prestige, and convenience, which directly impact property prices.

The Core Central Region (CCR) comprises Singapore’s most prestigious districts, including parts of Districts 1, 2, 4, 6, and 7, and covering Districts 9, 10, and 11. This region is best known for its prime locations, luxury developments, and close proximity to the city’s central business and shopping districts. Naturally, properties in the CCR command the highest prices. Based on the latest Q1 2025 transactions, the median price of a 60 to 70 sqm condominium unit in District 9 stands at $1,588,000. Buyers looking for larger units can expect to pay more, with the median price of an 80 to 90 sqm unit in District 10 reaching $2,460,000. The premium pricing reflects the central location, luxurious lifestyle, and amenities these districts offer.

Moving slightly outwards, the Rest of Central Region (RCR) offers a more balanced option for buyers who want the convenience of city-fringe living without the hefty CCR price tag. Districts within the RCR include parts of Districts 1 – 2, 4 – 7, 13 – 15, and 20, as well as the whole of Districts 3, 8, and 12. Popular areas like Tiong Bahru, Queenstown, and parts of Bukit Merah are located within the RCR. According to the Q1 2025 data, the median price for a 60 to 70 sqm unit in District 3 was $1,550,000. For buyers considering larger spaces, an 80 to 90 sqm unit in District 5, which covers parts of Pasir Panjang and West Coast, transacted at a median price of $1,735,000. The RCR is often seen as the sweet spot, offering a good balance of accessibility, amenities, and relative affordability compared to the CCR.

Further out into the suburban areas lies the Outside Central Region (OCR), which offers Singapore’s most affordable private condominiums. The OCR includes parts of Districts 5, 14, 15 and 20 and the whole of Districts 16 – 19 and 21 – 28. These districts cover areas like Punggol, Sengkang, Choa Chu Kang, and Jurong. OCR condominiums appeal mainly to first-time homebuyers, young families, and those looking for larger living spaces at lower prices. Based on recent transactions, the median price of a 60 to 70 sqm unit in District 19 is around $1,270,000. Meanwhile, an 80 to 90 sqm unit in District 23, which covers locations such as Bukit Batok and Bukit Panjang, recorded a median transacted price of $1,200,000.

The significant price differences across the three regions highlight the importance of location in Singapore’s property market. Property buyers can expect a premium price tag for central locations that offer better connectivity, established amenities, and higher investment potential. On the other hand, the suburban OCR offers greater affordability and larger living spaces, making it an attractive option for property buyer with a tighter budget or bigger space requirements. Understanding these regional price differences is a crucial first step in planning your condo purchase and setting realistic expectations based on your affordability.

Buyer's Stamp Duty (BSD) and Additional Buyer's Stamp Duty (ABSD)

When purchasing a private condominium in Singapore, it is essential to factor in the Buyer’s Stamp Duty (BSD) and, for some buyers, the Additional Buyer’s Stamp Duty (ABSD). Significant upfront costs must be planned carefully, as they directly affect your budget and affordability.

The Buyer’s Stamp Duty (BSD) is payable by all buyers, regardless of nationality or the number of properties owned. It is calculated based on the higher purchase price or the property’s market value. As of Feb 15, 2023, the BSD rates for residential properties are as follows:

- 1% on the first $180,000

- 2% on the next $180,000

- 3% on the next $640,000

- 4% on the next $500,000

- 5% on the next $1.5 million

- 6% on the amount exceeding $3 million

Most first-time buyers purchasing a private condominium between $1.5 million and $2 million, the BSD payable can range from approximately $44,600 to $69,600, depending on the final purchase price. It is a mandatory tax that the buyer must pay within 14 days of exercising the Option to Purchase (OTP).

It is important to note that BSD must be paid in cash first. If you intend to utilize your CPF Ordinary Account (OA) savings to cover the BSD, you will still need to pay the amount in cash upfront. The CPF reimbursement will only be processed upon legal completion of the property purchase.

In addition to BSD, some buyers may also need to pay the Additional Buyer’s Stamp Duty (ABSD). ABSD is determined based on your residency status and the number of residential properties you already own. ABSD does not apply to Singapore citizens (SCs) purchasing their first residential property under the ABSD rules.

For married couples with at least one SC also enjoy this ABSD exemption when jointly purchasing their first home, the first residential property counted under the ABSD rules. However, if neither buyer is a Singapore Citizen, the ABSD will apply based on the higher applicable rate according to the couple’s residency status.

The current ABSD rates for first residential property purchases are:

- Singapore Permanent Residents (PRs): 5%

- Foreigners: 60%

For example, a Singapore PR purchasing a $1.5 million condo will need to pay an additional $75,000 in ABSD on top of the BSD. In comparison, a foreigner buying the same property would incur a hefty $900,000 in ABSD on top of the BSD. This tax must also be paid upfront in cash first.

Both BSD and ABSD form a significant part of your upfront property costs. Failing to budget for these taxes can lead to unexpected financial strain, especially for PRs and foreign buyers. It is advisable to factor the taxes incurred in your affordability calculations early and seek professional advice if you are planning multiple property purchases or more complex ownership structures.

Financing the Condominium

Financing a private condominium in Singapore is very different from financing an HDB flat, and understanding the rules is crucial before committing to any purchase. Private properties must be financed through bank loans, which are subject to stricter lending criteria.

The first factor that affects your loan eligibility is the Loan-to-Value (LTV) ratio. For first-time buyers, the maximum LTV is 75% of the valuation price or property price, whichever is lower. This means you must prepare at least a 25% down-payment, of which 5% must be in cash, and the remaining 20% can come from CPF savings or cash.

However, qualifying for the 75% maximum loan is not automatic. Banks will evaluate your financial profile based on the Total Debt Servicing Ratio, in short, TDSR, which limits your total monthly debt obligations — including the new home loan, car loans, credit cards, and other debts — to 55% of your gross monthly income. This ensures borrowers do not overcommit beyond what their income can realistically support.

In addition, banks assess loan eligibility using a stress-tested interest rate (currently around 4% or higher) rather than the actual loan package rate. This calculation ensures buyers can handle future interest rate hikes. Borrowers must also be mindful of the loan tenure. The maximum loan tenure for private property is 30 years, but if the loan extends beyond 30 years or the borrower’s age crosses 65 years before the loan ends, the LTV ratio may be reduced further, requiring a larger down payment.

Given these conditions, it is highly recommended that you work with a banker or mortgage broker early in the process to assess your loan capacity and avoid any unpleasant surprises when making an offer.

Impact of Property’s Remaining Lease on Loan and CPF Usage

When purchasing a private condominium, it is not just the price or location that matters — the remaining lease of the property plays a critical role in determining the LTV limit which directly determine how much loan you can borrow and how much CPF you can use.

For properties with a 99-year leasehold, banks and the CPF Board will assess the remaining lease years before approving your loan and CPF usage. The key requirement is that the property’s remaining lease cover the youngest buyer up to 95 years old. Suppose this condition is met and the buyers also pass the Total Debt Servicing Ratio (TDSR) assessment. In that case, according to standard guidelines, they will generally be eligible for the maximum Loan-to-Value (LTV) ratio and no lower CPF usage restriction.

However, if the remaining lease is insufficient to last till the youngest buyer turns 95, both the LTV ratio and CPF usage limits will be pro-rated. This means you may have to fork out a larger cash down payment and rely less on your CPF savings. For example, if you are 35 years old and the property has only 55 years of lease left, the remaining lease covers you till age 90 — which falls short of the 95-year guideline. As a result, the bank may offer a lower loan quantum, and the CPF Board may restrict your CPF usage limit.

This rule is particularly important if you are considering older resale condominiums or projects that have been around for several decades. While such properties may seem more affordable upfront, the restrictions on financing and CPF usage can significantly increase your cash outlay.

Therefore, it is advisable to check the property’s remaining lease carefully and understand its implications for your loan and CPF usage before making any decision. If unsure, engaging a reliable banker or property agent can help you determine the numbers and avoid costly surprises later in your purchase process.

Monthly Loan Repayment

Understanding how your monthly loan repayment is structured is essential for long-term financial planning. Instead of focusing solely on how much loan amount you qualify for, property buyers should carefully assess how the repayment fits into their monthly budget — especially since mortgage installments are typically one of the largest recurring expenses for any property owner.

Your monthly installment is influenced by the final loan amount approved, the interest rate offered by the bank, and your chosen loan tenure. While a longer loan tenure can lower your monthly repayment, it also increases the total interest paid over the loan period. Additionally, many bank loan packages offer lower promotional rates in the initial years, which may rise after the lock-in period. You must plan beyond the initial low repayments and prepare for possible rate adjustments if you cannot secure the refinance or reprice of your mortgage.

For illustration, let’s assume you purchase a condominium priced at $1.5 million and secure the maximum 75% loan, amounting to $1,125,000. If your bank applies an interest rate of 4% over a 30-year loan tenure, your estimated monthly repayment will be around $5,374.

However, if your loan package offers a 3% promotional rate for the first three years, your initial monthly repayment could be lower, approximately $4,743. Once the fixed-rate period ends, the interest may rise according to market conditions, leading to higher monthly repayments.

| Property Price | Loan Amount (75%) | Interest Rate | Loan Tenure | Estimated Monthly Repayment |

|---|---|---|---|---|

| $1,500,000 | $1,125,000 | 4% | 30 years | $5,374 |

| $1,500,000 | $1,125,000 | 3% | 30 years | $4,743 |

This example highlights why it’s important not to rely solely on promotional interest rates when planning your finances. Buyers should always stress-test their affordability by estimating repayments at higher interest rates to avoid financial strain if rates increase in the future.

It is also crucial to ensure your monthly repayment fits within your budget and complies with the Total Debt Servicing Ratio (TDSR) limit. Exceeding this limit can affect your loan approval or force you to reduce your loan quantum, thus increasing the initial cash payment.

Before you start your property hunting journey, it is highly recommended that you engage a banker or mortgage broker to obtain an In-Principle Approval (IPA). An IPA provides a clear picture of your approved loan amount and estimated monthly repayments, giving you confidence to make property decisions that align with your financial capability.

What is the Average Salary You Need to Earn to Buy a Condo in Singapore?

One of the most common questions first-time buyers have is — how much salary do I need to comfortably afford a condo in Singapore? While there is no one-size-fits-all answer, the required income largely depends on the property price, loan amount, and your existing financial commitments.

As mentioned earlier, the Total Debt Servicing Ratio (TDSR) is capped at 55%. This means your total monthly debt obligations — including your condo mortgage, car loans, personal loans, and credit card debts — cannot exceed 55% of your gross monthly income. Using this guideline, we can estimate the minimum monthly income required to afford different property price points based on a 75% loan, 4% interest rate, 30-year loan tenure, and no other monthly debt obligations.

| Condo Price | Loan (75%) | Estimated Monthly Repayment (4% / 30 yrs) | Minimum Gross Monthly Income (55% TDSR) |

|---|---|---|---|

| $1 Million | $750,000 | $4,774 | $8,680 |

| $1.5 Million | $1,125,000 | $5,374 | $9,770 |

| $2 Million | $1,500,000 | $7,166 | $13,030 |

| $2.5 Million | $1,875,000 | $8,958 | $16,288 |

You may connect with me if you need help working out your budget before you start hunting for your ideal home.

Downpayment and Buyer's Stamp Duty ( BSD) Considerations

In addition to your monthly income, you must prepare for the 25% downpayment and Buyer’s Stamp Duty (BSD), as mentioned. For example:

- $1.5 million condo: Minimum downpayment is $375,000 (5% cash + 20% CPF or cash)

- BSD payable: $44,600 (payable in cash first; you may apply CPF reimbursement if you decide to use your CPF OA savings)

- Total upfront cost: $419,600 (excluding legal and valuation fees)

Buyers must also be aware that only 5% of the downpayment must be in cash, while the rest can be paid using CPF Ordinary Account (OA) savings.

Cash and CPF Components

| Condo Price | 5% Cash | 20% CPF / Cash | BSD (Approx.) | Total Upfront Payment |

|---|---|---|---|---|

| $1 Million | $50,000 | $200,000 | $24,600 | $274,600 |

| $1.5 Million | $75,000 | $300,000 | $44,600 | $419,600 |

| $2 Million | $100,000 | $400,000 | $69,600 | $569,600 |

| $2.5 Million | $125,000 | $500,000 | $94,600 | $719,600 |

CPF Usage vs Cash Requirements

The 5% cash component is mandatory. If sufficient, the remaining 20% downpayment and BSD can be paid using CPF OA savings. However, if your CPF balance is insufficient, you must cover the shortfall in cash.

Important Variables That Affect Condo Prices and Affordability

When planning to buy a condominium in Singapore, it’s not just about the property price or monthly repayments. Several important variables influence a condo’s price range and long-term value, which should guide your decision-making.

Location remains one of the biggest price drivers. Condominiums in the Core Central Region (CCR) naturally command higher prices due to their prime addresses, proximity to the Central Business District (CBD), shopping belts, and reputable schools. Buyers pay a premium for these areas’ convenience, prestige, and potential investment returns. On the other hand, condos located in the Outside Central Region (OCR) are generally more affordable, making property in OCR attractive to first-time buyers and families seeking larger spaces. However, OCR properties may require longer commutes and may not have the same rental demand or resale potential as CCR projects.

Another factor affecting price is the development size and the range of facilities provided. Larger developments often include full facilities such as swimming pools, gyms, tennis courts, BBQ pits, and function rooms, adding value and appeal. These projects may be priced higher but offer better amenities and potentially better resale or rental demand. In contrast, boutique developments with fewer than 100 units and limited facilities may be priced lower but could appeal to buyers who prefer privacy and a quieter living environment.

Additionally, future developments in the surrounding area — such as new MRT stations, upcoming shopping malls, business hubs, or transformation plans — can significantly influence property values. Choosing a location with upcoming growth potential may mean higher prices today but could result in better capital appreciation over time.

If you want to learn how to identify properties with strong growth potential while managing risks, feel free to connect with me. I’ll be happy to share my 7 Steps Framework for Identifying Low-Risk, High-Profit Potential Properties — designed to help buyers like you make smarter property decisions with confidence.

The Importance of Financial Planning Before Buying a Property

Buying a private condominium is a major financial commitment that goes beyond just securing a home loan or having enough savings for the downpayment. I’m reiterating this point because I feel it is essential — proper financial planning is crucial to ensure you don’t overstretch yourself and end up facing cash flow issues or financial stress later on.

Many buyers only focus on the purchase price or monthly mortgage repayments. Still, it’s equally important to assess your overall financial health — including your current income, existing debts, monthly expenses, savings, and long-term financial goals. Remember, owning a condo comes with recurring costs such as monthly loan repayments, property tax, fire insurance, maintenance fees, and sinking fund contributions. These expenses add up and must be factored into your monthly budget.

A well-thought-out financial plan also considers life stages and future plans — whether you’re planning to start a family, change jobs, or invest in another property later. Overcommitting to a property that strains your finances can limit your flexibility, making it harder to cope with unexpected expenses like job loss, medical emergencies, or rising interest rates.

Engaging a financial advisor or an experienced real estate agent can help you map out your budget and ensure you have a realistic view of what you can comfortably afford. This includes understanding your loan eligibility, working out your CPF usage, and balancing your cash reserves to avoid depleting your savings.

Ultimately, financial planning gives you a clear roadmap and peace of mind, helping you make better property decisions without sacrificing your lifestyle or future goals. Being prudent at this stage ensures that your property purchase becomes a stepping stone to growing your wealth, not a financial burden.

The Importance of an In-Principle Approval (IPA)

I emphasize this because it is essential for the initial budget planning stage. Getting an In-Principle Approval (IPA) from a bank or mortgage broker should always be your first step before starting your property search.

An IPA is a pre-assessment by the bank confirming how much loan you are eligible to borrow from the bank based on your income, existing debts, and current lending rules like the Total Debt Servicing Ratio (TDSR) and Loan-to-Value (LTV) limits. This document is usually valid for up to a month, giving you clarity on your borrowing capacity and helping you plan your budget realistically.

Many buyers make the mistake of house-hunting or committing to a property before knowing how much they can actually borrow. This often leads to disappointment, stress, or even the risk of forfeiting the 1% Option Fee for resale condo (usually 1%) or 5% Booking Fee for new launch if they later fail to secure the necessary loan. With rising property prices and tightening loan regulations, an IPA acts as a financial checkpoint, ensuring you don’t waste time viewing properties outside your budget.

More importantly, having an IPA in hand strengthens your negotiating position. Sellers and agents take you more seriously when you’re a qualified buyer with a pre-approved loan. It also gives you the confidence to make timely offers without worrying about your loan approval later.

Engaging a mortgage broker or banker early in your property journey can help you compare loan packages across different banks, secure better interest rates, and advise you on the best financing structure based on your goals.

In short, the IPA is not just a formality—it is your financial safety net, helping you search with confidence and preventing costly mistakes later in the process.

Connect with me if you need a recommendation for a mortgage broker to assist you with your IPA application. It’s free of charge (FOC) and a non-obligatory check — to give you a clear picture of your loan eligibility before you commit.

Handy Checklist for Condo Buyers

Buying a private condominium in Singapore can feel overwhelming, especially for first-timers. To help you avoid missing any important steps and stay organized, here’s a handy checklist to guide you through the entire process — from planning your budget to securing the keys to your new home.

- Get Your In-Principle Approval (IPA)

- Obtain an IPA from a bank or mortgage broker to confirm your maximum loan eligibility.

- This helps you set a clear budget and shortlist properties within your means.

- Calculate Your Total Budget (Upfront & Monthly Costs)

- Factor in your downpayment (5% cash + 20% CPF/cash), Buyer’s Stamp Duty (BSD), and potential ABSD (if applicable).

- Work out your estimated monthly loan repayment, property tax, maintenance fees, and other recurring expenses.

- Start Property Hunting Based on Your Approved Budget

- Focus your search on projects and unit sizes that fit your budget and long-term needs.

- Shortlist properties with good growth potential and suitable locations.

- Make an Official Offer and Secure the Option to Purchase (OTP)

- Negotiate the price with the seller or seller’s agent.

- Once agreed, pay the 1% Option Fee to secure the OTP.

- Work Out Upfront Payment Details

- Prepare for the remaining 4% exercise fee, BSD, legal fees, valuation fees, and any other upfront costs.

- Finalize your cash and CPF breakdown for payments.

- Decide on Your Preferred Bank Loan

- Confirm the loan package you’re taking up — fixed or floating rates.

- Submit your final loan application to your chosen bank.

- Exercise the OTP at Your Law Firm and pay BSD

- Within the OTP validity period (typically 14-21 days), exercise the OTP and pay the 4% option exercise fee and BSD.

- Your lawyer will assist in this process and handle the conveyancing work.

- Wait for Legal Completion

- The entire legal process takes about 8 to 12 weeks.

- Once completed, collect your keys and officially become a proud condo owner.

Bonus Tip:

Always review your finances at every stage and consult professionals if needed. This prevents costly mistakes and ensures a smooth buying journey.

If you need help at any point or want professional recommendations — from mortgage brokers to lawyers or valuation experts — feel free to reach out to me.

Conclusion — Plan Wisely, Buy Smart

Buying your first private condominium in Singapore is a significant financial milestone, but it doesn’t have to be overwhelming if you plan wisely and understand the key numbers upfront. From calculating your affordability and understanding stamp duties to securing your loan and planning your monthly repayments, every step matters in ensuring you make a sound property decision.

I hope this guide has given you a clearer picture of the true costs involved and what it takes to comfortably own a condo in Singapore. Whether you’re buying for your own stay or future investment, it always pays to do your homework, plan your finances carefully, and avoid overstretching your budget.

Feel free to connect with me if you need guidance or want someone to walk you through the process. I’ll be happy to share my 7 Steps Framework for Identifying Low-Risk, High-Profit Potential Properties and help you confidently navigate your property journey.

I can also connect you with trusted mortgage brokers and legal partners and provide market insights—non-obligatory and free consultation—to help you make well-informed decisions.

Ready to start your property journey? Let’s develop a plan that fits your goals and budget.

5 Common Mistakes You Can Avoid When Buying a Condo in Singapore

Buying a private condominium is a big financial decision, and it’s common for first-time buyers to overlook certain important factors. Below are some of the most common mistakes you should avoid:

- Starting Your Property Hunt Without an IPA

Viewing properties or making offers without securing your In-Principle Approval (IPA) first is risky. You may end up committing to a property you can’t get the loan for — risking your Option Fee.

- Underestimating Upfront and Recurring Costs

Many buyers only focus on the purchase price and monthly loan repayments but forget about the following:

- Buyer’s Stamp Duty (BSD)

- Legal fees

- Maintenance fees

- Property taxes

- Insurance and renovation costs

These can add up significantly.

- Overstretching Budget to Buy Bigger or Nicer

Buying a property at the edge of your loan limit or savings may seem tempting, but it leaves little room for emergencies, rising interest rates, or lifestyle changes.

- Ignoring the Remaining Lease and Its Impact

Older condos with shorter leases might seem more affordable, but they may restrict loan amounts and CPF usage and affect future resale value.

- Not Aligning Property Purchase with Long-Term Plans

Failing to consider family plans, career moves, or potential upgrading later may result in outgrowing the unit or being financially stuck.

5 Frequently Asked Questions (FAQ) About Buying a Condo in Singapore

Q1: How much cash do I need to buy a $1.5 million condo?

At minimum, 5% of the purchase price ($75,000) must be in cash. You’ll also need to set aside cash for valuation fees and any CPF or Loan shortfall.

Q2: Can I use CPF to pay for Buyer’s Stamp Duty (BSD)?

Yes, but you must pay the BSD in cash first. After legal completion, you can claim the amount from your CPF Ordinary Account (OA).

Q3: What happens if the condo’s remaining lease doesn’t cover the youngest buyer until age 95?

Both the Loan-to-Value (LTV) ratio and CPF usage will be pro-rated, requiring you to pay more cash upfront. This also impacts resale value.

Q4: How long does the condo purchase process take in Singapore?

Once the Option to Purchase (OTP) is issued, the legal completion process usually takes 8 to 12 weeks.

Q5: Is it compulsory to get an In-Principle Approval (IPA)?

It’s not compulsory but highly recommended. Without an IPA, you risk losing your Option Fee if your bank loan isn’t approved.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls