Table of Contents

The Trend of Upgrading to Private Property

In recent years, there has been a noticeable trend of homeowners in Singapore upgrading from HDB flats to private properties. It’s not just about owning a better home; it’s about improving quality of life, growing financially, and preparing for the future. For many, upgrading to a condo or even a landed property signals a new stage in life, a step toward greater comfort, privacy, and investment opportunities.

This trend is picking up because more people now have the financial capacity to make this move. As Singaporeans build their careers and wealth, many see owning private property as an essential goal. The desire to move into a condo or landed property isn’t just about luxury—it’s about making a long-term investment. Private properties often appreciate faster than HDB flats, making them an attractive option for homeowners who are thinking ahead, especially when considering retirement. This long-term investment potential provides a sense of security and confidence for homeowners.

With more people desiring exclusive facilities such as swimming pools, gyms, and enhanced security, private condos provide a level of convenience that HDB flats cannot offer. Upgrading isn’t just about having more space; it’s about enjoying a more premium lifestyle in a secure and well-maintained environment. Families deciding to upgrade to private property, in particular, are drawn to the idea of better amenities for their children and more spacious homes that can accommodate their family’s growing needs. This improved lifestyle is something to be excited about and eager to experience.

Moreover, government policies like the Additional Buyer’s Stamp Duty (ABSD), loan-to-value limits (LTV), and Total Debt Servicing Ratio (TDSR) are significant factors that influence homeowners’ decision to upgrade. While the government puts these rules in place to manage housing affordability and prevent property speculation in Singapore, this lead to the importance of proper timeline and financial planning for homeowners considering a move from their HDB flat to private property. Despite these regulations, many still find the benefits of upgrading outweigh the costs, especially when viewed as part of a long-term financial strategy.

This growing trend reflects the broader aspirations of many Singaporean homeowners. They see upgrading as improving their living conditions and securing their financial future. The question for many isn’t if they should upgrade but when and how to take the leap into private property ownership.

Why Do Homeowners Upgrade to Condos or Landed Properties?

Many Singaporean homeowners start their property journey with an HDB flat, but as life changes, so do their housing needs and aspirations. Upgrading from an HDB flat to a private condo or landed property offers several benefits beyond just a change of scenery. Let’s explore why more and more people are making this move.

Enhanced Lifestyle and Amenities

One of the biggest draws of upgrading to a condo is the improved lifestyle that comes with private property living. Condos often provide a range of recreational facilities, like swimming pools, gyms, barbecue pits, and even tennis courts, which the condo management maintains for the residents’ enjoyment. These facilities are built into the development, allowing homeowners to indulge in a more luxurious and convenient lifestyle without leaving their residences.

Other significant benefits include 24-hour security and gated access. For families with young children or those who travel frequently, the added layer of security can provide much-needed peace of mind. Security personnel on-site and controlled entry points offer a greater sense of safety, which you can’t find in the HDB estates. The dedicated maintenance teams also ensure that common areas remain clean and well-maintained, contributing to a pleasant living environment.

For homeowners who enjoy socializing or hosting gatherings, condo facilities like function rooms, BBQ areas, and even community events foster a sense of community while still enjoying privacy and exclusivity.

Adapting to Changing Family Needs

As families evolve, their housing needs change as well. While not all condos offer significantly larger living spaces, many provide flexible layouts and modern designs that better accommodate changing lifestyles.

For example, condos often feature open-plan living spaces, which make homes feel more spacious and modern. This kind of design can be ideal for young families, professionals who work from home, or homeowners who want more versatile spaces for dining, relaxing, or entertaining.

Moreover, many condos are designed with functional and space-saving features such as built-in storage, flexible room layouts, or home office spaces. These designs allow families to better utilize the available space in a practical way. For families with children, having access to condo amenities such as children’s playgrounds, wading pools, and family-friendly facilities can make daily life more enjoyable, even if the physical space inside the unit is smaller.

Prestige and Status Symbol

Let’s be honest—there’s a social status attached to owning private property. In Singapore, upgrading to a condo or landed home is often seen as a sign of financial success. For some homeowners, moving into a private property represents a significant life achievement, reflecting their hard work, career success, and stability. It’s more than just about practicality; it’s about the prestige of living in an exclusive development.

Whether inviting guests to a beautifully maintained condo or enjoying the privacy of a landed property, upgrading offers a sense of personal pride. The move can elevate a person’s social standing and be seen as a reward for years of saving and careful financial planning.

Forced Saving for Future Retirement Plans

Upgrading to private property also acts as a form of “forced saving” for the future. Private properties, especially condos and landed homes, tend to appreciate in value faster than HDB flats. When homeowners upgrade, they’re not just buying a better home—they’re investing in an asset that can grow in value over time.

Upgrading to private property could be a smart financial move for those thinking about retirement. By the time you retire, you may be able to sell the private property for a substantial profit or use it to generate rental income. This “forced savings” through property appreciation gives homeowners a financial safety net in their later years. Instead of merely saving money in a bank, they grow their wealth through property ownership.

Improved Privacy and Exclusivity

Condos and landed homes often come with gated security and limited access, offering homeowners an added layer of privacy. In contrast to HDB living, where many neighbors are in close proximity, private properties provide a more exclusive environment, making it ideal for those who value personal space and security.

For landed property owners, the privacy is even more significant. Owning a piece of land and having your private yard allows for a level of seclusion that cannot be matched by high-rise living. This is especially appealing to families with children or individuals who enjoy outdoor space for activities like gardening or hosting private gatherings.

Financial Considerations: Is It Worth Upgrading to a Condo?

Upgrading from an HDB flat to a condo is a significant financial decision, and proper planning is crucial to avoid unnecessary costs. One key aspect is managing the timeline of selling your HDB flat and purchasing the condo. Timing it well can help you avoid financial strain, such as the Additional Buyer’s Stamp Duty (ABSD) and the costs of holding two properties simultaneously. Here’s what you need to consider to determine if upgrading to a condo is the right financial move for you. Before taking the leap, let’s break down the key financial factors you should evaluate.

Affordability and Mortgage Planning

Before purchasing private property, it’s essential to evaluate your affordability. Upgrading to a condo typically involves higher upfront costs and a larger mortgage, so knowing how much you can comfortably borrow and repay is essential.

Calculating Your Budget

When upgrading, consider not only the condo’s purchase price but also other associated costs like ABSD, legal fees, renovation, and maintenance costs. Financial experts recommend keeping your total debt obligations—including your mortgage, car loans, and any other debt—55% of your gross monthly income, as per Singapore’s Total Debt Servicing Ratio (TDSR). This helps ensure your property upgrade fits your budget without causing financial strain.

Mortgage Loans

Banks typically allow you to borrow up to 75% loan to value (LTV) of the condo’s value, where minimally 5% is cash and the balance 20% cash or CPF outlay for the down payment. Additionally, mortgage loans may have variable interest rates, so you should account for possible fluctuations in monthly payments over time.

Monthly Mortgage Payments and Assessing Future Costs

Beyond the purchase, another factor to consider is your monthly mortgage payments. You’ll need to budget for ongoing expenses like property taxes, higher utility bills, and monthly maintenance fees, which are often several hundred dollars, depending on the size and type of condo. These costs can add up over time, and it’s important to factor them into your long-term financial plan. You’ll need to ensure that your income can comfortably cover these repayments.

HDB Upgrade to Condo ABSD (Additional Buyer's Stamp Duty)

One of the most significant financial challenges of upgrading to a condo is dealing with the Additional Buyer’s Stamp Duty (ABSD). If you still own your HDB flat when purchasing a condo, you’ll be considered to own a second property and thus subject to ABSD. As of 2023, the ABSD rate for Singapore citizens buying a second property is 20 percent of the purchase or valuation price, whichever is higher, which can significantly increase your upfront costs.

Exploring these options and seeking professional advice is important to understand which route best suits your financial situation. While ABSD can be a burden, planning strategically and systematically can help minimize its impact.

The timing of your HDB’s sale and your condo’s purchase is critical to avoid paying ABSD unnecessarily. For homeowners unsure whether to sell their HDB or keep it, understanding the implications of ABSD is a key part of the decision-making process.

Planning your upgrade timeline well can help you avoid unnecessary costs. This involves coordinating the sale of your HDB flat and the purchase of your condo in a way that minimizes financial strain. For example, selling your HDB flat before purchasing a condo ensures you have liquid funds for the down payment, minimizing ABSD payment, but it may require renting in the interim. On the other hand, buying a condo first can avoid the inconvenience of renting but may involve holding onto two properties and paying Additional Buyer’s Stamp Duty (ABSD).

Careful planning and understanding the timeline are crucial to avoiding pitfalls. Here’s how to manage the financial aspects when considering upgrading.

Is It Financially Worth It?

The decision to upgrade to a condo ultimately comes down to whether it makes financial sense in the long term. While the costs of owning a condo are higher, the potential returns from property appreciation can make the move worthwhile.

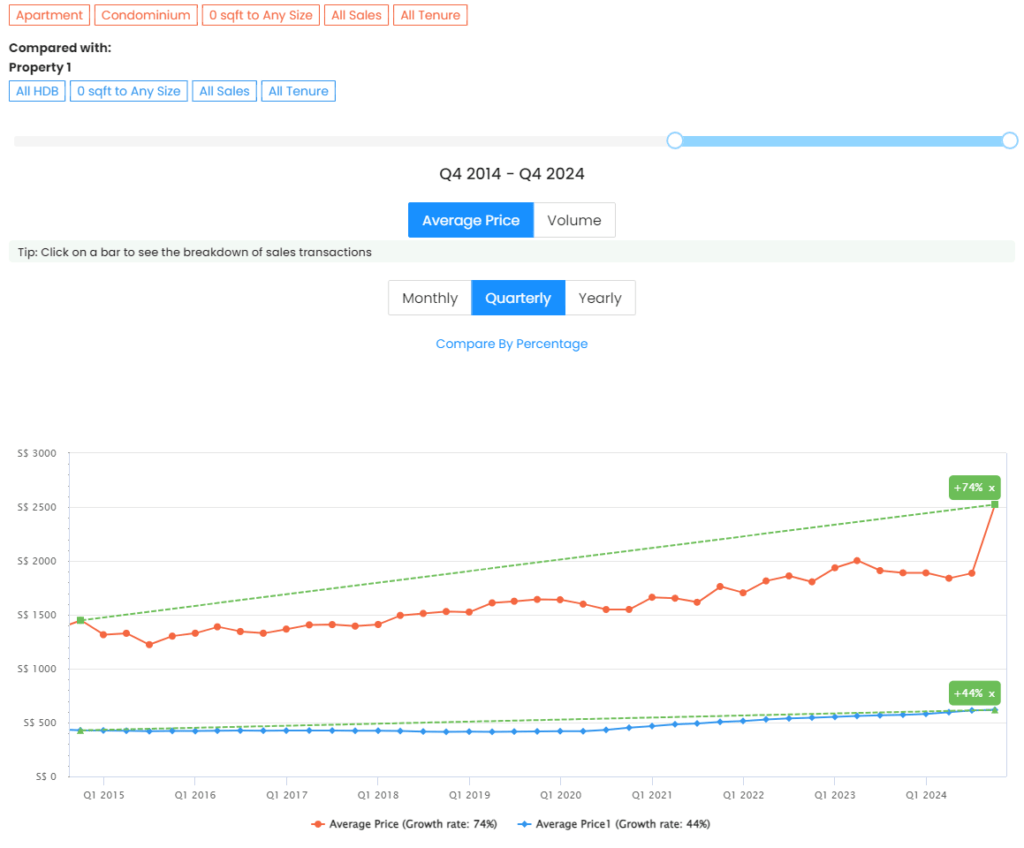

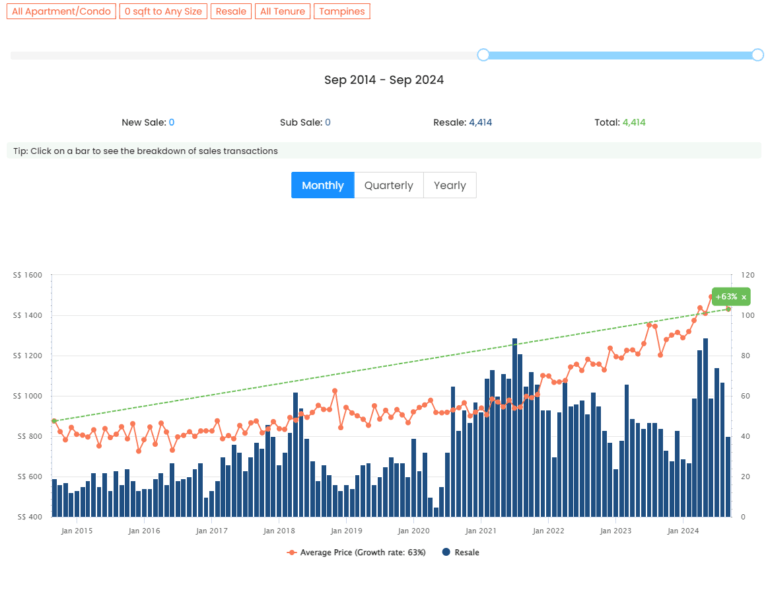

- Property Appreciation: Historically, private properties, especially condos in desirable locations, tend to appreciate faster than HDB flats. Over a 10-15-year period, condos often provide higher returns on investment, making them a better option for homeowners looking to grow their wealth through property ownership. However, property appreciation depends heavily on market conditions, and it’s essential to consider both potential risks and benefits.

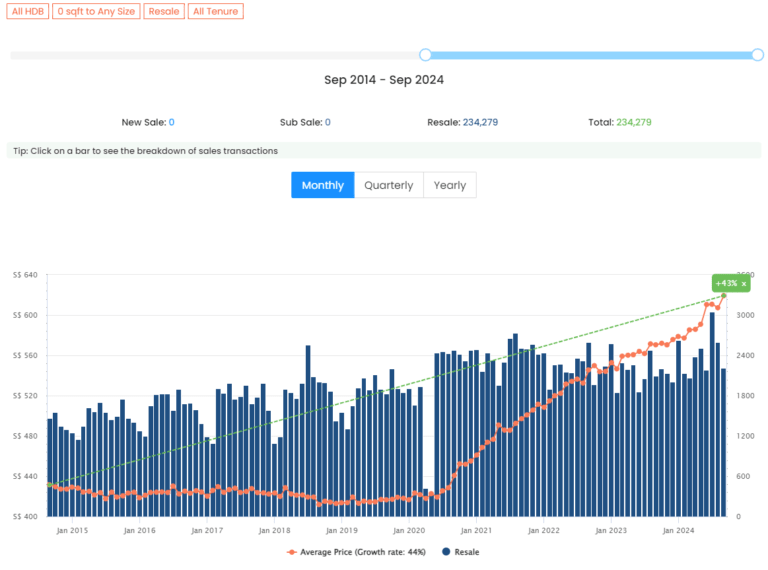

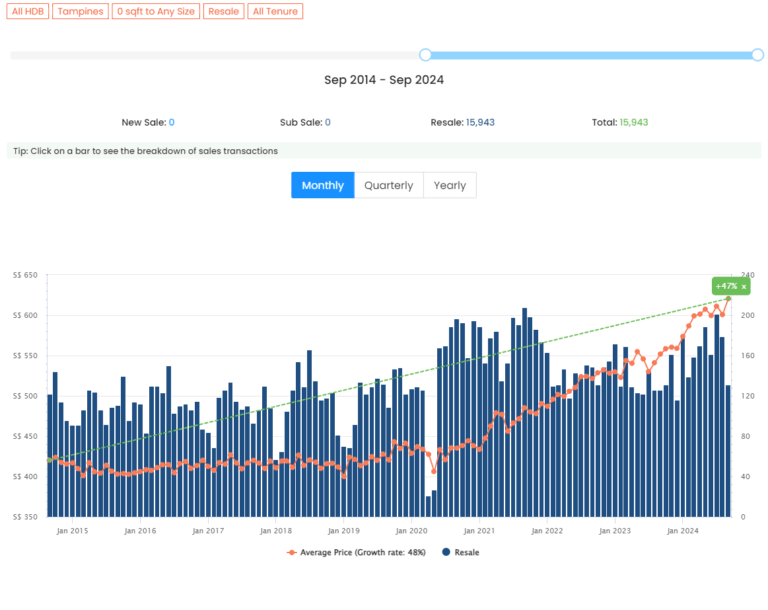

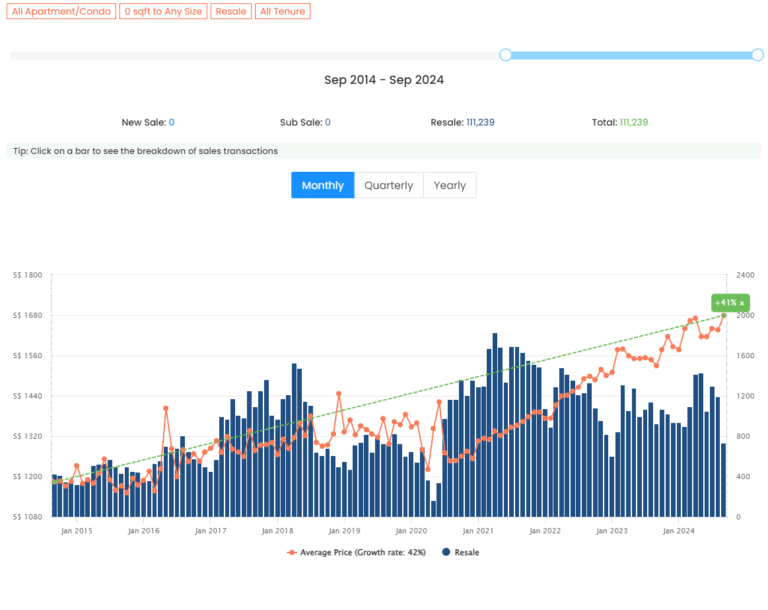

HDB Vs Condo 10 Year Trend (2014 to 2024) Source: Edgeprop - Maintenance and Other Costs: Condos come with ongoing maintenance fees, which cover the upkeep of common areas, facilities, and security. While these fees contribute to a more luxurious living environment, they add to the overall cost of condo ownership. Additionally, there may be sinking fund contributions for larger repair projects, which can increase your financial obligations over time. When considering whether upgrading is worth it, be sure to factor in these ongoing costs and how they might impact your budget in the future.

- Planning Your Upgrade Timeline: Planning your upgrade timeline is crucial to minimize costs and avoid financial strain. Ideally, you want to sell your HDB flat and purchase your condo to avoid holding two properties simultaneously, as this would require paying ABSD and could create a heavy financial burden.

- Sell First or Buy First?: Selling your HDB flat before purchasing a condo can free up funds for the down payment and exempt you from ABSD. However, this may require you to rent temporarily, which comes with costs. On the other hand, buying a condo first ensures a seamless transition but involves paying ABSD or holding two mortgages simultaneously, which can be financially stressful. Carefully planning the sequence of events and working with a real estate agent to align the sale and purchase dates can help you avoid these challenges. By organizing your upgrade timeline efficiently and understanding your financial obligations, you can ensure a smoother transition to condo ownership.

If done thoughtfully, upgrading from HDB to a condo can be rewarding. By assessing affordability, understanding the implications of ABSD, and carefully planning your timeline, you can make a smart decision that aligns with your long-term financial goals. While upgrading involves higher upfront and ongoing costs, the potential for property appreciation and improved lifestyle often make it worth the investment.

Can You Buy a Condo Without Selling Your HDB?

For many HDB homeowners, the idea of upgrading to a private condo without selling their HDB flat sounds appealing. After all, keeping your HDB flat while purchasing a condo offers the best of both worlds—you get to enjoy the perks of private property while retaining your subsidized public housing. But is it possible, and what are the financial and regulatory implications? Let’s break it down.

Holding Two Properties: Pros and Cons

Owning an HDB flat and a condo can be financially rewarding, especially if you plan to hold onto the HDB flat for rental income or future resale value. However, it also comes with several challenges and financial obligations that need careful consideration.

Pros of Holding Two Properties:

- Potential Rental Income: If you plan to upgrade to a condo but retain your HDB flat, you could rent out your HDB flat after fulfilling the Minimum Occupation Period (MOP), typically 5 years. HDB flats, particularly those in mature estates, are often in high demand for rentals, allowing you to generate a steady rental income stream while enjoying your new private property.

- Capital Appreciation: Over time, both properties could appreciate in value. Holding onto your HDB flat while owning a condo could increase your total wealth, as you benefit from the potential appreciation of two properties instead of one.

- Future Flexibility: Retaining your HDB flat gives you flexibility. You could choose to sell either property in the future depending on which market performs better. This flexibility allows you to have a choice to make decisions based on market conditions, maximizing your financial returns.

Cons of Holding Two Properties:

- Higher Loan Restrictions: Buying a second property reduces the loan-to-value (LTV) ratio. Instead of borrowing up to 75% of the condo’s value (the LTV for a first property), you’ll only be able to borrow up to 45%. This means you’ll need more cash or CPF savings to make the down payment, which could strain your finances.

- Additional Buyer’s Stamp Duty (ABSD): The Additional Buyer’s Stamp Duty (ABSD) is the most significant downside to holding two properties. As of 2023, Singapore citizens must pay 20% ABSD when purchasing a second property. This can amount to a large sum, significantly increasing the cost of buying a condo without selling your HDB flat first. You’ll need to carefully weigh whether the benefits of holding two properties outweigh this substantial upfront cost.

| Citizenship | First Property | Second Property | Third or More |

|---|---|---|---|

| Singapore Citizens | 0% | 20% | 30% |

| Singapore PR | 5% | 30% | 35% |

| Foreigner | 60% | 60% | 60% |

| Corporate | 65% | 65% | 65% |

- Ongoing Costs: Owning two properties means dealing with two financial obligations, including mortgage payments, property taxes, maintenance fees, and insurance costs. This could significantly burden your monthly cash flow, especially if interest rates rise or rental demand softens.

Navigating the Regulations

While buying a condo without selling your HDB flat is possible, several important regulations and considerations must be considered, including the Minimum Occupation Period (MOP), ABSD exemptions, CPF, and mortgage loan limitation.

Minimum Occupation Period (MOP)

Before you can rent out or hold onto your HDB flat after purchasing a condo, you must have fulfilled your MOP, which is typically 5 years. During this period, you must live in the HDB flat and cannot rent out the entire unit. If you have yet to reach your MOP, buying a condo while owning your HDB flat may not be an option. You must wait until the MOP ends and consider selling your HDB flat to avoid ABSD and other complications.

ABSD Exemptions and Strategies

As mentioned, buying a second property incurs ABSD. However, there are a few strategies to minimize or avoid ABSD altogether:

- Selling First: The most straightforward way to avoid ABSD is to sell your HDB flat before purchasing your condo. This way, your condo is considered your primary residence, and you won’t need to pay ABSD.

- Buying Under a Different Name: If one spouse doesn’t currently own a property, for example, wife is listed as an essential occupier of your HDB flat instead of owner, the wife can purchase a private property after the HDB MOP period, and the ABSD is not payable. This option, too, requires careful consideration of loan eligibility and financial commitments.

CPF and Loan Limitations

When you buy a second property, you must remember that your ability to use CPF for the down payment and monthly mortgage payments becomes more restricted. You must set aside the CPF Basic Retirement Sum (BRS) in your CPF before using any excess CPF funds for your second property. This can limit your access to CPF for your condo purchase, requiring you to use more cash upfront.

Additionally, as mentioned earlier, the LTV for a second property is lower, meaning you can only borrow up to 45% of the property’s value. This means you’ll need more cash or CPF savings for the down payment, adding financial pressure.

Is it Worth Holding Two Properties?

Whether or not it’s worth buying a condo without selling your HDB flat largely depends on your financial situation and long-term goals. If you have sufficient savings to cover the down payment, ABSD, and ongoing mortgage payments, holding two properties can be a profitable strategy, especially if you plan to rent out your HDB flat or wait for it to appreciate further.

However, the financial burden of paying ABSD, maintaining two properties, and managing two mortgages can be considerable. It’s essential to carefully evaluate your finances and consider the risks before owning both properties. Consulting with a property expert can help you assess whether this strategy aligns with your long-term goals.

Owning an HDB flat and a condo offers potential financial rewards but has significant costs and regulatory hurdles. Understanding the implications of ABSD, CPF usage, and loan restrictions is crucial to making an informed decision. While buying a condo without selling your HDB flat is possible, careful planning is required to ensure it’s financially viable and aligned with your investment goals.

Another way many homeowners choose to own 2 properties would be selling their HDB flat, and subsequently proceed to buy one private property under each name, one for own-stay and one for investment. This concept is commonly known as sell 1 buy 2 concept.

For many Singaporean homeowners, upgrading from an HDB flat to a private condo is a big financial leap. However, there’s a middle ground that offers the best of both worlds: Executive Condominiums (ECs). ECs may often be a stepping stone between HDB flats and private condos because they start as public housing but eventually become private properties. This hybrid nature of ECs makes them an attractive option for those looking to upgrade their homes without stretching their finances too far.

Let’s explore why upgrading to an EC can be smart and how it transitions between public and private property.

An Executive Condo is a hybrid of private and public housing designed to meet the needs of Singaporeans who aspire to upgrade from HDB flats but may not yet be financially ready to purchase a full private property. ECs are developed and sold by private developers but are subsidized by the government, making them more affordable than private condos. The key difference between an EC and a private condo is that ECs are subject to certain HDB regulations for the first ten years after purchase.

ECs function similarly to HDB flats for the first five years, meaning they are considered like public housing and have certain eligibility criteria and a MOP period. After five years, owners can sell their ECs to Singaporeans and Permanent Residents (PRs). After ten years, ECs are fully privatized, meaning the ECs can be sold to foreigners and are treated as private properties. This gradual transition from public to private property makes ECs a unique option for HDB upgraders.

Why Choose an EC Over a Private Condo?

For homeowners looking to upgrade from an HDB flat but are concerned about the high costs of private condos, ECs offer several key advantages:

- More Affordable Than Private Condos: One of the benefits of ECs is that they are significantly more affordable than private condos. ECs are subsidized by the government, so their launch prices are often lower than private condos in similar locations. This makes ECs a more accessible option for HDB homeowners who want to upgrade but may not have the budget to jump straight into private property ownership.

Additionally, because ECs start as public housing, eligible first-timer buyers can apply for the CPF Housing Grants, lowering the cost for the eligible buyers. These grants can provide up to $30,000 in savings, making ECs an even more attractive option for those eligible to buy an EC.

. - Full Condominium Facilities: Despite their lower cost, ECs come with many of the same amenities as private condos. EC developments typically have full condominium facilities such as swimming pools, gyms, BBQ pits, tennis courts, and function rooms. This allows EC owners to enjoy a private condo lifestyle at a more affordable price point.

The quality of ECs is also on par with private condos, as they are developed by the same private developers who build high-end condominiums. EC owners enjoy the best of both worlds: access to luxurious facilities while benefiting from a lower purchase price.

. - Government Subsidies and Support: As a type of public housing, ECs receive support and subsidies from the government. This includes eligibility for CPF Housing Grants and lower initial prices. For many families, this makes ECs a more achievable upgrade than private condos, particularly for young couples or first-time upgraders.

Additionally, ECs are subject to HDB’s rules for the first five years, meaning they have certain protections in place. For example, ECs are not affected by the Additional Buyer’s Stamp Duty (ABSD) if it’s your first property purchase, making them a more cost-effective option for upgraders looking to avoid hefty stamp duty fees.

Transition to Full Private Ownership

One of the most appealing aspects of upgrading to an EC is the eventual transition to full private property status. As mentioned earlier, after the first five years, EC owners can sell their units to Singaporeans and PRs, and after ten years, the EC becomes fully privatized and can be sold to foreigners as well. At this point, the EC functions just like any other private condo, and owners can enjoy the benefits of private property appreciation.

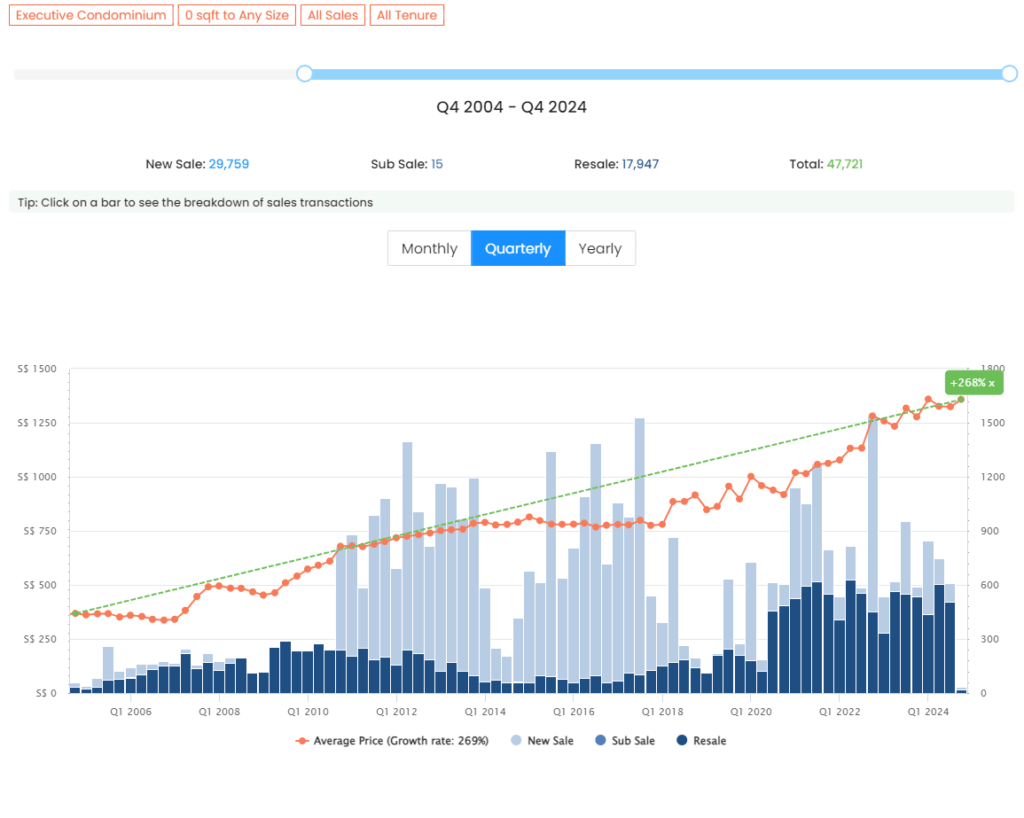

- Capital Appreciation Potential: As ECs transition to fully privatized status, they often experience a significant increase in value. This is because, after ten years, ECs are no longer bound by the same restrictions as HDB flats and are considered private property. Historically, ECs have shown strong capital appreciation, especially in desirable areas with good amenities and public transport access.

This capital appreciation can provide a significant financial boost for homeowners who upgrade to an EC. When their EC reaches full private status, owners may see their property’s value rise, allowing them to either sell for a profit or hold onto a valuable private property asset.

EC Market Trend 2004 – 2024. Source: Edgeprop - Affordability at Entry, Private Condo Benefits at Exit: For many HDB upgraders, ECs provide a balanced entry into the private property market. Government subsidies and lower prices offer affordability during the initial purchase and provide the long-term benefits of private property ownership once fully privatized.

.

For those who may not have the financial ability to purchase a private condo right away, ECs serve as a stepping stone, allowing them to enjoy condo living while benefiting from capital appreciation over time.

It’s important to note that ECs come with eligibility criteria similar to HDB flats, especially during the first five years. These include:

- Citizenship: At least one applicant must be a Singaporean citizen, and the other applicant must be a Singapore citizen or PR.

- Household Income Cap: The household income for EC applicants must not exceed $16,000 per month.

- MOP (Minimum Occupation Period): Like HDB flats, ECs are subject to a 5-year Minimum Occupation Period, during which the owner must live in the unit and cannot sell or rent out the entire property.

- First-Time and Second-Time Buyers Only: New ECs are only available to first-timer and second-timer applicants (i.e., existing HDB flat owners). This means those already owning private property cannot purchase new ECs.

Once these conditions are fulfilled, you may purchase a new EC. After the five-year MOP period, EC owners can sell their units to a broader pool of buyers where the buyers are not restricted by the household income cap, MOP period, or first and second-timer rules.

Is Upgrading to an EC Worth It?

Upgrading to an EC can be an excellent stepping stone for homeowners transitioning from HDB living to private property. It offers a more affordable entry into condo living, complete with full facilities while benefiting from government subsidies. As ECs transition to full private property status, their value tends to appreciate, providing homeowners with lifestyle improvements and potential financial gains.

For those who want to upgrade but find private condos out of reach, ECs offer a compelling alternative. By offering affordability at entry and long-term capital appreciation, ECs serve as a bridge between public housing and full private property ownership.

Upgrading to an Executive Condo (EC) is an attractive option for many HDB homeowners who are ready to move on from public housing but need more time for the financial leap to a private condo. With the benefits of government subsidies, a lower price point, and full condo facilities, ECs provide a solid stepping stone on the path to private homeownership.

From Condo to Landed Property: Taking the Next Step

For many homeowners, upgrading from a condo to a landed property represents the pinnacle of homeownership in Singapore. Landed properties like terrace houses, semi-detached homes, and bungalows are highly coveted due to their privacy, space, and prestige. But this significant upgrade isn’t just about lifestyle; it’s also about making a long-term investment. While the leap from condo to landed property can be financially and logistically challenging, many homeowners see it as the ultimate way to elevate their living standards and future-proof their wealth.

Why Some Homeowners Choose to Upgrade to Landed Homes

Homeowners who have lived in condos often desire even more space, privacy, and control over their living environment. Landed homes, which offer the luxury of owning the land on which the property stands, fulfill these needs in ways that condos cannot. Here are some reasons why homeowners decide to make this upgrade:

- More Privacy and Exclusivity: One of the main reasons homeowners upgrade from a condo to a landed property is the greater sense of privacy. In a condo, you share common spaces with many neighbors, including lobbies, lifts, and recreational areas. With a landed home, you enjoy a more secluded living environment where your nearest neighbors are much farther away. This sense of exclusivity is a major draw for those who value privacy and personal space.

Additionally, owning a landed property means having full control over your space. Unlike condos, where you must adhere to management rules and limitations, landed homes allow you to modify and renovate your home as you see fit. This flexibility particularly appeals to homeowners who enjoy customizing their living spaces or want to expand or alter their homes.

. - Space and Flexibility: Landed properties offer significantly more living space than condominiums. This additional space can make a difference for families with children or those seeking a multi-generational living setup. Landed homes typically have multiple levels, larger bedrooms, and spacious living and dining areas, providing a more comfortable living arrangement for large families or those regularly entertaining guests.

Another key benefit is the outdoor space. Landed homes have gardens and patios or may have private swimming pools, allowing homeowners to create outdoor retreats. This is especially valuable for families with young children or pets who need more space to run and play. Additionally, gardening enthusiasts or those who enjoy outdoor activities can fully utilize these spaces in ways most condo living does not allow.

. - Long-Term Investment Potential: Due to their scarcity, landed properties, particularly freehold ones, are considered prime real estate investments in Singapore. While condos may appreciate over time, landed homes often experience even higher appreciation rates, especially if they are located in desirable neighborhoods. Over the long term, owning a landed property can result in significant capital gains.

Given that Singapore is a densely populated city with limited land, the supply of landed properties remains constrained, making them highly sought after. As a result, their value tends to increase more consistently, especially compared to leasehold condos with a depreciating tenure over time. For homeowners who view the property as a key component of their wealth-building strategy, upgrading to a landed home can be a wise long-term investment.

Financial Implications

Upgrading from a condo to a landed property requires a substantial financial commitment. The landed property prices in Singapore are significantly higher than condos, particularly in prime districts. However, the investment can yield significant returns for financially prepared people over time. Below are some key financial aspects to consider:

- Higher Property Prices: Landed homes, especially the freehold ones, usually command a premium price in Singapore. Depending on the location, condition and size of the property, you may need to prepare a much larger budget than purchasing a condo. For instance, a terrace house in a suburban area could easily cost several million dollars, while larger semi-detached homes or bungalows in prime districts can exceed $10 million.

Additionally, down payments for landed properties are typically higher due to the high purchase price. With an LTV (Loan-to-Value) ratio of up to 75%, you’ll need to have at least 25% of the property’s value in cash or CPF savings for the down payment, as well as the Buyer’s Stamp Duty (BSD) and any applicable Additional Buyer’s Stamp Duty (ABSD).

. - Increased Maintenance and Renovation Costs: Owning a landed property comes with significantly higher maintenance costs than a condo. Unlike condos, where management fees cover the upkeep of common areas and amenities, landed homeowners are solely responsible for maintaining their own property. This includes the upkeep of the garden, repairs to the home’s exterior, and general maintenance of larger spaces. Over time, these costs can add up, so it’s important to factor them into your budget.

Renovation costs are another key consideration. Landed homes, especially older ones, may require extensive renovations to modernize or tailor them to your needs. Whether upgrading the interior design, adding extensions, or maintaining outdoor areas, renovation costs for landed properties can be significantly higher than those for condos.

. - Higher Property Taxes: Landed properties come with higher annual property taxes compared to condos. Property taxes in Singapore are based on your property’s Annual Value (AV), which tends to be higher for landed homes due to their size and value. This means you’ll need to set aside a larger sum each year for property taxes, which can vary depending on whether the home is owner-occupied or rented.

Is It Worth Upgrading to Landed Property?

Whether to upgrade from a condo to a landed property depends on your personal goals, lifestyle, and financial readiness. If you’re looking for more space, privacy, and the potential for long-term appreciation, a landed property could be an excellent investment. It provides the ultimate control over your living environment and offers the flexibility to make your home your own.

However, the financial commitment is substantial. You’ll need to consider whether you’re prepared for the higher upfront costs, ongoing maintenance, and potential renovation expenses. Additionally, the long-term value of a landed property may be more attractive than a condo, particularly in Singapore’s land-scarce environment, making it a smart move for those focused on wealth-building through property investment.

Upgrading from a condo to a landed property is a significant step for homeowners. Landed properties offer greater privacy, space, and long-term investment potential. While the financial and maintenance responsibilities are much higher, many find that the benefits of landed living, including more room for family and personalization, make it a worthwhile investment.

Challenges and Risks of Upgrading

Upgrading from an HDB flat to a private condo or landed property can be exciting, promising better amenities, more space, and a higher standard of living. However, this transition is not without its challenges and risks. Homeowners must be well-prepared for the potential financial, emotional, and logistical hurdles of upgrading. Moving too hastily or without proper planning can lead to financial strain, stress, and even regret. Before deciding to upgrade, let’s dive into the key challenges and risks homeowners should be aware of.

Financial Stress and Commitment

Upgrading to private property involves a significant financial commitment, and this is perhaps the biggest challenge for most homeowners. While private condos or landed homes offer a range of benefits, they come with higher upfront costs, mortgage repayments, and ongoing expenses. Here are some financial stress points to consider:

- Higher Initial Costs: When upgrading to a condo or landed property, you’ll face higher initial costs such as:

- Down Payment: Private property purchases typically require a larger down payment than HDB flats. For private properties, the Loan-to-Value (LTV) ratio is capped at 75% if you do not have any other outstanding mortgage loan, meaning you’ll need to fork out 25% of the property price as a downpayment, of which a minimum of 5% must be in cash, and 20% can be CPF savings or cash payment. If you upgrade to a landed home, the down payment can be significantly higher due to the property’s higher price tag.

- Stamp Duties: Stamp duties, particularly the Additional Buyer’s Stamp Duty (ABSD), can add significant costs if you buy a second property without selling your HDB first. ABSD rates are currently 20% for Singapore citizens purchasing a second property, amounting to hundreds of thousands of dollars in additional expenses.

- Higher Monthly Mortgage Payments: Private properties usually come with larger mortgages. If upgrading from a fully paid or partially paid HDB flat, you’ll need to adjust to higher monthly mortgage payments, especially if the interest rates rise. Additionally, private property loans typically have higher interest rates than HDB loans, which are pegged to the CPF rate.

For homeowners on a tight budget, these higher payments could become a financial burden, affecting their cash flow and overall financial security. Before upgrading, assessing whether your income can comfortably support the new mortgage without compromising your quality of life is essential. - Ongoing Maintenance Costs: Owning a private condo or landed home comes with ongoing maintenance costs that are generally higher than those of HDB flats. For condos, monthly maintenance fees can range from a few hundred to over a thousand dollars, depending on the facilities available and the size of your unit. These fees cover the upkeep of amenities such as swimming pools, gyms, gardens, and security.

For landed properties, maintenance costs can be even more substantial, as you’re responsible for the upkeep of your entire property, including the exterior and outdoor spaces. Regular repairs, landscaping, and property improvements can add up over time.

Emotional and Logistical Considerations

While financial concerns are at the top of my mind, upgrading also involves emotional and logistical challenges that can add stress to the process.

- Emotional Attachment to Your HDB Flat: For many homeowners, selling their HDB flat comes with an emotional price. HDB flats often carry sentimental value, especially for families who have lived in their flats for many years or raised children there. Leaving behind the community, neighbors, and familiar surroundings can be difficult, particularly if your family are moving to a different neighborhood.

This emotional attachment can sometimes cause hesitation, making it harder to move forward with the upgrade. Before deciding to sell, you must weigh your emotional readiness for the change, as moving into a new private property means adjusting to a new environment. - Managing the Transition Process: Logistically, upgrading to a new property can be complicated, especially if you’re trying to time the sale of your HDB flat with the purchase of your new condo or landed home. You’ll need to carefully plan the sequence of events to avoid holding two properties simultaneously or being left without a home for a period.

Some of the common logistical challenges include:- Timing the Sale and Purchase: Selling your HDB flat and purchasing a new property requires careful coordination. Selling first can help free up funds for your next home, but you may need to find temporary housing in the interim. On the other hand, buying first could mean paying for both properties simultaneously, triggering ABSD and other financial pressures.

- Temporary Housing Arrangements: If there is a gap between selling your HDB and moving into your new home, you may need to rent a place temporarily. This can be costly, especially if rental prices are high, adding additional stress to the transition.

- Renovation and Moving: Renovation is often part of the upgrade process. Whether buying a brand-new condo or a resale landed property, you’ll likely need to budget time and money for renovations. Managing contractors, sourcing materials, and making design decisions can be time-consuming and stressful. Delays in renovation could also impact your moving date, causing further logistical headaches.

The process of moving itself can also be a challenge, especially if you’re relocating a large family or dealing with fragile belongings. Coordinating movers, packing, and settling into a new place requires careful planning and patience.

Potential Pitfalls of Upgrading

Upgrading isn’t always easy, and homeowners who don’t plan carefully can fall into common pitfalls.

- Overstretching Financially: One of the most common mistakes homeowners make when upgrading is overstretching themselves financially. Getting caught up in the excitement of buying a bigger, better home is easy, but overestimating what you can afford to buy can lead to financial stress. Homeowners should carefully assess their budget, considering all ongoing costs, including mortgage payments, property taxes, insurance, and maintenance fees.

- Assuming Property Prices Will Always Rise: Many homeowners upgrade with the expectation that their new property will appreciate over time, but property markets can be unpredictable. While private properties and landed homes tend to appreciate in value over the long term, short-term market fluctuations can occur. Homeowners must be prepared for potential market downturns or periods where their property’s value may stagnate or decrease.

- Underestimating Maintenance Costs: Another common pitfall is underestimating the ongoing costs of maintaining private property, particularly for landed homes. While condos typically have management fees that cover basic maintenance, landed homeowners are responsible for all repairs and upkeep. These costs can add up, especially if the property is older or requires significant renovations.

Upgrading your home can offer many benefits, but it also comes with challenges you should be aware of. You must carefully weigh these factors, from the financial strain of higher mortgage payments and maintenance costs to the emotional toll of leaving behind your HDB flat. Proper planning, realistic budgeting, and emotional preparedness are vital to ensuring the upgrade is smooth and successful.

Case Study: HDB Profit vs Private Property Profit Over 10-15 Years

One of the most significant considerations for most homeowners deciding whether to upgrade from an HDB flat to a private property is the potential for financial growth. Property is often seen as a long-term investment, and many Singaporeans hope to build wealth through property appreciation. In this case study, we will compare the potential profit from holding an HDB flat versus upgrading to private property, focusing on a 10 year time horizon.

HDB Flat: A Steady but Limited Appreciation

HDB flats in Singapore have historically been considered affordable for citizens wanting to own a home. However, HDB properties generally appreciate at a slower rate compared to private properties due to their status as public housing.

HDB Resale Price Index (RPI) Between Q3 2023 and Q3 2024

| Year | Quarter | Index | % Change from Previous Quarter |

|---|---|---|---|

| 2024 | III (Flash Estimate) | 192.6 | 2.5% |

| II | 187.9 | 2.3% | |

| I | 183.7 | 1.8% | |

| 2023 | IV | 180.4 | 1.1% |

| III | 178.5 | 1.3% |

HDB Resale Price Index (RPI) Between Q3 2023 and Q3 2024

Here’s a breakdown of what HDB owners can expect in terms of appreciation over 10-15 years:

- Initial Purchase Price and Subsidies: When Singaporeans buy an HDB flat, they benefit from government subsidies and grants, which make the initial purchase more affordable. A typical 4-room HDB BTO flat in a non-mature estate might cost between $300,000 and $350,000, and a mature estate might cost between $440,000 and $500,000, depending on location and other factors. With CPF housing grants, the cost may be reduced further, making it an accessible option for many first-time buyers.

Appreciation Over 10-15 Years: While HDB flats appreciate, their growth is typically slower than private properties. Over the past decade, HDB resale prices have experienced periods of stagnation, especially when the government introduced cooling measures to keep housing affordable.

Let’s assume an HDB flat purchased at $450,000 in a mature estate in Tampines appreciates at an annual rate of 4.7% over 10 years. In this case, the flat’s value would increase to approximately $712,326 after 10 years. Assuming the same growth rate, over 15 years, the flat would be worth around $896,216.

While this is a decent return, it’s important to note that the growth in HDB value can be more limited compared to private properties due to factors such as the lease decay on 99-year leasehold HDB flats. Additionally, HDB prices are more stabilized, which means they are less subject to market fluctuations that can increase private property prices.

Key Factors Affecting HDB Appreciation

- Location: Flats in more desirable, mature estates tend to appreciate faster, while those in non-mature estates may see slower growth.

- Lease Decay: HDB flats are 99-year leasehold properties, and as the lease approaches its end, the flat’s value may depreciate.

- Government Policies: HDB resale prices are influenced by government policies that aimed at keeping public housing affordable, which can limit rapid price appreciation.

Private Condo: Higher Potential for Appreciation

In contrast, private properties, including condos and landed homes, generally offer higher appreciation potential over time, making them a popular choice for homeowners looking to upgrade. Private properties are not as tightly regulated as HDB flats, and their values are influenced by market demand, location, and other economic factors.

Private Property Non-Landed Property Price Index (PPI) Between Q3 2023 and Q3 2024

| Year | Quarter | Index | % Change from Previous Quarter |

|---|---|---|---|

| 2024 | III | 196.7 | -0.3% |

| II | 197.3 | 0.6% | |

| I | 196.1 | 1.0% | |

| 2023 | IV | 194.2 | 2.3% |

| III | 189.8 | 2.2% |

Private Property Non-Landed Property Price Index (PPI) Between Q3 2023 and Q3 2024

- Initial Purchase Price: Let’s assume you bought a condo for $1,500,000 in Tampines. While this is a much higher upfront cost than an HDB flat, the growth potential is also greater.

Appreciation Over 10-15 Years:

Private condos, especially those in desirable locations, tend to appreciate at higher rates than HDB flats. Historically, private property prices in Singapore have risen by 4-7% annually, depending on market conditions. From the past 10 years’ trend, the average annual growth is about 6.3% in Tampines. Thus, a $1,500,000 condo could appreciate to around $2,763,273 after 10 years and $3,750,509 after 15 years.

This represents a significant return on investment compared to the slower appreciation seen in HDB flats. For homeowners focused on building wealth through property, upgrading to a private condo provides a more significant opportunity for capital appreciation, particularly if the property is located in a growing or high-demand area.

Key Factors Affecting Private Condo Appreciation

- Location: Condos in prime areas or near future infrastructure developments (e.g., MRT stations, malls) tend to appreciate more.

- Freehold vs. Leasehold: Freehold properties appreciate more than leasehold condos, which are not subject to lease decay.

- Market Demand: Demand from both local and foreign buyers, particularly in attractive locations, can drive the value of private condos.

Profit Comparison Over 10-15 Years

Now, let’s compare the potential profit from each property type over a 10-15 year period.

Scenario 1: HDB Flat

- Initial Purchase Price: $450,000

- Appreciation Rate: 4.7% annually

- Value After 10 Years: $712,326

- Value After 15 Years: $896,216

- Total Appreciation Over 15 Years: $446,216 (before considering any maintenance costs or fees)

Scenario 2: Private Condo

- Initial Purchase Price: $1,500,000

- Appreciation Rate: 6.3% annually

- Value After 10 Years: $2,763,273

- Value After 15 Years: $3,750,509

- Total Appreciation Over 15 Years: $2,250,509 (before factoring in mortgage interest, stamp duty, and maintenance fees)

As we can see from this comparison, the condo provides a much larger profit over a 10-15 years. Despite the higher initial investment, the condo appreciates faster and offers significantly higher returns. This increased profit margin is one of the primary reasons homeowners choose to upgrade from HDB flats to private condos.

Disclaimer: Please note that the calculation and property price indicated above is for illustration purposes only and it may differ from the actual property price appreciation of a subject property as it is subjected to the individual condo performance.

Conclusion: Which Provides Better Returns?

The decision to upgrade from an HDB flat to a private property depends on your financial goals, risk tolerance, and long-term plans. If your primary goal is wealth-building through property appreciation, upgrading to a private condo offers a significantly higher potential for profit over a 10-15 year period. However, you must be prepared for the higher upfront costs, holding expenses, and potential market risks.

On the other hand, if you prefer a lower-risk, more stable investment, holding onto your HDB flat can still provide steady, if slower, appreciation. HDB flats are generally more affordable to maintain, and their prices are less volatile, making them a safer bet for homeowners with a conservative financial outlook.

Ultimately, deciding between staying in an HDB flat or upgrading to a private condo hinges on your circumstances and financial readiness. Each option has pros and cons, but the potential for higher profits makes private property more attractive for those with the resources to upgrade.

Step-by-Step Guide to Upgrading

Upgrading from an HDB flat to a private condo or landed property is a significant financial and lifestyle decision. While it can offer better amenities, increased space, and the potential for greater appreciation, the process involves careful planning and coordination. Rushing into an upgrade without proper preparation can lead to financial strain, logistical challenges, and unnecessary stress. This guide will walk you through the essential steps to successfully upgrade your property.

Step 1: Assess Your Financial Situation

The first and most critical step when considering an upgrade is to assess your financial readiness. Upgrading to private property involves higher upfront costs, ongoing expenses, and potential risks. Before diving into the process, you must evaluate your financial health and ensure that you are stable enough to take on the additional financial burden.

Calculate Your Budget:

Begin by determining your budget for the new property. Take into account:

- Down Payment: For private properties, the down payment is typically 25% of the property’s purchase price. You’ll need 5% of this in cash, and you can pay the rest (20%) through CPF savings or cash.

- Stamp Duties: You must account for the Buyer’s Stamp Duty (BSD). If you’re buying a second property without selling your HDB flat first, you must also account for the Additional Buyer’s Stamp Duty (ABSD).

- Mortgage Payments: Understand how much you’ll need to pay monthly and whether you can comfortably service the loan. Use Singapore’s Total Debt Servicing Ratio (TDSR), which caps your total debt repayments at 55% of your gross monthly income, to determine your maximum loan.

- Ongoing Costs: Consider maintenance fees, property taxes, and any future renovation costs. Private properties, especially condos, have monthly maintenance fees that cover common areas and amenities. For landed properties, factor in additional maintenance responsibilities such as repairs, landscaping, and external upkeep.

Secure Financing

You’ll need to secure financing for your new home. Private property loans differ from HDB loans, so if you’re upgrading, you’ll need to take a bank loan with stricter terms:

- Loan-to-Value (LTV): The maximum loan you can take for private properties is 75% of the property’s value. This means you need to prepare a larger cash and CPF savings for the down payment than purchasing an HDB flat.

- Interest Rates: Private property loans typically have floating interest rates, which can fluctuate based on the market conditions. Ensure that you are comfortable with potential rate increases over time.

Step 2: Plan Your Upgrade Timeline

Timing is everything when upgrading, especially if you own an HDB flat. Planning the timeline for selling your HDB flat and purchasing your new property is crucial to avoid financial stress and additional costs like ABSD.

Sell First or Buy First? When upgrading, you have two main options:

- Sell Your HDB First: This strategy allows you to use the proceeds from your HDB sale to finance the down payment on your new home. Selling first also helps you avoid paying ABSD. However, you may need to rent a temporary home until you purchase and move into your new property, which adds additional costs and logistical challenges.

- Buy Your Private Property First: If you buy your condo or landed home first, you’ll conveniently move in directly without worrying about renting a temporary place. However, buying before selling means you’ll likely be hit with ABSD, as the government considers this your second property. You’ll need to ensure that you have sufficient funds to cover this tax and manage two properties for a period of time.

Factor in Renovation Time: If you’re purchasing a resale condo or landed property, you’ll likely want to renovate before moving in. Be sure to account for the time needed to renovate your new home when planning your move-out date from your HDB flat. Renovations can take a few weeks to several months, depending on the work required.

Step 3: Engage the Right Professionals

Navigating the upgrade process requires expertise, and engaging the right professionals will help ensure a smooth transition.

- Hire a Property Agent: A knowledgeable property agent can guide you through the process of selling your HDB flat and buying your new private property. They’ll help you price your HDB flat correctly, market it effectively, and handle negotiations with potential buyers. For your new home, an agent can help identify properties that fit your needs, budget, and lifestyle and assist in negotiations with sellers or developers.

- Work with a Mortgage Broker: A good mortgage broker can assist you secure the best loan package for your situation. Since private property loans have more complex terms than HDB loans, a broker can compare rates from different banks, ensuring you get a competitive deal.

- Engage a Lawyer: Property transactions involve legal contracts, and it’s essential to have a property lawyer to ensure the sale and purchase agreements are properly drafted and in compliance with Singapore’s laws. They’ll handle all the paperwork, including stamp duty payments, title deeds, and loan agreements.

Step 4: Search for Your Ideal Property

Once you’ve assessed your finances and planned your timeline, it’s time to begin your property search. Whether upgrading to a condo or landed home, you must identify properties that meet your lifestyle needs and budget.

Choose the Right Location: Location is one of the important factors in determining your property’s future value and enjoyment. Consider:

- Accessibility: Proximity to MRT stations, bus stops, and major expressways can greatly enhance the convenience of daily commuting.

- Amenities: Find properties near good schools, shopping malls, dining options, and healthcare facilities. Future infrastructure developments can also add value to the property.

- Growth Potential: Consider areas with ongoing or upcoming developments that may drive future property appreciation.

Consider Your Lifestyle Needs: When choosing a property, think about your current and future lifestyle needs:

- Family Size: Will the property comfortably fit your current and future family size? Consider the living spaces and the number of bedrooms and bathrooms the property has.

- Facilities: If you’re upgrading to a condo, evaluate the available facilities, such as swimming pools, gyms, BBQ pits, and playgrounds. Consider outdoor spaces like gardens, patios, and parking areas for landed properties.

Step 5: Sell Your HDB Flat

If you decide to move on and sell your HDB flat before or after purchasing your new home, you’ll need to prepare your flat for sale and market it effectively.

- Price Your HDB Correctly: Work with your property agent to set a competitive price for your HDB flat. Your pricing strategy should consider recent market trends, the condition of your flat, and the demand in your area. Overpricing the selling price can lead to a longer time for your property to be on the market, while underpricing may leave money on the table.

- Market Your Flat Effectively: A successful sale often depends on how well your property is marketed. High-quality photos, virtual tours, and online listings on popular property portals are essential in attracting potential buyers. Your agent will also arrange viewings and help negotiate offers on your behalf.

Step 6: Purchase Your New Property

Once you’ve found the ideal property, you’ll need to make an offer and proceed with the purchase. Be prepared to negotiate the offer price and terms of the sale.

- Make an Offer: Work with your agent to submit an offer on your chosen property. Be prepared to negotiate price, payment terms, and inclusions such as furniture or appliances with the seller or developer. Your agent will guide you through this process to ensure you get a fair deal.

- Secure Your Financing: Once your offer is accepted, you need to finalize your mortgage loan with the bank. Ensure you meet all requirements, provide the necessary documents, and lock in your interest rates.

Step 7: Completion and Moving

After all legal agreements are signed, it’s time to prepare for moving day. Depending on whether your new home requires renovations, you may need to time your move carefully.

- Manage Your Renovations: If renovations are required, work closely with your contractors to ensure the renovation project stays on schedule and within budget. Once the renovations are complete, you’ll be ready to move in.

- Plan Your Move: Hire a reliable moving company to help you transport your belongings to your new home. Be sure to label boxes carefully, manage fragile items, and coordinate the move-in dates to avoid any delays

Step 8: Settle into Your New Home

Once you’ve completed the purchase and moved into your new home, take some time to settle in. Set up utilities, internet services, and other essentials. It’s also important to review ongoing maintenance tasks and ensure you know your new property’s rules and regulations, especially if you’ve moved into a condo with shared facilities.

Upgrading from an HDB flat to a private property involves several steps, each requiring careful planning and financial assessment. By following this guide, you can ensure a smoother, more seamless transition to your new home, allowing you to enjoy the benefits of private property ownership with minimal stress.

Conclusion

Upgrading from an HDB flat to a private property is a significant decision that can significantly impact your lifestyle, financial future, and long-term goals. As we’ve explored in this article, upgrading has many advantages, from increased privacy and better amenities to a higher potential for property appreciation. However, it also brings financial challenges, risks, and a level of commitment that requires careful consideration.

Lifestyle Benefits: More Space, Privacy, and Amenities

One of the most compelling reasons homeowners choose to upgrade to private property is the improvement in lifestyle. Whether it’s a condo with luxurious amenities such as swimming pools, gyms, and 24-hour security or a landed property with personal outdoor spaces and complete privacy, the upgrade offers a higher standard of living than an HDB flat.

For families, the additional space and facilities can enhance daily life, offering greater comfort and more opportunities for leisure and family bonding. For professionals and retirees, upgrading to private property can mean living in a more serene, secure, and prestigious environment.

Moreover, private condos can be located in prime locations, offering proximity to essential services, shopping malls, schools, and transport options. While this is not a given for every condo, living in a well-connected area can significantly improve your quality of life.

Financial Rewards: Higher Appreciation Potential

From a financial perspective, upgrading to private property can be lucrative over the long term. As discussed in the case study, private properties tend to appreciate faster than HDB flats, offering more significant capital gains over 10- to 15-year years. For homeowners focused on wealth-building, upgrading to private property can provide a good return on investment, especially when timed with market cycles and located in high-demand areas.

For example, a well-located condo or landed home can appreciate significantly over time, allowing you to profit from selling the property in the future or generating rental income. In contrast, while HDB flats provide more stability, their price appreciation is often more limited due to government regulations and the 99-year leasehold nature of public housing.

However, it’s crucial to remember that property markets can fluctuate, and appreciation is not guaranteed. Those upgrading to private property need to be prepared for potential market downturns and higher maintenance and mortgage costs. The decision should be based on both your financial capacity and long-term goals.

Risks and Challenges: Financial Strain and Commitment

While upgrading offers many benefits, it has risks. One of the biggest challenges is managing the financial burden of private property ownership. The costs of upgrading include a larger down payment, potentially higher monthly mortgage repayments, and ongoing maintenance fees. For landed property owners, maintaining and repairing the home falls entirely on you, adding further costs.

Additionally, the Additional Buyer’s Stamp Duty (ABSD) can be a significant financial hurdle for those buying a second property without selling their HDB flat first. This tax, currently at 20% for Singaporean citizens purchasing a second home, adds a substantial cost to your financial planning.

Homeowners must also be emotionally and logistically prepared to sell their current home, manage the transition to a new property, and possibly handle renovations or temporary accommodation if needed.

In short, upgrading to private property requires a clear understanding of your financial situation and an honest evaluation of whether you can comfortably manage the increased costs and commitments.

Is Upgrading to Private Property Worth It?

So, is upgrading to private property worth it? The answer highly depends on your personal goal and circumstances. Here are some key considerations:

1. Financial Readiness: Upgrading to private property requires a strong financial foundation. You should ensure that you have enough savings for the down payment, can comfortably service the mortgage, and have a buffer for ongoing costs such as maintenance, property taxes, and renovations. If your financial situation allows this, upgrading can be a rewarding long-term investment.

2. Lifestyle Preferences: If you want to improve your living environment, enjoy exclusive amenities, and have more privacy, upgrading to a private condo or landed home can significantly enhance your lifestyle. If these factors are important to you, and you’re ready for the higher costs associated with private property, the move will likely be worth it.

3. Long-Term Goals: Your decision should always align with your long-term goals. Upgrading can offer substantial financial rewards if you’re looking to build wealth through property appreciation and are willing to take on the risks associated with private property ownership. On the other hand, staying in an HDB flat may be a better option if you’re seeking stability and lower financial risk.

4. Retirement Planning: For those considering how the property affects their retirement plans, upgrading to private property can act as a form of forced savings. Over time, the property can appreciate, providing a valuable asset that you can either sell for a profit or rent out for additional income during retirement. However, ensuring that your retirement plans are well-structured and that you are not overextending yourself financially while upgrading is essential.

Final Thoughts: Making the Right Decision

Upgrading to private property can be a fantastic way to enhance your lifestyle and build long-term wealth. Still, it requires careful planning, financial stability, and a clear understanding of your goals. By weighing the lifestyle benefits, potential financial rewards, and risks and challenges involved, you can make a more informed decision about whether upgrading is right for you.

Whether upgrading to private property is worth it depends on your unique situation. If you’re ready to take on the financial commitment and are excited about the lifestyle improvements, the rewards of upgrading can be substantial. However, if you’re more risk-averse or prefer a more affordable and stable living arrangement, staying in your HDB flat might be the better choice.

If you’re still unsure whether upgrading to private property is the right move for you, or if you have specific questions about your personal situation, feel free to reach out to me. As a property agent with extensive experience helping homeowners navigate this important decision, I can offer unbiased, professional advice tailored to your needs. Whether you’re looking for guidance on financing, understanding the property market, or planning your upgrade timeline, I’m here to help you make a well-informed choice. Contact me today for a no-obligation consultation, and let’s explore your options together!

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588