The Property Purchase 99-1 Arrangement in Singapore: What is Considered Legal Arrangement vs. Illegal Loophole, and what are the differences between the two?

Table of Contents

Introduction

Navigating Singapore’s property market can be challenging, especially with the Additional Buyer’s Stamp Duty (ABSD) casting a shadow over second and subsequent property purchases. With recent news reported on 8th May 2024 of a $60 million clawback from 166 private property deals exploiting the “99-to-1” loophole, understanding the difference between the legal and illegal ways of using the 99-1 arrangement is crucial.

This article explained an illustrative case study to uncover the risks, rewards, and consequences of the 99-1 arrangement in Singapore. Although the example illustrated about the couple, Jessica and Mark, both Singaporeans, isn’t real, it serves as a valuable educational guide on navigating the 99-1 arrangement legally while avoiding potential pitfalls.

Understanding ABSD and Its Application in Singapore

In Singapore, the Additional Buyer Stamp Duty, in short ABSD, is a tax imposed on property buyers of residential property in Singapore, particularly those purchasing a second or subsequent property will incur the ABSD on top of the standard Buyer Stamp Duty (BSD). The ABSD rates were increased after the latest cooling measures introduced in April 2023:

| Citizenship | 1st Property | 2nd Property | 3rd or Subsequent Properties |

|---|---|---|---|

| Singapore Citizens | 0% | 20% | 30% |

| Singapore Permanent Residents (PRs) | 5% | 30% | 35% |

| Foreigners | 60% | 60% | 60% |

| Entities or Trustee | 65% | 65% | 65% |

Since Mark already owned a condo, he would face a 20% ABSD if he wanted to co-own a new property with Jessica, as it is considered 2nd property purchase under Mark’s name. Thus, an extra $200,000 in ABSD is payable if they purchase a $1 million property together.

Types of Property Ownership: Joint Tenancy vs. Tenancy-In-Common

Before proceeding with the purchase, Jessica and Mark had to decide how to structure their property ownership. They had two main options:

- Joint Tenancy: Both parties share equal property ownership (50-50). In case one party passes away, the survivor inherits the entire property.

- Tenancy-In-Common: Each co-owner holds a specified share of the property, which could be any ratio (e.g., 70%-30%, 99%-1%, or any combination that makes up 100%). In case of death, the deceased’s share is distributed according to Singapore intestate succession laws or their will, if any.

Jessica and Mark opted for the tenancy-in-common arrangement, with Jessica owning 99% and Mark 1%, believing this would give them greater flexibility.

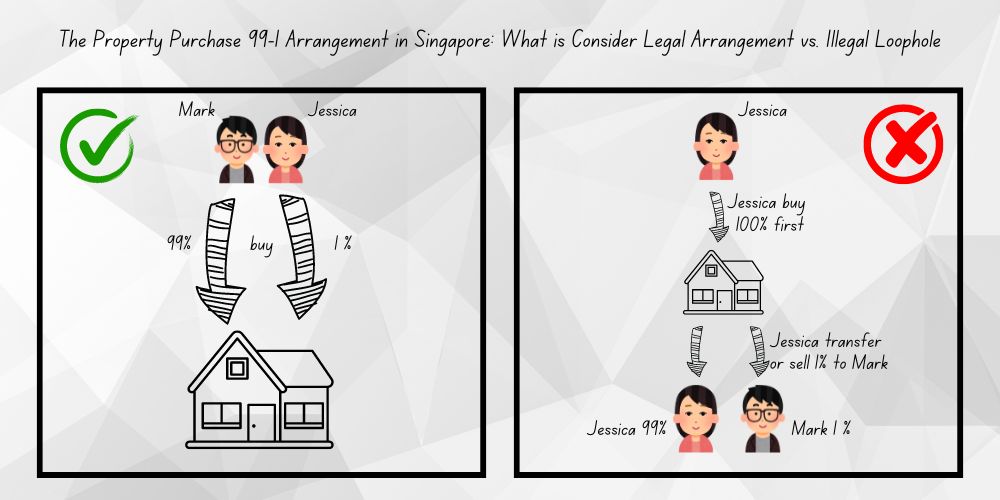

The Illegal 99-1 Loophole (For knowledge purposes only and strictly not allowed to do so)

Jessica and Mark heard about the so-called “99-1 loophole,” where the primary owner would first buy the property in full 100% and later sell a small share (typically 1%) to a co-owner who already owned another property.

How It Works:

- Jessica buys 100% of the property as a first-time buyer, thus avoiding ABSD.

- Jessica sells 1% of the property to Mark, who pays ABSD only on that 1% share.

Example Illustration:

- Property Purchase Price: $1,000,000

- Jessica buys 100% and avoids ABSD.

- Jessica then sells 1% to Mark for $10,000.

- Mark pays only $2,000 in ABSD (20% of the $10,000 he purchased from Jessica), thus avoiding a full ABSD of $200,000.

The Consequences: Jessica and Mark believed they had found an intelligent way to reduce their tax liability. However, their excitement was short-lived. The IRAS (Inland Revenue Authority of Singapore) can begin investigating suspicious transactions involving the 99-1 arrangement. Thus far, when writing this article, IRAS has found 166 cases exploiting this loophole, resulting in a clawback of $60 million in ABSD in the news reported on 8th May 2024.

In such a transaction arrangement, Jessica and Mark were deemed to be engaging in a tax avoidance scheme, and they can be ordered to pay the full ABSD of $200,000 and a 50% penalty, amounting to an additional $100,000.

Lesson Learned: Using the 99-1 loophole to evade ABSD is tax avoidance. IRAS has the authority under Section 33A of the Stamp Duties Act to reassess such transactions as a joint purchase and recover the rightful ABSD plus a penalty.

The Legitimate 99-1 Arrangement

Jessica and Mark could consult a professional real estate consultant or a lawyer specializing in property transactions to understand the correct and legal way to structure their purchase if they are in doubt.

How It Works:

- Jessica and Mark could buy the property together, with Jessica holding 99% and Mark holding 1% as Tenancy-In-Common ownership. Unlike the former, the 99-1 loophole, where Jessica first purchases 100% in full and later sells 1% to Mark.

- Since Mark owns a residential property, thus this is considered his 2nd residential property purchase; 20% ABSD is payable based on the full purchase price.

- Both incomes are considered for loan eligibility, providing more flexibility in loan quantum.

- IRAS allows the 99-1 arrangement if there are bona fide commercial reasons and not used to evade ABSD.

Example Scenario:

- Property Purchase Price: $1,000,000

- Jessica holds 99%, and Mark holds 1%.

- Both incomes are used to assess for a larger loan with a smaller downpayment.

- Pay 20% ABSD based on the entire purchase price. (Since Mark already owns a residential property, thus this purchase is considered buying 2nd residential property)

Legal Considerations:

- This arrangement is legal when not used to avoid ABSD.

- IRAS allows the arrangement for genuine commercial reasons, such as maximizing loan eligibility.

The differences between the "99-1 Loophole Arrangement" vs the "Legitimate 99-1 Arrangement"

Why Is the 99-1 Loophole Arrangement Illegal?

Jessica and Mark’s story highlights the importance of understanding the legality of the 99-1 arrangement.

Tax Avoidance vs. Tax Evasion

- Tax Avoidance: Using legal loopholes to reduce tax liability, like the “99-1 loophole” arrangement, can attract penalties if deemed abusive.

- Tax Evasion: Illegally underreporting income or falsifying documents is a crime.

Penalties for Illegal 99-1 Arrangements

- IRAS can reassess any property purchase and recover the rightful ABSD with a 50% surcharge on the underpaid ABSD will be imposed.

- In extreme cases, penalties can reach up to 400% of the amount undercharged.

When Are 99-1 Transactions Allowed by IRAS?

- Bona Fide Commercial Reasons:

- Co-investing the property where the ownership share is divided based on investment ratios.

- Couples were maximizing loan eligibility for their primary residence.

- Authority Under Section 33A:

- The illegal “99-1 loophole” arrangement is considered two transactions, where one party purchases 100% in full (one transaction) and subsequently sells a small share (typical 1% is another transaction).

- IRAS can disregard individual transactions and treat them as a single joint purchase if they suspect tax avoidance.

- Bona Fide Commercial Reasons:

Moving Forward with Financial Security

After comparing the differences between the illegal 99-1 loophole and the legal 99-1 arrangement, Jessica and Mark sought a trustworthy real estate consultant to refine their investment strategy. With a comprehensive understanding of ABSD rules, they moved forward with their property investment goals.

Legal 99-1 Arrangement: Planning Ahead Armed with the proper legal knowledge, Jessica and Mark opted for a legitimate 99-1 arrangement for their next purchase. Here’s how they did it:

- Consultation and Preparation

- They met with their lawyer and real estate consultant to discuss their goals and ensure compliance with ABSD rules.

- They decided on a $1.2 million property located in a strategic area that could attract both rental and resale demand.

- Executing the Purchase

- Tenancy-In-Common: Jessica held 99% of the property, and Mark held 1%.

- Both their incomes were considered for a larger home loan.

- The property was purchased as their primary residence, qualifying them for a better mortgage rate.

- Ensuring Compliance with IRAS

- They provided clear documentation of their finances and intentions, satisfying IRAS that this was a bona fide purchase.

- They maintained accurate records of the property transaction, ensuring transparency and legality.

- Consultation and Preparation

Expanding Their Portfolio

With a solid financial foundation established through their first legal 99-1 arrangement, Jessica and Mark may also explore expanding their portfolio strategically in the future:

Building a Balanced Portfolio Jessica and Mark didn’t have to stop at two properties. They can diversify their investments and explore other strategies while remaining within legal boundaries:

- Diversifying Property Types

- Residential and Commercial Properties: They can balance their property portfolio with a good mix of residential and commercial properties.

- Different Locations: They can spread their investments across various districts to minimize regional market risks.

- Investing in REITs

- To diversify further, Jessica and Mark can invest in real estate investment trusts (REITs).

- This can expose them to the property market without owning more real estate directly.

- Diversifying Property Types

Securing Long-Term Financial Goals

With a clear understanding of the rules and sound investment strategies, Jessica and Mark are on track to achieve their long-term financial goals:

- Retirement Planning

- Their properties generate passive income that supports their retirement plan.

- They continue to refinance and reinvest, optimizing their returns.

- Legacy Building

- Jessica and Mark have established wills to ensure their properties are passed down smoothly.

- They are also exploring trusts to further secure their legacy for future generations.

- Retirement Planning

Final Thoughts

Jessica and Mark’s journey through the property market is a testament to the importance of understanding the rules and seeking professional guidance. If used correctly, the 99-1 arrangement can be a powerful tool for managing finances and expanding property portfolios. However, misuse can lead to significant financial penalties and legal complications.

Key Takeaways

- Consult Professionals: Consult a lawyer or real estate consultant when considering complex property transactions.

- Know the Rules: Understand the implications of ABSD and the differences between tax avoidance and evasion.

- Document Everything: Keep accurate records and provide transparent documentation to IRAS.

- Diversify Wisely: Explore different investment avenues to balance risk and optimize returns.

By following these principles, Jessica and Mark invested with peace of mind, built a solid financial future, and are an inspiration to other property investors in Singapore. Their story emphasizes that the right way is still the best and that careful planning can potentially help them navigate even the most challenging situations.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls