Table of Contents

How to Upgrade When My HDB Reached Minimum Occupation Period (MOP)

Reaching the Minimum Occupation Period (MOP) for your HDB flat is a significant milestone that opens up new possibilities for many Singapore homeowners. The MOP, typically a five-year period during which homeowners are required to live in their flats, is designed to ensure stability in Singapore’s public housing market. Once you’ve successfully completed this period, you gain the freedom to sell, rent out, or upgrade your property—offering exciting opportunities to enhance your lifestyle, improve your family’s comfort, or even secure a better investment for your future.

Many homeowners approach this stage with mixed emotions—excitement for new beginnings, coupled with understandable uncertainty about the next steps. You might be wondering if it’s the right time to upgrade your property, how to smoothly handle the financial transition, or whether upgrading will truly benefit your family in the long term. Questions such as “should I upgrade from HDB to condo?” or “how does upgrading impact my finances and lifestyle?” are common and valid.

In this comprehensive guide, I’ll address all these concerns clearly and practically, without overwhelming jargon. I’ll explore various options, including upgrading to Executive Condominiums (EC) or private condominiums, highlighting key factors such as financial readiness, timelines, and potential pitfalls. My goal is to provide genuine, relatable insights to make your upgrading journey comfortable and informed. Let’s walk through this exciting new phase of your homeownership journey together.

Understanding the HDB Minimum Occupation Period (MOP)

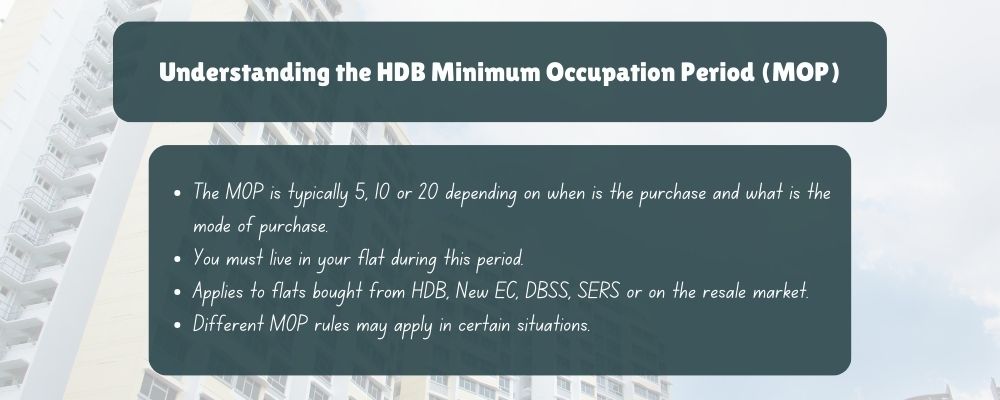

The Minimum Occupation Period (MOP) is a mandatory requirement imposed by the Housing Development Board (HDB) on all homeowners who purchase an HDB flat. Usually set at five years, the primary objective of the MOP is to encourage genuine home ownership and prevent speculative property purchases that can destabilize the housing market.

During this MOP, you’re required to physically occupy your HDB flat and cannot sell or fully rent it out. However, renting out individual rooms within your flat is permitted. This restriction ensures that flats remain accessible primarily to genuine homeowners rather than investors, thus promoting community stability and cohesion.

Completing your MOP signifies that you’ve fulfilled your obligations as a homeowner. It officially grants you the flexibility to make decisions about your property—whether selling it to upgrade to a larger or better-situated home, renting it out for additional income, or keeping it as your long-term family home for personal occupancy.

Understanding the details and significance of the MOP can help you plan effectively for your future property goals. Whether you’re considering a move due to family expansion, career opportunities, or financial planning, knowing the exact date your MOP concludes will enable you to strategize and optimize your property decisions for maximum benefit.

Moreover, being aware of the MOP guidelines helps prevent accidental violations, which could lead to financial penalties or administrative complications. Thus, fully grasping the concept of the MOP and its implications is essential as you approach this critical stage in your homeownership journey.

HDB Minimum Occupation Period (MOP) By Mode of Purchase

| Mode of Purchase | Minimum Occupation Period (MOP) |

|---|---|

| Flat bought directly from HDB | 5 years (Standard/Unclassified flats); 10 years (Plus/Prime flats) |

| Flat bought under DBSS from developer | 5 years |

| Flat bought under SERS announced before 7 Apr 2022 (Replacement site) | Either 7 years from selecting flat, or 5 years from collecting keys (whichever first) |

| Flat bought under SERS announced before 7 Apr 2022 (Other site) | 5 years from collecting keys |

| Flat bought under SERS announced on or after 7 Apr 2022 | 5 years from collecting keys |

| Resale flat bought from open market | 5 years (Standard/Unclassified flats); 10 years (Plus/Prime flats) |

| Flat bought under Fresh Start Housing Scheme | 20 years |

Assessing Your Financial Readiness

Assessing your financial readiness is a crucial step before deciding to upgrade from your HDB flat. To start, calculate the potential cash proceeds from selling your current flat. This calculation should factor in your outstanding housing loan, resale levy (if applicable), legal fees, agent commission fees, and importantly, the refund of CPF savings utilized for your current flat along with the accrued interest. Subtracting these costs from the potential selling price gives you a clear picture of how much cash you’ll have available for your next property.

Next, carefully evaluate your CPF savings. Your CPF Ordinary Account (OA) funds can significantly ease the financial burden of purchasing your next home, as these funds can be used for down payments and servicing monthly housing loans. If your current home wasn’t a BTO directly purchased from HDB or if you didn’t previously apply for a housing grant when purchasing a resale flat, you may review your housing grant eligibility if you decide to upgrade to a larger HDB flat. However, if you’re upgrading to a private property, housing grants aren’t available unless you’re purchasing a brand-new EC as a first-timer.

Understanding your Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR) is equally important. The TDSR limits your total monthly debt obligations to 55% of your gross monthly income, while the MSR restricts your monthly mortgage repayments to no more than 30% of your gross monthly income for HDB flats and ECs. Knowing these ratios will help you determine how much you can comfortably borrow without overstretching your finances.

Lastly, remember to account for additional expenses associated with upgrading, such as renovation costs, stamp duties, legal fees, and potential temporary housing costs if your next home isn’t immediately ready for occupation. Thorough financial planning at this stage helps ensure that your upgrade process is smooth, financially manageable, and stress-free, ultimately allowing you to enjoy your new home comfortably.

Exploring Your Property Upgrade Options

When considering upgrading from your HDB flat, several attractive options become available. Executive Condominiums (ECs) and private condominiums are the most common choices among homeowners. ECs are hybrid developments designed for Singaporeans, offering the benefits of both public and private housing. Initially more affordable than fully private condos, ECs become fully privatized after ten years, providing potential for significant property value appreciation. Current market prices for brand-new ECs typically start from around $1,650 per square foot (psf).

However, it’s important to note that ECs are subject to the Mortgage Servicing Ratio (MSR), limiting monthly repayments to 30% of your gross monthly income. This can lower your loan quantum compared to private condominiums, which are assessed by the Total Debt Servicing Ratio (TDSR), allowing repayments up to 55% of your income. Additionally, ECs require you to fulfill another Minimum Occupation Period (typically five years) before you can sell or rent out the entire unit.

Here’s a quick comparison based on a monthly income of $16,000, a 30-year loan tenure, and an interest rate of 4%:

| Property Type | Monthly Income | Monthly Repayment | Loan Quantum |

|---|---|---|---|

| Executive Condominium (MSR 30%) | $16,000 | $4,800 | ~$1,005,000 |

| Private Condominium (TDSR 55%) | $16,000 | $8,800 | ~$1,843,000 |

Private condominiums generally start from about $2,100 psf in similar areas within the Outside Central Region (OCR). Within the private condo category, you have several options: resale condominiums, resale ECs (which have fulfilled their initial 5-year MOP and are eligible for sale), and brand-new condos purchased directly from developers.

Consider your personal needs, lifestyle preferences, proximity to schools and workplaces, and future growth potential when making your decision. Ultimately, your choice should align with your financial comfort level, future aspirations, and long-term goals.

Steps to Sell Your HDB and Buy a New Home

Selling your existing HDB flat and upgrading to a new property involves several critical steps that require careful coordination and planning. Here’s how you can smoothly navigate this important transition:

- Financial Planning and Loan Approval:

Before starting the selling process, secure financing for your next property. Engage banks or mortgage brokers to obtain in-principle approval (IPA) for your loan, clearly outlining how much you can borrow. This step provides clarity and confidence when shortlisting your next home. If financing is not feasible, it may not be practical to proceed with selling. - Intent to Sell Submission:

Submit your Intent to Sell through the HDB Resale Portal. This is a mandatory step before marketing your flat and must be completed at least seven days before granting the Option to Purchase (OTP) to a buyer.

- Preparation and Valuation:

Get your flat professionally evaluated to determine its current market value. Engaging an experienced property agent can help you accurately price your flat based on recent transaction data and market trends. Preparing your home by decluttering, deep cleaning, or minor renovations can significantly enhance its appeal to potential buyers. - Marketing and Listing Your Flat:

Choose an experienced agent to market your flat effectively. Professional photography, virtual tours, and engaging listings on property portals can significantly boost your flat’s visibility. Ensure all essential documentation, like proof of ownership and necessary approvals from HDB, is readily available to facilitate a smoother transaction. - Negotiation and Offer Acceptance:

Once offers start coming in, carefully review each proposal. Consider not just the offered price but also the buyer’s financing readiness and timeline flexibility. Your agent will negotiate on your behalf, helping you secure the best possible deal that aligns with your upgrading plans. - Selecting and Purchasing Your New Home:

With financing clarity and a secured buyer for your existing flat, actively begin viewing and selecting your new property. If you want to avoid paying Additional Buyer’s Stamp Duty (ABSD), it’s safer to wait until your HDB buyer exercises your HDB OTP before securing your next home’s OTP. Your agent should also conduct thorough market research to ensure that the property you are considering is performing well, avoiding any properties that may underperform. Evaluate options carefully based on location, amenities, future growth, and pricing. - Submit HDB Resale Application:

Once both parties have signed the OTP, submit your HDB resale application through the HDB Resale Portal, along with the necessary supporting documents. Await HDB’s acceptance, endorsement, and Sale & Purchase (S&P) approval notification. - Legal Processes and Timeline Management:

Engage a solicitor to handle all legal documentation, from the sale of your HDB flat to the purchase of your new home. Timeline management is particularly crucial here, not just for coordinating moving dates but also for ensuring timely handling of financial transactions (fund in and out timelines). Coordinate closely with your agent and solicitor to minimize any transitional stress or unnecessary expenses. - Completion and Moving:

Upon completion of legal formalities and transactions, finalize your moving plans. Schedule renovations, if necessary, at your new property, and plan your moving day carefully. Proper coordination at this stage ensures you settle comfortably into your new home without unnecessary delays or stress.

- Financial Planning and Loan Approval:

By systematically following these steps, you can confidently manage the sale of your existing HDB flat and the purchase of your new home, making your upgrading journey smoother and more rewarding.

Maximizing Your Property Investment

When upgrading your property, it’s essential to not only focus on immediate lifestyle improvements but also on maximizing your long-term property investment. Here are some practical strategies to help you achieve this goal:

Choose Properties with Strong Growth Potential:

Look for properties in areas undergoing or planned for significant development and infrastructure improvements, such as new MRT lines, commercial hubs, schools, or amenities. Such developments typically boost property values and make your investment more attractive to future buyers or tenants.

Research and Understand Market Trends:

Regularly stay informed about property market trends, including fluctuations in supply and demand, interest rate changes, government cooling measures, and economic outlook. Being knowledgeable about these factors helps you make informed decisions, allowing you to purchase at optimal times.

Consider Rental Yield and Capital Appreciation:

Evaluate both the potential rental income and long-term capital appreciation when selecting your new property. Properties with a good balance of these factors provide a steady passive income stream and ensure that your asset appreciates over time.

Buy Properties that Appeal Broadly:

Properties with universal appeal—such as being near good schools, transport networks, or essential amenities—tend to attract a wider pool of potential buyers or tenants. This broader appeal enhances the property’s marketability, making it easier to sell or rent in the future.

Evaluate the Property's Condition and Renovation Potential:

Choose properties in good structural condition or those that only require minor renovations. While renovating can add value, extensive repairs can drain your resources. If renovating, opt for improvements that meaningfully increase property value without overly inflating your budget.

Diversify Your Investment Portfolio:

If financially feasible where you and your spouse is executing the sell 1 buy 2 strategy, consider diversifying your property investments geographically across different regions in Singapore. Diversification reduces your overall investment risk and enhances opportunities for growth and returns.

Leverage Professional Advice:

Engage reliable property agents, financial advisors, and legal professionals to ensure that your property investments are well-informed and strategic. Expert advice can significantly enhance the effectiveness of your investment decisions.

By thoughtfully applying these strategies, you can effectively maximize your property investment, balancing short-term benefits with long-term financial security and wealth accumulation.

Real-Life Success Stories from My Clients

Learning from real-life examples can offer valuable insights and inspiration for homeowners planning to upgrade. Here are some relatable success stories from my own clients who successfully transitioned from their HDB flats to upgraded properties:

Upgrading from Resale HDB to a Brand-New Executive Condo:

My client sold their 5-room resale HDB flat, successfully cashing out $145,000. They reinvested the proceeds to buy a brand-new 3-bedroom Executive Condominium (EC) priced at $780,000. Today, their EC investment has appreciated significantly, with a current market valuation of around $1.21 million, highlighting the substantial financial benefits of their strategic upgrade.

Selling a HDB BTO Flat to Purchase Both a Resale Condo and a New Launch Condo:

Another client cashed out over $290,000 from their 4-room HDB BTO flat sale. They strategically reinvested in a 2-bedroom, 2-bathroom new launch condominium, later selling it at Temporary Occupation Permit (TOP) to realize a profit of $210,000. Simultaneously, they purchased a resale private condominium at $1.57 million for their own stay. The resale condo has since appreciated significantly, now valued at approximately $2.3 million, illustrating their well-calculated property investment approach.

Upgrading from a 5-Room HDB Flat to a Resale Private Property:

A client upgraded by cashing out over $200,000 from their 5-room HDB flat. They invested in a resale private condominium at a purchase price of $1.7 million, which has proven to be highly rewarding, with the property’s current market valuation approximately $3.048 million. This example emphasizes the strong appreciation potential and financial rewards of strategically chosen resale private properties.

These real-life scenarios highlight the importance of careful financial planning, timely market decisions, and strategic property selection. By learning from these successful examples, you can confidently approach your upgrading journey, aiming for both enhanced lifestyle quality and significant financial growth.

Common Mistakes to Avoid When Upgrading

When upgrading your property, it’s essential to be aware of common pitfalls to ensure a smooth and beneficial transition. Here are several mistakes homeowners frequently make and tips on how to avoid them:

Inadequate Financial Planning:

Many homeowners underestimate the total costs involved in upgrading. Beyond the purchase price, there are renovation expenses, agent commissions, legal fees, stamp duties, temporary accommodation costs, and potential moving costs. It’s crucial to meticulously plan and allocate funds to each of these expenses to avoid financial strain.

Misjudging Property Market Timing:

Timing the market perfectly is difficult, yet many homeowners attempt it, potentially leading to unfavorable outcomes. Rather than speculating on short-term market fluctuations, focus on your long-term goals and select properties that match your financial ability and personal needs. Consulting an experienced property agent can help you understand market cycles better and guide you in making informed decisions.

Not Checking Financing Early:

Always secure bank In-Principle Approval (IPA) first to ensure you have clear financial boundaries and avoid last-minute financial complications. Without verifying financing early, homeowners might face unexpected challenges, potentially jeopardizing the entire upgrading process.

Ignoring Property Performance and Future Potential:

Buying a property solely based on personal preference without researching its historical performance and future potential can be risky. Always work closely with your agent to analyze transaction histories, growth patterns, and future development plans in the area. Avoid properties with poor historical performance or uncertain growth prospects.

Underestimating Timeline Coordination and Fund Flow:

Proper timeline management is crucial, not only for coordinating moving dates but also to ensure your sales proceeds and CPF savings refund are received in time to complete your next property purchase. Mismanaging fund flow timelines can lead to stressful and costly situations. Consider options like a bridging loan from banks to manage short-term financing gaps effectively. It’s also essential to time the selling and buying OTP exercise dates correctly to avoid incurring Additional Buyer’s Stamp Duty (ABSD); the purchase exercise date must come after the selling exercise date.

Understanding ABSD Remission and Refund for Married Couples:

Only Singaporean married couples are eligible for ABSD refund if they jointly purchase their next property before selling their existing property. To qualify, the existing property must be sold within 6 months after purchasing the next property. Importantly, this refund only applies if both spouses’ names are included in the purchase of the new property. If the property is bought under a single spouse’s name, ABSD refund is not applicable.

However, if the purchase OTP exercise date occurs after the selling OTP exercise date, ABSD is not payable regardless of whether the next property is purchased using a single name or joint names.

Overstretching Your Budget:

Falling in love with a dream property is easy, but it is vital to remain realistic about your financial limits. Overextending your finances can significantly impact your quality of life. Always stay within your predetermined budget, accounting for possible interest rate hikes or other unexpected financial commitments.

Not Considering Future Resale Value:

Even if you plan on staying in your upgraded property for the long term, circumstances may change, and you might eventually sell your home. Thus, always consider factors that influence resale value, such as location, amenities, nearby developments, and connectivity.

By being mindful of these common pitfalls and proactively addressing them, you can ensure your upgrading journey is not only successful but also smooth and rewarding.

Frequently Asked Questions (FAQs) About Upgrading

Navigating the property upgrading journey can raise many questions. Here are some common queries homeowners often ask when considering upgrading:

When is the best time to upgrade after fulfilling my MOP?

While there is no definitive “best” time, generally, the ideal moment to upgrade is when you are financially ready, have clear property goals, and the market conditions support your upgrading plans. Additionally, property prices in Singapore generally trend upward, meaning entering the market earlier can help you avoid being priced out in the future. It’s also important to consider your age, as a shorter loan tenure can impact your loan quantum, potentially creating obstacles for upgrading.

Can I buy private property while still owning my HDB flat?

Yes, but doing so will incur Additional Buyer’s Stamp Duty (ABSD), significantly increasing your purchase cost. If avoiding ABSD is crucial, it’s advisable to sell your HDB flat first before purchasing your new property.

What is the difference between Executive Condominiums (ECs) and private condominiums?

ECs start as public housing with certain restrictions, including a Minimum Occupation Period (MOP). After ten years, ECs fully privatize. Private condominiums have no such restrictions from the start and typically offer broader amenities and flexibility, but usually at higher prices.

Can I use CPF savings to finance my new property?

Yes, CPF Ordinary Account (OA) savings can be used for the down payment and ongoing mortgage repayments for your next property, subject to CPF usage limits.

How can I ensure I do not overstretch my finances when upgrading?

Always obtain a bank In-Principle Approval (IPA) to clearly understand your borrowing limits. Carefully evaluate all upgrading-related costs, maintain a realistic budget, and ensure you have sufficient cash reserves for unforeseen expenses.

How soon after selling my HDB can I buy another property?

Typically, there are no specific waiting periods after selling your HDB flat before purchasing your next property. However, carefully managing timelines is crucial to avoid ABSD and other financial implications. If you plan to use the proceeds from your home sale and CPF refund for your next purchase, you must time these transactions to ensure funds are available before completing your next property purchase. Temporary accommodation or negotiating an extension of stay with your buyer might be necessary to ensure smooth transitions.

Should I buy a new launch condo or a resale condo?

Both options have their merits. A new launch condo often provides better appreciation potential and initial lower pricing, with payments structured progressively according to construction stages, initially requiring smaller loans. Resale condos offer immediate occupancy for personal use or immediate rental income for investors, alongside established amenities. Your choice depends on your financial goals, lifestyle preferences, and personal circumstances.

By addressing these frequently asked questions, you can gain clarity and confidence as you plan your property upgrading journey, ensuring it aligns with your goals and financial capabilities.

Conclusion: Making Your Property Upgrade a Smooth Journey

Upgrading your property after fulfilling your HDB MOP is a significant and rewarding decision, offering the potential for enhanced lifestyle benefits, financial growth, and long-term wealth accumulation. As you embark on this journey, remember the critical importance of assessing your financial readiness carefully, including loan eligibility, CPF contributions, and overall budget considerations. Selecting the right type of property, whether an Executive Condominium or a private condominium, requires strategic evaluation based on your lifestyle needs, investment goals, and future growth prospects.

Learning from real-life experiences, being mindful of common mistakes, and staying informed about the property market can greatly enhance your confidence and decision-making abilities. It’s essential to maintain realistic expectations, plan meticulously, and coordinate closely with property agents, financial institutions, and legal advisors to ensure a smooth, stress-free transition. Proper timeline management, understanding ABSD implications, and maximizing your property’s investment potential are crucial elements in successfully navigating the upgrading process.

If you are still unsure or find yourself overwhelmed by the complexities involved, don’t hesitate to reach out for professional guidance. As an experienced real estate consultant, I’m here to provide personalized, practical advice tailored specifically to your unique circumstances and aspirations. Whether you’re curious about market conditions, financial strategies, or how to best time your transactions, I’m here to help. Let’s connect and explore the next steps together, ensuring your property upgrading journey is rewarding, secure, and aligned with your long-term goals. If after helping you assess your situation, I determine it is too risky for you to proceed, I will frankly advise you to stay put if your current situation isn’t ideal for upgrading.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Senior Associate District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

The Special EC Deferred Bridging Loan for HDB Upgraders

Planning to buy a new EC while still owning an HDB? Learn how the Special EC Deferred Bridging Loan helps cover CPF shortfall and avoid cashflow stress.

Selling Your Condo in Singapore 2025: Step-by-Step Guide & What to Know Before You Start

Selling your condo soon? Learn how to sell a condo in Singapore with confidence — from staging and pricing to picking a trusted property agent. Avoid costly mistakes and discover tips that help you sell faster and smarter.

Where Can You Find and How to Buy an Executive Condominium in 2025

Upcoming Tampines St 62 Aurelle of Tampines 晶莹轩 EC Target Q1 2025 Launching. Other Available New Launch EC in 2025. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Buying a Property in Singapore? 8 Key Tips on What to Look Out For

What to look out for when buying a condo or property in Singapore? Learn 8 key tips to help you choose or spot the right property for investment or own stay with capital appreciation and exit strategy.

Is It Still Safe to Enter the Property Market In 2025 Amid U.S. Tariffs?

How Trump’s Tariffs Could Affect Singapore’s Condo And HDB Prices. Is it safe to enter the Singapore property market in 2025 amid recession fears and U.S. tariffs? Learn how interest rates, supply trends, and market resilience could shape your next move.

How to Upgrade When My HDB Reached Minimum Occupation Period (MOP)

For HDB owners who have fulfilled the 5-year MOP (Minimum Occupation Period) in Singapore, discover your next move. Find out if you should sell your flat (resale HDB) or upgrade to a private property, with clear tips for smart homeownership planning.