Table of Contents

HDB Case Study: Another Sale and Purchase Timeline Problem Solved For My Client! Sold In 8 Days With 35K Above Valuation!

Suppose you intend to sell or buy a property and got no idea about the timeline involved, be it document submission or payment timeline. In that case, it is good to read on to understand why the timeline is so important.

I am happy for my client that I managed to help them solve their timeline issue, and this is what I did for them.

I was referred to these sellers by a close friend about their intention to sell their HDB flat and move closer to the more central area. We had an initial phone conversation to clarify their intent and plans before the meet-up, and I understand that they need to unlock the fund from their existing HDB flat to purchase the next one. However, the seller informed me that they had paid an option fee in exchange for an Option to Purchase (OTP) to buy an HDB flat they liked two days ago! 𝐈 𝐰𝐚𝐬 𝐥𝐢𝐤𝐞 𝐎𝐌𝐆!

“They need to unlock the funds from the existing property to buy the next flat. But they have paid the option fee to buy the next flat before they start selling their current flat! How can the funds from the existing property be unlocked in time to pay for the next flat?”

The problem is that they need to sell their current HDB flat first to unlock the cash proceeds and CPF funds they utilized for their current HDB flat before they can pay for the next one. But they have yet to list their current HDB flat for sale.

Some of you may be thinking, how about using the HDB Enhanced Contra Facility if they use an HDB loan? Alternatively, if they are using a bank loan for the purchase, they can consider applying for the Bank Bridging Loan. However, for this to work, they must ensure they have a ready buyer to buy their current HDB flat. If not, the timeline may not be in time to get the sales approval for their current flat to disburse the fund for purchasing their next flat.

According to HDB, With the HDB Enhanced Contra Facility (ECF), the homeowner may:

- Sell their existing HDB flat and buy another resale HDB flat concurrently, utilizing the cash proceeds and refunded CPF savings from their current HDB flat*

- Reduce the out-of-pocket payments needed for the next home

- Reduce the housing loan amount needed and the subsequent monthly repayments

* refunded CPF savings cannot be used to pay stamp duty and legal fees.

According to POSB/DBS, the purpose of a bridging loan:

- It is a short-term loan of up to 6 months.

- Is applicable for the purchase of all property types

- It is to help you pay for the downpayment of your new property purchase (except for the initial 5% cash) while waiting for the sale proceeds/refunded CPF saving from the current property.

- The interest payable is only on the bridging loan you apply for during the short bridging loan duration. Once you have received your sales proceeds/refunded CPF saving from your current property, you will need to pay the bridging loan fully.

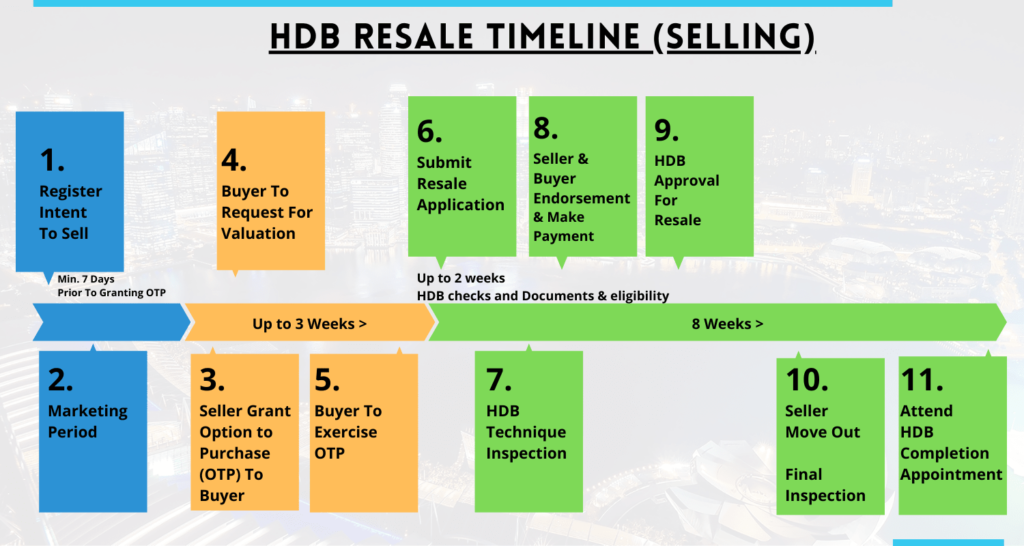

Timeline Planning is one of the essential tasks a realtor needs to plan for their client for the sale & purchase process to complete the transaction smoothly. However, it is not as straightforward as you think because every sale and purchase timeline may be unique as different scenarios arise for other property or client profiles.

Some examples are:

- Pure selling HDB or private property

- Pure buying HDB or private property

- Selling resale HDB Buying collecting BTO flat

- Selling HDB Buying a private resale property (upgrading)

- Selling HDB Buying new launch private property (upgrading)

- Selling a private property Buying HDB (downgrading)

- Selling HDB and buying another HDB (relocation/upsizing/downsizing)

- Buying new launch property from developer (EC/Private property)

Different scenarios have different timelines to match, especially regarding the financial part. In short, is your fund ready for the purchase?

What Is The Sales And Purchase Timeline

Back To My Client Timeline For Sale and Purchase of HDB Resale Flat

If this client (seller) had not met me, they may have gone a step further to exercise the option to purchase (OTP) contract of the property they are buying, which would lock them into a binding contract with the seller, and this cannot be reversed. Thus, without unlocking their current HDB flat fund, they will not be able to make payments for the next flat they buy.

After crafting the timeline for them, they only have a short and limited timeframe to secure a buyer for their house to proceed with the buying process.

I advised them on the steps to take note of the buying process for things to work out well. The first is to exercise the OTP on the latest date possible (21 days option period) and pre-amp the seller that they may need to use up the maximum resale application submission period. My top priority is to secure a buyer for them at the fastest possible time at the right price they desire.

After going through the house condition with them, I advise them what the necessary things they need to do to make their home more presentable and likable.

Through a broad marketing exposure on the advertisement that I have put up via multiple platforms, and coupled with my co-broker networks that I expose the for sale listing, I have managed to help my seller to secure a buyer within 8 days of marketing their HDB flat. And not only that, but I also managed to secure a much higher closing price than the recent transactions with 35k Cash Over Valuation (COV).

We signed off the option to purchase (OTP) on the 8th day of marketing, which is also one day after the 7-day cooling off period before they can grant the buyer an OTP as per the HDB’s rule stated in the Intent to Sell, which all sellers need to submit to HDB before selling their flat.

Thank God for leading an excellent buyer to buy their lovely HDB flat. With careful timeline negotiation with the buyer to match my client’s timeline on the HDB resale application date and completion date that my client needed for the buys and sells of the HDB. I crafted a perfect timeline for both their buying and selling and enough time for them to carry out their renovation before handing it over to the new homeowner.

To all homeowners, you must understand the timeline if you intend to sell your current flat and buy the next home. You need to follow the sales and purchase timeline as planned to transact smoothly and avoid putting yourself in an unnecessary situation that you can avoid initially to prevent any financial loss.

If you need help with how to go about buying, selling, or upgrading your property, connect with me for an unbiased non-obligatory consultation for more clarity.

Need Real Estate Consultation?

Contact Me

Feel free to connect with me!

Group District Director

Huttons Asia Pte Ltd

CEA Registration No.: R026434F

Agency License: L3008899K

Contact: 93839588

Singapore New Launch Condos 2026: Where the Next Property Opportunities Are Emerging

Discover Singapore new condo launches in 2026, upcoming projects, supply trends and property market outlook to help buyers and investors make informed decisions.

How Property Loan Strategies Help Singapore Investors Improve Cash Flow and ROI Through Smart Leverage

Learn how property loans and leverage help Singapore investors improve cash flow, boost ROI, and build long-term wealth with smarter financing strategies.

Where Can You Find and How to Buy an Upcoming Executive Condominium (EC) in 2025

Buying Exec Condo EC Guides 2025. Upcoming Otto Place EC at Tengah. Aurelle of Tampines 晶莹轩 EC at Tampines St 62. Other Available New Launch EC. Altura EC 雅乐轩, North Gaia EC, Lumina Grand EC 昱丰嘉园. Purchase Procedures Guides Available.

Understand Property Wealth Planning

Ever heard of the term ‘Property Wealth Planning’ (PWP) and wondered what it means? Well, you’re not alone. Let’s dive in and understand the strategy.

Singapore URA Draft Master Plan 2025: New Housing Clusters, Land Rezoning & Key Transformation Areas Announced

Explore Singapore’s Draft Master Plan 2025 — featuring new housing clusters, rezoned land parcels, and major transformations across Bukit Timah Turf City, Kranji Racecourse, Greater One-North, and the Greater Southern Waterfront.

What You Need to Know About Sales Proceeds After Selling Your Property

What You Need to Know About Sales Proceeds After Selling Your Property. Proper property financial calculations are crucial, and overlooking any costs can lead to unexpected financial shortfalls