Updated on 4th July 2025 due to new Seller Stamp Duty announcement.

Table of Contents

What You Need to Know About Sales Proceeds After Selling Your Property

As a homeowner, understanding what happens to the proceeds from selling your home is crucial. Do you need to refund the CPF savings you used for housing, and how about the outstanding loan? This article provides insights into this and other common questions about property sales.

Home sellers typically expect to profit from their property sale in a thriving market. However, after repaying their mortgage, many are surprised that not all remaining proceeds are immediately available as cash.

If you used your CPF savings to buy your property, you’ll need to refund the principal amount withdrawn plus accrued interest back to your CPF account after the sale. Additionally, any housing grants received, along with accrued interest, must be returned to your Ordinary Account. If the refunded grant exceeds $30,000, the CPF Board may allocate part of the refund to your Special Account (CPF SA) / Retirement Account (CPF RA) and MediSave Account (CPF MA).

The primary intention of CPF savings is to meet your retirement needs. Using CPF funds to purchase property reduces the amount available for your retirement. Therefore, you must refund the amount used, plus the accrued interest, when you sell your home.

Sellers must account for other expenses, which I will touch on in this article when selling the property, in addition to the CPF refund, as these costs can impact the net proceeds from the sale.

You may use any amount refunded to your CPF Ordinary Account to finance your next home or contribute to your retirement fund. This article may help you better plan your finances by answering some common questions many homeowners may have about the net sales proceeds after you sell your property.

Do I Need to Refund the CPF Funds I Used for Housing Payment After I Sell My Property?

Absolutely! Suppose you have tapped into your CPF savings for your downpayment or to service your housing loan. In that case, you must refund the principal amount you withdrew from your CPF account and the accrued interest when you sell your property. This interest is equivalent to what you would have earned if the money had remained in your CPF account, ensuring that your retirement savings are not diminished by using these funds for housing purposes.

If you are 55 years old and above and have yet to fulfill your Retirement Account, the CPF refund after you sell your property is primarily used to replenish your Retirement Account and your Full Retirement Sum. This mechanism ensures that you have adequate savings set aside for your retirement years. Any excess refund beyond the Full Retirement Sum will be disbursed in cash, providing additional liquidity you can use as needed.

It is crucial to stay informed about the exact refund amount required when selling your property. You can log into your CPF account via the CPF website using your Singpass and navigate to the housing dashboard to access this information easily. The housing dashboard provides a detailed breakdown of the principal amount used, the accrued interest, and any housing grants that need to be refunded.

What If I Had Pledged My Property to Withdraw Cash from My Retirement Account?

All home sellers are required to refund the CPF principal amount used for housing, along with the accrued interest incurred. However, if you are 55 and older and have previously pledged your property to withdraw cash from your Retirement Account, in that case, you will need to refund the pledged amount back to your CPF Retirement Account in addition to the principal withdrawn and accrued interest when you sell the property.

This means that, in addition to returning the CPF savings used for your property purchase and the interest you would have earned if those funds had remained in your CPF account, you must also refund the amount pledged for your Retirement Account withdrawal. This ensures that your Retirement Account is properly replenished, helping to secure your financial stability during retirement.

Understanding these requirements is essential for effective financial planning when selling your property. This is particularly important for those planning their retirement finances, as it ensures you maintain sufficient funds in your CPF accounts. By being aware of these obligations, you can better prepare for the financial implications of selling your home, ensuring compliance with CPF regulations and avoiding unexpected shortfalls. Proper financial planning and knowledge of these rules will help you better navigate the complexities of property sales and CPF refunds, providing peace of mind and financial security for your retirement.

What About the CPF Housing Grant I Received to Buy My HDB Flat?

When you sell your HDB flat, you must refund any housing grants you received for its purchase, along with the accrued interest. The refunded grant amount typically goes back into your CPF Ordinary Account. However, if the total grants received exceed $30,000, the CPF Board may allocate a portion of the refund to your Special Account, Retirement Account, and MediSave Account.

This allocation ensures that your CPF savings continue to support your future financial needs, including healthcare and retirement. The accrued interest that must be refunded when you sell your property represents the amount your grant would have earned if it had remained in your CPF accounts.

For instance, if you received a housing grant of $40,000, part of the refund exceeding $30,000 might be distributed across your CPF accounts, such as your Special Account and MediSave Account. This helps maintain the balance required for your retirement and assists in meeting your healthcare needs through the MediSave Account.

Understanding this process is crucial for proper financial planning when selling your HDB flat. Knowing that a portion of the grant refund can be used for healthcare and retirement provides a clearer picture of your financial situation. It helps ensure that you remain prepared for future financial requirements and that your CPF savings continue to grow, securing your financial well-being.

Properly managing the refund of your housing grants and accrued interest is essential in the property sale process. Awareness of these obligations helps you navigate the financial aspects of selling your HDB flat, ensure compliance with CPF regulations, and maintain the integrity of your retirement and healthcare savings.

What Happened If My Sales Proceeds Are Not Sufficient in Covering the CPF Refund Amount?

Suppose your property’s selling price is insufficient to cover the required CPF refund after repaying your outstanding home loan. In that case, you do not need to top up the shortfall in cash, provided you sold the property at market value. This means that the CPF Board acknowledges the fair market value of your property and does not require you to pay the difference out of pocket.

However, it is important to note that any option money received from the buyer, such as an option fee or option exercise fee, is considered part of the selling price. Therefore, you must refund this amount to your CPF account before completing the sale transaction. This ensures that all proceeds from the sale are accounted for and used to repay your CPF withdrawals.

The distribution of your sales proceeds to different co-owners will vary depending on the type of property being sold and the date it was purchased or refinanced. For instance, if you purchased or refinanced a private property on or after 1 Sept 2002, or if you bought an HDB flat, the CPF Board will refund the amount to you and your co-owner’s CPF accounts in specific proportions:

- Amount refunded to owner A’s CPF account = Required CPF refund for owner A / Required CPF refund for owner A & B x Refunded Amount.

- Amount refunded to owner B’s CPF account = Required CPF refund for owner B / Required CPF refund for owner A & B x Refunded Amount.

Understanding how your sales proceeds are distributed is crucial for planning your financial future. This knowledge helps ensure that you and any co-owners know how the refunds will be handled and how much will be returned to each CPF account. This process maintains transparency and helps manage expectations regarding the funds available post-sale.

Properly managing the distribution of sales proceeds ensures compliance with CPF regulations and helps maintain financial stability. It is important to stay informed about these procedures to ensure a smooth and hassle-free property sale, securing your financial well-being and that of your co-owners.

REAL or NOT? “I must pay back my CPF in cash if the money from selling my house is not enough.” (Source: CPF Board)

Do I Have to Pay Stamp Duty if I Sell My Property?

Yes, if you sell a private property within three years of purchasing it, you are required to pay the Seller’s Stamp Duty (SSD). The SSD rates are structured to disincentivize short-term property flipping. They are calculated based on the higher market value or selling price of the residential property as of the date of sale or disposal. Specifically, the rates are as follows:

| Holding Period | Rates from Mar 11, 2017 to Jul 3, 2025 | Rates on and after Jul 4, 2025 |

|---|---|---|

| Up to 1 year | 12% | 16% |

| More than 1 year but up to 2 years | 8% | 12% |

| More than 2 years but up to 3 years | 4% | 8% |

| More than 3 years but up to 4 years | 0% | 4% |

| More than 4 years | 0% | 0% (no change) |

Source: Ministry of National Development, Ministry of Finance and Monetary Authority of Singapore, Jul 3, 2025

However, if you hold onto your property long enough after the required holding period before selling it, you are exempt from paying SSD. This exemption encourages longer-term property ownership and can result in significant savings when you sell.

Understanding the implications of SSD is crucial for your financial planning, especially if you are considering selling your property within a short period after purchase. Factoring in the potential SSD costs may help you make an informed decision about the timing of the sale of your property and the overall financial impact.

Proper planning and awareness of these stamp duty requirements can help you manage your finances more effectively, ensuring that you do not encounter unexpected costs when selling your property. This knowledge is particularly important for investors and homeowners who are navigating the complexities of the real estate market.

On the other hand, if you own an HDB flat, it is unlikely that you need to pay the SDD because of the minimum occupation period (MOP), which minimally you will hold for five years, which surpasses the SSD holding period of 3 or 4 years. However, there may be cases where SSD is still payable, for example, HDB flat bought under the HDB SERS (Selective En bloc Redevelopment Scheme), where SERS sites announced before 7 Apr 2022. The homeowner who purchased at the designated replacement site may sell the replacement flat only after meeting one of the following MOP, whichever is earlier:

- 7 years from the date of selection of the SERS replacement flat

- 5 years from the date of collecting the keys

Thus, if HDB takes 5 years to build the replacement flat, you may only need to fulfill 2 more years before the 7-year mark reached from the date of selection of your replacement flat. As such, you may be subject to SSD.

If you want to understand more about any other special scenario where you are unsure if you are subject to SSD, you may contact IRAS or myself to double-check.

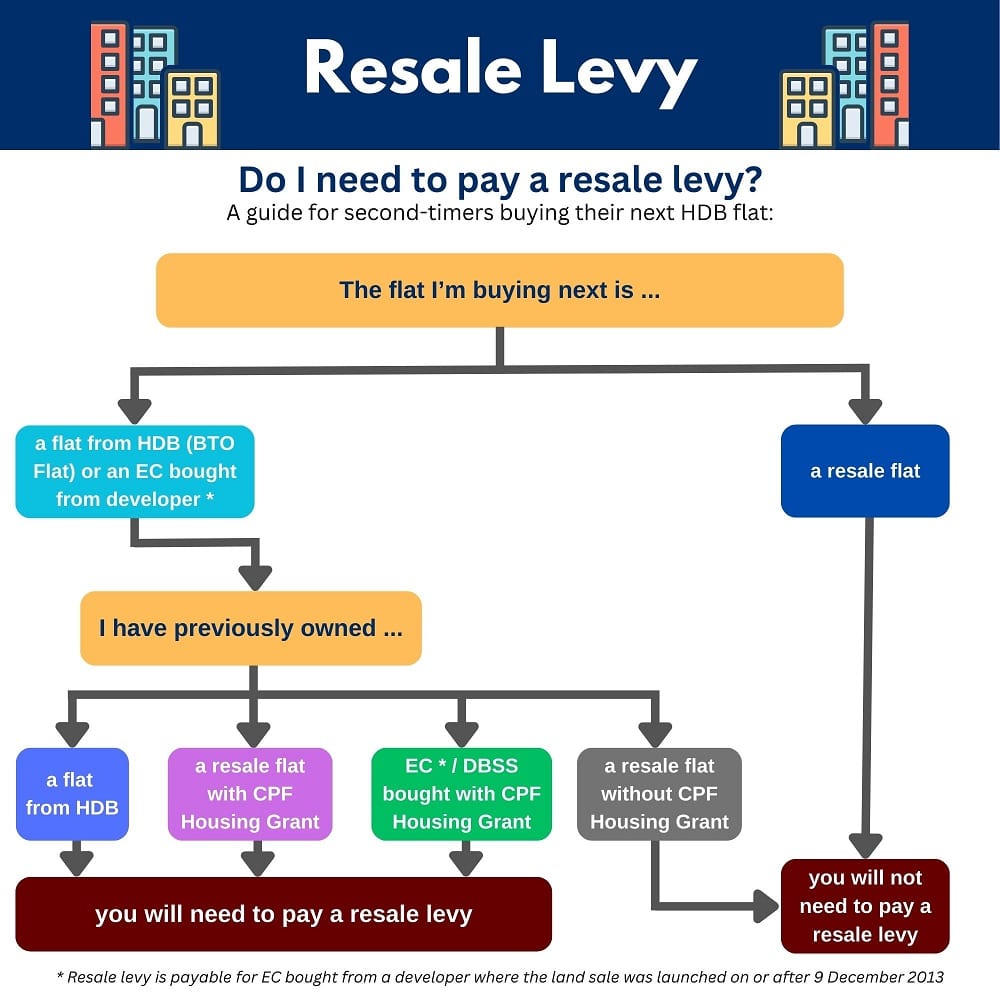

What Is the Resale Levy for HDB Flat Owners?

When Does the Resale Levy Apply?

The resale levy applies if you have previously bought a flat directly from HDB or if you received a CPF Housing Grant when purchasing a resale flat. If you decide to sell this subsidized flat and buy another subsidized flat or executive condominium, you will need to pay a resale levy.

How Much Is the Resale Levy?

The resale levy payable depends on the type of flat you are selling. Here are the current rates:

Subsidised flat sold on or after 3 March 2006

If you have sold your first subsidised flat from 3 March 2006 onwards, you will pay a fixed amount resale levy as follows:

| First Subsidised Housing Type | Resale Levy Amount | |

|---|---|---|

| Households | Recipient of CPF Housing Grant (Singles) | |

| 2-room/ 2-room Flexi flat | $15,000 | $7,500 |

| 3-room flat | $30,000 | $15,000 |

| 4-room flat | $40,000 | $20,000 |

| 5-room flat | $45,000 | $22,500 |

| 3Gen flat | $45,000 | Not applicable |

| Executive flat | $50,000 | $25,000 |

| Executive Condo | $55,000 | Not applicable |

The resale levy ensures an equitable distribution of housing subsidies and helps maintain the affordability of public housing for future buyers.

How Is the Resale Levy Paid?

If the first subsidized flat were disposed of after key collection to the second subsidized flat, the resale levy payable would be deducted from the net proceeds upon selling the first subsidized flat. Any shortfall is to be paid in cash.

If the first subsidized flat was disposed of before key collection to the second subsidized flat, the resale levy was paid in cash upon key collection to the second subsidized flat.

Impact on Your Financial Planning

Understanding the resale levy is crucial for financial planning, especially if you plan to purchase another subsidized flat after selling your current one. The resale levy can significantly impact your net proceeds and your budget for your next home. It is advisable to factor in this cost when calculating your potential earnings from the sale, especially when you want to sell your current subsidized flat and purchase another subsidized flat. By understanding when the resale levy applies, how much it is, and how it is paid, you can better prepare yourself for any financial implications and ensure smoother transitions in your housing journey.

Proper planning and awareness of these regulations will help you navigate the HDB resale process more effectively and make informed decisions about your next home purchase.

What Other Expenses Should I Be Aware of When Selling?

When selling your property, you must consider additional expenses beyond the CPF refund and Seller’s Stamp Duty. These costs can impact your net proceeds and should be considered in your financial planning.

Agent's Service Fees

Administrative Costs

There are various administrative costs associated with selling a property, especially for HDB flats. These costs can vary depending on the type of flat you are selling. For instance, administrative fees can range from $40 to $80 for HDB flats. These fees cover the necessary paperwork and processing required to complete the transaction.

Legal or Conveyancing Fees

Legal or conveyancing fees are another consideration. These fees cover the legal work required to transfer ownership of the property. If there is no outstanding loan or your outstanding loan is with HDB, then the legal or conveyancing fees range depends on the selling price and flat type if you engage in HDB conveyancing. If your outstanding loan is from the Bank, you are required to engage a private law firm for the conveyancing.

Miscellaneous Costs

Other miscellaneous costs may be associated with selling your property besides the abovementioned expenses. These can include valuation fees, property tax, and maintenance charges that need to be settled before the sale can be completed. It is advisable to make a comprehensive list of all potential expenses to avoid any surprises.

Summary

Selling your property involves several financial considerations impacting your net proceeds and future planning. If you used CPF savings for housing, you must refund the principal amount plus accrued interest. If you are 55 and above and have pledged your property to withdraw cash from your Retirement Account, you must refund the pledged amount to your Retirement Account when you sell your property..

Any housing grants received must be refunded, including accrued interest. If the grants exceed $30,000, part of the refund may be allocated to your Special Account, Retirement Account, and MediSave Account, ensuring continued support for healthcare and retirement needs.

If your sales proceeds are insufficient to cover the required CPF refund after settling your home loan, you do not need to top up the shortfall in cash, provided you sold your property at market value or higher. You also have to refund any option money or deposit received from the buyer to your CPF account.

Seller’s Stamp Duty (SSD) applies if you sell a private property within the holding period as mentioned earlier. The SSD rates range from 16% to 4% or 12% to 4% depending on your date of acquisition/purchase and date of disposal. No SSD is required if the property is held after the holding period as mentioned earlier.

Additional expenses, such as agent’s service fees and administrative and legal fees, must be considered. These costs can affect your net proceeds, so managing them ensures a smoother transaction process.

If you are an HDB flat owner, you may need to pay a resale levy if you sell your subsidized flat and buy another subsidized flat or executive condominium. The levy varies based on the flat type.

Understanding and planning for these financial obligations ensures a smoother selling process, maximizing your financial benefits and securing your future needs. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls. If in doubt, always consult a real estate professional for advice.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls