Table of Contents

How Investors Reduced or Avoided ABSD When Buying a Second Property

To manage the housing market in Singapore, certain regulations have been established, such as the Additional Buyer’s Stamp Duty (ABSD), Total Debt Servicing Ratio (TDSR), and Loan to Value (LTV). These regulations are expected to remain in place.

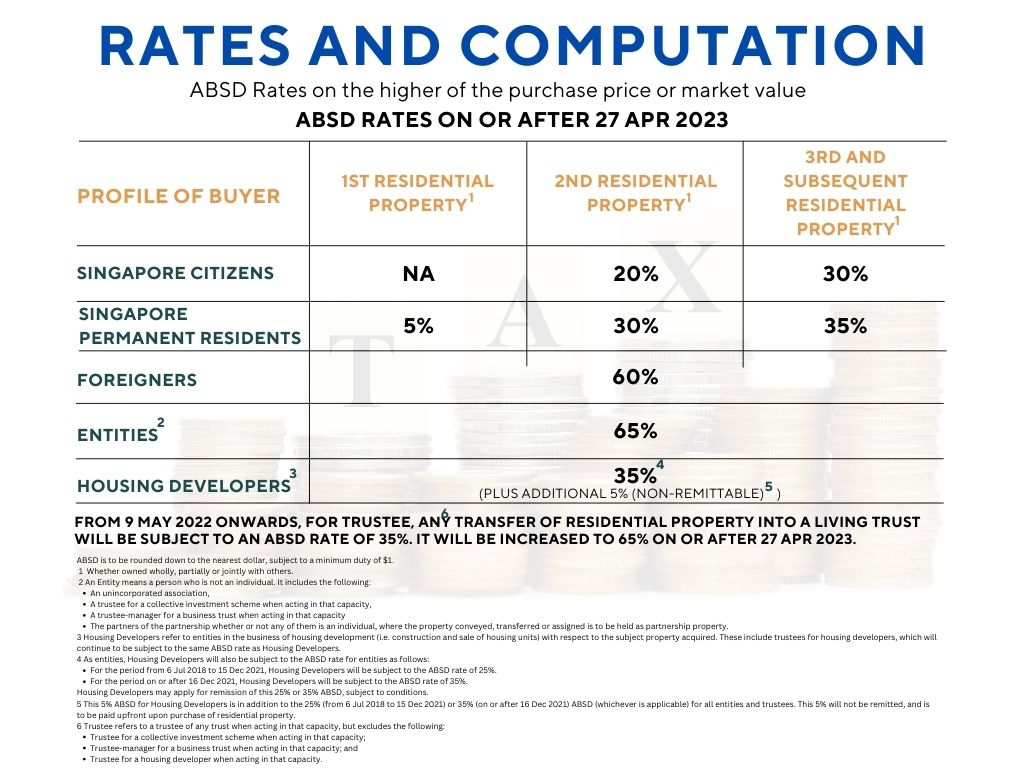

From July 6, 2018, the ABSD for Singaporeans purchasing a second residential property increased to 12%, and later rose to 17% on December 16, 2021. More recently, from April 27, 2023, it was raised to 20%. ABSD is an extra tax that homebuyers need to pay in addition to the standard Buyer Stamp Duty (BSD). Singaporeans are subject to this tax when buying a second or subsequent residential property, while permanent residents and foreigners are taxed on the first residential property they acquire in Singapore.

Here’s a quick overview of the ABSD rates:

With the cooling measures in place, many homeowners find it harder to start investing in a second property in Singapore’s current real estate market.

There are a few ways to reduce costs or avoid ABSD. Beside Sell One Buy Two concepts, there is another method many have heard of is by decoupling. Let’s explore more about this option with some case studies.

A decoupling method, in layman’s terms, means one of the owners (owner A) buys over the other owner’s (owner B) total share of the existing property, which is sometimes referred to as “part-purchase.”

This method not only allow you to retain your current private property under Owner A name, it also free up owner B to purchase another property at NO or reduced ABSD depending on their citizenship and the number of properties owned.

Type of Property Prerequisites For Decoupling

HDB (Public Housing)

Not all property type is eligible for decoupling. One example is a married couple that owns the HDB flat. In HDB terms, it’s referring to resale part-share or Change in Flat Ownership (Not Through a Sale).

According to HDB, resale part-share is only allowed for transfer between “parents and children” or “buying over ex-spouse’s share.”

As such, most HDB owners left with the option of selling HDB before they free up both names to buy two properties under one each.

If you would like to know more about the feasibility of selling your HDB and buy two properties under one name each, you may contact me over a non-obligatory friendly sharing session.

Private Residential Property

Generally, as of today’s rules, decoupling is still allowed on the private residential property without much restriction but does make sure all parties involved are financially stable and not going bankrupt.

CASE STUDY

To make it easier to understand, let take a look at the following case study.

Case Study 1: Private Condominium Home-owner Profile:

- Mr. and Mrs. Lee intend to buy one more private property for investment in 2022.

- Mr. and Mrs. Lee, both Singaporean jointly owe equal shares on their current property (first and only property)

- Assuming Mrs. Lee’s monthly income is eligible for a maximum of 75% LTV (loan to value) for decoupling.

Decoupling Method:

Property decoupling in Singapore has become a popular strategy for homeowners and investors looking to manage their property portfolios and minimize Additional Buyer’s Stamp Duty (ABSD). Decoupling involves transferring the ownership of a jointly-owned property to a single owner, allowing the other party to purchase another property as their first home, thereby avoiding the hefty ABSD on second properties. This approach is particularly advantageous in the current market, where savvy buyers are keen on optimizing their investments while adhering to government regulations. Understanding the intricacies of property decoupling can provide significant financial benefits and enhance long-term property investment strategies.

- Mr. Lee to Sell his 50% to Mrs. Lee

- Current Property Valuation: $1.2mil

- Existing Housing Loan: $650,000

- CPF utilization with accrued interest:

- Mr. Lee’s: $200,000

- Mrs. Lee’s: 150,000

- CPF OA balance:

- Mr. Lee’s: $100,000

- Mrs. Lee’s: $250,000

| Remark | ||

|---|---|---|

| Selling Price | $600,000 | 50% of $1.2m property valuation |

| Loan Redeemed | $325,000 | 50% of $650k outstanding loan |

| CPF Refund | $200,000 | |

| Cash Proceed | $75,000 |

| Remark | ||

|---|---|---|

| Refinance 50% of Existing Loan | $325,000 | 50% of $650k outstanding loan |

| Buying Price | $600,000 | 50% of $1.2m property valuation |

| – Option Fee | $30,000 | 5% of Purchasing Price |

| – Down-payment | $120,000 | 20% of Purchasing Price |

| – Buyer’s Stamp Duty | $12,600 | |

| – Legal Fee | $5,500 +/- | |

| – New Loan | $450,000 | 75% of Purchasing Price |

| Total Housing Loan | $775,000 | $325,000 + $450,000 |

| Total CPF Needed | $138,100 | $120,000 + $12,600 + $5,500 |

| Total Cash Needed | $30,000 | 5% Option Fee |

Since it’s her first residential property, there is no ABSD payable.

The legal fee for decoupling will be involved in sale and purchase, which usually is in the range of $5,500 to $6,000 as it requires two legal firms acting for buyer and seller, respectively.

During the legal completion day of the decoupling process, the disbursement is as following:

- The new bank will disbursement a total of $775,000:

- $650,000 to redeem existing bank’s loan in full

- $125,000 to pay back Mr. Lee’s CPF

- Buyer CPF fund $120,000 + initial deposit $30,000

- $75,000 to pay back Mr. Lee’s CPF (release from Mrs. Lee CPF account)

- $45,000 from CPF (release from Mrs. Lee CPF account)

- $30,000 in cahier’s order from the buyer as the initial deposit

- The new bank will disbursement a total of $775,000:

In decoupling, the most crucial part is on the buyer side as the available CPF fund and new housing loan that he/she can secure will determine how much upfront cash they need standby before they proceed to do the decoupling.

For the above case study, Mrs. Lee has enough funds from her CPF OA and able to secure 75% LTV for the housing loan. The upfront cash needed is only $30,000.

After completing decoupling, Mr. Lee is now free to proceed to purchase the next property without incurring ABSD.

Let take a look at the different option if Mr. and Mrs. Lee proceed to buy with or without decoupling and the cost involved.

Option 1: Went ahead to buy second property at $1mil without decoupling.

Mr. Lee is considered purchasing a second property. As a Singaporean, he is liable to 17% Additional Buyer’s Stamp Duty (ABSD) on top of the Buyer’s Stamp Duty (BSD) back in 2022. If he will to buy after 27 April 2023, it will be 20% ABSD.

As he is still servicing his first property housing loan, it is considering taking up a second housing loan, which limits him to 45% LTV. However, he can do a restructuring to his first housing loan to free up himself up so that he can take up a maximum loan of 75% for the purchase.

- Buyer’s Stamp Duty (BSD) Payable: $24,600

- Additional Buyer’s Stamp Duty (ABSD): $170,000

- Total Stamp Duty (BSD + ABSD): $194,600

Option2: DECOUPLE FIRST before second property purchase at $1mil.

Mr. Lee is considered purchasing the first property after the decoupling process. Thus ABSD is not payable.

- Buyer’s Stamp Duty (BSD) Payable: $24,600

- Total costs Stamp Duty (BSD) for second property: $24,600

If executing option 2, total stamp duty payable will be from decoupling and purchasing second property will be:

- Decoupling ($12,600) + second property ($24,600) = $37,200

Sell Current Co-Owned Property First and Buy Two Properties, One Under Each Name

You may refer to the following article for more details for this option.

Navigating Through Asset Progression in Singapore’s Property Market

In summary

Although option one is paying a lesser legal fee (one purchasing only), the Stamp Duty is higher due to ABSD incur.

On the other side, option two need to pay a slightly high legal fee (Decoupling + 2nd property purchase), but Stamp Duty is lower.

But not all property works well with decoupling that will results in minimum Stamp Duty payable.

It all depends on the property value between your existing property and the property that you are going to purchase.

In general, decoupling should work well if your current property value is lower than the property that you are buying or almost similar value.

Some other factors that result in higher cost when using decoupling method are:

- When one of the parties is Singapore PR or foreigner, or

- The part-share property is still within Seller’s Stamp Duty holding period.

Lastly, my advice is to get a real estate professional to help you determine whether decoupling work the best for you or is there a better option available that suit you best.

Please drop me a note for a non-obligatory friendly discussion in person so that I can advise you in detail which method may suit you best.

Other related media coverage:

Get the Right Help for Your Property Deal

Making decisions about property investment and financial planning can be challenging, but you don’t have to do it alone. Whether you’re considering using the first time buyer or season investors, depending on your situation, getting expert advice can make things much clearer and easier.

I’m here to offer personalized help and information that fits your situation. I can assist you in understanding Singapore’s housing market better, helping you with your financial decisions and property plans.

If you’re looking for guidance or have questions about your property deal, connect with me today. I’m ready to help you make informed choices and support you in achieving your property goals in Singapore.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls