Table of Contents

Property Investment Entry Signals to Improve Your Returns in Singapore's Property Market

The Resurgence of Singapore’s Property Market and the Importance of Strategic Investment

Since 2017, Singapore’s property market has experienced a significant resurgence, attracting both institutional and retail investors back into the fold. After a period of subdued activity, mainly due to government cooling measures, the market has seen a robust return of investor interest. This renewed vigor is not just a temporary trend but a great testament to the enduring appeal of Singapore’s real estate as a stable and profitable investment.

Understanding the Cyclical Nature of Property Markets

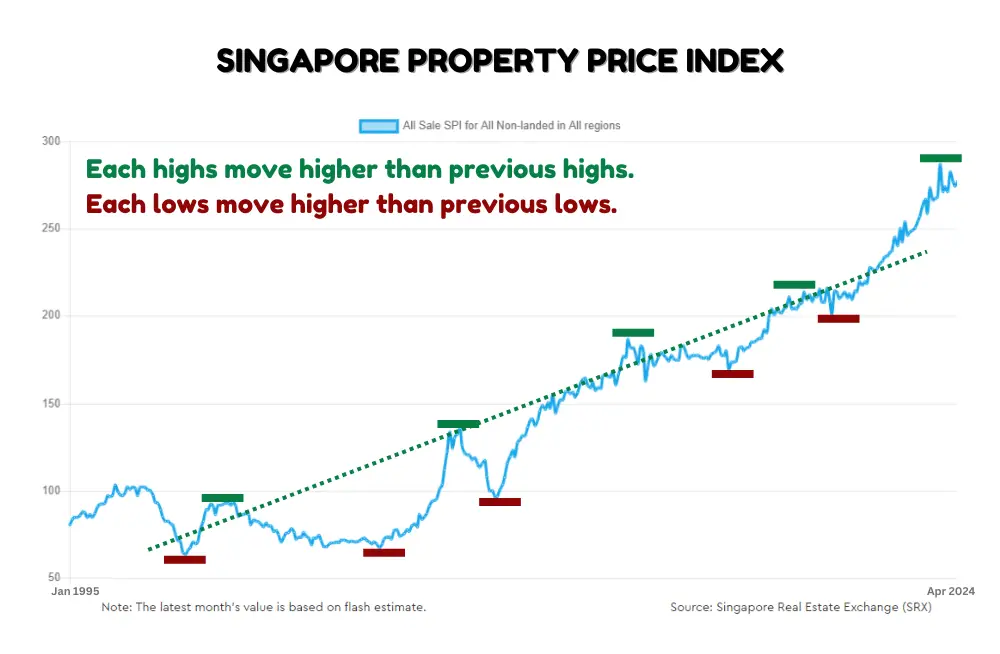

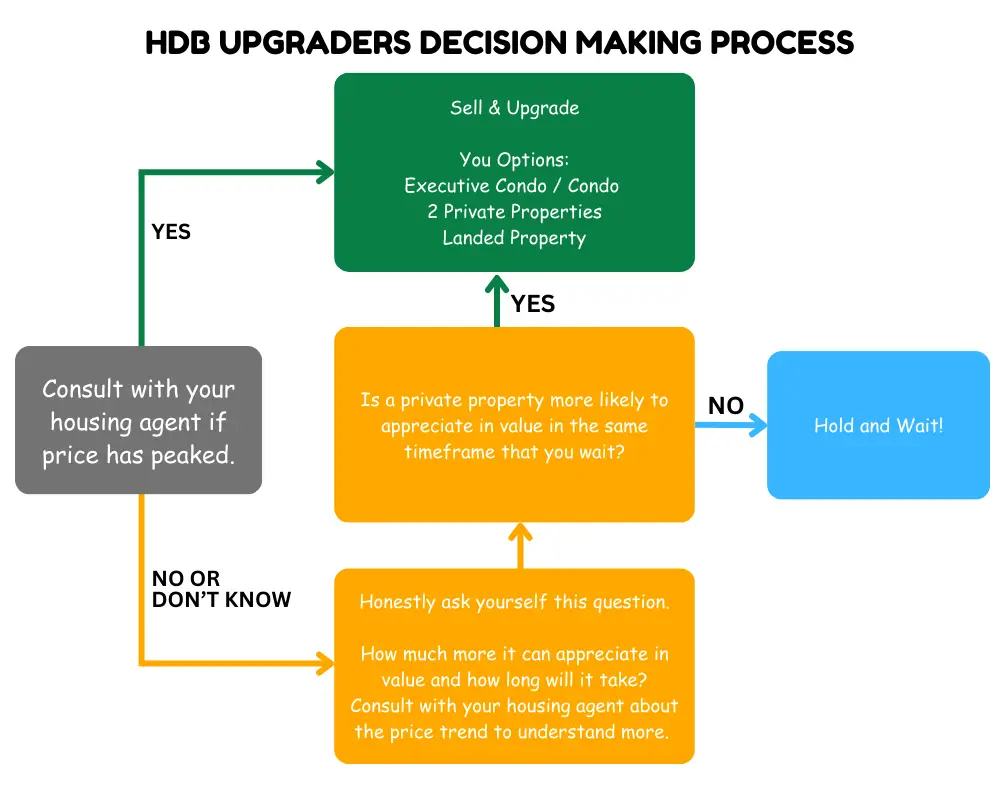

It’s essential for both new and seasoned investors to recognize that the property market, like all markets, operates in cycles. The Singapore property price index over the past two decades reveals a pattern where each peak is higher than the last, and each low is still above previous troughs. This cyclical nature underscores the importance of timing and strategy in property investment. Understanding these property market cycles can help investors make informed decisions that help to maximize their returns over the long term.

Why Invest in Singapore Real Estate?

Singapore’s property market offers some of the best long-term returns on equity compared to other investment instruments. Several factors contribute to this strong performance:

- Strength of the Singapore Dollar: The Singapore dollar’s stability and strength make it an attractive currency for investors, who use it to hedge against inflation and currency fluctuations.

- High Leverage Opportunities: Singapore’s financial system offers favorable conditions for leveraging investments, allowing investors to maximize their capital and potentially increase returns.

- Global Appeal: Singapore is not just a regional investment hub but an asset class in its own right. Its strategic location, robust legal framework, and economic stability make it a preferred choice for international investors.

Local vs. Overseas Investments

As a Singaporean investor, you might be tempted to explore opportunities overseas, especially in markets that promise high returns. However, investing locally has its distinct advantages. The Singapore property market provides a level of protection against inflation, which is as inevitable as taxes and death. By investing in local real estate, you can benefit from the compounding effects of inflation, akin to earning interest on your assets.

The Power of Compound Interest in Real Estate

Albert Einstein’s quote famously referred to compound interest as the “eighth wonder of the world.” This principle is particularly relevant in real estate, where the compound effects of inflation can significantly increase the value of your property over time. By staying invested in Singapore’s property market, you not only protect your wealth but, at the same time, also allow it to grow steadily through the years.

Setting the Stage for Your Investment Journey

This article provides foundational knowledge for those embarking on their property investment journey. Before you start the process of searching for your ideal investment property, it’s crucial to go through the following checklist. It ensures you are well-prepared and can make informed decisions aligning with your financial goals.

Pre-Investment Checklist: Preparing for a Smart Property Investment

Before you start searching and purchasing a property in Singapore, following a pre-investment checklist is essential to ensure you’re fully prepared. This preparation helps you avoid potential pitfalls and ensures your investment journey is as smooth as possible.

Finances: Understanding Your Financial Standing

Consult a Property Wealth Planner: Before even looking at potential properties, the first step is to get a clear picture of your financial situation. Speaking with a property wealth planner is highly recommended. These professionals can help you assess the initial cash and CPF outlay required, including the down payment, buyer’s stamp duties, legal fees, and miscellaneous costs. By doing so, you can greatly avoid costly mistakes that could hinder your goal of financial freedom.

Assessing Initial Cash/CPF Outlay: Understanding the financial commitments involved in property investment is crucial. A property wealth planner can assess your initial cash and CPF outlay and guide you in calculating the minimum cash and CPF required. This step ensures you’re financially ready to purchase without unexpected financial strain.

Loan Eligibility: Ensuring You Can Borrow What You Need

Checking Maximum Loan Eligibility: The Total Debt Servicing Ratio (TDSR) framework is the key factor in determining how much you can borrow for your property purchase. It’s essential to check your maximum loan eligibility early to avoid any surprises after placing a deposit. A property wealth planner or mortgage banker can help you in understanding how much you can borrow and ensure you’re within the limits set by the TDSR framework.

Consulting a Property Wealth Planner or Mortgage Banker: A property wealth planner usually works hand in hand with a mortgage broker to help investors navigate the complexities of loan eligibility. It is good to start engaging with a mortgage banker early in your investment journey, as they can help advise you on the best financing options available and help you secure a loan that aligns with your financial goals.

Manner of Holding: Structuring Your Investment Wisely

Optimizing Tax Savings and Funding: For investors who already own an HDB flat or private property and are looking to acquire a second property, it’s crucial to consider the manner of holding. A property wealth planner can provide advice on various options to optimize tax savings and qualify for additional funding. This is particularly important if you plan to grow your property portfolio and need access to higher leverage and lower costs.

Strategic Planning for Multiple Properties: Proper planning for how you hold your properties can significantly impact your investment returns. By structuring your ownership to maximize tax efficiency and funding options, you can better position yourself for future investments.

Investment Goal and Horizon: Defining Your Property Investment Strategy

Setting Clear Investment Goals: Before you start looking for properties, you must have a clear idea of your investment goal and horizon. Are you investing for short-term gains, long-term appreciation, or rental income? Understanding your primary objectives will help you narrow down the types of properties and locations to focus on.

Aligning Your Investment Strategy with Your Goals: By defining your investment horizon, you can focus your energy on segments of the market that are most likely to help you achieve your goals. Whether it’s high-yield rental properties or areas poised for capital appreciation, a clear investment strategy aligned with your goals will save you time and effort in your property search.

The 4 Entry Signals for an Investment Grade Property: Key Indicators for Maximizing Returns

When investing in real estate, particularly in Singapore’s competitive property market, identifying an investment-grade property is crucial for maximizing returns. While many factors influence property values, focusing on specific entry signals can significantly increase the likelihood of making a profitable investment. Below, we explore four critical entry signals that every savvy investor should consider.

Capital Growth Potential: Investing in Properties with Strong Appreciation Prospects

Understanding Capital Growth Potential: Capital growth potential refers to a property’s ability to appreciate in value over time. One key indicator of a property’s capital growth is how its price performs relative to the overall price index of its district. For instance, if a property has appreciated more than the average price increase in its district over the past year, it could indicate higher buying demand. This demand is often driven by factors such as proximity to amenities, development quality, and the area’s reputation.

Factors Contributing to Capital Growth: Several factors contribute to a property’s capital growth potential:

- Location: Properties in prime locations, such as those near MRT stations, reputable schools, or shopping malls, tend to have higher capital growth prospects.

- Development Quality: Well-maintained properties with modern facilities and appealing designs are more likely to appreciate over time.

- District Performance: Properties in districts that consistently outperform the market are likely to continue appreciating.

Resale properties have the advantage of historical data, which allows you to analyze past performance and make more informed decisions. Properties consistently outperforming their district’s average growth rate are often considered good investments. However, conducting thorough research and consulting with a property wealth planner is essential to identify properties with the strongest capital growth potential.

For new projects, you may need to consider points 3 and 4, the growth story, and the entry price to determine whether they have capital growth potential.

Rental Yields: Ensuring Steady Income from Your Property Investment

Importance of Rental Yields: Rental yield is a key metric that many investors use to measure the return on investment from rental income relative to the property’s purchase price. A property with a high rental yield indicates strong tenant demand, making it a desirable investment. In Singapore, rental yields vary depending on the location and type of property. Generally, properties in areas with high rental demand, such as those near business districts or universities, tend to offer better yields.

Analyzing Rental Data: Before investing, studying the rental market in the area you’re considering is crucial. Look at the rental yields of similar properties nearby to gauge the potential returns. For example, while two projects might be located in the same neighborhood, one might have significantly higher rental yields due to better facilities, newer construction, or more desirable layouts.

Benchmarking Rental Yields by Region: In Singapore, rental yields can vary based on the property’s region:

- Core Central Region (CCR): Expect a rental yield of at least 3%.

- Rest of Central Region (RCR): A rental yield of around 3.5% is typical.

- Outside Central Region (OCR): Properties here should ideally offer a 4% or more rental yield.

These benchmarks can guide your investment decisions, helping you focus on properties that offer the best returns relative to their location.

Growth Story: Investing in Areas with Strong Future Potential

The Impact of Infrastructure and Development: One of the most compelling reasons to invest in specific properties is their growth story. It refers to the potential for future appreciation driven by planned or ongoing infrastructure developments in the area. For example, areas undergoing significant government-led projects, such as new MRT lines, business parks, or residential developments, often see substantial property value increases over time.

Case Studies of Growth Areas in Singapore: Looking at past examples in Singapore, areas like Jurong, Punggol, and Sengkang have seen property values rise significantly due to major infrastructure investments. These developments transformed these regions into desirable residential areas, resulting in strong capital appreciation for properties.

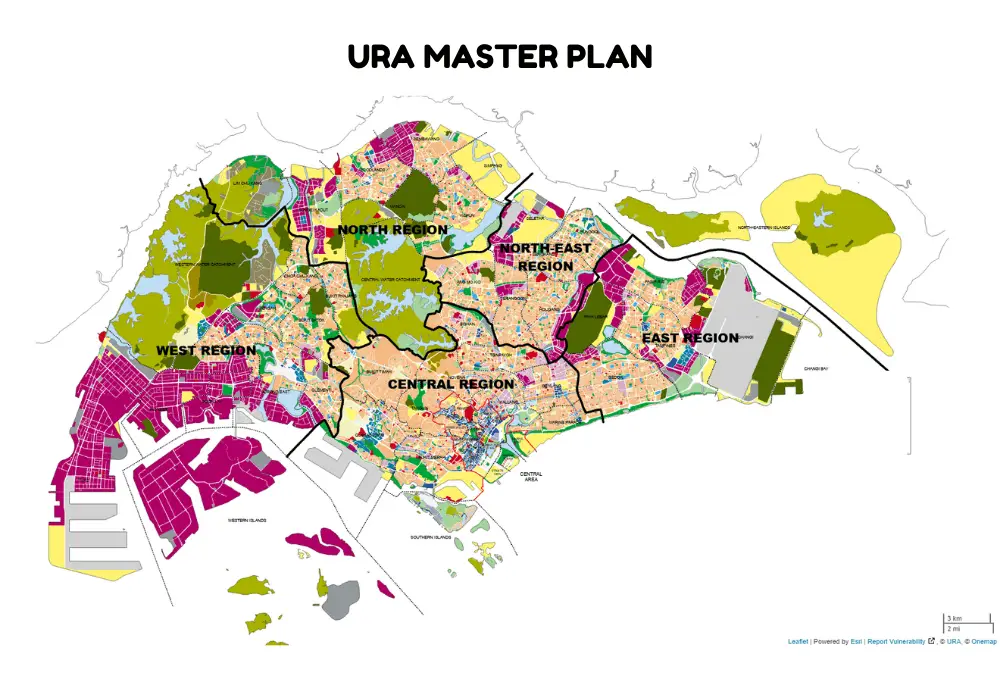

Emerging Growth Areas: The Urban Redevelopment Authority (URA) Master Plan is an invaluable resource for investors looking to identify emerging growth areas. The Master Plan outlines the government’s long-term development goals for different parts of Singapore, highlighting areas likely to see increased demand and property value appreciation in the coming years. For instance, upcoming growth areas like Paya Lebar, Bidadari, Marina Bay, Pasir Panjang, and Woodlands are expected to benefit from significant infrastructure upgrades and urban development.

The Importance of Research: Investing in growth areas requires thorough research. While these areas may offer promising returns, it’s essential to avoid speculative investments based purely on potential. Instead, look for concrete signs of development, such as approved infrastructure projects or commercial developments, that indicate a strong future growth story.

Right Entry Price: Buying at a Price That Maximizes Your Returns

Importance of the Right Entry Price: The entry price is one of the most critical factors in determining the profitability of your property investment. Buying a property at or below market value gives you an immediate advantage by providing what’s known as “built-in profits.” It is particularly important in a market like Singapore, where property prices are generally high.

Below Market Value (BMV) Properties: One of the best strategies for resale properties is to look for properties priced below market value (BMV). These opportunities allow investors to start with built-in equity, meaning the property is already worth more than the purchase price. BMV properties are often found in distressed sales, such as those involving financial difficulties or urgent sales, and can be a great way to maximize returns from the outset.

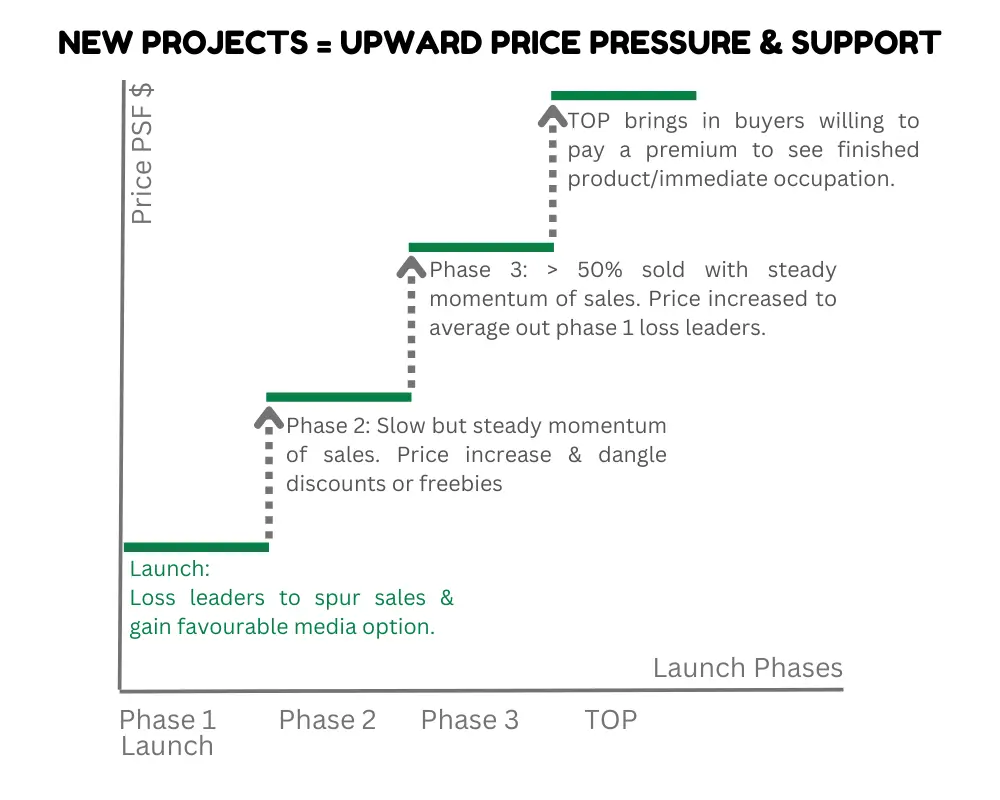

Right Entry Price for New Launches: When it comes to new launch properties, buying below market value is rarely possible because these properties are typically priced at a premium. However, you can still find a good deal. The key is to compare new launch properties with similar developments and identify those with the lowest risk and highest upside potential.

Factors to Consider in New Launches:

- Land Costs: Singapore’s land scarcity drives up land costs, impacting the pricing of new developments.

- Material and Labor Costs: Inflation in material and labor costs contributes to higher prices for new properties.

- Developer’s Pricing Strategy: Developers often release units in phases, with prices increasing over time. Getting in early can sometimes result in better pricing.

Reducing Downside Risk: One advantage of buying a new launch property is the reduced downside risk. Since you’re purchasing at the same price as other buyers and because developers typically raise prices in phases, there’s often upward pressure on prices after the initial launch. Additionally, owners tend to hold onto properties until they can sell at a profit, which reduces the likelihood of significant price drops

Summary: Maximizing Your Property Investment Potential in Singapore

Investing in real estate is one of the most effective ways to build wealth, particularly in a market as dynamic and resilient as Singapore’s. However, the key to maximizing your returns lies in making clear and informed decisions based on thorough research and understanding of the property market. By focusing on the four critical entry signals—capital growth potential, rental yields, growth story, and the right entry price—you can significantly enhance the profitability of your investment.

Combining Multiple Signals for a Strong Investment

The more entry signals your property investment meets, the greater its potential for success. Ideally, your investment should tick all four boxes:

- Strong capital growth potential

- Attractive rental yields

- A compelling growth story

- A favorable entry price

However, even if a property meets just two or three criteria, it may still represent a solid investment opportunity. The idea is to weigh these factors carefully and prioritize the properties that align with your financial goals and risk tolerance.

For instance, a property with a compelling growth story might offer substantial long-term capital appreciation, even if its current rental yield is modest. Conversely, a property with a high rental yield might provide steady income while you wait for its value to appreciate. Understanding how these factors interact helps you make more strategic decisions and optimize your property portfolio for short-term gains and long-term growth.

Utilizing Expert Guidance for Informed Decisions

Property investment is not a solo endeavor. To navigate the complexities of the Singapore property market, it’s essential to assemble a team of experts who can provide you with the insights and advice you need to succeed. It includes engaging a property wealth planner, mortgage specialist, and legal advisor who can help you identify blind spots and avoid costly mistakes.

Property Wealth Planner: A property wealth planner can help you assess your financial situation, develop an investment roadmap, and ensure that your investment strategy aligns with your long-term goals. They can also provide:

- Valuable advice on tax planning.

- Structuring your investments.

- Identifying the best opportunities in the market.

Mortgage Specialist: Securing the right financing is crucial to the success of your investment. A mortgage specialist can guide and assist you through the process of obtaining a loan, ensuring that you secure the best possible terms. They can also help you understand the implications of the Total Debt Servicing Ratio (TDSR) and other regulatory frameworks on your borrowing capacity.

Legal Advisors: Property transactions involve a range of legal considerations, from contract reviews to ensuring compliance with local regulations. Engaging a qualified legal advisor can help you through these complexities and protect your interests throughout the transaction process.

Avoiding Common Investment Pitfalls

Even the most promising property investment can go awry if common pitfalls are not carefully avoided. Some of the most frequent mistakes include overleveraging, underestimating the total cost of ownership, and neglecting to conduct adequate due diligence. By working with a team of experts in the related field, you can minimize these risks and ensure that your property investment decisions are based on sound financial principles.

Overleveraging: While leveraging can amplify your returns, it also increases your risk. It’s important to borrow within your means and maintain a buffer for unexpected expenses or market downturns.

Underestimating Costs: In addition to the property purchase price, property ownership involves ongoing costs such as maintenance, property taxes, and insurance. Proper budgeting ensures that you are not caught off guard by these expenses.

Inadequate Due Diligence: Thorough research is essential before making any investment. It includes analyzing market trends, assessing the property’s condition, and understanding the area’s long-term prospects.

The Role of Strategic Planning is Essential in Long-Term Success

The Singapore property market is characterized by its cyclical nature, where periods of rapid growth are often followed by phases of consolidation. Strategic planning is crucial to navigating these cycles successfully. By staying informed about property market trends and adjusting your investment strategy as needed, you can then maximize your returns and build a robust property portfolio over time.

One of the most effective strategies is to remain flexible and open to opportunities that align with your investment goals. It might involve selling a property that has reached its peak value or reinvesting in emerging growth areas identified in the URA Master Plan. Adapting your strategy in response to changing market conditions is key to long-term success in real estate investment.

Final Thoughts: Building Wealth Through Informed Property Investment

Real estate investment offers immense potential for wealth creation, particularly in a stable and growing market like Singapore’s. However, success in property investment requires more than just capital—it demands knowledge, careful planning, and the ability to identify and act on key entry signals. By leveraging the insights in this guide, you can make informed decisions that enhance your investment outcomes and contribute to your financial freedom.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588