Table of Contents

Progressive Payment Scheme For Singapore’s New Launch Properties

Navigating Singapore’s property market can feel like decoding a complex puzzle, especially when you’re eyeing a new launch property from the developer. You’ve probably encountered the term – Progressive Payment Mode or Progressive Payment Scheme. But what is it in layman’s terms?

Think of it as an installment plan for new homes. Instead of paying the full price where your full loan kicks in for your dream condo immediately, the Progressive Payment Scheme breaks down the cost into manageable stages, aligning with construction milestones.

With a surge in searches like “buying new launch property in Singapore” and “new launch property payment schedule,” it’s evident that Singaporeans want clarity on their home-buying journey. Understanding this payment method makes you one step closer to making informed decisions in the bustling Singaporean property landscape.

Understanding the Dynamics of the Progressive Payment Scheme

The essence of the Progressive Payment Scheme lies in its structured approach, which aligns payments with the construction stages of a property. This ensures that if construction delays occur, payment timelines will adjust accordingly.

Upon completing each construction phase, developers communicate with your legal representatives, signaling the due payment for that specific milestone. Based on your financial setup, the next steps involve either a direct cash payment from your end or a prompt from the bank to disburse the relevant loan amount.

It’s vital to note that payments should be made to the developer within a 14-day window from receiving the developer’s notice. Delays beyond this period might incur additional charges.

The following table clearly explains the stages of a typical payment breakdown for a new launch condominium unit under the progressive payment scheme.

Different stages of the Progressive Payment Scheme

| Stage of Construction Completion | % of Purchase Price |

|---|---|

| Booking of Unit | 5% Cash |

| Upon signing S&P Agreement or within 8-weeks from date of Option | 15% Cash or CPF |

| Completion of foundation work | 5% Cash or CPF 5% Cash or CPF or Loan |

| Completion of reinforced concrete framework | 10% Cash or CPF or Loan |

| Completion of partition walls | 5% Cash or CPF or Loan |

| Completion of roofing | 5% Cash or CPF or Loan |

| Completion of door frames, windows frames, electrical wiring, internal plastering and plumbing work | 5% Cash or CPF or Loan |

| Completion of car park, drains and roads serving the housing project | 5% Cash or CPF or Loan |

| Obtained Temporary Occupation Permit (TOP) | 25% Cash or CPF or Loan |

| Obtained Certificate of Statutory Completion (CSC) | 15% Cash or CPF or Loan |

The monthly installment will kick-start once the bank makes the first disbursement, which depends on your loan-to-value (LTV) for the purchase. For example, if you secured a 75% loan, your first disbursement will be on completion of the foundation stage, where you will start your monthly installment on the foundation stage. If you secured a 60% loan, your first disbursement will be on completion of the partition walls stage, and your monthly installment will start at this stage.

Do note that sometimes the developer may notify more than one stage completion at once, where the bank will disburse the total sum based on the completion stage being called for.

If you purchase the unit later, for example, 12 months after the initial launching day, the developer will likely call for several stages of progressive payments at one go after you sign the sales and purchase agreement. For example, if you purchase the new launch condo after the completion of the “reinforced concrete framework” stage, the developer will likely call for “foundation stage” (10%) + “reinforced concrete framework” (10%) payment after you sign the sales and purchase agreement.

Example of Calculating the Progressive Payment Scheme for New Launch Property

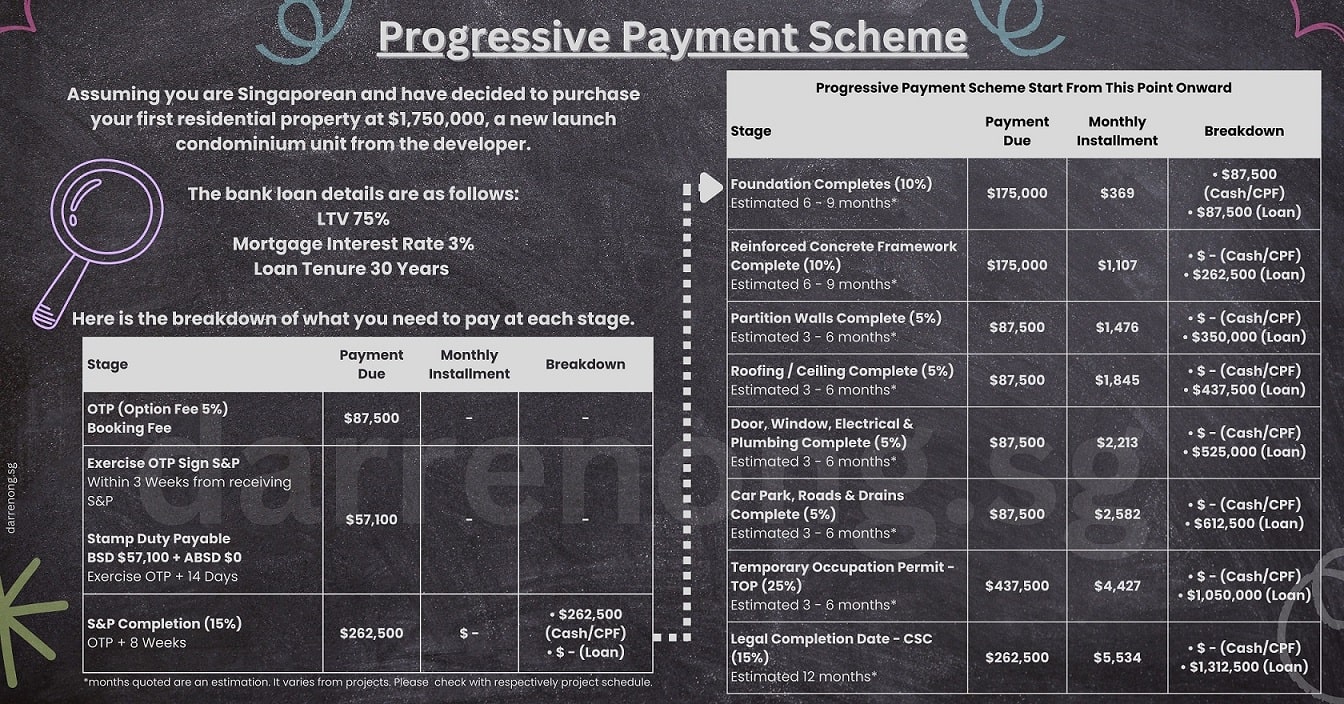

Assuming you are Singaporean and have decided to purchase your first residential property at $1,750,000, a new launch condominium unit from the developer.

The bank loan details are as follows:

- LTV 75%

- Mortgage Interest Rate 3%

- Loan Tenure 30 Years

Here is the breakdown of what you need to pay at each stage.

Booking Fee

Once you decide to book a unit, you must pay a booking fee to secure the Option to Purchase (OTP).

Booking fee = 5% x $1,750,000= $87,500

Please note that you cannot loan or use CPF OA savings for the booking fee. Thus, you must prepare and get this sum in your bank by issuing the developer the $87,500 cheque to book the unit.

If you need one, you may also apply for a mortgage loan after receiving the OTP from the developer.

Exercise OTP and Sales and Purchase (S&P) agreement

The developer will deliver the Sales and Purchase (S&P) agreement to you within 14 days from the OTP date.

Please note that the OTP will expire 3-weeks after receiving the S&P agreement. Thus, you will need to exercise the OTP by signing the S&P agreement within the 3-weeks and return the S&P agreement to the developer if you decide to proceed with the purchase.

At this stage, you need to prepare:

- Any stamp duty payable (Cash or CPF), The IRAS here explains the stamp duty payable, and

- Legal fee (Cash or CPF)

Initial Downpayment Payable

Lastly, you must pay the initial downpayment within 8 weeks from the option date.

- Initial Downpayment of 15% x $1,750,000 = $262,500 (Cash or CPF)

Thereafter, the mode of payment you will enter into is the progressive payment scheme as follows:

Progressive Payment Scheme Starts Here (Progressive Payment Scheme Breakdown Details)

If you apply for a home loan, the bank will disburse the fund to the developer at a different stage when the developer completes each building stage. You will start your monthly installment once the bank disburses the funds to the developer.

Below is a detailed explanation of the payment breakdown and monthly installment at each completion stage.

Benefits of the Progressive Payment Scheme

As the name “progressive payment scheme” suggests, the payments will increase progressively at different stage when the developer building construction progress. It offer the benefits for buyers in terms of cash flow management. Instead of making a lump-sum payment for the full purchase price, buyers make payments in progressive stages as the construction advances.

This approach helps in spreading out financial commitments, ensuring a more balanced and manageable financial plan.

One advantage is that you will have lower monthly installments initially, and even if the developer delays the construction, the monthly installment stay at where you last paid. Moreover, the initial lower monthly repayments under this scheme provide buyers with greater disposable income, enabling them to manage their finances more effectively.

Another advantage is that the progressive payment scheme also serves as a reminder for the developer to keep building construction progress on time to recover the payment and deliver the property in time for the future homeowner.

Summary of the Progressive Payment Scheme

The Progressive Payment Scheme (PPS) is a widely adopted payment structure for purchasing new launch properties in Singapore, including Executive Condominiums (ECs). This scheme requires buyers to make payments in stages, corresponding to the property’s construction milestones. It begins with an initial downpayment, typically around 20%, followed by incremental payments as various phases of the development are completed.

This staged payment method offers several advantages, including enhanced transparency and predictability, allowing buyers to better manage their cash flow by spreading financial commitments over time. By aligning payments with construction progress, buyers experience a reduced immediate financial burden and gain potential capital appreciation once the project is fully completed.

Furthermore, the Progressive Payment Scheme ensures that both developers and buyers remain in sync with the construction timeline, promoting a smoother and more efficient transaction process. This approach not only facilitates a balanced financial plan but also offers peace of mind by tying financial outlays to tangible progress in property development. As a result, PPS is highly favored in the real estate market for its ability to offer both financial flexibility and investment security.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Senior Associate District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

The Special EC Deferred Bridging Loan for HDB Upgraders

Planning to buy a new EC while still owning an HDB? Learn how the Special EC Deferred Bridging Loan helps cover CPF shortfall and avoid cashflow stress.

Selling Your Condo in Singapore 2025: Step-by-Step Guide & What to Know Before You Start

Selling your condo soon? Learn how to sell a condo in Singapore with confidence — from staging and pricing to picking a trusted property agent. Avoid costly mistakes and discover tips that help you sell faster and smarter.

Where Can You Find and How to Buy an Executive Condominium in 2025

Upcoming Tampines St 62 Aurelle of Tampines 晶莹轩 EC Target Q1 2025 Launching. Other Available New Launch EC in 2025. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Buying a Property in Singapore? 8 Key Tips on What to Look Out For

What to look out for when buying a condo or property in Singapore? Learn 8 key tips to help you choose or spot the right property for investment or own stay with capital appreciation and exit strategy.

Is It Still Safe to Enter the Property Market In 2025 Amid U.S. Tariffs?

How Trump’s Tariffs Could Affect Singapore’s Condo And HDB Prices. Is it safe to enter the Singapore property market in 2025 amid recession fears and U.S. tariffs? Learn how interest rates, supply trends, and market resilience could shape your next move.

How to Upgrade When My HDB Reached Minimum Occupation Period (MOP)

For HDB owners who have fulfilled the 5-year MOP (Minimum Occupation Period) in Singapore, discover your next move. Find out if you should sell your flat (resale HDB) or upgrade to a private property, with clear tips for smart homeownership planning.