The 3 Options To Pay Down Your Monthly Mortgage Loan Today in Singapore. Which Is a Better Option – CPF or Cash?

| How to Pay Home Installment | Pay Home Loan Installment | Pay House Installment with CPF | Pay House Installment with Cash |

I was often being asked by friends and clients, which is a better option to pay down their home loans. Many of the first time buyers also have the misconception that they cannot utilize their CPF savings in their CPF Ordinary Account to pay down the mortgage loans if they took up the loan from the bank.

The same questions, which is a better option to pay down the mortgage loan, pop up again recently when I helped my client in refinancing to lower interest rate packages for their home.

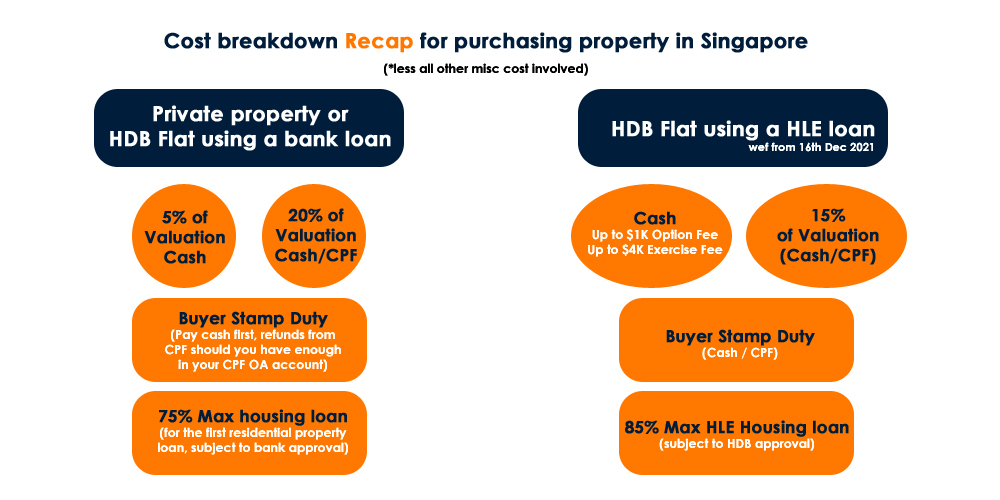

It doesn’t matter either you own private residential property or public housing (HDB), whether your mortgage loan is from the bank or HDB. The monthly repayment method is technically similar for both the housing category.

For public or private residential homes, you can opt to use your cash-saving or CPF Ordinary Account (OA) saving to pay for your monthly mortgage loan installments.

I also came across some homeowners prefer to use cash instead of CPF to pay down their mortgage loans, which most homeowners may think it is safer to have more cash on hand as a form of security.

Let me share my explanation of why:-

There are pros and cons for each method to pay your monthly home loan installments.

Option 1: Paying your monthly mortgage by cash saving

The pros of paying down your mortgage by cash will help you build up your CPF saving for your retirement as the CPF board pay us risk-free interest each year.

Paying down your mortgage by cash also helps to prevent negative cash proceeds in the future when you decide to sell your property.

A simple layman explanation about negative cash proceeds:-

It is a scenario where you need to refund all your sales proceeds back to your CPF Ordinary Account after repaying the full outstanding mortgage loan, leaving no cash profit on hand. It means that you are in a position where you need to fork out your cash saving from your pocket when you purchase your next property.

The downside of servicing the monthly mortgage loan by cash is that you need to pay down your monthly mortgage in cash, and thus you may face cash flow issues if you are earning just enough to cover the monthly mortgage, which prevents you from saving up for the rainy day.

A simple case study about paying down the monthly mortgage loan by cash.

Paul applied for a bank loan to buy a flat for $400,000.

He pays the initial 25% ($100,000) in cash and took up a mortgage loan of 75% ($300,000) at 1.5% interest for 25 years. His monthly installment works out to be $1,199.81, which he uses cash to services the monthly mortgage.

In 10 years, Paul decides to sell the flat at $500k at the valuation price. He does not need to refund his CPF account as he did not utilize his CPF saving to pay down the monthly mortgage.

The outstanding mortgage loan is $191,368.34. Therefore after repaying the total outstanding mortgage loan, Paul will receive the balance sales proceeds of $308,631.66 in cash.

With the cash proceeds Paul received, he can then move to purchase his next property without touching his cash savings for the initial cash downpayment and highly with some additional cash proceeds for renovation and other forms of investments.

Option 2: Paying your monthly mortgage by CPF saving

The pros of using CPF saving to pay down your monthly mortgage loan are that you will have more hard cash on hand for other investment opportunities or rainy days.

When you utilized your CPF saving to pay down the monthly mortgage loan, you need to know about CPF accrued interest. Instead of the CPF board paying you the 2.5% risk-free interest per annum, you need to pay the 2.5% interest on the amount that you utilized to pay down the home loan.

The cons are you may end up with little or no cash proceeds if you sell the property after many years or worst when the property valuation starts to decline.

A simple case study about utilizing or not utilizing your CPF saving to pay down the mortgage.

Simon applied for a bank loan to buy a flat for $400,000.

He then utilized his CPF saving to pays for the initial 25% ($100,000) downpayment and took up a mortgage loan of 75% ($300,000) at 1.5% interest for 25 years.

His monthly installment works out to be $1,199.81, and he pays it using his CPF saving.

Ten years later, Simon decides to sell the flat at $500k at the valuation price. After selling the flat, he needs to refund his CPF account of $291,487.68 (principal + accrued interest) as he utilizes his CPF savings to pay down the monthly mortgage.

The outstanding mortgage loan is $191,368.34.

Therefore after the repayment of the outstanding mortgage loan, the balance sales proceeds is $500,000 – $191,368.34 = $308,631.66.

He then needs to refund $291,487.68 (principal + accrued interest) that he used for the property back to his CPF Ordinary Account. Now Simon ended up with only $17,143.98 left in cash proceeds.

After he pays the misc cost, agent commission, and conveyancing fee, he may end up with no more cash on hand or negative sales scenario.

Many may think that Simon can use the refunded CPF saving in his CPF Ordinary Account for his next home purchase. The answer is yes, he can use his CPF saving, but he still needs some cash for the option exercise fee when purchasing the next home. It means that he will need to fork out some money from his pocket to buy the next home since there are no sales proceeds (cash) from selling his previous home.

Even worse, some do not have sufficient cash savings for the next purchase, ended up putting their plans off for upgrading.

Option 3: Paying down your monthly mortgage by partial cash and CPF saving.

The third option is to balance options 1 and 2, which uses both your CPF and cash saving.

It will reduce the chance of negative sales proceeds occurrence when you decide to sell the property.

It also allows you to use less cash to pay down the monthly mortgage, saving more spare money for other investment opportunities or rainy days.

In partial cash and CPF repayment, if your CPF contribution is higher than what you have used for your monthly installment, technically, you can still build up your CPF saving for your retirement.

About CPF Accrued Interest

There is also a misconception that I always hear from some homeowners. They are so happy that they pay off their full outstanding loan using their CPF saving within the shortest possible time, and they are debt-free.

Yes, indeed, you are debt-free as you do not need to pay the monthly mortgage anymore. But do note that when you use the CPF saving to pay down your property from your CPF Ordinary Account, the accrued interest is still snowballing even though you fully paid off the mortgage loan. It will only stop snowballing the day you sell your property or the day you use cash to redeem back all the CPF saving utilized in your property.

It’s mean the longer you hold the residential property, using your CPF saving, to service the monthly mortgage loan, the higher the chance of getting a negative sales scenario.

Do note that you need to appeal to the CPF board for wavier should your sale proceeds is not sufficient to refund the CPF amount you utilized for the property.

On the other hand, to fully capitalize on the risk-free returns that CPF pay us, some homeowners prefer to use cash to service their monthly mortgage loan.

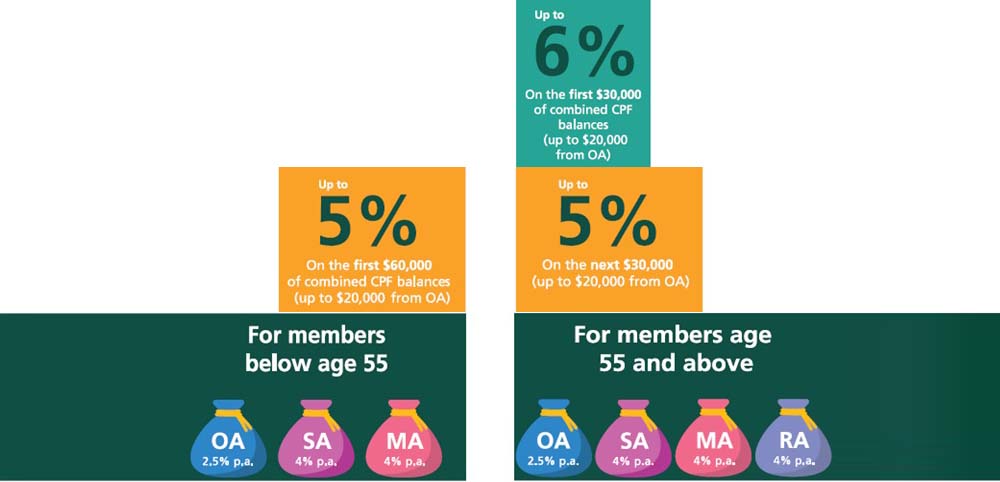

The risk-free interest that CPF pays us is 2.5% per annum (or 3.5% on the first $20k in the CPF Ordinary Account). In the long run, it may help to hedge against inflation.

You can even move your CPF OA saving to your CPF Special Account (SA) to enjoy even higher interest at 4% risk-free returns for early retirement.

Can you find any other 4% risk-free returns investment in this current market?

There is no right or wrong approach to which method works best for you. To pay down your home loan that most suit your situation has to boil down to several factors and your preferred retirement plans, your commitment, and your affordability.

If your cash saving is depleting severely as a result of your mortgage installment, then it is not advisable to fully pay using cash. Importantly you need to set aside some cash funds for either rainy days or investment opportunities.

Imagine that after paying down the monthly mortgage in cash, and you left a minimum or nothing in your bank, you can be in an awful situation if something happened that you need money to tide over.

It is worse if you turn to personal loans or credit, which incur costly interest per annum, which defeats the purpose of growing your CPF saving.

In Summary

Either way, whether you use your CPF saving or cash savings or both CPF and cash saving to pay down your monthly mortgage loan. You will be more clear about what you can afford and how you want to plan for your upgrading plan or retirement plan.

If you are planning to buy a property and unsure which is the best option that suits you and needs professional advice, do drop me an email or message for a friendly non-obligatory discussion.

| The 3 Options To Pay Down Your Monthly Mortgage Loan Today in Singapore |

Need a professional opinion either on your real estate investment plans, the best buy options available, or need help in marketing your properties?

Schedule a 1-time FREE 30-mins Property Wealth Planning consultation now.

My PWP consultation includes:

– An in-depth financial affordability assessment and timeline planning

– A clear and customized investment road map with relevant investment insights

– A curated list of best buys in today’s market with good growth potential and minimal risks

– Selecting the highest potential new launch project units

– Advice on the sale marketing plan and getting a buyer for your property fast

Hello, I am Darren Ong

As a real estate professional, my duty is to help my clients achieve financial freedom and grow their wealth through Property Wealth Planning™.

I believe that with prudent strategies and a clear investment road map, anyone can enjoy a life of abundance and financial stability.

Darren Ong (王伟丞)

Associate District Director of Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: +65 9383 9588