Singapore first had a confirmed COVID-19 case on 23rd January 2020. Thanks to the Government’s effort to react fast enough to keep the community cases low while dealing with the spread of the dormitory outbreak.

In the real estate industry, we are functioning as per usual during the pre-COVID-19 circuit breaker period. But everyone starts to take personal precautions.

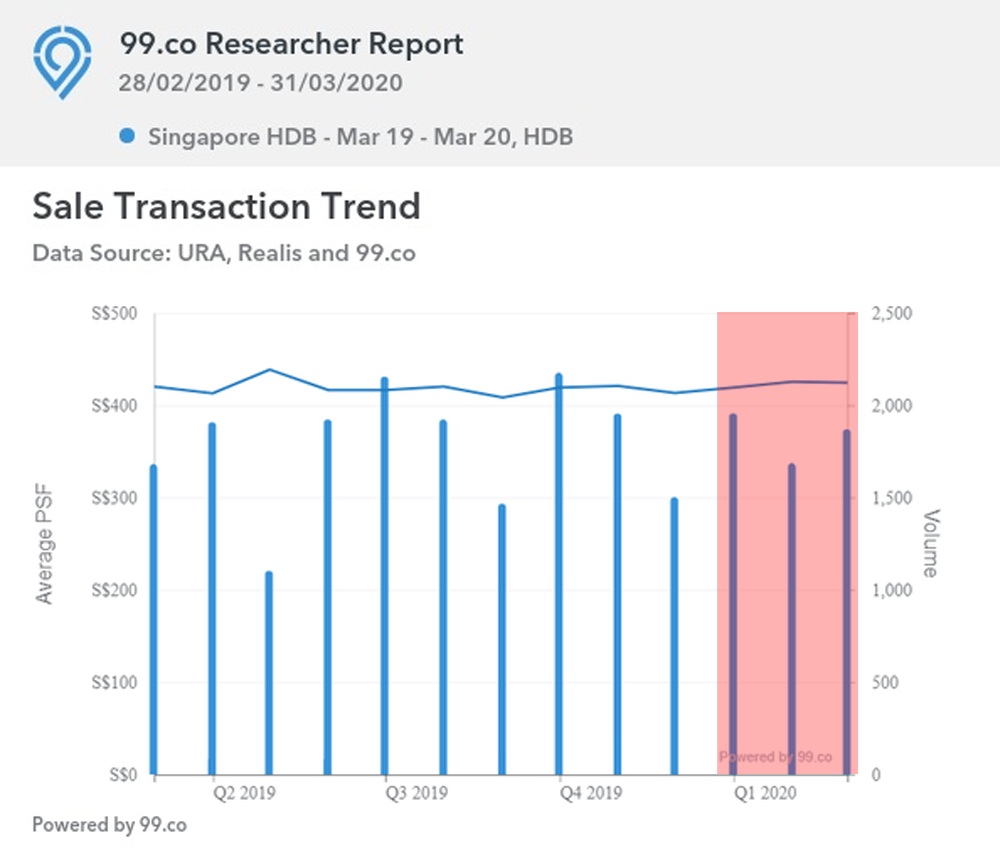

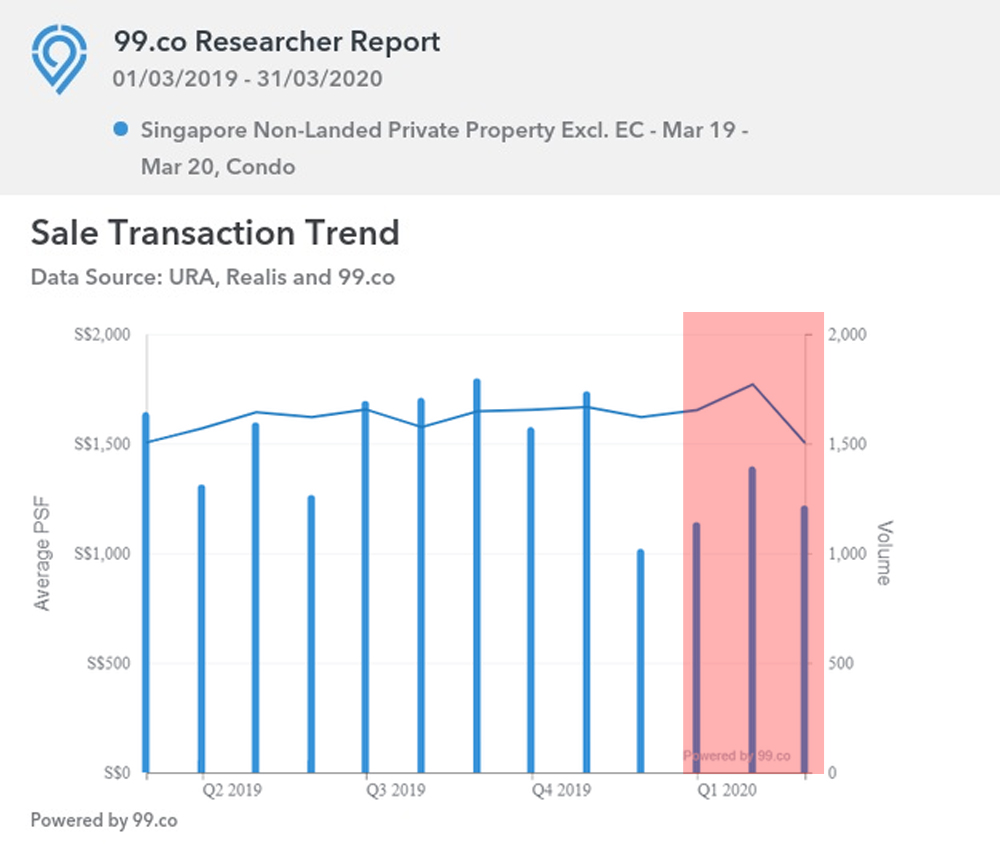

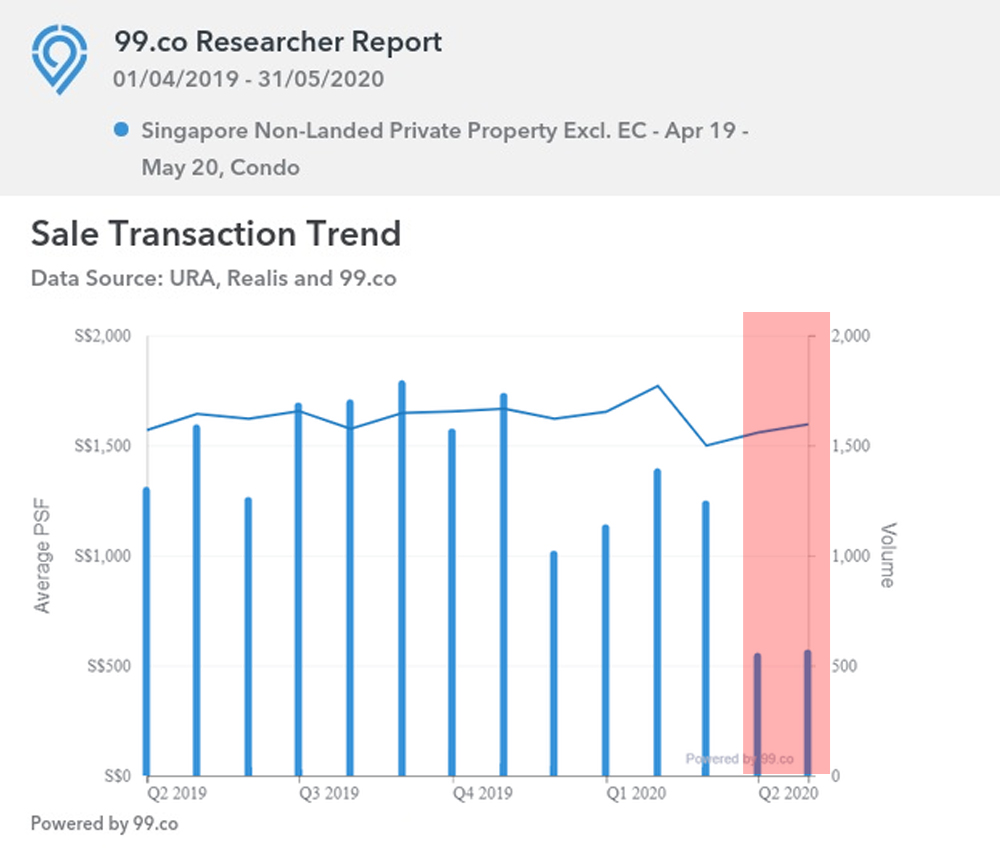

The numbers of non-landed private property and HDB transactions were consistent during the pre-COVID-19 circuit breaker period compared to 2019 before the COVID-19 outbreak.

But some businesses had been affected during the pre-COVID-19 circuit breaker period from January 2020 to early April 2020, and the real game-changer strike during the COVID-19 circuit breaker period between 7th April 2020 and 1st June 2020 (1 month 3 weeks 4 days). During the circuit breaker period, it further affected many other companies.

The real estate industry cannot escape, as well, during the COVID-19 circuit breaker period. The number of transactions dived down to a record low. The realtor like myself has to pick up and adapt to the new norm and new ways to conduct our businesses virtually as no physical viewing of property is allowed.

Some examples like:

- conducting the virtual presentation to clients

- showing property virtually via the online conferencing platform with the homeowner participation to be the cameraman for their home tour.

- showing property via the virtual tour that was pre-uploaded on online hosting.

- Signing of documents digitally.

Just as the outbreak hit Singapore that affects many, the Government periodically rolls out a series of budgets such as Fortitude, Resilience, Solidarity, and Unity budget to help businesses and residents tide over difficult times. A series of policies and measures were introduced as well to soften the impact to help support the Singapore economy.

Besides adapting to the new norm, I believe most of you are also trying hard to adapt to work from home when all the family members under the same household are home. It is challenging for a young parent with young children at home while working from home.

Furthermore, many have to find their corner to work from home while busy at the online conference with their respective colleagues or clients. This was one reason that I see more homeowners looking for a bigger house after we transit into circuit breaker phase 1.

Also, many need to entertain their young children while working, and I believe many of you are now very well trained to be a multitasker.

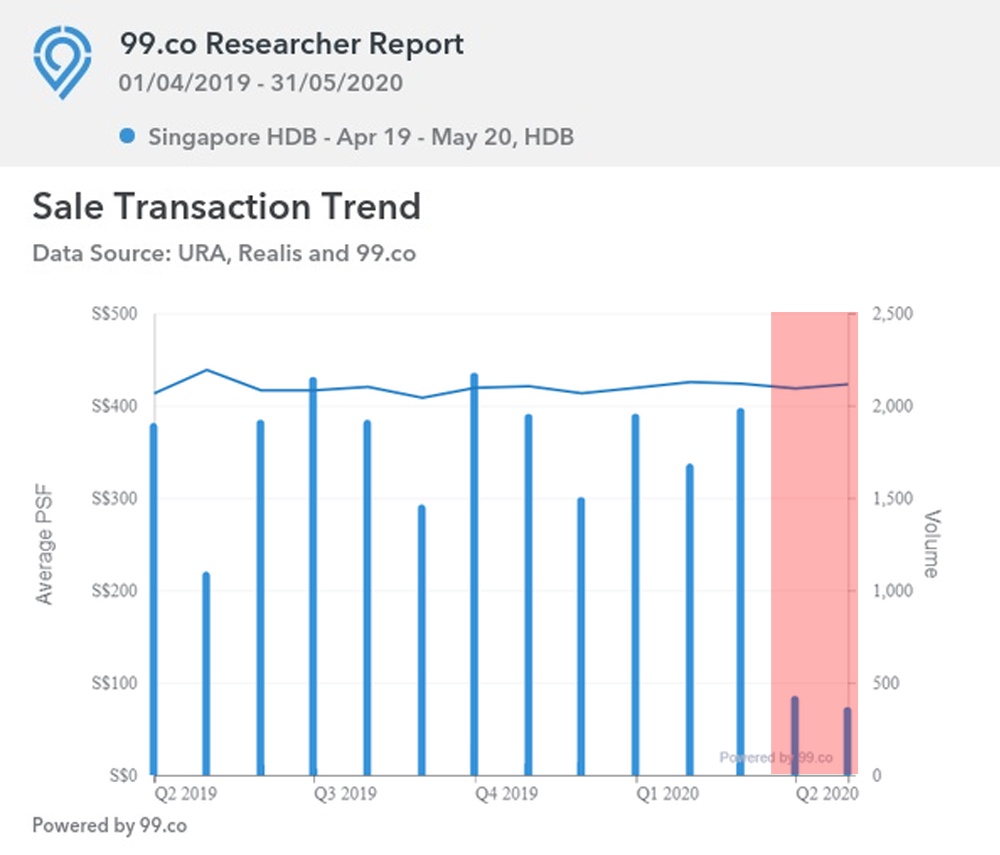

As the number of COVID-19 cases was under control, the Government decided to end the circuit breaker. Singapore officially transits into post-COVID-19 circuit breaker phase 1 on the 2nd June 2020, which last until 18th June 2020.

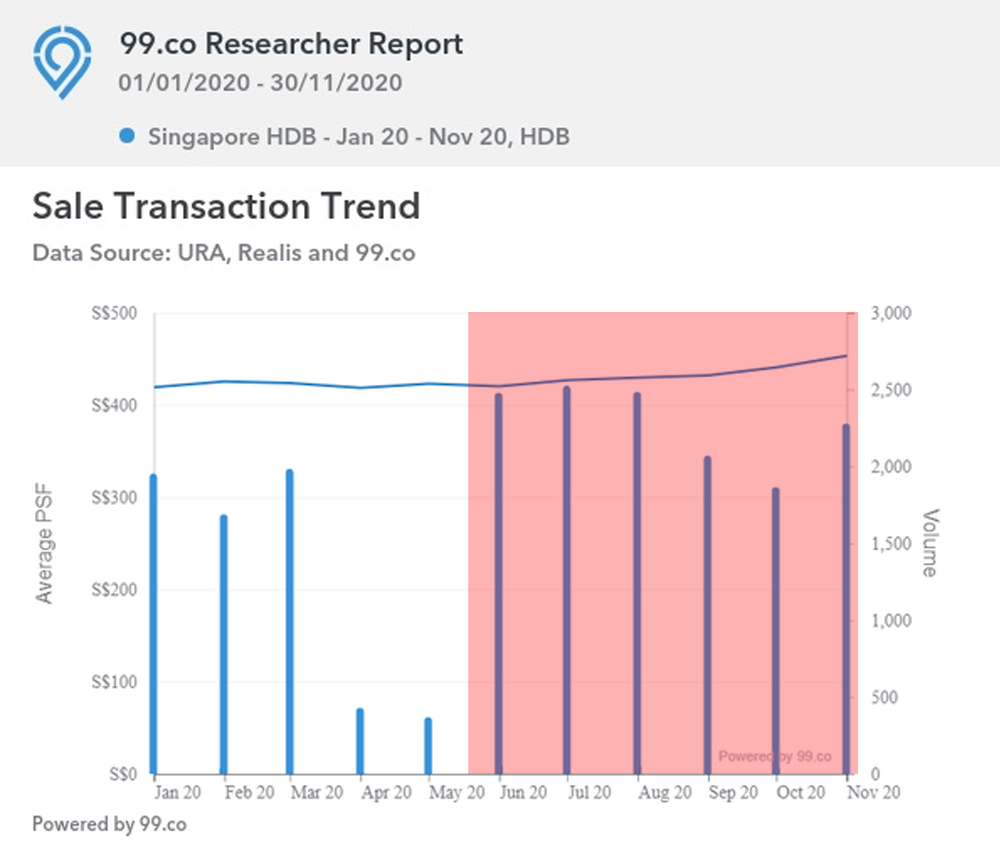

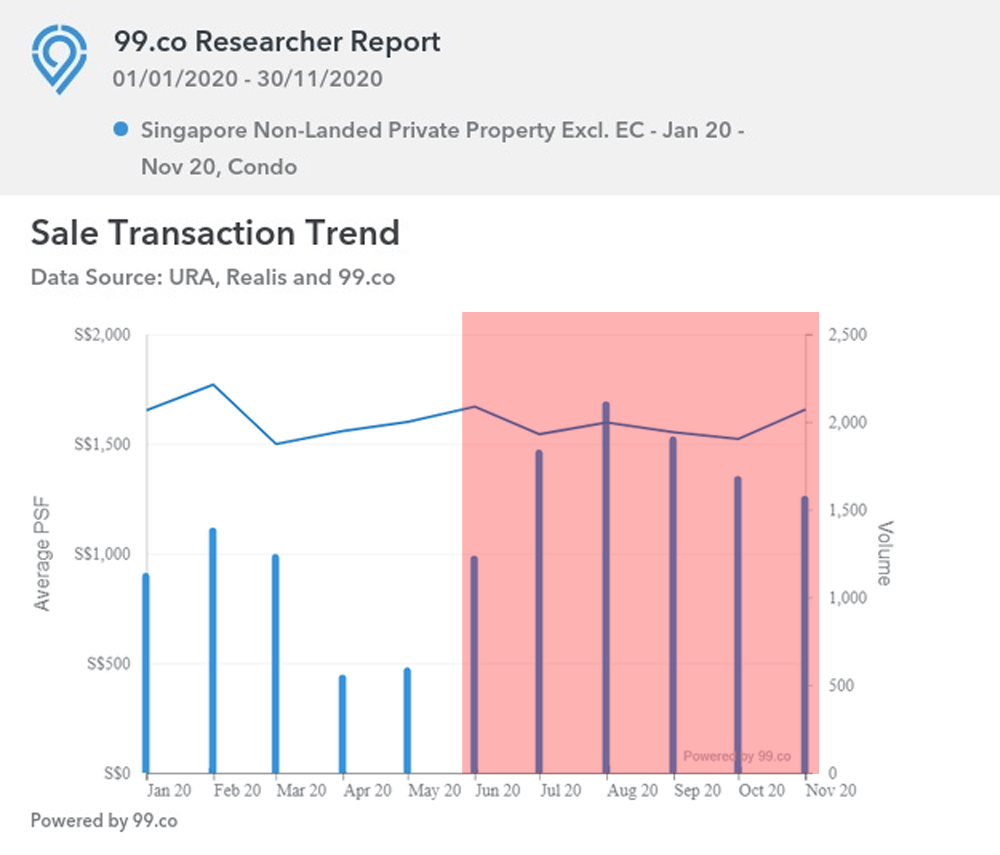

At the start of phase 1, there is a sudden rush of property demand where property sales volume spike across the various segment.

As there are many HDB flat turn MOP in 2020 with many homeowners decided to take the chance to upgrade when the interest rate was low, the HDB resale volume remains consistently high throughout phase 1 and 2 of the post-COVID-19 circuit breaker period.

In the private non-landed property segment, the resale volume and new home sale volume also remain consistently high throughout the same period in phase 1 and 2 of the post-COVID-19 circuit breaker period. This was because many HDB upgraders from the HDB flat turned MOP and investors to enter and invest during a downturn while waiting for the economy to recover.

Finally, the good news of the COVID-19 vaccine surfaced from various companies in production.

On 21st December, Singapore became the 1st nation in Asia to receive the Pfizer-BioNTech COVID-19 vaccine’s shipment.

Singapore also officially transits into post-COVID-19 circuit breaker phase 3 on 28th December 2020 and is still ongoing till further notice by the Government.

As I have mentioned earlier regarding the past months’ hectic schedule due to the increase in demand, more HDB homeowners are taking this chance to cash out and upgrade to private property with interest rates at an all-time low. Besides handling the “selling only” and “buying only” cases for my clients, I am fortunate to successfully help eight of my clients execute their Property Wealth Planning to invest in private property or upgrade from HDB to private property in 2020.

Moving forward into 2021, with the news of the COVID-19 vaccine, let hope for its effectiveness to stop COVID-19 in time to come and a speedy recovery on the economy locally and globally.

I want to take this chance to congratulate them again for making a move from HDB to private property for a better future.

Now that we are approaching the end of the challenging year in 2020. I wish everyone well and look forward to fetching the brand new year of 2021 filled with good health, good luck, lots of joy, love and prosperity!

Lastly, if you plan for an upgrade or have any real estate needs, please feel free to contact me for a short discussion, and I see how I can help you.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls