Table of Contents

The 3 Stages of A Singapore 99-Year Leasehold Property Investment Life Cycle: Growth, Stagnation, or Decline Determine A Property Is Profitable or Unprofitable!

In this article, I will share and explain the three stages of a Singapore leasehold property life cycle in the secondary market (resale market) with some examples to illustrate the different stages.

As everyone knows, property investments are traditionally considered ‘passive’ and safer as they are less volatile than investments such as equities and stocks.

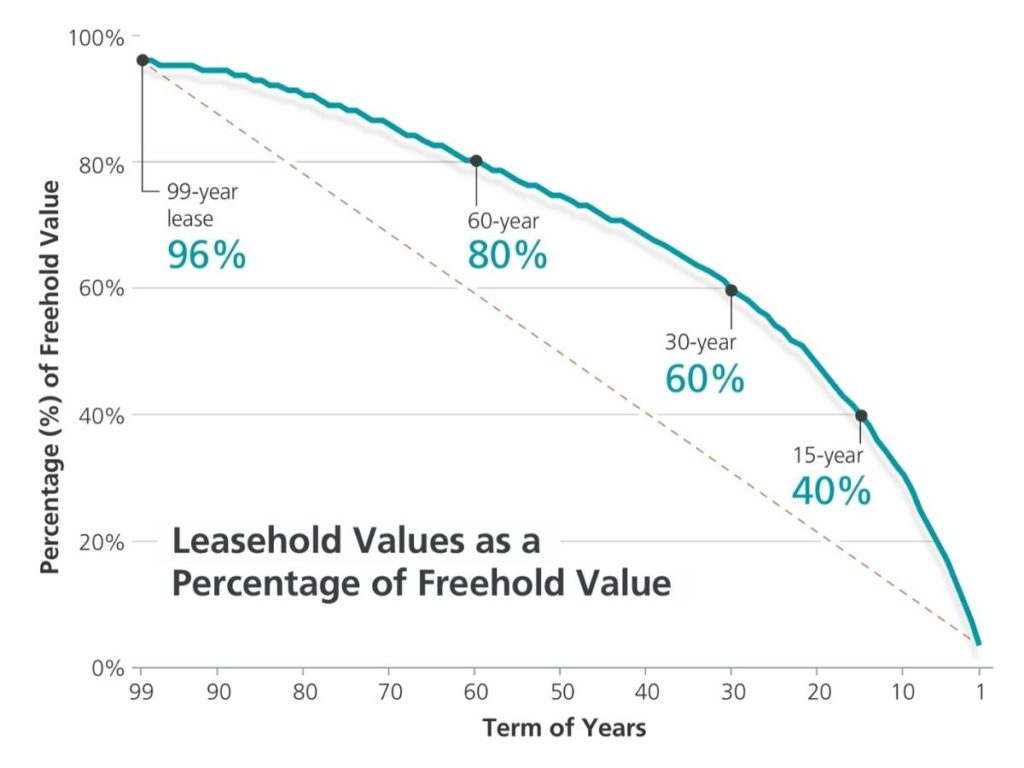

However, in passive management, it does not mean that a ‘buy and hold forever’ strategy will work for all types of properties. Furthermore, the ‘buy and hold forever’ also does not mean it is automatically a safe approach as value decays over time for leasehold properties. The property value that decays over time is explained in Bala’s curve, where property value will become zero upon the expiry of the leasehold term.

In Singapore, the most common leasehold term is 99 years. Thus, upon expiration at 99 years, the property’s value becomes zero, and the property ownership returns to the state.

Aside from the Freehold (or equivalent 999/9999 years leasehold) properties, the growth trajectory of 99 years leasehold properties generally falls into three stages over time which, in short, I call GSD (Growth, Stagnation, Decline).

As a property owner, you may often overlook the different stages, and by the time you realize it, it may fall into the stagnation stage or, worst, into the declination stage. As no one can predict or time the market in any investment, it is always good to keep yourself up to date on the real estate market and monitor the trend of your property investment. If you are unsure of your property performance, you are most welcome to drop me a message for a discussion about your property performance assessment.

As a property investor or buyer, it is always good to analyze the resale leasehold property performance and at which stage it is currently, which will determine if the property is profitable or unprofitable before you start any price negotiation with the seller.

Let me illustrate some examples of the three stages in some of the condos in Singapore, about the growth, stagnation, and declination stages trend.

Properties That Are In Growth Value Stage: Example 1

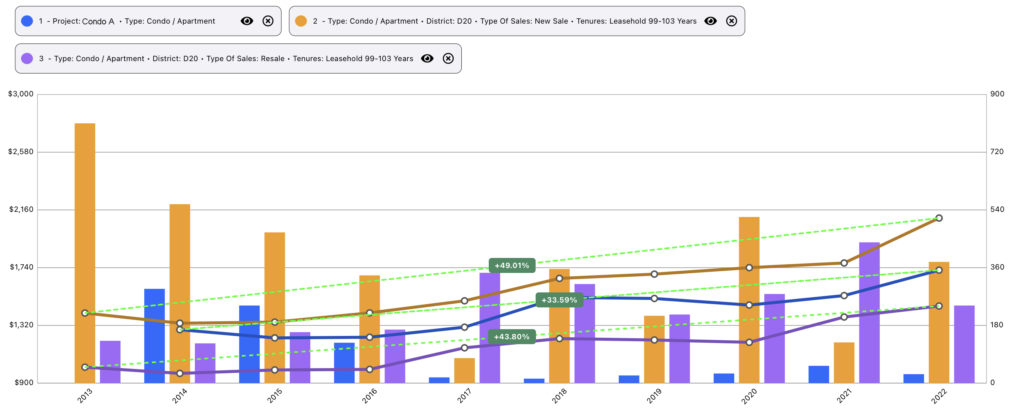

One straightforward way to check the growth prospects of a property is to compare it against the price index of the resale properties and new properties of the same tenure within the same district.

Let’s take a closer look at the above example. It illustrates how over the past ten years, Condo A has performed relatively well (33.59%) vs. the prices of other 99-year new private condominiums (49.01%) and private resale condominiums (43.80%) in district 20.

(Note: COVID delays created artificial upward price pressures for typically stagnant projects, which we foresee will normalize once COVID passes.)

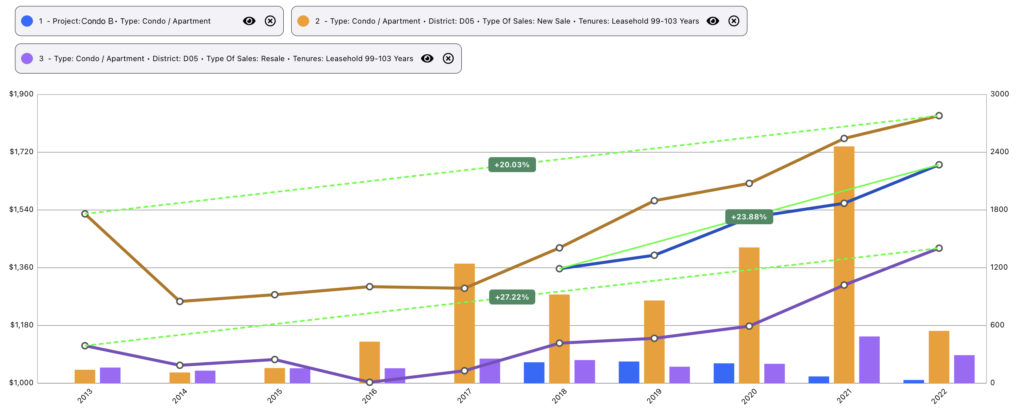

Properties That Are In Growth Value Stage: Example 2

In the example above, Condo B, despite being launched only five years ago, has performed relatively well (23.88%) against the prices of other 99-year new private condominiums (20.03% over 10 years) and private resale condominiums (27.22% over 10 years) in district 5.

(Note: COVID delays created artificial upward price pressures for typically stagnant projects, which we foresee will normalize once COVID passes.)

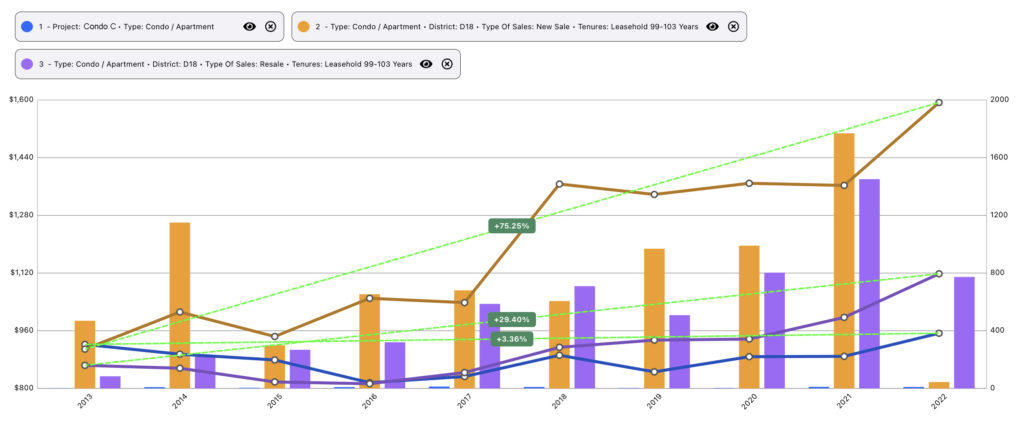

Properties That Are In Stagnation Value Stage: Example 3

In this Stagnation example, it shows how over the past 10 years, Condo C has seen stagnation in value (3.36%) vs. the price of other 99-year new private condominiums (75.25%) and private resale condominiums (29.40%) in district 18.

(Note: COVID delays created artificial upward price pressures for typically stagnant projects, which we foresee will normalize once COVID passes.)

Properties That Are In Stagnation Value Stage: Example 4

In this Stagnation example, it shows how over the past 10 years, Condo D has seen stagnation in value (4.27%) vs. the price of other 99-year new private condominiums (29.60%) and private resale condominiums (30.60%) in district 23.

(Note: COVID delays created artificial upward price pressures for typically stagnant projects, which we foresee will normalize once COVID passes.)

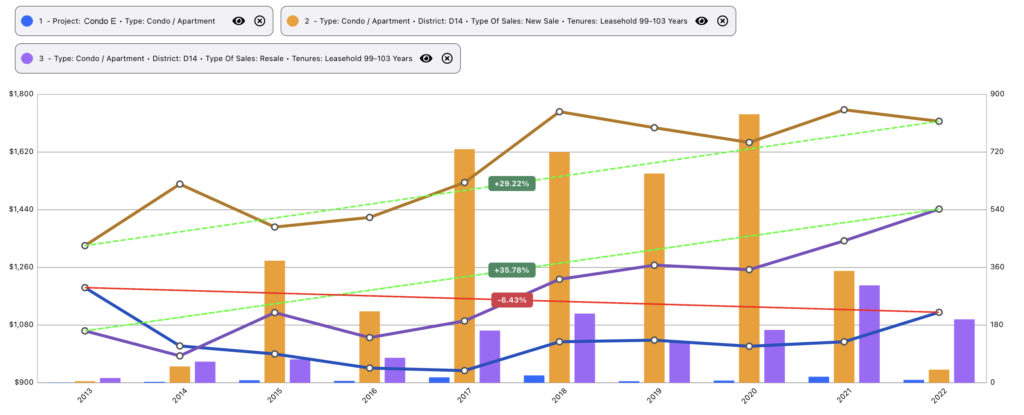

Properties That Are In Declination Value Stage: Example 5

In this declination example, it shows over the past 10 years. Condo E has shown underperformed (-6.43%) vs. the prices of other 99-year new private condominiums (29.22%) and private resale condominiums (35.78%) in district 14.

(Note: COVID delays created artificial upward price pressures for typically stagnant projects, which we foresee will normalize once COVID passes.)

Factors May Affect a Property’s Growth Potential

You may ask what factors can affect the growth rate of a property versus its surroundings. Here are some of the main factors:

- The size of the development. (Usually, larger development tends to perform better.)

- Bought fair or overpriced at launch.

- The remaining tenure.

- Do not have much HDB upgraders demand nearby.

- Rental Yields (Grow/Stagnate/Decline).

- Amenities and/or transportation hubs.

- The conditions and maintenance issues.

- Unit layout. (regular versus irregular).

- Unit type. (1/2/3/4/5 bedroom /Penthouse, etc.)

- Location of the development. (E.g., Growth hotspots, URA transformation plans, upcoming MRT stations/transport hubs, a good number of upcoming GLS / Enbloc plots, etc.)

- Enbloc potential

The more factors a property fulfills, the higher the likelihood it will continue to appreciate in the long term and vice versa.

In Summary

Property owners or investors must understand that 99-year leasehold properties require active management from time to time so that you can ‘recycle’ the profits and funds from stagnant and declining properties into higher profit potential properties especially seen in brand new or younger properties.

Although one can say that rental yields (if it’s a tenanted unit) will still ultimately result in a gain for the property owner. But it is better to seek capital gains and rental yields as this compounds growth faster than rent alone.

This will allow a property investor’s portfolio to continue to outperform the general market and enjoy greater capital growth on their equity within the same period.

Get the Right Help for Your Property Deal

For a detailed analysis of your property portfolio and an in-depth discussion, you may reach out to me for a Property Wealth Planning consultation. A Property Wealth Planning (PWP) consultation covers the following:

- An in-depth financial affordability assessment and customized timeline planning

- Highly relevant investment insights

- Entry and exit strategies

- A clear and customized investment road map caters to your needs

- A curated list of the current market best buys with good growth potential & minimal risks

- Identifying units with the highest potential in upcoming new launches

- Finding out if your property has stagnated in price and your options

- Advice on the marketing strategies and securing a buyer for your property in the shortest possible time

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls