Table of Contents

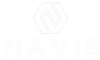

The Special Executive Condominium (EC) Deferred Bridging Loan for HDB Upgraders

For many HDB upgraders in Singapore, buying a new Executive Condominium (EC) is a natural next step in their property journey. It offers a more elevated lifestyle — with greater privacy, full condo facilities, and the feel of private housing, all at a more accessible price point compared to private condos.

If you’re still living in your current HDB flat, you’re likely to opt for the Deferred Payment Scheme (DPS). This scheme provides you with the flexibility to defer the bulk of your EC payments until the project receives its Temporary Occupation Permit (TOP), allowing you to avoid servicing both your HDB loan and the EC’s progressive payment simultaneously.

However, suppose you’re planning to use the sale proceeds or CPF refund from your existing HDB flat to fund part of your EC purchase. In that case, you may run into a short-term cashflow issue — especially if you’re unable to secure the full 75% mortgage loan due to loan restrictions or income ceiling considerations.

That’s where the Special EC Deferred Bridging Loan comes in. Tailored specifically for HDB upgraders, this financing option helps you cover the shortfall temporarily, allowing you to secure your EC unit without rushing to sell your flat prematurely or settling for a lower price.

In this guide, we’ll explain how the Special EC Bridging Loan works, when it’s useful, and what to consider when planning your HDB sale timeline — so you can upgrade smoothly and with confidence.

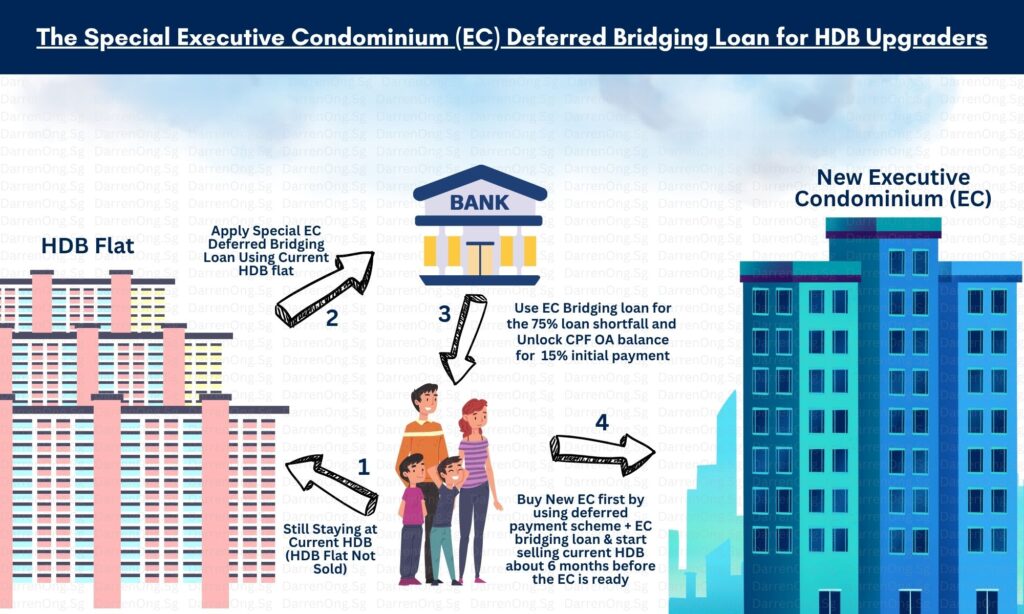

Understanding the Order of Payment Using Cash, CPF, and Bank Loan

When buying any property in Singapore — including a new Executive Condominium (EC) — it’s essential to understand the fixed payment sequence that applies to all purchases. This sequence determines how your funds must be used, starting with Cash, followed by CPF savings, and finally, a bank loan.

Here’s how it works:

- You must pay the Cash portion first.

- CPF funds can only be used after the cash portion is paid

- Bank loan disbursement only comes after both cash and CPF portions are fulfilled

Let’s break it down with a simple example.

Suppose you’re financing your new EC purchase using:

- 10% Cash

- 20% CPF

- 70% Bank Loan (assuming you’re unable to secure the full 75%)

Whenever a payment is due, you must use Cash to pay the first 10% based on this example. Once the 10% cash payment is fulfilled, you can use your CPF Ordinary Account (OA) funds to cover the next 20%. The housing loan portion can only be disbursed after the combined 30% (Cash + CPF) has been settled.

| Deferred Payment Scheme Breakdown | Amount |

|---|---|

| 5% Booking Fee | 5% Cash |

| 15% Downpayment | 5% Cash 10% CPF |

| Balance Payment | 10% CPF, then 70% Bank Loan |

This strict payment order is often where HDB upgraders face challenges. Many still have their CPF tied up in their current HDB flat, and if they are unable to obtain the full 75% loan quantum, they may need to top up the shortfall using additional Cash or available CPF OA balance.

That’s where the Special EC Deferred Bridging Loan comes in. It helps to temporarily bridge the gap — giving you time to sell your HDB, unlock your CPF, and proceed with your EC purchase without unnecessary delays.

Understanding this payment structure early allows you to plan your EC financing more accurately — and avoid last-minute surprises that could affect your upgrading timeline.

EC Payment Scheme – NPS vs DPS

When purchasing a new Executive Condominium (EC), buyers are typically given a choice between two main payment schemes:

Understanding how each one works — and how it affects your cash flow, mortgage obligations, and property timeline — is key to making the right financial decision.

Here’s a breakdown of how each scheme works:

Under NPS, you begin servicing your housing loan progressively as the EC is being constructed. Loan disbursement is tied to the completion stages of the project, typically over a 2- to 3-year period before the TOP.

This scheme is more suitable for buyers who:

- Are first-time purchasers with no existing property loan

- Have already sold their current home or don’t have overlapping loan commitments

- Are financially ready to service a second loan during the construction phase

- Prefer to enjoy slightly lower prices, as NPS units typically don’t carry the DPS premium

With DPS, you pay the initial 20% downpayment (5% cash + 15% CPF/cash) upfront, but you are not required to start servicing the bank loan until the EC receives its Temporary Occupation Permit (TOP) — typically 2 to 3 years later.

This scheme is ideal for HDB upgraders who:

- Are still living in their HDB flat and need time to sell it

- Wish to avoid overlapping housing loans

- Require additional time to unlock CPF funds or Cash tied up in their current property

Comparison between Normal Payment Scheme (NPS) vs Deferred Payment scheme (DPS)

| Feature / Stage | Normal Payment Scheme (NPS) | Deferred Payment Scheme DPS |

|---|---|---|

| Loan Repayment Starts | Immediately (based on building stages) | Only upon Temporary Occupation Permit (TOP) |

| Cashflow Requirement During Construction | Higher – monthly loan installments start early | Lower – no loan servicing until TOP |

| Downpayment | 5% Cash + 15% CPF/Cash | 5% Cash + 15% CPF/Cash |

| Suitable For | Buyer with no existing housing loan | HDB upgraders still living in their flat or those still servicing current HDB flat loan |

| Flexibility In Selling Existing HDB Flat | Less flexible – may need to sell home quickly, if need to utilized current HDB flat funds | More flexible – time to sell HDB before EC is ready |

| Price of EC Unit | Slightly lower (no DPS premium) | Slightly higher (includes DPS premium of 2-3%) |

| Interest Accrued Before TOP | Yes, on disbursed loan amount | No interest until loan kicks in at TOP |

Understanding the difference between NPS and DPS can help you choose the right scheme based on your timeline, financial situation, and transition needs. Most HDB upgraders tend to lean towards DPS — especially when they need time to sell their flat and access their CPF.

EC Payment Schedule: Normal Progressive Scheme vs Deferred Payment Scheme Breakdown

Below is the breakdown of the estimated payment timeline.

| Description / Stage | Timeline | Normal Payment Scheme (NPS) | Deferred Payment Scheme DPS |

|---|---|---|---|

| Upon Grant of Option to Purchase (OTP) – Booking Fee | Immediate | 5% | 5% |

| Upon Signing of Sale & Purchase Agreement (S&P) | 9 weeks from OTP | 15% BSD + Legal Fees | 15% BSD + Legal Fees |

| Completion of Foundation Work | 6-9 months after S&P | 10% | Deferred |

| Completion of Reinforced Concrete Framework | 6-9 months after S&P | 10% | Deferred |

| Completion of Brick Walls | 3-6 months | 5% | Deferred |

| Completion of Roofing / Ceiling | 3-6 months | 5% | Deferred |

| Completion of Electrical Wiring, Internal Plastering, Plumbing & Door / Windows Installation | 3-6 months | 5% | Deferred |

| Completion of of Car Park, Roads & Drainage Works | 3-6 months | 5% | Deferred |

| Notice of Vacant Possession (TOP) | TOP (Approx. 2-3 years) | 25% | 65% |

| Legal Completion Date (CSC) | Legal Completion | 15% | 15% |

Additional Notes for EC Buyers When Purchasing a New EC from a Developer

Before proceeding with your new Executive Condominium (EC) purchase from a developer, consider the following important points — especially for HDB upgraders and second-time applicants.

1. DPS Premium Increases Final Purchase Price

If you opt for the Deferred Payment Scheme (DPS), be prepared to pay 2–3% more for the EC unit compared to buyers who choose the Normal Payment Scheme (NPS). This is known as the DPS premium, and it’s factored into the unit price to account for the delayed payment and loan disbursement timeline.

2. Buyer's Stamp Duty (BSD) Still Applies

All EC buyers are required to pay Buyer’s Stamp Duty (BSD), calculated based on the purchase price or market value, whichever is higher. This applies even though ECs are considered partially subsidized public housing at the launch stage.

- BSD must be paid within 14 days of signing the Sales & Purchase Agreement (S&P).

- It can be paid using your CPF Ordinary Account (OA) or Cash.

Good news: EC buyers do not need to pay Additional Buyer’s Stamp Duty (ABSD) — even if they have not sold their existing flat at the point of purchase.

3. Second-Timer Buyers Must Pay Resale Levy

Suppose you’ve previously bought a subsidized flat (e.g., BTO, resale flat with CPF Housing Grant, or EC with CPF housing grant or EC purchased from a developer after 2015). In that case, you’re considered a second-timer buyer and will be required to pay a Resale Levy when buying a new EC.

Resale Levy Payable – Household vs Singles

Here’s the official Resale Levy Table if your subsidized flat was sold on or after 3 March 2006:

| Type of First Subsidized Flat Sold | Household (Married Couple / Family) | Single |

|---|---|---|

| 2-room flat | $15,000 | $7,500 |

| 3-room flat | $30,000 | $15,000 |

| 4-room flat | $40,000 | $20,000 |

| 5-room flat | $45,000 | $22,500 |

| Executive flat / Maisonette | $50,000 | $25,000 |

| Executive Condominium (EC) | $55,000 | Not Applicable |

| 3-Gen flat | $45,000 | Not Applicable |

NOTE: The resale levy is typically deducted from your sale proceeds when you sell your existing flat if you book your EC before selling your existing flat. If you sold your flat before booking the EC, then the resale levy is payable in Cash before the EC obtains TOP.

4. Special EC Deferred Bridging Loan for HDB Upgraders

The Special EC Deferred Bridging Loan is a short-term financing solution designed explicitly for HDB owners who have not yet sold their flats. It helps cover any CPF or cash shortfall required for the EC downpayment — particularly when funds are still tied up in the existing flat.

This loan is beneficial for buyers who:

- Are choosing DPS but are unable to secure the full 75% bank loan

- Have their CPF OA funds locked in their current HDB

- Want to avoid a rushed sale or selling their HDB at a poor price

By bridging the temporary cash-flow gap, this loan enables you to secure your EC unit first and plan the sale of your current HDB flat with greater flexibility and less pressure.

Why the Special EC Deferred Bridging Loan Matters

For many HDB upgraders in Singapore, one of the biggest hurdles when buying a new Executive Condominium (EC) isn’t eligibility — it’s cash-flow timing.

Even if you qualify for a new EC and plan to sell your current flat, there’s often a mismatch between when payment is due and when your funds — especially CPF — are available. This is where the Special EC Deferred Bridging Loan becomes a valuable tool to help you bridge that gap.

Why Cashflow Becomes a Problem

Let’s say you’re buying an EC under the Deferred Payment Scheme (DPS) and intend to use both your CPF savings and the sale proceeds from your HDB to pay for the purchase.

Here’s where things get tricky:

- You must pay 15% (after the 5% booking fee) within 9 weeks of signing the Option to Purchase.

- While you may have enough CPF OA balance to cover the 15%, you may not be allowed to use all of it if you fail to secure the full 75% loan.

This is a very common hurdle for EC buyers due to Mortgage Servicing Ratio (MSR) limits, which cap your loan amount based on income. Many HDB upgraders face reduced loan approval, leading to a shortfall.

To make up for the shortfall, you’ll need to tap into:

- CPF funds still tied up in your current HDB or

- Cash proceeds from your flat’s sale — but you haven’t sold it yet

To make matters more restrictive, remember what we covered earlier in

“Understanding the Order of Payment Using Cash, CPF and Bank Loan”:

Your funds must be used in a fixed order — Cash → CPF → Bank Loan.

If your HDB hasn’t been sold, your CPF refund and cash proceeds aren’t accessible, and your current CPF OA balance may be insufficient due to the bank loan cap. This leaves a temporary cashflow gap, even if your overall finances are sound.

What This Bridging Loan Helps With

The Special EC Deferred Bridging Loan is designed to cover this shortfall temporarily, giving you the flexibility to:

- Sell your HDB at the right price instead of rushing into a sale

- Unlock your CPF OA and sale proceeds before your HDB is sold, using this bridging loan

- Proceed with your EC purchase smoothly, without unnecessary delays or financial stress

It allows you to secure your EC unit first and repay the bridging loan later — using CPF refunds or cash proceeds once your HDB transaction is completed, typically before the EC is ready for TOP.

Who This Loan Is Meant For

This loan is specially designed for HDB upgraders:

- Who are still living in their existing flat and

- Who are buying under the Deferred Payment Scheme (DPS) and

- Who need to use CPF or cash proceeds still tied up in their current property and

- Who faces a shortfall due to reduced loan approval (i.e., less than 75% loan)

A Common Misunderstanding

Many buyers assume they must sell their HDB first before purchasing an EC.

While that’s one possible route, it isn’t always the best — especially if you end up rushing your sale or accepting a lower price to meet EC payment deadlines.

With the Special EC Deferred Bridging Loan, you gain the flexibility to:

- Secure your EC unit early (before popular stacks sell out)

- Sell your HDB on your terms at a better price and timeline

- Avoid stress from overlapping or rushed transition periods

5 Scenarios to Assess If the Special EC Deferred Bridging Loan Is Needed (After Paying 5% Cash Booking Fee)

Section A: Using Deferred Payment Scheme (DPS) But No Bridging Loan Needed

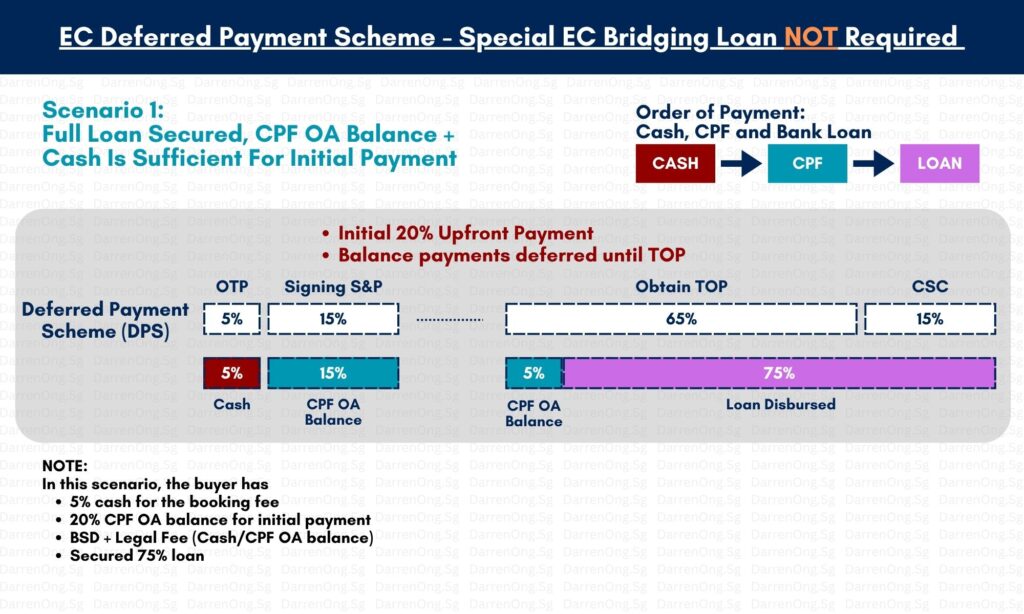

Scenario 1: Full Loan Secured, CPF OA Balance + Cash Is Sufficient for Initial Payment

In this scenario, the buyer has:

- 5% cash for the booking fee

- 20% CPF OA balance to cover the initial payment

- BSD and legal fees (paid using cash or CPF)

- Secured 75% bank loan

No shortfall arises; thus, no bridging loan is required.

(Scenario 1 Full Loan Secured + Sufficient CPF OA Balance + Cash for Initial Payment)

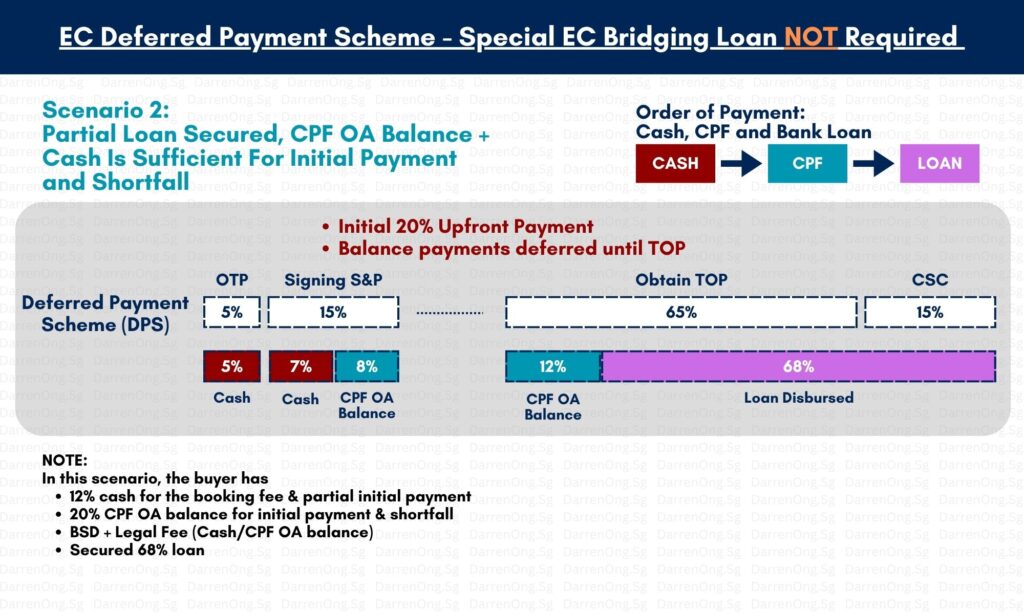

Scenario 2: Partial Loan Secured, CPF OA Balance + Cash Is Sufficient for Initial Payment and Shortfall

In this scenario, the buyer has:

- 12% cash for the booking fee and part of the initial payment

- 20% CPF OA balance to cover the rest of the initial payment and shortfall

- BSD and legal fees (paid using cash or CPF)

- Secured 68% bank loan

CPF + cash is sufficient to cover both the initial 20% and the 7% shortfall

→ No bridging loan required

(Scenario 2 Partial Loan Secured, But CPF + Cash Covers Initial Payment and Shortfall)

Section B: Using Deferred Payment Scheme (DPS) - Special EC Bridging Loan Is Needed

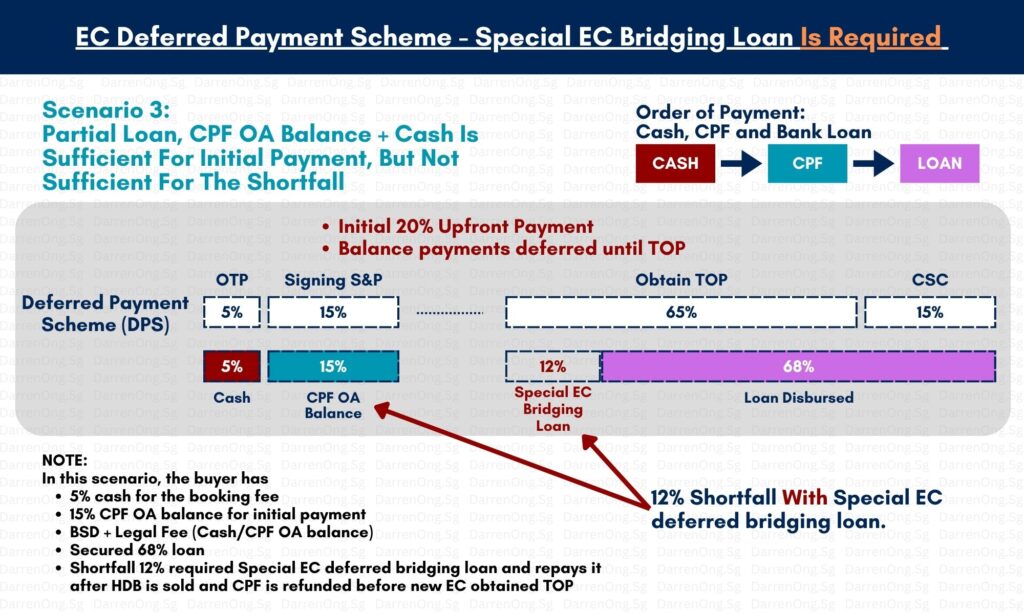

Scenario 3: Partial Loan, CPF OA Balance + Cash Is Sufficient for Initial 20%, But Not the Shortfall

In this scenario, the buyer has:

- 5% cash for the booking fee

- 15% CPF OA balance for the remaining initial 20%

- BSD and legal fees (paid using cash or CPF)

- Secured 68% bank loan

- Faces a 12% shortfall

To utilize the 15% CPF OA balance for payment, the buyer can apply for a Special EC Deferred Bridging Loan to bridge the 12% shortfall temporarily. This allows the CPF OA funds to be used for the initial 15% without triggering cash-first payment requirements. The bridging loan is repaid later after the HDB is sold and the CPF is refunded — ideally before the EC obtains its Temporary Occupation Permit (TOP).

(Scenario 3 Partial Loan + Not Sufficient For The Shortfall WITH Special EC Bridging Loan)

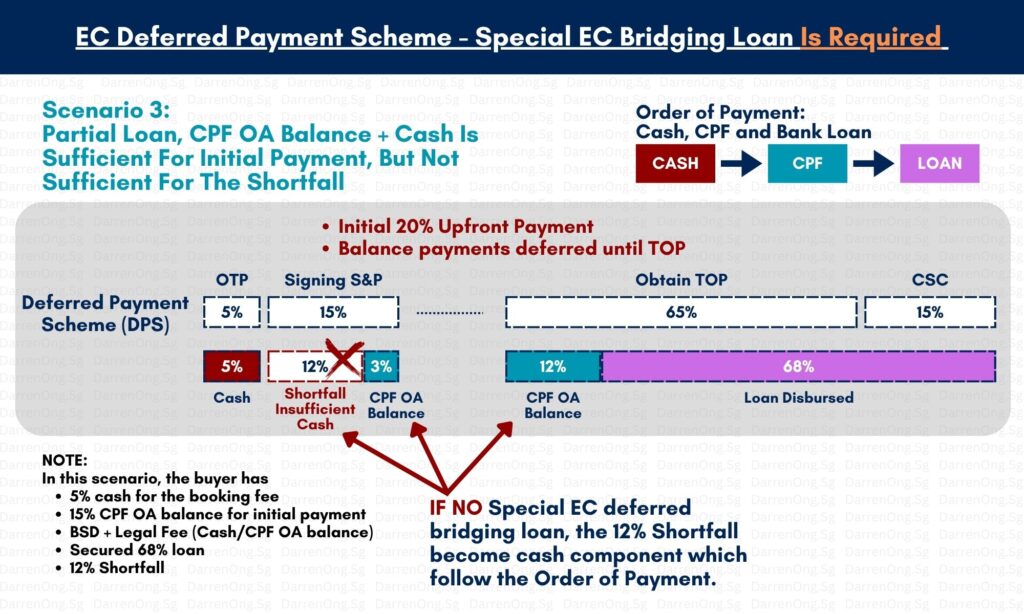

Now, let’s examine what happens if there is no special EC bridging loan.

Due to the payment order rules (Cash, CPF, Loan), the 12% shortfall becomes a cash component. This means the buyer must pay the 12% shortfall in Cash first before CPF funds can be released for subsequent payment — resulting in an unnecessarily high upfront cash burden.

(Scenario 3 Partial Loan + Not Sufficient For The Shortfall WITHOUT Special EC Bridging Loan)

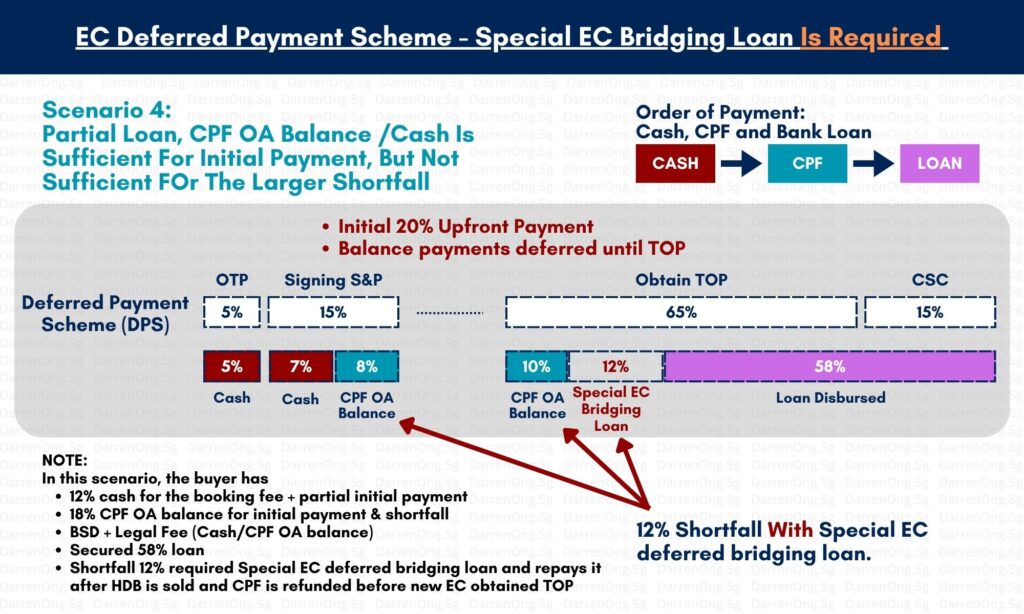

Scenario 4: Partial Loan, CPF OA Balance /Cash Is Sufficient For Initial Payment, But Not Sufficient For The Larger Shortfall

In this scenario, the buyer has

- 12% cash for the booking fee and part of the initial payment

- 18% CPF OA balance for the remaining initial payment and partial shortfall

- BSD and legal fees (paid using cash or CPF)

- Secured 58% bank loan

- Faces a 12% shortfall

Again, the Special EC Deferred Bridging Loan can be used to bridge this 12% gap. This ensures you can deploy your CPF OA funds efficiently without the need to front-load Cash. The bridging loan is repaid after the HDB is sold and CPF is refunded — before EC reaches TOP.

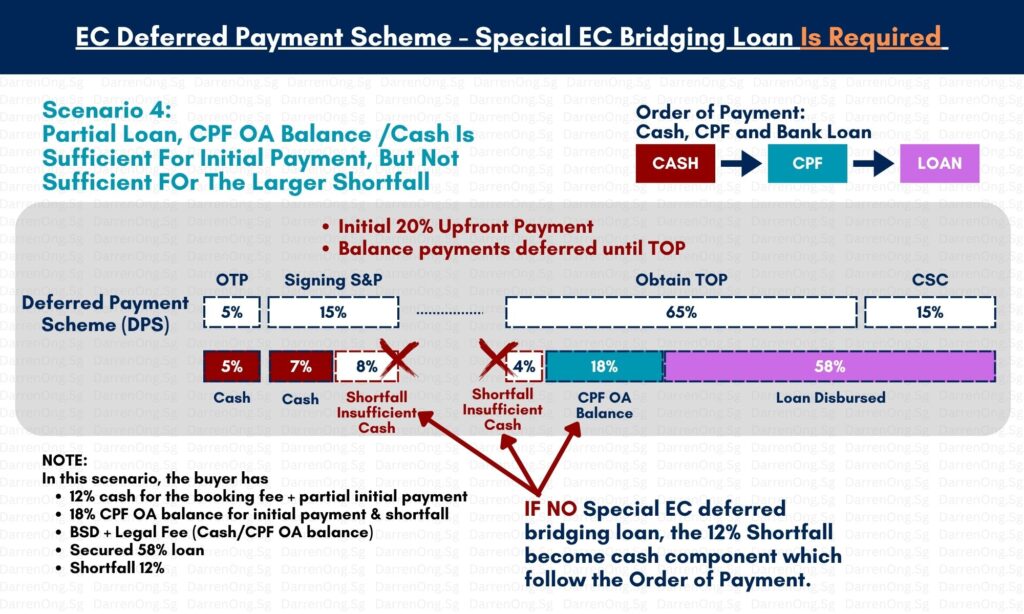

Now, let’s examine what happens if there is no special EC bridging loan for this scenario.

The 12% shortfall becomes a cash requirement, and due to the cash-first rule, the buyer must pay up to 24% in Cash before CPF OA can be used. This puts unnecessary pressure on the buyer’s liquidity.

(Scenario 4 Partial Loan + Not Sufficient For The Shortfall WITHOUT Special EC Bridging Loan)

Section C: Not Qualified for Special EC Deferred Bridging Loan

Scenario 5: Insufficient Cash + CPF OA Balance For Initial 20%. Special EC Bridging Loan Not For Initial 20% Payment

In this scenario, the buyer has:

- 5% Cash (used for the booking fee)

- 10% CPF OA balance, totaling only 15% available

- an HDB flat, and CPF and Cash proceeds remain locked in the existing flat

Special EC Deferred Bridging Loan cannot be used because:

- It only applies to the 65% deferred payment tranche

- It cannot be used to finance the initial 20% downpayment

The buyer must:

- Restructure finances (e.g., top-up CPF OA, prepare more Cash), or

- Sell the existing HDB flat first to unlock CPF and sale proceeds before booking the new EC

(Scenario 5 Insufficient Cash + CPF OA Balance For Initial Payment)

How the Special EC Deferred Bridging Loan Works (With Calculation Example)

When buying a new Executive Condominium (EC) directly from a developer, many HDB upgraders in Singapore face a common challenge — not a lack of funds, but a cashflow mismatch. Most of their CPF savings and sale proceeds are still tied up in their existing HDB flat, making it hard to meet EC payment deadlines.

This is where the Special EC Deferred Bridging Loan becomes a helpful financial solution that bridges the gap.

How Banks Typically Calculate the Special EC Bridging Loan

While different banks may vary slightly in their calculations, most follow this standard approach:

- Determine the HDB flat’s Current Market Value (CMV) – based on the bank’s assessment

- Take 80%–85% of that CMV to account for a conservative buffer

- Subtract outstanding HDB loan amount

- Subtract CPF refund amount – including principal and accrued interest

This gives the estimated cash proceeds.

Then, to determine the maximum Special EC Bridging Loan amount, banks typically consider:

Cash Proceeds + CPF Refunds (P + I) = Maximum EC Bridging Loan Amount

Please note that the bank will not take any resale levy payable into consideration when determining the special EC bridging loan. However, it may be a good idea to factor in the resale levy amount payable, if applicable to you, as you will need to pay this amount upon selling the HDB flat.

Case Study: Samuel & His Wife – HDB Upgraders with CPF Tied Up

Samuel and his wife are upgrading from their HDB flat to a new EC, priced at $1.4 million, using a deferred payment scheme.

They qualify to buy the EC, but most of their CPF savings are still locked in their existing flat. Their HDB has a current market value of $600,000, and the bank recognizes 80% (or possibly 85%) of that value for loan assessment purposes. Here’s their situation:

Current HDB Flat Details and Maximum EC Bridging Loan Eligibility:

| Item | Amount |

|---|---|

| Current CPF OA Balance | $250,000 |

| HDB Market Value (CMV) | $600,000 |

| Bank Recognition (80% of CMV) | $480,000 |

| Outstanding HDB Loan | – $80,000 |

| CPF Refunds (P+I) | – $200,000 |

| Resale Levy (2nd Timer) | – $0 (assumed NA for this case) |

| Estimated Cash Proceeds | $200,000 |

| Maximum EC Bridging Loan | $200,000 (Cash Proceeds) + $200,000 (CPF Refunds) = $400,000 |

EC Purchase Breakdown With Special EC Bridging Loan:

| Component | Amount (SGD) | Remark |

|---|---|---|

| EC Purchase Price | $1,400,000 | |

| 5% Cash (Booking Fee) | $70,000 | Paid in Cash |

| 15% (Initial Down Payment) | $210,000 | Using CPF OA Balance (Bridging loan unlocks this) |

| Loan Secured (60%) | $840,000 | Loan Secured |

| Shortfall | $210,000 | Covered by Special EC Bridging Loan |

| Buyer’s Stamp Duty (BSD)* | $39,600 | Using CPF OA balance or Cash |

| Legal Fee (Estimated) | $3,000 | Using CPF OA balance or Cash |

Let’s take a look at what happens at the EC purchase breakdown if Samuel and his wife proceed to purchase without the EC Bridging Loan:

| Component | Amount (SGD) | Remark |

|---|---|---|

| EC Purchase Price | $1,400,000 | |

| 5% Cash (Booking Fee) | $70,000 | Paid in Cash |

| 15% (Initial Down Payment) | $210,000 | CPF Blocked. Paid in Cash |

| Loan Secured (60%) | $840,000 | Loan Secured |

| Shortfall Without Using Bridging Loan | $210,000 | Shortfall pay using CPF later TOP stage |

| Buyer’s Stamp Duty (BSD)* | $39,600 | Using CPF OA balance or Cash |

| Legal Fee (Estimated) | $3,000 | Using CPF OA balance or Cash |

Without the bridging loan, Samuel cannot access his CPF OA to make the 15% payment due to the shortfall. The payment order rule (Cash → CPF → Loan) requires the shortfall to be cleared first — and that burden falls on cash, unless the bridging loan is used.

How the EC Bridging Loan Helps Samuel

- Allows use of CPF OA funds for the initial 15% payment

- Avoids cash shortfall problems from reduced loan quantum

- Buys time to sell their HDB flat later — without stress

- Repay bridging loan only after HDB sale and CPF refund are completed

Key Takeaways:

- The Special EC Deferred Bridging Loan isn’t based on how much you want to borrow — it’s based on how much the bank expects you to receive from your HDB sale proceeds + CPF refund.

- You must still have enough to cover the initial 20% downpayment (5% cash + 15% CPF/cash).

- The special EC bridging loan unlocks your CPF OA balance usage by bridging the 65% shortfall during the DPS timeline.

- It does not apply to the first 20% downpayment — buyers must prepare this portion separately.

Conditions for Using the Special EC Deferred Bridging Loan

Before applying for the Special EC Deferred Bridging Loan, it’s essential to understand the key eligibility conditions. This loan is designed to help genuine HDB upgraders (those with an existing HDB flat) who face temporary cash flow challenges and are unable to secure the full 75% loan — not buyers who lack the upfront capital for the initial 20% down payment.

Special EC Deferred Bridging Loan Eligibility Criteria:

1. You Must Be Purchasing a New EC from Developer

This bridging loan is only applicable for ECs bought directly from developers during the initial launch phase. It does not apply to resale ECs or private condos.

2. You Are Still Living in Your Existing HDB Flat

You must still own and be living in your HDB flat at the time of EC purchase. This ensures there are actual sale proceeds and CPF refunds that can be unlocked later to repay the loan.

3. You Are Using the Deferred Payment Scheme (DPS)

The Special EC Bridging Loan is structured around the Deferred Payment Scheme, where the bulk of the payment (65%) is due only upon TOP. It does not apply to those using the Normal Payment Scheme (NPS).

4. Your CPF OA and Sale Proceeds Are Tied Up in Your Existing Flat

The bridging loan is meant to unlock CPF OA usage for the 15% downpayment portion when:

- You’ve already paid 5% cash booking fee

- You can’t fully utilize your CPF OA due to the shortfall caused by reduced loan quantum (i.e., you didn’t get 75% loan)

- Your CPF savings and sale proceeds are still stuck in your current HDB flat

5. You’ve Passed the Bank’s Bridging Loan Assessment

Banks will still assess your eligibility based on the following:

- Valuation of your HDB flat (typically up to 80%–85%)

- Your outstanding HDB loan amount

- CPF refund (principal + accrued interest)

- Any resale levy applicable

- Your ability to service the bridging loan after the sale

The maximum loan amount will depend on the bank’s estimate of the proceeds from the sale of your flat.

6. Bridging Loan Must Be Paired With a Mortgage Loan

7. Bridging Loan Duration Is Short-Term

The loan is typically meant to last no more than 6 months.

Borrowers are expected to fully repay the bridging loan and any accrued interest within 6 months — ideally after their HDB is sold.

8. HDB Approval Letter Required to Trigger the Loan

To activate the bridging loan, you must first obtain a sale approval letter from HDB confirming your intent to sell your existing flat.

This approval is needed before the bank will disburse the bridging loan.

To ensure timely activation, it’s best to start your HDB selling process around 6 months before your EC’s expected TOP date.

9. Plan HDB Sale Timeline Around EC TOP (Plan Ahead to Avoid Bottlenecks)

It’s advisable to begin marketing your HDB at least 6 months before the EC’s expected TOP date to ensure that the HDB Approval Letter arrives on time and avoids delays in activating the bridging loan.

If your HDB sale is delayed or the approval process is slowed down, your bridging loan disbursement may be delayed by the bank — and this can delay your EC key collection or even risk breaching payment deadlines at TOP.

10. Bridging Loan Activates at the Same Time as Mortgage Loan

Once your EC reaches Temporary Occupation Permit (TOP) status, the bridging loan is typically activated concurrently with your EC mortgage loan — both kick in at the same stage of the payment schedule.

11. Cancellation Fees May Apply

If the bridging loan is approved but later not used or canceled, some banks may impose a cancellation or admin fee.

Always check with your bank regarding any penalties or administrative charges in such cases.

12. Not Eligible For Special EC Deferred Bridging Loan If:

- You do not have sufficient CPF or Cash to meet the initial 20% down payment (5% Cash + 15% CPF) — you cannot use the special EC bridging loan for this purpose.

- You’re buying a resale EC or private property.

- You opted for the Normal Payment Scheme (NPS).

- You have already sold your flat, and CPF funds are available — in that case, you don’t need the bridging loan.

Special EC Deferred Bridging Loan Eligibility Summary

| Condition | Requirement |

|---|---|

| Type of Property | EC Purchased directly from the developer |

| Current Residence | Still own and living in HDB flat |

| Payment Scheme | Deferred payment scheme (DPS) only |

| CPF / Sale Proceeds Status | Funds are still locked in the HDB flat |

| Initial 20% Down Payment | Must be paid separately (Special EC bridging loan not usable here) |

| Bank Bridging Assessment | Must qualify based on estimated sale proceeds |

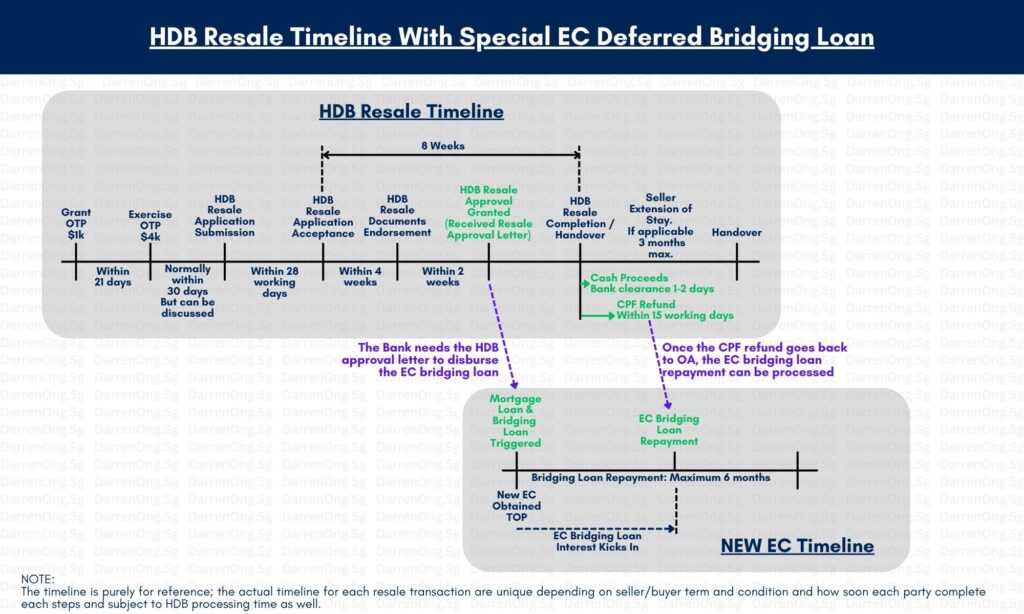

HDB Resale Procedures & Timeline and Why It Matters When Using the EC Bridging Loan

When upgrading from an HDB flat to a new EC under the Deferred Payment Scheme (DPS), timing your HDB sale is crucial — especially if you plan to use the Special EC Deferred Bridging Loan.

This EC bridging loan can only be activated and disbursed after HDB issues the Sale Approval Letter, and repayment relies on CPF refunds and cash proceeds from the HDB sale. That’s why having a clear timeline helps prevent unnecessary delays or disruptions in your EC financing.

Special EC Deferred Bridging Loan Eligibility Summary

| Step | Milestone | Estimated Timing |

|---|---|---|

| 1 | Issue Option to Purchase (OTP) | Day 0 |

| 2 | Buyer Exercises OTP | Within 21 calendar days |

| 3 | Submit Resale Application | Normally with 30 calendar days |

| 4 | HDB Accepts Resale Application | Within 28 working days |

| 5 | Endorse Resale Documents Online | Within 4 weeks after HDB has accepted the resale application |

| 6 | HDB Grants Sale Approval Letter | Within 2 weeks after endorsing the HDB documents |

| 7 | HDB Completion Appointment at HDB HUB | 8 weeks from HDB accepts resale application |

| – Cash Proceeds disbursed to seller | Cashier’s order (1-2 days for bank clearance) | |

| – CPF Refund (P+I) | Within 14 working days |

Pro Tip:

Always work backward from your EC’s expected TOP date to determine when to start your HDB sale.

For best results, start marketing your HDB 6 months before EC TOP, and aim to complete the resale process at least 1 month before EC key collection.

Common Misconceptions About the Special EC Deferred Bridging Loan

The Special EC Deferred Bridging Loan is a helpful financial tool designed explicitly for HDB upgraders purchasing a new Executive Condominium (EC) under the Deferred Payment Scheme (DPS). However, there are still some common misunderstandings about how it works — and who it’s really for.

Let’s clear them up:

Misconception 1: “You can use the EC bridging loan for the first 20% downpayment.”

Reality:

The bridging loan cannot be used to fund the initial 20% payment (i.e., 5% cash + 15% CPF/cash).

It is only applicable after the first 20% has been paid — to cover any shortfall arising from reduced loan approval, typically at the 65% payment tranche under DPS.

Misconception 2: “I have some CPF OA balance; I can use it for a downpayment even if I haven't settled the cash shortfall.”

Reality:

CPF can only be used after the full cash component is paid, according to the fixed order of payment: Cash → CPF → Bank Loan

If there is a loan shortfall and the buyer’s CPF OA balance cannot cover the full shortfall and the buyer does not use an EC bridging loan, the buyer must cover the shortfall cash portion first before the buyer’s CPF OA funds can be drawn — unless the CPF OA balance is sufficient to cover the entire shortfall.

If your CPF OA balance has sufficient funds to fully cover the shortfall after the initial 5% cash payment, then you can proceed without using additional Cash.

But if your CPF OA is not enough to cover the shortfall entirely, and you do not take a bridging loan, the shortfall will be treated as a cash component, meaning you’ll need to top up in Cash before you use your CPF OA balance.

This is why cash-flow planning is so important — to avoid unpleasant surprises during payment.

Misconception 3: “The bridging loan is for anyone buying an EC.”

Reality:

The Special EC Deferred Bridging Loan is not for all EC buyers — it is designed explicitly for HDB upgraders who:

- Have not sold their flat yet

- Are relying on CPF funds currently tied up in their HDB

- Are choosing the Deferred Payment Scheme (DPS)

- Face a cash/CPF shortfall due to reduced loan eligibility (less than 75%)

Misconception 4: “If I use the bridging loan, I’ll end up with more long-term debt.”

Reality:

This is a short-term bridging facility, not a long-term mortgage.

Most buyers repay it in full after they sell their HDB and receive the CPF refund and sale proceeds — usually before EC obtains TOP.

No long-term repayment is required if funds are managed properly.

Misconception 5: “I must sell my HDB first before buying an EC.”

Reality:

This isn’t always necessary. While selling first is one way to unlock CPF, it can lead to a rushed sale or below-market pricing.

With the Special EC Deferred Bridging Loan, you can:

- Secure your EC unit first

- Take your time to sell your HDB at the right price

- Avoid stress from overlapping deadlines

By understanding what this loan is and isn’t, you’ll be able to make better, more informed decisions when planning your EC upgrade.

Summary & Final Tips

Buying an Executive Condominium (EC) while still owning an HDB flat can be exciting — but it also comes with timeline and cashflow planning challenges.

If you’re opting for the Deferred Payment Scheme (DPS) and your CPF or sale proceeds are still tied up in your flat, the Special EC Deferred Bridging Loan may give you the flexibility you need to proceed without financial strain.

Here’s a quick recap of what to remember:

- You must still pay the initial 5% cash + 15% CPF/cash downpayment on your own

- he bridging loan only helps to cover the shortfall caused by a reduced loan quantum (e.g., 60% instead of 75%)

- The HDB Sale Approval Letter is required before the loan can be activated and disbursed by the bank

- Start planning your HDB sale at least 6 months before EC TOP

- Work with someone who can help you time everything smoothly — from selling your HDB to unlocking your CPF and planning EC disbursements

Still Not Sure? Let’s Have a Short Discussion

If you’re:

- An EC buyer (first-timer or HDB upgrader) wondering how to plan ahead for downpayment and loan shortfall

- An HDB seller who’s collecting EC keys soon and is not sure when to start selling

… it’s worth having a quick chat to avoid last-minute stress.

Feel free to drop me a message — even a short conversation can give you the clarity you need to move forward confidently.

Let’s plan it right so your upgrade journey stays smooth and stress-free.

You may be keen to read more about:

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Senior Associate District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

The Special EC Deferred Bridging Loan for HDB Upgraders

Planning to buy a new EC while still owning an HDB? Learn how the Special EC Deferred Bridging Loan helps cover CPF shortfall and avoid cashflow stress.

Selling Your Condo in Singapore 2025: Step-by-Step Guide & What to Know Before You Start

Selling your condo soon? Learn how to sell a condo in Singapore with confidence — from staging and pricing to picking a trusted property agent. Avoid costly mistakes and discover tips that help you sell faster and smarter.

Where Can You Find and How to Buy an Executive Condominium in 2025

Upcoming Tampines St 62 Aurelle of Tampines 晶莹轩 EC Target Q1 2025 Launching. Other Available New Launch EC in 2025. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Buying a Property in Singapore? 8 Key Tips on What to Look Out For

What to look out for when buying a condo or property in Singapore? Learn 8 key tips to help you choose or spot the right property for investment or own stay with capital appreciation and exit strategy.

Is It Still Safe to Enter the Property Market In 2025 Amid U.S. Tariffs?

How Trump’s Tariffs Could Affect Singapore’s Condo And HDB Prices. Is it safe to enter the Singapore property market in 2025 amid recession fears and U.S. tariffs? Learn how interest rates, supply trends, and market resilience could shape your next move.

How to Upgrade When My HDB Reached Minimum Occupation Period (MOP)

For HDB owners who have fulfilled the 5-year MOP (Minimum Occupation Period) in Singapore, discover your next move. Find out if you should sell your flat (resale HDB) or upgrade to a private property, with clear tips for smart homeownership planning.