Table of Contents

Is your property helping you grow your wealth—or is it just keeping you comfortable?

For many homeowners in Singapore, the property is often seen as just a place to live. But the truth is, your home can be a powerful tool to build wealth and grow your retirement capital—if you use it strategically.

In this article, I’ll debunk some of the most common misconceptions about property upgrading and show you how making smart moves now can help you secure your financial future faster than you thought possible.

The property market in Singapore has long been a reliable path to wealth creation. With strong government regulations, consistent demand, and a history of stable appreciation, real estate remains one of the most accessible ways for everyday Singaporeans to grow their wealth. Yet, many homeowners hold back from making moves that could significantly accelerate their wealth-building journey.

Why? Because they believe in common myths like “I need to pay off my HDB before I upgrade fully” or “I’ll wait for the perfect market timing.” These misconceptions often result in missed opportunities and delayed financial growth.

Many people also view their first property as a final destination rather than a stepping stone. The idea of upgrading feels daunting—after all, it means taking on a bigger mortgage, higher monthly payments, and more responsibility. But what if I told you that upgrading smartly could set you up for a more comfortable retirement and help you build Capital faster?

Think of your property as more than just four walls and a roof—it’s a financial tool. One that, when used correctly, can unlock wealth, generate passive income, and provide you with the flexibility to enjoy your golden years without worrying about finances. The sooner you start thinking this way, the better positioned you’ll be to grow your retirement capital.

This article will guide you through the misconceptions that may hold you back, the strategies that can help you upgrade smartly, and real-life examples of homeowners who have successfully grown their wealth through strategic property moves.

If you’ve ever wondered whether you’re making the most out of your property—or if upgrading is worth the risk—this article is for you.

Let’s dive in and explore how you can turn your current home into a powerful wealth-building asset.

“Your First Property Has to Be an HDB” – Why Private Property Could Be a Smarter Start

Many first-time buyers default to purchasing an HDB flat because it feels safe and affordable. Government grants, lower loan requirements, and the idea of starting small make HDBs an appealing option. After all, who wouldn’t want to take advantage of schemes like the CPF Housing Grant or the Enhanced Housing Grant? For many, it seems like the perfect stepping stone into the property market.

But here’s the truth: starting with private property (if you can afford it) can help you build wealth faster.

Let me share Samuel’s story:

When Samuel and his wife were house hunting, they had two options:

- A 4-room HDB flat in Woodlands for $450,000

- A 3-bedroom EC at Forestville for $750,000

At first, the HDB seemed like the safer bet—lower monthly payments, more government subsidies, and less financial strain. However, after calculating his affordability, Samuel realized that the EC offered better long-term appreciation potential. Even though the upfront costs were higher, the potential returns outweighed the initial investment.

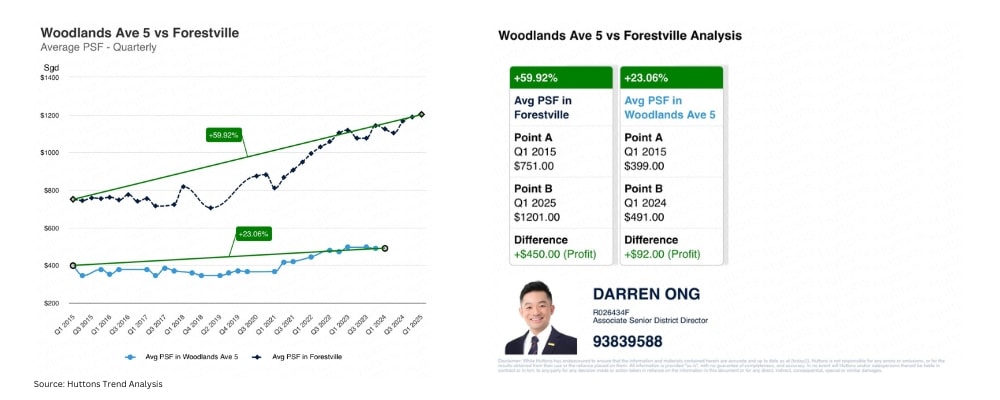

Fast forward 10 years:

- The HDB appreciated by 23%, reaching about $554,000

- The EC appreciated by 60%, hitting $1.2 million

That’s over $400,000 more in capital gains—just by starting with a property with better appreciation potential.

Why does this happen?

- Private properties and ECs often appreciate faster than HDBs because they typically offer better locations and superior facilities and attract a wider pool of buyers, driving up demand and value over time.

- ECs have a unique advantage—they are bought at a subsidized rate but become semi-private after the 5-year Minimum Occupation Period (MOP) and fully privatized after 10 years, often leading to significant appreciation.

- HDB flats, while stable, often result in lower returns due to their lower entry price, meaning the capital gains are generally smaller than higher-value private properties.

The Bigger Picture:

Starting with private property also means you may have access to more flexible financing options, better locations, and higher rental yields if you decide to rent out your property in the future. While the initial cost is higher, the long-term returns can more than make up for it.

Moreover, private properties often offer better amenities, higher potential for rental income, and greater flexibility when it comes to selling. Unlike HDBs with a 5-year MOP and various eligibility restrictions, private properties can be sold or rented out with fewer constraints, giving you more control over your investment.

Key Takeaway:

Don’t limit yourself to an HDB if you have the financial means. Starting with private property or an Executive Condo can fast-track your path to upgrading and wealth-building. While HDBs provide a great foundation for many, exploring private property options could open doors to faster capital appreciation and more significant financial growth in the long run.

“I’ll Upgrade When the Time is Right” – Why Waiting Could Cost You More

It’s a common thought: “I’ll wait for the perfect time to upgrade.” It feels logical—after all, the property market fluctuates, and no one wants to buy when prices are high. But here’s the reality: waiting for the “right time” often leads to missed opportunities and higher costs.

The truth is, there’s rarely a “perfect” time. Property markets are cyclical, influenced by various factors like interest rates, government policies, and global economic conditions. Trying to perfectly time the market is almost impossible, even for seasoned investors.

Here’s why waiting can actually cost you more in the long run:

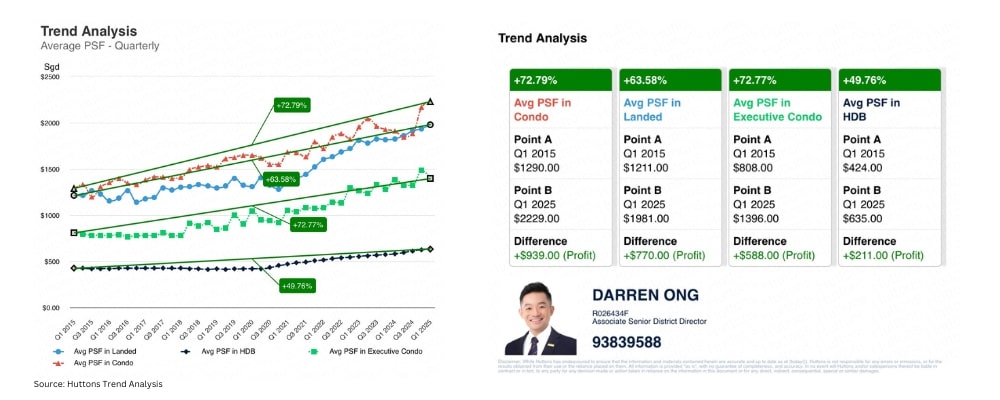

- Property prices trend upwards over time: Singapore’s property market has shown consistent long-term growth. Even during downturns, prices tend to recover and surpass previous peaks. The longer you wait, the more expensive your ideal upgrade could become.

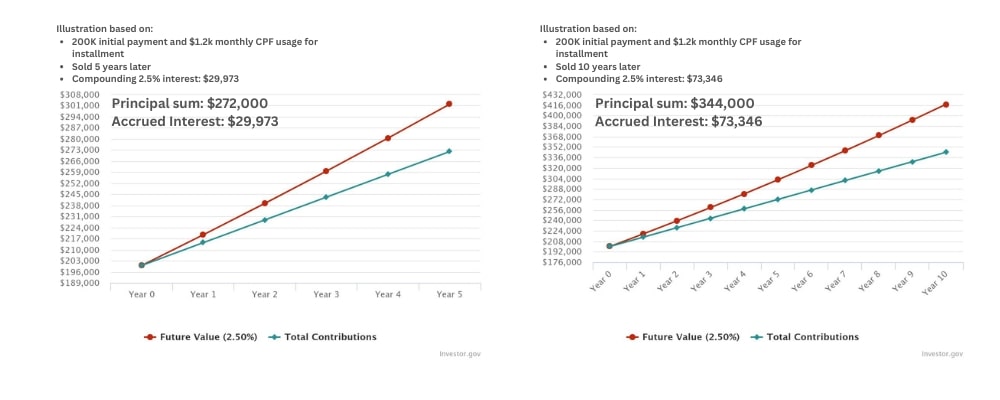

- CPF accrued interest builds up: Every dollar you use from your CPF to pay for your current property accrues interest (currently 2.5% per annum), which you’ll need to refund when you sell. The longer you wait, the more accrued interest accumulates, reducing the cash proceeds you’ll get from selling.

| Details | 5 Years | 10 Years |

|---|---|---|

| Initial Principal Sum | $200,000 | $200,000 |

| Monthly OA Usage | $1,200 | $1,200 |

| Final Principal Sum | $272,000 | $344,000 |

| Accrued Interest | $29,973 | $73,346 |

| Assumed Capital Appreciation (Woodlands Ave 5 Example) | 12% | 23% |

| Purchase Price | $450,000 | $450,000 |

| Selling Price | $504,000 | $554,000 |

| Assume No Outstanding Loan | $0 | $0 |

| Cash Proceeds (Selling Price – Final Principal Sum – Accrued Interest) | $202,027 | $136,654 |

- Loan tenures shrink as you age: Banks in Singapore typically allow home loans up to age 65. Waiting means a shorter loan tenure, which leads to higher monthly repayments and reduces your borrowing capacity.

| Details | Age 35 | Age 45 |

|---|---|---|

| Loan Tenure | 30 years | 20 years |

| Monthly Income | $14,000 | $16,000 |

| Stress Test Interest Rate | 4% | 4% |

| Loan Quantum | $1,612,851 | $1,452,192 |

Typical Example:

Mark considered upgrading in 2017 but hesitated, thinking he’d wait for the market to dip. Back then, the condo he had his eye on was priced at $1.2 million. Today, it’s selling for $1.8 million. Meanwhile, his HDB appreciated only modestly, making the upgrade significantly more expensive—not just due to the higher price but also because he now qualifies for a lower loan quantum from the bank. Had he acted earlier, he could have secured a better deal and benefited from the condo’s appreciation.

The Cost of Waiting:

- Inflation: Property prices often outpace inflation, meaning that money sitting idle in savings loses purchasing power over time.

- Opportunity Cost: While you wait, others who have upgraded are already enjoying capital appreciation and potential rental income.

Here’s a Thought: What if, instead of waiting, you made a calculated move now? Even if the market isn’t “perfect,” entering sooner means you start benefiting from appreciation and can take advantage of current loan rates and policies.

Key Takeaway:

Time in the market beats timing the market. Acting sooner often leads to better opportunities and lower long-term costs. Don’t let the fear of imperfect timing keep you from building wealth through property upgrading.

“I Need Huge Savings to Upgrade” – How Leverage Can Help You Upgrade Sooner

One of the most common misconceptions about upgrading property is the belief that you need massive savings before making a move. Many homeowners think they need to fully pay off their existing mortgage or accumulate hundreds of thousands of dollars in savings before considering upgrading. But here’s the reality: most people who successfully upgrade do so by leveraging their existing assets, not by saving a fortune.

The Power of Leverage:

In simple terms, leverage means using borrowed money to increase your potential return on investment. Property involves using a combination of your existing home equity (cash proceeds after selling), CPF savings, and a mortgage loan to finance your upgrade.

Here’s how it works:

- Unlock equity from your current property: As your property appreciates in value, the difference between the outstanding loan and the current market value becomes your usable equity. This equity can be tapped into when you sell your current property and use the cash proceeds for the next purchase.

- Use CPF savings and bank loans: For most property purchases, you can use up to 20% of your CPF Ordinary Account (OA) for the down payment, alongside a bank loan that covers up to 75% of the property price. You’ll only need to fork out 5% in cash, which, in many cases, can be covered by the current property proceeds when you sell.

- Maximize returns through property appreciation: By controlling a high-value asset with a relatively small cash outlay, you can benefit from property price appreciation over time. This amplifies your returns.

Example:

Take Sarah and David, who owned a 4-room HDB flat purchased at $450,000. After 6 years, their flat appreciated to $600,000. They sold the flat and unlocked about $250,000 in equity after settling the outstanding loan and CPF refunds.

With this equity, they bought a $1.3 million condo. They used:

- $65,000 (5%) in cash from the sales proceeds

- $260,000 (20%) from CPF and sales proceeds

- $975,000 (75%) through a bank loan

Five years later, the condo appreciated to $1.7 million, giving them an additional $400,000 in equity. Their initial cash outlay of $65,000 turned into a significant gain, resulting in an impressive 515% return on investment (ROI). This highlights the power of leverage—turning a relatively small upfront cash amount into substantial equity growth over time.

Why Leverage Works:

- Controlled risk: You’re using other people’s money (the bank’s) and your CPF savings to control a valuable asset.

- Amplified returns: Even modest property appreciation can lead to significant gains when leveraging.

Addressing the Fear of Debt: Many people fear taking on more debt when upgrading, but not all debt is bad. Using “good debt” strategically—like a mortgage on an appreciating asset—can accelerate wealth building. The key is to manage your monthly payments responsibly, ensuring they remain within your means.

Key Takeaway:

You don’t need hundreds of thousands in cash to upgrade. You can upgrade and build wealth faster by leveraging your existing assets, CPF savings, and bank financing. Don’t let the myth of needing huge savings hold you back from making smarter property moves.

“Upgrading is Just About Getting a Bigger Home” – It’s Actually About Building Wealth

Many people think that upgrading their property is simply about moving into a bigger, more luxurious home—a better view, more space, or nicer amenities. While these perks can be appealing, upgrading is about much more than just enhancing your living conditions—it’s a strategic move to grow your wealth.

The True Purpose of Upgrading:

The key to understanding the power of upgrading lies in seeing property not just as a home but as a financial tool. When used strategically, upgrading can help you unlock wealth, generate passive income, and strengthen your financial future.

Here’s how upgrading helps build wealth:

- Capital Appreciation: By moving into a property with higher growth potential, you position yourself to benefit from stronger capital gains over time. Private properties, particularly those in prime locations or new developments, tend to appreciate more than the older ones.

- Unlocking Dormant Capital: Many homeowners sit on properties that have appreciated but don’t leverage that growth. Upgrading allows you to unlock this “dormant” equity and reinvest it into a higher-growth asset, accelerating your wealth-building journey.

- Passive Income Opportunities: If you can retain your first property and rent it out after upgrading, you can create an additional income stream. The rental income you collect can help offset your mortgage on the upgraded property or serve as a source of passive income. For this, you may explore restructuring your property ownership status if you own private property to free up one name for the next purchase.

- Portfolio Diversification: Upgrading can also be a step toward building a property portfolio. Owning multiple properties provides diversification, reduces risk, and enhances long-term wealth potential.

Example:

Consider Jason and Emily, who initially bought a 4-room HDB flat for $420,000. After 7 years, the flat appreciated to $580,000. Instead of sitting on that equity, they sold the flat and used the proceeds to upgrade to a $1.4 million private condo.

Over the next 6 years, their condo appreciated to $1.85 million, resulting in a $450,000 gain. By making that strategic upgrade, they not only enjoyed living in a better home but also significantly increased their net worth.

Upgrading Is a Financial Strategy, Not Just a Lifestyle Choice:

While the idea of moving into a nicer home is exciting, it’s essential to view upgrading as a calculated financial decision. The right upgrade can offer both lifestyle improvements and substantial financial benefits.

Key Takeaway:

Upgrading isn’t just about getting a bigger or fancier place—it’s a powerful tool for building wealth. Focusing on properties with higher growth potential and making strategic moves can turn each upgrade into a stepping stone toward financial freedom.

“I’ll Wait Until I’ve Fully Paid Off My Home” – Why That Could Be Holding You Back

It’s a common belief among homeowners: “I should fully pay off my current home before considering upgrading.” On the surface, it sounds like a responsible and safe financial strategy—after all, who wouldn’t want to be debt-free? But when it comes to property investing and wealth-building, waiting to fully pay off your home could hold you back.

The Problem with Waiting:

When you focus solely on paying off your existing mortgage, you’re letting your property’s equity sit idle. This “dormant capital” could otherwise be working harder for you. Property values in Singapore generally appreciate over time, but if your equity is locked into your current home, you miss the chance to leverage it for greater returns.

Here’s Why Waiting Can Be a Missed Opportunity:

- Dormant Capital Doesn’t Grow: While your property may appreciate, the equity tied up in it doesn’t generate income or help you invest in higher-growth opportunities.

- Property Prices Will Continue to Rise: By the time you fully pay off your mortgage—often 20 to 30 years down the road—property prices may have significantly increased, making your next upgrade far more expensive.

- Lease decaying may slow down the growth of your property: While Singapore’s property market has shown consistent long-term appreciation, it’s essential to consider the individual performance of your property. Older homes, especially those with shorter remaining leases, may not appreciate as quickly—or could even face value decline over time. That’s why I often recommend lease renewal strategies, such as unlocking equity from an older property and reinvesting in a newer one with a longer lease. This strategy protects your investment and positions you for stronger capital growth in the future.

- Loan Tenure Shortens as You Age: The older you are when you finally decide to upgrade, the shorter your loan tenure will be. Banks typically cap loan tenures based on age, leading to higher monthly repayments and reducing your borrowing power, meaning lower loan quantum that you can borrow.

Example:

Let’s take Adam, who bought his HDB flat for $400,000. He focused on paying it off aggressively and succeeded after 15 years. By then, the market had appreciated, and private condos once $800,000 were now priced at $1.5 million. Despite being mortgage-free, Adam found himself priced out of many options due to the significant price increase and a shortened loan tenure based on his age and lower loan he can get.

Had Adam chosen to unlock the equity in his HDB after 7-8 years—when it appreciated to $600,000—he could have upgraded to a private condo earlier, benefiting from market growth and enjoying capital appreciation along the way.

Read more about lease decaying effect:

3 Stages of a property investment life cycle & how to identify what stage yours is in now

The Smarter Approach:

- Leverage Existing Equity: Instead of waiting, consider unlocking the equity in your current home once it has appreciated significantly. Use the proceeds to upgrade to a higher-growth property.

- Strategic Debt is Good Debt: Not all debt is bad. When managed wisely, mortgage debt on an appreciating asset can help accelerate wealth-building.

- Time in the Market Matters: The sooner you enter higher-growth property segments, the more time your investment has to appreciate.

Key Takeaway:

Waiting to fully pay off your home before upgrading might feel safe, but it can limit your wealth-building potential. By strategically unlocking your home’s equity and upgrading sooner, you can accelerate your financial growth and take full advantage of rising property markets.

“Upgrading is Too Risky” – Why Playing It Too Safe Can Cost You More

Many homeowners hesitate to upgrade because they believe it’s too risky. The thought of taking on a bigger mortgage, navigating fluctuating property markets, and dealing with the complexities of selling and buying can feel overwhelming. But here’s the thing: while upgrading carries some risks, playing it too safe could cost you more in missed opportunities.

The Real Risk? Doing Nothing:

While staying in your current home and avoiding additional debt may seem safe, this strategy can hinder your financial growth. Property markets in Singapore have shown consistent long-term appreciation, and by sitting on the sidelines, you could be missing out on significant capital gains.

Why Playing It Too Safe Can Be Costly:

- Opportunity Cost: Property values generally appreciate over time. By delaying an upgrade, you risk paying much higher prices in the future for the same type of property. Meanwhile, others who have upgraded are already enjoying capital appreciation.

- Inflation Erodes Value: Money sitting in your bank savings account loses value over time due to inflation. Instead of letting your funds sit idle, investing in an appreciating asset like property can help preserve and grow your wealth.

- Rising Interest Rates: Mortgage rates fluctuate. Delaying an upgrade could mean securing a higher interest rate and increasing borrowing costs.

- Intangible vs. Tangible Investments: While many people prefer to play it safe by keeping their money in savings accounts, stocks, or other intangible assets, property offers the advantage of being a tangible, appreciating asset. Unlike intangible investments, a property not only grows in value over time but also serves as a physical space you can live in or rent out. This dual purpose—both as a home and as an investment—makes the property one of the most stable and rewarding ways to grow your wealth while enjoying immediate, real-world benefits in Singapore.

Example:

Consider Emily and James, who debated upgrading from their HDB flat to a private condo. Concerned about market risks, they waited five years, hoping for prices to dip. Instead, property values rose, and the condo they had their eye on increased from $1.1 million to $1.5 million. Not only did they miss out on potential appreciation, but their loan options were also more limited due to rising interest rates and higher loan quantum.

Managing Risks Smartly:

- Do Your Research: Understanding the market, future developments, and location potential can help you make informed decisions.

- Secure Financing Early: Locking in lower mortgage rates and understanding your loan options can mitigate financial risks.

- Plan for Contingencies: Always set aside an emergency fund to cover unexpected costs—such as temporary housing during the transition, renovation expenses, or even sudden unemployment—to ensure you have a safety net that can tide you over.

Why Strategic Upgrading Isn’t as Risky as It Seems:

When approached thoughtfully, upgrading can be a calculated risk with significant rewards. You can minimize risks and maximize gains by leveraging existing home equity, securing favorable financing, and choosing properties with strong growth potential.

Key Takeaway:

Upgrading carries some risks, but playing it too safe can lead to missed opportunities and limited financial growth. It’s important to remember that all types of investments—whether in stocks, bonds, or even savings—carry some level of risk. However, property stands out as a tangible asset, providing greater stability and security than more volatile investments.

With proper planning and a strategic approach, upgrading can be a powerful financial tool to help you accelerate your wealth-building journey while balancing potential risks and rewards.

Oh ya, and for those who haven’t purchased your first property yet—what are you waiting for? Owning your first home isn’t just about having a roof over your head; it’s one of the most powerful ways to build wealth and secure your financial future. Start early when you still have financial flexibility—it’ll make a huge difference down the road!”

“I Don’t Want to Overcommit” – How to Upgrade Smart Without Overstretching

One of the biggest concerns homeowners have about upgrading is the fear of overcommitting financially. It’s understandable—no one wants to end up “house poor,” where most of your income goes into mortgage payments, leaving little for other expenses or savings. But here’s the good news: upgrading smartly without overstretching your finances is entirely possible.

The Fear of Overcommitting:

For many, the idea of taking on a larger mortgage is daunting. They worry about higher monthly repayments, unexpected expenses, or potential changes in income. However, upgrading doesn’t have to mean living paycheck to paycheck or sacrificing your lifestyle.

Here’s How to Upgrade Smart Without Overstretching:

- Set a Realistic Budget: Banks may approve you for a larger loan, but that doesn’t mean you should max out your borrowing capacity. It’s always wise to keep your monthly mortgage repayments within or slightly below the limits set by MAS regulations. At the time of writing, MAS guidelines cap the Mortgage Servicing Ratio (MSR) for HDB purchases at 30% of your gross monthly income and the Total Debt Servicing Ratio (TDSR) for private properties at 55%. Staying comfortably within these limits ensures you’re not overstretching your finances and leaves room for other expenses and savings. Additional costs include property taxes, monthly conservancy charges (for HDB), maintenance fees (for condos), and insurance.

- Utilize CPF Wisely: In Singapore, you can use your CPF Ordinary Account (OA) savings to pay for your home’s down payment and monthly mortgage installments. This reduces your cash outflow and makes monthly payments more manageable.

- Choose the Right Loan Package: Opt for mortgage packages that align with your risk appetite. Fixed-rate loans provide stability with consistent monthly payments, while floating-rate loans may offer lower initial rates but can fluctuate over time. The good news? Once the lock-in period ends, you can reprice or refinance your loan if interest rates rise too high, giving you flexibility to manage your mortgage more effectively.

- Build a Financial Buffer: Always set aside an emergency fund—ideally, 6-8 months of living expenses and mortgage payments. This ensures you’re covered in case of unexpected events like job loss or medical emergencies.

- Consider Dual-Income Strategies: If you’re upgrading with a partner, structure the mortgage so that it aligns with both incomes to maximize your loan eligibility and manage repayments effectively. Some couples explore a strategy known as “decoupling”, where one spouse sells their share of the existing property to the other (remaining owner), freeing up the outgoing owner’s name to purchase another property as the first property under the freed-up name without incurring Additional Buyer’s Stamp Duty (ABSD). However, it’s important to note that decoupling is only applicable to private properties due to HDB regulations, which do not allow ownership restructuring in the same way.

Caution: While this strategy can help couples build a property portfolio, it should only be considered if both partners have stable incomes and are not financially overstretched. Managing two mortgages comes with increased responsibility, so ensure you’re financially prepared before executing this plan.

Example:

Daniel and Lisa were concerned about overcommitting to upgrade from their 4-room HDB to a $1.4 million condo. They structured their finances carefully:

- Used $80,000 in sales proceeds and $320,000 from CPF for the down payment.

- Opted for a fixed-rate mortgage to keep monthly payments predictable.

- Kept their mortgage at 45% of their combined income.

- Maintained an emergency fund of $50,000 for added security.

With this plan, they upgraded comfortably without sacrificing their lifestyle.

Key Takeaway:

Upgrading doesn’t have to mean financial strain. By planning carefully, setting realistic budgets, and utilizing tools like CPF and strategic loan packages, you can upgrade smartly without overstretching your finances. It’s all about making informed decisions and ensuring your home remains a source of financial growth—not stress.

Conclusion – Start Growing Your Retirement Capital Through Owning Property and Smart Upgrading

Upgrading your property isn’t just about getting a bigger or nicer home—it’s about making strategic moves that can significantly help you accelerate your path to financial freedom. Throughout this article, we’ve explored how property can serve as a powerful tool for wealth-building, helping you grow your retirement capital faster and more effectively.

The key takeaway? Smart upgrading is about timing (as early as possible), leveraging smartly, and execute strategic planning. It’s about recognizing opportunities and making calculated decisions that position you for long-term financial success.

Why Smart Upgrading Matters:

- Property as a Wealth-Building Tool: In Singapore’s robust real estate market, property isn’t just a place to live—it’s a valuable, appreciating asset. By upgrading strategically, you can unlock greater capital appreciation and fast-track your journey toward financial freedom.

- Leveraging to Multiply Returns: Strategic use of leverage—through CPF savings, bank loans, and unlocked equity—allows you to control higher-value assets without needing to save massive amounts of cash. This accelerates your wealth-building journey.

- Maximizing Time in the Market: The longer you delay upgrading, the more opportunities you miss. Property prices generally trend upwards over time, and waiting often results in paying more for the same asset later.

- Avoiding Common Pitfalls: Many homeowners fall into the trap of waiting too long, overcommitting, or playing it too safe. As we’ve discussed, each of these strategies carries risks—whether it’s missing out on appreciation, limiting borrowing capacity due to age, or holding onto dormant Capital.

Your Next Move:

If you’ve been holding back on upgrading—whether out of fear, misconceptions, or uncertainty—it’s time to reconsider. Smart upgrading isn’t about taking reckless risks; it’s about making informed decisions that align with your financial goals.

- Evaluate Your Current Property: Is it appreciating at a rate that helps you build wealth? If not, consider an upgrade.

- Understand Your Financial Standing: Work out your budget, loan eligibility, and CPF balances to see how you can smartly structure your next property purchase.

- Plan for the Future: Think about your long-term goals. Are you looking to build a property portfolio? Generate passive income? Secure a fully paid retirement home?

Haven’t Bought Your First Property Yet? Here’s Why You Should Start Now:

If you’re still waiting to purchase your first property—or living with your parents—you could use this perfect opportunity to start taking action to invest in real estate without rushing to move out. Owning a property isn’t just about having your own space—it’s a powerful tool to build wealth and grow your retirement capital.

For those staying with family, there’s a unique advantage: you can buy your first private property and rent it out to collect passive income while still living rent-free. If you opt for a new launch condo, you could enjoy potential capital appreciation over the next few years without the immediate need to manage tenants (since it’s still under construction), giving you time to plan your next move strategically.

Starting early lets you maximize time in the market, benefit from property appreciation while building equity, and even use rental income to offset mortgage costs. Entering the market sooner gives you more flexibility and options for future upgrades, investments, or rental opportunities.

Don’t wait until rising prices, tighter loan restrictions, or life circumstances limit your options. The sooner you act, the sooner you can put your money to work and begin your journey toward long-term financial freedom. Take advantage of this phase in life, start building your property portfolio, and let your first home be the foundation of your wealth-building journey.

Before I wrap up, here’s what I want to leave you with: Building retirement capital through property isn’t just a dream—it’s a completely achievable goal with the right strategy. By understanding the market, leveraging your assets, and making timely upgrades—or even taking that first step into property ownership—you can set yourself up for a strong financial future that supports your retirement goals.

The best time to start is now. The sooner you make your property work harder for you, the faster you’ll reach your financial milestones.

If this article has sparked some ideas or questions about your property journey, I’m here to help. Let’s discuss your options, explore potential upgrades, and craft a strategy tailored to your goals.

Connect with me today, and let’s start growing your retirement capital through owning property and smart upgrading.

P.S. If you found this guide helpful, feel free to share it with friends or family who might also benefit from these insights.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls