Updated on 4th July 2025 due to new Seller Stamp Duty announcement.

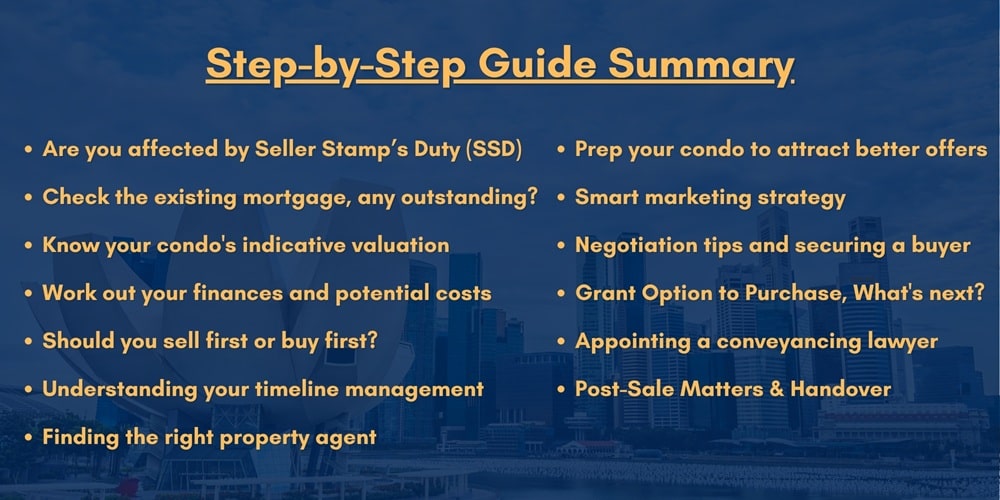

Table of Contents

Planning to Sell Your Condo? Read This First

Selling a condo in Singapore might seem straightforward at first — especially when the property market is active, and you hear stories of units being snapped up within days. However, the truth is that there’s more going on behind the scenes than simply listing your unit online and waiting for offers to come in. Whether you’re planning to upgrade, cash out, or simply move on to your next chapter, the process of selling your condo requires careful planning and a few important decisions along the way.

Many homeowners tend to underestimate the amount of groundwork needed before they can even put up the “For Sale” listing. From checking whether you’re still liable for Seller’s Stamp Duty (SSD) to understanding current market demand to sort out your financials and timeline — every step can have a significant impact on how smoothly your sale goes and, more importantly, how much you walk away with at the end of the transaction.

This guide is written with you, the everyday homeowner, in mind. Whether this is your first time selling a property or it’s been a while since your last transaction, I’ll walk you through what to look out for before making your move. No jargon, no hard sell — just clear, simple explanations based on what happens in today’s Singapore property market.

The goal here is to help you avoid common mistakes and make better decisions — so you can sell confidently, without regrets. Let’s dive in.

1. Are You Affected by Seller’s Stamp Duty (SSD)?

Before listing your condo for sale, one of the most important things to check is whether you’re still within the Seller’s Stamp Duty (SSD) period. SSD is a tax that applies if you sell your property within a certain timeframe after purchase. It was introduced to curb short-term property speculation in Singapore, and the amount can be substantial, significantly affecting your net proceeds if you’re not careful.

As of the 4th July 2025, SSD applies to all residential properties sold within four years from the date of acquisition on or after 4th July 2025. Any property bought before 4th July 2025 will still follow the previous rules. Here’s a simple breakdown:

| Holding Period | Rates from Mar 11, 2017 to Jul 3, 2025 | Rates on and after Jul 4, 2025 |

|---|---|---|

| Up to 1 year | 12% | 16% |

| More than 1 year but up to 2 years | 8% | 12% |

| More than 2 years but up to 3 years | 4% | 8% |

| More than 3 years but up to 4 years | 0% | 4% |

| More than 4 years | 0% | 0% (no change) |

Source: Ministry of National Development, Ministry of Finance and Monetary Authority of Singapore, Jul 3, 2025

For example, let’s say you bought your condo before 4th July 2025 for $1.5 million and plan to sell it 18 months later for $1.6 million. With SSD at 8%, you would need to pay $128,000 in SSD taxes. If you bought your condo on or after 4th July 2025 for $1.5 million and plan to sell it 18 months later for $1.5 million. With the new SSD of 12%, you would need to pay $192,000 in SSD taxes — a significant portion of your sale proceeds in both examples. That’s why it’s important to check your SSD status early.How to Determine SSD Liability

To determine whether SSD applies, you must calculate the holding period based on two dates: the date of purchase or acquisition and the date of sale or disposal. IRAS clearly defines these.

Date of Acquisition refers to:

- The date of acceptance of the Option to Purchase (OTP), meaning the date you exercised the OTP*

- The date of the Sale and Purchase Agreement

- For new HDB flats, the date of the Agreement for the Lease

- The date of transfer to a beneficiary if the property was previously held in trust for non-identifiable beneficial owners

- The Date of Transfer, if none of the above apply

*Note: This exclusion applies to OTPs that are subject to the signing of the Sale and Purchase Agreement.*

Date of Disposal refers to:

- The date the buyer accepts the OTP* you issued, meaning the date the buyer exercises the OTP you issued

- The date of the Sale and Purchase Agreement

- The Date of Transfer, if the above is not applicable

*Similarly, this excludes OTPs that are subject to further conditions such as signing of the SPA.

If you’re unsure how to work out these dates, your property agent or lawyer can help clarify. Many homeowners assume SSD is based simply on calendar years — but it’s actually calculated by exact dates, down to the day.

You may use the IRAS SSD Calculator to determine if you are liable for SSD here: https://mytax.iras.gov.sg/ESVWeb/default.aspx?target=MSDSellResidentialIndustrialProperty.

However, if you are still unsure about the date, I would suggest checking with your property agent or your law firm to confirm.

Should You Still Sell If SSD Applies?

In some cases, even if you’re still within the SSD period, it might still make sense to proceed — especially if you’re cashing out for a bigger opportunity or your property’s value has appreciated significantly. But you’ll need to weigh the costs against your goals.

The key takeaway is to know where you stand before making any plans to sell. SSD can be a dealbreaker for some or just a planning point for others — but either way, it shouldn’t come as a surprise at the last minute.

2. Check on Your Existing Loan or Mortgage

Before you decide to sell your condo, one of the first things you should do is check the status of your existing home loan or mortgage. This often-overlooked step can have a direct impact on your net sale proceeds, your selling timeline, and your ability to buy your next property — especially if you’re planning to upgrade soon after the sale.

Check Your Outstanding Loan Balance

Log in to your bank’s online portal to check your outstanding loan balance, or call your bank and ask for an estimate, such as one based on a potential sale completion in two months. This will give you a clear idea of how much you still owe, including any accrued interest up to full repayment.

When your condo is sold, the sale proceeds will first be used to redeem your outstanding loan, so it’s crucial to know this figure early. It helps you estimate how much you’ll be left with after the sale — in both cash and CPF.

If you’ve been using your CPF Ordinary Account (OA) to pay your monthly installments or downpayment, don’t forget that all CPF monies used, including accrued interest, will have to be refunded back to your CPF account upon completion of the sale. This refund affects your net cash proceeds and may also impact the amount of CPF you can use for your next property.

Are You Within a Lock-In Period?

Check whether your current loan is still within a lock-in period, a standard clause in many mortgage packages. If so, you may be subject to an early redemption penalty, typically around 1.5% of your outstanding loan balance. In addition, some banks may impose admin fees or claw back legal subsidies previously given when you signed the loan.

All of this can reduce your actual profit, so it’s best to review your loan letter of offer or check with your banker to confirm the terms early.

Notice Period for Loan Redemption

Most banks in Singapore require a two-month written notice for loan redemption. If you redeem your loan earlier without notice, the bank may charge notice period interest — basically charging you for the shortfall in notification. That’s why checking your loan details early helps you avoid unnecessary costs and allows you to serve notice promptly.

Why This Step Matters

In short, reviewing your mortgage details early helps you:

- Avoid surprise penalties, admin fees, or legal clawbacks

- Serve timely loan redemption notices to avoid interest charges

- Plan your cash flow and CPF usage more accurately

- Optimize your loan eligibility if you’re upgrading to a new property

- Estimate your net sale proceeds with greater certainty

It might seem like a small task, but getting clarity on your existing mortgage early in the process can save you time, money, and a whole lot of stress down the road — especially if your next move involves another property purchase.

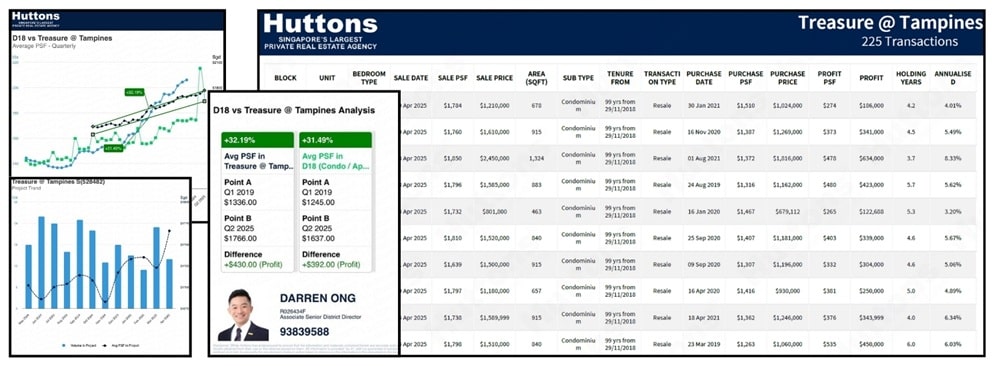

3. Know Your Condo’s Market Value Before You List

One of the most common mistakes sellers make is assuming their condo is worth more than it really is — or sometimes, even less. That’s why, before listing your unit, it’s essential to have a clear and realistic understanding of its current market value.

In Singapore, condo prices can vary quite a bit, even within the same development. Factors like floor level, unit facing, renovation condition, and recent nearby transactions all come into play. A good starting point is to conduct a Comparative Market Analysis (CMA), which involves comparing your unit with other similar properties in the same project and surrounding area that have recently been sold or are currently listed.

Many homeowners rely on asking prices from portals like PropertyGuru or 99.co. While those figures give a general sense of the market, it’s worth remembering that the asking price isn’t the same as the transacted price. What buyers are paying today can be very different from what your neighbor hopes to get. That’s why reviewing recent transaction data provides a much more accurate gauge of what the market is genuinely willing to pay.

You can also check indicative valuations from local banks or get a snapshot from multiple property platforms. A property agent can help with this comparison, but keep in mind that these valuations are still rough estimates — they may not fully reflect your unit’s unique attributes, such as its layout, orientation, or whether it has been well-renovated.

For a clearer picture, many sellers turn to an experienced agent who can interpret the data, assess your unit on-site, and suggest a realistic pricing strategy based on actual buyer behavior. A good agent will help you position your price correctly — not too high that you scare away genuine interest and not too low that you short-change yourself.

Remember, pricing your condo right isn’t about “testing the market” with a high number and hoping for the best. If your price is too far off, you risk sitting on the market for months with no offers. But if it’s well-calculated and based on sound market comparisons, you’re more likely to attract qualified buyers and negotiate confidently.

At the end of the day, knowing your condo’s actual market value puts you in control — and helps you make smarter, better-informed decisions from the very start.

4. Work Out Your Finances and Potential Costs

Now that you’ve decided whether to sell first, buy first, or do both concurrently, the next step is to take a close look at your finances. Whether you’re planning to upgrade, right-size, or cash out, knowing your numbers early on will help you make clearer decisions — and avoid being caught off guard halfway through the process.

Many homeowners tend to focus only on the selling price, but what matters is the net proceeds — how much you’ll actually walk away with after settling your home loan, refunding CPF, and paying all necessary fees and charges. This final figure plays a big role in determining what you can afford for your next property and whether your timeline and transition plan are feasible.

What to Calculate Before Selling

Here’s a breakdown of the key financial components to consider:

Outstanding Mortgage Loan

Your existing bank loan will need to be redeemed using the sales proceeds. You can get an updated loan redemption statement from your bank to estimate this figure based on your expected completion date.

CPF Refund (with Accrued Interest)

Any CPF OA savings used to finance your property — including downpayment, stamp duties, or monthly installments — must be refunded into your CPF account, along with accrued interest. This refund happens automatically during the sale and reduces your net cash proceeds.

Legal Or Conveyancing Fees

Sellers typically pay $2,500 to $3,000 in legal fees for conveyancing services, depending on the law firm handling the transaction.

Real Estate Agent Servicing Fees (Commission)

The standard agent fee for a sale is usually around 2% of the transacted price, subject to GST. This is paid upon completion, and it’s a key cost to factor into your sale calculations.

Seller's Stamp Duty (SSD), if applicable

Depends on your date of purchase or acquisition and the date of sale or disposal.

- If your date purchase or acquisition is on or before 3rd July 2025 and you are selling within the 3-years holding period, SSD of up to 4% to 12% of the sale price may apply.

- If your date of purchase or acquisition is on or after 4th July 2025 and you are selling within the 4-years holding period, SSD of up to 4% to 16% of the sale price may apply (as explained in Section 2). This must be deducted from your sale proceeds.

MCST Fees and Property Tax

Maintenance fees and property tax will be prorated up to the legal completion date. Any unpaid balances must be cleared before handover.

Loan Redemption Penalties

If you’re still within your mortgage’s lock-in period, check for early redemption penalties (typically around 1.5% of your outstanding loan amount), as well as potential clawbacks of legal subsidies or interest charges for the notice period.

Utilities and Sinking Fund Contributions

Ensure that you settle any outstanding utilities or MCST sinking fund payments before completion. These may be small but are still legally required to be cleared before the handover.

Estimating Your Net Proceeds

Once you’ve identified all these cost items, you can work out a rough estimate of how much cash and CPF you’ll get back from the sale. A simplified formula looks like this:

- Expected Selling Price

- Less Outstanding Loan

- Less CPF Refund (Principal sum with accrued interest)

- Less Real Estate Service Fees (Commission)

- Less Legal Or Conveyancing Fees

- Less Seller’s Stamp Duty (SSD), if applicable

= Net Sale Proceeds (Cash) + CPF Refund

These are the funds you’ll likely rely on for your next property purchase. If you’re upgrading, this also means calculating whether these proceeds will be enough to cover:

- The downpayment (cash + CPF)

- Buyer’s Stamp Duty (BSD) and possibly ABSD

- Renovation and moving costs

Any buffer funds needed for short-term rental, furniture, or lifestyle adjustments

Why This Step Is So Important

Having a clear understanding of your financial position allows you to move forward with more certainty. You’ll know what kind of next property is within reach, how much loan you need to take, and whether your timeline is realistic based on your available funds.

If this sounds like a lot to figure out on your own, you don’t have to. A good agent or financial advisor can walk you through the numbers, prepare a simple breakdown, and help you spot any blind spots early — so you avoid making decisions that might stretch you too thin later on.

The earlier you get your numbers right, the easier it becomes to plan your next step with confidence.

5. Should You Sell First or Buy First?

This is one of the most common questions homeowners ask — and honestly, there’s no one-size-fits-all answer. Whether you should sell your current condo first or secure your next home before selling really depends on a few key factors: your financial situation, your comfort with risk, and how flexible your timeline is.

Let’s walk through the main approaches and how each one works.

Option 1: Selling First, Then Buying

For many condo homeowners, selling first offers peace of mind. Once your current unit is sold, you’ll have a clear picture of your available cash, CPF refunds, and how much you can afford for your next property. You also won’t need to pay Additional Buyer’s Stamp Duty (ABSD) if you buy your next home after selling your existing one — which can translate into substantial savings.

The trade-off, however, is timing. Once your sale is locked in, the pressure is on to find a replacement home quickly. If nothing suitable appears, you may feel rushed or end up renting temporarily while searching. To reduce stress, consider negotiating a longer completion period or requesting a temporary extension of stay from the buyer. Some sellers also choose to move into a short-term rental to give themselves the breathing room to find the right next home without rushing.

Option 2: Buying First, Then Selling

Buying your next condo first — without selling your current one — is ideal if you already have a clear idea of your dream home and don’t want to risk missing out on it. You get the assurance of securing your next property before giving up your current one. This approach is beneficial if you’re waiting for a rare unit, planning around school enrollments, or have specific needs that are hard to compromise on.

However, this path comes with higher financial demands. Since you’ll be holding onto two properties temporarily, you’ll need to pay the Additional Buyer’s Stamp Duty (ABSD) upfront. You may be eligible for ABSD remission if you’re a married Singaporean couple and sell your first property within 6 months of purchasing the second one.

You’ll also need to qualify for a second mortgage, which is subject to stricter financing rules:

- The Loan-to-Value (LTV) limit for a second housing loan is reduced to 45%, meaning you’ll need to fork out a larger 55% downpayment.

- Your ability to borrow is also subject to the Total Debt Servicing Ratio (TDSR), which caps your total monthly loan obligations (including your current home loan) at 55% of your gross monthly income.

- Suppose you’re still servicing your first mortgage. In that case, the remaining loan liability will reduce your Total Debt Service Ratio (TDSR), making it harder to qualify for a sufficient loan on your next property.

- On top of that, CPF usage is restricted — if you’re below 55, you’ll need to set aside your Basic Retirement Sum (BRS) before using any remaining CPF OA savings for the second property.

This route requires very careful cash flow and loan eligibility planning. It’s essential to crunch the numbers upfront and have a clear timeline to sell your existing property soon after your new purchase — especially if you’re relying on ABSD remission to recover the stamp duty paid.

Option 3: Doing Both Concurrently (Sell and Buy Together)

For many Singapore condo homeowners, a concurrent sell-and-buy strategy offers a practical middle ground. This means you begin marketing your current condo while also viewing and shortlisting potential new homes. If everything is timed well, you can sell your existing property and exercise the Option-to-Purchase (OTP) on your next home — all without triggering the Additional Buyer’s Stamp Duty (ABSD).

The key to this approach lies in precise timing. You’ll need to ensure your buyer exercises their OTP first before you exercise your purchase OTP. It may sound like a delicate balancing act, but with proper planning — and a good agent guiding both ends — it’s absolutely doable.

This method helps you avoid unnecessary stamp duties, manage your transition more smoothly, and reduce the risk of being caught between two homes. It’s a popular strategy for those who want the best of both worlds — more certainty and better control.

So… Which Option Is Right for You?

There’s no single “correct” route. Ultimately, it comes down to what matters most to you and what best fits your current situation.

- If you want certainty and lower financial risk → selling first may be the safer choice.

- If you’re afraid of missing out on the right unit → buying first might offer peace of mind (if your finances allow it).

- If you want to avoid ABSD and manage both sides efficiently → a concurrent strategy could offer the best flexibility.

Whichever route you take, the key is to start planning early, carefully walk through your numbers and timeline, and get support from someone experienced who can coordinate both sides of the move. With the right guidance and preparation, you can transition smoothly and make decisions that align with your lifestyle and long-term financial goals — without all the stress.

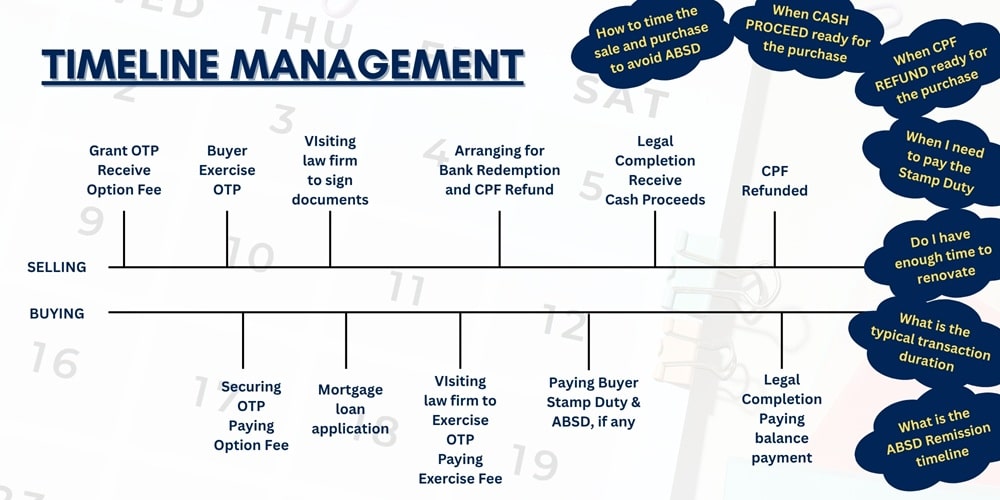

6. Get Your Timeline Right – Avoid Last-Minute Stress

When it comes to selling a condo — especially if you’re also planning to buy another property — timing is everything. Even with a good price and solid finances, poor timeline planning can lead to unnecessary stress, rushed decisions, or unexpected costs, such as short-term rentals or storage.

Whether you’re selling first, buying first, or managing both simultaneously, it’s crucial to map out your timeline from the start clearly. Knowing what happens when will help you make better decisions and avoid last-minute scrambling.

Understanding the Typical Timeline to Sell a Condo

Here’s a general idea of how the selling process usually unfolds:

- Property preparation (cleaning, decluttering, staging) and arranging marketing materials (photos, videos, floorplans)

- Marketing and viewings phase

- Offer received → Negotiation → Granting of Option to Purchase (OTP)

- Buyer exercises OTP (Standard Option Period typically 14–21 days)

- Legal completion process begins — this takes around 8 to 12 weeks, during which the buyer’s bank disburses the loan and both conveyancing lawyers manage the necessary paperwork.

In total, from listing to legal completion, it typically takes about 2.5 to 3.5 months — although this can be faster or slower depending on the market and specific negotiation terms.

Managing Your Transition Timeline

If you’re also purchasing another property, this is where things can get tricky. You’ll need to carefully align your sale completion date with your purchase completion date so that funds are available on time and your transition between homes is as smooth as possible.

Some sellers assume things will “just work out,” only to find themselves in a difficult spot — either selling their home too early before securing the next one or buying before they can access their sales proceeds. That’s where timeline stress usually begins.

To manage your transition more smoothly, consider:

- Negotiating a longer completion period with your buyer (e.g., 12 weeks instead of 8) and looking into bank bridging loan options if needed

- Requesting a temporary extension of stay post-completion (usually 2–3 months, subject to buyer’s agreement) to allow time for renovations or a smoother transition into your new home

- Timing your purchase OTP to be exercised after your buyer exercises their OTP — especially important if you’re trying to avoid ABSD

- Keeping your options open for short-term rental in case there’s a gap between sale and purchase that can’t be avoided

These strategies give you more control and flexibility — but they require early planning and coordination.

Why Timeline Planning Matters

Getting your dates right isn’t just about convenience; it’s about accuracy. It can directly affect your cash flow, loan eligibility, ABSD remission timeline, and overall peace of mind.

For example, if you’re buying first and aiming to qualify for ABSD remission, your existing property must be sold within 6 months from the purchase date. That timeline needs to be tracked and managed from the beginning — you won’t want to miss the window due to delays or misalignment.

On the other hand, if you’re selling first and plan to use your CPF or sale proceeds for your next home, you must ensure the funds are released in time to meet the purchase completion date; otherwise, you may need to secure a bridging loan or use more cash upfront.

The bottom line is to give yourself a buffer. Things don’t always go perfectly according to plan, but with proper timeline management, you’ll have room to adapt. A well-thought-out timeline reduces stress, avoids unnecessary costs, and ensures you stay in control of the entire process — from start to finish.

7. Finding the Right Property Agent for the Job

Selling your condo isn’t just about putting it up on a portal and hoping for the best — it’s about positioning your unit correctly, timing the market, negotiating confidently, and, most importantly, planning the entire journey from start to finish. That’s why choosing the right property agent can make a huge difference.

A good agent is more than just a middleman. The right one acts as your strategist, market analyst, project coordinator, and negotiator — all rolled into one. They help you avoid costly mistakes, spot opportunities, and guide you through the process with clarity and confidence.

What to Look For in a Good Agent

Not all agents operate the same way. Some focus heavily on transactions, while others take a more consultative approach. Here’s what to consider when deciding who to work with:

- Track record and experience – Have they handled similar condo types or properties in your area before? Someone familiar with your development or district will likely have a better understanding of how buyers think, what pricing works, and how to position your unit in the current market effectively.

- Clear and data-backed advice – A good agent should provide you with recent transaction data and competitor listings, and explain how they plan to position your unit. They should also walk you through potential scenarios and exit plans rather than just quoting a high price to impress you.

- Communication style – You’ll be working closely with this person for at least a few months. Ensure they’re responsive, proactive, and easy to communicate with. Selling a home is a two-way process — so having someone who truly listens is key.

- Marketing strategy – Ask about their plan beyond just listing on PropertyGuru. Do they use professional photography, virtual tours, social media targeting, or video walkthroughs? The more exposure your unit gets, the better your chances of getting strong offers.

- Integrity and transparency – You want someone who’s upfront, realistic and gives honest advice — even if it’s not what you want to hear. The goal is to sell well, not just fast.

Speak to a Few Agents Before You Shortlist Who to Work With

It’s perfectly okay — and actually recommended — to speak to two or three agents before deciding who to work with exclusively. Some sellers rush into signing with the first person they meet, only to later realize there was a mismatch in expectations or communication style.

Take the time to compare their marketing proposals, pricing strategies, and how well they understand your unit and area. It also helps to see who listens attentively, asks thoughtful questions, and gives you a clear roadmap rather than vague promises.

And don’t feel pressured to go with the one who quotes the highest potential price. An agent who throws out the most optimistic number may not necessarily be the one who helps you sell well — especially if it leads to overpricing and longer waiting times. Choose someone realistic, well-prepared, and genuinely looking out for your best interests.

Selling your condo is a big move — and having the right agent by your side can take a massive weight off your shoulders. With the right partnership, you’ll feel more supported, make more informed decisions, and ultimately achieve better results.

8. Prep Your Condo for Viewing to Attract Better Offers

Once you’ve decided which property agent to work with and set your targeted sale price, the next crucial step — and one that many sellers overlook — is preparing your condo for viewings. In the real estate market, the condition and presentation of your unit can directly impact how much attention it receives — and, more importantly, how much buyers are willing to offer.

Buyers aren’t just buying square footage — they’re buying emotion, comfort, and lifestyle. A clean, well-maintained, and thoughtfully presented home helps them picture themselves living there. That emotional connection often leads to a quicker sale and a better price.

Decluttering

Start with the basics. Remove excess furniture, personal items, and old magazines to create a space that feels clean and uncluttered. The goal is to create a clean, open, and neutral environment that appeals to a wide range of buyers.

If your unit is smaller, decluttering becomes even more critical — the fewer visual distractions, the larger and airier the space will feel.

Minor Repairs and Touch-Ups

Tidy homes sell better — and minor flaws can turn buyers off quickly. Fix anything that’s broken or looks worn out. Leaky taps, loose handles, non-working light fixtures, or patchy walls might seem minor, but they signal poor maintenance to buyers.

Simple improvements, such as a fresh coat of paint, replacing old bulbs, or steam cleaning curtains and upholstery, can go a long way in making the space feel refreshed. You don’t need a full renovation — just ensure everything works and looks well-maintained.

Stage the Space with Purpose

You don’t need to hire a professional staging company to make your condo look attractive. Often, small changes to furniture arrangement and styling can already make a big difference:

- Arrange furniture to maximize space and natural flow.

- Add tasteful décor touches, such as cushions, throws, or indoor plants.

- Use warm lighting during evening viewings to create a welcoming atmosphere.

If your unit is tenanted, work closely with your tenants to keep the home tidy and accessible during viewings. A clean and cooperative environment facilitates smoother and more effective showings.

Professional Visuals

Before a buyer even sets foot in your home, their first impression starts online — through photos and videos. This is where professional visuals can make all the difference.

Great lighting, proper angles, and high-resolution shots showcase your unit in the best light. Whether it’s a nicely renovated kitchen or an unblocked view, these visuals should highlight your unit’s best features and attract more eyeballs — leading to more inquiries and, ultimately, stronger offers.

Think of home preparation as your final polish before showtime. Just like how retail stores tidy up their displays before customers arrive, your condo deserves the same attention. A well-presented home stands out, creates emotional appeal, and shows pride of ownership — all of which contribute to faster sales and better offers.

9. Plan a Smart Marketing Strategy (Don’t Just Post and Pray)

With your condo cleaned up, decluttered, and ready for viewing, the next key step is to ensure it gets seen by the right buyers — and that starts with a smart, intentional marketing plan.

In today’s market, simply listing your property on PropertyGuru and hoping for the best is no longer enough. If you want serious buyers to take notice—and compete for your unit—your marketing must go beyond the basics.

Understand Your Competition

Before pricing your unit, consider what else is available nearby. Are there similar units in your condo or neighboring developments also for sale? Are they high-floor, renovated, pool-facing? What are they asking, and more importantly — what are they transacting at?

Your agent should provide you with a thorough Comparative Market Analysis (CMA) that includes current listings, recent transactions, and how your unit compares. This helps you position your asking price realistically and attract buyers who are already shopping in your segment.

Overpricing may cause your listing to go stale. Underpricing may result in you leaving money on the table. A good pricing strategy is about hitting that sweet spot — where your home stands out as good value and still leaves room to negotiate.

First Impressions Start Online

Almost all buyers today start their search online, which means your listing must grab attention within seconds.

Here’s what makes a listing stand out:

- Professional photos that show off space, light, and flow

- Video walkthroughs or virtual tours to help buyers visualize the space from anywhere

- A clean, styled interior (which you’ve already prepped in the previous step)

When buyers see well-crafted visuals, they tend to feel that the unit is well-maintained — and that sets a positive tone before they even step inside.

Go Beyond the Property Portals

Portals like PropertyGuru, 99.co and SRX are essential, but they shouldn’t be your only channels. Many serious buyers — especially upgraders or younger couples — spend more time on social media platforms like Facebook, Instagram, and YouTube.

Your agent should have a digital strategy in place that includes:

- Targeted social media ads — filtered by location, income group, age range, or even interests

- Short-form video teasers on Instagram or TikTok to generate buzz

- Lead capture and follow-up systems to ensure no inquiry slips through

Marketing is not just about visibility — it’s about getting in front of the right people at the right time, and that often means going where the buyers are.

Track Performance and Stay Proactive

Marketing doesn’t stop after posting the listing. A good agent will track weekly performance — how many people are viewing the ad, calling in, booking viewings, and what kind of feedback is coming in from showings.

If the response is low, they should be ready to adjust the strategy — whether it’s the listing price, the cover photo, the ad copy, or even the timing of when it’s being pushed online.

In short, marketing your condo is part art, part strategy. It’s not just about putting the word out — it’s about positioning your unit to shine. With the right visuals, data-backed pricing, and a strong online presence, your listing won’t just sit there — it’ll work hard to attract genuine, ready buyers.

10. Negotiation Tips and Securing a Buyer

Once viewings begin and interest picks up, it’s only a matter of time before offers start coming in. This is where things can get both exciting and nerve-wracking — because negotiation is where deals are won or lost.

At this stage, it’s not just about accepting the highest offer. It’s about evaluating the full picture: price, buyer profile, timeline, and conditions. The key is to stay calm and objective and work closely with your agent to secure an offer that aligns with both your goals and timeline.

Don't Jump at the First Offer (But Don't Ignore It Either)

Sometimes, the first offer that comes in can be a strong one — especially if your unit is well-priced and well-presented. But some sellers hesitate, thinking a better offer might be just around the corner.

While it’s good to test interest, do weigh each offer carefully. A reasonable first offer from a serious buyer is often worth serious consideration — especially if it comes with flexibility on completion, no special conditions, or a clean financial profile.

Your agent can guide you through how “hot” the current market is and whether holding out could lead to a better deal — or just more waiting.

Understand the Buyer's Position

It’s not just about the price offered. The buyer’s intent and readiness are also important considerations.

- Is the buyer already approved for a loan?

- Are they first-time buyers, or do they need to sell their current property first?

- Do they need a long completion, or are they in a rush?

Sometimes, a slightly lower offer from a ready, flexible buyer may be more valuable than a higher offer with lots of conditions or uncertainty.

Create a Win-Win Situation

The best negotiations are not about hard standoffs — they’re about mutual understanding and value exchange.

Be open to discussion. If an offer comes in slightly below your expectations, but you sense the buyer is serious, consider countering with a reasonable price or offering some flexibility (such as allowing an early renovation or furniture handover).

Likewise, if a buyer needs a slightly later move-in date and you have room to accommodate, offering that flexibility may help you secure the deal without compromising on price.

Rely on Your Agent's Experience

A good agent will help you read the buyer’s profile, spot red flags, and guide you on how far to push — or when to close.

They’ll also help keep negotiations professional and objective, especially if emotions start to run high. Ultimately, your agent serves as a buffer to protect your interests while facilitating progress.

Securing a buyer isn’t just about getting an offer — it’s about sealing the right deal. With a strategic mindset, strong communication, and the proper guidance, you’ll be able to negotiate confidently, avoid unnecessary friction, and close with terms that work for you.

11. Granting Option to Purchase (OTP) to the Buyer – What Happens Next?

Once you and the buyer agree on the sale price and terms, the next formal step is to grant the Option to Purchase (OTP) — a legally binding document that gives the buyer the right (but not the obligation) to buy your condo within a set timeframe.

If you’ve appointed a property agent, they’ll usually help prepare the OTP. But if your case is more complex — say, involving tenancy, divorce, or trust arrangements — it’s a good idea to get your lawyer involved early to vet the details.

What happens after granting the OTP? Don’t worry — here’s a simple step-by-step guide to walk you through.

What Is the OTP and Why It Matters

The Option to Purchase is a legal contract between you (the seller) and the buyer. It clearly outlines the key terms of the sale:

- Agreed sale price

- Option fee (typically 1% of the purchase price)

- Option period (usually 14 to 21 calendar days)

- Proposed completion date

- Any special clauses (e.g., extension of stay, partial furnishings, tenancy handover, etc.)

Once you sign the OTP and issue it to the buyer, they’ll pay the 1% option fee, which is non-refundable unless otherwise stated.

⚠️ Tip: Before you issue the OTP, double-check that the buyer has secured in-principle loan approval or sufficient funds. This reduces the risk of last-minute backouts.

What Happens During the Option Period?

During this 14–21 day window, the buyer has time to:

- Secure final bank loan approval

- Finalise legal and financial checks

- Decide whether to proceed with the purchase

While the option is live, your condo is exclusively reserved for that buyer, meaning you cannot entertain other offers until the option to purchase (OTP) is either exercised or lapses. So, only issue it when you’re confident in the buyer’s commitment.

When the Buyer Exercises the OTP

If the buyer decides to proceed, they will exercise the OTP by signing the acceptance section and paying an additional 4% of the purchase price (making up the usual 5% deposit in total). This must be done within the option period (e.g., by Day 14 or Day 21).

Once exercised, the deal becomes legally binding — both buyer and seller are now contractually obligated to complete the transaction.

What If the Buyer Doesn't Exercise the OTP?

If the buyer backs out or doesn’t act by the deadline, the OTP expires. You keep the 1% option fee, and you’re free to relist your unit for sale.

Appointing a Conveyancing Lawyer

Both you and the buyer will need to appoint conveyancing lawyers to handle the legal paperwork and transfer of funds. If you haven’t appointed one yet, now is the time.

Your lawyer will:

- Prepare and vet all sale-related documents

- Liaise with your bank to redeem any existing mortgage

- Coordinate CPF refunds (if your CPF was used)

- Handle transfer of sales proceeds and final handover

🧠 Tip: Appoint your lawyer early — they can help identify and flag any potential legal risks before you commit to the sale.

The Option to Purchase stage is the turning point — where verbal negotiations become a legal commitment. Understanding the procedures that follow helps you stay in control, avoid surprises, and move confidently into the final phase of your condo sale.

12. Choosing Your Conveyancing Lawyer

Many homeowners assume that once the Option to Purchase (OTP) is granted, things will fall into place. However, in reality, your conveyancing lawyer plays a crucial role in ensuring the smooth, timely, and accurate legal and financial handover of your condo sale.

If you’re selling your condo in Singapore, choosing the right conveyancing lawyer is not just a formality — it can directly affect how quickly your bank loan gets discharged, how soon you receive your sales proceeds, and whether your CPF refunds are processed without delay. A good condo sale lawyer also helps identify issues early and provides you with peace of mind during a process that involves tight deadlines and a lot of coordination between parties.

What Does a Conveyancing Lawyer Actually Do?

Here’s a look at what your lawyer will handle behind the scenes:

Redemption of Your Existing Loan

Your lawyer will liaise with your bank to arrange full repayment of your outstanding mortgage, including obtaining the official loan redemption statement. They will also prepare and submit the seller’s loan discharge instructions to your bank to ensure a smooth initiation of the process.

CPF Refund Tracking and Coordination

If you used CPF funds for your down payment or monthly installments, your lawyer will handle the CPF refund to your Ordinary Account (OA), including accrued interest. The refund typically occurs within two weeks of the legal completion date, and your lawyer will ensure that all necessary documents are submitted correctly and on time.

Bank Disbursement Timeline Management

Your lawyer coordinates closely with the buyer’s solicitor and bank to ensure that funds from the buyer’s end are disbursed on schedule. This helps avoid unnecessary delays and keeps the completion timeline on track.

Title Deed Handling and Transfer

If your mortgage has already been fully redeemed (meaning there is no outstanding loan), your title deed is likely held in your personal custody. However, if the bank is still holding it, your lawyer will promptly handle the request for its release to ensure legal completion. For strata-titled condos, your lawyer will also prepare the necessary documentation to effect the ownership transfer and ensure it is properly lodged with the Singapore Land Authority (SLA).

Settle Outstanding Payments

Your lawyer will also ensure that all outstanding charges are adequately settled before legal completion. This includes:

- MCST maintenance fees

- Property tax

- Season parking charges (if applicable)

These charges are usually prorated up to the date of legal completion. Any excess payments made beyond the handover date will be refunded to you after reconciliation.

Legal Paperwork and Final Completion

Your lawyer will prepare and process all legal documents required for the transfer of ownership, including coordinating the disbursement of your sale proceeds. They’ll also work closely with your bank and CPF Board to ensure that all payments, refunds, and instructions are carried out smoothly.

When Should You Appoint a Lawyer?

If your sale is relatively straightforward, your property agent can recommend a trusted lawyer when you issue the Offer to Purchase (OTP) to the buyer. But if your transaction involves special terms — such as tenancy handover, partial furnishings, or an extension of stay — it’s best to appoint your lawyer early so they can review and advise before the OTP is signed.

Choosing the Right Lawyer

Not all lawyers offer the same service or responsiveness. Here’s what to look for when choosing your conveyancing lawyer in Singapore:

- Proven experience handling condo sales, especially those involving existing mortgages or tenanted units

- Good communication and prompt response — timelines are tight, and you need someone who keeps you updated

- Transparent legal fee structure — check what’s included, such as CPF coordination, loan discharge handling, and bank liaison

- Strong track record of meeting bank and HDB/URA completion deadlines — especially important if you’re selling and buying concurrently

Having a competent conveyancing lawyer on your side ensures all the legal and financial moving parts — from mortgage discharge to CPF refund tracking — are handled with care. It’s one of those things that’s easy to overlook, but it can make a huge difference in how smooth (or stressful) your sales experience turns out to be.

13. Final Handover and Post-Sale Matters

After the buyer exercises the Option to Purchase (OTP), the final step of your condo sale journey is legal completion and handover. While it may feel like everything is nearly done, this stage still involves a few important financial, legal, and practical steps to ensure a smooth conclusion.

What Happens on Legal Completion Day

On the legal completion day — typically 8 to 12 weeks after the option to purchase (OTP) is exercised — your conveyancing lawyer will meet with the buyer’s lawyer to complete the transaction. Behind the scenes, this includes:

- Disbursement of funds from the buyer’s bank

- Redemption of your outstanding mortgage

- Refund of CPF monies used

- Legal transfer of ownership

- Release of your sale proceeds

If you’re still occupying the property, the physical handover usually takes place on the same day — unless both parties had earlier agreed to an extension of stay.

Prepare for the Final Handover

Before the completion date, ensure that your unit is cleared of personal items (unless otherwise agreed with the buyer), tidied up, and ready for its new owner. A smooth and respectful handover sets the right tone for a proper deal closure.

Be ready to return the following items:

- All sets of house keys

- Access cards and condo entry fobs

- Car park decals or assist with IU number transfer

- Gate transponder, if any

- Remote controls for air-conditioning, ceiling fans, lighting systems, or automated gates

Returning these items fully avoids any post-completion disputes or confusion.

CPF Refund and Disbursement of Sale Proceeds

All CPF monies you’ve used for the property — including the downpayment and any monthly installments — will be refunded to your CPF Ordinary Account, together with accrued interest. This typically happens within two weeks of legal completion.

Your net sale proceeds, after settling your outstanding loan, legal fees, and any prorated expenses, will be disbursed to you in the form of a cashier’s order from your lawyer’s trust account.

Don't Forget to Update Your Mailing Address

This simple but often overlooked step can cause inconvenience later. Be sure to update your residential address with:

- ICA (via Singpass) — for official government records

- Insurance providers, banks, and telcos

- Memberships, subscriptions, and other organizations

Also, consider applying for SingPost’s Mail Redirection Service to ensure nothing important is missed during your transition to the new address.

Tie Up Loose Ends Smoothly

The legal completion and final handover mark the closing chapter of your condo sale journey. With proper coordination, clear communication, and attention to these final details, you’ll be able to wrap things up cleanly — and step into your next phase with confidence.

14. Wrapping It All Up – A Story of a Smooth Transition

James and Claire, a couple in their early 40s, had been living in their condo in Queenstown for the past 8 years. With their two kids growing up and entering upper primary school, space was starting to feel tight — plus, they wanted to move closer to a good secondary school. So, they began exploring the idea of selling their current condo and upgrading to a bigger unit in the East.

Like most homeowners, their first questions were:

“Should we sell first or buy first? Can we avoid ABSD? And what if we end up with no place to stay in between?”

They decided to meet with an agent who helped them break down the details. First, they checked their outstanding loan and CPF usage to calculate the potential net sale proceeds. With those numbers in hand, they could see their budget for the next home — no guessing involved.

Together with their agent, they planned a concurrent sell-and-buy strategy. While their condo was being marketed, they started viewing properties in the East. Their agent advised on pricing strategy, engaged a photographer, and prepped the home to shine online.

Within two weeks, they received a serious offer. With a longer completion timeline and a 2-month extension of stay negotiated, the transition became less stressful. They exercised the Option to Purchase (OTP) for their new condo only after their buyer exercised it — so no Additional Buyer’s Stamp Duty (ABSD) was triggered. Their lawyer handled all the documents, loan redemption, and CPF refunds and liaised with the MCST to ensure a smooth handover.

By the time they handed over their unit, they had already completed minor works at their new home — no need to rush or rent. Claire even remembered to update their address with ICA and applied SingPost’s mail redirection service “just in case.”

Looking back, James said,

“It wasn’t just about selling the house. It was about planning it properly — like a journey with a map. Without that, we would’ve been lost.”

Key Takeaways from James & Claire's Journey

- Start early and assess: Understand your financial position and CPF refund obligations before planning your next move.

- Decide on your selling or buying sequence: Choose between selling first, buying first, or doing both concurrently — based on your comfort level and timeline.

- Prep and present your home well: Decluttering, staging, and professional visuals make a huge difference in attracting serious buyers.

- Choose the right agent and lawyer: Experience, responsiveness, and strategy matter — not just availability.

- Plan your transition carefully: Use extension of stay or bridging loans if needed. Avoid ABSD by timing your sale and purchase correctly.

- Don’t forget post-sale admin: Update your address and hand over all access items, such as car park decals, gate transponders, and keys, properly.

Frequently Asked Questions (FAQ)

1. What is the typical timeline for selling a condominium in Singapore?

From the time you list your unit to legal completion, the whole process usually takes about 3 to 4 months.

Here’s a quick breakdown:

- 1 to 4 weeks for marketing and viewings

- 2 to 3 weeks for the Option to Purchase (OTP) to be exercised

- 8 to 12 weeks for legal completion

This can vary depending on market conditions, buyer readiness, and how well your unit is priced and presented.

2. When will I receive my proceeds after selling?

Your cash proceeds (after paying off your loan and refunding CPF) will be disbursed on legal completion day — usually via cashier’s order.

Your CPF refund (if used) will be credited back to your OA within 2 weeks after completion.

3. What fees do I need to pay when I sell my condo?

Here are the typical costs involved:

- Conveyancing legal fees

- Agent service fee

- Bank redemption fees (if any): Early repayment penalty or notice period interest

- MCST and property tax: Will be prorated up to the completion date

Ensure that you clarify all costs upfront with your lawyer and agent.

4. Is stamp duty payable when I sell a condominium?

Only if you’re selling within the Seller’s Stamp Duty (SSD) period:

| Holding Period | Rates from Mar 11, 2017 to Jul 3, 2025 | Rates on and after Jul 4, 2025 |

|---|---|---|

| Up to 1 year | 12% | 16% |

| More than 1 year but up to 2 years | 8% | 12% |

| More than 2 years but up to 3 years | 4% | 8% |

| More than 3 years but up to 4 years | 0% | 4% |

| More than 4 years | 0% | 0% (no change) |

Source: Ministry of National Development, Ministry of Finance and Monetary Authority of Singapore, Jul 3, 2025

This applies to both Singaporeans and foreigners.

5. How long must I hold my condo before selling it?

To avoid SSD, you must hold your condo for at least three years from the date of purchase or acquisition. For property purchased on or before 3rd July 2025, it will be at least three years. For property purchased on or after 4th July 2025, it will be at least four years.

Additionally, if you’re still in a mortgage lock-in period, verify whether your bank charges a penalty for early repayment.

6. Can I sell and buy without paying the Additional Buyer's Stamp Duty (ABSD)?

Yes, but only if the timing is managed correctly.

If you’re upgrading or moving from one private property to another:

- Selling first avoids ABSD completely.

- If buying first, Singaporean married couples may qualify for ABSD remission — but they must sell their first property within 6 months of the second purchase.

Planning your timeline well is key to avoiding unnecessary stamp duty.

Common Mistakes to Avoid When Selling Your Condo

Even with the best intentions, many condo owners fall into similar traps during the selling process — often because they rush in without enough planning. Here are some common pitfalls you’ll want to avoid:

1. Overpricing Your Unit Without Proper Market Check

It’s tempting to aim high, especially if your neighbor sold for a good price or if you spent a lot on renovations. However, without a proper Comparative Market Analysis (CMA), you may end up overpricing your unit and deter serious buyers. A stale listing that sits on the market for too long often ends up selling for less than it could have if it were priced correctly from the start.

2. Skipping the Prep Work – Clutter, Repairs, and Presentation

First impressions matter. A messy, poorly maintained unit will turn off buyers even if the location and layout are excellent. Decluttering, fixing minor issues, and staging the space (even with simple touches) can make a huge difference in how your home is perceived — and how much someone is willing to offer.

3. Relying on Weak Marketing That Doesn't Stand Out

Just posting your listing on PropertyGuru isn’t enough in today’s market. Poor photos, missing details, or a lack of social media presence can lead to fewer viewings. A strong, multi-platform marketing strategy with high-quality visuals and targeted outreach helps you stand out from the crowd and attract serious offers.

4. Poor Timeline Planning and Financial Coordination

Whether you’re selling first, buying first, or doing both concurrently — timeline and financial planning are key. Many sellers overlook the need to synchronize sale completion dates with new home purchases, resulting in last-minute scrambling for funds, temporary accommodations, or even Additional Buyer’s Stamp Duty (ABSD) liabilities. Work out your finances and plan your steps early.

5. Forgetting About SSD or Mortgage Lock-in Penalties

Failing to check your Seller’s Stamp Duty (SSD) timeline or mortgage lock-in period can result in thousands of dollars in unexpected costs. Before listing your unit, always verify these details with your bank and review your holding period — it can be the difference between a profitable sale and one with hidden losses.

These missteps are common — but easily avoidable with the proper planning and support. By being informed and prepared, you’ll be in a much stronger position to sell with confidence and achieve the best possible outcome.

Helpful Tips Before You Sell

Selling your condo is more than just a transaction — it’s a major life move. Whether you’re upgrading, rightsizing, or making your next investment, here are a few practical tips that can make your journey smoother and less stressful:

1. Work with Someone Who Truly Listens

Your property agent shouldn’t just be someone who pushes for a quick deal. Find someone who takes the time to understand your goals, listens to your concerns, and maps out a clear plan with you — not just for selling but also for what comes next.

2. Selling and Buying at the Same Time? Start Planning Early

If you’re planning to sell and buy around the same period, timing becomes everything. Start planning early to ensure you have sufficient time to view potential new homes, plan your finances, and properly align key dates. The earlier you plan, the more options you’ll have — and the less pressure you’ll feel later.

3. Don't Just List — Market with Intention

Posting a listing online is easy. However, to secure strong offers, you’ll need a compelling presentation, clear pricing, and a well-defined marketing strategy that targets the right buyers. Think professional visuals, smart social media targeting, and detailed listing copy that brings out your unit’s strengths.

4. Think Long-Term, Not Just This Sale

A successful condo sale sets the stage for your next chapter — whether that’s upgrading to a better asset, retiring with peace of mind, or unlocking cash for other goals. Don’t focus solely on price. A smooth sale, with the right timeline and planning, can make all the difference in your next move.

These small steps and mindset shifts often lead to better outcomes — not just financially but also emotionally. When you’re ready and well-prepared, selling doesn’t have to be overwhelming. It can actually be a rewarding and empowering experience.

To Sum It All Up, Selling a Condo Doesn't Have to Be Stressful

Selling your condo in Singapore may feel like a big step — and truthfully, it is. There are financial details to sort out, legal documents to handle, and timelines to manage, especially if you’re buying another property simultaneously. But with the right guidance and preparation, the process doesn’t have to be overwhelming.

As you’ve seen throughout this guide, success comes down to three things:

- Planning early and clearly

- Working with people you trust

- Making informed decisions at every step

Whether you’re hoping to unlock capital for your next upgrade, moving closer to family, or just planning a new chapter in life — a well-executed condo sale can help you move forward smoothly and with peace of mind.

Need Help With Your Condo Sale Plan?

If you’re unsure where to begin or would like someone to guide you through the steps, I’m happy to help.

There is no pressure, no hard selling — just a friendly conversation to understand your situation and share what options you might have based on the current market.

Feel free to drop me a message anytime or reach out. Sometimes, all it takes is a simple chat to get more clarity.

Here’s to a smooth and successful next step in your property journey.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls